Professional Documents

Culture Documents

Invoice: Seller Details

Uploaded by

Mata BharatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invoice: Seller Details

Uploaded by

Mata BharatCopyright:

Available Formats

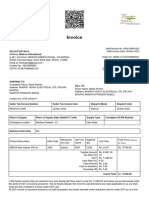

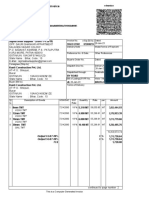

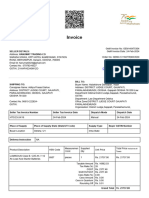

Invoice

GeM Invoice No: GEM-42678231

SELLER DETAILS: GeM Invoice Date: 29-Mar-2024

Address: ADHUNIK FURNITURE

14, Adhunik Furniture, Kanya Pathshala Road, Ramna Road, Order No: GEMC-511687756926948

Gaya, BIHAR, 823001 Order Date: 23-Mar-2024

Email Id: adhunikfurniture3188@gmail.com

Contact No : 08709949092

GSTIN: 10EDNPK0961C1ZZ Click here to download seller invoice

BILL TO:

Buyer Name: Abhishek Kumar , Abhishek Kumar

SHIPPING TO:

Address: Indian Institute of Management Boddh Gaya Gaya

Consignee Name: Abhishek Kumar

BIHAR 824234 Department of Higher Education Indian Institute

Address: Indian Institute of Management Boddh Gaya GAYA

of Management (IIM)

BIHAR 824234

GSTIN: 10AAAAI9985K1ZC

Department: Department of Higher Education

Contact No: 0631-2200238-

Office Zone:BIHAR

GSTIN: 10AAAAI9985K1ZC

Organisation: Indian Institute of Management (IIM)

Ministry: Ministry of Education

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

Adhun/695/23-24 29-Mar-2024 Manual 29-Mar-2024

Place of Supply Place of Supply State (State/UT Code) Supply Type Buyer GSTIN Number

Buyer Location Bihar / 10 Intra-State 10AAAAI9985K1ZC

Delivery Instruction NA

Measurem GST UQ Supplied Total Price inclusive

Product Description HSN Code Unit Price

ent Unit Name Qty all Taxes

SUPREME Plastic Moulded Chair

With Arms With Cushion Separate BUNDL

94018000 pieces 8 Rs. 3088.80 Rs. 24710.40

Plastic Moulded Seat and Back ES

Fitted on Support Structure

Taxable Amount Rs. 20941.02

Tax Rate (%) 18

CGST Rs. 1884.69

SGST/UTGST Rs. 1884.69

Cess Rate (%) 0.00

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. 0.00

Grand Total Rs. 24710.40

I /We hereby declare that our maximum turn over during last three years is only Rs. 22158038 and hence we arenotcovered under

the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are made applicable to us, we shall

issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shallbe liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Bta Pre4Document2 pagesBta Pre4msNo ratings yet

- OVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceDocument2 pagesOVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceLakshaya EnterprisesNo ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- L0JJYm1iUlAzNDUvRE1tektJQnlqZz09 InvoiceDocument2 pagesL0JJYm1iUlAzNDUvRE1tektJQnlqZz09 Invoicemankari.kamal.18022963No ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Tax InvoiceDocument3 pagesTax Invoicekraaz7174No ratings yet

- Invoice: Click Here To Download Seller Tax InvoiceDocument2 pagesInvoice: Click Here To Download Seller Tax InvoiceRaghavendra Rao GNo ratings yet

- V3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceDocument2 pagesV3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceOmkar DaveNo ratings yet

- GEMC-511687720852142 Invoice PDFDocument2 pagesGEMC-511687720852142 Invoice PDFrip111176No ratings yet

- Minipack ProformaDocument2 pagesMinipack ProformaGunjan PatelNo ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- Tax Invoice: IS9537 25MMDocument1 pageTax Invoice: IS9537 25MMPunit SinghNo ratings yet

- BTI-013 Bolt, Nut, Washer Park GroveDocument2 pagesBTI-013 Bolt, Nut, Washer Park GroveGARIMANo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- BT Pre3Document1 pageBT Pre3msNo ratings yet

- Bts 44445Document1 pageBts 44445msNo ratings yet

- eWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceDocument2 pageseWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceRuskin S. KhadirahNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceAdinarayana RaoNo ratings yet

- GSTN: 27CTKPS0720C1ZV: Date of Supply: 05/12/2023Document19 pagesGSTN: 27CTKPS0720C1ZV: Date of Supply: 05/12/2023Omar SunasaraNo ratings yet

- Tax Invoice - HB-2023-24-7905 - 21-Feb-24Document2 pagesTax Invoice - HB-2023-24-7905 - 21-Feb-24shrungar.ornament1No ratings yet

- NDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceDocument2 pagesNDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceInclusive Education BranchNo ratings yet

- aGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceDocument2 pagesaGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceSandeep KumarNo ratings yet

- Po SRV 4513Document1 pagePo SRV 4513Ankit KumarNo ratings yet

- ABSLI 008108666 Renewal 16JAN2024 200000.00Document1 pageABSLI 008108666 Renewal 16JAN2024 200000.00jyotsanaNo ratings yet

- 2208237918Document1 page2208237918NEW GENERATIONSNo ratings yet

- Sss Kunti 502Document2 pagesSss Kunti 502msNo ratings yet

- Iphone 11 Imagine PDFDocument2 pagesIphone 11 Imagine PDFJonassy SumaïliNo ratings yet

- Nivarshana InvoiceDocument1 pageNivarshana InvoiceSuguna VSNo ratings yet

- RentoMojo - Start Renting - Furniture, Appliances, Electronics 1Document2 pagesRentoMojo - Start Renting - Furniture, Appliances, Electronics 1Trilok AshpalNo ratings yet

- RSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceDocument2 pagesRSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceRavi Kant RohillaNo ratings yet

- Pi MaldaDocument1 pagePi Maldaraja734No ratings yet

- InvoiceDocument1 pageInvoicerajesh sNo ratings yet

- Bta s2Document2 pagesBta s2msNo ratings yet

- Sales 3742Document1 pageSales 3742momskitchen.storeNo ratings yet

- Screenshot 2021-07-05 at 6.40.56 PMDocument1 pageScreenshot 2021-07-05 at 6.40.56 PMChandu HiremathNo ratings yet

- dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceDocument2 pagesdkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceAkash ChoudharyNo ratings yet

- Invoice: Seller Details: Private LimitedDocument2 pagesInvoice: Seller Details: Private LimitedHusain KanchwalaNo ratings yet

- ZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoiceDocument2 pagesZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoicePratyush kumar NayakNo ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- BaburhatDocument1 pageBaburhatabhisek royNo ratings yet

- Tax Invoice RECIPIENT (Billed To) CONSIGNEE (Shipped To) ChhaattisgarhDocument9 pagesTax Invoice RECIPIENT (Billed To) CONSIGNEE (Shipped To) ChhaattisgarhSumedha SawniNo ratings yet

- 45077760, Bhagwati EnterprisesDocument2 pages45077760, Bhagwati EnterprisesRitika TyagiNo ratings yet

- bkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceDocument2 pagesbkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceInclusive Education BranchNo ratings yet

- Bta s1Document1 pageBta s1msNo ratings yet

- Invoice 1695482030Document1 pageInvoice 1695482030sapkalniraj2005No ratings yet

- Laxmi Metal Press Ing Works Pvt. LTD.: Invoice Cum ChallanDocument5 pagesLaxmi Metal Press Ing Works Pvt. LTD.: Invoice Cum ChallanSujit Kumar SinghNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceChethan PhoenixNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceChethan PhoenixNo ratings yet

- 2208238380Document1 page2208238380NEW GENERATIONSNo ratings yet

- Tax Invoice: Sold From / Dispatch FromDocument2 pagesTax Invoice: Sold From / Dispatch FromBharat BhushanNo ratings yet

- Iteminvoice SampleDocument4 pagesIteminvoice Sampleshashwatsankrit1515No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Air ConditionerDocument3 pagesAir ConditionerMata BharatNo ratings yet

- Buy LIME 25 KG (Packed in Lined HDPE Bags Lime Online - GeMDocument6 pagesBuy LIME 25 KG (Packed in Lined HDPE Bags Lime Online - GeMMata BharatNo ratings yet

- Anabond Industrial Grade Silicone Sealant, Size 310 Milliliter in Cartridge2Document3 pagesAnabond Industrial Grade Silicone Sealant, Size 310 Milliliter in Cartridge2Mata BharatNo ratings yet

- Buy Unbranded Carbon Steel Spike Barrier 50-54 Tonnes Online - GeMDocument5 pagesBuy Unbranded Carbon Steel Spike Barrier 50-54 Tonnes Online - GeMMata BharatNo ratings yet

- Buy ANABOND Industrial Grade Silicone Sealant, Size 310 Milliliter in Cartridge Online - GeMDocument5 pagesBuy ANABOND Industrial Grade Silicone Sealant, Size 310 Milliliter in Cartridge Online - GeMMata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 346-350Document5 pages1385465617HandBook For POs (2013) - 346-350Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 271-280Document10 pages1385465617HandBook For POs (2013) - 271-280Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 321-330Document10 pages1385465617HandBook For POs (2013) - 321-330Mata BharatNo ratings yet

- Buy Unbranded Small Size X-Ray Baggage Inspection System Online - GeMDocument5 pagesBuy Unbranded Small Size X-Ray Baggage Inspection System Online - GeMMata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 241-250Document10 pages1385465617HandBook For POs (2013) - 241-250Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 251-260Document10 pages1385465617HandBook For POs (2013) - 251-260Mata BharatNo ratings yet

- Find DuplicatesDocument5 pagesFind DuplicatesMata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 211-220Document10 pages1385465617HandBook For POs (2013) - 211-220Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 231-240Document10 pages1385465617HandBook For POs (2013) - 231-240Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 261-270Document10 pages1385465617HandBook For POs (2013) - 261-270Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 201-210Document10 pages1385465617HandBook For POs (2013) - 201-210Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 161-170Document10 pages1385465617HandBook For POs (2013) - 161-170Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 181-190Document10 pages1385465617HandBook For POs (2013) - 181-190Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 191-200Document10 pages1385465617HandBook For POs (2013) - 191-200Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 51-60Document10 pages1385465617HandBook For POs (2013) - 51-60Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 221-230Document10 pages1385465617HandBook For POs (2013) - 221-230Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 91-100Document10 pages1385465617HandBook For POs (2013) - 91-100Mata BharatNo ratings yet

- 1385465617HandBook For POs (2013) - 101-110Document10 pages1385465617HandBook For POs (2013) - 101-110Mata BharatNo ratings yet

- HandBook For POs (2013) - 11-20Document10 pagesHandBook For POs (2013) - 11-20Mata BharatNo ratings yet

- AIIMS NORCET 2022 Memory Based Paper 11th September 2022 EnglishDocument20 pagesAIIMS NORCET 2022 Memory Based Paper 11th September 2022 EnglishMata BharatNo ratings yet

- The Cash Flows From Granting CreditDocument4 pagesThe Cash Flows From Granting CreditGray JavierNo ratings yet

- P04b The Accounting Process Merchandising BusinessDocument36 pagesP04b The Accounting Process Merchandising BusinessDeul ErNo ratings yet

- UPES Marekting Managment Assignment 1Document17 pagesUPES Marekting Managment Assignment 1gourav kumarNo ratings yet

- Business Plan Industrial Weights and Scales SalesDocument31 pagesBusiness Plan Industrial Weights and Scales SalesJames ZacharyNo ratings yet

- Cost Classification of Financial StatementsDocument3 pagesCost Classification of Financial StatementsShiela Mae Clemente MasilangNo ratings yet

- Balance ScorecardDocument2 pagesBalance ScorecardNoviatni Dwi UtamiNo ratings yet

- Winning Market Through Market Oriented Strategic PlanningDocument25 pagesWinning Market Through Market Oriented Strategic PlanningKafi Mahmood NahinNo ratings yet

- StuDocu - Free Summaries, Past Exams & Lecture Notes PDFDocument28 pagesStuDocu - Free Summaries, Past Exams & Lecture Notes PDFManish Kumar100% (2)

- First Mover AdvantageDocument3 pagesFirst Mover AdvantageLitaPramudiantariNo ratings yet

- AFAR1 Seatwork On Installment SalesDocument4 pagesAFAR1 Seatwork On Installment SalesGoal Digger Squad VlogNo ratings yet

- Atlassian SalesDocument14 pagesAtlassian SalesTanisha AgarwalNo ratings yet

- MI CH 5. Pricing Calculations PDFDocument2 pagesMI CH 5. Pricing Calculations PDFPonkoj Sarker TutulNo ratings yet

- Modernisasi PPN E Commerce EropaDocument3 pagesModernisasi PPN E Commerce EropaHery RusdamanNo ratings yet

- Statement of Comprehensive Income (SCI)Document7 pagesStatement of Comprehensive Income (SCI)Pedana RañolaNo ratings yet

- Assignment 2 - RITIKA SHARMADocument6 pagesAssignment 2 - RITIKA SHARMARitika SharmaNo ratings yet

- Assignment Original Table 1Document2 pagesAssignment Original Table 1Test MockNo ratings yet

- CIMA P2 2020 NotesDocument156 pagesCIMA P2 2020 NotesJonathan Gill100% (1)

- Brand & Product Management IntroductionDocument3 pagesBrand & Product Management IntroductionVinodshankar BhatNo ratings yet

- Introduction To Sales Management and Its Evolving RolesDocument52 pagesIntroduction To Sales Management and Its Evolving RolesyesNo ratings yet

- Physical Distribution Chapter 7Document63 pagesPhysical Distribution Chapter 7Yeshambel EwunetuNo ratings yet

- Chapter 5, Applying Excel Required 3Document1 pageChapter 5, Applying Excel Required 3Mohammad Yousuf SalimNo ratings yet

- Business EconomicsDocument2 pagesBusiness Economicssally100% (1)

- Chương 8 Test BankDocument32 pagesChương 8 Test BankMỹ HuyềnNo ratings yet

- EZZSTEEL Strategic Audit: Presented To: Dr. Saneya El-GalalyDocument20 pagesEZZSTEEL Strategic Audit: Presented To: Dr. Saneya El-GalalyCarlos NgNo ratings yet

- 2 Northern Pacific R. Co. v. United States, 356 U.S. 1 (1958)Document1 page2 Northern Pacific R. Co. v. United States, 356 U.S. 1 (1958)RonnieEnggingNo ratings yet

- On May 1 2014 Lowell Company Began The Manufacture ofDocument1 pageOn May 1 2014 Lowell Company Began The Manufacture ofAmit PandeyNo ratings yet

- Chapter 4 EXEMPT SalesDocument14 pagesChapter 4 EXEMPT SalesKaila SalemNo ratings yet

- Chapter 19-OurDocument10 pagesChapter 19-OurArc619No ratings yet

- Letter of Intent - Supply of Crude & Refined Palm Oil - (#P0082)Document2 pagesLetter of Intent - Supply of Crude & Refined Palm Oil - (#P0082)Yulia Puspitasari67% (3)

- C5Document18 pagesC5DANH LÊ VĂNNo ratings yet