Professional Documents

Culture Documents

MFA Homework 8 - With With Equity and Multiple Debt

Uploaded by

Rehan AsifOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MFA Homework 8 - With With Equity and Multiple Debt

Uploaded by

Rehan AsifCopyright:

Available Formats

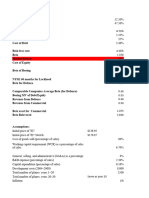

Question 1

ABC Ltd has two bonds details are as under:

A B

Face value of the bond 100 100

Coupon rate 16% 9%

Market value 110 ?

Remaining term (Years) 3 4

Market rate (Kd) ? 11%

Redemption Value 105 100

Required

Find the market value of bond A and Market rate for Bond B.

Solution

Market rate (Kd) for bond A will the IRR

- 1 2 3

Market Value (110)

Interest 16 16 16

Redemption value 105

Net Cash Flows (110) 16 16 121

PV at 10% (110) 14.55 13.22 90.91 8.68 NPV (+ve)

PV at 15% (110) 13.91 12.10 79.56 (4.43) NPV (-ve)

a 10%

b 15%

A 8.68

B (4.43)

IRR = a + (A/(A-B)) x (b-a) 13.31%

Market value of bond B

1 2 3 4

Interest 9.00 9.00 9.00 9.00

Redemption 100

Net Cash 9.00 9.00 9.00 109.00

PV at Mkt Rate (Kd) 8.11 7.30 6.58 71.80

Market value per bond (Rs) 93.80

Question 2

Ehsan Limited has the following capital structure on 31 Dec 2023:

Share Capital (Rs 10 per share) 800,000

Reserves 3,360,000

6% Bond (redeemable on 31 Dec 25) Face Value Rs 100 2,450,000

7.6% Bond (redeemable on 31 Dec 26) Face Value Rs 100 1,470,000

Further information

1. Dividend history for the last few years:

Year 2022 2021 2020 2019

Dividend 10.2676 9.4605 9.0100 8.5000

2. Price earnings ratio of the company in market is observed at 8.

3. Dividend payout ratio is determined to be 65%

4. 6% bond has a market value of Rs 102.6 per bond.

5. Market rate for 7.6% bond is 5.1% p.a.

Required

Calculate WACC of the company on 31 Dec 2022

Solution

Weighted Average cost of company

Source Mkt Value Rate Amount

Equity 10,109,609 15.153% 1,531,922

6% Bond 2,513,700 5.1422% 129,259

7.6% Bond 1,600,012 5.1000% 81,601

14,223,321 1,742,781

WACC 12.25%

Equity

Dividend per share 2022 10.2676

Dividend payout ratio 65%

EPS (grossed up) 15.7963 (55.0825/65%)

PE multiple 8.00

Market Value per share 126.37

Market value of total equity 10,109,609

Cost of equity

Growth rate

Latest dividend 10.2676

Oldest Dividend 8.5000

Time 3 Years

Growth rate 6.5000% (10.2676/8.5)^(1/3)-1

Cost of equity

Dividend par share (Latest) 10.2676

Growth rate in dividend 6.500%

Market Value per share 126.37

Ke 15.153%

6% Bond market value is given as Market Rate (Kd) is missing

- 1 2 3

Market Value (102.60)

Interest 6 6 6

Redemption value 100

Net Cash Flows (103) 6 6 106

PV at 10% (103) 5.45 4.96 79.64 -12.55 NPV (-Ve)

PV at 4% (103) 5.77 5.55 94.23 2.95 NPV (+Ve)

a 4%

A 2.95 b 10%

B (12.55)

IRR = a + (A/(A-B)) x (b-a) 5.14%

Market Value

Market Value per bond of Rs 100 102.60

6% Bonds in issue 24,500

Total Market Value 2,513,700

7.6% bond (Market rate is given Market Value is to be found out)

1 2 3 4

Interest 7.60 7.60 7.60 7.60

Redemption value 100

Net Cash Flows 8 8 8 108

PV at 5.1% 7.23 6.88 6.55 88.19 108.84

Market Value

Market Value per bond of Rs 100 108.84

7.6% Bonds in issue 14,700

Total Market Value 1,600,012

You might also like

- 9th Homework MFADocument2 pages9th Homework MFAAhmed RazaNo ratings yet

- Uv0052 Xls EngDocument12 pagesUv0052 Xls Engpriyanshu14No ratings yet

- Radio 1 Financial AnalysisDocument5 pagesRadio 1 Financial AnalysisFahad AliNo ratings yet

- Answer 1. The Correct Answers Are A and BDocument9 pagesAnswer 1. The Correct Answers Are A and BBadihah Mat SaudNo ratings yet

- EPS (TTM) 11.89 Growth Rate 12% Minimum Rate of Return 15% Margin of Safety 50%Document19 pagesEPS (TTM) 11.89 Growth Rate 12% Minimum Rate of Return 15% Margin of Safety 50%Neeraj PaliwalNo ratings yet

- Colgate Palmolive ModelDocument51 pagesColgate Palmolive ModelAde FajarNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- By: Vinit Mishra SirDocument109 pagesBy: Vinit Mishra SirgimNo ratings yet

- Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15Document9 pagesFree Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15MBA grievanceNo ratings yet

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- Chapter09 SMDocument17 pagesChapter09 SMkert1234No ratings yet

- Nike Inc - Cost of Capital - Syndicate 10Document16 pagesNike Inc - Cost of Capital - Syndicate 10Anthony KwoNo ratings yet

- Fin 465 Case 45Document10 pagesFin 465 Case 45MuyeedulIslamNo ratings yet

- FLIP Finance and Banking Practice Test 2Document13 pagesFLIP Finance and Banking Practice Test 2Sukhdeep Singh AashtNo ratings yet

- Cap ST Change 3 SolDocument9 pagesCap ST Change 3 SolKinNo ratings yet

- Final Excel FileDocument14 pagesFinal Excel FileArif RahmanNo ratings yet

- Net Income ($M) 8382 EBIT ($M) 13224 Income Tax Expense ($M) 5016 Return On EquityDocument21 pagesNet Income ($M) 8382 EBIT ($M) 13224 Income Tax Expense ($M) 5016 Return On EquityRahil VermaNo ratings yet

- Answers To Practice Questions: Valuing BondsDocument15 pagesAnswers To Practice Questions: Valuing BondsdwarakanathdasNo ratings yet

- FM09-CH 03Document14 pagesFM09-CH 03vtiwari2No ratings yet

- Sesi 3 Corporate Finance Bond Valuation 3 Sep 2022Document7 pagesSesi 3 Corporate Finance Bond Valuation 3 Sep 2022Evi PutriNo ratings yet

- Ch11 PDFDocument6 pagesCh11 PDFnagendra reddy panyamNo ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- Extra Calculation Questions For Final ExamsDocument3 pagesExtra Calculation Questions For Final ExamsSooXueJiaNo ratings yet

- Group4 DeluxeDocument7 pagesGroup4 DeluxeHEM BANSAL100% (1)

- HP-Compaq Merger AnalysisDocument15 pagesHP-Compaq Merger AnalysisAnubhav AroraNo ratings yet

- Chapter 6 Cost of CapitalDocument37 pagesChapter 6 Cost of CapitalAkshat SinghNo ratings yet

- 8th Homework MFADocument3 pages8th Homework MFAAhmed RazaNo ratings yet

- K (D1/P0) + G: WockhardtDocument2 pagesK (D1/P0) + G: WockhardtYYASEER KAGDINo ratings yet

- Managements Discussion Analysis 2022Document111 pagesManagements Discussion Analysis 2022arvind sharmaNo ratings yet

- CaseDocument13 pagesCaseHương Trang NguyễnNo ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- Chapter 7 Problems Valuation and Characteristics of BondsDocument16 pagesChapter 7 Problems Valuation and Characteristics of Bondsrony_naiduNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- SIP Performance of Select Equity Schemes Leaflet - November 2023Document4 pagesSIP Performance of Select Equity Schemes Leaflet - November 2023Tanuj BhattNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Cpa 8Document13 pagesCpa 8justinorchidsNo ratings yet

- CPKDocument6 pagesCPKBilly GemaNo ratings yet

- Nike Inc Cost of Capital Blaine KitchenwDocument11 pagesNike Inc Cost of Capital Blaine KitchenwAlvaro Gallardo FernandezNo ratings yet

- Evaluating The Firm'S Dividend PolicyDocument11 pagesEvaluating The Firm'S Dividend PolicyYash Aggarwal BD20073No ratings yet

- LP Income 3252 - 201216171418Document27 pagesLP Income 3252 - 201216171418theredcornerNo ratings yet

- CPA 8 - Financial Management - Paper 8 SolutionsDocument15 pagesCPA 8 - Financial Management - Paper 8 SolutionsjustinorchidsNo ratings yet

- BANK3011 Workshop Week 4 SolutionsDocument5 pagesBANK3011 Workshop Week 4 SolutionsZahraaNo ratings yet

- Financial Management FM Final PaperDocument13 pagesFinancial Management FM Final PaperSaqib AliNo ratings yet

- Reversion Net Operating Income:: Five Year Leveraged IRR AnalysisDocument15 pagesReversion Net Operating Income:: Five Year Leveraged IRR Analysisalexs617No ratings yet

- Paper14 SolutionDocument20 pagesPaper14 Solutionஜெயமுருகன் மருதுபாண்டியன்No ratings yet

- Cxannual Result enDocument34 pagesCxannual Result endescent3dNo ratings yet

- Chapter 16Document11 pagesChapter 16Aarti J50% (2)

- Chapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument5 pagesChapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- Brand CoDocument7 pagesBrand CoCamila VillamilNo ratings yet

- PayTM FinancialsDocument43 pagesPayTM FinancialststNo ratings yet

- Sol ps2Document3 pagesSol ps2Antariksh ShahwalNo ratings yet

- SD17 Hybrid F9 Answers Clean ProofDocument10 pagesSD17 Hybrid F9 Answers Clean ProofVinny Lu VLNo ratings yet

- FLIP Finance and Banking Practice Test 2Document14 pagesFLIP Finance and Banking Practice Test 2Ritu SainiNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Financial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskFrom EverandFinancial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Accounts NotesDocument23 pagesAccounts Notesgyani broNo ratings yet

- Chapter 3 FinmanDocument11 pagesChapter 3 FinmanJullia BelgicaNo ratings yet

- Starting A Financial PlanDocument4 pagesStarting A Financial PlanElishaNo ratings yet

- Synopsis Icici FinancialDocument10 pagesSynopsis Icici FinancialbhatiaharryjassiNo ratings yet

- SATYAM Group Case StudyDocument3 pagesSATYAM Group Case StudyRushi AbheeshaiNo ratings yet

- A Firm's Sources of FinancingDocument19 pagesA Firm's Sources of FinancingisqmaNo ratings yet

- BRPAT00098400000056652 NewDocument8 pagesBRPAT00098400000056652 NewWorld WebNo ratings yet

- Annexure 7 PDFDocument2 pagesAnnexure 7 PDFRatnesh kumar yadavNo ratings yet

- My Home Raka Price ListDocument1 pageMy Home Raka Price ListManohar Reddy MavillaNo ratings yet

- Gxau Cure Full PCFDocument20 pagesGxau Cure Full PCFsherry.hsiaoNo ratings yet

- ch15 MCDocument26 pagesch15 MCWed CornelNo ratings yet

- BW LuxuryDocument2 pagesBW LuxuryRsu KambangNo ratings yet

- Itmg 20230306Document5 pagesItmg 20230306Hanna WesleyNo ratings yet

- Ripple + XRP HistoryDocument55 pagesRipple + XRP Historymikedudas100% (2)

- United Bank of IndiaDocument5 pagesUnited Bank of IndiaRajesh DubeyNo ratings yet

- Operation Classroom: October 11-17, 2020Document19 pagesOperation Classroom: October 11-17, 2020Bogdan ȘerbanNo ratings yet

- DSE ClearingDocument6 pagesDSE ClearingMohammed Anwaruzzaman100% (1)

- Microfinance Pulse Report Oct 2019-Equifax PDFDocument28 pagesMicrofinance Pulse Report Oct 2019-Equifax PDFEshani ShahNo ratings yet

- Past Year ACC106 Oct 2012 PDFDocument11 pagesPast Year ACC106 Oct 2012 PDFShamNo ratings yet

- Ultratech Balance SheetDocument2 pagesUltratech Balance SheetPappu BhatiyaNo ratings yet

- A Project Report On Fundamental Analysis of Mahindra Amp Mahindra CompanyDocument114 pagesA Project Report On Fundamental Analysis of Mahindra Amp Mahindra CompanyamritabhosleNo ratings yet

- AChanda Kisan Credit FinalDocument52 pagesAChanda Kisan Credit FinalGaurav DeshmukhNo ratings yet

- Chapter 5Document6 pagesChapter 5Fathimath SayyidaNo ratings yet

- ACCT550 Homework Week 6Document6 pagesACCT550 Homework Week 6Natasha DeclanNo ratings yet

- Unit 3 Assignment 2 Task 2Document4 pagesUnit 3 Assignment 2 Task 2Noor KilaniNo ratings yet

- Real Estate FundsDocument5 pagesReal Estate FundsDigito DunkeyNo ratings yet

- Account Summary - 7382041247: ChecksDocument4 pagesAccount Summary - 7382041247: ChecksJack SheldenNo ratings yet

- Simple Interest Compounded Interest Population Growth Half LifeDocument32 pagesSimple Interest Compounded Interest Population Growth Half LifeCarmen GoguNo ratings yet

- HedgingDocument19 pagesHedgingRupa H GowdaNo ratings yet

- Sole Proprietorship Accounting TransactionsDocument17 pagesSole Proprietorship Accounting TransactionsErica Mae GuzmanNo ratings yet