Professional Documents

Culture Documents

Civics Grade 12 Chapter 9

Uploaded by

Nardose Teshome0 ratings0% found this document useful (0 votes)

7 views4 pagesOriginal Title

Civics Grade 12 chapter 9

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views4 pagesCivics Grade 12 Chapter 9

Uploaded by

Nardose TeshomeCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Addis Ababa city Administration Education Bureau

“Education at Home” Program Unit summery Note

Subject: Civics and Ethics Education

GRADE: 12th

UNIT NINE: SAVING

• Saving is the habit of using money and other resource wisely and not spending money

(resource).

• Saving refers the habit of keeping (setting aside something out one’s own present earning for

future time earning.)

• Savings is the portion of income not spent on current expenditures.

• Mathematically it can be expressed as income minus consumption.

• Saving can be making meaningful by developing the habit of planning and proper utilization

of resources like money, time and even labor.

• Income: is the money that you earn (take in) and have available to spend.

• Expenses: are thing on which you spend money.

1. Fixed expense: are expenses that one has to pay regularly?

2. Flexible expense: are expenses that do not occur regularly or not always the same amount?

• Saving account: is an account that holds the money you deposit.

• Interest: is money that banks pay you at regular intervals (monthly or annually).

• Wealth: is a total accumulated property for a long period of time

• Budget: is a plan for using the money you have. It is a set of guideline to use money wisely.

Form/ way of saving

• Cash saving: refers keeping money in modern banks when the availability of modern financial

institution is widespread,

• Tangible assets: like livestock, crops, gold etc. in traditional financial institution is risky.

Use of saving:

• For emergency purpose (for time of sickness temporary/permanent disability).

• For social obligations i.e. weeding, ceremonies & holidays.

• For nurturing and educating children

• For increasing (boost) income

• For future consumption

• For improvement of their lives (make life more comfortable)

• For special needs of the family

• For enjoyment or refreshment

• For buy a big thing also at large

Good money managers understand the important of living within their income and learn to

budget and live on their budget.

Steps of budgeting (to make plan) to spending saving money are:

Determine income: budget starting form identify the source and amount of income

Record expenses: Using a small note book writes down (record) each amount your activity

spends money for a period of time

1 | planning is a primary activity for any action

Create a plan: based on your short- term and long term goal use money wisely by giving

priorities to save for achieving a goal. Plan is a set of decision about what and how to do

something to reach one’s goal

Stick to your plan: refers checking you budget regularly to see you are staying within plan or

not.

Financial institution:

1. Formal (modern) financial institutions

It includes banks, credit union (association), insurance companies, micro –finance institution etc.

Banks are institution used to deposit money

Advantage of banks is

• Secured (grunted) or save money in are and insured place

• It is Quick to withdrawal/convenient to withdraw money if needed.

• Earning interest (external money)

2. Informal (traditional) financial institution

• Ikub: is a periodically rotating community saving and credit institution. In ikub members

receiving large sum at some point in agree time

• Ider: is a none- profitable community saving institution for emergency cases

Traditional practice that affect saving: The level of saving is mainly related with the level of

income.

1. Extravagance:

Extravagance is the habit of spending (using resource in an uncontrolled way)

2. Absence of family planning:

• Family is a group of people related with by blood and marriage (live together)

• Family planning: is a deliberative and voluntary decision about reproduction increases

awareness about medical service, health family life and to avoid un wanted pregnancies

• Contraception: Is a method (deliberate action) using drugs like pills, condoms, and fertility

awareness other birth control techniques to prevent UN planed pregnancy and limit the number of

children.

3. religion dogmatism:

Religious dogmatism refers the attitude of believers to accept what is parched as an established

fact without questioning about its effect.

Modern saving practice

1. Economical use of income and material

• Economical use of materials and income is an indispensable factor in leading a successful life

• Wasting income refers spending income on goods services without assessing their alternative

selling price.

• To lead a meaningful life avoiding wastage of income and materials.

2. Reducing extravagance practice

• Traditional excessive consumption and extravagance practice is a factor that has contribution for

low level of saving. Then to reduce extravagance awareness creation through media & idir is

necessary.

3. Family planning: Family planning is the only solution to limiting or controlling the birth rate

(high rate of population growth and high dependency ration).

2 | planning is a primary activity for any action

4. Planned life–style: Avoid unnecessary expenditure and acting accordingly to lead successful,

health and self –fulfilling life. Saving is impossible without planning.

A. Saving institution: To keep (deposit) a large amount of money in saving institution than

putting in pocket.

B. Resource management and planning: Resources are things like material, human and natural

resource. Used to achieve our goal

Managing resource: Resource management refers using resource wisely and involves four steps.

1. planning: is a precondition (primary) for any action

It is most important to manage (use) resource more effectively, efficiently properly and

successfully

2. Organizing: rearranging what we will do. organizing process has three steps:

• develop a schedule

• assemble the needed resource

• prepare to act

3.Implementing: after planning & organizing you must ready to precede your plan to done.

At the end out the plan in to action

1.monitor the plan and your progress

4. Evaluating: when the task is completed the next management process is evaluating the

task. i.e.

• evaluating the plan

• evaluating the performance

5. proper use of public utilities:

Public utilities are social services known as electricity, water supply transportation and

communication and communication facilities that help people to live better.

• Conservation: is a mechanism of protecting resource to life. Then we can avoid wasting

water by using water conservation.

Ways to conserve water are

• Use after with minimum amount

• Don’t run unnecessarily

• Close pipe tightly after use

• Don’t throw any garbage (plastic material) in to running water

• Energy is the resource for producing usable power like electricity, gas fuel oil, fuel – wood

etc.

• The purpose of energy is to produced light, to serve as fuel, to pump water, to drive

vehicles

Advices (tips) for proper use of electric energy (conserving energy) are:

i. turn off lights, TV sets, radios and appliances

ii. replace high –wastage bulbs with low –wastage bulbs

iii. use fluorescent bulbs (use less energy than other bulb

Remember:

• Planning, conservation, preservation and substitutions are among the useful and possible

ways of saving.

• Credit associations, banks and other financial institutions are among the national agents

which work hard to encourage investment.

3 | planning is a primary activity for any action

• IMF and World Bank on the other hand are the two most powerful institutions with

primary objective of poverty reduction.

• Saving means doesn’t spend more than you earn and make priority list of your

expenditures.

4 | planning is a primary activity for any action

You might also like

- Consumer Stuff For Kids A Teaching and Learning ResourceDocument121 pagesConsumer Stuff For Kids A Teaching and Learning ResourceSimpliciusNo ratings yet

- Financial PlanningDocument18 pagesFinancial PlanningckzeoNo ratings yet

- Financial LiteracyDocument27 pagesFinancial LiteracyLea E Hondrade100% (3)

- 1 Welcome Financial LiteracyDocument13 pages1 Welcome Financial LiteracyKhosrow KhazraeiNo ratings yet

- Gamma Engine - I20Document20 pagesGamma Engine - I20Reza Varamini100% (4)

- Money Saving Strategies: Laura Connerly, PH.D., Assistant Professor - Family and Consumer EconomicsDocument5 pagesMoney Saving Strategies: Laura Connerly, PH.D., Assistant Professor - Family and Consumer EconomicsAhmedinNo ratings yet

- KG 102 Rev 7Document131 pagesKG 102 Rev 7GusNo ratings yet

- Partial Molar Heat Content and Chemical Potential, Significance and Factors Affecting, Gibb's-Duhem EquationDocument11 pagesPartial Molar Heat Content and Chemical Potential, Significance and Factors Affecting, Gibb's-Duhem EquationRhakhoNo ratings yet

- VAC Financial Literacy NotesDocument19 pagesVAC Financial Literacy NotesDaksh Gautam92% (13)

- Rec 670Document158 pagesRec 670gfdNo ratings yet

- Leroy Somer ALTERNATORDocument18 pagesLeroy Somer ALTERNATORroozbehxoxNo ratings yet

- Finacial LiteracyDocument49 pagesFinacial LiteracyAngel kaye RafaelNo ratings yet

- Financial LiteracyDocument26 pagesFinancial LiteracylottyNo ratings yet

- 03 Budgeting and Your Financial HealthDocument75 pages03 Budgeting and Your Financial Healthlight247_1993100% (1)

- Learning Module In: Personal FinanceDocument6 pagesLearning Module In: Personal FinanceRomelen Caballes CorpuzNo ratings yet

- Household Resource ManagementDocument35 pagesHousehold Resource ManagementKring DonaireNo ratings yet

- Tle-Household Resource ManagementDocument8 pagesTle-Household Resource ManagementJ-anne Valentin Huerto100% (3)

- Personal Finance 1-10Document329 pagesPersonal Finance 1-10Sonali Nahata100% (2)

- Business FinanceDocument5 pagesBusiness FinanceRizzie Feal BalquinNo ratings yet

- SavingDocument11 pagesSavingAmmar KiderNo ratings yet

- 3rd Quarter Quarter Civic Note Grade 10Document3 pages3rd Quarter Quarter Civic Note Grade 10G and B Family building100% (1)

- Antim Prahar 2024 Financial Planning and Tax ManagementDocument41 pagesAntim Prahar 2024 Financial Planning and Tax Managementyipej24216No ratings yet

- Processes of Management GRADE 8Document36 pagesProcesses of Management GRADE 8felmcdonald14No ratings yet

- Educ 204 REPORT. Chapter4 - Last Sub. TopicDocument11 pagesEduc 204 REPORT. Chapter4 - Last Sub. TopicJeallea S. AenlleNo ratings yet

- Week 1 Intro To Household FMDocument29 pagesWeek 1 Intro To Household FMThanaselan PunichelvanaNo ratings yet

- FamilybudgetingDocument30 pagesFamilybudgetingNeethu VincentNo ratings yet

- Household Resource ManagementDocument33 pagesHousehold Resource ManagementKaiRae Asakura0% (1)

- Familybudgeting 140117071008 Phpapp01 141004043430 Conversion Gate01 PDFDocument30 pagesFamilybudgeting 140117071008 Phpapp01 141004043430 Conversion Gate01 PDFjhenilyn ramosNo ratings yet

- SEC Personal Financial PlanningDocument13 pagesSEC Personal Financial PlanningJagriti100% (3)

- Btech Economics Updated Study Material Till 8th Feb 2022-WedDocument106 pagesBtech Economics Updated Study Material Till 8th Feb 2022-WedJashanpreet SinghNo ratings yet

- Module 05: Designing A Personal Budget: Topics To Be CoveredDocument6 pagesModule 05: Designing A Personal Budget: Topics To Be CoveredA.g. ShakibNo ratings yet

- Student Budget Guide-Iit BombayDocument3 pagesStudent Budget Guide-Iit Bombay6103.parth.kesharwaniNo ratings yet

- MoneymattersguideDocument28 pagesMoneymattersguideBrian JonesNo ratings yet

- A. The Concept of Home EconomicsDocument5 pagesA. The Concept of Home EconomicsHya Balasabas - Dagangan100% (1)

- Opmelect3 Module1 Personal Financial Planning 2023 2024Document70 pagesOpmelect3 Module1 Personal Financial Planning 2023 2024JOHANNA GRACE JAVELLANA RADANNo ratings yet

- Group Project V, P, RDocument16 pagesGroup Project V, P, R1073vaishnav pawarNo ratings yet

- Amjid 3Document17 pagesAmjid 3jaish khanNo ratings yet

- Chapter One 2Document4 pagesChapter One 2Eyuel SintayehuNo ratings yet

- H.E. 6-Week 1Document66 pagesH.E. 6-Week 1Maria Menie RachoNo ratings yet

- F.1 LS Topic 1 Managing Finance and Sensible Consumption (Stu)Document14 pagesF.1 LS Topic 1 Managing Finance and Sensible Consumption (Stu)s2023076No ratings yet

- Q2 W 2 PERSONAL FINANCE Part 2Document36 pagesQ2 W 2 PERSONAL FINANCE Part 2Jas ZyNo ratings yet

- Project PlanningDocument11 pagesProject PlanningPaulino ShainneNo ratings yet

- TextDocument1 pageTexthaboonsaleeban331No ratings yet

- Financial PlanningDocument10 pagesFinancial PlanningPaul James Mazo GabayNo ratings yet

- Dfi 201 Chapter One Lecture 1Document21 pagesDfi 201 Chapter One Lecture 1raina mattNo ratings yet

- CHP4 - Low ResDocument24 pagesCHP4 - Low ResJunaid ZafarNo ratings yet

- HeleDocument8 pagesHelecountryball80No ratings yet

- Managerial 1Document136 pagesManagerial 1reda gadNo ratings yet

- Topic One: Introduction General OverviewDocument27 pagesTopic One: Introduction General OverviewKelvin mwaiNo ratings yet

- Updated PCTP SBP 23Document154 pagesUpdated PCTP SBP 23Precious Onyeka OkoyeNo ratings yet

- 6 Financial LiteracyDocument7 pages6 Financial LiteracyELDREI VICEDONo ratings yet

- ECON1220 (Midterms)Document492 pagesECON1220 (Midterms)meganyaptanNo ratings yet

- Economics 6 Sept-2Document61 pagesEconomics 6 Sept-2Tavnish SinghNo ratings yet

- CFPB Your-Money-Your-Goals Savings Plan Tool 2018-11 ADADocument3 pagesCFPB Your-Money-Your-Goals Savings Plan Tool 2018-11 ADAbutterNo ratings yet

- Chapter 4Document19 pagesChapter 4Michelle DiazNo ratings yet

- Laikka Mae Gabuat (BENLACE)Document3 pagesLaikka Mae Gabuat (BENLACE)hazelgenovanaNo ratings yet

- Planning: Prof. Mithun Kumar GuhaDocument27 pagesPlanning: Prof. Mithun Kumar GuhaArya LuckyNo ratings yet

- TLE6 H.E. Q2 W1 Fillable - Sittie Aine MacatbarDocument9 pagesTLE6 H.E. Q2 W1 Fillable - Sittie Aine MacatbarAljun Alag RollanNo ratings yet

- Competency 2 AdditionalDocument13 pagesCompetency 2 AdditionalDan Jave Dumpa100% (1)

- Different Types of Finance: (Anoushka Agarwal-1920234)Document3 pagesDifferent Types of Finance: (Anoushka Agarwal-1920234)bts foreverNo ratings yet

- Creating A Student Budget Guide PDFDocument4 pagesCreating A Student Budget Guide PDFCasazdNo ratings yet

- B. J. M. College of Nursing. B. J. M. College of Nursing. B. J. M. College of Nursing. B. J. M. College of NursingDocument31 pagesB. J. M. College of Nursing. B. J. M. College of Nursing. B. J. M. College of Nursing. B. J. M. College of Nursingshubham rathodNo ratings yet

- Module 1Document5 pagesModule 1Dana MobayedNo ratings yet

- Lab Manual Fluid Mechanics & Hydraulics: Mehran University of Engineering and Technology, JamshoroDocument75 pagesLab Manual Fluid Mechanics & Hydraulics: Mehran University of Engineering and Technology, JamshoroBais JumaniNo ratings yet

- Ts Eamcet: Question Paper 2017Document39 pagesTs Eamcet: Question Paper 2017songa akashNo ratings yet

- EWS 3 User Guide C BDocument4 pagesEWS 3 User Guide C Bchn_rakesh3120No ratings yet

- High Flow NAMUR Valve G1/4" & G1/2": For Control of Pneumatic ActuatorsDocument20 pagesHigh Flow NAMUR Valve G1/4" & G1/2": For Control of Pneumatic ActuatorsIon FloareaNo ratings yet

- GIET University Department of Basic Scence and Humanities Engineering ChemistryDocument3 pagesGIET University Department of Basic Scence and Humanities Engineering ChemistryARI ESNo ratings yet

- Physical Sciences GR 11 Exam Guidelines 2024 EngDocument28 pagesPhysical Sciences GR 11 Exam Guidelines 2024 Engnthabisengmemory258No ratings yet

- Alternator FR Signal Circuit TroubleshootingDocument4 pagesAlternator FR Signal Circuit TroubleshootingLazarus GutaNo ratings yet

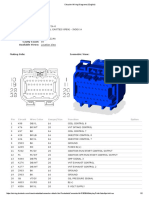

- Pin Circuit Wire Color Gauge/Size Function OptionDocument2 pagesPin Circuit Wire Color Gauge/Size Function OptionFabricio TavaresNo ratings yet

- TS0138 BMW Series1 ECM-MisfireDocument1 pageTS0138 BMW Series1 ECM-MisfireWanu MatibeNo ratings yet

- HL - 90 InstallationDocument30 pagesHL - 90 InstallationEcu318seNo ratings yet

- WITH SOLUTIONS Open Channel and Alternate Stages of FlowDocument43 pagesWITH SOLUTIONS Open Channel and Alternate Stages of FlowMark PulongbaritNo ratings yet

- J300, J4ATS, J7ATS Transfer Switches 260, 400, and 600 Amp SizesDocument8 pagesJ300, J4ATS, J7ATS Transfer Switches 260, 400, and 600 Amp SizesNina SakuraNo ratings yet

- Revision Notes - Unit 2 AQA Chemistry A-LevelDocument16 pagesRevision Notes - Unit 2 AQA Chemistry A-LevelWajid AliNo ratings yet

- Addressing Dewatering Challenges With Intelligent Drive Solutions MiningDocument2 pagesAddressing Dewatering Challenges With Intelligent Drive Solutions MiningKrrishNo ratings yet

- Peyras Et Al 1992Document11 pagesPeyras Et Al 1992Valter AlbinoNo ratings yet

- Eccentric Vibratory Mills - Theory and Practice: Eberhard Gock, Karl-Eugen KurrerDocument9 pagesEccentric Vibratory Mills - Theory and Practice: Eberhard Gock, Karl-Eugen KurrerNikita BogdanovNo ratings yet

- You Are Writing A Research Paper On Energy Policy in The United StatesDocument9 pagesYou Are Writing A Research Paper On Energy Policy in The United Statesgvzrg8jy100% (1)

- Importance of Human Resource Management in An Organization: By: Amulya PDocument7 pagesImportance of Human Resource Management in An Organization: By: Amulya PVarshini NagarajuNo ratings yet

- Methods, Processes and Equipment Involved in Manufacturing SteelDocument22 pagesMethods, Processes and Equipment Involved in Manufacturing SteelNiño Gerard JabagatNo ratings yet

- Practice Test 004Document4 pagesPractice Test 004Nguyễn Thu HươngNo ratings yet

- IELTS Writing Task 1 Sample - Bar Chart - ZIMDocument3 pagesIELTS Writing Task 1 Sample - Bar Chart - ZIMHuy Hoàng DươnghhNo ratings yet

- Orocco and Estern Ahara: by Philip A. SzczesniakDocument6 pagesOrocco and Estern Ahara: by Philip A. SzczesniakouarraqNo ratings yet

- PQT Chapter 2 - Atomic Structure and Interatomic BondingDocument25 pagesPQT Chapter 2 - Atomic Structure and Interatomic BondingNguyễn Việt TiếnNo ratings yet

- Development of Switched Reluctance Traction Drive For Belaz 7513Document2 pagesDevelopment of Switched Reluctance Traction Drive For Belaz 7513amir sadighiNo ratings yet

- Annex7 PDF PDFDocument14 pagesAnnex7 PDF PDFrajarao001No ratings yet