Professional Documents

Culture Documents

Appendix II

Uploaded by

abainaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appendix II

Uploaded by

abainaCopyright:

Available Formats

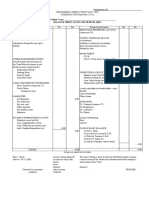

APPENDIX II

FINANCIAL STATUS REPORT

(Short Form) Submit Form

(Follow instructions on next page)

1. Federal Agency and Organizational 2. Grant or Award Number Assigned by OJP OMB Approval Page of

Element to Which Report is Submitted No.

U.S. Dept. of Justice 1121-0264 1 1

Office of Justice Programs (OJP) pages

Expires 1/3/2006

3. Recipient Organization (Name and complete address, including ZIP code)

4. Vendor Number 5. Recipient Internal Code or Identifying Number (if any) 6. Final Report 7. Basis

X Yes No Cash X Accrual

8. Funding/Grant Period (See Instructions) 9. Period Covered by this Report

From: (Month, Day, Year) To: (Month, Day, Year) From: (Month, Day, Year) To: (Month, Day, Year)

10. Transactions: I II III

Previously This Cumulative

Reported Period

a. Total outlays $0.00 $0.00 $0.00

b. Recipient share of outlays $0.00

c. Federal share of outlays $0.00

d. Total unliquidated obligations

$0.00

e. Recipient share of unliquidated obligations

f. Federal share of unliquidated obligations

g. Total Federal share (Sum of lines c and f)

$0.00

h. Total Federal funds authorized for this funding period

i. Unobligated balance of Federal funds (Line h minus line g) $0.00

a. Type of Rate (Place "X" in appropriate box)

11. Indirect Provisional Predetermined Final Fixed

Expense b. Rate c. Base d. Total Amount e. Federal Share

0% $0.00

12. Remarks: Attach any explanations deemed necessary or information required by Federal sponsoring agency in compliance with governing legislation.

PROGRAM INCOME:

A. Block/Formula pass through C. Forfeit E. Expended

B. Federal Funds Subgranted D. Other B. Unexpended $0.00

13. Certification: I certify to the best of my knowledge and belief that this report is correct and complete and that all outlays and unliquidated obligations

are for the purposes set forth in the award documents.

Typed or Printed Name and Title Telephone (Area code, number and extension)

Signature of Authorized Certifying Official Date Report Submitted

DOJ Standard Form 269a (REV 2002)

Paperwork Reduction Act Notice. Under the Paperwork Reduction Act a person is not required to respond to a collection of information unless it displays a currently valid OMB

control number. We try to create forms and instructions that are accurate, can be easily understood, and which impose the least possible burden on you to provide us with

information. The estimated average time to complete and file this application is 90 minutes per application. If you have comments regarding the accuracy of this estimate, or

suggestions for making this form simpler, you can write to the Office of Justice Programs, US Department of Justice, 810 Seventh Street, NW, Washington, DC 20531

Submit Form

MARCH 2005 223

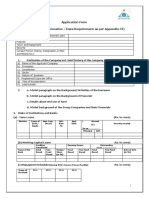

APPENDIX II

OFFICE OF JUSTICE PROGRAMS INSTRUCTIONS

FOR FINANCIAL STATUS REPORTING (SF269A)

(Web-Based SF269A)

The quarterly Financial Status Report (FSR) is due 45 days after the end of the calendar quarter. Please be reminded that this is a report of expenditures

not a request for reimbursement. To request reimbursement, use an OJP payment system*. Send the completed report to: Office of Justice Programs,

Attn:Control Desk, 810 Seventh Street, NW - 5 Floor, Washington, DC 20531 or fax them to (202) 616-5962 or alternate fax #(202)353-8475. Please type or

print legibly and do not change any pre-printed information. If you have already filed an FSR for the current calendar reporting quarter and need to

make changes, please submit a corrected FSR and print “AMENDED” or “CORRECTED” at the top of the form.

Note: Without a current FSR on file, funds will not be disbursed.

Please ensure that you fill out every space (except Box #5) of this report, or your FSR will not be processed.

1. Pre-printed as: U.S. Dept. of Justice, Office of Justice Programs Line 10g is the total Federal share of your cash outlays and unpaid

obligations regardless of whether you have received reimbursement.

2. Enter the OJP grant number found on your grant award document. It will be the total of Column III, Lines 10c and 10f. Line 10h is the

For example, 2001-TE-CX-0000. total amount of your award. Change this amount only if you have

received a supplemental award. Line 10i is the amount of your total

3. Enter current name and address of the award recipient. award which has not either been expended through a cash outlay or

encumbered by an unpaid obligation. It is the difference between

4. Enter the assigned 9 digit OJP vendor number as recorded on your Column III, Lines 10h minus 10g equals Line 10i.

grant award document.

11. Please refer to your award documents to complete this section. This

5. Enter any identifying number assigned by your organization for your section will only be completed if you have a Negotiated Indirect Cost

internal use. If none, leave blank. Rate with your cognizant agency.

6. If you have finished expending funds and recording your required

match related to this award, regardless of whether they have been or Line 11a Indicate the type of rate that you have. Line 11b is the

will be reimbursed by the Federal Government, check “Yes.” indirect cost rate in effect during this current reporting period. Line 11c

Otherwise, check “No.” is the amount of the base against which the cost rate is applied. Line

11d is the total amount of indirect costs charged during this current

7. Indicate whether your accounting system uses a CASH or an reporting period. Line 11e is the Federal Government share of the

ACCRUAL basis for recording transactions related to this award. For amount reported on Line 11d. (11b x 11c = 11d)

reports prepared on a CASH basis, outlays are the sum of actual cash

disbursement for direct purchases of goods and services at the lowest Note: If more than one rate was in effect during this reporting period,

funding level. For reports prepared on an ACCRUAL basis, outlays attach a schedule showing all applicable rates amounts for Line 11b

are the sum of actual cash disbursement at the lowest funding level. through 11e.

Unpaid obligations represent the amount of obligations that you

incurred at the lowest funding level but have not yet paid out. 12. Line 12A is the cumulative amount of Federal funds your State

agency has passed-through to local units of government, other

8. Enter both the begin and end dates of the award period. specified groups or organizations as directed by the legislation of the

program.

9. Enter the FROM and TO dates for the current reporting calendar

quarter as listed below. Line 12B is the cumulative amount of Federal funds subgranted

Reporting Quarter Reports Due Not Later than including amounts subgranted to State agencies and amounts

Jan 1 through Mar 31 May 15 reported on Line 12A.

Apr 1 through Jun 30 Aug 14

Jul 1 through Sep 30 Nov 14 Line 12C is the cumulative Federal portion of forfeited assets to be

Oct 1 through Dec 31 Feb 14 used in this grant whether the assets were forfeited as a result of this

Note: Data for more than one calendar quarter may be rolled up into one grant or another grant.

report for the first report submitted.

Line 12D is the cumulative Federal portion of program income earned

10. Lines 10a, 10b, and 10c refer to your cash outlays including the from other than forfeited assets. This is income from sources such as

value of in-kind match contributions for this award at the lowest registration fees, tuition, and royalties. This amount should not be

funding level (i.e., monies you have spent). Column I is the cumulative included in Box 10.

total of expenditures for the prior reported calendar quarter. Amounts

in this column came from your previous report. Column II is for the Line 12E is the cumulative amount of program income from all

current reporting calendar quarter’s outlays and for any corrections sources, including forfeited assets and interest earned, which have

needed. Column III is for the result when adding across the amounts been expended by your organization. This amount should not be

reported in Columns I and II. The total of lines 10b and 10c should included in Box 10.

equal the amount reported on line 10a for each column.

Line 12F is the balance of unexpended program income

Lines 10d, 10e, and 10f should only be completed if you indicated in (12C + 12D - 12E).

Box 7 that you are on an accrual basis of accounting. Lines 10d, 10e,

and 10f refer to the amount of unpaid obligations or accounts payable 13. Along with your printed name and telephone number, please

you have incurred. Items such as payroll (which has been earned, but remember to sign and date the FSR. It will not be processed

not yet paid) is an example of an accrued expense. Line 10d is the without signature.

total of your unpaid obligations to date.

Line 10e is your share of these unpaid obligations. Line 10f is the

Federal share of unpaid obligations. The total of lines 10e and 10f

should equal the amount on line 10d.

*If you need any assistance on the financial aspect of your OJP grants, contact the OC Customer Service Center

at 1-800-458-0786 or email us at ask.oc@usdoj.gov

MARCH 2005 224

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- HourlyHighlighter GM Combined 11 3Document28 pagesHourlyHighlighter GM Combined 11 3WDIV/ClickOnDetroit100% (1)

- IFADGrant Forms2018Document22 pagesIFADGrant Forms2018EmanuelNo ratings yet

- Bullard - General InstructionsDocument4 pagesBullard - General InstructionsMichael LeeNo ratings yet

- Module 8 - AGNODocument4 pagesModule 8 - AGNOquennie vilchezNo ratings yet

- Use The Following Information For Items 1 To 5:: Chapter 5 - Problem 1: True or FalseDocument33 pagesUse The Following Information For Items 1 To 5:: Chapter 5 - Problem 1: True or FalseAlarich Catayoc80% (5)

- 1 Accounting For Budgetary AccountsDocument5 pages1 Accounting For Budgetary AccountsBaron MirandaNo ratings yet

- Print To Be Taken On Annexure 1 - Declaration From Borrowers With Foreign Currency ExposureDocument1 pagePrint To Be Taken On Annexure 1 - Declaration From Borrowers With Foreign Currency Exposureshyam kayal50% (2)

- Wire Transfer FormDocument1 pageWire Transfer FormMaissa MejdoubNo ratings yet

- GA 2020 CARES Financial and Progress ReportDocument8 pagesGA 2020 CARES Financial and Progress ReportJim HoftNo ratings yet

- Request For Advance or Reimbursement: (See Instructions On Back)Document1 pageRequest For Advance or Reimbursement: (See Instructions On Back)sushantNo ratings yet

- DISCLOSURE STATEMENT Sep2020 With SignatureDocument1 pageDISCLOSURE STATEMENT Sep2020 With SignatureYumi ChanNo ratings yet

- Local Agency Agreement Supplement: Project DescriptionDocument4 pagesLocal Agency Agreement Supplement: Project DescriptionlyesNo ratings yet

- Request For Federal AssistanceDocument2 pagesRequest For Federal AssistanceBou EidNo ratings yet

- Annexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsDocument7 pagesAnnexure D: Report For The - (I/II/III/IV) Quarter Ended - Period Covered by The Report: - (3/6/9/12) MonthsNarendra Ku MalikNo ratings yet

- IND AS 20 - Bhavik Chokshi - FR ShieldDocument7 pagesIND AS 20 - Bhavik Chokshi - FR ShieldSoham Upadhyay100% (1)

- Villio SlabbedDocument10 pagesVillio SlabbedSlabbedNo ratings yet

- Downloadable Solution Manual For Core Concepts of Government and Not For Profit Accounting 2nd Edition Granof CH2 Rev GWSM2e 2Document13 pagesDownloadable Solution Manual For Core Concepts of Government and Not For Profit Accounting 2nd Edition Granof CH2 Rev GWSM2e 2Abood AlissaNo ratings yet

- Name of The Public Trust - Balance Sheet As On 31St March, 2004Document2 pagesName of The Public Trust - Balance Sheet As On 31St March, 2004NIKHIL KASATNo ratings yet

- SD Credit RDocument2 pagesSD Credit RRoger Labuguen AnolingNo ratings yet

- Company Name: Financial Follow Up Report (FFR - I)Document4 pagesCompany Name: Financial Follow Up Report (FFR - I)Ravikanth MehtaNo ratings yet

- Case 12-20409-mdm Doc 1 Filed 01/16/12 Page 1 of 36Document36 pagesCase 12-20409-mdm Doc 1 Filed 01/16/12 Page 1 of 36melaniel_coNo ratings yet

- Financial Statement (Short Form) Division: (Attach A Completed Schedule A)Document4 pagesFinancial Statement (Short Form) Division: (Attach A Completed Schedule A)rfortier6760No ratings yet

- Monthly Operating Report: United States Bankruptcy CourtDocument22 pagesMonthly Operating Report: United States Bankruptcy CourtsperlingreichNo ratings yet

- Blank Form HDocument2 pagesBlank Form Hh4g9w7d6xzNo ratings yet

- Committee To Elect Flossie DusekDocument4 pagesCommittee To Elect Flossie DusekZach EdwardsNo ratings yet

- This Study Resource Was: Easy RoundDocument9 pagesThis Study Resource Was: Easy RoundAiziel OrenseNo ratings yet

- QRS & FFS (Controlling & Monitoring) Formats / Tools (Statement No 1)Document16 pagesQRS & FFS (Controlling & Monitoring) Formats / Tools (Statement No 1)waman.gokhaleNo ratings yet

- Government Accounting QuizDocument2 pagesGovernment Accounting QuizKate Fernandez100% (2)

- Basic Annual Financial Report Example 2Document7 pagesBasic Annual Financial Report Example 2Bé TiếnNo ratings yet

- This Study Resource Was: Chapter 13 Multiple ChoicesDocument6 pagesThis Study Resource Was: Chapter 13 Multiple ChoicesChris Jay LatibanNo ratings yet

- PHS398 ModularBudget 1 2-V1.2Document1 pagePHS398 ModularBudget 1 2-V1.2saNo ratings yet

- Chapter 3 - The Government Accounting Process 2Document63 pagesChapter 3 - The Government Accounting Process 2Clark AgustinNo ratings yet

- CE Government Accounting PDFDocument9 pagesCE Government Accounting PDFjtNo ratings yet

- Application For DFC-DPA Loan Program (DFC-014) : Omb NoDocument17 pagesApplication For DFC-DPA Loan Program (DFC-014) : Omb NoSam KnightNo ratings yet

- Monthly Operating Report: United States Bankruptcy CourtDocument23 pagesMonthly Operating Report: United States Bankruptcy CourtsperlingreichNo ratings yet

- A.Jenis-Jenis AkunDocument18 pagesA.Jenis-Jenis Akundwita maya PuspitasariNo ratings yet

- Lehman Brothers Holdings Inc.: The State of The EstateDocument41 pagesLehman Brothers Holdings Inc.: The State of The EstateTroy UhlmanNo ratings yet

- 55 - Bryan FontenotDocument30 pages55 - Bryan FontenotAnonymous vRG3cFNjANo ratings yet

- Financial Statements of A CompanyDocument12 pagesFinancial Statements of A CompanyRiddhi SharmaNo ratings yet

- Chapter 03 The Government Accounting ProcessDocument20 pagesChapter 03 The Government Accounting ProcessRygiem Dela CruzNo ratings yet

- ANNEX B. Form 3d Medium-Term Financing PlanDocument5 pagesANNEX B. Form 3d Medium-Term Financing PlanAlimoden AnsaryNo ratings yet

- RMC No. 13-2024 - Annex A - BIR Form No. 17.60Document1 pageRMC No. 13-2024 - Annex A - BIR Form No. 17.60Anostasia NemusNo ratings yet

- Latest Promissory Note 11.21.17Document1 pageLatest Promissory Note 11.21.17Michael John PedrasaNo ratings yet

- FA1 Exercises 2022Document19 pagesFA1 Exercises 2022baothi298No ratings yet

- Macroeconomics QuestionnaireDocument7 pagesMacroeconomics QuestionnaireSarikaNo ratings yet

- Fund Flow StatementDocument21 pagesFund Flow StatementSarvagya GuptaNo ratings yet

- The Government Accounting ProcessDocument26 pagesThe Government Accounting ProcessAldrin John TungolNo ratings yet

- Federal Financial Report: (Follow Form Instructions)Document7 pagesFederal Financial Report: (Follow Form Instructions)munirahameedNo ratings yet

- New Annual Report ERC Form DU AO1 1Document97 pagesNew Annual Report ERC Form DU AO1 1Jopan SJNo ratings yet

- Verizon Iowa Good Government Club - 6038 - ScannedDocument46 pagesVerizon Iowa Good Government Club - 6038 - ScannedZach EdwardsNo ratings yet

- Solution Manual For Financial Accounting Information For Decisions 7th Edition by Wild ISBN 0078025893 9780078025891Document19 pagesSolution Manual For Financial Accounting Information For Decisions 7th Edition by Wild ISBN 0078025893 9780078025891dennischavezrmobpyfget100% (28)

- Loan Application FormDocument9 pagesLoan Application FormrohitNo ratings yet

- Department of Labor: sf424Document2 pagesDepartment of Labor: sf424USA_DepartmentOfLaborNo ratings yet

- This Study Resource Was: Quiz 1: Public Accounting and BudgetingDocument6 pagesThis Study Resource Was: Quiz 1: Public Accounting and BudgetingReggie AlisNo ratings yet

- Xii - Economics - Sample Paper - Answer KeyDocument10 pagesXii - Economics - Sample Paper - Answer KeyMishti GhoshNo ratings yet

- Annual Reports ActivityDocument1 pageAnnual Reports ActivityRoy SunNo ratings yet

- Afgnpo MidtermDocument12 pagesAfgnpo Midtermjr centenoNo ratings yet

- Government Accounting Exam PhilippinesDocument4 pagesGovernment Accounting Exam PhilippinesLJ Aggabao100% (1)

- ABM 2 SummativeDocument3 pagesABM 2 SummativeDindin Oromedlav LoricaNo ratings yet

- Verizon Iowa State Good Government - 6038 - ScannedDocument38 pagesVerizon Iowa State Good Government - 6038 - ScannedZach EdwardsNo ratings yet

- 51 Clayton VoisinDocument3 pages51 Clayton VoisinAnonymous vRG3cFNjANo ratings yet

- Adenipekun Emmanuel Adedapo: Customer StatementDocument5 pagesAdenipekun Emmanuel Adedapo: Customer StatementEmmanuel AdenipekunNo ratings yet

- AKM Week 3Document4 pagesAKM Week 3ELSA SYAFIRA ANANTANo ratings yet

- أثر تطبيق نظام إدارة الجودة iso 9001 على تحسين أداء قطاع الصناعة التقليدية والحرف دراسة حالة مؤسسة - datte el ghazel - بسكرةDocument17 pagesأثر تطبيق نظام إدارة الجودة iso 9001 على تحسين أداء قطاع الصناعة التقليدية والحرف دراسة حالة مؤسسة - datte el ghazel - بسكرةlearneenglish940No ratings yet

- Activity: 1 Multiple Choice Questions - Bsslaw4 AAI DATE DUE: October 20, 2020 Turqueza Daryl DavidDocument49 pagesActivity: 1 Multiple Choice Questions - Bsslaw4 AAI DATE DUE: October 20, 2020 Turqueza Daryl DavidOne DozenNo ratings yet

- Agreement of SaleDocument3 pagesAgreement of SaleAYAN AHMEDNo ratings yet

- MC Donals West LifeDocument1 pageMC Donals West Lifevivekrajbhilai5850No ratings yet

- NSS Exploring Economics 1 (3 Edition) : Answers To ExercisesDocument14 pagesNSS Exploring Economics 1 (3 Edition) : Answers To Exercisesrrrrr88888No ratings yet

- Corporate Finance and Investment Decisions and Strategies 9Th Edition Full ChapterDocument41 pagesCorporate Finance and Investment Decisions and Strategies 9Th Edition Full Chapterharriett.murphy498100% (24)

- IBAÑEZ - O1 Graphic Organizer or Table MappingDocument2 pagesIBAÑEZ - O1 Graphic Organizer or Table MappingBen Aldrian IbañezNo ratings yet

- A Study On Mutual Funds in India PDFDocument6 pagesA Study On Mutual Funds in India PDFSahida ParveenNo ratings yet

- Marks and Spencer Marketing ProjectDocument15 pagesMarks and Spencer Marketing ProjectAbdur KhanNo ratings yet

- M&A OutlineDocument5 pagesM&A OutlineDina YavichNo ratings yet

- Econ 24 CH1 To CH3Document18 pagesEcon 24 CH1 To CH3Muyano, Mira Joy M.No ratings yet

- Bond Carry TradingDocument6 pagesBond Carry TradingDinesh GaddamNo ratings yet

- Business Case Study Scenario - Pets N PawsDocument2 pagesBusiness Case Study Scenario - Pets N PawsRutha KidaneNo ratings yet

- Ads 411 (Tutorial) - Week 9: Week Without WallDocument2 pagesAds 411 (Tutorial) - Week 9: Week Without WallAryne Blessie ParkNo ratings yet

- MAN IndiualDocument15 pagesMAN IndiualAvinash GajbhiyeNo ratings yet

- Questions and Answers On FriaDocument18 pagesQuestions and Answers On FriaJoseph John Santos Ronquillo100% (1)

- Liquidity Position Analysis of Nabil Bank Limited: A Project Work ReportDocument9 pagesLiquidity Position Analysis of Nabil Bank Limited: A Project Work ReportSalım RaıŋNo ratings yet

- The Indonesian Economy From The Colonial Extraction Period Until The Post-New Order Period: A Review of Thee Kian Wie's Major WorksDocument12 pagesThe Indonesian Economy From The Colonial Extraction Period Until The Post-New Order Period: A Review of Thee Kian Wie's Major WorksKhairul SaniNo ratings yet

- Importanceand Roleof Entrepreneurshipin EconomicDocument5 pagesImportanceand Roleof Entrepreneurshipin EconomicSasquarch VeinNo ratings yet

- Detailed Supply Chain of Lenskart 1Document10 pagesDetailed Supply Chain of Lenskart 1contactme251198No ratings yet

- Complainant Respondent: Adelita S. Villamor, Atty. Ely Galland A. Jumao-AsDocument3 pagesComplainant Respondent: Adelita S. Villamor, Atty. Ely Galland A. Jumao-AsChristineNo ratings yet

- European Union: French Yrene May Mata and Jowie Del Rosario, StudentsDocument9 pagesEuropean Union: French Yrene May Mata and Jowie Del Rosario, StudentsFrench Yrene May MataNo ratings yet

- MOJAKOE AK1 UTS 2014 GasalDocument12 pagesMOJAKOE AK1 UTS 2014 GasalVincenttio le CloudNo ratings yet

- Analisis Pengaruh Inflasi, Kurs, Utang Luar Negeri Dan Ekspor Terhadap Cadangan Devisa IndonesiaDocument23 pagesAnalisis Pengaruh Inflasi, Kurs, Utang Luar Negeri Dan Ekspor Terhadap Cadangan Devisa IndonesiaarifNo ratings yet

- B2C - Brochure - Cambridge Judge - Circular Economy and Sustainability StrategiesDocument15 pagesB2C - Brochure - Cambridge Judge - Circular Economy and Sustainability Strategies1977zigzNo ratings yet