Professional Documents

Culture Documents

Performance Evaluation Study Unit

Uploaded by

Takudzwa MashiriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performance Evaluation Study Unit

Uploaded by

Takudzwa MashiriCopyright:

Available Formats

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

CHARTERED ACCOUNTANTS ACADEMY

MANAGEMENT ACCOUNTING & FINANCE DEPARTMENT

CERTIFICATE OF THEORY IN ACCOUNTING

STUDY UNIT 2: PERFORMANCE EVALUATION

1|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Contents

1. Introduction ................................................................................................................... 3

2. Learning objectives under Performance Evaluation ........................................................ 3

3. Study material................................................................................................................ 3

4. Competence Framework expectation............................................................................. 4

5. Examination possibilities ................................................................................................ 5

6. Assumed Knowledge ...................................................................................................... 6

7. Integration ..................................................................................................................... 6

8. Course Notes ................................................................................................................. 7

8.1. Goals of Performance Evaluation ................................................................................ 7

8.2. Responsibility accounting ........................................................................................... 7

8.3. Financial performance measures ................................................................................ 8

8.4. Return on Investment (ROI) ...................................................................................... 10

8.5. Residual income (RI) ................................................................................................. 12

8.6. Economic Value Added (EVA) ................................................................................... 13

8.7. Accounting-based measures and a company-wide WACC ......................................... 14

8.8. Ways of over-coming the disadvantages................................................................... 14

8.9. Financial statement Analysis and Ratios ................................................................... 15

8.10. Non-financial performance measures ................................................................... 17

8.11. The Balanced Scorecard ........................................................................................ 18

8.12. Tips and examination technique ........................................................................... 19

8.13. Performance evaluation: Guidelines ..................................................................... 19

9. Practice Question ......................................................................................................... 21

2|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

1. Introduction

This unit provides guidance on the principles behind performance

evaluation. Performance evaluation can be noted as an effective

communication tool between the employee and employer and a

method used to analyse and document the execution of actions by

an employee against set organisational goals and standards. A

performance measurement system should provide in detail what is

being measured, how it is going to be measured, what performance

measurement indicators are going to be used and how the data

obtained through performance evaluation is going to be used to

produce some meaningful intended outcomes.

2. Learning objectives under Performance Evaluation

After studying this unit, one should be able to:

• Understand why performance measurement is important;

• Distinguish between functional and divisionalised organisation structures, and

between management performance and division performance;

• Calculate Return on Investment (ROI), Residual Income (RI) and Economic Value

Added (EVA) and how they tie into Net Present Value;

• Understand EVA and EVA adjustments;

• Understand the different strategies a firm can adopt;

• Understand the Balanced Scorecard, and its link to financial outcomes;

• Understand the integration of the Balanced Scorecard with other syllabus areas.

3. Study material

• Colin Drury (2012). "Management and Cost Accounting". 8th South African Edition,

South – Western Cengage Learning.

• CAA Applied Management Accounting and Finance MAF 401/2 Module 2

3|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

4. Competence Framework expectation

COMPETENCE AREA: MANAGEMENT DECISION MAKING AND CONTROL

VI-1.1 Identifies management’s information needs and the entity’s key

performance indicators

− Determines what information is relevant and useful to both management and

the governing body for the purposes of decision making and control based on

the entity’s mission, vision and strategies and competitive position, economic,

competitive and operating environments, products and governance structure

− Identifies key performance indicators, including any sector-specific tracking

needs

− Describes and gives examples of non-financial key performance indicators that

might be suitable for evaluating the entity’s effectiveness, such as – market

share, customer satisfaction, health and safety record, sales (or other) volume

comparisons, impact of economic, environmental, social and governance

factors, service delivery, economic, efficient and effective use of the limited

resources.

− Considers the applicability of the following performance measurement and

control techniques and tools, including – activity-based costing, activity-based

management, balanced score card and benchmarking

VI-1.2 Evaluates the design of the entity’s responsibility accounting system

− Gains an understanding of the arrangement of an entity’s governance

structure and responsibility accounting centres.

− Evaluates the impact of the structures on performance evaluation and

incentivisation, in the context of the entity’s strategies and enhancement of

shareholder wealth and fulfilment of stakeholder expectations or mandate.

− Evaluates the effectiveness and appropriateness (including strengths,

weaknesses and effect of accounting distortions) of the performance incentive

mechanisms (including measures of profit, return on investment, residual

income and economic value added) and makes suggestions for improvement.

− Considers the creation of medium- to long-term value for stakeholders or

fulfilment of mandate.

4|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

VI-1.3 Analyses the financial performance of an entity and makes and/or

evaluates recommendations for improvement

− Analyses, evaluates and explains the financial performance of the entity, or

division, branch, department, etc., in the context of the entity’s product,

competitive position, strategic plans, operations and activities during the

period(s) and with consideration to cash flows, business risks, other financial

risks, working capital policies, financial management principles, and

management control mechanisms in place, where appropriate.

− Identifies and uses financial analysis tools and methods appropriate to the

purpose of the evaluation, including – ratio and trend analysis, CVP and

sensitivity analysis and appropriate categorisation, allocation and

presentation of financial information.

− Identifies, determines, explains and excludes the effect of any distortions

resulting from the application of IFRS or the entity’s internal or external

accounting policies on the financial performance of the entity.

− Identifies reasons for any areas of strength or concern in performance,

including management control over the entity and decision making, as well as

the nature of the entity’s product, competitive position, operations, activities

and operating environment.

− Identifies areas and makes and/or evaluates suggestions for potential

improvement in profitability, management of resources, enhancement of the

value of the entity or fulfilment of a mandate (or maximisation of service

delivery outcomes).

− Conducts further analysis of recommendations, utilising decision-making

techniques, and identifies further relevant financial considerations and

appropriate cost management techniques (including, but not limited to, cost

driver identification and analysis, the behaviour and relevance of costs to long-

term decision making and control and control mechanisms

5. Examination possibilities

Performance evaluation has been examined frequently in the ITC. However, you

should be aware of the behavioural implications of performance evaluation systems.

5|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

6. Assumed Knowledge

The following is assumed knowledge which you should have to tackle Performance

Evaluation.

1. Corporate Strategy

2. Governance structure, linking with compensation structure

3. Activity-based costing and Activity-based management

4. CVP and sensitivity analysis

5. Working capital management

6. Financial statement and ratio analysis

7. Integration

This topic can be integrated with Relevant Costing (decision making), Transfer Pricing,

Standard Costing, Sustainability and Corporate Governance linking with compensation

structure.

Transfer Pricing

Standard Costing

Performance

Evaluation

Ratio analysis

Compensation

schemes

(governance)

6|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

8. Course Notes

In the transfer pricing section, we highlighted the advantages and disadvantages of

decentralisation. Decentralisation highlights the problems of goal congruence, managerial

effort, and sub-unit autonomy. Thus, we need to consider the measurement of segment

performance in developing management motivation toward the achievement of

organisational goals. Performance evaluation is closely linked to the incentives and

rewards offered to management thus, it is important to select a performance evaluation

system that does not encourage mischievous behaviour.

8.1. Goals of Performance Evaluation

• Encourage cost control;

• Fairness in terms of only holding managers accountable for results within their

control;

• Encourage goal congruence;

• Hold managers accountable for resources/assets under their control; and

• Penalise mangers for actions that are not in the best interest of the company.

8.2. Responsibility accounting

Responsibility accounting is the term used to describe decentralisation of authority,

with the performance of the decentralised units measured in terms of accounting

results.

With a system of responsibility accounting there are five types of responsibility

centre: cost centre; revenue centre; profit centre; contribution centre; and

investment centre.

Type of Principal performance

Manager has control over…

responsibility measures

centre

Cost centre Controllable costs

• Variance analysis

• Efficiency measures

Revenue centre Revenues only • Revenues

Profit centre − Controllable costs • Profit

− Sales prices (including

transfer prices)

Contribution As for-profit centre except that • Contribution

centre expenditures reported on a

marginal cost basis

7|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Type of Principal performance

Manager has control over…

responsibility measures

centre

Investment − Controllable costs • Return on

centre − Sales prices (including investment

transfer prices) • Residual income

− Output volumes • Other financial ratios

− Investment in non-

current assets and

working capital

There are strong arguments for producing two measures of divisional profitability —

one to evaluate managerial performance and the other to evaluate the economic

performance of the division.

Controllable profit is the most appropriate measure of a divisional manager’s

performance (should be measured relative to budget performance).

Looking at how the Invested Capital should be measured for performance evaluation:

a) If a manager's performance is being evaluated, only those assets which can be

traced directly to the division and are controllable by the manager should be

included.

b) If it is the performance of the investment centre that is being appraised, a

proportion of the investment in head office assets would need to be included

because an investment centre could not operate without the support of head

office assets and administrative backup. A similar point of view is that, these costs

would be incurred had the division been a stand-alone company.

8.3. Financial performance measures

a) Return on investment (ROI)

8|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

b) Residual income (RI)

c) Economic value added (EVA™)

Notes

ROI Profit Profit is usually NOPAT + [i x (1-t)

If NPBT is given, the adjustment for interest is (NPBT + i) x

Net Investment 74.25%

When evaluating an individual, allocated costs, such as

head

office costs are excluded from profit, as these are not

controllable by the manager. They can be included for the

evaluation of a division as they are costs that would be

incurred

had the division been a stand-alone company.

Profit - WACC x Net Investment = Total Assets - Current Liabilities or

RI Net

Investment Net Investment = Equity + Long Term Liabilities.

Only permanent sources of finance must be used when

calculating the net investment, i.e. the current portion of a

long

term liability is excluded from current liabilities.

Whether or not a source of finance is permanent depends

on the nature of the business. For example in a large

EVA (Profit ± adjustments) – retailer,

[WACC x (Net investment Trade payables could be a permanent source of finance if

± they

adjustments)] always make all purchases on credit, compared to a smaller

business where trade payables might just be bridging

form of finance.

The assets that are included in net investment are those that

are

controllable by the manager/division. Assets managed

centrally

are not included. Take note of whether the division is a profit

or

Investment

centre.

9|P ag e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Net book value is often used to reflect the investment

although

this is often conceptually incorrect. It is preferable to

ascertain the

assets present value or replacement cost less

depreciation.

8.4. Return on Investment (ROI)

Return on investment (ROI) shows how much profit has been made in relation to the

amount of capital invested and is calculated as (profit/capital employed) x 100%.

The profit figure for ROI should always be the amount before any interest is charged.

Profit is usually - NOPAT + [interest x (1 – t)]

- If NPBT is given, the interest adjustment is (NPBT + interest) x 74.25%

ROI can have behavioural implications and lead to dysfunctional decision-making

when used as a guide to investment decisions. It focuses attention on short-run

performance whereas investment decisions should be evaluated over their full life.

Therefore, profit can be evaluated using either net assets or gross assets employed:

- NOPAT/Net Assets employed

- NOPAT/Net Assets + Accumulated Depreciation (Gross Assets)

- Net Assets employed = Total Assets – Current Liabilities

Note: Only permanent sources of finance must be used when calculating Net Assets.

Idle assets and assets acquired for future use (not employed in current year) are

omitted from the calculation.

Profit after depreciation as a % of net assets employed

This is probably the most common method, but it does present a problem. If an

investment centre maintains the same annual profit and keeps the same assets

without a policy of regular replacement of non-current assets, its ROI will increase

year by year as the assets get older. This can give a false impression of improving

performance over time. Therefore, there could be a disincentive to investment centre

managers to reinvest in new or replacement assets.

Profit after depreciation as a % of gross assets employed

This would remove the problem of ROI increasing over time as non-current assets

get older.

10 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

The ROI based on gross book value suggests that the asset will perform consistently

in each of the years they are employed, which is probably a more valid conclusion.

However, using gross book values to measure ROI has its disadvantages. Most

important of these is that measuring ROI as return on gross assets ignores the age

factor and does not distinguish between old and new assets.

• Older non-current assets usually cost more to repair and maintain

• Inflation and technological change alter the cost of non-current assets

The theoretical solution to the problem is to value assets at their economic cost (i.e.

the present value of future net cash inflows) but this presents serious practical

difficulties.

An alternative calculation of ROI is the Du Pont model:

ROI = [Sales/Invested Capital = (Asset turnover) ] x [Net Income/Sales = (N.P margin)]

= Net Income/Invested Capital

8.4.1. Massaging the ROI

If a manager's large bonus depends on ROI being met, the manager may feel

pressure to massage the measure. The asset base of the ratio can be altered

by increasing/decreasing payables and receivables (by speeding up or delaying

payments and receipts).

8.4.2. ROI and new investments

If investment centre performance is judged by ROI, we should expect that the

managers of investment centres will probably decide to undertake new capital

investments only if these new investments are likely to increase the ROI of

their centre and thus the required rate of return(WACC) of the company might

be disregarded.

8.4.3. Advantages of using ROI

• As it is a relative measure (%), therefore comparisons with other divisions,

companies and available investments are possible;

• It reveals information about cost control and asset management; and

• It is simple to calculate and easily understood by managers.

• External stakeholders (analysts/investors) usually use ROI as a measure of

overall company performance.

11 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

8.4.4. Disadvantages of using ROI

• It encourages management to either not replace assets or inappropriately

sell assets. This decreases the denominator and increases ROI;

• ROI does not support goal congruence. The acceptable return on a new

project for the company is WACC. If WACC< Project A < ROI, such a project

will not be accepted as it will reduce the ROI of the division, but it would

have created value for the company. If Project A is an existing project, a

manager might discontinue it in order to boost ROI resulting in shrinkage

of the business;

• ROI can result in acceptance of value destroying projects. If ROI < Project

A< WACC, Project A will be accepted, as it will boost the ROI of the division,

but since the return is less than WACC, value is being destroyed; and

• ROI encourages management to target percentage returns and not to

maximise returns in absolute terms i.e. they will rather accept a R5m

investment that returns 30% (R1.5m) rather than a R10m investment that

returns 20% (R2m). As long as WACC is less than 20% the second

investment should be accepted.

• It is easily manipulated (i.e. increasing/decreasing payables and

receivables, by speeding up or delaying payments and receipts, alters the

Net Assets).

8.5. Residual income (RI)

An alternative way of measuring the performance of an investment centre, instead of

using ROI, is residual income (RI). Residual income is a measure of the centre's profits

after deducting a notional or imputed interest cost.

Formula = Profit – (WACC x Net Investment)

Only permanent sources of finance must be used when calculating the net investment

(i.e. the current portion of a long-term liability is excluded from current liabilities)

The imputed cost of capital might be the organisation's/division’s cost of borrowing

or its weighted average cost of capital.

12 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

8.5.1. Advantages of RI

a) It is claimed that RI is more likely to encourage goal congruence

Residual income will increase if a new investment is undertaken which earns

a profit in excess of the imputed interest charge on the value of the asset

acquired. In contrast, when a manager is judged by ROI, a marginally

profitable investment would be less likely to be undertaken because it would

reduce the average ROI earned by the centre as a whole.

b) Aligned with NPV principles, this encourages long-term based decisions.

c) Residual income is more flexible since it enables different cost of capital

percentages to be applied to different investments that have different levels

of risk.

8.5.2. Disadvantages of RI

a) It is an absolute measure and therefore comparisons are difficult; and

b) It encourages cutting of discretionary expenditure that could have long-

term benefit, for example training costs.

If RI is used it should be compared with budgeted/target levels which reflect

the size of the divisional investment.

8.6. Economic Value Added (EVA)

EVA is based on the residual income concept. It incorporates adjustments to the

divisional financial performance measure for distortions introduced by GAAP. EVA is

designed to measure the value added to shareholder wealth and to motivate

managers to maximise shareholder value.

EVA = (Profit ± adjustments) – [WACC x (Net Investments ± adjustments)]

a) Managers can increase shareholders value by:

i. Increasing the return on existing assets;

ii. Investing in new assets which generate a return which is higher than the

WACC; and

iii. Selling assets where the return on capital is below the WACC. This happens

when the present value of the future economic cash flows (economic

value) is less than the disposal value.

b) Adjustments are intended to convert historic accounting profit to an

approximation of economic profit. Certain accounting adjustments typically made

are:

c) Expenditure that has the potential for enduring benefit. For example, the costs of

a major marketing campaign would be expensed in the year incurred, but from an

EVA perspective, these costs would be capitalised and impaired over the period

that the benefits were expected to accrue.

13 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

d) Operating leases are capitalised and expensed over the life of the asset. This is

because the asset base would otherwise be understated. The opening balance of

the leases that is included is the present value of the lease commitments. The pre-

tax cost of debt is used as the discount rate. The net profit is adjusted by adding

back the lease expense and replacing this with the depreciation of the capitalised

lease.

e) The profit must be adjusted from the absorption costing to variable costing basis.

8.6.1. Advantages of EVA

i. It considers risk (WACC)

ii. Flexible measure (i.e. WACC can be adjusted for divisional specific risk)

iii. Avoids accounting manipulation

iv. It is based on NPV and working capital management principles

v. It motivates decisions in the interest of the business.

8.6.2. Disadvantages of EVA

i. It is an absolute measure (i.e. difficult to compare organisations which are

different in size).

ii. Complex calculation

iii. Accounting based measure

8.7. Accounting-based measures and a company-wide WACC

Disadvantages of using accounting-based measures and a company-wide WACC

include:

• Managers are encouraged to reduce potentially beneficial discretionary

expenditure;

• Accounting figures can be manipulated;

• Accounting measures do not represent free cash flow; and

• The company WACC might not be representative of the risk of the division being

evaluated, which could make results look artificially poor or impressive.

8.8. Ways of over-coming the disadvantages

Ways of over-coming the disadvantages using accounting-based measures and a

company-wide WACC :

• More than one measure should be used;

• Some non-financial measures should also be used to evaluate performance

(consider the use of a balanced score card);

• Accounting figures can be adjusted in a similar manner to calculating EVA;

• Discounted EVA can be applied.

14 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

8.9. Financial statement Analysis and Ratios

This is a common method which is used to measure performance particularly

between companies, different departments or comparing with prior years.

SUMMARY OF COMMON FINANCIAL RATIOS

RATIO CALCULATION INTERPRETATION

Profitability ratios

Gross profit Sales − Cost of sales Indication of the

margin Sales margin available to

cover non-production

expenses

Operating profit Profit before interests and taxes Indication of the firm’s

margin Sales profitability without

regard to the interest

charges resulting from

the capital structure

Net profit Profit after taxes Shows after tax profit

margin Sales per dollar of sales.

Unacceptably low

margins could indicate

relatively low sales

prices or relatively high

costs (or both)

Return on total Profit before tax + interest Measure of return on

assets Sales total

investment in the

enterprise (from both

shareholders and

lenders)

Return on equity Profit after tax Measures return on

Shareholders equity investment by ordinary

shareholders

Earnings per Profit after tax − pref div Measures earnings

share Weighted Ave Number Of Shares available for each

ordinary share in issue

Liquidity ratios

15 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Current ratio Current assets Measures extent to

Current liabilities which short-term

creditors are covered

by short-term assets

(payable/ realisable

within a year)

Quick ratio (acid Current assets − inventory Measures ability to pay

test) Current liabilities short term obligations

without relying on sale

of inventories

Inventory to net Inventory Measures extent to

working capital Current assets − Current liabilities which the firm’s

working capital is tied

up in stock

Solvency ratios

Debt to assets Total debt Measures extent to

(Gearing ratio) Total assets which operations have

been financed by

borrowed funds

Debt to equity Total debt Measures funds

Shareholders equity provided by lenders

versus funds provided

by owners

Interest cover Profit before interest and tax Measures extent to

Total interest expense which earnings can

decline without the

firm defaulting on

finance costs

Efficiency ratios

Inventory Sales Indicates

turnover Finished goods on hand appropriateness of

inventory of finished

goods held

Accounts Accounts receivable Measures average

× 365

receivable Credit sales length of time for the

collection period

16 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

firm to collect its credit

sales

Fixed assets Sales Measures utilisation of

turnover Fixed assets the firm’s assets

Other

P/E ratio Current market price per share Measures market

After tax earnings per share expectations of future

earnings

Dividend pay-out Annual dividend per share Indicates the

ratio After tax earnings per share percentage of profits

paid out as dividends

Dividend cover Profit after tax − pref div Measures the capacity

Dividend paid to ordinary shareholders of an organisation to

pay dividends out of

the profit attributable

to shareholders

8.10. Non-financial performance measures

Non-financial performance measures are important if the available financial

performance measures not completely reflect the manager’s contribution to the

firm’s total value. Again, non-financial performance measures serve as an indicator for

the firm’s long-term performance. From a motivation point of view, non-financial

measures can be helpful because any combination of performance measures that

reduces the risk imposed on the agent through a contract is beneficial to the principal.

Furthermore, combining different performance measures may help the principal in

inducing specific activities, and thereby to reduce managerial short-sightedness.

Generally, non-financial measures have no intrinsic value for the director. Rather, they

are leading indicators that provide information on future performance not contained

in accounting measures.

17 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

8.11. The Balanced Scorecard

The need to integrate financial and non-financial measures of performance and

identify key performance measures that link measurements to strategy led to the

emergence of the balanced scorecard. The balanced scorecard was devised by Kaplan

and Norton in 1992. According to Kaplan and Norton, previous performance

measurement systems that incorporated non-financial measurements used ad hoc

collections of such measures, more like checklists of measures for managers to keep

track of and improve than a comprehensive system of linked measurements. The

balanced scorecard philosophy creates a strategic focus by translating an

organization’s vision and strategy into operational objectives and performance

measures for the following four perspectives.

Strategy is implemented by specifying the major objectives for each of the four

perspectives and translating them into specific performance measures, targets and

initiatives. There may be one or more objectives for each perspective and one or more

performance measures linked to each objective. Only the critical performance

measures are incorporated in the scorecard.

8.11.1. Four components of the balanced scorecard

a. The Learning and Growth Perspective - improve and create value?

To ensure that an organization will continue to have loyal and satisfied

customers in the future and continue to make excellent use of its resources,

the organization and its employees must keep learning and developing. Hence

there is a need for a perspective that focuses on the capabilities that an

organization needs to create long-term growth and improvement. This

perspective stresses the importance of organizations investing in their

infrastructure (people, systems and organizational procedures) to provide the

capabilities that enable the accomplishment of the other three perspectives’

objectives.

b. The Internal Business Process Perspective - where must we excel?

The internal business perspective requires that managers identify the critical

internal processes for which the organization must excel in implementing its

strategy. Critical processes should be identified that are required to achieve

the organization’s customer and financial objectives.

c. The Customer Perspective - how do customers see us?

The customer perspective should identify the customer and market segments

in which the business unit will compete. The customer perspective underpins

the revenue element for the financial perspective objectives. Typical generic

objectives in this quadrant increasing market share, increasing customer

18 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

retention, increasing customer acquisition, increasing customer satisfaction

and increasing customer profitability.

d. The Financial Perspective - how do we look to shareholders?

The financial perspective specifies the financial performance objectives

anticipated from pursuing the organization’s strategy and the economic

consequences of the outcomes expected from achieving the objectives

specified from the other three perspectives. Therefore, the objectives and

measures from the other perspectives should be selected to ensure that the

financial outcomes will be achieved. Three core financial themes that drive the

business strategy include revenue growth and mix, cost reduction and asset

utilization.

Examples

Internal business Process – internal measures of efficiency, variances, quality and time

Learning and growth – innovation, new products

Customer – new customers, customer satisfaction

Financial – RI, ROI, focus on cost reduction, asset utilisation, revenue growth

8.12. Tips and examination technique

It is important to identify that the appropriate type of responsibility centre will depend

on the degree of autonomy given to the manager. Managers cannot be held

responsible for issues beyond their control.

With investment centres there are two generally accepted measurement techniques,

Return on Investment and Residual Income. While these two performance

measurement methods are very similar, the residual income is regarded as being

conceptually superior as it sets managers the correct hurdle rate for decision-making.

8.13. Performance evaluation: Guidelines

How to approach a question:

− Make sure you understand how to analyse Income statement and Balance sheet –

− Go through the financial statements and identify unusual items, or big changes

between current and preceding years.

− Go through ratios to identify problem areas (Traditional, Line-by-line = common

size, Non-financial ratios)

− Understand information in question:

• What has been provided: internal management accounts (Variable costing

analysis, good for breakeven point and capacity analysis)/ external Annual

19 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Financial Statements (IFRS) – good for seeing if company has even made a

profit or if there is a positive cash balance

• Ensure the problem areas identified in ratios tie into information about

company eg, poor debtors collection ties into high debtors; huge restructuring

in current period ties into a large increase in fixed costs, working capital

management issues etc.

− Structure:

− General comments from scenario – issues identified through reading through

question, for example:

• Sales decreasing

• High debtors: now selling more on credit

• High stock, short shelf life

• Ratio analysis focusing on problem areas

− Discuss working capital management (if applicable)

− Discuss profitability and sustainability issues

− Break Even Point, capacity and borrowings (Debt/Equity) – especially if the company

has made a loss, can it ever break even!

− If possible, discuss Economic Value Added

20 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

9. Practice Question

Background

Zip Bottling Co. Ltd has been in business for five hectic years. During this time the business

has grown enormously. The reason for this is the drink called Zip which has taken a small but

profitable share of the market for low alcohol drinks. Zip Bottling Co. Ltd obtained the

franchise for the drink in Japan at the beginning of 2005 and has manufactured in a single

manufacturing facility ever since then. Expansion of the facility commenced in 2008 and was

completed in May 2009. Expansion consisted of additional fermentation, packaging and

pasteurising facilities. The plant had been considered too large when it was completed but it

is now well utilised even to the extent of sometimes working double shifts. No revaluation of

plant and machinery is put through the books and the figure shown in the balance sheet is

cost less accumulated depreciation. The property on which the business is situated, has

appreciated over the years and the company has re-valued the land and buildings each year.

Of late, the growth in volume sales has slipped somewhat, as the price of the product has

increased over the five years to the point that it is now creating some market resistance. The

main cause of the increase in selling price is considered by management to be the increase in

raw material costs.

The key ingredient in Zip is a base supplied by Japan which defies all analysis but smells like a

mixture of cream soda and yeast. It causes the fermentation of the basic mix of rice mash and

fruit juices and adds some flavour as well. As this is an imported component, it is subject to

exchange rate fluctuations as well as normal price increases and is now becoming very

expensive. The problem is that the drink cannot be made without the base. The company uses

a variable costing system and, as these are internal management financial statements, stocks

are valued at variable cost. The company has a stable labour force and treats all labour costs

as fixed costs. Thus, variable costs are primarily raw materials.

Zip was originally marketed through bottle stores but in later years has been marketed

through supermarkets as well. The supermarkets have had their effect on the credit terms

granted. Most of the volume is now through the supermarket chains.

Zip has an alcohol level of 1.5% and is slightly fizzy. It has a sweetish taste and is considered

to appeal to the younger set. Because of this the company has recently launched a massive

TV and radio advertising campaign. The bulk of this cost is still to be incurred in the coming

year. The management are a little concerned as they have stocked up with the product in

anticipation, but the shelf life of the product is only eight weeks. After eight weeks it starts to

go sour and darkens unacceptably.

The company only sells Zip in a non-returnable 500ml bottle which is shrink wrapped in a six

pack. The storage of the finished product is on pallets. The company has started on a

21 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

programme to replace the pallets as many of them are five years old and are starting to break

up. (Note that there are 200 bottles in a hectolitre - hl).

Set out below are the balance sheet, income statement and cash flow statement prepared by

the accountant. He has also calculated some ratios.

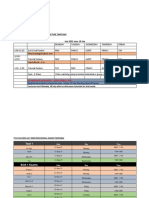

ZIP Bottling Company Limited

Statement of Financial Position as at 31 2008 2009 2010

March

Capital

Share capital 2 000 000 2 000 000 2 000 000

Non-distributable reserve 485 490 629 100 754 510

Retained earnings 1 935 160 4 322 390 7 007 070

4 420 650 6 951 490 9 761 570

Interest bearing debt

Bank overdraft 6 450 562 640 1 509 850

Long term loans 0 476 630 1 813 620

6 450 1 039 270 3 323 470

Capital employed 4 427 100 7 990 760 13 085 040

Non-current assets

Land and buildings 1 528 600 1 672 210 1 797 620

Plant and machinery 952 800 1 644 300 2 393 600

Motor vehicles 286 000 339 000 691 000

Returnable containers and pallets 193 400 283 800 419 000

2 960 800 3 939 310 5 301 220

Current assets

Bank and cash 6 800 9 400 1 160

Debtors - Trade 1 253 790 3 182 290 5 487 640

- Other 32 770 52 830 79 230

Stocks - Finished goods 303 030 719 790 1 458 930

- Work in progress 71 960 133 690 310 330

- Raw materials 977 390 2 018 130 3 829 690

- Other 38 650 101 660 237 670

2 684 390 6 217 790 11 404 650

Current liabilities

Creditors - Trade 517 900 922 100 1 859 930

22 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

- Excise 373 800 644 800 975 470

- Accruals & Prov. 12 710 21 680 42 330

Receiver of Revenue 313 680 577 760 743 100

1 218 090 2 166 340 3 620 830

Net working capital 1 466 300 4 051 450 7 783 820

Employment of capital 4 427 100 7 990 760 13 085 040

ZIP Bottling Company Limited

Income Statement for year ended 31

March 2008 2009 2010

SALE VOLUME hls 107 100 154 300 188 600

PRODUCTION VOLUME hls 108 500 165 100 214 400

GROSS SALES INCOME 21 094 900 35 563 570 51 998 730

Excise duty 4 772 100 8 231 370 12 452 800

Promotional discount 772 600 1 163 400 2 197 430

NET SALE INCOME 15 550 200 26 168 800 37 348 500

Variable cost of sales 4 908 540 8 443 170 13 071 820

GROSS MARGIN 10 641 660 17 725 630 24 276 680

Fixed costs 7 082 350 12 253 620 18 103 320

Depreciation 274 340 361 640 595 610

3 284 970 5 110 370 5 577 750

Interest received 3 800 5 500 5 800

Miscellaneous income 7 440 9 140 15 280

OPERATING PROFIT 3 296 210 5 125 010 5 598 830

Interest - Long term loan 0 88 970 340 960

- Other 850 60 130 283 850

PROFIT BEFORE TAX 3 295 360 4 975 910 4 974 020

Taxation 1 614 730 2 338 680 2 039 350

PROFIT AFTER TAX 1 680 640 2 637 230 2 934 670

Dividends paid 200 000 250 000 250 000

1 480 640 2 387 230 2 684 670

ZIP BOTTLING COMPANY LTD CASH FLOW STATEMENT FOR YEAR ENDED 31 MARCH

2008 2009 2010

Cash generated from operating activities: $000's $000's $000’s

Operating profit 3 296 210 5 125 010 5 598 830

23 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Add: Depreciation 274 340 361 640 595 610

Cash generated from operations 3 570 550 5 486 650 6 194 440

Cash utilised/generated - working capital

- Stock 554 320 1 582 240 2 863 350

- Debtors 443 970 1 948 560 2 331 750

- Creditors & accruals (156 440) (684 170) (1 289 150)

Cash generated from operating activities 2 728 700 2 640 020 2 288 490

Finance costs 850 149 100 624 810

Taxation paid 1 386 910 2 074 600 1 874 010

Cash available from operating activities 1 340 940 416 320 (210 330)

Dividends 200 000 250 000 250 000

Cash retained from operating activities 1 140 940 166 320 (460 330)

Cash utilised in investment activities:

Additions to fixed assets

- Capital cost of:

- Maintaining operations 197 140 437 930 1 327 200

- Expanding operations 960 280 758 610 504 910

Net cash invested 1 157 420 1 196 540 1 832 110

Funding requirement 16 480 1 030 220 2 292 440

Cash injected from financing activities

Bank overdraft 6 450 556 190 947 210

Long term loan 0 476 630 1 336 990

Increase/(Decrease) in borrowings 6 450 1 032 820 2 284 200

Decrease/(Increase) in cash on hand 10 030 (2 600) 8 240

Total financing 16 480 1 030 220 2 292 440

ZIP Bottling Company Limited

Ratios at 31 March 2008 2009 2010

GROSS MARGIN % 68.4% 67.7% 65.0%

Gross margin x 100

Net sales income

OPERATING PROFIT TO SALES 21.2% 19.6% 15.0%

Operating profit x 100

Net sales income

24 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

SALES TO CAPITAL EMPLOYED 3.51 3.27 2.85

Net sales income

Capital employed

DEBTORS DAYS 22.3 33.2 39.1

Total debtors x 365

Gross sales

STOCK DAYS (TOTAL STOCK) 103.4 128.5 163.0

Total stock x 365

Cost of sales

STOCK DAYS (FINISHED GOODS STOCK) 22.5 31.1 40.7

Finished goods stock x 365

Cost of sales

STOCK DAYS (RAW MATERIAL STOCK) 72.7 87.2 106.9

Raw material stock x 365

Cost of sales

CREDITORS DAYS 38.5 39.9 51.9

Trade creditors x 365

Cost of sales

(in the absence of a purchases figure)

TRADE CYCLE 87.2 121.8 150.2

RETURN ON CAPITAL EMPLOYED 74.5% 64.1% 42.8%

Operating profit x 100

Capital employed

RETURN ON EQUITY 38.0% 37.9% 30.1%

Net profit after tax x 100

Shareholders' equity

25 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Required

Management has asked you to analyse and report on the reasons for the poor results for

the year and to suggest any ways to improve profitability in both the short and the long

term. If insufficient information is supplied for full comment, indicate what further

information you would call for.

26 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Suggested Solution

Analyse and report on the reasons for the poor results for the year and to suggest any

ways to improve profitability in both the short and the long term.

• If insufficient information is supplied for full comment, indicate what further

information you would call for.

This is an internal set of financial statements and thus they do not have the same format as

published statements. The intention is for the analysis to be on the company’s performance

from a managerial accounting point of view.

This is further emphasised by the ratios supplied (mostly focusing on operating profit and

asset management) and by the low gearing (interest bearing debt to share capital and

reserves is 34% in 2010).

The company has made some poor strategic decisions, and this has placed the company in

danger of not continuing its profitability in the long term. For this reason, the headings

chosen are:

• Profitability

• Asset management

• Liquidity and cash flow management

• Risk

Profitability:

Operating profit generated from sales:

This ratio depends on selling prices, volumes, variable cost management and fixed cost

management.

Selling prices and contribution:

As the company manufactures and sells one product, it is possible to analyse its pricing

strategy. The selling prices and contributions for the respective years are:

2008 2009 2010

Gross selling price per hl 196.96 230.48 275.71

Gross selling price per bottle 0.98 1.15 1.38

Percentage increase 17.0% 19.6%

Excise per hl 44.56 53.35 66.03

Percentage increase 19.7% 23.8%

Net selling price per hl 145.19 169.60 198.03

Percentage increase 16.8% 16.8%

Variable cost per hl 45.83 54.72 69.31

27 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Percentage increase 19.4% 26.7%

Contribution per unit 99.36 114.88 128.72

Percentage increase 15.6% 12.0%

It is evident that the management was unable to pass the excise increase on to the

customer. This is evidenced by the fact that even with this lower selling price increase, the

increase was met with resistance from the market.

The excise per hl increased by 19.7% in 2009 yet the gross selling price increased by only

17%.

In 2010 the excise increased by 23.8% yet the gross selling price increased by only 19.6%.

The gross selling price per unit has been calculated to compare to the prices charged by

similar products per bottle.

This is the wholesale price and the bottle store or supermarket will need to add its mark

up. The price does not seem excessive but a comparison to cider, beer etc. is needed.

It seems that the management consider the product to be price sensitive. There are four

clues that this may be so:

• The comment in the details of the case that the selling price is creating some

resistance.

• The reluctance of management to pass on all the excise cost increase.

• The change to marketing through supermarkets to endeavour to gain more sales

with a lower retail mark up

• The high promotional discounts offered to attempt (presumably) to generate

additional sales volume.

This pricing policy had an effect on the net income per unit which is increasing by 16.8%

year on year.

When this net income per unit is compared to the variable cost per unit, it is evident that

the pricing policy has not taken cost increases into account.

Variable costs have increased by 19.4% in 2009 and a huge 26.7% in 2010.

The net effect of this is the poor contribution per unit. This combined with the huge

increases in fixed costs makes the break-even units higher each year:

The break-even units on these fixed costs, using the contribution per unit calculated above,

would be:

2008 2009 2010

28 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Calculation $7 356 690/$99.36 $12 615 260/$114.88 $18 698

930/$128.72

BEP units = 74 041 = 109 813 = 145 269

For a product, such as this, which could have a short life cycle, it seems foolish to increase

the fixed costs by 71.5% in 2009 and 48.2% in 2010.

It appears the company is increasing capacity and operating gearing in the assumption that

volume will continue to increase year after year.

If inflation is assumed at 15% and 2008 is taken as a base, the fixed costs (including

depreciation) for the three years should have been:

2008 2009 2010

Fixed costs $7 356 690 $8 460 194 $9 729 223

It is no wonder that the operating profit to sales ratio has declined from 21.2% to 19.6% to

15% over the three years.

Taking the above into account the company should consider several actions which include:

− Investigate the pricing of the product to ensure that the maximum cost is passed

onto the consumer without affecting the volume and the total sales

− Forecast the volume anticipated with that volume and ensure that the facilities are

not expanded if not required.

− Consolidate and make full use of the current infrastructure without incurring any

additional fixed costs. The use of activity-based costing could be of benefit to

identify value added and non-value-added costs in the operating areas and

discretionary and fundamental costs in the support areas. It should be possible to

manage the fixed costs down as it is likely that there is excessive spending.

− Implement a variable cost management programme to ensure that there is

minimum wastage. A part of the variable cost increase is the imported base. An

analysis of this cost should be undertaken to ensure that there is minimum loss.

Perhaps negotiations can be instituted with the supplier to reduce the price.

Asset management:

Sales generated from assets:

The sales to capital employed ratio has declined from 3.51 to 3.27 to 2.85. This could either

be viewed as reducing the number of times fixed assets plus working capital has turned

29 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

over or a reduction in the rand sales generated by the asset base. Either way, there is a

problem.

In analysing the problem, it is useful to separate working capital from fixed assets and

calculate the ratio for these separately. (Net sales are used as the company does not benefit

from the gross sales). Note that as assets are not re-valued, the net book value of fixed

assets may give a distorted picture.

2008 2009 2010

Net sales to fixed assets: 5.25 6.64 7.05

Net sales to working capital: 10.61 6.46 4.80

Despite the substantial increases in fixed assets, the problem clearly lies in working capital

management.

This conclusion is supported by the increase in the net trade cycle which has increased from

87.2 days to 121.8 days to 150.2 days.

Looking at the individual elements of working capital:

− Debtors days have extended from 22.3 days to 33.2 days to 39.1 days. Much of this

is due to the change in policy where sales are being made through supermarkets.

− These organisations usually take longer credit terms. The carrying cost of these

debtors is increasing each year and is placing pressure on the company to borrow

to finance these debtors. In addition, problems with bad debts could arise.

− Stock days reflect a major problem in the company. Production seems to have

delusions about the possible sales and each year are manufacturing more than is

being sold (see income statement volumes).

− There is clearly a problem with forecasting and producing to anticipated demand

rather than to actual demand. There is excessive stock in all categories of stock

particularly finished goods and raw materials.

− With a shelf life of 8 weeks, the company is facing possible large stock write offs.

Further, the carrying cost of this excessive stock is placing pressure on the company

to finance its working capital.

− Creditors days have been estimated using cost of sales. This is not an accurate figure

but does reflect that the company is taking an increasingly long time to pay its

accounts.

− The result is either a loss of discounts or an increase in price from the supplier to

cover the longer terms taken. The company may be losing its good relationships

with its suppliers.

30 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Clearly the company is overtrading. Actions that management should consider include:

Formulation of a credit policy and the institution of credit management to ensure that the

laid down terms are adhered to.

A major drive on both production costs and stock levels is required. This points to the need

to institute JIT principles. The company needs have a good look at its production process to

ensure minimum non-value-added time such as wait, set up, inspection, move times etc.

They need to set up controls over variable costs. Production should be changed to the pull

system with quantities geared to actual demand rather than anticipated demand.

Liquidity and cash flow management:

Because of poor operating management, i.e. cost and working capital management, there

has been a decrease in profitability and an increase in working capital.

As a result, the company has been forced to fund operating costs and working capital from

borrowings.

The problem is not serious as yet, but the cash flow statement shows cash retained from

operating activities to have declined from 1 140 940 in 1988 to 166 320 in 2009 and a

negative 460 330 in 2010.

The company has invested in fixed assets consistently over the three years, both to

maintain operations and to expand operations.

This has resulted in an increase in borrowings and in turn in the interest on those

borrowings. Interest cover (using cash generated from operating activities) has declined

from 17.7 times [$2640020/($88970+$60130)] in 2009 to 3.7 times

[$2288490/$340960+$283850)] in 2010.

The average time take to pay total liabilities, using cash generated from operations

(operating profit plus non-cash items), is still low and has increased as follows:

2008 2009 2010

Total liabilities $1 224 540/$3 570 $3 205 610/$5 486 $6 944 300/$6 194

550 650 440

= 0.34 = 0.58 = 1.12

There are no specific management actions that need to be directed toward liquidity

management.

31 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

If the overall stock level is reduced by, say, 40 days, this would release approximately

$ 1.4 million (based on 40 times the daily cost of sales) into the business.

Similarly, if debtors were reduced by, say, 5 days this would release approximately

$700 000 (based on 5 times the daily gross sales) into the business.

Some of this would be used to reduce creditors days but will still have a considerable impact

on the interest-bearing debt.

Risk

The return on equity of this business has declined considerably in 2010.

Several factors need to be considered when assessing whether the 30.1% return is still

acceptable.

This appears to be a high after-tax return, but fixed assets have not been revalued. If this

were done, the return would decline.

One also must take into consideration, the likelihood of the return continuing in future

years and the vulnerability of the company to fluctuations in economic activity.

The company is reliant on a single product which may have a short product life cycle.

Despite this, the company has invested considerable amounts in anticipation of future

growth in sales.

If the product goes out of favour with the group who are currently buying it, the company

will not be able to generate sufficient sales to be profitable.

The company should be investigating entering the market in similar product such as cider.

The low alcohol market is very competitive, and the company is faced with tough

competitor action if it grows too big.

The company is reliant on an overseas supplier who is the only supplier of a key ingredient.

This adds to the risk as this source of supply can be removed at any time unless there is a

contract.

The high level of working capital and fixed costs makes it difficult for the company to reduce

its scale of operations quickly if volumes change downwards.

The huge increases in fixed costs coupled with the decline in contribution per unit has

resulted in an ever-increasing break even.

Any change in the economic climate could place the company in a non-profitable situation.

32 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

APPLIED MANAGEMENT ACCOUNTING AND FINANCE STUDY PACK 402 – MODULE 2 2021

Conclusion

The company should stop expanding with immediate effect and instead determine demand

for Zip in the current market. This may require them to undertake market research to

establish this. This may result in the company having to reduce capacity in the most cost-

effective way.

The company should look for new customers to sell their product to as well as opportunities

to differentiate their product in order to stimulate sales demand.

The company should improve working capital management by introducing a new working

capital policy (benchmarked with other companies selling to supermarkets), as well as a

new working capital system to manage working capital more efficiently.

This will resolve to a large extent the liquidity problems. The company should introduce JIT

to reduce the large quantities of the different types of inventory on hand.

33 | P a g e ©PROPERTY OF CAA LEARNING MEDIA 2021

You might also like

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- The Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)From EverandThe Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Rating: 4.5 out of 5 stars4.5/5 (3)

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- Advance Performance Management APMDocument18 pagesAdvance Performance Management APMpaknet0% (1)

- Reformulated By: Muhammadu Sathik RajaDocument34 pagesReformulated By: Muhammadu Sathik RajaAnkitSinghNo ratings yet

- Role of Managerial Accounting and Its Direction Toward A Specific FieldDocument4 pagesRole of Managerial Accounting and Its Direction Toward A Specific FieldBududut BurnikNo ratings yet

- Module Study Pack (Stretigic Management Accounting)Document328 pagesModule Study Pack (Stretigic Management Accounting)Rimon BD100% (3)

- SMP - Evaluation - Monitoring.ControlDocument22 pagesSMP - Evaluation - Monitoring.ControlIsabela BautistaNo ratings yet

- Chapter 01 Overview of Cost Management and StrategyDocument8 pagesChapter 01 Overview of Cost Management and StrategyAccounting MaterialsNo ratings yet

- Chapter 7.controllingDocument40 pagesChapter 7.controllingAmby Marielle MasiglatNo ratings yet

- Managerial Economics MCQsDocument6 pagesManagerial Economics MCQsAmitnprince100% (1)

- Differential Cost Analysis Relevant CostingDocument10 pagesDifferential Cost Analysis Relevant CostingBSIT 1A Yancy CaliganNo ratings yet

- Ac 4104 - Strategic Cost ManagementDocument26 pagesAc 4104 - Strategic Cost ManagementLikzy Redberry100% (2)

- BEC Study Guide 4-19-2013Document220 pagesBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- Irqb Guideline 1 Kpi Final VersionDocument16 pagesIrqb Guideline 1 Kpi Final VersionDelong KongNo ratings yet

- Management Accounting 6th Edition Atkinson Solutions ManualDocument43 pagesManagement Accounting 6th Edition Atkinson Solutions Manualeddiehickmanfwgdmnxbyz100% (14)

- Chapter 6 Cost Accounting Problem 1-3Document6 pagesChapter 6 Cost Accounting Problem 1-3Baby MushroomNo ratings yet

- CH - 7 Strategy Evaluation and ControlDocument10 pagesCH - 7 Strategy Evaluation and ControlSneha Singh100% (1)

- Strategic Cost Management ACCO 20113: College of Accountancy and Finance Department of AccountancyDocument9 pagesStrategic Cost Management ACCO 20113: College of Accountancy and Finance Department of AccountancyglcpaNo ratings yet

- ZIMCODEDocument130 pagesZIMCODETakudzwa Mashiri100% (1)

- AMA - Essay 5Document9 pagesAMA - Essay 5Deborah WilliamsNo ratings yet

- MA. M6. NotesDocument47 pagesMA. M6. Noteslim hwee lingNo ratings yet

- BSC and Other TechniquesDocument17 pagesBSC and Other TechniquesHARSHIT KUMAR GUPTA 1923334No ratings yet

- Financial Analysis eDocument3 pagesFinancial Analysis eSuraj AminNo ratings yet

- P5 Apc NOTEDocument248 pagesP5 Apc NOTEprerana pawarNo ratings yet

- Divisional Performance Analysis-1Document8 pagesDivisional Performance Analysis-1Tedlyn EtuNo ratings yet

- Unit13 PDFDocument12 pagesUnit13 PDFEngr AtiqNo ratings yet

- Em 212 Managerial Accounting Midterm Examination First Semester 2021-2022Document3 pagesEm 212 Managerial Accounting Midterm Examination First Semester 2021-2022Mary Cris DalumpinesNo ratings yet

- Strategic Management 11Document25 pagesStrategic Management 11Mubashra BloggersNo ratings yet

- Strategic EvaluationDocument2 pagesStrategic EvaluationJungkook RapmonNo ratings yet

- Managerial-Accounting CompressDocument80 pagesManagerial-Accounting CompressRowilson Rey Bayson NovalNo ratings yet

- Managerial AccountingDocument79 pagesManagerial AccountingnaenaenaenaeNo ratings yet

- UNIT V According To CSVTUDocument7 pagesUNIT V According To CSVTUAbhinav ShrivastavaNo ratings yet

- Management Accounting: Information That Creates ValueDocument27 pagesManagement Accounting: Information That Creates ValueTraaidyNo ratings yet

- Management Accounting - Costing and Budgeting (Edexcel)Document21 pagesManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- Structural Considerations in Strategic Implementation: Structuring ActivitiesDocument5 pagesStructural Considerations in Strategic Implementation: Structuring ActivitiesUday Singh0% (1)

- The Sigma Guidelines-Toolkit: Sustainability ScorecardDocument13 pagesThe Sigma Guidelines-Toolkit: Sustainability ScorecardCPittmanNo ratings yet

- BSC - GeneralDocument3 pagesBSC - Generalmohd1234567No ratings yet

- Business Strategy ModuleDocument7 pagesBusiness Strategy ModulesafdsfdjlkjjNo ratings yet

- BSBFIA412 - AssessmentPi 2Document25 pagesBSBFIA412 - AssessmentPi 2Pattaniya KosayothinNo ratings yet

- Unit 10Document10 pagesUnit 10Shah Maqsumul Masrur TanviNo ratings yet

- Ac+4104+ +Strategic+Cost+ManagementDocument42 pagesAc+4104+ +Strategic+Cost+ManagementChristiana AlburoNo ratings yet

- Unit 13Document3 pagesUnit 13Syedmunimejaz EjazNo ratings yet

- Strategy Evaluation & ControlDocument63 pagesStrategy Evaluation & ControlAnjali BalakrishnanNo ratings yet

- Unit 4Document37 pagesUnit 4Raveena SharmaNo ratings yet

- Setting An Audit StrategyDocument14 pagesSetting An Audit Strategyyamiseto0% (1)

- RA 8293 Intellectual Property LawDocument25 pagesRA 8293 Intellectual Property Lawjohn paolo josonNo ratings yet

- Advanced Performance Management SyllabusDocument1 pageAdvanced Performance Management SyllabusAbdus Shaheed Miah SayeedNo ratings yet

- Strategic Management 11Document26 pagesStrategic Management 11Victoria77No ratings yet

- Orientation On Balanced Scorecard (BSC)Document42 pagesOrientation On Balanced Scorecard (BSC)MikealayNo ratings yet

- FSADocument4 pagesFSAVinod MenonNo ratings yet

- Research On The Dimensions and Path Selection of Enterprise Performance Evaluation Under Balanced ScorecardDocument4 pagesResearch On The Dimensions and Path Selection of Enterprise Performance Evaluation Under Balanced ScorecardBhavish RamroopNo ratings yet

- Management Accounting 6th Edition Atkinson Solutions ManualDocument35 pagesManagement Accounting 6th Edition Atkinson Solutions Manuallilyadelaides4zo100% (17)

- Straco ReviewerDocument5 pagesStraco ReviewerKemberly JavaNo ratings yet

- 11 Performance MeasurementDocument12 pages11 Performance MeasurementvishalNo ratings yet

- Project Synopsis FinanceDocument8 pagesProject Synopsis FinanceMuhammed SanadNo ratings yet

- Performance Management System of Bank AlfalahDocument17 pagesPerformance Management System of Bank AlfalahWaqaz Jamil80% (5)

- Strategy Evaluation and ControlDocument4 pagesStrategy Evaluation and ControlSumandembaNo ratings yet

- Chapter - 20: Effective ControlDocument32 pagesChapter - 20: Effective Controlcooldude690No ratings yet

- AKMY 6e ch01 - SMDocument20 pagesAKMY 6e ch01 - SMMuhammad Ahad Habib Ellahi100% (2)

- Q1 Feasibility of Richard RummeltDocument9 pagesQ1 Feasibility of Richard RummeltSaad Ali RanaNo ratings yet

- PM QuestionsDocument6 pagesPM QuestionsFacts FactsNo ratings yet

- Strategic Cost Management - REVIEWERDocument5 pagesStrategic Cost Management - REVIEWERdemdemeter07No ratings yet

- Financial and Economic Analysis of A ProjectDocument32 pagesFinancial and Economic Analysis of A ProjectYohannes AlemuNo ratings yet

- BBa 3yr Unit 5Document47 pagesBBa 3yr Unit 5sai rocksNo ratings yet

- MS - 43 Solved AssignmentDocument13 pagesMS - 43 Solved AssignmentIGNOU ASSIGNMENTNo ratings yet

- ITC June 2022 MAF Discussion Question 1 OPM 10042022Document10 pagesITC June 2022 MAF Discussion Question 1 OPM 10042022Takudzwa MashiriNo ratings yet

- Hre 2024Document5 pagesHre 2024Takudzwa MashiriNo ratings yet

- Dividend Policy Tutorial QuestionDocument9 pagesDividend Policy Tutorial QuestionTakudzwa MashiriNo ratings yet

- UntitledDocument11 pagesUntitledTakudzwa MashiriNo ratings yet

- International Finance Study UnitDocument21 pagesInternational Finance Study UnitTakudzwa MashiriNo ratings yet

- Cta 2&Ft Applied Financial Accounting Reporting 2022 Test 1 - Scenario - TDDocument9 pagesCta 2&Ft Applied Financial Accounting Reporting 2022 Test 1 - Scenario - TDTakudzwa MashiriNo ratings yet

- Cta 2&FT Applied Financial Accounting Reporting 2022 Test 1 - Required - TDDocument1 pageCta 2&FT Applied Financial Accounting Reporting 2022 Test 1 - Required - TDTakudzwa MashiriNo ratings yet

- Cta 2021 Level 2 Applied Auditing and Governance Eos - Required - FinalDocument2 pagesCta 2021 Level 2 Applied Auditing and Governance Eos - Required - FinalTakudzwa MashiriNo ratings yet

- Cta 2ft End of Semester Financial Accounting Reporting 2022 - ScenarioDocument9 pagesCta 2ft End of Semester Financial Accounting Reporting 2022 - ScenarioTakudzwa MashiriNo ratings yet

- Cta Fulltime July 2022 Provisional TimetableDocument2 pagesCta Fulltime July 2022 Provisional TimetableTakudzwa MashiriNo ratings yet

- Money, Happiness and InvestingDocument65 pagesMoney, Happiness and InvestingTakudzwa MashiriNo ratings yet

- Tax ActsDocument625 pagesTax ActsTakudzwa MashiriNo ratings yet

- Midterm - Set ADocument8 pagesMidterm - Set ACamille GarciaNo ratings yet

- Cost Accaunting 2Document12 pagesCost Accaunting 2ዝምታ ተሻለNo ratings yet

- pp04Document16 pagespp04Ilya YasnorinaNo ratings yet

- COST ANALYSIS - 62 Questions With AnswersDocument6 pagesCOST ANALYSIS - 62 Questions With Answersmehdi everythingNo ratings yet

- Activity-Based Costing (ABC) - An Effective Tool For Better ManagementDocument9 pagesActivity-Based Costing (ABC) - An Effective Tool For Better ManagementErica CallosNo ratings yet

- 03 Integrated and Non IntegratedDocument8 pages03 Integrated and Non Integratedamarjeet amarNo ratings yet

- Contribution Margin Income StatementDocument3 pagesContribution Margin Income StatementMeghan Kaye LiwenNo ratings yet

- Systems Design: Job-Order CostingDocument60 pagesSystems Design: Job-Order CostingPriha AliNo ratings yet

- Creed Corporation Is Considering Manufacturing A New Engine Designated As PDFDocument2 pagesCreed Corporation Is Considering Manufacturing A New Engine Designated As PDFDoreenNo ratings yet

- Cost Accounitng - ProblemsDocument39 pagesCost Accounitng - Problems21BCO021 Karthi VNo ratings yet

- Exercises On Cost Behavior Analysis and UseDocument5 pagesExercises On Cost Behavior Analysis and UseRK SanchezNo ratings yet

- BBA I SEM II Advanced AccountancyDocument109 pagesBBA I SEM II Advanced AccountancyVarshaNo ratings yet

- Cengage Book List PDFDocument20 pagesCengage Book List PDFasd123412100% (1)

- Responsibility AccountingDocument2 pagesResponsibility Accountingswati.bhattNo ratings yet

- Bac 201 - Course OutlineDocument2 pagesBac 201 - Course OutlineRebeccah NdungiNo ratings yet

- 5 - Inventory Estimation Part 2Document19 pages5 - Inventory Estimation Part 2Jozelle Grace PadelNo ratings yet

- QMS SmaDocument19 pagesQMS SmaBassel JaberNo ratings yet

- Marginal and Profit Planning - Unit IV CH 4Document22 pagesMarginal and Profit Planning - Unit IV CH 4devika125790% (1)

- Chapter 5 PDFDocument71 pagesChapter 5 PDFSyed Atiq TurabiNo ratings yet

- Learning Objective 1: Identify Relevant and Irrelevant Costs and Benefits in A DecisionDocument62 pagesLearning Objective 1: Identify Relevant and Irrelevant Costs and Benefits in A DecisionRabbi RahmanNo ratings yet

- Notes On Process Costing System - PDF - ProtectedDocument14 pagesNotes On Process Costing System - PDF - Protectedhildamezmur9No ratings yet

- Assignment 2 Operating Financial Budget Wasilios Kapsalis 2Document10 pagesAssignment 2 Operating Financial Budget Wasilios Kapsalis 2api-643999740No ratings yet

- Accounting 202Document8 pagesAccounting 202Gortex MeNo ratings yet

- CH 04Document50 pagesCH 04Shaiful HussainNo ratings yet

- Master AccountingDocument12 pagesMaster Accountingyeshi janexoNo ratings yet