Professional Documents

Culture Documents

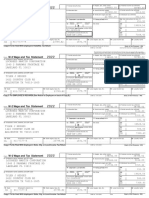

Edgar Flores W-2 Form

Edgar Flores W-2 Form

Uploaded by

ethannguyen939Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Edgar Flores W-2 Form

Edgar Flores W-2 Form

Uploaded by

ethannguyen939Copyright:

Available Formats

a Employee's social security number For Official Use Only

123-XX-XXXX OMB No. 1545-0008

b Employer Identification Number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

12-XXXXXXX $5,505.00 $336.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social secuity tax withheld

$5,505.00 $341.31

5 Medicare wages and tips 6 Medicare tax withheld

$5,505.00 $79.82

Wynwood Pool Cleaning

999 Spellman Ave. 7 Social security tips 8 Allocated tips

Los Angeles, CA 90004

d Control number 9 10 Dependent care benefits

e Employee's first name and initial Last name Suff. 11 Nonqualfied plans 12a See instructions for box 12

C

o

d

e

Statutory Retirement Third-party

13 employee plan sick pay 12b

C

o

d

e

14 Other 12c

C

o

d

e

12d

EDGAR J. FLORES C

111 West Main St. o

d

Los Angeles, CA 90004 e

f Employee's address and ZIP code

15 State Employer's State ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

CA 12-XXXXXXX $5,505.00 $55.05

Department of the Treasury - IRS

2023

You might also like

- 5S Audit Check Sheet: Department: - Completed By: - Supervisor: - DateDocument1 page5S Audit Check Sheet: Department: - Completed By: - Supervisor: - DateP K Senthil Kumar50% (4)

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageWage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesse Nichols100% (1)

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008SuheilNo ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument1 pageWage and Tax Statement: Copy C-For Employee'S RecordslidiaNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- W-2 Wage and Tax Statement: J-EE Ret - 1983.18Document1 pageW-2 Wage and Tax Statement: J-EE Ret - 1983.18what is thisNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerhossain ronyNo ratings yet

- Magnum Management Corp One Cedar Point DR Sandusky Oh 44870Document7 pagesMagnum Management Corp One Cedar Point DR Sandusky Oh 44870Hermes Andrés LugmañaNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- Bars Performance AppraisalDocument6 pagesBars Performance AppraisalPhillip Miler0% (1)

- Ardra Syam - MBA17012 - Business Law EXAMDocument3 pagesArdra Syam - MBA17012 - Business Law EXAMmanasrmohantyNo ratings yet

- 2021 W2 Edgar FloresDocument1 page2021 W2 Edgar FloresDAISY CRAINNo ratings yet

- 2021 W2 Angela LiDocument1 page2021 W2 Angela LiDAISY CRAINNo ratings yet

- 2021 W2 Marcus RobertsDocument1 page2021 W2 Marcus RobertsDAISY CRAINNo ratings yet

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerIgnacio Manzanares EstebanNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerAlberto R. JuarezNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSADocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSAJohn LNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008jacqueline corral0% (1)

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerdtoxidNo ratings yet

- Wage and Tax Statement: Copy 1-For State, City, or Local Tax DepartmentDocument2 pagesWage and Tax Statement: Copy 1-For State, City, or Local Tax DepartmentVicky KeNo ratings yet

- Main Irs Form W 2 Wage and Tax StatementDocument11 pagesMain Irs Form W 2 Wage and Tax Statementjeffery lamarNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerJessi EliasNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerHot HeartsNo ratings yet

- 61 F 28319 Bcac 1Document1 page61 F 28319 Bcac 1MickeyNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerGlendaNo ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- Wage and Tax StatementDocument10 pagesWage and Tax Statementjennamayer2No ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- Wage and Tax Statement: White Stone Construction, Inc 5052 49TH ST Woodside Ny 11377Document1 pageWage and Tax Statement: White Stone Construction, Inc 5052 49TH ST Woodside Ny 11377Isaac OlagbemisoyeNo ratings yet

- w2 PDFDocument6 pagesw2 PDFNEKRONo ratings yet

- US Internal Revenue Service: Fw2as - 2001Document12 pagesUS Internal Revenue Service: Fw2as - 2001IRSNo ratings yet

- Annemarie BednarDocument3 pagesAnnemarie BednarSmerling PaulinoNo ratings yet

- XXX-XX-8635 1486.48 105.99: Wage and Tax StatementDocument6 pagesXXX-XX-8635 1486.48 105.99: Wage and Tax Statementsheyla vergaraNo ratings yet

- w2 FINALDocument10 pagesw2 FINALmuhammad mudassarNo ratings yet

- LA w2 NewDocument1 pageLA w2 Newchde795No ratings yet

- Untitled 3Document1 pageUntitled 3Gregory SMithNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- XXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084Document6 pagesXXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084CR FNo ratings yet

- w2-2020 Fillabalbe BlankDocument1 pagew2-2020 Fillabalbe Blankmuhammad mudassarNo ratings yet

- W2 DataDocument2 pagesW2 Dataahasgahsg031No ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- IRS Form W2Document2 pagesIRS Form W2nurulamin00023No ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- Magnum Management Corp 8039 Beach BLVD Buena Park Ca 90620Document7 pagesMagnum Management Corp 8039 Beach BLVD Buena Park Ca 90620SamNo ratings yet

- W2Form 2020Document10 pagesW2Form 2020bassomassi sanogoNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument1 pageWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atHenry KilmekNo ratings yet

- Your 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2Document7 pagesYour 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2bassomassi sanogoNo ratings yet

- US Internal Revenue Service: fw2 - 2001Document12 pagesUS Internal Revenue Service: fw2 - 2001IRSNo ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- IRS W-2 (2007v) by Forms in Word 1-29-07Document11 pagesIRS W-2 (2007v) by Forms in Word 1-29-07MARIELLE ZIZZANo ratings yet

- Pyw223s EeDocument1 pagePyw223s EeSean KingNo ratings yet

- Your 2021 Forms W-2 Are EnclosedDocument7 pagesYour 2021 Forms W-2 Are Enclosednethpas622No ratings yet

- A Reflection On Organizational ChartDocument2 pagesA Reflection On Organizational ChartRachel Martin0% (1)

- Report On Industrial Visit: Hindusthan National Glass & Industries Limited RishraDocument11 pagesReport On Industrial Visit: Hindusthan National Glass & Industries Limited RishrabhubaneshwariNo ratings yet

- Shinde R.Document8 pagesShinde R.rutuja shindeNo ratings yet

- Written CommunicationDocument3 pagesWritten CommunicationJericho PedragosaNo ratings yet

- Starting An Employment Agency in Singapore - Recruitment Agency, Staffing AgencyDocument6 pagesStarting An Employment Agency in Singapore - Recruitment Agency, Staffing Agencyyssrinidhi_556880879No ratings yet

- Technical Recruiter Job DescriptionDocument2 pagesTechnical Recruiter Job Descriptiontmack1972No ratings yet

- 6 - Human Resources ManagementDocument47 pages6 - Human Resources ManagementMinh NguyệtNo ratings yet

- Review of Literature: Misra, K.K (1974) - Labour Welfare in Indian Industries, Meerut, Meenakshi PrakashanDocument36 pagesReview of Literature: Misra, K.K (1974) - Labour Welfare in Indian Industries, Meerut, Meenakshi PrakashanalwinNo ratings yet

- Research JollibeeDocument15 pagesResearch JollibeeOMAYOMAYNo ratings yet

- Introduction of Apple. Inc.: (Nature and Experiences)Document11 pagesIntroduction of Apple. Inc.: (Nature and Experiences)Vi AtilanoNo ratings yet

- Data Analysis Ant Interpretation TABLE 4.1 Age of The RespondentDocument46 pagesData Analysis Ant Interpretation TABLE 4.1 Age of The RespondenteswariNo ratings yet

- HRM - Unit 1Document23 pagesHRM - Unit 1Preeti BhaskarNo ratings yet

- Case Study in MGT15Document3 pagesCase Study in MGT15Mikkoy18No ratings yet

- Compensation at Ali Akbar GroupDocument13 pagesCompensation at Ali Akbar GroupHaroon Z. ChoudhryNo ratings yet

- 11Document2 pages11Anna CiciNo ratings yet

- Case Study 2 - The Restructuring of Voltas LimitedDocument3 pagesCase Study 2 - The Restructuring of Voltas LimitedChandrasekhar Kotillil0% (1)

- Jeopardy Study Guide-Human ResourcesDocument2 pagesJeopardy Study Guide-Human ResourcesSofíaNo ratings yet

- Emails Between Linda Blumkin, Rachel Lakin at BEAS and John Martin at Licensing UnitDocument55 pagesEmails Between Linda Blumkin, Rachel Lakin at BEAS and John Martin at Licensing UnitRebecca LavoieNo ratings yet

- PantaloonsDocument7 pagesPantaloonsapi-335697758No ratings yet

- Managing The Cause of Work Related Stress (HSE)Document62 pagesManaging The Cause of Work Related Stress (HSE)Nurfitria Rahman Pipit100% (1)

- Maintenance Manpower PDFDocument15 pagesMaintenance Manpower PDFNaeem IqbalNo ratings yet

- HR Carter Cleaning Case 4Document5 pagesHR Carter Cleaning Case 4Hussein ElsawafNo ratings yet

- Employee Turnover 104Document28 pagesEmployee Turnover 104Rogil Jacob DanielNo ratings yet

- Organizational Reward System PDFDocument74 pagesOrganizational Reward System PDFjamil AhmadNo ratings yet

- Promotion Policy - Guidelines - 2 PDFDocument6 pagesPromotion Policy - Guidelines - 2 PDFMehtab Ahmed100% (1)

- A Step-By-Step Guide To Outsourcing Your HRDocument18 pagesA Step-By-Step Guide To Outsourcing Your HRInsperityNo ratings yet

- ATH TechnologiesDocument3 pagesATH TechnologiesAnurag PGXPM15No ratings yet