Professional Documents

Culture Documents

Wage and Tax Statement: Copy 1-For State, City, or Local Tax Department

Wage and Tax Statement: Copy 1-For State, City, or Local Tax Department

Uploaded by

Vicky KeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wage and Tax Statement: Copy 1-For State, City, or Local Tax Department

Wage and Tax Statement: Copy 1-For State, City, or Local Tax Department

Uploaded by

Vicky KeCopyright:

Available Formats

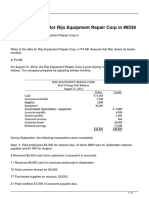

a Employee’s social security number

22222 XXX XX 6004 OMB No. 1545-0008

xxx

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

630578682

82,911.82 16,489.03

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Royal Auto Group 6,946.26

5 Medicare wages and tips 6 Medicare tax withheld

3400 Black Horse Pike, Had-

don Township, NJ 08107 1,624.53

7 Social security tips 8 Allocated tips

179.78

d Control number 9 10 Dependent care benefits

100.83

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a

C

Eddie D Lovett o

d

e

13 Statutory Retirement Third-party 12b

employee plan sick pay C

111 Heather St, Browns Mills, o

d

NJ 08015 e

14 Other 12c

C

o

d

e

12d

C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

63057868200 3,784.23

Form W-2 Wage and Tax Statement

Copy 1—For State, City, or Local Tax Department

2022 Department of the Treasury—Internal Revenue Service

a Employee’s social security number

VOID

XXX XX 6004 OMB No. 1545-0008

xxx

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

630578682 82,911.82 16,489.03

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Royal Auto Group 6,946.26

5 Medicare wages and tips 6 Medicare tax withheld

3400 Black Horse Pike, Had-

don Township, NJ 08107 1,624.53

7 Social security tips 8 Allocated tips

179.78

d Control number 9 10 Dependent care benefits

100.83

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

Eddie D Lovett o

d

e

13 Statutory Retirement Third-party 12b

Royal Auto Group employee plan sick pay C

o

d

e

111 Heather St, Browns Mills,

NJ 08015 14 Other 12c

C

o

d

e

12d

C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

63057868200 3,784.23

Form W-2

Copy D—For Employer

Wage and Tax Statement 2023 Department of the Treasury—Internal Revenue Service

For Privacy Act and Paperwork Reduction

Act Notice, see separate instructions.

You might also like

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageWage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesse Nichols100% (1)

- Untitled 3Document1 pageUntitled 3Gregory SMithNo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008SuheilNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- 2021 W2 Angela LiDocument1 page2021 W2 Angela LiDAISY CRAINNo ratings yet

- 2021 W2 Marcus RobertsDocument1 page2021 W2 Marcus RobertsDAISY CRAINNo ratings yet

- Wage and Tax StatementDocument10 pagesWage and Tax Statementjennamayer2No ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- Annemarie BednarDocument3 pagesAnnemarie BednarSmerling PaulinoNo ratings yet

- w2 FINALDocument10 pagesw2 FINALmuhammad mudassarNo ratings yet

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSADocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSAJohn LNo ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument1 pageWage and Tax Statement: Copy C-For Employee'S RecordslidiaNo ratings yet

- 2021 W2 Edgar FloresDocument1 page2021 W2 Edgar FloresDAISY CRAINNo ratings yet

- Edgar Flores W-2 FormDocument1 pageEdgar Flores W-2 Formethannguyen939No ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerGlendaNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008jacqueline corral0% (1)

- w2 PDFDocument6 pagesw2 PDFNEKRONo ratings yet

- W-2 Wage and Tax Statement: J-EE Ret - 1983.18Document1 pageW-2 Wage and Tax Statement: J-EE Ret - 1983.18what is thisNo ratings yet

- w2-2020 Fillabalbe BlankDocument1 pagew2-2020 Fillabalbe Blankmuhammad mudassarNo ratings yet

- W-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageW-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesus GarciaNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerIgnacio Manzanares EstebanNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerhossain ronyNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerAlberto R. JuarezNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerdtoxidNo ratings yet

- Magnum Management Corp One Cedar Point DR Sandusky Oh 44870Document7 pagesMagnum Management Corp One Cedar Point DR Sandusky Oh 44870Hermes Andrés LugmañaNo ratings yet

- Wage and Tax Statement: White Stone Construction, Inc 5052 49TH ST Woodside Ny 11377Document1 pageWage and Tax Statement: White Stone Construction, Inc 5052 49TH ST Woodside Ny 11377Isaac OlagbemisoyeNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- IRS Form W2Document2 pagesIRS Form W2nurulamin00023No ratings yet

- XXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084Document6 pagesXXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084CR FNo ratings yet

- Magnum Management Corp 8039 Beach BLVD Buena Park Ca 90620Document7 pagesMagnum Management Corp 8039 Beach BLVD Buena Park Ca 90620SamNo ratings yet

- Main Irs Form W 2 Wage and Tax StatementDocument11 pagesMain Irs Form W 2 Wage and Tax Statementjeffery lamarNo ratings yet

- W2Form 2020Document10 pagesW2Form 2020bassomassi sanogoNo ratings yet

- Pyw223s EeDocument1 pagePyw223s EeSean KingNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerJessi EliasNo ratings yet

- 61 F 28319 Bcac 1Document1 page61 F 28319 Bcac 1MickeyNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document4 pagesWage and Tax Statement: OMB No. 1545-0008jgoldson235No ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerHot HeartsNo ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument3 pagesWage and Tax Statement: Copy C-For Employee'S RecordsyoNo ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- 2020 W2 FormDocument7 pages2020 W2 FormMaria HowellNo ratings yet

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- W2 DataDocument2 pagesW2 Dataahasgahsg031No ratings yet

- US Internal Revenue Service: Fw2as - 2001Document12 pagesUS Internal Revenue Service: Fw2as - 2001IRSNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- IRS W-2 (2007v) by Forms in Word 1-29-07Document11 pagesIRS W-2 (2007v) by Forms in Word 1-29-07MARIELLE ZIZZANo ratings yet

- XXX-XX-8635 1486.48 105.99: Wage and Tax StatementDocument6 pagesXXX-XX-8635 1486.48 105.99: Wage and Tax Statementsheyla vergaraNo ratings yet

- Takoya Carter-Navy-Federal-Credit-Union-August - StatementDocument4 pagesTakoya Carter-Navy-Federal-Credit-Union-August - StatementVicky KeNo ratings yet

- Piedmont Urgent Care-1Document1 pagePiedmont Urgent Care-1Vicky KeNo ratings yet

- Piedmont Urgent Care-1Document1 pagePiedmont Urgent Care-1Vicky KeNo ratings yet

- HMC Urgent Care Dearborn-1Document1 pageHMC Urgent Care Dearborn-1Vicky KeNo ratings yet

- Navy Federal Credit Union August StatementDocument4 pagesNavy Federal Credit Union August StatementVicky Ke100% (1)

- Carmenceita S2Document1 pageCarmenceita S2Vicky KeNo ratings yet

- GST Calu-Aug-19 PDFDocument1 pageGST Calu-Aug-19 PDFLokambal RNo ratings yet

- Simple GST Invoice For Single Rate of Goods and ServicesDocument8 pagesSimple GST Invoice For Single Rate of Goods and ServicesKM computer & online workNo ratings yet

- CPA Reg Practice Individual TaxationDocument2 pagesCPA Reg Practice Individual TaxationMatthew AminiNo ratings yet

- Question bank-BBA 208-Income Tax by Dr. Preeti JindalDocument2 pagesQuestion bank-BBA 208-Income Tax by Dr. Preeti JindalDrPreeti JindalNo ratings yet

- Section 45B of GST 1990Document1 pageSection 45B of GST 1990786_haiderNo ratings yet

- Autoland Subic MotorsDocument2 pagesAutoland Subic MotorsGuile Gabriel AlogNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- ACCA ATX Paper Sep 2018Document16 pagesACCA ATX Paper Sep 2018Dilawar HayatNo ratings yet

- The Accounting Records of Steven Corp A Real Estate Developer PDFDocument2 pagesThe Accounting Records of Steven Corp A Real Estate Developer PDFFreelance WorkerNo ratings yet

- SA300622Document1 pageSA300622JEFF WONNo ratings yet

- Offer Letter BalwantDocument1 pageOffer Letter Balwanthranjalisharma95No ratings yet

- Concentrix Daksh Services India Private Limited Payslip For The Month of March - 2024Document1 pageConcentrix Daksh Services India Private Limited Payslip For The Month of March - 2024Joydip SahaNo ratings yet

- Contoh Tax CalcDocument2 pagesContoh Tax CalcswippyNo ratings yet

- GST Update 18.11.2017Document39 pagesGST Update 18.11.2017sridharanNo ratings yet

- Query Results - 1Document13 pagesQuery Results - 1arnoldvkNo ratings yet

- Digest RR 14-2001 PDFDocument1 pageDigest RR 14-2001 PDFCliff DaquioagNo ratings yet

- Taxation Law Review Notes 2021 DR LIMDocument5 pagesTaxation Law Review Notes 2021 DR LIMMJ Cadlaon SecretariaNo ratings yet

- Refer To The Data For Rijo Equipment Repair Corp inDocument2 pagesRefer To The Data For Rijo Equipment Repair Corp inMiroslav Gegoski0% (1)

- (See Rule - ) Registration Certificate Issued Under SectionDocument4 pages(See Rule - ) Registration Certificate Issued Under SectionAnonymous gabKypRNo ratings yet

- Rule: Income Taxes: Consolidated Return Regulations— Section 108 Application To Consolidated Group Members Indebtedness Income DischargeDocument17 pagesRule: Income Taxes: Consolidated Return Regulations— Section 108 Application To Consolidated Group Members Indebtedness Income DischargeJustia.comNo ratings yet

- Rmo 43-90 PDFDocument5 pagesRmo 43-90 PDFRieland Cuevas67% (3)

- Section 5 of Income Tax ActDocument4 pagesSection 5 of Income Tax ActParth PandeyNo ratings yet

- Ranchi Po Box - State Post Code Fax - Telephone - CityDocument1 pageRanchi Po Box - State Post Code Fax - Telephone - CityImranNo ratings yet

- 1 - PRELIMINARY-Q - As - AFTER SESSION 4Document6 pages1 - PRELIMINARY-Q - As - AFTER SESSION 4Mighty SinghNo ratings yet

- Declaration 206AB and 206CCA For Vendor & CustomerDocument2 pagesDeclaration 206AB and 206CCA For Vendor & CustomerAbhimanyu100% (1)

- SSPOFADVDocument1 pageSSPOFADVfreddieaddaeNo ratings yet

- Mukan Dan Ji - 233 - 14-04-2021Document1 pageMukan Dan Ji - 233 - 14-04-2021Sudharshan KaushikNo ratings yet

- 2022-05-29T19-16 Transaction #4974283512683938-9956431Document2 pages2022-05-29T19-16 Transaction #4974283512683938-9956431Rupesh AsthanaNo ratings yet

- BC 604, Income Tax Law & Practice, 2022Document12 pagesBC 604, Income Tax Law & Practice, 2022davusingh786No ratings yet

- Laws of Taxation in TanzaniaDocument508 pagesLaws of Taxation in TanzaniaRuhuro tetere100% (3)