Professional Documents

Culture Documents

T NG H P Graphs

Uploaded by

Annie DuolingoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T NG H P Graphs

Uploaded by

Annie DuolingoCopyright:

Available Formats

GRAPHS:

Production Possibilities Frontier/Curve

1 : Inefficient use of resources, but it is possible to produce at this point.

2 : Scarcity prevents this level of production without new resources. (trade may

also make this point possible).

3 to 4 : Increasing opportunity costs if PPC is concave. This is due to resources not

being equally adaptable to both products. For constant costs the PPC will be a straight

line.

•Increases in the quality or quantity of resources as well as technological

improvements will shift the PPC outward.

•Decreases in the quality or quantity of resources will shift the PPC inward.

* Supply and Demand Shifts

Single Shifts

•Demand ↑= P ↑ Q ↑: Point 1 to 2

•Demand ↓= P ↓ Q ↓: Point 1 to 8

•Supply ↑= P↓ Q↑: Point 1 to 6

•Supply ↓= P ↑ Q↓:Point 1 to 5

Double Shifts

•When 1 axis shows an increase then decreases with each shift, that axis is

indeterminate.

•Demand ↓ Supply ↓

P Indeterminate Q ↓:Point 1 to 8 to 7.

•Demand ↑ Supply ↑

P Indeterminate Q ↑: Point 1 to 2 to 4.

•Demand ↑ Supply ↓

P ↑ Q Indeterminate: Point 1 to 2 to 3.

•Demand ↓ Supply ↑

P ↓ Q Indeterminate: Point 1 to 8 to 9

*Aggregate Supply and Aggregate Demand (The AS/AD Model)

•LRAS is equal to the full employment level of output.

•In the long run the economy will always return to LRAS.

•In the short run the economy can have an inflationary gap (output above LRAS) or a

recessionary gap (output below LRAS)

•AD is equal to GDP and C+Ig+G+Xn

•The government can use fiscal policy to shift AD right or left.

•The Fed can use Monetary Policy to shift AD right or left.

•AS can shift because of changes in productivity, costs of inputs, or supply shocks.

•The LRAS can shift based on anything that would move the production possibilities

curve (see micro)

•If the economy is not at long run equilibrium, workers will eventually get lower

(Recessionary gap) or higher (Inflationary gap) wages which means a change in input

costs causing a shift of the AS towards long-run equilibrium

Parts of the Short-Run Aggregate Supply Curve

•The SRAS is the same thing as the AS curve

•An economy with an AS curve like A will be able to increase output without increasing

the price level.

•An economy with an AS curve like B will be able to increase output while increasing the

price level.

•An economy with an AS curve like C cannot increase output. Only price levels can

increase.

**Remember the output and price level will be determined by the intersection between

this curve and the AD curve (not shown)

*Loanable Funds Market

•The supply for loanable funds is determined by how much money is being saved in the

economy.

•The demand for loanable funds is determined by the amount of investment businesses

would like to make.

•If the government increases spending it causes a decrease in the supply of loanable

funds (the government has taken them to deficit spend) that creates a higher interest

rate. AKA “Crowding out.”

(an increase in the demand of loanable funds instead of a decrease in supply is also

acceptable)

•If the government decreases spending it causes an increase in the supply of loanable

funds that creates a lower interest rate. AKA Crowding in. (a decrease in the demand of

loanable funds instead of an increase in supply is also acceptable)

•The interest rate effects the quantity of investment in an economy (part of GDP) so a

change in the interest rate will cause a shift in the AD curve.

•The foreign exchange markets can also affect loanable funds. i.e. If financial capital is

flowing into a country (capital account) there will be an increase in the supply of loanable

funds.

*Money Market ( SUPPLY & DEMAND FOR MONEY)

• MS is the amount of money in the economy as calculated by M1 or M2.

•The Federal Reserve (AKA Central Bank) regulates the money supply through open

market operations (buying and selling bonds or securities), discount rate, reserve

requirement.

•Expansionary monetary policy shifts the MS right.

•Contractionary monetary policy shifts the MS left.

•The MD can move because of a change in the number of transactions in an economy

(C+Ig+G+Xn) or a change in the desire to hold cash as an asset.

Phillips Curve

• The SRPC shows the inverse relationship between the inflation rate and the

unemployment rate.

•The LRPC lies at the Natural Rate of Unemployment (full employment).

•The intersection between the SRPC and the LRPC is the expected rate of inflation.

•When an economy is in long-run equilibrium the inflation rate will be at the intersection

between the LRPC and the SRPC.

•Changes in AD will cause movement along the SRPC.

•Changes in AS will shift the SRPC left or right.

•Changes in inflation expectations will cause SRPC to shift left or right.

*Foreign Exchange Market

•Supply and demand determine the exchange rates for world currencies.

•The demand for a currency will shift because of a:

● Change in the interest rate for this country or other countries

● Change in the expected future exchange rate

● Change in anything that would make foreigners want to have more of this

countries currency

•The supply for a currency will shift because of a:

● Change in the interest rate for this country or other countries

● Change in the expected future exchange rate

● Change in anything that would make foreigners want to have more of this

countries currency

•Anytime there is an increase in the demand for a currency, there is simultaneously a

decrease in the supply of the same currency. And there will be a decrease in the

demand for the other currency and an increase in supply of the other currency.

***Remember this is foreign supply and demand for these currencies.

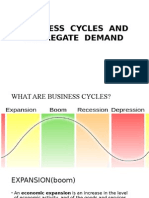

Business Cycle

•Natural fluctuations in economic activity over time

•Expansion is also called recovery

•Peaks coincide with an inflationary gap and may bring high inflation.

•Contraction that last more than 6 months are generally referred to as recessions.

•Troughs coincide with a recessionary gap and bring high unemployment and possibly

deflation.

EQUATIONS:

You might also like

- IB Economics SL9 - AD and ASDocument10 pagesIB Economics SL9 - AD and ASTerran75% (4)

- Ch. 22 & 23 - As-AD Analysis - PostedDocument35 pagesCh. 22 & 23 - As-AD Analysis - PostedEslam HendawiNo ratings yet

- CH3 Aggregate Demand and Aggregate SupplyDocument40 pagesCH3 Aggregate Demand and Aggregate SupplyTiviyaNo ratings yet

- Macroeconomics: Le Phuong Thao Quynh Faculty of International Economics Email:quynhlpt@ftu - Edu.vnDocument47 pagesMacroeconomics: Le Phuong Thao Quynh Faculty of International Economics Email:quynhlpt@ftu - Edu.vnAnh Ôn KimNo ratings yet

- Session 17Document16 pagesSession 17Sid Tushaar SiddharthNo ratings yet

- Macro Economics 2023 Short Cheat SheetDocument7 pagesMacro Economics 2023 Short Cheat Sheetnarane rampNo ratings yet

- MoneyDocument46 pagesMoneyLuna VeraNo ratings yet

- IS LM AnalysisDocument40 pagesIS LM AnalysisPrahaladh100% (1)

- Unit 5: Long-Run Consequences of Stabilization PoliciesDocument81 pagesUnit 5: Long-Run Consequences of Stabilization PoliciesPriscilla SamaniegoNo ratings yet

- Aggregate Demand and Aggregate Supply EconomicsDocument38 pagesAggregate Demand and Aggregate Supply EconomicsEsha ChaudharyNo ratings yet

- IS-LM ModelDocument31 pagesIS-LM ModelAbdoukadirr SambouNo ratings yet

- Powerpoint Presentation Long-Run Aggregate Supply and DemandDocument49 pagesPowerpoint Presentation Long-Run Aggregate Supply and DemandVivek Mishra100% (1)

- Aggregate Demand & Supplu ModelDocument20 pagesAggregate Demand & Supplu ModelShajeer HamNo ratings yet

- My Aggregate Demand & Aggregate Supply (Edited For Class)Document113 pagesMy Aggregate Demand & Aggregate Supply (Edited For Class)ShivamNo ratings yet

- EC 102 Revisions Lectures - Macro - 2015Document54 pagesEC 102 Revisions Lectures - Macro - 2015TylerTangTengYangNo ratings yet

- Macroeconomic Policy Instruments - IDocument35 pagesMacroeconomic Policy Instruments - IAbdoukadirr SambouNo ratings yet

- Aggregate Demand and Aggregated Supply: Namibian Business SchoolDocument42 pagesAggregate Demand and Aggregated Supply: Namibian Business SchoolMartha AntonNo ratings yet

- Group Assignment Eco121 - Group 5 - Mkt1807Document11 pagesGroup Assignment Eco121 - Group 5 - Mkt1807Hoàng Thanh Tùng (FE FPTU HN)No ratings yet

- Inflation DeflationDocument18 pagesInflation DeflationkenbobalajiNo ratings yet

- Chapter 8 BernankeDocument36 pagesChapter 8 BernankeAkash missriNo ratings yet

- Tugas PPT MakroDocument50 pagesTugas PPT MakroIrma CitarayaniNo ratings yet

- Worksheet For Chapter 13 (2023)Document39 pagesWorksheet For Chapter 13 (2023)Ncebakazi DawedeNo ratings yet

- Inflation and The Quantity Theory of MoneyDocument22 pagesInflation and The Quantity Theory of MoneyBình Nguyễn ĐăngNo ratings yet

- Session 18Document15 pagesSession 18Sid Tushaar SiddharthNo ratings yet

- Week 5 - SII2013 (Compatibility Mode)Document65 pagesWeek 5 - SII2013 (Compatibility Mode)Jason PanNo ratings yet

- AD-AS Model To Study Business Cycles: Prof. Biswa Swarup Misra Dean, XIMBDocument58 pagesAD-AS Model To Study Business Cycles: Prof. Biswa Swarup Misra Dean, XIMBDeepak GrandheNo ratings yet

- ECO 104 Faculty: Asif Chowdhury: Aggregate Demand & Aggregate Supply (Part 1) (Ch:20 P.O.M.E)Document16 pagesECO 104 Faculty: Asif Chowdhury: Aggregate Demand & Aggregate Supply (Part 1) (Ch:20 P.O.M.E)KaziRafiNo ratings yet

- Business Cycles and Aggregate DemandDocument40 pagesBusiness Cycles and Aggregate DemandSnehal Joshi100% (1)

- Shifts of The Curve: Price Level Money Supply ExogenousDocument28 pagesShifts of The Curve: Price Level Money Supply ExogenousKoyakuNo ratings yet

- AS-AD ModelDocument59 pagesAS-AD Modelanchal11102003No ratings yet

- MECO Lecture11Document23 pagesMECO Lecture11saif ur rehmanNo ratings yet

- Week 2Document18 pagesWeek 2Yd LeeNo ratings yet

- Inflation DeflationDocument18 pagesInflation DeflationData AnalystNo ratings yet

- Aggregate Supply & Aggregate DemandDocument51 pagesAggregate Supply & Aggregate DemandRahul ShakyaNo ratings yet

- Aggregate Demand & Aggregate SupplyDocument19 pagesAggregate Demand & Aggregate SupplyShifana ARNo ratings yet

- " in The Name of Allah The Most ." Beneficial and The Most MercifulDocument27 pages" in The Name of Allah The Most ." Beneficial and The Most MercifulFahad Ali KhanNo ratings yet

- Inflation and DeflationDocument7 pagesInflation and Deflationelle06No ratings yet

- The Mundell-Fleming ModelDocument29 pagesThe Mundell-Fleming ModelMuhammad Faheem JanNo ratings yet

- Slides For Topic 4 - InflationDocument23 pagesSlides For Topic 4 - InflationNesma HusseinNo ratings yet

- EW Macro 6Document41 pagesEW Macro 6Galib HossainNo ratings yet

- ECONOMICS Exchange Rate DeterminationDocument21 pagesECONOMICS Exchange Rate DeterminationMariya JasmineNo ratings yet

- Inflation DeflationDocument18 pagesInflation DeflationSteeeeeeeeph100% (2)

- Aggregate Demand and Supply: Factors That Change The Price Level and Real GDPDocument53 pagesAggregate Demand and Supply: Factors That Change The Price Level and Real GDPCunanan, Malakhai JeuNo ratings yet

- 3.elasticity Approach To The BoPDocument40 pages3.elasticity Approach To The BoPVelichka DimitrovaNo ratings yet

- Aggregate Demand and Supply AnalysisDocument44 pagesAggregate Demand and Supply AnalysisTinotenda DubeNo ratings yet

- Exchange Rate Determination: Prepared by Mariya Jasmine M YDocument21 pagesExchange Rate Determination: Prepared by Mariya Jasmine M Ydeepika singhNo ratings yet

- Week3 Thursday SlidesDocument36 pagesWeek3 Thursday SlidesSiham BuuleNo ratings yet

- L2 Exchange Rate DeterminationDocument25 pagesL2 Exchange Rate DeterminationKent ChinNo ratings yet

- Trade Foreign UniversiDocument7 pagesTrade Foreign Universi22070615No ratings yet

- Currency and FinancialsDocument38 pagesCurrency and FinancialsSammy MosesNo ratings yet

- Lecture 9, 10 and 11 - Principles of MacroDocument38 pagesLecture 9, 10 and 11 - Principles of Macromussy001No ratings yet

- Chaopte r34 NotesDocument5 pagesChaopte r34 Noteschinsu6893No ratings yet

- Macroeconomics Barrons Ch. 14-18Document25 pagesMacroeconomics Barrons Ch. 14-18sherin benjaminNo ratings yet

- Supply and Demand Models of Financial MarketsDocument24 pagesSupply and Demand Models of Financial MarketsPatricio BarnuevoNo ratings yet

- The IS - LM CurveDocument28 pagesThe IS - LM CurveVikku AgarwalNo ratings yet

- Eco 104: Introduction To Introduction To Macroeconomics: Lecture 7-9 (Chapter 7) Parisa ShakurDocument17 pagesEco 104: Introduction To Introduction To Macroeconomics: Lecture 7-9 (Chapter 7) Parisa ShakurTariqul Islam AyanNo ratings yet

- Review of The Previous LectureDocument36 pagesReview of The Previous LectureMuhammad Usman AshrafNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- Chap 6.2Document11 pagesChap 6.2Annie DuolingoNo ratings yet

- Chap 6.1Document17 pagesChap 6.1Annie DuolingoNo ratings yet

- Chap 6.3Document6 pagesChap 6.3Annie DuolingoNo ratings yet

- Chap 5Document20 pagesChap 5Annie DuolingoNo ratings yet

- Chap 6.2Document11 pagesChap 6.2Annie DuolingoNo ratings yet

- Chap 4Document17 pagesChap 4Annie DuolingoNo ratings yet

- CH 1Document2 pagesCH 1Annie DuolingoNo ratings yet

- Organizing Presentations To Connect With Audiences: Getting Off To A Good Start in The IntroductionDocument6 pagesOrganizing Presentations To Connect With Audiences: Getting Off To A Good Start in The IntroductionAnnie DuolingoNo ratings yet

- Chap 10Document2 pagesChap 10Annie DuolingoNo ratings yet

- Chap 9Document2 pagesChap 9Annie DuolingoNo ratings yet

- Slide VerDocument3 pagesSlide VerAnnie DuolingoNo ratings yet

- Chap 7Document2 pagesChap 7Annie DuolingoNo ratings yet

- IntroDocument2 pagesIntroAnnie DuolingoNo ratings yet

- Chap 1Document4 pagesChap 1Annie DuolingoNo ratings yet

- Chapter 05 Short Workplace Messages and Digital MediaDocument66 pagesChapter 05 Short Workplace Messages and Digital MediaAnnie DuolingoNo ratings yet

- Chap 2Document3 pagesChap 2Annie DuolingoNo ratings yet

- Chap 3Document2 pagesChap 3Annie DuolingoNo ratings yet

- Unit Test 3 Chapters 9 14Document31 pagesUnit Test 3 Chapters 9 14Annie DuolingoNo ratings yet

- Incident ReportDocument1 pageIncident ReportAnnie DuolingoNo ratings yet

- Chap 4Document3 pagesChap 4Annie DuolingoNo ratings yet

- Unit Test 1 Chapters 1 4Document33 pagesUnit Test 1 Chapters 1 4Annie DuolingoNo ratings yet

- Progress ReportDocument2 pagesProgress ReportAnnie DuolingoNo ratings yet

- Chapter 13 The Job Search RÇsumÇs and Cover MessagesDocument67 pagesChapter 13 The Job Search RÇsumÇs and Cover MessagesAnnie DuolingoNo ratings yet

- Chapter 01 Thriving in A Digital Social and Mobile WorkplaceDocument65 pagesChapter 01 Thriving in A Digital Social and Mobile WorkplaceAnnie DuolingoNo ratings yet

- T NG H P EquationsDocument3 pagesT NG H P EquationsAnnie DuolingoNo ratings yet

- EssayDocument14 pagesEssayAnnie DuolingoNo ratings yet

- T NG H P EquationsDocument3 pagesT NG H P EquationsAnnie DuolingoNo ratings yet

- Early Marriage in VNDocument8 pagesEarly Marriage in VNAnnie DuolingoNo ratings yet

- Chapter 7Document12 pagesChapter 7Annie DuolingoNo ratings yet

- Micromanagement (Full)Document52 pagesMicromanagement (Full)Annie DuolingoNo ratings yet

- BUS 475 Capstone Final Examination Part 2 Questions & Answers at StudentwhizDocument8 pagesBUS 475 Capstone Final Examination Part 2 Questions & Answers at StudentwhizstudentwhizNo ratings yet

- A Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Document19 pagesA Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Shaun WooNo ratings yet

- IDC Funded Business Partners List Q4 of 2019 20 FY 18 August 2020Document6 pagesIDC Funded Business Partners List Q4 of 2019 20 FY 18 August 2020eccleciasmahlakoaneNo ratings yet

- Strengths and Weakness of Airborne FedexDocument2 pagesStrengths and Weakness of Airborne FedexSrilakshmi ShunmugarajNo ratings yet

- Motives For Internationalisation of Financial Markets: ProfitabilityDocument9 pagesMotives For Internationalisation of Financial Markets: ProfitabilityPearl KhuranaNo ratings yet

- Marketing Plan For Aski Ausaid Agri CenterDocument7 pagesMarketing Plan For Aski Ausaid Agri CenterLey Anne PaleNo ratings yet

- A Case Study and Presentation of TATA NANODocument11 pagesA Case Study and Presentation of TATA NANOK Y RajuNo ratings yet

- Defining Business Ethics Chapter SummaryDocument4 pagesDefining Business Ethics Chapter SummarySeng TheamNo ratings yet

- SHOPPING (EP1-week 1)Document11 pagesSHOPPING (EP1-week 1)Athirah Fadzil100% (1)

- Usa Policy y GlobalizationDocument11 pagesUsa Policy y GlobalizationmayuNo ratings yet

- 2019 CIMIC Group Annual Report - 4 February 2020Document252 pages2019 CIMIC Group Annual Report - 4 February 2020SAMUEL PATRICK LELINo ratings yet

- FPA Candidate HandbookDocument32 pagesFPA Candidate HandbookFreddy - Marc NadjéNo ratings yet

- Quess CorpDocument22 pagesQuess CorpdcoolsamNo ratings yet

- Shakey's 2021Document69 pagesShakey's 2021Megan CastilloNo ratings yet

- Ricardo Pangan ActivityDocument1 pageRicardo Pangan ActivityDanjie Barrios50% (2)

- Hedging For Profit - Constructing Robust Risk-Mitigating PortfoliosDocument6 pagesHedging For Profit - Constructing Robust Risk-Mitigating Portfoliosandremdm2008No ratings yet

- Darden Case Book 2019-2020 PDFDocument155 pagesDarden Case Book 2019-2020 PDFJwalant MehtaNo ratings yet

- Doing Business in Lao PDR: Tax & LegalDocument4 pagesDoing Business in Lao PDR: Tax & LegalParth Hemant PurandareNo ratings yet

- Coca Cola Research PaperDocument30 pagesCoca Cola Research PaperUmarNo ratings yet

- Strategic Management: Environmental Analysis For Make in India InitiativeDocument31 pagesStrategic Management: Environmental Analysis For Make in India InitiativeChandra kalaNo ratings yet

- Iran Tax TreatyDocument3 pagesIran Tax TreatyHossein DavaniNo ratings yet

- Labor Law MCQDocument12 pagesLabor Law MCQalexes negroNo ratings yet

- Mishkin CH 14Document18 pagesMishkin CH 14Sravan KumarNo ratings yet

- Arguments Against Corporate Social ResponsibilityDocument6 pagesArguments Against Corporate Social ResponsibilityScorus OvidiuNo ratings yet

- HFS HOT Vendors Hfs Hot Vendors Compendium 2018 2021 RS 2106 v1.0FINALDocument211 pagesHFS HOT Vendors Hfs Hot Vendors Compendium 2018 2021 RS 2106 v1.0FINALVidhya Charan PNo ratings yet

- Benefits Management - Key Principles (Ogc)Document4 pagesBenefits Management - Key Principles (Ogc)Muhemmed AhmedNo ratings yet

- 10 Pitfalls March 2015 PDFDocument1 page10 Pitfalls March 2015 PDFShahid AkramNo ratings yet

- Gold Mastercard Titanium Mastercard Platinum MastercardDocument3 pagesGold Mastercard Titanium Mastercard Platinum MastercardRoseyy GalitNo ratings yet

- Tejas UCLEntrepreneurshipDocument4 pagesTejas UCLEntrepreneurshiprahul jainNo ratings yet

- RHDdqokooufm I1 EeDocument14 pagesRHDdqokooufm I1 Eedeshdeepak srivastavaNo ratings yet