Professional Documents

Culture Documents

Options Strategy Builder

Uploaded by

Rajesh KrishnaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Options Strategy Builder

Uploaded by

Rajesh KrishnaCopyright:

Available Formats

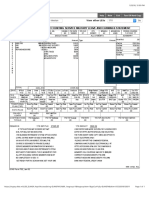

Opstra Options Analytics

NIFTY

Select Index/Stock

Spot Price: 19447 Futures Price: 19484.55

Lot Size: 50 IV: 10.52 IV Percentile: 12.85

NIFTY IV Chart DTE: 7

Date

24-08-2023

Select Pay-off Date

BULLISH

BEARISH

Long Short

NON-DIRECTIONAL Call Put

Bull Bull

Call Spread Put Spread

Call Ratio Long

Back Spread Synthetic

Range Bullish

Forward ButterPy

Bullish

Condor

Options

Select Segment

24AUG2023

Select Expiry

19500

Select Option Strike

PE

Select Option Type

Buy Sell

Lot Qty. 120

Option Price: 124.65 Option IV: 9.36

ADD POSITION

Option Chain

NOTES SAVE STRATEGY

Strategy Positions RESET

Select All

100x 24AUG2023 19300CE - ₹

S (0)

213.75

120x 24AUG2023 19500PE - ₹

B (0)

124.65

Prob. of ProDt 48.76%

Max. ProDt ₹ UndeDned

Max. Loss ₹ UndeDned

Max. RR Ratio NA

Breakevens 0-19438.0

Total PNL ₹0

Net Credit ₹ +3,20,850

Estimated Margin/Premium ₹ +1,14,57,250

PAYOFF CHART FUTURES CHART GREEKS

NIFTY SPOT FUTURES

-2σ -1σ 19447 +1σ +2σ

10,000,000

8,000,000

6,000,000

4,000,000

P&L 464,850.00

Profit/Loss

2,000,000 Chg. from Spot: (-0.26%)

t+0 P&L 354,847.87

0

-2,000,000

-4,000,000

-6,000,000

-8,000,000

18289 18981 1939619673 20365

Underlying Price

Ⓒ opstra.de5nedge.com

Positional Delta: -13806.48 Theta: -14152.19 Gamma: 6.73 Vega: 35856.59 Total PNL: ₹ 0

0

Spot (%):

0

V (%):

0

Next n Days:

You might also like

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- How To Start Trading The No BS Guide PDFDocument43 pagesHow To Start Trading The No BS Guide PDFZac Ver100% (2)

- PayStatement-Feb 24 2023Document1 pagePayStatement-Feb 24 2023alejandro avila barbaNo ratings yet

- Master The Markets TOM WILLIAMSDocument190 pagesMaster The Markets TOM WILLIAMSapi-17183348100% (3)

- Clearing and Settlement ProcessDocument15 pagesClearing and Settlement Processviralpatel60No ratings yet

- Ca Final SFM Forex SummaryDocument20 pagesCa Final SFM Forex SummaryAnish AnishNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Pay SlipDocument1 pagePay SlipVISHESH JAISWALNo ratings yet

- Pay Slip - 607043 - Jun-22Document1 pagePay Slip - 607043 - Jun-22Supriya KandukuriNo ratings yet

- The World of CreditDocument121 pagesThe World of Creditapi-24147782No ratings yet

- Deposit CalculationDocument4 pagesDeposit CalculationShubha MurthyNo ratings yet

- Whitepaper EarnfinexDocument38 pagesWhitepaper EarnfinexVitaliy Che KogoNo ratings yet

- Kajal BasakDocument1 pageKajal BasakpukhrajsoniNo ratings yet

- Pay Slip - 607043 - Jul-22Document1 pagePay Slip - 607043 - Jul-22Supriya KandukuriNo ratings yet

- Project Report On Treasury ManagementDocument6 pagesProject Report On Treasury ManagementnoordonNo ratings yet

- Upl-Jan 24Document3 pagesUpl-Jan 24N.M. EESWARANNo ratings yet

- Options Strategy Builder 01Document2 pagesOptions Strategy Builder 01Jaivanth SelvakumarNo ratings yet

- Nifty Diagonal CalenderDocument3 pagesNifty Diagonal CalenderN.M. EESWARANNo ratings yet

- Upl ComdorDocument3 pagesUpl ComdorN.M. EESWARANNo ratings yet

- Options Trade Options Strategy Builder 7Document1 pageOptions Trade Options Strategy Builder 7GaaliNo ratings yet

- Expiry 18Document1 pageExpiry 18lakshmanNo ratings yet

- Price List Axia 2023Document1 pagePrice List Axia 2023Raden PeroduaNo ratings yet

- Brokerage Calculator-Zerodha PDFDocument1 pageBrokerage Calculator-Zerodha PDFbasanisujithkumarNo ratings yet

- Nifty and Bank Nifty - ATM - MIS 10 Lot Both SellDocument7 pagesNifty and Bank Nifty - ATM - MIS 10 Lot Both SellCA Rakesh PatelNo ratings yet

- Daily Market Update Report 30-03-2020 PDFDocument6 pagesDaily Market Update Report 30-03-2020 PDFTejvinder SondhiNo ratings yet

- Neeraj Mutual FundDocument6 pagesNeeraj Mutual FundRUCHINEERAJNo ratings yet

- Voids Posi CalcDocument16 pagesVoids Posi CalcGianluca DefendiNo ratings yet

- Pre Print HeaderDocument1 pagePre Print HeaderAnonymous gqXYebllkNo ratings yet

- Pay Slip DecDocument1 pagePay Slip DecMalix EagleNo ratings yet

- HYS AUDI QuoteDocument1 pageHYS AUDI QuoteJovel RocafortNo ratings yet

- Monday To Thursday Exit 3 PMDocument2 pagesMonday To Thursday Exit 3 PMधीरज चव्हाणNo ratings yet

- MTBSL: MTB Securities LimitedDocument2 pagesMTBSL: MTB Securities LimitedMuhammad Ziaul HaqueNo ratings yet

- Ages 1Document8 pagesAges 1bobNo ratings yet

- COQ $0.00000114 Trending #2, COQINU Chart, Live Forecast DEXToolsDocument1 pageCOQ $0.00000114 Trending #2, COQINU Chart, Live Forecast DEXToolsVinicius Corrêa de AssisNo ratings yet

- Credit CalculationDocument1 pageCredit CalculationMT FinanceNo ratings yet

- Est 24029615Document2 pagesEst 24029615services.darrenguecoNo ratings yet

- Most Active Calls: Map of The Market Top Ten Gainers / Losers Most Active Securities / ContractsDocument2 pagesMost Active Calls: Map of The Market Top Ten Gainers / Losers Most Active Securities / ContractstapasNo ratings yet

- Righteous Ncube Quotation Suppy OnlyDocument6 pagesRighteous Ncube Quotation Suppy OnlyrighteousNo ratings yet

- Perhitungan Working Hours DiggerDocument120 pagesPerhitungan Working Hours Diggerosmaini sutraNo ratings yet

- Learn2Invest Session 10 - Asian Paints ValuationsDocument8 pagesLearn2Invest Session 10 - Asian Paints ValuationsMadhur BathejaNo ratings yet

- PortfolioStatement 26-12-2021Document1 pagePortfolioStatement 26-12-2021Tonoy TanvirNo ratings yet

- Options Bull BearDocument6 pagesOptions Bull BearRaunaq KulkarniNo ratings yet

- 17 Salary - Slip - Format - For - It - CompanyDocument1 page17 Salary - Slip - Format - For - It - Company光甘No ratings yet

- Stock Mock - Backtest Index Strategies+-50 ATM Nifty 9.20 To 1.10Document6 pagesStock Mock - Backtest Index Strategies+-50 ATM Nifty 9.20 To 1.10CA Rakesh PatelNo ratings yet

- Bonds - April 19 2021Document3 pagesBonds - April 19 2021Lisle Daverin BlythNo ratings yet

- Img 0002Document5 pagesImg 0002Guna SeelanNo ratings yet

- Investor - Sheet - P&LDocument7 pagesInvestor - Sheet - P&LRamnish MishraNo ratings yet

- Kotak Standard Multicap Fund (G)Document4 pagesKotak Standard Multicap Fund (G)Rudhra MoorthyNo ratings yet

- PLDocument1 pagePLCA Satyaraju KolluruNo ratings yet

- Trading Journal Template 05Document1 pageTrading Journal Template 05Dery AnggaraNo ratings yet

- Year 0 - 8000 - 8800 1 7600 6800 2 7800 7600 3 8400 7800 4 9600 7950 5 9800 8300 6 8450 7 8900 8 9300 Project Rose Project LilyDocument2 pagesYear 0 - 8000 - 8800 1 7600 6800 2 7800 7600 3 8400 7800 4 9600 7950 5 9800 8300 6 8450 7 8900 8 9300 Project Rose Project LilySourav SinghNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument1 pageBroker:: Hero Insurance Broking India Pvt. LTDAakash MotorsNo ratings yet

- Display of Details For Tariff or DescriptionDocument2 pagesDisplay of Details For Tariff or DescriptionZankar R ParikhNo ratings yet

- Very Unclear What About Other Ratios?Document6 pagesVery Unclear What About Other Ratios?smedupeNo ratings yet

- Break Even Exit For Intraday Commodities: Profit / Loss 480Document35 pagesBreak Even Exit For Intraday Commodities: Profit / Loss 480karthiNo ratings yet

- Screenshot 2021-06-17 at 2.43.47 PMDocument1 pageScreenshot 2021-06-17 at 2.43.47 PMsudam pandaNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash Memoharishankar chourasiyaNo ratings yet

- Nov 2023 10Document7 pagesNov 2023 10SUNKARA ISNo ratings yet

- 100 PT Stop Loss - 9.30 - StockMockDocument324 pages100 PT Stop Loss - 9.30 - StockMockbayagani rakeshNo ratings yet

- Shubham Question 2Document17 pagesShubham Question 2Shubham DeyNo ratings yet

- Bonds - August 21 2022Document3 pagesBonds - August 21 2022Lisle Daverin BlythNo ratings yet

- Buying Run - DefaultDocument20 pagesBuying Run - Defaultrowilson reyNo ratings yet

- Mobilization and DemobilizationDocument1 pageMobilization and DemobilizationJeyjay BarnuevoNo ratings yet

- C200 PortfolioStatement 01-03-2023 PDFDocument2 pagesC200 PortfolioStatement 01-03-2023 PDFworld tech engineeringNo ratings yet

- Shri Samarth Forgings PVT LTD: Purchase OrderDocument13 pagesShri Samarth Forgings PVT LTD: Purchase OrderMahendra PatilNo ratings yet

- Lightweight Concept BIW Design 1700649299Document24 pagesLightweight Concept BIW Design 1700649299Rajesh KrishnaNo ratings yet

- PFS - Investor Presentation - 18-Nov-22 - TickertapeDocument32 pagesPFS - Investor Presentation - 18-Nov-22 - TickertapeRajesh KrishnaNo ratings yet

- Existing Residence For Mr. Devaraju at Coimbatore: R O A DDocument1 pageExisting Residence For Mr. Devaraju at Coimbatore: R O A DRajesh KrishnaNo ratings yet

- Germany Job Seeker Visa: Complete Process OverviewDocument7 pagesGermany Job Seeker Visa: Complete Process OverviewRajesh KrishnaNo ratings yet

- Future Role of Hedge FundsDocument9 pagesFuture Role of Hedge FundsgenoNo ratings yet

- FIN555 Homework 4 SP19 SolutionDocument6 pagesFIN555 Homework 4 SP19 Solutionreiner satrioNo ratings yet

- Chapter 3 (Part 2)Document23 pagesChapter 3 (Part 2)Abo BakrNo ratings yet

- Consolidated Rules of Bursa Malaysia Securities BHDDocument323 pagesConsolidated Rules of Bursa Malaysia Securities BHDjerlson83No ratings yet

- CFAP 4 BFD Winter 2022Document6 pagesCFAP 4 BFD Winter 2022Ammar FatehNo ratings yet

- Options Futures and Other Derivatives 10th Edition Hull Test BankDocument25 pagesOptions Futures and Other Derivatives 10th Edition Hull Test BankTonyaWilliamswejr100% (40)

- Treasury and Risk Management SampleDocument62 pagesTreasury and Risk Management SampleFede0007No ratings yet

- TN DTTCDocument40 pagesTN DTTC050609211552No ratings yet

- Merrill Lynch FuturesDocument3 pagesMerrill Lynch Futuresmaginoo69No ratings yet

- ICT InfrastructureDocument38 pagesICT InfrastructureNatpro Cool100% (1)

- Glossary Ec SimplifiedDocument163 pagesGlossary Ec Simplifiedwomoli6850No ratings yet

- Maminco Sdn. Bhd. Scandal Case StudyDocument7 pagesMaminco Sdn. Bhd. Scandal Case Studymohd athoiNo ratings yet

- Problem Set 5: Futures, Options & Swaps Q1.: British Pound Futures, US$/pound (CME) Contract 62,500 PoundsDocument9 pagesProblem Set 5: Futures, Options & Swaps Q1.: British Pound Futures, US$/pound (CME) Contract 62,500 PoundsSumit GuptaNo ratings yet

- Narrative Report On International Financial ManagementDocument8 pagesNarrative Report On International Financial ManagementWang TomasNo ratings yet

- Capital MKTDocument42 pagesCapital MKTcpriyacpNo ratings yet

- Module 2 - Forwards & FuturesDocument84 pagesModule 2 - Forwards & FuturesSanjay PatilNo ratings yet

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocument28 pagesDerivatives and Foreign Currency: Concepts and Common TransactionsElle PaizNo ratings yet

- CH 01 The Investment SettingDocument56 pagesCH 01 The Investment Settingdwm1855100% (1)

- J Wings Finance PRJCTDocument51 pagesJ Wings Finance PRJCTPrince PurshiNo ratings yet

- Financial Institutions Management A Risk Management Approach 8Th Full ChapterDocument41 pagesFinancial Institutions Management A Risk Management Approach 8Th Full Chapterjessica.walsh233100% (29)

- Advanced - Quantitative - Finance With - C++ - Sample - ChapterDocument14 pagesAdvanced - Quantitative - Finance With - C++ - Sample - ChapterPackt PublishingNo ratings yet

- Uts Trading BlueprintDocument4 pagesUts Trading BlueprintBudi MulyonoNo ratings yet