Professional Documents

Culture Documents

1692674556155-VNGMD Updated Hold MAS 20230826EN Ed S

1692674556155-VNGMD Updated Hold MAS 20230826EN Ed S

Uploaded by

nguyennauy25042003Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1692674556155-VNGMD Updated Hold MAS 20230826EN Ed S

1692674556155-VNGMD Updated Hold MAS 20230826EN Ed S

Uploaded by

nguyennauy25042003Copyright:

Available Formats

August 22, 2023

[Vietnam] Logistics

Gemadept Corporation Hold

(GMD VN) (Maintain)

Divestment boosts profits TP: VND53,000

Upside: -2.2%

Mirae Asset Securities (Vietnam) JSC.

Chau Bui chau.bn@miraeasset.com.vn

Business update Jump in profits from Nam Hai Dinh Vu port (NHDV) divestment: In 2Q23, pressured by weak

export-import activities, Gemadept Corporation (GMD) recorded a 6.73% YoY drop in revenue,

reaching VND912.2bn. However, gross margin increased slightly, with gross profits nearly unchanged,

at VND430.7bn. The divestment of NHDV brought a financial profit of VND1,844bn. Profits from

financial activities soared to VND1,863.5bn in 2Q23 (vs. VND3.9bn in 2Q22). As a result, 2Q23 operating

profits and NPAT jumped dramatically, reaching respectively VND2,166.5bn (2Q22: VND364.1bn) and

VND1,711.5bn (2Q23: VND334.2bn). In 1H23, GMD recorded revenue of VND1,814.1bn (-2.3% YoY)

and NPAT of VND1,966.3bn (+200.7% YoY). Notably, gross margin from both seaport (45.3%) and

logistics businesses (52.8%) improved (1H22: 41.7% and 45.6%, respectively).

Associates saw mixed results: In 1H23, two of GMD’s main associates saw profits decline. 1H23

profits from SCSC Cargo Service Corporation (SCS VN) reached VND80.3bn (-26.5% YoY). GMD

recorded a loss of VND49.4bn from the Gemalink port (1H22: profit of VND69.3bn). By contrast,

logistics associates like CJ Gemadept Logistics Holdings (VND25.5bn; flat YoY) and “K” Line-Gemadept

(VND6.8bn; +33.3% YoY) maintained solid results.

Clearance volume fell: With weakened export-import activities, total volume passing through GMD’s

systems in 1H23 fell significantly to 1.33mn TEU (-16.8% YoY), of which Northern area volume

accounted for 515,000 TEU (-7.9% YoY) and Southern volume 815,000 TEU (-22.6% YoY).

Nam Dinh Vu Phase 2 (NDV2): In May 2023, NDV2 has been officially operated, which adds nearly

700,000 TEU into GMD container capacity. GMD aims to start NDV Phase 3 which is expected to be

completed in 2025.

2023 forecast Maintain 2023F revenue; increase 2023F NPAT: We expect export-import activities should improve

in 2H23, amid continued growth in key Vietnam export markets and signs of recovery in consumer

confidence. Thus, we maintain our 2023 revenue forecast of VND3,784.9bn (-3.3% YoY). Despite

significant profits from NHDV, as well as improvements in gross margin, profits from associates may

drop to VND279.5bn (-26.8% YoY; previous forecast VND611.7bn). We increased our 2023 NPAT

forecast to VND2,719.9bn (+135.1%; from previous VND2,389.4bn).

Recommendation Maintain VND53,000 TP and Hold rating: We used the discounted free cashflow for the firm (FCFF)

method to value GMD stock, with the following key assumptions: 1) A required rate of return of 14%;

2) a long-term growth rate of 5% from 2033; and 3) on-time completion of GMD’s key projects. Thus,

we maintain our VND53,000 target price and Hold rating for GMD.

Key data

(%) VN-Index GMD VN Share price (08/21/23, VND) 54,200 Market cap (VNDbn) 16,305

130

OP (23F, VNDbn) 3,113 Shares outstanding (mn) 301

110

Consensus OP (23F, VNDbn) 1,477 Free float (%) 96.0

90

EPS growth (23F, %) 155.6 Foreign ownership (%) 47.2

70

P/E (23F, x) 6.7 Beta (12M) 0.8

50

Market P/E (x) 16.2 52-week low (VND) 36,400

30

Aug 22 ct 22 Dec 22 Feb 23 Apr 23 Jun 23 Aug 23 VN-Index 1,178 52-week high (VND) 60,400

Share performance Earnings and valuation metrics

(%) 1M 6M 12M FY () FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 FY 2025

Absolute -5.9 3.6 5.3 Revenue (VNDbn) 2,606 3,206 3,916 3,785 4,130 4,235

Relative -5.2 -8.1 11.9 OP (VNDbn) 496.3 861.5 1,357 3,113 1,719 1,910

OP margin (%) 19.0 26.9 34.6 82.2 41.6 45.1

NPATMI (VNDbn) 371 621 994 2,339 1,338 1,495

EPS (VND) 1,166 1,930 3,037 7,761 4,438 4,960

ROE (%) 6.7 10.2 14.6 26.7 13.7 13.8

P/E (x) 42.0 26.6 14.9 6.7 11.8 10.5

P/B (x) 2.2 2.2 1.9 1.8 1.6 1.5

Source: Company data, Mirae Asset Securities (Vietnam) JSC Research estimates

PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES & DISCLAIMERS IN APPENDIX 1 AT THE END OF REPORT.

August 22, 2023 Gemadept Corporation

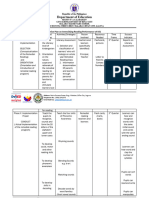

Table 1. Business results & forecast (VNDbn)

1H22 1H23 % YoY New 2023F Old 2023F Consensus Guidelines

Revenue 1,857.8 1,814.1 -2.3 3,784.9 3,784.9 3,831.7 3,920

Pre-tax profits 720.3 2,486.5 +245.2 3,052.7 2,703.1 2,801.6 1,136

Source: Company data, Bloomberg, Mirae Asset Vietnam Research

Table 2. Company guidelines vs. actual results (VNDbn)

Revenue Pre-tax profits

FY

Guidelines Actual % Difference Guidelines Actual % Difference

2019 2,800 2,643 -5.6 695 705 1.4

2020 2,150 2,606 21.2 500 513 2.5

2021 2,700 3,206 18.8 630 806 28.0

2022 3,800 3,916 3.0 1,000 1,308 30.8

Source: Company data, Mirae Asset Vietnam Research

Table 3. Valuation sensitivity (VND)

Required return on equity (%)

Long-term growth rate (%)

11.00 12.00 13.00 14.00 15.00 16.00 17.00

2.00 61,325 56,495 52,577 49,340 46,624 44,318 42,337

3.00 64,047 58,486 54,067 50,477 47,506 45,011 42,889

4.00 67,548 60,976 55,889 51,842 48,549 45,820 43,525

5.00 72,215 64,176 58,167 53,110 49,800 46,776 44,267

6.00 78,750 68,443 61,095 55,596 51,328 47,923 45,145

7.00 88,552 74,417 64,999 58,277 53,239 49,325 46,197

Source: Company data, Mirae Asset Vietnam Research

Mirae Asset Vietnam Research 2

August 22, 2023 Gemadept Corporation

Investment thesis, valuation, and risks

Gemadept Corporation (GMD VN/Hold/TP: VND53,000)

Investment thesis

Gemadept Corporation (GMD VN) is a leading logistics corporation in Vietnam with a system

of seaports, warehouses, and depots throughout the country. In which, GMD currently runs

the GML deep-water port in the Cai Mep – Thi Vai cluster, which is one of the few seaports

able to receive vessels of nearly 200,000 DTW. In addition, GMD also has a portfolio of

associates that cooperate in providing complete logistics solutions. In 2022, total container

volume through GMD’s system accounted for 12.5% of Vietnam’s total container clearance

volume.

Due to GMD’s dominant role in Vietnam’s seaport segment, it is well positioned to benefit

from the country’s trade growth.

Valuation

We used the discounted free cashflow for the firm (FCFF) method to value GMD stock, with

the following assumptions: 1) A required rate of return at 14%, as the Fed has hinted at a

further rise in the policy rate, despite a slowing pace of increase; 2) a long-term growth rate

of 5% from 2033; and 3) on-time completion of GMD’s key projects. Thus, we calculate the fair

value of GMD stock at VND53,000, and recommend a Hold rating.

Risks to rating and valuation

We believe the key risks to our Hold rating and valuation include:

- Changes in GMD new investment plans, divestment of rubber projects, and CAPEX

demand.

- Expansion in the Nam Dinh Vu and Lach Huyen areas and increased local competition.

- Weak demand in Vietnam’s key export markets, leading to lower clearance volume.

- Changes in unit service price, which is strictly controlled by the government.

Mirae Asset Vietnam Research 3

August 22, 2023 Gemadept Corporation

Gemadept Corporation (GMD VN)

Income statement (summarized) Balance sheet (summarized)

(VNDbn) 2022 2023 2024 2025 (VNDbn) 2022 2023 2024 2025

Revenue 3,915.6 3,784.9 4,130.1 4,235.2 Current assets 2,724.5 3,136.8 2,961.8 3,573.1

COGS -2,270.7 -2,235.3 -2,420.5 -2,491.0 Cash & Equivalents 1,428.3 1,985.3 1,706.9 2,286.7

Gross profits 1,644.9 1,549.6 1,709.6 1,744.2 Trading securities 17.9 17.9 17.9 17.9

Interest from financial activities 24.2 1,983.0 102.4 137.2 Receivables 975.6 946.2 1,032.5 1,058.8

Financial costs -177.7 -131.7 -119.4 -103.9 Inventories 82.2 72.7 79.3 81.3

Profits from associates 406.5 279.5 646.2 768.3 Other current assets 220.6 114.7 125.2 128.3

SG&A -541.3 -567.7 -619.5 -635.3 Non-current assets 10,465.9 11,393.7 11,851.6 12,406.4

Operating profits 1,356.6 3,112.7 1,719.3 1,910.5 PP&E 6,100.9 6,875.9 6,828.3 6,771.2

Other income -48.3 -60.0 -40.0 -40.0 Investment in associates 3,032.4 3,185.2 3,690.7 4,302.6

Pre-tax profits 1,308.3 3,052.7 1,679.3 1,870.5 Other long-term investments 37.5 37.5 37.5 37.5

Income tax -151.3 -332.8 -124.0 -132.3 Other non-current assets 1,295.1 1,295.1 1,295.1 1,295.1

After-tax profits 1,157.0 2,719.9 1,555.3 1,738.2 Total assets 13,190.4 14,530.5 14,813.4 15,979.5

Profits of controlling shareholders 995.0 2,339.1 1,337.6 1,494.9 Short-term Payables 2,767.7 2,018.6 1,321.6 1,355.3

Short-term debts 543.4 493.7 486.0 413.8

Long-term debts 1,486.2 1,337.5 1,188.9 1,040.3

Other long-term payables 386.5 386.5 386.5 386.5

Welfare fund 62.8 118.9 108.2 144.1

Total liabilities 5,246.6 4,355.3 3,491.3 3,340.0

Charter capital & funds 5,699.2 5,699.2 5,699.2 5,699.2

Retained earnings 1,228.2 3,078.8 4,008.0 5,081.9

Non-controlling interests 1,016.4 1,397.2 1,615.0 1,858.3

Equity 7,943.8 10,175.2 11,322.2 12,639.4

Total resources 13,190.4 14,530.5 14,813.5 15,979.5

Cash flow statement (summarized) Key valuation metrics/ratios

(VNDbn) 2022 2023 2024 2025 2022 2023 2024 2025

CFO 2,332.8 140.6 326.7 1,209.3 P/E (x) 14.9 6.7 11.8 10.5

After-tax income 1,157.0 2,719.9 1,555.3 1,738.2 P/B (x) 1.9 1.8 1.6 1.5

Depreciation & Amortization 375.6 418.6 438.1 458.1 EPS (VND) 3,037 7,761 4,438 4,960

Profits from investment activities -419.7 -2,262.5 -748.7 -905.5 BPS (VND) 22,986 29,126 32,209 35,773

Others -31.4 -131.0 -117.7 -83.7 DPS (VND) 1,200 1,000 1,000 1,000

Chg. in receivables -162.6 29.3 -86.3 -26.3 Revenue growth (%) 22.1 -3.3 9.1 2.5

Chg. in inventory -13.4 9.5 -6.6 -2.0 Operating profit growth (%) 57.5 129.4 -44.8 11.1

Chg. in other current assets 9.9 105.9 -10.5 -3.2 EPS growth (%) 62.5 155.6 -42.8 11.8

Chg. in payables 1,304.0 -749.1 -697.0 33.6 Dividend yield (%) 2.4 1.9 1.9 1.9

CFI -1,269.5 916.2 -147.3 -107.3 Accounts receivable turnover (x) 4.3 4.0 4.0 4.0

CAPEX -1,395.2 -1,193.5 -390.5 -401.0 Inventory turnover (x) 25.1 25.0 25.0 25.0

Inflow from liquidation 4.4 0.0 0.0 0.0 Accounts payable turnover (x) 0.9 0.9 1.5 1.5

Dividends received 173.7 2,109.7 243.1 293.6 ROA (%) 8.8 18.7 10.5 10.9

CFF -337.6 -499.7 -457.7 -522.1 ROE (%) 14.6 26.7 13.7 13.8

Inflow from share issuance 0.0 0.0 0.0 0.0 Accounts payable to equity (%) 34.8 19.8 11.7 10.7

Share buyback 0.0 0.0 0.0 0.0 Total debt to equity (%) 25.5 18.0 14.8 11.5

Net borrowing 90.6 -198.4 -156.3 -220.7 Interest coverage ratio (x) 8.6 24.6 15.4 19.4

Dividends -428.1 -301.4 -301.4 -301.4

Net CF 725.8 557.0 -278.4 579.8

Begin cash 659.3 1,428.3 1,985.3 1,706.9

End cash 1,428.3 1,985.3 1,706.9 2,286.7

Source: Company data, Mirae Asset Vietnam Research

Mirae Asset Vietnam Research 4

August 22, 2023 Gemadept Corporation

Appendix 1

Important disclosures and disclaimers

Two-year rating and TP history

Company Date Rating TP (VND)

(VND) GMD VN 12M target price

Gemadept Corporation 03/27/2023 HOLD 53,000

70,000

Gemadept Corporation 11/29/2022 BUY 57,000

60,000

Gemadept Corporation 07/04/2022 BUY 64,000

50,000

TRADING

Gemadept Corporation 05/30/2022 64,000

BUY 40,000

Gemadept Corporation 12/15/2021 HOLD 50,500 30,000

20,000

10,000

0

Aug 22 ct 22 Dec 22 Feb 23 Apr 23 Jun 23 Aug 23

Stock ratings Sector ratings

Buy Expected 12-month performance: +20% or greater Overweight Expected to outperform the market over 12 months

Trading Buy Expected 12-month performance: +10% to +20% Neutral Expected to perform in line with the market over 12 months

Hold Expected 12-month performance: -10% to +10% Underweight Expected to underperform the market over 12 months

Sell Expected 12-month performance: -10% or worse

Rating and TP history: Share price (─), TP (▬), Not Rated (■), Buy (▲), Trading Buy (■), Hold (●), Sell (◆)

* Our investment rating is a guide to the expected return of the stock over the next 12 months.

* Outside of the official ratings of Mirae Asset Daewoo Co., Ltd., analysts may call trading opportunities should technical or short-term material developments arise.

* The TP was determined by the research analyst through valuation methods discussed in this report, in part based on estimates of future earnings.

* TP achievement may be impeded by risks related to the subject securities and companies, as well as general market and economic conditions.

Analyst certification

The research analysts who prepared this report (the “Analysts”) are subject to Vietnamese securities regulations. They are neither registered as research

analysts in any other jurisdiction nor subject to the laws and regulations thereof. Opinions expressed in this publication about the subject securities and

companies accurately reflect the personal views of the Analysts primarily responsible for this report. MAS policy prohibits its Analysts and members of their

households from owning securities of any company in the Analyst’s area of coverage, and the Analysts do not serve as an officer, director or advisory board

member of the subject companies. Except as otherwise specified herein, the Analysts have not received any compensation or any other benefits from the

subject companies in the past 12 months and have not been promised the same in connection with this report. No part of the compensation of the Analysts

was, is, or will be directly or indirectly related to the specific recommendations or views contained in this report but, like all employees of MAS, the Analysts

receive compensation that is determined by overall firm profitability, which includes revenues from, among other business units, the institutional equities,

investment banking, proprietary trading and private client division. At the time of publication of this report, the Analysts do not know or have reason to know

of any actual, material conflict of interest of the Analyst or MAS except as otherwise stated herein.

Disclaimers

This report is published by Mirae Asset Securities (Vietnam) JSC (MAS), a broker-dealer registered in the Socialist Republic of Vietnam and a member of the

Vietnam Stock Exchanges. Information and opinions contained herein have been compiled in good faith and from sources believed to be reliable, but such

information has not been independently verified and MAS makes no guarantee, representation or warranty, express or implied, as to the fairness, accuracy,

completeness or correctness of the information and opinions contained herein or of any translation into English from the Vietnamese language. In case of

an English translation of a report prepared in the Vietnamese language, the original Vietnamese language report may have been made available to investors

in advance of this report.

The intended recipients of this report are sophisticated institutional investors who have substantial knowledge of the local business environment, its common

practices, laws and accounting principles and no person whose receipt or use of this report would violate any laws and regulations or subject MAS and its

affiliates to registration or licensing requirements in any jurisdiction shall receive or make any use hereof.

This report is for general information purposes only and it is not and shall not be construed as an offer or a solicitation of an offer to effect transactions in

any securities or other financial instruments. The report does not constitute investment advice to any person and such person shall not be treated as a client

of MAS by virtue of receiving this report. This report does not take into account the particular investment objectives, financial situations, or needs of individual

clients. The report is not to be relied upon in substitution for the exercise of independent judgment. Information and opinions contained herein are as of the

date hereof and are subject to change without notice. The price and value of the investments referred to in this report and the income from them may

depreciate or appreciate, and investors may incur losses on investments. Past performance is not a guide to future performance. Future returns are not

guaranteed, and a loss of original capital may occur. MAS, its affiliates and their directors, officers, employees and agents do not accept any liability for any

loss arising out of the use hereof.

MAS may have issued other reports that are inconsistent with, and reach different conclusions from, the opinions presented in this report. The reports may

reflect different assumptions, views and analytical methods of the analysts who prepared them. MAS may make investment decisions that are inconsistent

with the opinions and views expressed in this research report. MAS, its affiliates and their directors, officers, employees and agents may have long or short

positions in any of the subject securities at any time and may make a purchase or sale, or offer to make a purchase or sale, of any such securities or other

financial instruments from time to time in the open market or otherwise, in each case either as principals or agents. MAS and its affiliates may have had, or

may be expecting to enter into, business relationships with the subject companies to provide investment banking, market-making or other financial services

as are permitted under applicable laws and regulations.

No part of this document may be copied or reproduced in any manner or form or redistributed or published, in whole or in part, without the prior written

consent of MAS.

Mirae Asset Vietnam Research 5

August 22, 2023 Gemadept Corporation

Mirae Asset Securities International Network

Mirae Asset Securities Co., Ltd. (Seoul) Mirae Asset Securities (HK) Ltd. Mirae Asset Securities (UK) Ltd.

One-Asia Equity Sales Team Units 8501, 8507-8508, 85/F 41st Floor, Tower 42

Mirae Asset Center 1 Building International Commerce Centre 25 Old Broad Street,

26 Eulji-ro 5-gil, Jung-gu, Seoul 04539 1 Austin Road West London EC2N 1HQ

Korea Kowloon United Kingdom

Hong Kong

Tel: 82-2-3774-2124 Tel: 852-2845-6332 Tel: 44-20-7982-8000

Mirae Asset Securities (USA) Inc. Mirae Asset Wealth Management (USA) Inc. Mirae Asset Wealth Management (Brazil)

CCTVM

810 Seventh Avenue, 37th Floor 555 S. Flower Street, Suite 4410, Rua Funchal, 418, 18th Floor, E-Tower Building

New York, NY 10019 Los Angeles, California 90071 Vila Olimpia

USA USA Sao Paulo - SP

04551-060

Brazil

Tel: 1-212-407-1000 Tel: 1-213-262-3807 Tel: 55-11-2789-2100

PT. Mirae Asset Sekuritas Indonesia Mirae Asset Securities (Singapore) Pte. Ltd. Mirae Asset Securities (Vietnam) JSC

Equity Tower Building Lt. 50 6 Battery Road, #11-01 7F, Le Meridien Building

Sudirman Central Business District Singapore 049909 3C Ton Duc Thang St.

Jl. Jend. Sudirman, Kav. 52-53 Republic of Singapore District 1, Ben Nghe Ward, Ho Chi Minh City

Jakarta Selatan 12190 Vietnam

Indonesia

Tel: 62-21-515-3281 Tel: 65-6671-9845 Tel: 84-8-3911-0633 (ext.110)

Mirae Asset Securities Mongolia UTsK LLC Mirae Asset Investment Advisory (Beijing) Co., Beijing Representative Office

Ltd

#406, Blue Sky Tower, Peace Avenue 17 2401B, 24th Floor, East Tower, Twin Towers 2401A, 24th Floor, East Tower, Twin Towers

1 Khoroo, Sukhbaatar District B12 Jianguomenwai Avenue, Chaoyang District B12 Jianguomenwai Avenue, Chaoyang District

Ulaanbaatar 14240 Beijing 100022 Beijing 100022

Mongolia China China

Tel: 976-7011-0806 Tel: 86-10-6567-9699 Tel: 86-10-6567-9699 (ext. 3300)

Shanghai Representative Office Ho Chi Minh Representative Office Mirae Asset Capital Markets (India) Private Limited

38T31, 38F, Shanghai World Financial Center 7F, Saigon Royal Building Unit No. 506, 5th Floor, Windsor Bldg., Off CST

100 Century Avenue, Pudong New Area 91 Pasteur St. Road, Kalina, Santacruz (East), Mumbai – 400098

Shanghai 200120 District 1, Ben Nghe Ward, Ho Chi Minh City India

China Vietnam

Tel: 86-21-5013-6392 Tel: 84-8-3910-7715 Tel: 91-22-62661336

Mirae Asset Vietnam Research 6

You might also like

- 02 - Mucor Spp.Document17 pages02 - Mucor Spp.Ivan Bandiola100% (1)

- Designing, Evaluating, and Validating SOP TrainingDocument7 pagesDesigning, Evaluating, and Validating SOP Trainingramban11No ratings yet

- Written Analysis of Case Study RDocument5 pagesWritten Analysis of Case Study RZia JuttNo ratings yet

- STB 2023 AgmDocument4 pagesSTB 2023 AgmLinh NguyenNo ratings yet

- 1683626985785-EN CTD Update 2Q23 Ed SDocument7 pages1683626985785-EN CTD Update 2Q23 Ed Snguyennauy25042003No ratings yet

- Gemadept Corporation: Maintain The RecoveryDocument7 pagesGemadept Corporation: Maintain The RecoveryDinh Minh TriNo ratings yet

- 1699933620936-EN NLG Update 4Q23 Hold Ed SDocument5 pages1699933620936-EN NLG Update 4Q23 Hold Ed Snguyennauy25042003No ratings yet

- TCB 1Q23 ResultsDocument4 pagesTCB 1Q23 ResultsLinh NguyenNo ratings yet

- HAG-2Q23 BriefDocument3 pagesHAG-2Q23 Briefnguyennauy25042003No ratings yet

- GMD - 20240320Document4 pagesGMD - 20240320phatNo ratings yet

- Viet Capital CTD@VN CTD-20221130-MPDocument13 pagesViet Capital CTD@VN CTD-20221130-MPĐức Anh NguyễnNo ratings yet

- Net Profit Surged in 2Q20: FlashnoteDocument5 pagesNet Profit Surged in 2Q20: FlashnoteVan Luong LuuNo ratings yet

- JS Com. Bank For Foreign Trade of Vietnam: Hold On The ThroneDocument7 pagesJS Com. Bank For Foreign Trade of Vietnam: Hold On The ThroneDinh Minh TriNo ratings yet

- 1695805182922-Stockrecommendation Oct2023 MAS ENDocument15 pages1695805182922-Stockrecommendation Oct2023 MAS ENnguyennauy25042003No ratings yet

- Solid Growth Momentum Maintains in 2H21: Bamboo Capital JSC (BCG) UpdateDocument15 pagesSolid Growth Momentum Maintains in 2H21: Bamboo Capital JSC (BCG) UpdateHoàng Tuấn AnhNo ratings yet

- VJC AviationDocument9 pagesVJC AviationTony ZhangNo ratings yet

- A Challenging Outlook - Cut To Hold: Company FocusDocument14 pagesA Challenging Outlook - Cut To Hold: Company FocusDuc BuiNo ratings yet

- IP COAL - PTBA - 26 Aug 2022Document6 pagesIP COAL - PTBA - 26 Aug 2022rizky lazuardiNo ratings yet

- CTD-20211125-MP VietcapDocument15 pagesCTD-20211125-MP VietcapĐức Anh NguyễnNo ratings yet

- HPG Brief 3q23engDocument4 pagesHPG Brief 3q23engnguyennauy25042003No ratings yet

- Gem Riverside To Support 2022 Growth Outlook: Dat Xanh Group (DXG) (BUY +56.0%) Update ReportDocument14 pagesGem Riverside To Support 2022 Growth Outlook: Dat Xanh Group (DXG) (BUY +56.0%) Update ReportLê Chấn PhongNo ratings yet

- Ciptadana Results Update 1H22 UNTR 29 Jul 2022 Reiterate Buy UpgradeDocument7 pagesCiptadana Results Update 1H22 UNTR 29 Jul 2022 Reiterate Buy UpgradeOnggo iMamNo ratings yet

- Bluedart Q3FY24 Result UpdateDocument8 pagesBluedart Q3FY24 Result UpdatedarshanNo ratings yet

- Sagar Cement 0121 NirmalBangDocument10 pagesSagar Cement 0121 NirmalBangSunilNo ratings yet

- BUMI - Initiation ReportDocument15 pagesBUMI - Initiation ReportBrainNo ratings yet

- Refrigeration Electrical Engineering Corporation: The Specter of CovidDocument8 pagesRefrigeration Electrical Engineering Corporation: The Specter of CovidDinh Minh TriNo ratings yet

- AmInv 95622347Document5 pagesAmInv 95622347Lim Chau LongNo ratings yet

- Asian-Paints Broker ReportDocument7 pagesAsian-Paints Broker Reportsj singhNo ratings yet

- Earnings Release 3Q22 1Document12 pagesEarnings Release 3Q22 1Yousif Zaki 3No ratings yet

- Vinhomes JSC: Maintaining Leadership PositionDocument10 pagesVinhomes JSC: Maintaining Leadership PositionTam NguyenNo ratings yet

- CT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Document11 pagesCT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Imran ansariNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- MM Forgings (Q1FY24 Result Update) - 15-Aug-2023Document10 pagesMM Forgings (Q1FY24 Result Update) - 15-Aug-2023instiresmilanNo ratings yet

- Coteccons Construction JSC: Back To The RaceDocument5 pagesCoteccons Construction JSC: Back To The RaceDinh Minh TriNo ratings yet

- CJ Century Logistics Holdings Berhad: TP: RM0.95Document3 pagesCJ Century Logistics Holdings Berhad: TP: RM0.95SirPojiNo ratings yet

- Ciptadana Result Update 1H23 ADRO 24 Aug 2023 Maintain Buy LowerDocument7 pagesCiptadana Result Update 1H23 ADRO 24 Aug 2023 Maintain Buy Lowerrajaliga.inggerisNo ratings yet

- SAWAD230228RDocument8 pagesSAWAD230228RsozodaaaNo ratings yet

- Mirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaDocument7 pagesMirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaekaNo ratings yet

- Ciptadana Results Update 1H23 BBTN 21 Jul 2023 Maintain Buy TP Rp2Document8 pagesCiptadana Results Update 1H23 BBTN 21 Jul 2023 Maintain Buy TP Rp2ekaNo ratings yet

- Viet Capital CTD@VN CTD-20221101-EarningFlashDocument4 pagesViet Capital CTD@VN CTD-20221101-EarningFlashĐức Anh NguyễnNo ratings yet

- Tata Motors (TTMT IN) : Q1FY21 Result UpdateDocument6 pagesTata Motors (TTMT IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- CIFC - Q1FY22 Result Update - 03082021 - 03-08-2021 - 14Document7 pagesCIFC - Q1FY22 Result Update - 03082021 - 03-08-2021 - 14Rojalin SwainNo ratings yet

- Pinduoduo (PDD US) : Well Positioned For Upcoming RecoveryDocument4 pagesPinduoduo (PDD US) : Well Positioned For Upcoming RecoveryAbhimanyu SinghNo ratings yet

- Grasim Industries: Results Above Estimates-Maintain ACCUMULATEDocument7 pagesGrasim Industries: Results Above Estimates-Maintain ACCUMULATEcksharma68No ratings yet

- Ssi - Antm 2022 04 21 enDocument5 pagesSsi - Antm 2022 04 21 enGo William GunawanNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Adro Mirae 02 Nov 2023 231102 150020Document9 pagesAdro Mirae 02 Nov 2023 231102 150020marcellusdarrenNo ratings yet

- Sanghvi Movers: Compelling ValuationsDocument9 pagesSanghvi Movers: Compelling Valuationsarun_algoNo ratings yet

- NH Korindo Sekuritas PGAS - Top and Bottom Line Recovers in 3Q20Document6 pagesNH Korindo Sekuritas PGAS - Top and Bottom Line Recovers in 3Q20Hamba AllahNo ratings yet

- Bản tin IR Q3.2023 (ENG)Document12 pagesBản tin IR Q3.2023 (ENG)nhungoc3028No ratings yet

- Ultratech Cement (UTCEM IN) : Q1FY21 Result UpdateDocument6 pagesUltratech Cement (UTCEM IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Bank Rakyat Indonesia: 4Q20 Review: Better-Than-Expected EarningsDocument7 pagesBank Rakyat Indonesia: 4Q20 Review: Better-Than-Expected EarningsPutri CandraNo ratings yet

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateDocument6 pagesAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyNo ratings yet

- Vcscacv 20230213 MPDocument12 pagesVcscacv 20230213 MPlinhatranNo ratings yet

- Prabhudas LiladharDocument6 pagesPrabhudas LiladharPreet JainNo ratings yet

- KEC International 01 01 2023 PrabhuDocument7 pagesKEC International 01 01 2023 Prabhusaran21No ratings yet

- BRS End of The Week Results Snapshot - 21.10.2022Document9 pagesBRS End of The Week Results Snapshot - 21.10.2022Sudheera IndrajithNo ratings yet

- Itmg - 2021 03 04 IdDocument4 pagesItmg - 2021 03 04 IdFaiz CapturexNo ratings yet

- NVL 20230210 AmDocument5 pagesNVL 20230210 AmNgocduc NgoNo ratings yet

- JK Lakshmi Cement 18062019Document6 pagesJK Lakshmi Cement 18062019saran21No ratings yet

- Indigo - 4QFY21 - HSIE-202106081507125073883Document9 pagesIndigo - 4QFY21 - HSIE-202106081507125073883Sanchit pandeyNo ratings yet

- Vietnam Today: VN-Index Jumps To 10-Month High As Financial Tickers Continue To SurgeDocument20 pagesVietnam Today: VN-Index Jumps To 10-Month High As Financial Tickers Continue To SurgeHoàng Thịnh NguyễnNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- EI 22sep9 US CPIDocument8 pagesEI 22sep9 US CPInguyennauy25042003No ratings yet

- HPG Brief 3q23engDocument4 pagesHPG Brief 3q23engnguyennauy25042003No ratings yet

- Topic 6 - Relevant Information For Decision MakingDocument53 pagesTopic 6 - Relevant Information For Decision Makingnguyennauy25042003No ratings yet

- HAG-2Q23 BriefDocument3 pagesHAG-2Q23 Briefnguyennauy25042003No ratings yet

- P-752 Unit14Document80 pagesP-752 Unit14Pourang EzzatfarNo ratings yet

- Summative Assessment For Tle 9 SampleDocument2 pagesSummative Assessment For Tle 9 SampleTeacher ClaireNo ratings yet

- 500 ML GBL, 500 ML GBL CleanerDocument2 pages500 ML GBL, 500 ML GBL CleanerbuygblcleanersNo ratings yet

- Ili RiverDocument4 pagesIli RiverRathiJyothiNo ratings yet

- Bell's Palsy - Symptoms and Causes - Mayo ClinicDocument6 pagesBell's Palsy - Symptoms and Causes - Mayo ClinicRoxan PacsayNo ratings yet

- Kinder Catch Up Friday Action PlanDocument4 pagesKinder Catch Up Friday Action PlanAriane PimentelNo ratings yet

- Grammar of PaintingDocument366 pagesGrammar of PaintingKarla Mollinedo100% (1)

- About Sheepdog Church Security Equipment?Document2 pagesAbout Sheepdog Church Security Equipment?hmareidNo ratings yet

- ABEM Terraloc Pro User ManualDocument101 pagesABEM Terraloc Pro User ManualMichael KazindaNo ratings yet

- Be InspiredDocument50 pagesBe InspiredBenMaddieNo ratings yet

- Newshound MagazineDocument24 pagesNewshound MagazineLovely BeconiaNo ratings yet

- 11 Doing Task-Based Teaching PDFDocument4 pages11 Doing Task-Based Teaching PDFDewa PutraNo ratings yet

- Holden Trailblazer 284082Document9 pagesHolden Trailblazer 284082Luke AustinNo ratings yet

- 400 Bad Request 400 Bad Request Nginx/1.2.9Document16 pages400 Bad Request 400 Bad Request Nginx/1.2.9thepraetorionNo ratings yet

- Gujarat Technological University: Mechanical Engineering (19) SUBJECT CODE: 2161903Document3 pagesGujarat Technological University: Mechanical Engineering (19) SUBJECT CODE: 2161903Bhavesh PatelNo ratings yet

- Bagi CHAPTER 2 - Ema Rohmah - 12431009 - Bhs - Inggris PDFDocument14 pagesBagi CHAPTER 2 - Ema Rohmah - 12431009 - Bhs - Inggris PDFnadia nur ainiNo ratings yet

- TEXT WORK Breakdown From Complete Stanislavski ToolkitDocument3 pagesTEXT WORK Breakdown From Complete Stanislavski ToolkitVj KamiloNo ratings yet

- Avinash Singh: Most Proud of ExperienceDocument2 pagesAvinash Singh: Most Proud of ExperienceAvinash SinghNo ratings yet

- How Old Is The Man Who Wrote The Letter?Document4 pagesHow Old Is The Man Who Wrote The Letter?Solis GerardoNo ratings yet

- Lecture-II Basics of Reinforced Concrete DesignDocument61 pagesLecture-II Basics of Reinforced Concrete Designjs kalyana rama100% (1)

- Notes On Molecular Orbital CalculationDocument170 pagesNotes On Molecular Orbital CalculationFreeWill100% (1)

- Preventing Early PregnancyDocument18 pagesPreventing Early PregnancyJoyce AlipayNo ratings yet

- Automatic Yield Management SystemDocument5 pagesAutomatic Yield Management SystemDavidBozinNo ratings yet

- BPM Technology TaxonomyDocument55 pagesBPM Technology TaxonomyKan FB100% (1)

- Aquatic EcosystemsDocument16 pagesAquatic Ecosystemsapi-323141584No ratings yet

- Linked ListDocument6 pagesLinked Listdarshancool25No ratings yet

- EDEM 506 Activity No. 1 - Compare and Contrast MatrixDocument5 pagesEDEM 506 Activity No. 1 - Compare and Contrast MatrixD-Lyca Fea SalasainNo ratings yet