Professional Documents

Culture Documents

MOU

MOU

Uploaded by

Sukumar Nayak0 ratings0% found this document useful (0 votes)

10 views9 pagesOriginal Title

MOU (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views9 pagesMOU

MOU

Uploaded by

Sukumar NayakCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

MEMORANDUM OF UNDERSTANDINGOMOL) ARRIVED AT

Page 1 of 12

BETWEEN THE

MANAGEMENT OF FOOD CORPORATION OF INDIA AND BHARTIVA KHADYA

NIGAM KARAMCHARI SANG

FCLON REVISED WAGE STRUCTURE

al

12:

14

RECOGNISED UNION AT ALL INDIA LEV

IN

PREAMBLE

WHEREAS the existing wage structure of Category III & IV employees of the Corporation

in Industrial Dearness Allowance pattern was revised as per Memorandum of Settlement

signed on 01.04.2010 for the period 01.01.2007 to 31.12.2016.

WHEREAS the Bhartiya Khadya Nigam Karamehari Sangh (BKNK Sangh) submitted

their Charter of Demands relating to revision of wage w.e.f, 01.01.2017. allowances and

other benefits vide its letters no. BKNKS/GS/NEC/2018 dated 30.01.2018 and 01.08.2018,

letter no, BENKS/NEC/ GS/ 2018 dated 23.07.2018.

WHEREAS in furtherance of the objective to arrive at a mutually agreed revised wage

structure w.e.f. 01.01.2017 based on the aforesaid Charters of Demands. Bipartite

negotiations with the Nationally recognized Union of Category III & IV employees and the

Management were commenced on 23" July, 2018 towards achieving a complete wage

settlement and to come to an amicable understanding in these matters.

The last wage revision being operative for a period of 10 years i.e. from 01.01.2007 to

31.12.2016, this Memorandum of Understanding (MOU) for wage settlement is now done

for a period of 10 years w.e.f, 01.01.2017 to 31.12,2026. as per the Department of Public

Enterprises (DPE) guidelines issued vide OM no. W-02/0015/2016-DPE(WC)-GL-

XXIV/17 dated 24.11.2017 and MOCAF&PD, New Delhi letter no, 17012/5/2017-FC-I!t

dated 28.06.2018 regarding wage policy for the 8” Round of Wage Negotiations for

workmen in Central Public Sector Enterprises (CPSES)

NOW as a result of the protracted discussions held during various rounds of negotiations, a

Memorandum of Understanding (MOU) has been reached in full and final settlement of

various demands contained in respective Charter of Demands. The term of which are set

out in the following paragraphs:-

Contd...

Jat She

Tiles as ( de

1%

Kee? my Be?

Cc “\\ .

pacts

Page 2 of 12

TERMS OF UNDERSTANDING

2. APPLICABILITY

This MOU shall cover all regular Category IIL & IV employees on IDA pay scales.

2.1, PERIOD OF OPERATION

The MOU shall cover the period effective from 01.01.2017 and operate till 31.12.2026 (10years)

LES OF PAY

The revised scales of pay effective from 01.01.2017 corresponding to the existing (pre-

revised) pay scales are as und

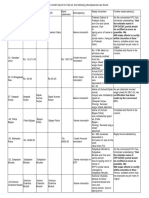

Scale Existing scales (Rs.) Revised scales (Rs.)

No.

S- 8100-18070 ae 23300 - 64000

S-2 8300-19710 a 24000 - 70000

8-3 8500-20580 24700-72000

S-4 8900-22100 26200 - 76300

S-5 9300-22940 28200 - 79200

86 {9900-25530 30500 - 88100

S-7 11100-29950 34000 - 103400.

S-8 13300-31050 36000 - 107200

a

Sipe

cz Le

* — Ber et?

(6 >

Contd.

tn Sheri

reo

\. fees

of

aod Abn < Fa

Lae! gin & Owacm 7 ssa

Page 3 of 12

3. METHODOLOGY FOR PAY FIXATION

3.L.a. ‘To arrive at the revised Basie Pay(BP) as on 11.2017. fitment methodology shall be as.

under:

A B e 1 D

| Revised BP as

O1.01,.2017)°

BasicPay + | | Industrial Dearness_ 115% of | | Agprepate amount |

Stagnation + Allowance (IDA) @ 119.5% | (A+B) | = | rounded off to the

Increment (s) as || as applicable on 1.12017 +, || next Rs.10/-,

| on 31.12.2016 (under the IDA pattern |

| (Personal Pay computation methodology |

/Special Pay not |_| linked to All India 1 |

| tobe included) | Cumulative Price Index

| (AICPI) 200)

00 series} |

eT case revised BP as on 01.01.2017 arrived so is less than the minimum of

pay scale, Pay will be fixed at the minimum of the revised pay scale.

3.1.b. Bunching of Pay, if applicable, shall be dealt as per the instruction issued by DPE vide

Annexure III(A) of OM No. W-02/0028/2017-DPE(WC)-GL-XIII/17 dated 03.08.2017

as amended from time to time.

3.2. After fixation of pay as per clause 3.1, the employees will be eligible for annual increment

in revised scale of pay as on 01.01.2017 @ 3% of revised basic pay and will be rounded off

to the next multiple of Rs.10.

y

be

The employees who have joined or shall be joining the services on or after 01.01.2017 will

be placed in the revised pay scales at the minimum of the scale from the date of their

joining, Such employees will not be eligible for the fitment benefit under the pay revision

4. ANNUAL INCREMENT

‘The annual increment would be @3% of the revised Basic Pay rounded off to the next

multiple of Rs. 10/-w.e.f. 01.01.2017.

Contd...

- a Grey —~

Sy Fee C

abs. Bier ale ( Bor

(ut Day? eet,

Sep? prrebaond Caled

CTAC HIT CHM Dvash & ened

cAI

Page 4 0f 12

IN OF PAY ON PROMOTION ON OR AFTER 01.01.2017

One notional inereme:

qual to the 3% of the basic pay being drawn by the emple

the pay scale before such promotion, would be granted and rounded off to the next multiple

of Rs 10/-

sin

INDUSTRIAL DEARNESS ALLOWANCE (IDA)

IDA as on 01.01.2017 will be Nil with link point of All India Consumer Price

Index(AICPI) 2001=100, which is 277.33. The IDA payable w.e.f, 01.04.2017 onwards

shall be as per the IDA rates circulated by DPE from time to time, Whenever DPE issues

instructions for merger of IDA into Basic Pay, the same shall also be applicable to category

II & IV employees in accordance with the guidelines issued by DPE.

HOUSE RENT ALLOWANCE (HRA)

The HRA on the revised scales of pay will be payable from 21.06.2018 at the rates

notified by the Govt. of India from time to time. The present rates of HRA as notified by

the Govt. of India are as under:~

CLASSIFICATION OF CITIES RATE OF HRA.

X-Class (Population of 50 Lakh and above) 24% of Basic Pay

'Y-Class (Population of 5 Lakh to 50 Lakh) 16% of Basic Pay

Z-Class (Population below 5 Lakh) 8% of Basic Pas

Rate of HRA will be revised to 27%, 18% & 9% for X, Y and Z class cities respectively

when IDA crosses 25% and further revised to 30%, 20% and 10% when IDA crosses

50%.

LEASED ACCOMMODATION

‘The Union demanded for lease facility as per the formula applicable to Category 1 & Il

employees. After protracted discussions, it is agreed to review the issue after 3 years from

the date of signing of Memorandum of Understanding (MOU).

Contd...

Ogle Zz ars

ee aE

(ye aes) = ae ex

(i ee. 70d be bar?

dediog

fo ve pce Kis han

Page 5 of 12

9 LOCATION BASED COMPENSATORY ALLOW AN

Location based Compensatory Allowances shuill be paid at the rates and other terms sind

conditions notified by: DPE vide O.M. No, W-020028 2017-DPEQWC)-GL-XVII7 dated

07.09.2017 as amended from time to time trom 21.06.2018

10, PERKS AND ALLOWANCES

10.1 For perks and allowances, cafeteria approach subject to ceiling of 35% of revised basic pay

will be adopted allowing Category III & IV employees to choose from a set or cafeteria of

perks and allowances formulated after approval of

fringe benefits.

(01 in lieu of existing allowances and

10.2. The employees will have choice of allowances/perks upto 32% of Basi¢ Pay under the

cafeteria in addition to LTC and PLI.

10.3 Out of overall ceiling of 35%, the ITC component shall be kept at 1% of basic pay and

the present LTC scheme shall continue to be regulated as per the current provisions as

amended from time to time.

10.4 The Productivity Linked Incentive scheme will also continue and the maximum incentive

payable under the scheme would be 2% of basic pay of employees subject to term and

conditions of PLI scheme. However, BKNK Sangh has demanded that PLI to be kept

outside the ceiling of Perks and allowances for which court case has been filed and hence.

keeping the existing scheme of PLI outside the ceiling of perks and allowances will be

reviewed depending upon the final outcome of court case.

10.5 The perks and allowances shall be payable w.c.f.01.01.2017.

10.6 As regards FCI owned accommodation provided to the employees. the Corporation’ would

bear the Income Tax liability on the “non-monetary perquisite” of which $0% shall be

loaded within the ceiling of 32% of Basic Pay on perks and allowances. This benefit shall

be payable w.e.f 21.06.2018,

Contd...

haya ose

Be |b exe

ye aan

Gas (ee tem) es

Sy ariel

cies) EN or al

Page 6 of 12

«1. OVERTIME ALLOWANCE

Board of Directors of FCI in its 386TH -BD Meeting dated 21.05.2018 had approved for

Keeping the payment of OTA outside the limit of Perks and Allowences. Further. in

compliance to Department of Food letter No. 16-1/2018-FC-I dated 01.01.2019 and

protracted discussions during wage negotiation, it is agreed for keeping payment of OTA

on revised Pay scale outside the ceiling of Perks and allowances. The OTA payment from

01.01.2017 to before the date of signing of Memorandum of Settlement (MOS) shall be

made on pre revised Pay scale and no arrear is payable. Further, OTA payment shall

continue to be regulated as per the existing provisions as amended from time to time

12. REIMBURSEMENT OF MEDICAL EXPENSES

‘The Union strongly demanded for reverting back to the earlier system of reimbursement of

actual medical expenses. Presently, the fixed amount of quarterly payment of Rs.2250/- per

quarter is being paid. In addition, Reimbursement of medical expenses for

prolonged/chronic diseases/lab test and the indoor treatment is paid over and above the said

limit, as per the existing scheme of the Corporation

However, afier protracted discussions it is agreed that existing system of reimbursement of

medical expenses shall be dispensed and reimbursement of actual medical expenses as

allowed to Category I and II shall be allowed from the date of the signing of Memorandum

of Settlement (MOS). The terms and conditions of reimbursement shall be applicable as per

instructions issued by the Corporation from time to time. Further, the reimbursement of

Medical expenses shall be reviewed after 3 years from the date of signing of Memorandum

of Understanding (MOU) by the Management in consultation with nationally recognized

Union.

13. SUPERANNUATION BENEFITS

13.1 The retirement benefits shall be allowed as per DPE instructions from time to time.

Corporation shall continue to contribute up to 30% of Basic Pay plus DA towards

Contributory provident Fund, Gratuity, Post-Retirement Medical Scheme and Pension

(DCPS) of employees.

Cont

Bob) gegen

ie a Ane re

Cee ta VL

Y ORT,

\ bet ey

CTeait Senn ovaud ( At fo

Page 7 of 12

13.2. The Ceiling of gratuity stands raised from Rs.10 Lakhs to Rs. 20 Lakhs w.e.f. 01.01.2017.

Besides the ceiling of gratuity shall increase by 25% whenever IDA rises by 50%. The

income tax exemption shall be allowed to employees on or after 29.03.2018.

The existing requirement of superannuation and minimum 15 years of service has been

dispensed with for the pension Scheme w.e.f. 01.01.2017,

13.4

The existing Post-Retitement Medical Benefits will continue to be linked to requirement of

superannuation and minimum of 15 years of continuous service for employees.

13.5 In case of food transferees who have opted for retirement benefits of the Central Govt.

servants under Section 12(A) of Food Corporation Act, 1964, the retirement benefits shall

be determined /allowed as per the Act

14. EXISTING ALLOWANCES:

14.1 All existing allowances/perquisite not specifically covered under this MOU ceases to

exist with effect from 01.01.2017. Further, no new allowance or perquisite or benefit, not

already applicable except the allowance or perquisite or benefit allowed by GOI and

circulated by DPE, will be allowed during the period of operation of this MOU.

14.2. Only allowances/perquisite i.e. Overtime allowance, location based compensatory

allowances are outside the purview of 35% ceiling of Perks and allowances.

15. TRANSFER GRANT

‘Transfer benefit viz. consolidated transfer grant and packing charges shall be revised

from date of signing of MOS.:-

‘Scale No. Rate as per last revision _| Revised

‘Transfer | Transfer Outside | Transfer Transfer Outside

Within | Region Within Region | Region

Region

S-1t0S-2 [4000 | One month Basic | 8800 80% of last

Pay month’s Basic Pay

$310 8-5 [6000 | OnemonthBasie | 13200 80% of last

Pa month's Basic Pay_|

8-6 8000 [One month Basic | 17600 80% of last

Pay month's Basic Pa

$-7&S-8 [10000 | One month Basic | 22000 80% of last

Pay month's Basic Pay |

© Fixed Transfer Grant shall increase by 25% every time whenever the IDA payable on the

revised pay structure goes up by 50%.

Sie ee

- ay

ite!

eee C5065 ST Co EM OVE EM J

16.

16.1

16.2

16.3

16.4

17.

171

17.2

173

17.4

17.5

Page 8 of 12

PRODUCTIVITY IMPROVEMENT AND COST EFFECTIVENESS

The Union has agreed to extend full support to all initiatives taken by management for

improving efficiency. enforcing strict discipline and punctuality

The Union has also agreed to reduce wa

¢ 10 improve utilization of all human.

material and technological resources for higher productivity and to make all out efforts to,

achieve the targets set under MOU with the Ministry of CAF&PD for improving the

efficiency and productivity

Ithas also been decided that re-deployment, rotation and re-training consistent with skills

and technology will be adopted. wherever necessary, especially in the context of

technological changes.

The Family Planning Incentive for small family norms shall be discontinued from

01.01.2017.

GENERAL

The fixed Interim Relief amount paid to the Category Ill & IV employees at the rate of

10% of the Basic pay as on 01.01.2017(pre-revised scale) subject to a minimum of Rs

1000/- per month shall be adjusted against the pay revision arrears payable under 1

MOU.

Arrears on account of Wage revision shall be paid after adjusting /recovering the amount

already paid at pre-revised Pay Scale

The payment of arrears shall be subject to deduction of Income tax, recoveries towards

‘on account of CPF, Pension (DCPS) etc. as per Rules.

Anomalies, if any, will be considered and addressed by the Managemen; suitably.

‘The management has no right to alter any clause of this MOU unilaterally without

agreement with nationally recognized Union

Contd.

Page 9 of 12

17.6 his MOL shall be in fowe aan! binding on the p

suid shall alse

continue to remai

in force until resis

17.7 This MOU is subject to the approval of the Board of Directors and the Gost, of India

Agreeing to the above. signed by both the panies at New Delhi on this day 1" of February 2019.

For and on behalf of For and on behalf of

Food Corporation of India Bhartiya Khadya Nigam Karamchari Sangh

js Le?

eyes ybasi, IAS) oi

Executive Director (Personnel) President (NEC)

tpt ech Dy

ne eshalget9

(Ai (U.S. Duggal )

Executite Director (Finance) Generéll Secretary(NEC)

rn phe ear 3

ae ta Sharma) DM. Dinit)

Chief General Manager (Finance) Sr. Vice President (NEC)

ene (Manjeet Singh)

jeneral Manager (IR-S) Sr. Addl. Genil. Secretary (NEC)

We

(Deyes* Kumar Yadav) (Bhabesh Kumar Saha)

Gerheral Manager (PE) Secretary (Co-ord), NEC

ES tare

iy. on

CHRRASH KUMAP) ci

Dag ernol Megs (Ef)

(Ran Pal Bike cae

‘Addl. Gent. Secy.(NEC)

gohege

(Ajit Kumar Dubey)

Vice President ( NEC)

He Kao Mots

i,

|

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Advocate - Fee Circular 2022Document9 pagesAdvocate - Fee Circular 2022Sukumar NayakNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Non Executive CompressedDocument16 pagesNon Executive CompressedSukumar NayakNo ratings yet

- GSTCredit Note OR2242504 AA03646Document1 pageGSTCredit Note OR2242504 AA03646Sukumar NayakNo ratings yet

- ShowfileDocument12 pagesShowfileSukumar NayakNo ratings yet

- Website AdvertisementDocument6 pagesWebsite AdvertisementSukumar NayakNo ratings yet

- OM Dated 12Document1 pageOM Dated 12Sukumar NayakNo ratings yet

- CWC HTC DEC-23 To FEB-24 Further ObservationsDocument6 pagesCWC HTC DEC-23 To FEB-24 Further ObservationsSukumar NayakNo ratings yet

- Disposal Mechanism of LDPE SheetsDocument2 pagesDisposal Mechanism of LDPE SheetsSukumar NayakNo ratings yet

- MOSDocument1 pageMOSSukumar NayakNo ratings yet

- Fresh Empanelment Private Hospitals Revision Room Rate Cghs 01 12 2010Document4 pagesFresh Empanelment Private Hospitals Revision Room Rate Cghs 01 12 2010Sukumar NayakNo ratings yet

- Agenda of FCI WT 12th Meeting-DS-6-10Document5 pagesAgenda of FCI WT 12th Meeting-DS-6-10Sukumar NayakNo ratings yet

- Gratuity Interest RateDocument6 pagesGratuity Interest RateSukumar NayakNo ratings yet

- Depressions Per Hour Through SpeedDocument4 pagesDepressions Per Hour Through SpeedSukumar NayakNo ratings yet

- Advertisement DRRDocument17 pagesAdvertisement DRRSukumar NayakNo ratings yet