Professional Documents

Culture Documents

BIB3204 IBM3203 Week12

BIB3204 IBM3203 Week12

Uploaded by

HITANSH KHANDELWALOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIB3204 IBM3203 Week12

BIB3204 IBM3203 Week12

Uploaded by

HITANSH KHANDELWALCopyright:

Available Formats

BIB3204/IBM3203 International Management S2/2023

Outline

BIB3204/IBM3203

International Management—

Week 12

Dr. Nichanan Sakolvieng

Department of International Business Management

Nichanan Sakolvieng, PhD

IBM3203/3713 International Management

Outline I. Organisational Performance

• Assess the performance outcomes of different strategies in terms of direct economic

• Ch. 12: Evaluating Strategies

outcomes and overall organisational effectiveness.

• Criteria and techniques that can be used to evaluate Organisational Effectiveness

Economic performance

organisational performance and strategic options.

• Direct measures of success in terms of • A broader set of performance criteria reflecting

economic outcomes--three main dimensions: internal operational efficiency or measures

• Performance in product markets (e.g. sales relevant to a wider range of stakeholders.

Figure 12.1: growth or market share) • Balanced scorecard--considers 4

Evaluating strategies perspectives, i.e. the customer, internal

• Accounting measures of profitability (e.g.

profit margin or return on capital business, innovation and learning, and

employed) financial perspectives.

• Financial market measures (e.g. share • Triple bottom line—pays explicit attention to

price). CSR and the environment; has 3 dimensions,

• These measures may seem objective but need i.e. economic, social, and environmental

to be carefully interpreted. measures.

Nichanan Sakolvieng, PhD • Overall effectiveness depends on both

economic and broader factors that support L-T

BIB3204/IBM3203 International Management prosperity of the orgn.

Nichanan Sakolvieng, PhD

BIB3204/IBM3203 International Management S2/2023

I. Organisational Performance (Cont.) I. Organisational Performance (Cont.)

• Gap Analysis Figure 12.2: Gap analysis

• Performance Comparisons

• compares achieved or

• Performance is measured in relation to: projected performance with

• Organisational targets. Management will typically set targets for desired performance.

sales growth or profitability. • Helps to identify shortfalls in

• Trends over time. Is performance improving or declining over a performance.

significant period of time (but be aware of cycles)? • The size of the ‘gap’ provides a

• Comparable organisations. Typically firms can benchmark guide to the extent to which

strategy needs to be changed

themselves against key competitors.

– a very large gap may

suggest transformational

change is needed.

Nichanan Sakolvieng, PhD Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

I. Organisational Performance (Cont.) II. Criteria and Techniques of Evaluation

• Complexities of Performance Analysis Table 12.1: The SAFe

criteria and techniques

of evaluation

• Performance measures can be contradictory, e.g. sales growth can be

achieved by cutting profit margins.

• Three sources of possible complexity:

• Organisations can manipulate outcomes in order to meet key performance

criteria.

• Organisations can legitimately manage performance perceptions and

expectations.

• The importance of particular measures can change over time.

Nichanan Sakolvieng, PhD Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

Nichanan Sakolvieng, PhD

BIB3204/IBM3203 International Management S2/2023

II. Criteria and Techniques of Evaluation (Cont.) II. Criteria and Techniques of Evaluation (Cont.)

Table 12.2: Suitability of

Suitability strategic options in

relation to strategic

• Assessing whether a proposed strategy addresses the key issues position

relating to the opportunities and threats an organisation faces.

• It is concerned with the overall rationale of the strategy:

• Does it exploit the opportunities in the environment and avoid the

threats?

• Does it capitalise on the organisation’s strengths and avoid or

remedy the weaknesses?

Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management NICHANAN SAKOVIENG, PHD

II. Criteria and Techniques of Evaluation (Cont.) II. Criteria and Techniques of Evaluation (Cont.)

Table 12.3: Some

examples of Suitability – screening techniques:

suitability

• Ranking

• Screening through scenarios

• Screening for bases of competitive advantage – using the VRIO

criteria

• Decision trees

Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

Nichanan Sakolvieng, PhD

BIB3204/IBM3203 International Management S2/2023

II. Criteria and Techniques of Evaluation (Cont.)

Acceptability

• is concerned with whether the expected performance outcomes of

a proposed strategy meet the expectations of stakeholders.

• There are three important aspects to acceptability:

1. Risk

2. Return

3. Stakeholder reactions.

Source: Whittington, R., Regner P., Angwin, D., Johnson. G. & Scholes, K. (2020). Exploring Strategy: Text and Cases. 12th Edition. Pearson.

Nichanan Sakolvieng, PhD Nichanan Sakolvieng, PhD

BIB3204/IBM3203 International Management BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

II. Criteria and Techniques of Evaluation (Cont.) II. Criteria and Techniques of Evaluation (Cont.)

Acceptability Acceptability

1. Risk--the extent to which strategic outcomes are unpredictable, 2. Returns--a measure of the financial effectiveness of a strategy.

especially with regard to negative outcomes. • Different approaches to assessing return:

• Risk can be assessed using: • Financial analysis—Return on capital employed (ROCE), payback

• Sensitivity analysis—assessing the extent to which the success of a period, discounted cash flow

preferred strategy is dependent on the key assumptions which underlie • Shareholder value analysis—which proposed strategies would

that strategy, i.e. what-if analysis. increase shareholder value—total shareholder return, economic

• Financial risk—assessing the possibility that the organisation may not be value added (EVA)

able to meet the key financial obligations necessary for survival; use ratios • Cost–benefit analysis—a money value should be put on all the costs

e.g. gearing (leverage) and liquidity

and benefits of a strategy, including tangible and intangible returns

• Break-even analysis—assessing the risks associated with different price to people and organisation.

and cost structures of strategies.

Nichanan Sakolvieng, PhD Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

Nichanan Sakolvieng, PhD

BIB3204/IBM3203 International Management S2/2023

II. Criteria and Techniques of Evaluation (Cont.) II. Criteria and Techniques of Evaluation (Cont.)

Feasibility

Acceptability

• whether a strategy could work in practice, i.e. whether an organisation

3. Reaction of stakeholders

has the capabilities to deliver a strategy.

• Stakeholder mapping (power/interest matrix) can be used to:

• Two key questions:

• understand the political context of strategies

• Do the resources and competences currently exist to implement

• understand the political agenda the strategy effectively?

• gauge the likely reaction of stakeholders to specific strategies. • If not, can they be obtained?

• If key stakeholders find a strategy to be unacceptable, then it is • Focus on three areas:

likely to fail.

• Finance

• People and their skills

• Resource integration

Nichanan Sakolvieng, PhD Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

II. Criteria and Techniques of Evaluation (Cont.) II. Criteria and Techniques of Evaluation (Cont.)

Feasibility

Table 12.6: Financial

strategy and the

1. Financial feasibility business life cycle

• funding and cash flows

• need to identify:

• the cash required for a strategy

• the cash generated by following the strategy

• the timing of any new funding requirements

Nichanan Sakolvieng, PhD Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

Nichanan Sakolvieng, PhD

BIB3204/IBM3203 International Management S2/2023

II. Criteria and Techniques of Evaluation (Cont.) II. Criteria and Techniques of Evaluation (Cont.)

Feasibility

Feasibility

3. Integrating resources

2. People and skills—three questions arise:

• The success of a strategy depends on the management of many

• Do people in the organisation currently have the competences to resource areas, for example:

deliver a proposed strategy?

• people

• Are the systems to support those people fit for the strategy?

• finance

• If not, can the competences be obtained or developed?

• physical resources

• information technology

• resources provided by suppliers and partners.

• It is essential to integrate resources – inside the organisation and in the

wider value system.

Nichanan Sakolvieng, PhD Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

II. Criteria and Techniques of Evaluation (Cont.) Conclusions

• Four qualifications of evaluation criteria:

• Be aware of conflicting conclusions and the need for

management judgement.

• Consistency between the different elements of a strategy is

essential.

• The implementation and development of strategies might

reveal unanticipated problems.

• Strategy development in practice isn’t always a logical or

even rational process.

Nichanan Sakolvieng, PhD Nichanan Sakolvieng, PhD

BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management BIB3204/IBM3203

NICHANAN SAKOVIENG, PHD

International Management

Nichanan Sakolvieng, PhD

You might also like

- Checking Summary: 000000669587953 Customer Service InformationDocument4 pagesChecking Summary: 000000669587953 Customer Service InformationKristopher88% (17)

- Wace Burgess Case StudyDocument5 pagesWace Burgess Case StudyAboubakr Soultan75% (4)

- Assessment Task 2 - BSBHRM512 HandoutDocument20 pagesAssessment Task 2 - BSBHRM512 HandoutAna Paula VianaNo ratings yet

- The Business Analyst as Strategist: Translating Business Strategies into Valuable SolutionsFrom EverandThe Business Analyst as Strategist: Translating Business Strategies into Valuable SolutionsNo ratings yet

- A Multidimensional Performance Model For Consolidating Balanced ScorecardDocument11 pagesA Multidimensional Performance Model For Consolidating Balanced ScorecardTiago100% (1)

- 2 Babbok v3 PDF Vieclamvui 31 61Document31 pages2 Babbok v3 PDF Vieclamvui 31 61thiquangdaiNo ratings yet

- Lecture Notes - PartnershipDocument7 pagesLecture Notes - PartnershipANTONIA LORENA BITUINNo ratings yet

- Lecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument8 pagesLecture Notes: Manila Cavite Laguna Cebu Cagayan de Oro Davaoace ender zeroNo ratings yet

- Strategic Management and Balanced Scorecard - CabreraDocument14 pagesStrategic Management and Balanced Scorecard - CabreraZandrine Paredes LaraNo ratings yet

- MAS.2901 - Overview of MASDocument6 pagesMAS.2901 - Overview of MASdaemonspadechocoyNo ratings yet

- Without A Strategy The Organization Is Like A Ship Without A Rudder, Going Around in Circles.Document28 pagesWithout A Strategy The Organization Is Like A Ship Without A Rudder, Going Around in Circles.Syed Aziz HaiderNo ratings yet

- Overview of MASDocument6 pagesOverview of MASDonna AmbaganNo ratings yet

- Construction Performance and Resource Optimization Chapter One Overview of Construction Performance ManagementDocument62 pagesConstruction Performance and Resource Optimization Chapter One Overview of Construction Performance Managementhaile mulunehNo ratings yet

- PM CH 2Document44 pagesPM CH 2jamshedjaved4673No ratings yet

- Performance ManagementDocument20 pagesPerformance Managementmy.nafi.pmp5283No ratings yet

- Goal Congruence Approach Under Advnced Strategic PlanningDocument4 pagesGoal Congruence Approach Under Advnced Strategic PlanningDr Sarbesh MishraNo ratings yet

- 1.understanding Management AccountingDocument38 pages1.understanding Management AccountingPAVITRAN JAGANAZANNo ratings yet

- 1.2. Strategic Management Process..Document46 pages1.2. Strategic Management Process..akhilalinkalNo ratings yet

- AdddDocument9 pagesAdddJuan LuzonNo ratings yet

- LOGframeDocument83 pagesLOGframeAnonymous Xb3zHioNo ratings yet

- VU Nature of Strategic Management Objectives:: On-Going ProcessDocument5 pagesVU Nature of Strategic Management Objectives:: On-Going Processjohn cutterNo ratings yet

- Winter 2014 Model Answer PaperDocument16 pagesWinter 2014 Model Answer PaperDiyaNegiNo ratings yet

- Sem 1Document32 pagesSem 1yolosNo ratings yet

- CIA CIA3 BookOnline SU1 OutlineDocument21 pagesCIA CIA3 BookOnline SU1 Outlineshahid yarNo ratings yet

- SM Chapter 2Document54 pagesSM Chapter 2VikramNo ratings yet

- Basics of Management AccountingDocument34 pagesBasics of Management AccountingLuis Guillermo Torres PicoNo ratings yet

- Organizational Planning and Goal SettingDocument29 pagesOrganizational Planning and Goal SettingDhananjay Singh ThakurNo ratings yet

- 3208 Intro To MA On BBDocument24 pages3208 Intro To MA On BBLim Jie XiNo ratings yet

- PEM C3 - StudentsDocument93 pagesPEM C3 - Studentsk60.2112153141No ratings yet

- Putting The Balanced ScorecardDocument12 pagesPutting The Balanced ScorecardArnabNo ratings yet

- Nama: Ghina Sabrina NPM: 205210565 Kelas: D (Manajemen Biaya) Resume CH 16Document9 pagesNama: Ghina Sabrina NPM: 205210565 Kelas: D (Manajemen Biaya) Resume CH 16Ghina SabrinaNo ratings yet

- MIS - Chapter 6Document11 pagesMIS - Chapter 6Biggola MikeNo ratings yet

- 1.1 Evolution of Management Accounting - Part 1Document23 pages1.1 Evolution of Management Accounting - Part 1Dabbie JoyNo ratings yet

- Best Practice For Implementing The Balanced ScorecardDocument9 pagesBest Practice For Implementing The Balanced ScorecardyasserNo ratings yet

- Implemention of Balance Score Card in An OrganizationDocument13 pagesImplemention of Balance Score Card in An OrganizationChandan Kumar SinghNo ratings yet

- Business Continuity Management - BCM - AssessmentDocument93 pagesBusiness Continuity Management - BCM - Assessmentnormatividad teletrabajo100% (1)

- Internal Audit: Session 32Document26 pagesInternal Audit: Session 32Abdullah EjazNo ratings yet

- MLS1 - Modified Learning Sheet No. 2Document7 pagesMLS1 - Modified Learning Sheet No. 2Elsa FlorendoNo ratings yet

- Module 1-1 Cost Accounting FundamentalsDocument9 pagesModule 1-1 Cost Accounting FundamentalsClaire BarbaNo ratings yet

- Final Strategic PlanningDocument18 pagesFinal Strategic PlanningRearatwa MamogaleNo ratings yet

- Introducing Babok v3 Whats New PDFDocument33 pagesIntroducing Babok v3 Whats New PDFElecciones NortedeSantanderNo ratings yet

- Sample Intake FormDocument2 pagesSample Intake FormRenato Barrientos La RosaNo ratings yet

- Maintenance Basic Indicators 1586878017Document20 pagesMaintenance Basic Indicators 1586878017Elbin Antonio EspinalNo ratings yet

- Defining Strategic Management (1) Three Ongoing ProcessesDocument1 pageDefining Strategic Management (1) Three Ongoing ProcessescocoNo ratings yet

- Engineering Management 2 - PlanningDocument38 pagesEngineering Management 2 - PlanningCraig PeriNo ratings yet

- Performance Management Chapter 1&2Document52 pagesPerformance Management Chapter 1&2Yasichalew sefineh100% (1)

- ABO - Week10 Non-Financial PerformanceDocument33 pagesABO - Week10 Non-Financial Performancejinman bongNo ratings yet

- PMA Economics 2018 Marking SchemeDocument9 pagesPMA Economics 2018 Marking Schememohamed ajwathNo ratings yet

- BSAIS-SBA 313 Information Sheet 2Document12 pagesBSAIS-SBA 313 Information Sheet 2jeraldtorressantos0626No ratings yet

- Session 1 - Lecture SlidesDocument31 pagesSession 1 - Lecture Slideshaddaoui zahraNo ratings yet

- Strategic ManagementDocument15 pagesStrategic ManagementShanmuganNo ratings yet

- University of London (LSE)Document33 pagesUniversity of London (LSE)Dương DươngNo ratings yet

- 3-6 SM Strategic Analysis - External & Internal EnvironmentDocument94 pages3-6 SM Strategic Analysis - External & Internal EnvironmentBorisNo ratings yet

- BPR Implementation MethodologyDocument23 pagesBPR Implementation MethodologyRahull R YadavaNo ratings yet

- IffatZehra - 2972 - 15876 - 1 - Chap 1Document51 pagesIffatZehra - 2972 - 15876 - 1 - Chap 1Sabeeh Mustafa ZubairiNo ratings yet

- HDFCDocument2 pagesHDFCMohit PoddarNo ratings yet

- Performance Measurement Using Balance Scorecard - A Case of NepalDocument9 pagesPerformance Measurement Using Balance Scorecard - A Case of NepalNaveed Mughal AcmaNo ratings yet

- BSBMGT517 BBQFun Operational PlanDocument3 pagesBSBMGT517 BBQFun Operational Planamita sharmaNo ratings yet

- Chapter 12 SMHDocument66 pagesChapter 12 SMHsalman parvezNo ratings yet

- Machin Learning GE404 Topic 1 Introduction EMDocument27 pagesMachin Learning GE404 Topic 1 Introduction EMMuhammad AzamNo ratings yet

- Babok V3 1. BapmDocument31 pagesBabok V3 1. BapmAakash ChhibberNo ratings yet

- Bus RouteDocument1 pageBus RouteMark Joseph Foliente PlandesNo ratings yet

- Pittman Company Budgeted Income Statement For The Year Ended December 31Document4 pagesPittman Company Budgeted Income Statement For The Year Ended December 31Caca LokaNo ratings yet

- Invoice 267977536-769933Document1 pageInvoice 267977536-769933Julz MariottNo ratings yet

- AT7Document8 pagesAT7gazer beamNo ratings yet

- Management Theory and Practice: Dr. Subrahmanyam ADocument40 pagesManagement Theory and Practice: Dr. Subrahmanyam ASri HarshithaNo ratings yet

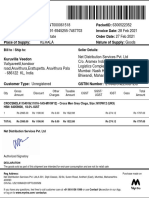

- Bill To / Ship To: Seller DetailsDocument1 pageBill To / Ship To: Seller DetailsErick MathewNo ratings yet

- Industry and Competitor Analysis: Bruce R. Barringer R. Duane IrelandDocument50 pagesIndustry and Competitor Analysis: Bruce R. Barringer R. Duane IrelandSuplex CityNo ratings yet

- Himel LTD: Total AssetsDocument37 pagesHimel LTD: Total AssetsAbdulAhadNo ratings yet

- Cost Assignment: Bsba MM 1Document11 pagesCost Assignment: Bsba MM 1Lara Camille CelestialNo ratings yet

- Session 10. Discovering Profound Insights Into Operational Excellence (Watson, 2020)Document56 pagesSession 10. Discovering Profound Insights Into Operational Excellence (Watson, 2020)taghavi1347No ratings yet

- Original PDF Horngrens Financial Managerial Accounting 6th Edition PDFDocument41 pagesOriginal PDF Horngrens Financial Managerial Accounting 6th Edition PDFjames.auiles492100% (38)

- Chapter 2 Bank ReconciliationDocument5 pagesChapter 2 Bank ReconciliationNicka NavarroNo ratings yet

- Las-Business-Finance-Q1 Week 4Document22 pagesLas-Business-Finance-Q1 Week 4Kinn JayNo ratings yet

- Guide To Real Estate Crowdfunding - Marsh & PartnersDocument21 pagesGuide To Real Estate Crowdfunding - Marsh & PartnersAnitaNo ratings yet

- Turkey Hospital PPP Project - Mr. Simon Jianjun Zhang - ICBCDocument21 pagesTurkey Hospital PPP Project - Mr. Simon Jianjun Zhang - ICBCHospital Equipping SolutiionsNo ratings yet

- Ananta Faturrahman P.H. - Audit Forensik - PPT Case Week 5Document10 pagesAnanta Faturrahman P.H. - Audit Forensik - PPT Case Week 5Cornelius cakraNo ratings yet

- Blue and Yellow Simple Human Illustrative Investing Finance Tips Finance PresentationDocument18 pagesBlue and Yellow Simple Human Illustrative Investing Finance Tips Finance PresentationQaiffaGreenNo ratings yet

- Case - Subhiksha - Managing Store OperationsDocument11 pagesCase - Subhiksha - Managing Store OperationsK ScholarNo ratings yet

- Allowance For Doubtful Accounts - Solutions PDFDocument1 pageAllowance For Doubtful Accounts - Solutions PDFPrecious NosaNo ratings yet

- Preparing A Bank Reconciliation - Financial AccountingDocument14 pagesPreparing A Bank Reconciliation - Financial AccountingsninaricaNo ratings yet

- NepalDocument25 pagesNepalPrabhat BaralNo ratings yet

- Unisys Plan SummaryDocument3 pagesUnisys Plan Summarynet2useNo ratings yet

- Chapter One Mening and Scope of Public FinanceDocument12 pagesChapter One Mening and Scope of Public FinanceHabibuna Mohammed100% (1)

- Original For Buyer: Pricing Description Rate Per TE (INR) Amount (INR)Document1 pageOriginal For Buyer: Pricing Description Rate Per TE (INR) Amount (INR)Ambreesh YadavNo ratings yet

- Kawanihan NG Ingatang-Yaman: Press ReleaseDocument2 pagesKawanihan NG Ingatang-Yaman: Press ReleasejessNo ratings yet

- Marginal CostingDocument15 pagesMarginal CostingShri VidhyaNo ratings yet

- Prelim PartnershipDissolutionSampleProblemDocument12 pagesPrelim PartnershipDissolutionSampleProblemLee SuarezNo ratings yet

- Banana Fibre and Fibre Based HandicraftsDocument5 pagesBanana Fibre and Fibre Based HandicraftsRAMANNo ratings yet