Professional Documents

Culture Documents

Examples of Use of Different Data Collection Methods in Banking and Finance Context

Examples of Use of Different Data Collection Methods in Banking and Finance Context

Uploaded by

Loganathaan Srimathi0 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

Examples of use of different data collection methods in banking and finance context

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesExamples of Use of Different Data Collection Methods in Banking and Finance Context

Examples of Use of Different Data Collection Methods in Banking and Finance Context

Uploaded by

Loganathaan SrimathiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Examples of how surveys, focus groups, experiments, interviews, observations,

and secondary sources can be used in the banking and finance context:

1. Surveys:

a. A bank could use a survey to gauge customer satisfaction with their

online banking platform, asking customers to rate various aspects of the

platform and provide suggestions for improvement.

b. A financial institution could conduct a survey to understand the most

popular investment products among its clients to help them create new,

targeted investment options.

2. Focus Groups:

a. A bank could organize a focus group with potential customers to

gather feedback on a new mobile banking app's usability, design, and

features before its official launch.

b. A financial advisory firm could conduct focus groups to explore

investors' attitudes and concerns about sustainable investing and use

that information to shape their investment advice and product

offerings.

3. Experiments:

a. A bank could run an experiment to test the effectiveness of different

marketing strategies on customer acquisition, by measuring the

response rates to various advertising campaigns.

b. A financial institution could perform a randomized controlled trial to

test the impact of different financial literacy programs on participants'

savings and investment behaviors.

4. Interviews:

a. A bank could conduct in-depth interviews with high-net-worth clients

to better understand their unique financial needs and preferences, in

order to tailor their wealth management services.

b. A financial regulator could interview representatives from various

financial institutions to assess their compliance with anti-money

laundering (AML) regulations and identify potential areas for

improvement.

5. Observations:

a. A bank could observe customer behavior in their branches to identify

patterns and inefficiencies in the customer service process, in order to

optimize the layout and staffing of their physical locations.

b. A financial technology company could conduct user testing sessions,

observing how users interact with their platform to identify areas for

improvement and enhance the overall user experience.

6. Secondary Sources:

a. A financial analyst could use historical stock market data and financial

statements of companies to conduct an analysis of their performance and

make investment recommendations.

b. A bank could use credit bureau data as a secondary source to assess the

creditworthiness of loan applicants, relying on their credit history,

outstanding debts, and other relevant information.

You might also like

- English: Quarter 3 - Module 5CDocument21 pagesEnglish: Quarter 3 - Module 5CRaisa Lima Darauay86% (7)

- HCCC Overview and SpecificationDocument68 pagesHCCC Overview and SpecificationMohammad Umer InamNo ratings yet

- Certified Credit Research AnalystDocument5 pagesCertified Credit Research AnalystPratik Rambhia17% (6)

- Chapter 16 Managing Marketing ChannelsDocument9 pagesChapter 16 Managing Marketing ChannelsMandy00011123322No ratings yet

- SPOUSES RAINIER JOSE M. YULO AND JULIET L. YULO vs. BANK OF THE PHILIPPINE ISLANDSDocument2 pagesSPOUSES RAINIER JOSE M. YULO AND JULIET L. YULO vs. BANK OF THE PHILIPPINE ISLANDSRizza Angela Mangalleno100% (1)

- Bank Customer ServiceDocument47 pagesBank Customer ServiceManojj21100% (1)

- BamkDocument5 pagesBamkAndrew UyNo ratings yet

- Banking PerformanceDocument5 pagesBanking PerformancechavezkristeljoyNo ratings yet

- UntitledDocument2 pagesUntitledsushil pokharelNo ratings yet

- PROJECT SCOPE OF THE QUANTUM BANK Group 2Document5 pagesPROJECT SCOPE OF THE QUANTUM BANK Group 2folaNo ratings yet

- Aditya Reynaldi - Growth Manager - JuloDocument2 pagesAditya Reynaldi - Growth Manager - JuloAditya ReynaldiNo ratings yet

- Nidhi ProjectDocument70 pagesNidhi ProjectuhkghjgjkNo ratings yet

- Customer Acceptance, Customer Care PolicyDocument7 pagesCustomer Acceptance, Customer Care PolicySiddhaa LNo ratings yet

- Digital Babking Final PDFDocument76 pagesDigital Babking Final PDFAafreen Choudhry100% (1)

- Roles of Financial Institutions in Entrepreneurship Development and Support InstitutesDocument3 pagesRoles of Financial Institutions in Entrepreneurship Development and Support InstitutesYashwanth S D E&CNo ratings yet

- 1 Bank LendingDocument56 pages1 Bank Lendingparthasarathi_inNo ratings yet

- A Report ON: Summer Internship ProjectDocument61 pagesA Report ON: Summer Internship ProjectDivyajit TonyNo ratings yet

- Consumer Grievances Handling MechanismDocument9 pagesConsumer Grievances Handling MechanismWajahat GhafoorNo ratings yet

- Careers in FinanceDocument50 pagesCareers in FinanceArjit KumarNo ratings yet

- Customer Churn PredictionDocument8 pagesCustomer Churn Predictionhemapardeep8No ratings yet

- Bank of Baroda - Summer Internship Project ReportDocument9 pagesBank of Baroda - Summer Internship Project ReportPramod KumarNo ratings yet

- 302 Unit 2Document19 pages302 Unit 2Vishal YadavNo ratings yet

- CRM Qbu2separateDocument40 pagesCRM Qbu2separategiryahaiNo ratings yet

- FM Structuring AssignmentDocument2 pagesFM Structuring AssignmentVinitNo ratings yet

- Corporate BankingDocument122 pagesCorporate Bankingrohan2788No ratings yet

- Careers in FinanceDocument49 pagesCareers in FinanceManish GoyalNo ratings yet

- Customer Service in BanksDocument49 pagesCustomer Service in BanksAnirudh SinghaNo ratings yet

- My PartDocument2 pagesMy PartShrutii SinghNo ratings yet

- Capstone Phase 3Document7 pagesCapstone Phase 3Muskan BohraNo ratings yet

- Review of LiteratureDocument6 pagesReview of LiteratureSaima NishatNo ratings yet

- NotesDocument11 pagesNotesvijoh98788No ratings yet

- Retail Banking Dec 2023Document10 pagesRetail Banking Dec 2023Rameshwar BhatiNo ratings yet

- Unit 7: Data Mining For Business Intelligence Applications: A) Balanced ScorecardDocument11 pagesUnit 7: Data Mining For Business Intelligence Applications: A) Balanced Scorecardtrupti.kodinariya981033% (3)

- Unit 5 Andhra Pradesh.Document18 pagesUnit 5 Andhra Pradesh.Charu ModiNo ratings yet

- Standard VDocument18 pagesStandard Vgohasap_303011511No ratings yet

- DM For BIDocument19 pagesDM For BIBibhuti boraNo ratings yet

- Answer Key MGN019Document10 pagesAnswer Key MGN019shyamNo ratings yet

- Assignment of IfsDocument6 pagesAssignment of Ifsexpert3ddesignstudioNo ratings yet

- Summer Internship Project Karvy....Document61 pagesSummer Internship Project Karvy....Preet Josan100% (2)

- Retail Banking Dec 2023Document10 pagesRetail Banking Dec 2023Rameshwar BhatiNo ratings yet

- Marketing Strategy Notes Prof Kalim KhanDocument94 pagesMarketing Strategy Notes Prof Kalim KhanPraveen PraveennNo ratings yet

- Chapter III Business PlanDocument4 pagesChapter III Business PlanARNEL ALDIPNo ratings yet

- Marketing and PromotionDocument14 pagesMarketing and PromotionlogeshrajaNo ratings yet

- Amazon Account Q&aDocument6 pagesAmazon Account Q&aRochel SantelicesNo ratings yet

- Group 3Document4 pagesGroup 3Ishan MaheshwariNo ratings yet

- Service MKT ProjectDocument1 pageService MKT ProjectMahesh DoijodeNo ratings yet

- Module 5 Emerging Issues in Service MarketingDocument7 pagesModule 5 Emerging Issues in Service MarketingShashank SmashNo ratings yet

- External Market Assessment and Internal Analysis GuidelineDocument62 pagesExternal Market Assessment and Internal Analysis GuidelineAbenetNo ratings yet

- ACCION InternationalDocument3 pagesACCION Internationalsalim11143No ratings yet

- Abstract - Emerging TechDocument2 pagesAbstract - Emerging TechAnu SinhaNo ratings yet

- General Parts of Business PlanDocument6 pagesGeneral Parts of Business PlanGabriel MartinNo ratings yet

- Tanya Maheshwari Canara Bank Mozo Hunt Task 2part4 RemovedDocument16 pagesTanya Maheshwari Canara Bank Mozo Hunt Task 2part4 Removedsunnykumar.m2325No ratings yet

- Assignment - 2 ON BB: 602 Entrepreneurship Submitted To: Submitted By: MR - Roshan Kumar Rajvir Kaur ROLL NO 10-28 Bba6 SemDocument7 pagesAssignment - 2 ON BB: 602 Entrepreneurship Submitted To: Submitted By: MR - Roshan Kumar Rajvir Kaur ROLL NO 10-28 Bba6 Semrajvirkaur5555777No ratings yet

- Introduction Customer Segmentation Is The Process of Dividing Customers Into Smaller Groups Based On Their Common Characteristics Such As AgeDocument9 pagesIntroduction Customer Segmentation Is The Process of Dividing Customers Into Smaller Groups Based On Their Common Characteristics Such As AgemebreaNo ratings yet

- New Product Development and Managing Innovation - Sem 4Document10 pagesNew Product Development and Managing Innovation - Sem 4Yash GuptaNo ratings yet

- Project ChaptersDocument15 pagesProject ChaptersNAVEEN GNo ratings yet

- BUSN 498 Business Strategy Final ProjectDocument3 pagesBUSN 498 Business Strategy Final Projectcsdemomail789No ratings yet

- Credit RatingDocument10 pagesCredit Ratingnguyentrinh.03032003No ratings yet

- Digital Marketing of Life. Accident and Health Insurance Products: Series 0001, #1From EverandDigital Marketing of Life. Accident and Health Insurance Products: Series 0001, #1No ratings yet

- Customer Analysis & Insight: An Introductory Guide To Understanding Your AudienceFrom EverandCustomer Analysis & Insight: An Introductory Guide To Understanding Your AudienceNo ratings yet

- Brand Research & Analysis: Understand Its Importance & ApplicationFrom EverandBrand Research & Analysis: Understand Its Importance & ApplicationNo ratings yet

- Sample RUBRICS STD3 TO 5 - HYE-2022-23Document1 pageSample RUBRICS STD3 TO 5 - HYE-2022-23Loganathaan SrimathiNo ratings yet

- Plan For Storytelling With DataDocument1 pagePlan For Storytelling With DataLoganathaan SrimathiNo ratings yet

- Best Practices For Storytelling With DataDocument2 pagesBest Practices For Storytelling With DataLoganathaan SrimathiNo ratings yet

- Exploratory Data Analysis Queries About BankFinanceDataDocument2 pagesExploratory Data Analysis Queries About BankFinanceDataLoganathaan SrimathiNo ratings yet

- Webinar StorytellingwithDataSession5-6Document30 pagesWebinar StorytellingwithDataSession5-6Loganathaan SrimathiNo ratings yet

- Best Practices of Data VisualizationDocument2 pagesBest Practices of Data VisualizationLoganathaan SrimathiNo ratings yet

- Webinar StorytellingwithDataSession3-4Document30 pagesWebinar StorytellingwithDataSession3-4Loganathaan SrimathiNo ratings yet

- Biases in StudiesDocument1 pageBiases in StudiesLoganathaan SrimathiNo ratings yet

- Consolidation of Differentiation StrategyDocument57 pagesConsolidation of Differentiation StrategyKe Lun ChuaNo ratings yet

- Vasudeva 2017Document60 pagesVasudeva 2017Vivek KhuranaNo ratings yet

- Financial Report For The Year 2020-21-DDocument74 pagesFinancial Report For The Year 2020-21-DAmanuel TewoldeNo ratings yet

- MGMT UNDocument357 pagesMGMT UNEXPOGREENNo ratings yet

- An ISO 9001-2008 Certified State Level Nodal AgencyDocument2 pagesAn ISO 9001-2008 Certified State Level Nodal AgencyBunty DasNo ratings yet

- Chapter 12 Systems Development, Program Changes, and Application AuditingDocument14 pagesChapter 12 Systems Development, Program Changes, and Application AuditingViola cariniNo ratings yet

- PDF CV & Cover Letter PDFDocument5 pagesPDF CV & Cover Letter PDFZarin RahmanNo ratings yet

- Yap - ACP312 - ULOd - in A NutshellDocument1 pageYap - ACP312 - ULOd - in A NutshellJunzen Ralph YapNo ratings yet

- Group3 Fiscal Theory of BudgetingDocument31 pagesGroup3 Fiscal Theory of BudgetingFerry Lyra FrondaNo ratings yet

- Ross StoresDocument8 pagesRoss StoresKumar SwamyNo ratings yet

- Gmail - Invoice - SLE001EC3807970, Purchased On - 2022-01-29Document2 pagesGmail - Invoice - SLE001EC3807970, Purchased On - 2022-01-29Sayan DeyNo ratings yet

- Chapter1 EconomicsDocument9 pagesChapter1 EconomicsSam PerezNo ratings yet

- Hitachi Cylinder AssemblyDocument2 pagesHitachi Cylinder AssemblyIgor BedrinanaNo ratings yet

- DFMPro 5.0 For SOLIDWORKS Installation GuideDocument17 pagesDFMPro 5.0 For SOLIDWORKS Installation GuideanupnairNo ratings yet

- Analyzing Punjab National Bank Scam: June 2019Document9 pagesAnalyzing Punjab National Bank Scam: June 2019TejaswiniNo ratings yet

- Topic 9 by DTL - Merchandise Buying and HandlingDocument23 pagesTopic 9 by DTL - Merchandise Buying and HandlingWalter InsigneNo ratings yet

- Government College of Management Sciences Abbottabad: Internship Report ON District Comptroller of Accounts AbbottabadDocument78 pagesGovernment College of Management Sciences Abbottabad: Internship Report ON District Comptroller of Accounts AbbottabadFaisal AwanNo ratings yet

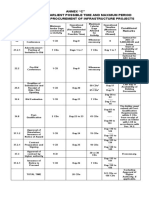

- Timelines InfrastructureDocument1 pageTimelines InfrastructureGie Bernal CamachoNo ratings yet

- Debate Mitra - CSRDocument2 pagesDebate Mitra - CSRsaman0711994No ratings yet

- Plate For Mounting Robotarm UR3 Item and Bosch ProfilesDocument1 pagePlate For Mounting Robotarm UR3 Item and Bosch ProfilesVickocorp SlpNo ratings yet

- Critical Capabilities For Oracle Cloud Application Services, Worldwide, 2022Document42 pagesCritical Capabilities For Oracle Cloud Application Services, Worldwide, 2022Arun KumarNo ratings yet

- 6258-Article Text-19696-1-10-20220722Document13 pages6258-Article Text-19696-1-10-20220722Khin Yadana AyeNo ratings yet

- List of ISO Standards PDFDocument20 pagesList of ISO Standards PDFKristal Newton80% (5)

- At Io N at Et: The Polytechnic Ibadan IRSDocument1 pageAt Io N at Et: The Polytechnic Ibadan IRSadegbola hamzatNo ratings yet

- Business Plan 2024 25Document23 pagesBusiness Plan 2024 25janjantuazon24No ratings yet

- Use of Software in Textile: Jawaharlal Drda Institute of Engineering and Technology, YavatmalDocument8 pagesUse of Software in Textile: Jawaharlal Drda Institute of Engineering and Technology, YavatmalRajesh Dwivedi100% (1)

- Marketing Tutorial Exercise 2Document5 pagesMarketing Tutorial Exercise 2Syed Muhd AmriNo ratings yet