Professional Documents

Culture Documents

Bank Indonesia Business Survey Quarter 3 - 2023' '

Bank Indonesia Business Survey Quarter 3 - 2023' '

Uploaded by

mza.arifinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Indonesia Business Survey Quarter 3 - 2023' '

Bank Indonesia Business Survey Quarter 3 - 2023' '

Uploaded by

mza.arifinCopyright:

Available Formats

QUARTER III - 2023 BUSINESS ACTIVITY REMAINS SOLID

The latest Business Survey conducted by Bank Indonesia indicates that business activity in the

third quarter of 2023 remained solid, as reflected by a weighted net balance (WNB) of 15.65%.

Strong business activity was supported by increasing performance in several economic sectors,

Business Activity

including Mining and Quarrying due to seasonal factors, the Manufacturing Industry on the

back of maintained demand, as well as the Construction sector in line with ongoing domestic

projects.

Production Capacity, Consistent with solid business activity, production capacity utilisation in the third quarter of 2023

Labour and Financial increased to 75.17% from 74.88% in the previous period, while labour utilisation remained in an

Condition expansionary phase despite moderation. On the other hand, corporate financial conditions

remained sound in general, despite retreating on the previous period.

Respondents predict persistently solid business activity in the fourth quarter of 2023, with a

WNB of 13.08%, driven by Wholesale and Retail Trade and the Repair of Motor Vehicles and

Business Optimism Motorcycles, Transportation and Logistics as well as Accommodation and Food Service

Activities in response to a seasonal spike in demand during the Christmas and New Year festive

period.

A. Business Activity

Business activity The latest Business Survey conducted by Bank Indonesia in the third quarter of 2023

remained solid in indicates persistently solid business activity compared to conditions in the previous period despite

the third quarter

quarterly moderation in line with cyclical trends. This was reflected by a Weighted Net Balance

of 2023, with

respondents (WNB) of business activity recorded at 15.65%, down from 16.62% in the second quarter of 2023

predicting robust (Graph 1). Several sectors posted gains, namely Mining and Quarrying (WNB 1.43%) in line with

growth in the

seasonal factors, the availability of production facilities, and increasing storage capacity; the

fourth quarter of

2023. Manufacturing Industry (WNB 2.81%) on the back of maintained demand; as well as Construction

(WNB 1.61%) given ongoing domestic projects supported by conducive seasonal/weather

conditions. Several other sectors, however, experienced moderation, including Agriculture, Forestry,

and Fishing (WNB 1.18%), specifically the Food Crop subsector in line with the dry season (gadu1)

harvest in West Java, Central Java, and East Java; Wholesale and Retail Trade, and Repair of Motor

Vehicles and Motorcycles (WNB 0.88%); as well as Accommodation and Food Service Activities

(WNB 0.54%), particularly Food Service Activities as demand normalises after the recent Eid-ul-Fitr

national religious holiday (Table 1 - Appendix).

1

The gadu harvest refers to rice harvested during the dry season.

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Graph 1 Business Activity

16.66 16.34 16.62

15.65

13.08

3.73 3.86

1.83

Respondents predict robust business activity growth in the fourth quarter of 2023, as

reflected by a WNB of 13.08%. Respondents expect the gains to be driven by, among others,

Wholesale and Retail Trade, and Repair of Motor Vehicles and Motorcycles (WNB 1.42%);

Transportation and Storage (WNB 1.26%); as well as Accommodation and Food Service Activities

(WNB 1.01%), driven by increasing domestic demand during the Christmas and New Year festive

period. Meanwhile, respondents predict a significant decline in terms of Agricultural, Forestry, and

Fishing activities (WNB -1.03%) as the Food Crop and Plantation Crop subsectors enter the planting

season, coupled with higher rainfall that is detrimental to Horticultural Crop subsector performance

(Table 1 - Appendix).

B. Production Capacity

Production Production capacity utilisation increased in the third quarter of 2023 to 75.17% from 74.88%

capacity utilisation

increased in the

in the second quarter of 2023 (Graph 2). Respondents reported broad-based gains across all sectors,

third quarter of except Agriculture, Forestry, and Fishing, led by the Electricity Supply sector (81.94%), Water Supply

2023. sector (76.01%), and Manufacturing Industry (74.38%) (Table 2 - Appendix).

Graph 2 Capacity Utilisation

81.31 81.94

76.01

75.05

74.90 74.38

73.81

73.58

69.55 69.69

74.88

75.17

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

C. Financial Conditions and Access to Credit

In general, Most respondents reported sound corporate financial conditions in the third quarter of

corporate financial

conditions

2023, as reflected by a 18.71% Net Balance (NB) of liquidity, which is nevertheless lower than the

remained sound in 24.28% recorded in the second quarter of 2023 (Graph 3). The decline was also indicated by a

the third quarter of

decrease in the percentage of respondents reporting looser liquidity conditions in the third quarter

2023, accompanied

by looser access to of 2023 to 24.35% from 29.44% in the previous period (Table 3 - Appendix).

credit.

Graph 3 Liquidity Conditions Graph 4 Profitability Conditions

30.0 25.0

21.22

24.28

25.0 20.0 18.80 18.17

20.46 19.64 16.40

20.0 18.71

15.0

15.0

10.0

10.0

5.0

5.0

0.0 0.0

I II III IV I II III IV I II III I II III IV I II III IV I II III

2021 2022 2023 2021 2022 2023

Corporate profitability also remained sound in the third quarter of 2023, as indicated by an

18.17% NB of profitability, down from 21.22% in the previous period (Graph 4). The percentage of

respondents reporting higher corporate profitability in the third quarter of 2023 decreased to

25.68% from 28.38% in the second quarter of 2023 (Table 3 - Appendix).

On the other hand, respondents confirmed looser access to bank loans in the third quarter

of 2023 as reflected by an increase in the corresponding NB to 4.64% from 4.21% in the second

quarter of 2023. This was also reflected by a modest uptick in the percentage of respondents

reporting looser access to bank loans to 8.90% from 8.82% in the previous period, while the

percentage of respondents reporting tighter access to bank loans decreased to 4.26% from 4.60%

in the reporting period (Table 3 - Appendix).

D. Labour Utilisation

Labour utilisation Labour utilisation remained in an expansionary phase in the third quarter of 2023, with the

remained in an

expansionary WNB decreasing to 3.76% from 3.95% in the second quarter of 2023 (Graph 5). A higher WNB of

phase in the third labour utilisation was reported by respondents in the Mining and Quarrying sector (WNB 2.05%)

quarter of 2023,

with respondents and Manufacturing Industry (WNB 0.11%) in response to increasing production activity. On the other

predicting a hand, moderating labour utilisation was confirmed by respondents in Accommodation and Food

relatively stable

trend in the fourth

Service Activities (WNB 0.13%), along with lower labour absorption in terms of Agriculture, Forestry,

quarter of 2023. and Fishing (WNB -0.32%) as well as Wholesale and Retail Trade, and Repair of Motor Vehicles and

Motorcycles (WNB -0.07%) in line with decreasing business activity (Table 4 - Appendix).

Respondents predict relatively stable labour utilisation in the fourth quarter of 2023, with a

WNB of 3.77%. Several sectors are expected to remain in positive territory, namely Mining and

Quarrying (WNB 1.83%), Financial Services (WNB 0.77%), Education Services (WNB 0.30%), and Real

Estate (WNB 0.28%). In contrast, respondents anticipate lower labour utilisation in Agriculture,

Forestry, and Fishing (WNB -0.31%) as well as Other Services (WNB -0.14%) (Table 4 - Appendix).

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Graph 5 Labour Utilisation

(% WNB)

3.95 3.76 3.77

3.33

1.94

E. Selling Price

An increase in the WNB to 14.43% from 12.85% indicated a build-up of inflationary pressures

at the producer level in the third quarter of 2023 (Graph 6). Higher selling prices in the reporting

Producers reported

a build-up of period were driven by increasing prices in the Agricultural, Forestry, and Fishing sector (WNB 2.99%);

inflationary Mining and Quarrying sector (WNB 1.24%), specifically the Oil and Natural Gas Mining subsector;

pressures in the

third quarter of and Manufacturing Industry (WNB 1.84%). Meanwhile, rising selling prices decelerated in terms of

2023, with milder Accommodation and Food Service Activities (WNB 0.43%) and Construction (WNB 1.80%) in line with

inflation forecast in

the fourth quarter lower promotional/marketing costs (Table 5 - Appendix).

of 2023. Respondents forecast milder inflationary pressures in the fourth quarter of 2023, as

indicated by a lower WNB of 11.15% compared to 14.43% in the third quarter of 2023. Milder

inflationary pressures are primarily expected in the Agricultural, Forestry, and Fishing sector (WNB

1.41%) as well as Mining and Quarrying sector (WNB 0.43%) given lower raw material costs. In

addition, rising prices are also expected to moderate in other economic sectors, namely Wholesale

and Retail Trade (WNB 2.35%) as well as Accommodation and Food Service Activities (WNB 0.38%)

in line with yearend promotional strategies (Table 5 - Appendix).

Graph 6 Selling Price

(% WNB)

20.87 21.52

14.43

12.85

11.15

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

F. Inflation

Respondents In the third quarter of 2023, respondents predicted 3.75% (yoy) average inflation in 2023,

predict 3.75%

inflation in 2023. which is relatively stable compared to the previous projection of 3.76% in the second quarter of 2023

(Graph 7). The latest prediction is within the national inflation target corridor for 2023 of 3.0%±1%.

By sector, the highest inflation rate was predicted by respondents in the Public Administration,

Defence, and Compulsory Social Security sector (4.15%), Other Services (4.10%) as well as Agriculture,

Forestry, and Fishing (4.07%). Conversely, the lowest average rate of 3.37% was predicted by

respondents in the Electricity Supply sector (Table 6 - Appendix).

Graph 7 Inflation

%yoy

6.00 5.51

5.00

4.06 BIBS Q1

4.00 3.68 3.76 BIBS Q2

3.34 3.43 3.75 BIBS Q3

3.21

3.00 2.72

3.13

2.72

2.00

1.87

1.68

1.00

*) Expectation

0.00

2018 2019 2020 2021 2022 2023*

Realized Inflation Inflation-(BIBS)

G. Investment

The corporate sector The corporate sector was more inclined to invest in the third quarter of 2023, as reflected

was more inclined to

by an increase in the WNB of investment to 8.67% from 7.60% in the previous period (Table 7 -

invest in the third

quarter of 2023, with Appendix). By sector, respondents reported higher third-quarter investment realisation in some

respondents economic sectors, primarily Mining and Quarrying (WNB 1.94%), the Manufacturing Industry (WNB

nevertheless

expecting 1.34%) and Financial Services (WNB 0.94%), driven by the purchase of new machinery, heavy

moderation moving equipment and vehicles, as well as building development and/or maintenance (Table 7 - Appendix).

forward.

Looking ahead, respondents expect investment to moderate in the fourth quarter of 2023

in line with seasonal trends, as reflected by a WNB of 5.68%. Moderation is predominantly predicted

in the Mining and Quarrying sector (WNB 0.41%) and Manufacturing Industry (WNB 0.74%).

H. Wages

Wages are still rising

in the second Rising wages have moderated in the second semester of 2023 compared to conditions in

semester of 2023,

despite slower growth the first semester of 2023 and second semester of 2022, as indicated by a decrease in the Net Balance

than in the first (NB) of wages to 12.97% from 42.11% in the first semester of 2023 and 13.62% in the second semester

semester of 2023 and

of 2022. All economic sectors recorded moderation compared to the same period of the previous

second semester of

2022.

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

year, with Accommodation and Food Service Activities experiencing the deepest decline in the Net

Balance to 17.39%, followed by Information and Communication (NB 13.33%) and the Manufacturing

Industry (NB 11.61%) ((Table 8 - Appendix).

Foreman/supervisor level salaries averaged Rp5.24 million per month in the second

semester of 2023, while employees below the foreman/supervisor level took home an average of

Rp3.37 million per month. By sector, Electricity Supply remunerated the highest wages/salaries in the

reporting period, namely Rp9.14 million per month for a foreman/supervisor and Rp6.0 million per

month for employees below the foreman/supervisor level (Table 9 - Appendix).

I. Profit Margin

Profit margins are Respondents forecast wider profit margins in the second semester of 2023 compared to

expected to increase

in the second conditions in the first semester of 2023 and second semester of 2022, increasing to 17.69% from

semester of 2023 15.53% in the first semester of 2023 and 15.10% in the second semester of 2022. By sector, higher

compared to

conditions in the profit margins were confirmed by respondents in Electricity Supply Sector, Mining and Quarrying

second semester of Sector, as well as Real Estate Sector, increasing respectively to 16.48%, 20.32%, and 19.96% in the

2022 and first

second semester of 2023 from 11.57%, 19.84% and 15.41% in the first semester of 2023 and from

semester of 2023.

10.08%, 14.46%, and 15.65% in the second semester of 2022 (Table 10 - Appendix).

J. Prompt Manufacturing Index – Bank Indonesia2

The latest PMI-BI According to the latest Prompt Manufacturing Index-Bank Indonesia (PMI-BI), Manufacturing

pointed to increasing

Industry performance has remained in an expansionary phase for almost the last two years, increasing

Manufacturing

Industry performance slightly to 52.93% in the third quarter of 2023 from 52.39% in the second quarter of 2023.

in an expansionary Respondents confirmed gains across all PMI-BI components, particularly Production Volume and

phase in the third

quarter of 2023, with Inventory Volume, while Order Volume remained in expansionary territory despite some moderation.

the trend expected to Furthermore, respondents reported a higher PMI-BI reading in most manufacturing subsectors, led

persist in the fourth

quarter of 2023.

by the Transportation Equipment Industry, Machinery and Equipment Industry, as well as the Non-

Metallic Mineral Products Industry.

Respondents expect manufacturing industry performance to remain solid in the fourth

quarter of 2023, as reflected by an expansionary PMI-BI reading above the 50% threshold at 52.25%.

Most PMI-BI components are predicted in an expansionary phase, led by Production Volume,

followed by Inventory Volume and Order Volume. In addition, respondents anticipate most

manufacturing subsectors to occupy expansionary territory, with the highest index readings posted

by the Leather, Leather Products, and Footwear Industry, Transportation Equipment Industry, as well

as the Non-Metallic Mineral Products Industry.

2

Full PMI-BI Report is available: https://www.bi.go.id/en/publikasi/laporan/default.aspx

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

K. Sectoral Review

Agricultural, Forestry, and Fishing Sector

Agricultural, Forestry, In general, Agricultural, Forestry, and Fishing sector activity moderated in the third quarter

and Fishing sector

activity moderated in

of 2023, as indicated by a decrease in the WNB to 1.18% from 2.34% in the previous period (Graph

the third quarter of 8). Moderation primarily stemmed from the Plantation Crop and Food Crop subsectors (WNB 0.44%)

2023, with a

in line with the dry season (gadu) harvest in West Java, Central Java, and East Java, as well as the

contraction

anticipated in the Fishing subsector (WNB 0.06%).

fourth quarter of

2023.

Consistent with business activity, labour utilisation in the Agricultural, Forestry, and Fishing

sector slumped into a contractionary phase in the third quarter of 2023, as indicated by a WNB of

-0.32%, thus reversing the positive 0.35% recorded in the second quarter of 2023 (Graph 9).

Respondents predict a deeper decline of Agricultural, Forestry, and Fishing sector activity in

the fourth quarter of 2023 based on a contractionary WNB of -1.03% (Graph 8). Business activity in

most subsectors is expected to fade, including the Food Crop subsector (WNB -0.95%) and

Plantation Crop subsector (WNB -0.46%) due to the onset of the planting season, accompanied by

higher rainfall that will impede Horticultural Crop subsector performance (WNB -0.14%)

(Table 1 - Appendix).

Respondents also expect labour utilisation in the Agricultural, Forestry, and Fishing sector

to contract in the fourth quarter of 2023 (Graph 9), as reflected by a WNB of -0.31%. Contractions

are forecast in nearly all subsectors, particularly the Plantation Crop subsector (WNB -0.17%) and

Horticultural Crop subsector (WNB -0.14%) (Table 4 - Appendix).

Graph 8 Business Activity of Graph 9 Labour Utilisation of Agricultural,

Agricultural, Forestry, and Fishing Sector Forestry, and Fishing Sector

(% WNB) (% qtq) (% WNB)

0.60

0.40

0.20

0.00

-0.20

-0.40

-0.60

-0.80

-1.00

I II III IV I II III IV I II III IV*

2021 2022 2023

Mining and Quarrying Sector

Mining and Mining and Quarrying sector activity increased in the third quarter of 2023, with the WNB

Quarrying sector

climbing to 1.43% from 0.62% in the previous period (Graph 10). The Oil and Natural Gas Mining as

activity increased in

the third quarter of well as Metalliferous Ore Mining subsectors maintained positive performance in line with seasonal

2023, with factors, the availability of production facilities, and increasing storage capacity. Meanwhile, an

moderation

predicted in the increase in the corresponding WNB to 2.05% from 1.04% pointed to higher labour utilisation in the

fourth quarter of Mining and Quarrying sector in the reporting period (Graph 11), driven by the Oil and Natural Gas

2023.

Mining as well as Metalliferous Ore Mining subsectors in response to rising production activity.

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Respondents expect solid yet moderating Mining and Quarrying sector activity in the fourth

quarter of 2023, as indicated by a WNB of 0.99% (Graph 10), supported by a stable Oil and Natural

Gas Mining subsector as well as expansion forecast in the Metalliferous Ore Mining and Other Mining

and Quarrying subsectors. Similarly, respondents predict labour utilisation to continue growing in

the fourth quarter of 2023, despite moderation to 1.83% from 2.05% in the previous period (Graph

11).

Graph 10 Business Activity of Mining and Quarrying Graph 11 Labour Utilisation of Mining and

Sector Quarrying Sector

(% WNB) (% qtq) (% WNB)

2.50

2.00

1.50

1.00

0.50

0.00

-0.50

-1.00

-1.50

-2.00

I II III IV I II III IV I II III IV*

2021 2022 2023

Manufacturing Industry

Manufacturing Indications of increasing Manufacturing Industry activity were observed in the third quarter

Industry activity of 2023, with the WNB reaching 2.81% from 2.21% in the second quarter of 2023 (Graph 12).

increased in the

third quarter of Respondents reported positive performance across several subsectors, led by the Transportation

2023, with Equipment Industry (WNB 0.67%), Basic Metals Industry (WNB 0.31%), and Non-Metallic Mineral

moderation

predicted in the

Products Industry (WNB 0.33%), on the back of maintained domestic demand. Increasing

fourth quarter of manufacturing industry activity in the third quarter of 2023 was also consistent with the latest Prompt

2023.

Manufacturing Index-Bank Indonesia (PMI-BI) reading, which increased slightly to 52.93% from

52.39% in the second quarter of 2023 (Graph 13).

In line with business activity, labour utilisation in the Manufacturing Industry increased and

moved out of a contractionary phase in the third quarter of 2023, with the WNB reaching 0.11% to

reverse the -0.16% recorded in the previous period (Table 4 - Appendix). Higher labour utilisation

was predominantly driven by the Food and Beverage Manufacturing Industry (WNB 0.18%), followed

by Paper and Paper Products, Printing and Reproduction of Recorded Media (WNB 0.07%) and the

Basic Metals Industry (WNB 0.03%).

Respondents expect manufacturing industry activity to remain solid in the fourth quarter of

2023 despite moderation, as indicated by a lower WNB of 0.98% from 2.81% in the third quarter of

2023. Respondents predict most manufacturing subsectors to remain in positive territory. Similarly,

the Prompt Manufacturing Index-Bank Indonesia (PMI-BI) is also forecast in an expansionary phase

at 52.25% in the fourth quarter of 2023, despite retreating from 52.93% in the third quarter of 2023.

Several PMI-BI components are expected to track gains, particularly Production Volume (56.30%)

and Inventory Volume (53.80%), while the Order Volume Index will remain in expansionary territory

despite decreasing to 54.15% (Table 11 - Appendix).

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

In terms of labour utilisation, respondents predict a decline in the fourth quarter of 2023 in

line with moderating business activity. Notwithstanding, the WNB of labour utilisation in the fourth

quarter of 2023 is expected to remain in an expansionary phase at 0.06% (Table 4 - Appendix). By

subsector, respondents expect moderation in the Food and Beverage Manufacturing Industry (WNB

0.12%), as well as Paper and Paper Products, Printing and Reproduction of Recorded Media (WNB

0%) and the Non-Metallic Mineral Products Industry (WNB 0%).

Graph 12 Business Activity of Manufacturing Graph 13 Business Activity of

Industry Sector Manufacturing Industry vs PMI - BIBS

(% WNB) (% qtq)

Construction Sector

Construction activity increased in the third quarter of 2023, as indicated by a higher WNB

Construction

activity increased in of 1.61% compared to 1.31% in the previous period (Graph 14). Most respondents acknowledged

the third quarter of ongoing domestic projects accompanied by seasonal/weather conditions conducive to construction

2023, with

moderation activity for the increase observed in the reporting period. Meanwhile, the WNB of labour utilisation

predicted in the in the Construction sector was positive in the third quarter of 2023 at 0.26%, relatively stable

fourth quarter of

2023.

compared to 0.24% in the second quarter of 2023 (Graph 15).

Respondents predict solid Construction sector activity in the fourth quarter of 2023 despite

moderation due to the completion of construction projects in line with historical trends, with the

WNB of business activity moderating to 1.25% from 1.61% in the previous period (Graph 14). In line

with moderating construction activity, a WNB of 0.10% also points to moderating labour utilisation

expected by respondents in the fourth quarter of 2023 (Graph 15).

Graph 14 Business Activity of Construction Sector Graph 15 Labour Utilisation of Construction Sector

(% qtq) (% WNB)

(% WNB) 0.80

0.60

0.40

0.20

0.00

-0.20

-0.40

-0.60

-0.80

-1.00

-1.20

I II III IV I II III IV I II III IV*

2021 2022 2023

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Wholesale and Retail Trade, and Repair of Motor Vehicles and Motorcycles Sector

Business activity in Business activity in the Wholesale and Retail Trade, and Repair of Motor Vehicles and

the Wholesale and

Retail Trade, and Motorcycles sector moderated in the third quarter of 2023, as reflected by a lower WNB of 0.88%

Repair of Motor from 1.68% in the second quarter of 2023 (Graph 16). Respondents confirmed moderating business

Vehicles and

Motorcycles sector activity in the Wholesale and Retail Trade, except of Motor Vehicles and Motorcycles subsector (WNB

moderated in the 0.23%) given the normalisation of demand after the Eid-ul-Fitr national religious holidays (Table 1 -

third quarter of 2023,

Appendix).

with increasing

activity predicted in Labour utilisation decreased in the reporting period in line with moderating business activity,

the fourth quarter of

2023. as indicated by a contractionary WNB of -0.07% to reverse the positive 0.92% recorded in the

previous period (Graph 17). The main contributor to lower labour utilisation in the reporting period

was the Wholesale and Retail Trade, except of Motor Vehicles and Motorcycles subsector (WNB -

0.20%) (Table 4 - Appendix).

Respondents expect business activity to rebound in the Wholesale and Retail Trade, and

Repair of Motor Vehicles and Motorcycles sector in the fourth quarter of 2023, with the WNB

increasing to 1.42% from 0.88% in the previous period (Graph 16). Activity in both subsectors, namely

the Sale of Motor Vehicles, Motorcycles, and Repair subsector (WNB 0.75%) as well as the Wholesale

and Retail Trade subsector (WNB 0.67%) expected to increase, driven by a seasonal spike in demand

during the Christmas and New Year festive period.

Looking ahead, respondents expect labour utilisation to improve in the Wholesale and Retail

Trade, and Repair of Motor Vehicles and Motorcycles sector in the fourth quarter of 2023, with the

WNB improving to -0.02% despite remaining in a contractionary phase (Graph 17). By subsector,

respondents expect labour absorption in the Sale of Motor Vehicles, Motorcycles, and Repair

subsector to increase (WNB 0.18%), but remain stable in terms of the Wholesale and Retail Trade,

except of Motor Vehicles and Motorcycles subsector (WNB -0.20%) (Table 4 - Appendix).

Graph 16 Business Activity of Wholesale and Retail Graph 17 Labour Utilisation of Wholesale and

Trade, and Repair of Motor Vehicles and Retail Trade, and Repair of Motor

Motorcycles sector Vehicles and Motorcycles sector

(% WNB) (% qtq) (% WNB)

1.50

1.00

0.50

0.00

-0.50

-1.00

-1.50

I II III IV I II III IV I II III IV*

2021 2022 2023

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

APPENDIX

Table 1 Business Activity Development and Outlook

(% Weighted Net Balance - WNB)

*) Expectation

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Table 2 Production Capacity Utilisation

(Percentage)

Table 3 Indicator of Financial Condition and Access to Financing

(Net Balance - NB)

INDICATORS

Financial condition over past three months:

- Liquidity

Better 27.45 27.02 29.44 24.35

Same 66.62 66.39 65.39 70.00

Worse 5.93 6.59 5.16 5.65

Net Balance (% Good - % Bad) 21.52 20.43 24.28 18.71

- Rentability

Better 26.91 26.62 28.38 25.68

Same 65.61 64.07 64.47 66.81

Worse 7.48 9.30 7.15 7.51

Net Balance (% Good - % Bad) 19.43 17.32 21.22 18.17

Access to credit over past three months:

Easy 9.06 8.87 8.82 8.90

Normal 86.44 86.55 86.58 86.85

Tight 4.50 4.57 4.60 4.26

Net Balance (% Easy - % Tight) 4.56 4.30 4.21 4.64

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Table 4 Labour Utilisation

(Weighted Net Balance – WNB)

*) Expectation

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Table 5 Selling Price

(Weighted Net Balance – WNB)

*) Expectation

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Table 6 Annual Inflation Expectations

(% of respondents)

3.54 4.41 3.76 4.07

3.73 3.90 3.20 3.54

3.84 3.96 3.91 3.83

3.24 3.56 3.69 3.37

3.37 3.50 3.78 3.41

3.78 3.98 3.73 3.88

3.99 3.75 3.97 4.02

3.37 4.17 3.67 3.60

3.47 4.66 3.75 3.63

3.11 3.83 3.57 3.50

3.66 4.51 3.79 3.64

3.37 6.00 4.45 3.98

3.47 4.03 3.48 3.60

3.22 3.72 3.39 4.15

2.71 3.38 3.68 3.97

3.26 3.57 3.86 3.40

3.11 4.02 4.20 4.10

TOTAL 3.43 4.06 3.76 3.75

National Inflation Target 3±1 3±1

Table 7 Realisation of Investment

(Weighted Net Balance – WNB)

7.75

*) Expectation

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Table 8 Wages / Salaries

(% Net Balance – NB)

AGRICULTURE, FORESTRY AND FISHERY 14.55 84.94 0.52 14.03 30.83 68.67 0.50 30.33 12.02 87.47 0.51 11.51

MINING AND QUARRYING 11.54 87.18 1.28 10.26 31.15 68.85 0.00 31.15 14.53 83.76 1.71 12.82

MANUFACTURING 14.87 84.49 0.63 14.24 51.44 47.28 1.28 50.16 13.76 84.08 2.16 11.61

ELECTRICITY AND GAS SUPPLY 24.19 75.81 0.00 24.19 45.61 52.63 1.75 43.86 26.00 74.00 0.00 26.00

WATER SUPPLY, SEWERAGE, WASTE MANAGEMENT AND REMEDIATION ACTIVITIES 16.07 82.14 1.79 14.29 26.53 71.43 2.04 24.49 9.52 90.48 0.00 9.52

CONSTRUCTION 7.48 90.19 2.34 5.14 27.03 71.43 1.54 25.48 11.19 87.76 1.05 10.14

WHOLESALE AND RETAIL TRADES, REPAIR OF MOTOR VEHICLE AND MOTORCYCLES 11.64 87.82 0.55 11.09 48.59 50.28 1.13 47.47 11.01 87.92 1.07 9.95

TRANSPORT AND STORAGE 14.04 83.63 2.34 11.70 41.06 57.49 1.45 39.61 12.75 87.25 0.00 12.75

ACCOMMODATION AND FOOD SERVICE ACTIVITIES 21.15 77.42 1.43 19.71 57.73 41.24 1.03 56.70 19.57 78.26 2.17 17.39

INFORMATION AND COMMUNICATION 13.41 85.37 1.22 12.20 52.00 48.00 0.00 52.00 14.67 84.00 1.33 13.33

FINANCIAL AND INSURANCE SERVICES 22.17 77.83 0.00 22.17 52.44 47.15 0.41 52.03 25.56 73.09 1.35 24.22

REAL ESTATE ACTIVITIES 10.00 88.57 1.43 8.57 34.09 65.91 0.00 34.09 11.46 87.50 1.04 10.42

BUSINESS SERVICES 18.03 80.33 1.64 16.39 35.94 64.06 0.00 35.94 12.50 85.94 1.56 10.94

PUBLIC ADMINISTRATION AND DEFENSE, COMPULSORY SOCIAL SECURITY 7.69 92.31 0.00 7.69 28.57 68.57 2.86 25.71 5.48 94.52 0.00 5.48

EDUCATION 12.71 86.44 0.85 11.86 17.98 82.02 0.00 17.98 13.73 86.27 0.00 13.73

HUMAN HEALTH AND SOCIAL WORK ACTIVITIES 11.67 88.33 0.00 11.67 45.12 53.66 1.22 43.90 18.60 81.40 0.00 18.60

OTHER SERVICES ACTIVITIES 10.00 90.00 0.00 10.00 41.18 58.82 0.00 41.18 14.29 85.71 0.00 14.29

Table 9 Average Wages / Salaries

(IDR per Month)

AGRICULTURE, FORESTRY AND FISHERY 2,188,225 3,183,708 2,189,911 3,108,413 2,355,188 3,283,183

MINING AND QUARRYING 3,323,191 6,021,716 3,213,227 5,441,696 3,060,343 5,130,996

MANUFACTURING 2,680,840 3,997,439 3,166,371 4,792,675 3,065,612 4,448,147

ELECTRICITY AND GAS SUPPLY 4,633,359 7,820,315 5,817,459 9,606,016 6,003,748 9,147,398

WATER SUPPLY, SEWERAGE, WASTE MANAGEMENT AND REMEDIATION ACTIVITIES 3,340,730 5,408,943 3,516,232 5,637,720 3,398,847 5,447,598

CONSTRUCTION 2,845,794 4,185,619 3,217,886 4,621,132 3,253,837 4,735,052

WHOLESALE AND RETAIL TRADES, REPAIR OF MOTOR VEHICLE AND MOTORCYCLES 2,595,888 3,940,976 2,849,563 4,446,551 2,855,116 4,442,161

TRANSPORT AND STORAGE 3,161,281 4,863,283 3,704,444 5,632,262 3,770,676 5,661,761

ACCOMMODATION AND FOOD SERVICE ACTIVITIES 2,661,196 3,859,784 2,817,374 4,084,067 2,926,052 4,342,279

INFORMATION AND COMMUNICATION 2,864,143 4,680,831 3,177,786 5,318,772 3,157,796 5,476,360

FINANCIAL AND INSURANCE SERVICES 4,049,541 7,301,906 4,573,582 8,305,650 4,364,276 8,027,915

REAL ESTATE ACTIVITIES 2,528,376 3,786,821 3,041,968 4,882,368 3,111,548 4,890,854

BUSINESS SERVICES 2,879,699 4,144,112 3,193,874 4,983,505 3,337,186 4,881,183

PUBLIC ADMINISTRATION AND DEFENSE, COMPULSORY SOCIAL SECURITY 2,752,722 4,904,197 2,684,343 4,928,630 3,739,948 5,748,814

EDUCATION 2,327,057 4,168,983 2,533,388 3,891,500 2,609,432 3,920,038

HUMAN HEALTH AND SOCIAL WORK ACTIVITIES 2,796,133 4,558,352 3,145,852 4,864,588 3,129,667 5,095,998

OTHER SERVICES ACTIVITIES 2,464,953 3,688,717 2,697,059 3,876,471 3,221,613 4,502,566

Table 10 Profit Margin

(%)

AGRICULTURE, FORESTRY AND FISHERY 19.56% 13.60% 17.91% 12.66% 23.57% 17.40%

MINING AND QUARRYING 14.46% 8.64% 19.84% 12.75% 20.32% 12.05%

MANUFACTURING 13.63% 10.02% 15.13% 10.50% 18.32% 13.42%

ELECTRICITY AND GAS SUPPLY 10.08% 1.21% 11.57% 1.93% 16.48% 1.42%

WATER SUPPLY, SEWERAGE, WASTE MANAGEMENT AND REMEDIATION ACTIVITIES 11.25% 1.00% 12.05% 0.27% 11.86% 0.24%

CONSTRUCTION 14.06% 9.97% 13.81% 9.99% 16.30% 11.49%

WHOLESALE AND RETAIL TRADES, REPAIR OF MOTOR VEHICLE AND MOTORCYCLES 14.68% 10.73% 14.02% 9.16% 15.63% 11.09%

TRANSPORT AND STORAGE 16.83% 12.36% 18.97% 12.35% 20.16% 13.60%

ACCOMMODATION AND FOOD SERVICE ACTIVITIES 20.43% 15.68% 21.33% 16.45% 22.72% 16.07%

INFORMATION AND COMMUNICATION 15.17% 11.78% 17.75% 12.74% 17.73% 16.88%

FINANCIAL AND INSURANCE SERVICES 13.33% 9.23% 16.05% 10.74% 15.82% 10.90%

REAL ESTATE ACTIVITIES 15.65% 11.54% 15.41% 10.81% 19.96% 14.63%

BUSINESS SERVICES 17.42% 13.02% 15.43% 9.50% 18.83% 12.02%

PUBLIC ADMINISTRATION AND DEFENSE, COMPULSORY SOCIAL SECURITY 10.13% 6.02% 8.91% 6.99% 11.41% 8.11%

EDUCATION 13.15% 9.45% 13.51% 7.54% 15.20% 10.49%

HUMAN HEALTH AND SOCIAL WORK ACTIVITIES 16.84% 13.44% 15.79% 11.59% 18.59% 13.91%

OTHER SERVICES ACTIVITIES 20.07% 12.47% 16.47% 10.71% 17.81% 11.07%

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

Table 11 Prompt Manufacturing Index - Bank Indonesia

(% Index)

*) Expectation

Business Survey

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

THIS PAGE INTENTIONALLY LEFT BLANK

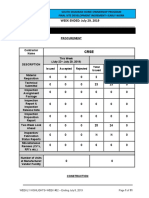

METHODOLOGY

The Business Survey has been conducted quarterly since the first quarter of 1993. In Quarter III-2023, the Survey was

extended to 3,170 enterprises spread throughout all regions of the Indonesian archipelago, selected using purposive

sampling. Statistically, the respondents have a sampling error of 2% at a 5% level of significance. Data is collated through

respondent questionnaires either by hardcopy or by online on BI website. The data is calculated using the net balance

method, namely by calculating the difference between the percentage of respondents whose answers increased, those

whose answers decreased and those whose answers remained the same. In the case of calculating the net balance of

business activity, selling price and labour utilization are calculated using the net weighted balance method. The weight

reflected the contribution of each sector to GDP. In Quarter I-2014, the Survey has been conducted in the last month of

the current quarter (one month earlier than usual). In addition, the questionnaire improvement and integrated web-based

application both were developed. Starting Quarter I-2023, there was update of the methodology from the base year 2000

Business Survey

to 2010.

EMISPDF id-sewatama-emis02 from 103.75.53.93 on 2023-11-17 15:37:50 GMT. DownloadPDF.

Downloaded by id-sewatama-emis02 from 103.75.53.93 at 2023-11-17 15:37:50 GMT. EMIS. Unauthorized Distribution Prohibited.

You might also like

- Comparative Study of Education in Kenya and Japan: What Can Kenya Learn?Document25 pagesComparative Study of Education in Kenya and Japan: What Can Kenya Learn?dulluamos78% (27)

- Planning Memorandum For The Audit Partner in Woolworths LimitedDocument9 pagesPlanning Memorandum For The Audit Partner in Woolworths LimitedTanmoy NaskarNo ratings yet

- NescafeDocument49 pagesNescafepatil_rekha0873% (11)

- Integrated Brand Audit - Macro EconomicsDocument17 pagesIntegrated Brand Audit - Macro Economicsduckhue.tranNo ratings yet

- Revised Operational GuidelinesDocument99 pagesRevised Operational Guidelinesm_sachuNo ratings yet

- Analysis of Agriculture and Allied Sector.: UNION BUDGET 2022-23Document15 pagesAnalysis of Agriculture and Allied Sector.: UNION BUDGET 2022-23asdNo ratings yet

- Editted-Integrated Farm Feasibility - Tariku GebreyesDocument10 pagesEditted-Integrated Farm Feasibility - Tariku GebreyesZelekeNo ratings yet

- Greater Jakarta: Industrial Q1 2020Document2 pagesGreater Jakarta: Industrial Q1 2020CookiesNo ratings yet

- Abia State 2023 Q2 Budget Performance ReportDocument47 pagesAbia State 2023 Q2 Budget Performance ReportAYOBAMI OJUAWONo ratings yet

- Acrex IntlDocument22 pagesAcrex IntlNarinder ThakurNo ratings yet

- Uganda Revenue Authority 9 Months Revenue Performance Report For The Period (July 2016 - March 2017) .Document14 pagesUganda Revenue Authority 9 Months Revenue Performance Report For The Period (July 2016 - March 2017) .URAuganda100% (2)

- Q3 2023 GDP ReportDocument35 pagesQ3 2023 GDP ReportShuyiNo ratings yet

- Interim Report q2 2023 230829Document20 pagesInterim Report q2 2023 230829amit.samdariyaNo ratings yet

- Rajasthan Electronics & Instruments LTDDocument3 pagesRajasthan Electronics & Instruments LTDmax0072No ratings yet

- Umuhigo ReportDocument4 pagesUmuhigo ReportMANIRAGABA AlphonseNo ratings yet

- Chapter-Six: Loan RecoveryDocument15 pagesChapter-Six: Loan RecoveryMithun MohaiminNo ratings yet

- 2023Q1. VN FMCG Monitor - by KantarDocument12 pages2023Q1. VN FMCG Monitor - by KantarĐặng Minh ChâuNo ratings yet

- Blemishing GDP Quarterly ResultsDocument4 pagesBlemishing GDP Quarterly ResultsCritiNo ratings yet

- Debrebirhan - Ankober - March Monthly ReportDocument9 pagesDebrebirhan - Ankober - March Monthly ReporttateekebedetanNo ratings yet

- MSC MMAR For August 2020Document20 pagesMSC MMAR For August 2020Ej ParañalNo ratings yet

- 2020 Q2 CushWake Jakarta IndustrialDocument2 pages2020 Q2 CushWake Jakarta IndustrialCookiesNo ratings yet

- IOSQ9788FD0Document9 pagesIOSQ9788FD0Kshitij SoniNo ratings yet

- Annoucement 22Q2 enDocument40 pagesAnnoucement 22Q2 enruhul aminNo ratings yet

- Revised Operational Guidelines PDFDocument99 pagesRevised Operational Guidelines PDFAKHI9No ratings yet

- Chapter IiDocument26 pagesChapter Iicristian0ebuengNo ratings yet

- Annual Report SIB 2019-20Document189 pagesAnnual Report SIB 2019-20SREE RAMNo ratings yet

- Press Note ON: Estimates of Gross Domestic Product For The First Quarter (April-June) 2023-24Document6 pagesPress Note ON: Estimates of Gross Domestic Product For The First Quarter (April-June) 2023-24Anirban BhattacharjeeNo ratings yet

- KGAL Outlook For Aviation Q1 2021Document6 pagesKGAL Outlook For Aviation Q1 2021GrowlerJoeNo ratings yet

- Sec (2017) 250 1Document71 pagesSec (2017) 250 1Juan Antonio Dela Cruz CruzNo ratings yet

- Economy FcciDocument17 pagesEconomy FccisureshdjNo ratings yet

- Airtel Africa PLC - Results For Half Year Ended 30 September 2023Document56 pagesAirtel Africa PLC - Results For Half Year Ended 30 September 2023Anonymous FnM14a0No ratings yet

- Chap 2Document17 pagesChap 2Nagina MemonNo ratings yet

- Economic PerformanceDocument5 pagesEconomic Performanceebrahim dankaliaNo ratings yet

- Ppaper 3Document7 pagesPpaper 3Endalkachew GutetaNo ratings yet

- Results Announcement For The Three and Six Months Ended June 30, 2023Document40 pagesResults Announcement For The Three and Six Months Ended June 30, 2023César JuniorNo ratings yet

- 中国消费:新时代的开始(英)Document6 pages中国消费:新时代的开始(英)jessica.haiyan.zhengNo ratings yet

- Marketing Plan (Bournvita)Document38 pagesMarketing Plan (Bournvita)Ayush SardaNo ratings yet

- Leased CircuitDocument2 pagesLeased CircuitAswin P SubhashNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedDocument6 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedJITHIN KRISHNAN MNo ratings yet

- JoltsDocument37 pagesJoltsrborgesdossantos37No ratings yet

- Vaibhav BFDocument9 pagesVaibhav BFVaibhav GuptaNo ratings yet

- L.S. Mills - 28072017Document7 pagesL.S. Mills - 28072017JituNo ratings yet

- Cma Data Report NagrajuDocument17 pagesCma Data Report NagrajuSRINIVASANo ratings yet

- BP - T124 - A2-1-3 - A2 - Pre-Work Assessment Activity 2 v3-0Document2 pagesBP - T124 - A2-1-3 - A2 - Pre-Work Assessment Activity 2 v3-0druudasNo ratings yet

- ABCRM PMS OFJune, 31.2023Document14 pagesABCRM PMS OFJune, 31.2023Ibsa Dase WorkuNo ratings yet

- Business Tracker Wave 2 Summary ReportDocument11 pagesBusiness Tracker Wave 2 Summary ReportEsinam AdukpoNo ratings yet

- Services: Impact of COVID-19 On Services SectorDocument20 pagesServices: Impact of COVID-19 On Services SectorArmaan KeshriNo ratings yet

- GDP - Q1 2023 - ReportDocument37 pagesGDP - Q1 2023 - Reportdavid.ocholiNo ratings yet

- 09-NBDB2022 Part2-Observations and RecommDocument28 pages09-NBDB2022 Part2-Observations and RecommjoevincentgrisolaNo ratings yet

- An Analysis of Wages and Salaries Extracted From Collective Agreements - Registered in 2018Document13 pagesAn Analysis of Wages and Salaries Extracted From Collective Agreements - Registered in 2018Marlon FordeNo ratings yet

- S-QUALITY Highlights 55 July-23 To 29-2019Document11 pagesS-QUALITY Highlights 55 July-23 To 29-2019Sehna SerajNo ratings yet

- Session II MurthyDocument19 pagesSession II MurthySaurav DuttaNo ratings yet

- 1.7. FABSecurities Lowerexpensesonadvertisementandpromotionaloffersboostedprofit Oct 13 2023Document5 pages1.7. FABSecurities Lowerexpensesonadvertisementandpromotionaloffersboostedprofit Oct 13 2023robynxjNo ratings yet

- CSEC Daily Digest 25th January 2023Document3 pagesCSEC Daily Digest 25th January 2023Suresh kumar ChockalingamNo ratings yet

- Budget Highlights: The Institute of Chartered Accountants of NepalDocument31 pagesBudget Highlights: The Institute of Chartered Accountants of Nepalshankar k.c.No ratings yet

- Amit Gebreigzihaber TransportationDocument10 pagesAmit Gebreigzihaber TransportationgemechuNo ratings yet

- Reliance Textile Industries Limited Annual Report 1976-77Document33 pagesReliance Textile Industries Limited Annual Report 1976-77Tariq SharmaNo ratings yet

- Q3FY23 Press ReleaseDocument9 pagesQ3FY23 Press ReleasercossichNo ratings yet

- Consumer Durables: February 2021Document33 pagesConsumer Durables: February 2021Surbhi Thakkar100% (1)

- Guidance On Ringfencing The Renewables Obligation (SLC 30)Document9 pagesGuidance On Ringfencing The Renewables Obligation (SLC 30)ytd7524No ratings yet

- Detail Note 2020q1 EnglishDocument16 pagesDetail Note 2020q1 Englishdilmisedara61No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Indonesia Economic Update - Inflation Heats Up More Than ExpectedDocument5 pagesIndonesia Economic Update - Inflation Heats Up More Than Expectedmza.arifinNo ratings yet

- Moody's - Petromindo Indonesia Coal Market Summit 20201019 (Confidential)Document23 pagesMoody's - Petromindo Indonesia Coal Market Summit 20201019 (Confidential)mza.arifinNo ratings yet

- Annual Report - PT Sekar Laut TBK - 2022Document145 pagesAnnual Report - PT Sekar Laut TBK - 2022mza.arifinNo ratings yet

- Biomass and Coal Co Combustion ASEAN Phase 2Document83 pagesBiomass and Coal Co Combustion ASEAN Phase 2mza.arifinNo ratings yet

- Solar PV Project Development Support PDFDocument21 pagesSolar PV Project Development Support PDFmza.arifinNo ratings yet

- BKPM&IIPC Presentation KOIF Juni 2015Document48 pagesBKPM&IIPC Presentation KOIF Juni 2015mza.arifin100% (1)

- Q2-Oil and GasDocument3 pagesQ2-Oil and Gasmza.arifinNo ratings yet

- Asosiasi DataDocument16 pagesAsosiasi Datamza.arifinNo ratings yet

- CV SummaryDocument3 pagesCV Summarymza.arifinNo ratings yet

- 4-Bus Mixing Console L Series Mixers: General Description FeaturesDocument3 pages4-Bus Mixing Console L Series Mixers: General Description FeaturesBanda SBANo ratings yet

- C 1040 092Document8 pagesC 1040 092aksyalNo ratings yet

- DCN Project ReportDocument6 pagesDCN Project ReportNur Fatin Firzanah Mohd Fauzi100% (1)

- Learner AnalysisDocument6 pagesLearner Analysisapi-252604284No ratings yet

- Mobile Id Client Reference Guide V 2 7 PDFDocument49 pagesMobile Id Client Reference Guide V 2 7 PDFNyamdorj PurevbatNo ratings yet

- Catalog Greiner - 980042 - GBO-PA - Catalogue - EN - 05.12.2023Document186 pagesCatalog Greiner - 980042 - GBO-PA - Catalogue - EN - 05.12.2023victor55stanNo ratings yet

- Nominal and Real Interest RatesDocument6 pagesNominal and Real Interest RatesGeromeNo ratings yet

- Oma MMS Enc V1 - 2 20050301 ADocument116 pagesOma MMS Enc V1 - 2 20050301 AcolonmeNo ratings yet

- Vintage Rc10 Buggy Mega ManualDocument438 pagesVintage Rc10 Buggy Mega ManualjaredliedahlNo ratings yet

- Well-Organized Modular Kitchen. ORIGINA POSTED On - by Itnseo75 - Mar, 2024 - MediumDocument6 pagesWell-Organized Modular Kitchen. ORIGINA POSTED On - by Itnseo75 - Mar, 2024 - Mediumitnseo75No ratings yet

- Fog Lamps Ford Fiesta 1.6Document2 pagesFog Lamps Ford Fiesta 1.6Ismael LopezNo ratings yet

- SKF Prefix SuffixDocument7 pagesSKF Prefix SuffixNath Boyapati67% (3)

- Exit Interview Form - 11.01Document5 pagesExit Interview Form - 11.01yaseennawazNo ratings yet

- A129 Pro Duo Dash Camera ManualDocument14 pagesA129 Pro Duo Dash Camera Manualdie0another0dayNo ratings yet

- Morang District Profile & Annual Report: 2061/62 Fiscal YearDocument38 pagesMorang District Profile & Annual Report: 2061/62 Fiscal YearAashutosh KarnaNo ratings yet

- Course Syllabus of Digital Image Processing (EE6131)Document1 pageCourse Syllabus of Digital Image Processing (EE6131)Ritunjay GuptaNo ratings yet

- Investigating The Link Between Motivation Work STR PDFDocument22 pagesInvestigating The Link Between Motivation Work STR PDFTim HuntNo ratings yet

- Karan ResumeDocument1 pageKaran Resumeganeshji loNo ratings yet

- Acer Aspire One AOD257-AOHAPPY2 Quanta ZE6 DA0ZE6MB6E0 Rev 1b Schematics PDFDocument35 pagesAcer Aspire One AOD257-AOHAPPY2 Quanta ZE6 DA0ZE6MB6E0 Rev 1b Schematics PDFJaiprakash Sharma100% (1)

- IGNOU MVPP 1 (PGDFSQM) PROJECT - Development of Training Modules For Workers On GMP & GHPDocument7 pagesIGNOU MVPP 1 (PGDFSQM) PROJECT - Development of Training Modules For Workers On GMP & GHPNiklausNo ratings yet

- MNJ PHDDocument178 pagesMNJ PHDCristian Paul Bolimbo PalgaNo ratings yet

- AbstractDocument4 pagesAbstractMohamed IbrahemNo ratings yet

- Quiz 2 TableDocument5 pagesQuiz 2 TableSathish BNo ratings yet

- EiMAS Calender 2022Document7 pagesEiMAS Calender 2022langithitam644No ratings yet

- 2a. D BT 02. Reliability Management. 8JP. OKDocument50 pages2a. D BT 02. Reliability Management. 8JP. OKadmiralengineerNo ratings yet

- 7.4 - Equations and Graphs of Trigonometric FunctionsDocument16 pages7.4 - Equations and Graphs of Trigonometric FunctionsJoven IsNo ratings yet

- 2012 Jay Feather Ultra Lite Owners ManualDocument101 pages2012 Jay Feather Ultra Lite Owners ManualRachel Naiman WilsonNo ratings yet

- Brazil BubbleDocument1 pageBrazil BubbleDanillo Gabriel NakanoNo ratings yet