Professional Documents

Culture Documents

Notes Sa Integacc

Uploaded by

caraaatbongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes Sa Integacc

Uploaded by

caraaatbongCopyright:

Available Formats

INTRODUCTION TO ACCOUNTING

DEFINITION ACCOUNTING AREA AND REPORTS PREPARED

Accounting is a service activity. Its function

Managerial Reports Management

is to provide quantitative information,

Financial Reports Stakeholders

primarily financial in nature about

Tax Reports Taxing Agencies

economic entities that is intended to be

Special Reports Regulatory Agencies

useful in making economic decision (ASC).

Accounting is the process of identifying, BUSINESS

measuring, and communicating economic

Engages in buying and selling

information to permit informed judgments

Concern is how to best use its resources

and decisions by users of the information.

Primary reason is to earn profit

Accounting is the art of recording,

classifying and summarizing in a significant BUSINESS RISK

manner and in terms of money,

transactions and events which are in part The higher the risk, the higher the return

at least of financial character and Anything riskier had the potential for much

interpreting the results thereof (ASC). greater returns than safer options

IMPORTANT ACTIVITIES MINIMIZE BUSINESS RISK

• Recording - recognition and non-recognition 1. Careful planning and control

of "accountable" events; analysis and 2. Making a business plan

measurement 3. Adequate knowledge

• Classifying - according to accounting 4. Right form of business and right type

elements; of operation

• Summarizing footing and cross-footing; LEGAL FORMS OF BUSINESS ORGANIZATION

• Interpreting - communicating financial Sole or Single Proprietorship - a small service-

results type business and retail establishments

managed by the manager who is also the

BASIC PURPOSE OF ACCOUNTING proprietor or owner.

The basic purpose of accounting is to provide Partnership - An agreement between two or

quantitative information about a business, more persons who bind themselves to

that is useful to statement users in making contribute money, property, or industry into a

economic decisions. common fund with the intention of dividing

profits among themselves.

ACCOUNTING AS A LANGUAGE OF BUSINESS

Corporation - an artificial being created by

operation of law having the right of succession

and the powers, attributes, and properties

expressly authorized by law or incident to its

existence.

SOLE PROPRIETORSHIP DISADVANTAGES

ADVANTAGES Complexity in organization and

regulation.

Easy to organize

Only the Board of Directors and other

Small capital is required

authorized officers can bind the

• Can be easily managed by the proprietor

corporation in contracts

• The owner gets all the profits from the

Shareholders have limited access and

business

control over management and operations

• The owner and not the business is being

Possibility of double taxation

taxed

DISADVANTAGES

Difficult to expand

Limited resources

Limited specialization in business

management

All losses are borne by the owner

Unlimited liability

PARTNERSHIP

ADVANTAGES

Better management because of the

presence of two or more participants

Possibility of bigger resources TYPES OF BUSINESS ACTIVITIES

Tax-exempt if professional partnership.

Operating – earning profit by selling

DISADVANTAGES goods & services

Investing - acquisition

Conflicts or quarrels between or among Financing - loans

the partners

Unlimited liability USERS OF INFORMATION

All partners may be held liable for the

1. Government

action of one partner

2. Managers

Possibility of double taxation

3. Suppliers

CORPORATION 4. Customer

5. Creditor

ADVANTAGES 6. Employees

Limited Liability 7. Investors

Power of succession

Greater source of capital

Continuity

Higher amount of profit

OPC

THE CONCEPTUAL FRAMEWORK OF

FINANCIAL REPORTING

PURPOSE

assist the Philippine Accounting Standards

Board (Board) to develop PFRS Standards

(Standards) that are based on consistent

concepts;

assist preparers to develop consistent

accounting policies when no Standard applies

to a particular transaction or other event, or Relevance – capacity of information’s to

when Standard allows a choice of accounting influence decisions

policy; and

assist all parties to understand and interpret a. Materiality – based on good

the Standards. judgement (professional, expertise)

b. Predictive Value – helps user increase

SCOPE likelihood of correctly predicting

1. Objective of financial reporting outcome of effects

2. Qualitative characteristics of useful c. Feedback Value – information

financial information provides feedbacks about previous

3. Financial statements and the reporting evaluation

entity Faithful Representation – actual effects of

4. The Elements of the Financial Statements transactions should be properly presented

5. Recognition and derecognition

6. Measurement a. Completeness – accountant shall

7. Presentation and disclosure disclose the material text known

8. Concepts of capital and capital b. Neutrality – free from bias

maintenance c. Free from error – no commission

OBJECTIVE OF FINANCIAL REPORTING ENHANCING ATTRIBUTES

The objective of general-purpose financial Comparability (between & across

reporting is to provide financial information entities) and Consistency (application

about the reporting entity that is useful to of accounting method between

existing and potential investors, lenders, and period)

other creditors in making decisions about Understandability

providing resources to the entity. Verifiability

Timeliness

FINANCIAL INFORMATION

ACCOUNTING ASSUMPTIONS

Profitability – result of operation, level of

income earned Business Entity Concept – separate to

owners

Liquidity - availability of cash, short-term

Going Concern – continuing

payables, current obligations

indefinitely of operations

Solvency – availability of cash for financial Periodicity – divided into periods

commitments when they fall due Monetary Unit – stated in terms of

unit measures (€)

THE ACCOUNTANCY PROFESSION One who represents his/her employer

before government agencies on tax and

BACHELOR'S DEGREE PROGRAMS IN

other matters related to accounting

ACCOUNTING

One when such employment or position

1. Bachelor of Science in Accountancy requires the holder to be a CPA

employment of incumbents to this

Assurance and Audit Services position.

Requires passing of the CPALE

PRACTICE IN EDUCATION/ACADEME

2. Bachelor of Science in Internal Auditing

One who is in an educational

Audit of Systems and Operations institution which involve teaching of

3. Bachelor of Science in Accounting accounting, auditing, management

Information System advisory services, accounting aspect

of finance, business law and taxation,

4. Bachelor of Science in Management and other related subjects

Accounting

PRACTICE IN GOVERNMENT

ACCOUNTING COURSES

One who holds or is appointed to, a

1. Financial Accounting and Reporting position in an accounting professional

2. Intermediate Accounting group in government or in a

3. Cost Accounting government-owned and/or

4. Management Accounting controlled corporation, including

5. Auditing those performing proprietary

6. Government and Non-Profit functions, where decision making

Accounting requires professional knowledge in

7. Tax Accounting the science of accounting

8. Forensic Accounting

ETHICS AND THE ACCOUNTING PROFESSION

CAREER OPPORTUNITIES IN ACCOUNTING

Integrity

PRACTICE IN PUBLIC ACCOUNTING Independence

Be it his/her individual capacity, or as a Confidentiality

partner or as a staff member in an Competence

accounting firm Objectivity

holding out himself/herself as one skilled PHILIPPINE ACCOUNTANCY ACT OF 2004 (RA 9298)

in the knowledge, science and practice of

accounting, and as a qualified person to OBJECTIVES

render professional services as a certified Accounting Education – standardization

public accountant; or offering or and regulation

rendering, or both, to more than one Certified Public Accountants - examination

client on a fee basis for registration

PRACTICE IN PRIVATE ACCOUNTING Practice of Accountancy - supervision

control and regulation

One who is involved in decision making

requiring professional knowledge in the

science of accounting, as well as the

accounting aspects of finance or taxation

PROFESSIONAL REGULATORY BODIES

1. Professional Regulation Commission (PRC) 4. Securities and Exchange Commission (SEC)

Maintaining and enforcing professional 5. Bangko Sentral ng Pilipinas (BSP)

examination

6. Bureau of Internal Revenue (BIR)

Promulgating and implementing

standards and ethics in the practice of a

profession

STANDARD SETTING BODIES

Providing legal and other regulatory

services such as hearing formal 1. Financial Reporting Standards Council

complaints (FRSC)

Acting on valid complaints by suspending 2. Auditing and Assurance Standards

and revoking the license of an erring Council (AASC)

professional

EDUCATION TECHNICAL COUNCIL

2. Board of Accountancy (BOA)

Assist the PRBOA in carrying out its

To prescribe and adopt the rules and powers and functions

regulations necessary for carrying out the Further assist the PRBOA in the

provisions of the Accountancy Act of attainment of the objective of

2004. continuously upgrading the accountancy

To supervise the registration, licensure education in the Philippines to make

and practice of accountancy in the Filipino CPAs globally competitive.

Philippines.

To administer oaths in connection with EXAMINATION, REGISTRATION AND

the administration of this Act. LICENSURE

To adopt an official seal of the Board. Qualifications of Applicants for Examination:

To monitor the conditions affecting the

practice of accountancy in the 1. Is a Filipino citizen.

Philippines. 2. Is of good moral character.

3. Is a holder of the degree of Bachelor

3. PHILIPPINE INSTITUTE OF CERTIFIED of Science in Accountancy conferred

PUBLIC ACCOUNTANTS (PICPA) by a school, college, academy or

institute duly recognized and/or

accredited by CHED or other

authorized government offices.

4. Has not been convicted of any

criminal offense involving moral

ACPAPP - Association of Certified Public turpitude.

Accountants Rating in the Licensure Examination :

ACPACI - Association of Certified Public Passing - a weighted general average of

Accountants in Commerce Industry seventy five percent (75%), with no grade

GACPA - Government Association of lower than sixty five percent (65%) in any

Certified Public Accountants given subject.

NACPAE - National Association of Certified Conditional – a weighted average of

Public Accountants in Education seventy five percent (75%) and above in at

least majority of subjects.

Failed - a weighted average of below Cash or Check Vouchers – used when cash

seventy-five (75%). is paid or when check is issued.

Check – a negotiable instrument used as a

substitute for cash, the payment for which

is drawn against the entities or individual’s

BOARD SUBJECTS current account.

1. FINANCIAL ACCOUNTING AND Statement of Account – a bill

REPORTING represented to a customer for a service

2. ADVANCED FINANCIAL rendered or for a merchandise given for

ACCOUNTING AND REPORTING which payment is demandable.

MANAGEMENT SERVICES

Delivery Receipt – a document that is

3. AUDITING

typically signed by the receiver of a

4. REGULATORY FRAMEWORK FOR

shipment to indicate that they have in fact

BUSINESS TRANSACTIONS

received the item being shipped and have

5. TAXATION

taken possession of it.

THE ACCOUNTING CYCLE

1. Transaction Analysis JOURNAL

2. Recording (Journals)

3. Posting (Ledgers) Book of Original Entry

4. Trial Balance Where debits and credits of each

5. Worksheet & Adjustments account are recorded

6. Financial Statements chronologically day by day

7. Closing Entries Simplest form is the “two-column

8. Post-Closing Entries general journal”

9. Reversing Entries Entry made is called “Journal

Entry”

POSTING (LEDGERS)

BUSINESS PAPERS = SOURCE PAPERS

Book of Final Entry

Invoice – issued by a seller when a Shows all the changes that took

merchandise is given to a client or place for a particular account

customer. The process of transferring from

Billing Statement – issued by the seller journal to the ledger is called

when a service is performed to a client or “posting”

customer. POSTING (T-ACCOUNTS)

Invoice & Billing Statement = Sales Account – a basic summary device

Transaction Normal balance side

Collection Receipt / Official Receipt - (assets, owner’s withdrawal, expenses =

issued by the seller to the buyer as written debit) (liabilities, owner’s equity, income =

evidence of receipt of payment. credit)

Billing statement << >> Official Receipt TRIAL BALANCE = SUMMARIZING MUST BE

Sales Invoice << >> Collection Receipt BALANCE

You might also like

- FAR Midterm ReviewerDocument4 pagesFAR Midterm ReviewerCresel ReposoNo ratings yet

- Accounting ReviewerDocument7 pagesAccounting ReviewerAdrian PeñafielNo ratings yet

- ACC406 - Chapter 1Document14 pagesACC406 - Chapter 1Carol LeslyNo ratings yet

- FAR Midterm Reviewer1Document4 pagesFAR Midterm Reviewer1Cresel ReposoNo ratings yet

- Module1 Introduction To AcctgDocument20 pagesModule1 Introduction To AcctgRian Hanz AlbercaNo ratings yet

- ACCT1A&B Reviewer Disadvantages: ABRAHAM, Daisy JaneDocument33 pagesACCT1A&B Reviewer Disadvantages: ABRAHAM, Daisy JaneGabriel L. CaringalNo ratings yet

- Elements of Financial StatementDocument33 pagesElements of Financial StatementKertik Singh100% (1)

- Midterm Exam (Reviewer)Document84 pagesMidterm Exam (Reviewer)Mj PamintuanNo ratings yet

- Chapter 1 Introduction To AcctgDocument11 pagesChapter 1 Introduction To AcctgNUR ANIS SYAMIMI BINTI MUSTAFA / UPMNo ratings yet

- ACC106 Chapter 1Document20 pagesACC106 Chapter 1ErynNo ratings yet

- BBAW2103 Topic 1Document30 pagesBBAW2103 Topic 1MOHD SYUKRI BIN ABDUL WAHAB STUDENTNo ratings yet

- MODULE 1 NotesDocument3 pagesMODULE 1 NotesJoshua AlvarezNo ratings yet

- (Lesson 1 P2) Importance of Accounting in BusinessDocument2 pages(Lesson 1 P2) Importance of Accounting in BusinessNEIL OBINARIONo ratings yet

- Slide of Session 1-2Document32 pagesSlide of Session 1-2tranhlthNo ratings yet

- Internal External: Prepared by M.T. SacramedDocument2 pagesInternal External: Prepared by M.T. SacramedLawrence CasullaNo ratings yet

- 1.1 Nature and Purpose of AccountsDocument12 pages1.1 Nature and Purpose of AccountsJustin MarshallNo ratings yet

- Fundamentals of AccountingDocument26 pagesFundamentals of AccountingSofia Naraine OnilongoNo ratings yet

- Introduction To Financial Accounting-Unit 1-1Document57 pagesIntroduction To Financial Accounting-Unit 1-1B-ton LimbeNo ratings yet

- Chapter 1-Introduction To Financial Accounting (Acc106)Document17 pagesChapter 1-Introduction To Financial Accounting (Acc106)Syahirah AzlyzanNo ratings yet

- Accounting and Its Environment - PowerPoint PresentationDocument30 pagesAccounting and Its Environment - PowerPoint PresentationBhea G. ManaloNo ratings yet

- Fundamentals of Accountancy Business and ManagementDocument7 pagesFundamentals of Accountancy Business and ManagementhansoNo ratings yet

- Week 1 - Introduction To AccountingDocument34 pagesWeek 1 - Introduction To AccountingAidon StanleyNo ratings yet

- Introduction To Accounting: Caec 1 & 2: Financial Accounting and ReportingDocument6 pagesIntroduction To Accounting: Caec 1 & 2: Financial Accounting and ReportingKlucifer XinNo ratings yet

- Accounting 1Document3 pagesAccounting 1Carmina Dongcayan100% (1)

- CFAS Reviewer Ch. 1 5Document3 pagesCFAS Reviewer Ch. 1 5Precious AnneNo ratings yet

- Note 1-Government AccountingDocument5 pagesNote 1-Government AccountingAngelica RubiosNo ratings yet

- Accounting ReviewerDocument30 pagesAccounting ReviewerCheesy MacNo ratings yet

- Basic AccountingDocument15 pagesBasic AccountingShellalyn RigonNo ratings yet

- Week 1 - Introduction To AccountingDocument34 pagesWeek 1 - Introduction To AccountingAidon StanleyNo ratings yet

- Funac Final Handouts 1 PDFDocument3 pagesFunac Final Handouts 1 PDFAubrey SalvadorNo ratings yet

- A1 NotesDocument43 pagesA1 NotesAndrea ReyesNo ratings yet

- CHAPTER 1 (Lecture Notes)Document20 pagesCHAPTER 1 (Lecture Notes)Nor Farhanah NanaNo ratings yet

- Far AssignmentDocument5 pagesFar AssignmentMy everyday LifeeeNo ratings yet

- LS 1 - ACCOUNTING AND ITS ENVIRONMENT Part 2Document53 pagesLS 1 - ACCOUNTING AND ITS ENVIRONMENT Part 2Danielle Angel Malana100% (1)

- Cfas NotesDocument3 pagesCfas NotesUyara LeisbergNo ratings yet

- Accounting and BookkeepingDocument2 pagesAccounting and BookkeepingClaire PintorNo ratings yet

- Finalized Mod 1&2 ReviewerDocument4 pagesFinalized Mod 1&2 ReviewerJoshua AlvarezNo ratings yet

- AD1101 AY15 - 16 Sem 1 Lecture 1Document21 pagesAD1101 AY15 - 16 Sem 1 Lecture 1weeeeeshNo ratings yet

- ACC 106 Chapter 1Document13 pagesACC 106 Chapter 1Firdaus Yahaya100% (4)

- Financial Accounting and ReportingDocument9 pagesFinancial Accounting and ReportingVipul 663No ratings yet

- CHAPTER 1 and 2 Overview and Concepts in AccountingDocument15 pagesCHAPTER 1 and 2 Overview and Concepts in AccountingVin FajardoNo ratings yet

- Financial Accounting: Acctg. 1Document19 pagesFinancial Accounting: Acctg. 1charie santosNo ratings yet

- Corporation: Meaning of BusinessDocument16 pagesCorporation: Meaning of BusinessAngelica ManahanNo ratings yet

- Entrep Group 9Document124 pagesEntrep Group 9Elizabeth VillarealNo ratings yet

- Fabm 2 PDFDocument3 pagesFabm 2 PDFgk concepcionNo ratings yet

- Good Gov ReviewerrrDocument12 pagesGood Gov ReviewerrrAlyssa GalivoNo ratings yet

- REVIEWERDocument12 pagesREVIEWEREva Mae LabardaNo ratings yet

- 18 AIS 012 (MD Jubayed Hossen)Document9 pages18 AIS 012 (MD Jubayed Hossen)Md JubayedNo ratings yet

- Session 1 With NotesDocument36 pagesSession 1 With NotesAhmad Ridwan FauziNo ratings yet

- Accounting in ActionDocument31 pagesAccounting in ActionTasim IshraqueNo ratings yet

- FM FinalsDocument8 pagesFM FinalsShane VelascoNo ratings yet

- I. Ms Concepts, Practices and Standards II. Cost Concepts and Classifications Iii. Financial Statement AnalysisDocument6 pagesI. Ms Concepts, Practices and Standards II. Cost Concepts and Classifications Iii. Financial Statement AnalysisDensNo ratings yet

- MBA 2021 - Pre-LOB - Sessions 1 and 2Document42 pagesMBA 2021 - Pre-LOB - Sessions 1 and 2martinNo ratings yet

- Accounting 01Document9 pagesAccounting 01reagan blaireNo ratings yet

- Introduction To Financial AccountingDocument30 pagesIntroduction To Financial AccountingSaad SulemanNo ratings yet

- Conceptual FrameworkDocument13 pagesConceptual FrameworkKate Louie RamasNo ratings yet

- Recording Classifying Summarizing: Sole ProprietorshipDocument6 pagesRecording Classifying Summarizing: Sole ProprietorshipLenmariel GallegoNo ratings yet

- Accounting EnvironmentDocument6 pagesAccounting EnvironmentdinishiappuhamyNo ratings yet

- Financial Accounting Valix Summary 1-7Document13 pagesFinancial Accounting Valix Summary 1-7Noel Guerra94% (65)

- Assignment in Partnership Operations (1)Document4 pagesAssignment in Partnership Operations (1)caraaatbongNo ratings yet

- Enhancing Procurement Strategies For Resolving Agency Issues in ClientDocument6 pagesEnhancing Procurement Strategies For Resolving Agency Issues in ClientcaraaatbongNo ratings yet

- Finals Reviewer DevpsychDocument15 pagesFinals Reviewer DevpsychcaraaatbongNo ratings yet

- Reviewer in Business FinanceDocument2 pagesReviewer in Business FinancecaraaatbongNo ratings yet

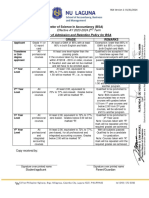

- NU Laguna BSA Admission and Retention Policy Revised 02152024Document1 pageNU Laguna BSA Admission and Retention Policy Revised 02152024caraaatbongNo ratings yet

- POCHEBSA231CDocument1 pagePOCHEBSA231CcaraaatbongNo ratings yet

- NSTP 1 ReviewerDocument6 pagesNSTP 1 ReviewercaraaatbongNo ratings yet

- Jemina InsightsDocument1 pageJemina InsightscaraaatbongNo ratings yet

- The Contemporary World ReviewerDocument4 pagesThe Contemporary World ReviewercaraaatbongNo ratings yet

- Giants of DawleyDocument94 pagesGiants of DawleytoobaziNo ratings yet

- Enterprise Risk ManagementDocument12 pagesEnterprise Risk ManagementAnoop Chaudhary67% (3)

- Oregon Drivers Manual - Oregon Drivers HandbookDocument128 pagesOregon Drivers Manual - Oregon Drivers HandbookpermittestNo ratings yet

- Philippine Health Care Providers, Inc. Vs CIR Case DigestDocument2 pagesPhilippine Health Care Providers, Inc. Vs CIR Case DigestJet jet NuevaNo ratings yet

- Jawaban Kieso Intermediate Accounting p19-4Document3 pagesJawaban Kieso Intermediate Accounting p19-4nadiaulyNo ratings yet

- Facebook Expose Part 1 of WitnessesDocument5 pagesFacebook Expose Part 1 of WitnessesByronHubbardNo ratings yet

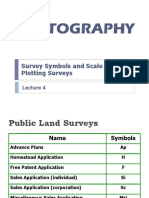

- GE 103 Lecture 4Document13 pagesGE 103 Lecture 4aljonNo ratings yet

- Health Records and The Law 5th EditionDocument436 pagesHealth Records and The Law 5th Editionprasad sardarNo ratings yet

- CSI Effect PaperDocument6 pagesCSI Effect PaperDanelya ShaikenovaNo ratings yet

- POS Retail User GuideDocument61 pagesPOS Retail User GuideDigitalpay DepartmentNo ratings yet

- Medical Malpractice Claim FormDocument2 pagesMedical Malpractice Claim Formq747cxmgc8No ratings yet

- Ratio AnalysisDocument36 pagesRatio AnalysisHARVENDRA9022 SINGHNo ratings yet

- Declaration of Ruth Stoner Muzzin 2-08-17Document75 pagesDeclaration of Ruth Stoner Muzzin 2-08-17L. A. PatersonNo ratings yet

- APHYD00136810000170072 NewDocument3 pagesAPHYD00136810000170072 NewNithin Sunny ChackoNo ratings yet

- WCL8 (Assembly)Document1 pageWCL8 (Assembly)Md.Bellal HossainNo ratings yet

- Samyu AgreementDocument16 pagesSamyu AgreementMEENA VEERIAHNo ratings yet

- Important Notice For Passengers Travelling To and From IndiaDocument3 pagesImportant Notice For Passengers Travelling To and From IndiaGokul RajNo ratings yet

- The UCC and The IRSDocument14 pagesThe UCC and The IRSjsands51100% (2)

- Tabang vs. National Labor Relations CommissionDocument6 pagesTabang vs. National Labor Relations CommissionRMC PropertyLawNo ratings yet

- Vasquez Vs CADocument8 pagesVasquez Vs CABerNo ratings yet

- Vocabulary Quiz 5 Group ADocument1 pageVocabulary Quiz 5 Group Aanna barchukNo ratings yet

- Copyreading and Headline Writing Exercise 2 KeyDocument2 pagesCopyreading and Headline Writing Exercise 2 KeyPaul Marcine C. DayogNo ratings yet

- Mongodb Use Case GuidanceDocument25 pagesMongodb Use Case Guidancecresnera01No ratings yet

- Downloads - Azure Data Services - Módulo 2Document11 pagesDownloads - Azure Data Services - Módulo 2hzumarragaNo ratings yet

- Ise II Writing A Formal Letter OfaDocument1 pageIse II Writing A Formal Letter OfaCristina ParraNo ratings yet

- Vikrant SinghDocument3 pagesVikrant SinghUtkarshNo ratings yet

- Solved Problems in Compound InterestDocument3 pagesSolved Problems in Compound Interestjaine ylevreb100% (1)

- Deed of Real Estate MortgageDocument6 pagesDeed of Real Estate MortgageCristopher ReyesNo ratings yet

- Crb84a5dddid2474989 BorrowerDocument13 pagesCrb84a5dddid2474989 BorrowerKaran SharmaNo ratings yet

- Informal Market and Work Decent 212689Document507 pagesInformal Market and Work Decent 212689Lenin Dos Santos PiresNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)