Professional Documents

Culture Documents

14207

Uploaded by

genenegetachew640 ratings0% found this document useful (0 votes)

2 views6 pagesNote

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNote

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views6 pages14207

Uploaded by

genenegetachew64Note

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Q 1//:

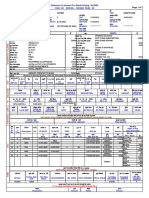

NUGGET MINING COMPANY

Bank Reconciliation 30,Nov. 2018

Balance per bank statement $ 22190

Add: deposit in transit (1) $ 3680

Bank error: incorrect check (7) 175 3855

Deduct: outstanding check (2) (5001)

Adjusted balance $ 21044

Balance per book $ 20502

Add: Interest collected by bank (3) $ 600

Error in recording check No.7322 (6) 180 780

Deduct: Bank service charge (4) 18

NSF check retured (5) 220 (238)

Adjusted balance $ 21044

b// Cash 542

Service charge 18

A/R 220

A/P 180

Interest revenue 600

Q 2//:

1. 600 units in ending inventory under FIFO, the unties remaining are the once purchased

most recently

24\10 200 units @ $11.60 = $2,320

16\10 400 units @ $ 10.80= $4,320

600 units $6,640

2. 600 units in ending inventory under the weighted-average method cost per unit must be

computed : $ 21,120\2,000 units = $10.56

600 units * $10.56= $6,336

3.600 units in ending inventory under LIFO method the units remaining are the ones

purchased earliest:

1\10 400 units @ 10.00 = $ 4,000

8\10 200 units @ 10.40 = $ 2,080

600 units $ 6,080

Q3// (a) Machine 1

year Cost Depreciation expense Accumulated depreciation

2012 $86000 (86000-6000\5)*6\12=8000 $8000

2013 86000 86000-6000/5=16000 24000

2014 86000 16000 40000

2015 86000 16000 56000

2016 86000 8000 64000

Machine 2

Year Book value DDB Depreciation expense Accumulated

beginning of year Rate depreciation

2015 $50000 40% 50000*40%*1/2=$10000 $10000

2016 40000 40% 40000*40%=16000 26000

b// Machine 1 Depreciation expense 8000

accumulated depreciation 8000

cash 20000

Accumulated depreciation 64000

Loss on sale equipment 2000

Equipment 86000

Machine 2

Depreciation expense 16000

Accumulated Depreciation 16000

Cash 32000

Accumulated Depreciation 26000

Equipment 50000

Gain on sale of equipment 8000

Q 4\\ Situation 1: Journal entries by Hacher Cosmetics:

To record purchase of 20,000 shares of Ramiz Fashion at a cost of $14 per

share

March 18, 2015

Equity Investments ................................................................................ 280,000

Cash .............................................................................................. 280,000

To record the dividend revenue from Ramiz Fashion:

June 30, 2015

Cash .......................................................................................... 7,500

Dividend Revenue ($75,000 X 10%) ............................................. 7,500

To record the investment at fair value:

December 31, 2015

Fair Value Adjustment ............................................................................... 20,000

Unrealized Gain or Loss—Income ................................................... 20,000*

*($15 – $14) X 20,000 shares = $20,000

Situation 2: Journal entries by Hamed, Inc.:

To record the purchase of 25% of Nader Corporation’s shares:

January 1, 2015

Stock Investments...................................................................................... 67,500

Cash [(30,000 X 25%) X $9] .............................................................. 67,500

Since Hamed, Inc. obtained significant influence over Nader Corp.,

Hamed, Inc. now employs the equity method of accounting.

To record the receipt of cash dividends from Nader Corporation:

June 15, 2015

Cash ($36,000 X 25%)................................................................................. 9,000

Stock Investments ............................................................................ 9,000

To record Holmes’s share (25%) of Nader Corporation’s net income of $85,000:

December 31, 2015

Stock Investments (25% X $85,000) .......................................................... 21,250

Revenue from investment ................................................................ 21,250

Q 5// HARDY CORPORATION

Statement of cash flow

For the year ended December 31,2018

Cash flow from operating activities

Net income $ 30,000

Adjustments to reconcile net income to net cash provided

by operating activities

Depreciation $ 25,000

Increase in accounts receivable (5,000)

Increase in prepaid insurance (4,000)

Increase in Accounts payable 6,000

Decrease in salaries payable (3,000) 19,000

Net cash provided by operating activities 49,000

Cash flows from investing activities

Collection of long-term loan 35,000

Proceeds from the sale of investments 27,000

Purchase of equipment (10,000)

Net cash provided by investing activities 52,000

Cash flow from financing activates

Issuance of common stock 20,000

Redemption of bonds (24,000)

Payment of dividends (9,000)

Net cash used by financing activates (13,000)

Net change in cash 88,000

Cash at beginning of period 14,000

Cash at end of period $102,000

Noncash investing and financing activities آ

Purchase of land by issuing bonds $ 40,000

You might also like

- Chapter-2 Solution For 27 and 28Document6 pagesChapter-2 Solution For 27 and 28Tarif IslamNo ratings yet

- Ventura, Mary Mickaella R - Cashflowp.321 - Group 3Document5 pagesVentura, Mary Mickaella R - Cashflowp.321 - Group 3Mary Ventura100% (1)

- Solution Aassignments CH 13Document2 pagesSolution Aassignments CH 13RuturajPatilNo ratings yet

- Statement of CashflowDocument9 pagesStatement of CashflowOwen Lustre50% (2)

- Solution Problem On Project EvaluationDocument5 pagesSolution Problem On Project EvaluationHasanNo ratings yet

- CASH FLOW ExampleDocument4 pagesCASH FLOW ExampleBiancaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- 1.statement of Cash Flows - MIDTERMDocument27 pages1.statement of Cash Flows - MIDTERMMaeNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- 0 - AE 17 ProblemsDocument3 pages0 - AE 17 ProblemsMajoy BantocNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Part 2 Joint Arrangements Class Consultation PDFDocument6 pagesPart 2 Joint Arrangements Class Consultation PDFidk520055No ratings yet

- Problem Set 6 BS CS 6Document3 pagesProblem Set 6 BS CS 6Rubab MirzaNo ratings yet

- Mock ExamDocument4 pagesMock ExamAna-Maria GhNo ratings yet

- Liabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsDocument3 pagesLiabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsAmit GodaraNo ratings yet

- Accounting Sharim Final ExamDocument5 pagesAccounting Sharim Final ExamsubhanNo ratings yet

- Chap 13 Statement of Cash FlowsPractice QuestionsDocument7 pagesChap 13 Statement of Cash FlowsPractice QuestionshatanoloveNo ratings yet

- Daa 101 Introduction To Accounting Ii - RispahDocument4 pagesDaa 101 Introduction To Accounting Ii - RispahSpencerNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- Warner Company Statement of Cash FlowsDocument2 pagesWarner Company Statement of Cash FlowsKailash KumarNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Chapter 42 - Teacher's ManualDocument13 pagesChapter 42 - Teacher's ManualHohohoNo ratings yet

- Complex GroupDocument5 pagesComplex Grouptαtmαn dє grєαtNo ratings yet

- Financial Accounting hw1Document5 pagesFinancial Accounting hw1Jermaine M. SantoyoNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Janjua CompanyDocument3 pagesJanjua CompanySyed Muhammad Ali OmerNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Non-Current Asset: Balance Sheet 31-Dec-20Document4 pagesNon-Current Asset: Balance Sheet 31-Dec-20Shehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- Advanced-Accounting-Part 1-Dayag-2015-Chapter-7Document33 pagesAdvanced-Accounting-Part 1-Dayag-2015-Chapter-7trisha sacramentoNo ratings yet

- Clarke Inc. HighlightedDocument4 pagesClarke Inc. HighlightedAdams BruinsNo ratings yet

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- Statement of Cash Flows: 1. True 6. True 2. False 7. False 3. False 8. True 4. True 9. True 5. True 10. FALSEDocument12 pagesStatement of Cash Flows: 1. True 6. True 2. False 7. False 3. False 8. True 4. True 9. True 5. True 10. FALSEJamie Rose AragonesNo ratings yet

- AnswerDocument3 pagesAnswerRE GHANo ratings yet

- ACCT 2500 Test 2 Format, Instructions and ReviewDocument17 pagesACCT 2500 Test 2 Format, Instructions and Reviewyahye ahmedNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisAsad RehmanNo ratings yet

- Huchapter 41 Statement of Cash Flows: Problem 41-1: True or FalseDocument14 pagesHuchapter 41 Statement of Cash Flows: Problem 41-1: True or FalseklairvaughnNo ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- Group 6 Assignment Crane Limited FinalDocument4 pagesGroup 6 Assignment Crane Limited FinalBernard KaisaNo ratings yet

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- Reporting & Interpreting Investments in Other CorporationsDocument12 pagesReporting & Interpreting Investments in Other CorporationslelydiNo ratings yet

- Description Income Statement Adjustments Statement of Cash FlowsDocument2 pagesDescription Income Statement Adjustments Statement of Cash FlowsFhem Leighn SimetraNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- WORKSHEET - 5 On CFSDocument6 pagesWORKSHEET - 5 On CFSNavya KhemkaNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Cebu Cpar Practical Accounting 1 Cash Flow - UmDocument9 pagesCebu Cpar Practical Accounting 1 Cash Flow - UmJomarNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Intacc Cash Flow SolutionDocument3 pagesIntacc Cash Flow SolutionMila MercadoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Enabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesFrom EverandEnabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- HAWASSA UNIVERSDocument3 pagesHAWASSA UNIVERSgenenegetachew64No ratings yet

- Ch- 2, Research (1)Document44 pagesCh- 2, Research (1)genenegetachew64No ratings yet

- International Public Sector Accounting Standard 23 Revenue From Non-Exchange Transactions (Taxes and Transfers) IPSASB Basis For ConclusionsDocument5 pagesInternational Public Sector Accounting Standard 23 Revenue From Non-Exchange Transactions (Taxes and Transfers) IPSASB Basis For Conclusionsgenenegetachew64No ratings yet

- @2015 IFA II CH 5 - Revenue RecognitionDocument98 pages@2015 IFA II CH 5 - Revenue Recognitiongenenegetachew64No ratings yet

- 2015@public Finance AssignmentDocument1 page2015@public Finance Assignmentgenenegetachew64No ratings yet

- @2015 Assignment I IFA IIDocument2 pages@2015 Assignment I IFA IIgenenegetachew64No ratings yet

- AA well-designe-WPS OfficeDocument4 pagesAA well-designe-WPS Officegenenegetachew64No ratings yet

- @2015 Ifa II CH 1 - CL - Con and Prov.Document62 pages@2015 Ifa II CH 1 - CL - Con and Prov.genenegetachew64No ratings yet

- CHAPTER FM I FinalDocument14 pagesCHAPTER FM I Finalgenenegetachew64No ratings yet

- BBA Syllabus Sem-6 (Finance)Document10 pagesBBA Syllabus Sem-6 (Finance)Mukesh GiriNo ratings yet

- Hindustan Unilever Limited VRIO VRIN Analysis Amp Solution MBA ResourcesDocument9 pagesHindustan Unilever Limited VRIO VRIN Analysis Amp Solution MBA ResourcesRoyal MarathaNo ratings yet

- Q3 Lesson 1 WEEK 1Document3 pagesQ3 Lesson 1 WEEK 1Irish CedeñoNo ratings yet

- From Ef Cient Markets Theory To Behavioral Finance PDFDocument60 pagesFrom Ef Cient Markets Theory To Behavioral Finance PDFReluxy1No ratings yet

- Topic 10 Copia FinanceDocument32 pagesTopic 10 Copia Financemarvalle2001No ratings yet

- How To Download Ebook PDF Mergers Acquisitions and Corporate Restructurings 7Th Edition Ebook PDF Docx Kindle Full ChapterDocument36 pagesHow To Download Ebook PDF Mergers Acquisitions and Corporate Restructurings 7Th Edition Ebook PDF Docx Kindle Full Chaptersteve.books604100% (26)

- Business Plan - EntrepDocument43 pagesBusiness Plan - EntrepHaishoNo ratings yet

- M-pesa Paybill Partners Customer Help Line s Number. Bartolimo Secondary School 38361 0723913786 Bartolimosec@Gmail.comDocument25 pagesM-pesa Paybill Partners Customer Help Line s Number. Bartolimo Secondary School 38361 0723913786 Bartolimosec@Gmail.comsaskiamogaleNo ratings yet

- ECO 101 - Pr. of MicroeconomicsDocument3 pagesECO 101 - Pr. of MicroeconomicsAniqaNo ratings yet

- Social Media Marketing: by Vivek KateliyaDocument68 pagesSocial Media Marketing: by Vivek KateliyaVIVEK KATELIYANo ratings yet

- Document (55) MarketingDocument3 pagesDocument (55) Marketingsn nNo ratings yet

- Customer StatementDocument19 pagesCustomer StatementAnissa WilliamsNo ratings yet

- Assignment - FSAB - Submission 06 May 2023Document4 pagesAssignment - FSAB - Submission 06 May 2023Amisha BoolkanNo ratings yet

- MPS 1941669 1202490 16026890L 04 2023Document2 pagesMPS 1941669 1202490 16026890L 04 2023Ajay AhlawatNo ratings yet

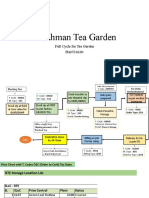

- Tea Garden Process Flow - SAPDocument3 pagesTea Garden Process Flow - SAPMahmoodNo ratings yet

- Revised Corporation CodeDocument93 pagesRevised Corporation Codeapriele rose hermogenesNo ratings yet

- Interviw Quetion AnsDocument11 pagesInterviw Quetion AnskumiNo ratings yet

- Chapter 1. PRDocument15 pagesChapter 1. PRJunboy SarmientoNo ratings yet

- Mobile Car Wash & Detailing Project Part 2Document4 pagesMobile Car Wash & Detailing Project Part 2rama sportsNo ratings yet

- Accounting Grade 12 Test 1 Self-Study (Lockdown Period)Document5 pagesAccounting Grade 12 Test 1 Self-Study (Lockdown Period)pleasuremaome06No ratings yet

- Evaluation and ControlDocument16 pagesEvaluation and ControlSachin Sapkota125No ratings yet

- ISC Board Class 12 Business Studies SyllabusDocument4 pagesISC Board Class 12 Business Studies SyllabusSiddharth ChhetriNo ratings yet

- Thesis On Marketing Mix StrategiesDocument8 pagesThesis On Marketing Mix Strategiesamberrodrigueznewhaven100% (1)

- 132 Singer V Carlisle (Tan)Document1 page132 Singer V Carlisle (Tan)AlexandraSoledadNo ratings yet

- DRF RequestDocument3 pagesDRF Requestjitender.singh29No ratings yet

- TanishChaudhary InternshalaResumeDocument2 pagesTanishChaudhary InternshalaResumeTanish ChaudharyNo ratings yet

- Consignment QuestionDocument2 pagesConsignment QuestionADITYA JAGTAPNo ratings yet

- Aman GuptaDocument10 pagesAman Guptapoojameenakshisundaram2001No ratings yet

- QP Mock 7 Buspaper1 May2019RDocument16 pagesQP Mock 7 Buspaper1 May2019RSadia PromiNo ratings yet

- 1060-2022 PO ATL M.S Bismillah AccessoriesDocument1 page1060-2022 PO ATL M.S Bismillah AccessoriesYounus SheikhNo ratings yet