Professional Documents

Culture Documents

Salary Sheet Format-1

Salary Sheet Format-1

Uploaded by

theraut19910 ratings0% found this document useful (0 votes)

6 views3 pagesOriginal Title

Copy of Salary Sheet Format-1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesSalary Sheet Format-1

Salary Sheet Format-1

Uploaded by

theraut1991Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

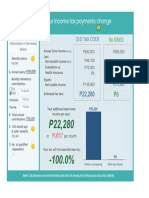

A B C D=(A+B+C)

Employee Basic Salary Allowance 20% Contn by

Pan No Marital Status Yearly Salary

Name Yearly Yearly employer(Yearly)

Single ABC 720,000.00 480,000.00 144,000.00 1,344,000.00

Couple XYZ 720,000.00 480,000.00 144,000.00 1,344,000.00

Note:

This format is for basic understanding of the SSF calculation

Other allowable deduction should be deduced For the calculation of Taxable Income

i. Basic Salary and Allowance are to be in the ratio of 60:40

ii. Contribution by employer is 20% of Basic Salary

1/3E of F SSF

Actual G of

Limit H U/S

Deduction I = (D - H) Tax

Assessable Contribution(3 deduction of 63(Lower of Taxable Income 0% 10%

Income

448,000.00 1%)

223,200.00 SSF

500,000.00 E , F, G)

223,200.00 1,120,800.00 - 10,000.00

448,000.00 223,200.00 500,000.00 223,200.00 1,120,800.00 - 10,000.00

Tax

20% 30% 36% Net Pay

40,000.00 126,240.00 - 944,560.00

40,000.00 111,240.00 - 959,560.00

You might also like

- Scenario ADocument10 pagesScenario ADandyNo ratings yet

- Assessment 4 Tax 1Document3 pagesAssessment 4 Tax 1Judy Ann Gaceta0% (1)

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Particulars Amount Exemption Net AmountDocument29 pagesParticulars Amount Exemption Net AmountDead Beat's RandomNo ratings yet

- Anwar Group of IndustriesDocument1 pageAnwar Group of IndustriesMoment RevealersNo ratings yet

- CH 2.TaxSalary IncomeDocument13 pagesCH 2.TaxSalary IncomeSajid AhmedNo ratings yet

- Assignment 9/17/2020: Use The Following Information For The Next Two QuestionsDocument6 pagesAssignment 9/17/2020: Use The Following Information For The Next Two QuestionsRosmar AbanerraNo ratings yet

- Partnership Operation Quiz 2Document2 pagesPartnership Operation Quiz 2cabbigatcrisanta04No ratings yet

- Bonus Calculation NameDocument3 pagesBonus Calculation NameambiNo ratings yet

- Topic 8 Company Tute Solutions 2021Document9 pagesTopic 8 Company Tute Solutions 2021HA Research ConsultancyNo ratings yet

- Assignment AccountingDocument6 pagesAssignment AccountingColine DueñasNo ratings yet

- Bonus With SolutionDocument8 pagesBonus With SolutionRica RegorisNo ratings yet

- Assignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionDocument2 pagesAssignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionSYEDA -No ratings yet

- Partnership and Corporation AccountingDocument2 pagesPartnership and Corporation AccountingEmman S NeriNo ratings yet

- Partnership Operation - 5Document3 pagesPartnership Operation - 5Jhon Rey LoretoNo ratings yet

- PayslipDocument1 pagePayslipSuyash RaulNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Principles of Taxation Solution # 3: Ans: 1 Year 1 Description Rs. Rs. Basic SalaryDocument7 pagesPrinciples of Taxation Solution # 3: Ans: 1 Year 1 Description Rs. Rs. Basic SalaryWarriach WarriachNo ratings yet

- Answers - Partnership OperationsDocument18 pagesAnswers - Partnership OperationsAllondra DapengNo ratings yet

- Partnership Operations - AssignmentDocument6 pagesPartnership Operations - AssignmentRosmar AbanerraNo ratings yet

- Tax Calculator AY 2021-22Document1 pageTax Calculator AY 2021-22mehedi hasanNo ratings yet

- 401k CalculatorDocument6 pages401k Calculatortrungtinh1506No ratings yet

- Discussion Answers On Employee BenefitsDocument33 pagesDiscussion Answers On Employee BenefitsJoeneil DamalerioNo ratings yet

- Tax Computation - 2019 PDFDocument1 pageTax Computation - 2019 PDFJurex JustinianNo ratings yet

- Valuing Capital Investment ProjectsDocument13 pagesValuing Capital Investment ProjectsSiddhesh MahadikNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- CompensationDocument1 pageCompensationDandyNo ratings yet

- Partnership Operations Name: Date: Professor: Section: Score: QuizDocument8 pagesPartnership Operations Name: Date: Professor: Section: Score: QuizNahwi Kimpa100% (1)

- AfstDocument15 pagesAfstAEDRIAN LEE DERECHONo ratings yet

- BonusDocument3 pagesBonusTricia Mae JabelNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- Question 1 Answer:A: Partnership OperationsDocument7 pagesQuestion 1 Answer:A: Partnership OperationsSharmaineMirandaNo ratings yet

- 1 BSG Compensation&TrainingDocument1 page1 BSG Compensation&TrainingBust everyNo ratings yet

- Partnership - OperationDocument11 pagesPartnership - OperationAiziel OrenseNo ratings yet

- SW# 2 CHAPTER 12 PROB 4,1-4 - GOZUNKAYE - XLSX - Sheet1Document3 pagesSW# 2 CHAPTER 12 PROB 4,1-4 - GOZUNKAYE - XLSX - Sheet1kaye gozunNo ratings yet

- Salary PDFDocument83 pagesSalary PDFGaurav BeniwalNo ratings yet

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- Income Statement and Statement of Financial Position Prepared byDocument7 pagesIncome Statement and Statement of Financial Position Prepared byFakhrul IslamNo ratings yet

- CTC - Salary CalculatorDocument4 pagesCTC - Salary Calculatorboopathi.nNo ratings yet

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanNo ratings yet

- Manual Solution 6-14Document5 pagesManual Solution 6-14Sohmono HendraiosNo ratings yet

- Offer Letter VistaraDocument2 pagesOffer Letter Vistara11913474sakshiNo ratings yet

- RMC No. 13-2024 - Annex B - Illustrations and Accounting EntriesDocument1 pageRMC No. 13-2024 - Annex B - Illustrations and Accounting EntriesAnostasia NemusNo ratings yet

- How Will Your Income Tax Payments Change How Will Your Income Tax Payments ChangeDocument1 pageHow Will Your Income Tax Payments Change How Will Your Income Tax Payments ChangeTin PortuzuelaNo ratings yet

- Quiz 1 Partnership AnswersDocument4 pagesQuiz 1 Partnership Answersdianel villarico100% (2)

- Chapter 2 Partnership OperationsDocument27 pagesChapter 2 Partnership OperationsKenaniah SanchezNo ratings yet

- It 2023 2024 7Document2 pagesIt 2023 2024 7luciferangellordNo ratings yet

- Tugas 2 MK IIDocument6 pagesTugas 2 MK IIKirana Maharani - SagasitasNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- ch14 ExercisesDocument10 pagesch14 ExercisesAriin TambunanNo ratings yet

- Tax Calculator 2018-19 (Farrukh Iqbal Khan)Document2 pagesTax Calculator 2018-19 (Farrukh Iqbal Khan)FarrukhNo ratings yet

- Lecture 8Document7 pagesLecture 8ahmed qazzafiNo ratings yet

- About BlankDocument1 pageAbout BlankSonu SheNo ratings yet

- Act130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Document15 pagesAct130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Nhel AlvaroNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet