Professional Documents

Culture Documents

De-Registration FAQ

Uploaded by

Marian Florin BaboeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

De-Registration FAQ

Uploaded by

Marian Florin BaboeCopyright:

Available Formats

De‐registration FAQ

Q: How does the process look like?

A: Once we have received the payment for the service, Avalara will first de‐register your VAT

number(s) and file any outstanding VAT returns you may have. If you are subscribed, you may be

asked to request catch‐up/retroactive returns with Amazon in order for us to complete all

outstanding fillings.

Detailed process can be found on the VAT de‐registration form.

Q: How long does the de‐registration process take?

A: The de‐registration times differ depending on the jurisdictions:

France up to 5 months

United Kingdom between 3‐10 working days

Poland up to 2 weeks

Czech Republic up to 1 month

Italy up to 2 months

Spain up to 3 months

Germany up to 3 months

Please note, these are the tax offices timelines and Avalara cannot speed up this process once the

de‐registration request has been sent to the tax authorities.

Q: How long will it take to complete my outstanding fillings?

A: All fillings will be completed according to the deadlines displayed on Seller Central. Whenever

applicable, if you are asked by us to request catch‐up/retroactive returns from Amazon, the sooner

this has been requested, the sooner we can start working on them and complete the process.

If you are unsubscribed, we will only be able to proceed with filling outstanding returns once we

have received all the required data. Any delays with providing those will also result in delayts

Q: Why am I asked to request catch‐up/retroactive returns with Amazon?

A: You may be asked to request catch‐up/retroactive returns from Amazon for different reasons.

Usually, the reason is that you have started activities in the country before you have been

onboarded with Avalara in which case these have not been filed by us. Other reasons include missing

payments to tax offices etc.

If you are subscribed, we can only file these once you have requested these periods with Amazon.

Q: I am asked to write the full date of when I stopped activities in the country, however I am still

trading in the country with my OSS number. What should I write?

A: In this case, we kindly ask you to write the full date of when you stopped all activities in the

country using the VAT number you wish to de‐register (not the OSS number).

Q: I have transferred/sold my account to another seller on Amazon, would that be a problem?

A: Please note, VAT Services by Amazon are not transferrable. Your Seller Central account is linked to

your VAT numbers and these cannot be changed. Any activity on these VAT numbers by new seller

will be linked to your name. If new seller needs VAT numbers, they need to sign up for a new

account on Amazon. We kindly ask you to get in touch with Amazon about this.

Q: I am unsubscribed from VAT Services by Amazon and am asked to provide multiple documents

– reports, POA etc. Why?

A: Once you unsubscribed from VAT Services by Amazon, Avalara has automatically stopped

completing fillings/VAT returns for you and revoked our POA, which may have resulted in

outstanding fillings in some/all countries. In order to file any outstanding returns, we need to

reinstate our POA with the tax authorities and receive data from you to complete all the returns.

That is why we may require from you to provide us with many documents.

Q: What happens if I don’t pay my invoice on time?

A: If you don’t pay your invoice on time, your de‐registration request will be archived accordingly

and you will need to go through the de‐registration process from the beginning.

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- How To Do A Self Employed Tax Return 2022Document15 pagesHow To Do A Self Employed Tax Return 2022Saint GNo ratings yet

- Minimum Payment Due: $62.00 New Balance: $4,144.92 Payment Due Date: 11/02/13Document3 pagesMinimum Payment Due: $62.00 New Balance: $4,144.92 Payment Due Date: 11/02/13nates280100% (1)

- Account Activity: Mar 18-Apr 19, 2011Document3 pagesAccount Activity: Mar 18-Apr 19, 2011Yusuf OmarNo ratings yet

- Self Employed DocumentDocument11 pagesSelf Employed DocumentapproachdirectNo ratings yet

- Billing ProcessDocument29 pagesBilling ProcessChandan Parsad100% (3)

- STMNT 112013 9773Document3 pagesSTMNT 112013 9773redbird77100% (1)

- Tax Mandate Letter - Anglo PDFDocument5 pagesTax Mandate Letter - Anglo PDFMark SilbermanNo ratings yet

- Revenue Recognition ConfigurationDocument5 pagesRevenue Recognition Configurationsheruf_aliNo ratings yet

- 1040 Engagement LetterDocument2 pages1040 Engagement LetterAshru AshrafNo ratings yet

- How Do I Reopen A Closed Cash App Account? Updated 2022Document7 pagesHow Do I Reopen A Closed Cash App Account? Updated 2022Cash App Closed AccountNo ratings yet

- Statement PDFDocument6 pagesStatement PDFNelson Lanyuy67% (3)

- Avalara Sales Tax GuideDocument10 pagesAvalara Sales Tax GuideJonathan ArcherNo ratings yet

- F 9465Document3 pagesF 9465Pat PlanteNo ratings yet

- 20140118053700Document3 pages20140118053700Jalal GogginsNo ratings yet

- P6 Tips and TricksDocument60 pagesP6 Tips and TrickssbtailorNo ratings yet

- AR Receivable Interview QuestionsDocument5 pagesAR Receivable Interview QuestionsKrishna Victory100% (1)

- Chapter 18 Audit of The Acquisition and Payment Cycle: Tests of Controls, Substantive Tests of Transactions, and Accounts PayableDocument7 pagesChapter 18 Audit of The Acquisition and Payment Cycle: Tests of Controls, Substantive Tests of Transactions, and Accounts Payableanon_821439789100% (3)

- Statement - 2014 06 05Document4 pagesStatement - 2014 06 05Sebastian WatersNo ratings yet

- Saving 5920Document5 pagesSaving 5920PhemmyDonOdumosu100% (2)

- Blank Petrol Bill ReceiptDocument12 pagesBlank Petrol Bill ReceiptSASI KUMARNo ratings yet

- Mandate LetterDocument6 pagesMandate LetterMark SilbermanNo ratings yet

- Austrian Practice of Natm Tunnelling Contracts 111221052038 Phpapp01Document18 pagesAustrian Practice of Natm Tunnelling Contracts 111221052038 Phpapp01laurenjiaNo ratings yet

- Po 328 34095420 0 UsDocument2 pagesPo 328 34095420 0 UsAnonymous SXTKyUsNo ratings yet

- Guideline VAT and Income Taxes For Uber Eats Couriers PDFDocument12 pagesGuideline VAT and Income Taxes For Uber Eats Couriers PDFAnonymous tOtqK2LWCL100% (1)

- Dewaa BillDocument3 pagesDewaa BillService SAVNo ratings yet

- Journal Entries of VATDocument4 pagesJournal Entries of VATSureshArigela0% (1)

- Auto Assessment 2Document6 pagesAuto Assessment 2Mark SilbermanNo ratings yet

- QC 16161Document12 pagesQC 16161john englishNo ratings yet

- FAQs About Registering As A Seller V10Document6 pagesFAQs About Registering As A Seller V10Karan SarvaiyaNo ratings yet

- Sa 150Document33 pagesSa 150shimogapradeepNo ratings yet

- Three Line AccountDocument3 pagesThree Line AccountkabulibazariNo ratings yet

- E Sugam LetterDocument2 pagesE Sugam Letterganga6013No ratings yet

- Faq ClaimsDocument5 pagesFaq ClaimsLeena NagpalNo ratings yet

- VAT RegistrationDocument23 pagesVAT RegistrationMT RANo ratings yet

- SAP Non PO ApprovalsDocument8 pagesSAP Non PO ApprovalsSudharsan PNo ratings yet

- Umbrella FAQDocument7 pagesUmbrella FAQKusuma NandiniNo ratings yet

- Freelance Payment Portal - A Summary For FreelancersDocument12 pagesFreelance Payment Portal - A Summary For FreelancersZenonNo ratings yet

- Oracle FAQsDocument15 pagesOracle FAQsjhakanchanjsrNo ratings yet

- ITR1 - Part 4 (Let Us File The Return)Document2 pagesITR1 - Part 4 (Let Us File The Return)gaurav gargNo ratings yet

- E-Filing Process Brief - Ver1Document16 pagesE-Filing Process Brief - Ver1Duniya da RajaNo ratings yet

- Expenses LetterDocument1 pageExpenses LettertalupurumNo ratings yet

- Chat Scripts 7.26.2023Document10 pagesChat Scripts 7.26.2023Astry BarriosNo ratings yet

- Directorate of Income Tax 20 SepDocument4 pagesDirectorate of Income Tax 20 SepOmkar KhanapureNo ratings yet

- File ITR 2Document8 pagesFile ITR 2Aman NarnawareNo ratings yet

- ItrDocument5 pagesItrdgdhandeNo ratings yet

- Checklist - New Company Compliance Set UpDocument3 pagesChecklist - New Company Compliance Set Upjimbrown123No ratings yet

- FAQs For CPC GrievanceDocument9 pagesFAQs For CPC GrievanceAabidNo ratings yet

- AP-How To Clear Receipt From The GR/IR When An Invoice Is Not ReceivedDocument4 pagesAP-How To Clear Receipt From The GR/IR When An Invoice Is Not ReceivedladmohanNo ratings yet

- Text 2Document2 pagesText 2SharonNo ratings yet

- Pay Taxation and HR Processes 2016 PDFDocument3 pagesPay Taxation and HR Processes 2016 PDFHafizur RahmanNo ratings yet

- Risk InvestigationDocument403 pagesRisk InvestigationNaguSwamyNo ratings yet

- Giving Your Business The Best Start With TaxDocument32 pagesGiving Your Business The Best Start With TaxdfasnedgeNo ratings yet

- Stripe Atlas Guide To Business TaxesDocument1 pageStripe Atlas Guide To Business TaxesKeyse BasoraNo ratings yet

- Some Questions Regarding E-Filling and Income Tax Return: 1. What Is E-Filing?Document8 pagesSome Questions Regarding E-Filling and Income Tax Return: 1. What Is E-Filing?omar_msNo ratings yet

- SpielsDocument7 pagesSpielsElyka RamosNo ratings yet

- Appeal For OCR (Order Cancellation Rate) TemplateDocument4 pagesAppeal For OCR (Order Cancellation Rate) Templateggmagaza1No ratings yet

- InvoicesDocument4 pagesInvoicesAbhijit PolNo ratings yet

- Payables Interview QuestionsDocument10 pagesPayables Interview QuestionsDanalakoti SuryaNo ratings yet

- Hsbcuk Account Closure FormDocument8 pagesHsbcuk Account Closure FormgaetanopetiNo ratings yet

- Accruals and Deferral Concept Is Used For Income and ExpenditureDocument3 pagesAccruals and Deferral Concept Is Used For Income and ExpenditureArchana KoreNo ratings yet

- 2012 ISA PackDocument12 pages2012 ISA Packinfo328750% (2)

- Tax Return HomeworkDocument7 pagesTax Return Homeworkerpx7jky100% (1)

- Tax Guide For New Companies (English)Document10 pagesTax Guide For New Companies (English)johnsolarpanelsNo ratings yet

- An Introduction To VATDocument3 pagesAn Introduction To VATSudipta MondalNo ratings yet

- Q&A v3Document5 pagesQ&A v3aaaaaaaaNo ratings yet

- Flow Chart General ProcedureDocument2 pagesFlow Chart General ProcedureLarimel ValdezNo ratings yet

- Authorisation Object ListDocument70 pagesAuthorisation Object Listsamirjoshi73No ratings yet

- Oracleapps Epicenter: Ar Deposit: Details, Setup, Flow, Accounting and ApiDocument5 pagesOracleapps Epicenter: Ar Deposit: Details, Setup, Flow, Accounting and ApiIrfan HussainNo ratings yet

- Muna Noor - OCEC Payment Plan InvoiceDocument1 pageMuna Noor - OCEC Payment Plan InvoiceMaryamsam SamNo ratings yet

- Formats & Procedures: Import of Capital GoodsDocument16 pagesFormats & Procedures: Import of Capital Goodsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Group Assignment TaxationDocument20 pagesGroup Assignment TaxationEnat Endawoke100% (1)

- Up Rustom II UavDocument25 pagesUp Rustom II UavLuptongaNo ratings yet

- Sem4 Complete FileDocument42 pagesSem4 Complete Fileghufra baqiNo ratings yet

- Faculty of Business Peace Leadership and Governance: Industrial Attachment Report Prepared byDocument22 pagesFaculty of Business Peace Leadership and Governance: Industrial Attachment Report Prepared byMunashe MuzambiNo ratings yet

- SG-Toolkit - Communications To Suppliers FINALDocument13 pagesSG-Toolkit - Communications To Suppliers FINALAnixNo ratings yet

- MS Sunitha Reddy GorreDocument1 pageMS Sunitha Reddy GorreAbiNo ratings yet

- AIS - Chap 5Document203 pagesAIS - Chap 5Nguyễn Khắc Quý HươngNo ratings yet

- Oracle Financials TheoryDocument173 pagesOracle Financials TheoryUdayraj SinghNo ratings yet

- FLP2399 Cert in Naval ArchitectureDocument4 pagesFLP2399 Cert in Naval ArchitectureSetyo ThreebNo ratings yet

- Auction Sales ProcessDocument6 pagesAuction Sales ProcessTapan PadhyNo ratings yet

- 03 e Measurement Book Ver 1.0Document40 pages03 e Measurement Book Ver 1.0TyagaraniNo ratings yet

- Tax Invoice: Sidharth Broadcasting Private LimitedDocument1 pageTax Invoice: Sidharth Broadcasting Private LimitedDinesh ChampatirayNo ratings yet

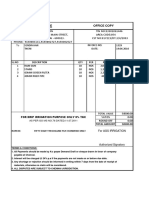

- Tax Invoice OfficeDocument1 pageTax Invoice OfficeAnonymous HdscNyJNo ratings yet

- AcON Pty, LTDDocument16 pagesAcON Pty, LTDTuba MirzaNo ratings yet

- INVOICE JULIADocument1 pageINVOICE JULIAJames AdamsNo ratings yet

- INS Form 1 December 7, 2019 Revision: 2 Page 1 of 6 PagesDocument2 pagesINS Form 1 December 7, 2019 Revision: 2 Page 1 of 6 PagesStacey Luvue42% (12)

- Sohail Resume DOTNETDocument4 pagesSohail Resume DOTNETAryan VermaNo ratings yet

- Gemc 511687719884749 25022022Document4 pagesGemc 511687719884749 25022022General ManagerNo ratings yet

- 14 PDFDocument15 pages14 PDFBindiya SalatNo ratings yet