Professional Documents

Culture Documents

UBL Annual Report 2018-102

UBL Annual Report 2018-102

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-102

UBL Annual Report 2018-102

Uploaded by

IFRS LabCopyright:

Available Formats

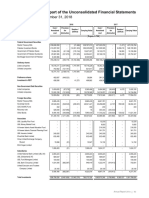

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

10.4.1 General provision represents provision amounting to Rs. 303.132 million (December 31, 2017: Rs. 247.323 million) against

consumer finance portfolio as required by the Prudential Regulations issued by the SBP and Rs. 4,139.453 million

(December 31, 2017: Rs. 2,630.143 million) pertaining to overseas advances to meet the requirements of the regulatory

authorities of the respective countries in which the overseas branches operate and on account of adoption of IFRS 9, as

explained in note 5.1.2. General provision also includes Rs. Nil (December 31, 2017: Rs. 328.700 million) which is based

on regulatory instructions. Further, the Bank carries provision of Rs. Nil (December 31, 2017: Rs. 49.088 million) as a

matter of prudence based on management estimates.

10.4.2 The Bank has availed the benefit of Forced Sale Value (FSV) of certain mortgaged properties held as collateral against non-

performing advances as allowed under BSD Circular 1 of 2011. Had the benefit under the said circular not been taken by

the Bank, the specific provision against non-performing advances would have been higher by Rs. 20.009 million (December

31, 2017: Rs. 24.540 million). The FSV benefit availed is not available for the distribution of cash or stock dividend to

shareholders.

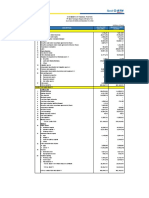

10.4.3 Particulars of provision against advances

2018 2017

Specific General Total Specific General Total

------------------------------------------------ (Rupees in '000) ------------------------------------------------

In local currency 25,749,531 303,132 26,052,663 25,185,167 296,411 25,481,578

In foreign currencies 30,143,494 4,139,453 34,282,947 14,256,443 2,958,843 17,215,286

55,893,025 4,442,585 60,335,610 39,441,610 3,255,254 42,696,864

Note 2018 2017

10.5 Particulars of write-offs ------- (Rupees in '000) -------

10.5.1 Against provisions 10.4 394,108 813,300

Directly charged to profit and loss account 76,056 92,992

470,164 906,292

10.5.2 Domestic

- Write-offs of Rs. 500,000 and above 10.6 14,851 607,829

- Write-offs of below Rs. 500,000 128,868 275,139

143,719 882,968

Overseas 326,445 23,324

470,164 906,292

10.6 Details of loan write-offs of Rs. 500,000 and above

In terms of sub-section (3) of Section 33A of the Banking Companies Ordinance, 1962, the statement in respect of written

off loans or any other financial relief of five hundred thousand rupees or above allowed to a person during the year ended

December 31, 2018 is given in annexure I to the unconsolidated financial statements (except in case of overseas branches

write-offs which is restricted by overseas regulatory authorities). This includes amounts charged off without prejudice to the

Bank's right to recovery.

10.7 Information related to Islamic financing and related assets is given in annexure II and is an integral part of these

unconsolidated financial statements.

Note 2018 2017

11. FIXED ASSETS ------- (Rupees in '000) -------

Capital work-in-progress 11.1 944,233 4,410,426

Property and equipment 11.2 44,854,866 40,797,947

45,799,099 45,208,373

11.1 Capital work-in-progress

Civil works 585,087 3,662,319

Equipment 359,146 748,107

944,233 4,410,426

100 United Bank Limited

You might also like

- Stock ValuationDocument24 pagesStock ValuationamarjeetNo ratings yet

- Cost of Capital FormulaDocument12 pagesCost of Capital FormulaCasey SolisNo ratings yet

- 18 Ubm 306 Financial Management Multiple Choice Questions. Unit-IDocument31 pages18 Ubm 306 Financial Management Multiple Choice Questions. Unit-ILaezelie Palaje100% (1)

- UBL Annual Report 2018-119Document1 pageUBL Annual Report 2018-119IFRS LabNo ratings yet

- UBL Annual Report 2018-96Document1 pageUBL Annual Report 2018-96IFRS LabNo ratings yet

- UBL Annual Report 2018-104Document1 pageUBL Annual Report 2018-104IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Document8 pages4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiNo ratings yet

- RHB Group Soci SofpDocument3 pagesRHB Group Soci SofpAnis SuhailaNo ratings yet

- Published Mar 2023Document17 pagesPublished Mar 2023sei jrNo ratings yet

- Interim Financial Statement Ashwin End 2077Document37 pagesInterim Financial Statement Ashwin End 2077Manoj mahatoNo ratings yet

- Financial Statement SingerDocument13 pagesFinancial Statement SingerAnuja PasandulNo ratings yet

- PakdebtDocument1 pagePakdebtkashifzieNo ratings yet

- Rastriya Banijya Bank Limited: Interim Financial StatementsDocument30 pagesRastriya Banijya Bank Limited: Interim Financial StatementsNepal LoveNo ratings yet

- Dec 2023 Financials UpdatedDocument102 pagesDec 2023 Financials Updatedpraveenramesh058No ratings yet

- Diamond Trust Bank Kenya LTD - Audited Group and Bank Results For The Year Ended 31st December 2017Document6 pagesDiamond Trust Bank Kenya LTD - Audited Group and Bank Results For The Year Ended 31st December 2017Anonymous KAIoUxP7100% (1)

- AlMeezan AnnualReport2023 MIIFDocument9 pagesAlMeezan AnnualReport2023 MIIFmrordinaryNo ratings yet

- Quarter Report April 20 2022Document29 pagesQuarter Report April 20 2022Binu AryalNo ratings yet

- Ebl 2016 Is BSDocument3 pagesEbl 2016 Is BSAasim Bin BakrNo ratings yet

- Quarter Report May 12Document27 pagesQuarter Report May 12Babita neupaneNo ratings yet

- Lapkeu TW II 2023 EngDocument21 pagesLapkeu TW II 2023 EngNur Arif Setya HendraNo ratings yet

- Debt Bulletin June 2023Document32 pagesDebt Bulletin June 2023Anne Nirmani RodrigoNo ratings yet

- Statements of Financial Position PT Bank Rakyat Indonesia (Persero) TBK As of June 30, 2021 and December 31, 2020 (In Million Rupiah)Document14 pagesStatements of Financial Position PT Bank Rakyat Indonesia (Persero) TBK As of June 30, 2021 and December 31, 2020 (In Million Rupiah)vivian rainsaniNo ratings yet

- Sibl-Fs 30 June 2018Document322 pagesSibl-Fs 30 June 2018Faizal KhanNo ratings yet

- EGH PLC Financial Statements For The Period Ended 31st March 2022Document2 pagesEGH PLC Financial Statements For The Period Ended 31st March 2022Saeedullah KhosoNo ratings yet

- Pak Elektron Limited: Condensed Interim Consolidated Balance Sheet AS AT MARCH 31, 2017Document9 pagesPak Elektron Limited: Condensed Interim Consolidated Balance Sheet AS AT MARCH 31, 2017Imran Abdul AzizNo ratings yet

- Statement August 31 2020Document30 pagesStatement August 31 2020NicolasNo ratings yet

- UBL Annual Report 2018-129Document1 pageUBL Annual Report 2018-129IFRS LabNo ratings yet

- Al Noor 2021Document1 pageAl Noor 2021Afan QayumNo ratings yet

- Thesis For Bba 4th YearDocument30 pagesThesis For Bba 4th YearDipen BhattaraiNo ratings yet

- Banco Central Do Brasil FS 2017-p67Document69 pagesBanco Central Do Brasil FS 2017-p67Qorxmaz AydınlıNo ratings yet

- Audited Financials Dec 2022Document1 pageAudited Financials Dec 2022EdwinNo ratings yet

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly)Document3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly)sanjiv sahNo ratings yet

- As Per Our Report Attached For and On Behalf of The Board of DirectorsDocument26 pagesAs Per Our Report Attached For and On Behalf of The Board of DirectorsAnup Kumar SharmaNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- UntitledDocument81 pagesUntitledArjun kumar ShresthaNo ratings yet

- UBL Annual Report 2018-154Document1 pageUBL Annual Report 2018-154IFRS LabNo ratings yet

- Enterprise GroupDocument8 pagesEnterprise GroupFuaad DodooNo ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- UBL Annual Report 2018-79Document1 pageUBL Annual Report 2018-79IFRS LabNo ratings yet

- Balance Sheet09Document1 pageBalance Sheet09sandsoni2002100% (1)

- Adam JeeDocument62 pagesAdam JeeUsman AliNo ratings yet

- NIB Financial Statements 2017Document12 pagesNIB Financial Statements 2017rahim Abbas aliNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- Institute of Rural Management Anand: 1. Non-Current AssetsDocument5 pagesInstitute of Rural Management Anand: 1. Non-Current AssetsDharampreet SinghNo ratings yet

- Financials VTLDocument13 pagesFinancials VTLmuhammadasif961No ratings yet

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Document3 pagesNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7No ratings yet

- Rev6 - LK BKP Per Mar 2021 Per Table (ENG)Document14 pagesRev6 - LK BKP Per Mar 2021 Per Table (ENG)IPutuAdi SaputraNo ratings yet

- Ifii 2017Document53 pagesIfii 2017Gracellyn AlexaNo ratings yet

- Capital Alliance PLC: Interim Financial StatementsDocument10 pagesCapital Alliance PLC: Interim Financial Statementskasun witharanaNo ratings yet

- Financial in WebsiteDocument38 pagesFinancial in WebsiteJay prakash ChaudharyNo ratings yet

- LWL Dec2021Document7 pagesLWL Dec2021Shabry SamoonNo ratings yet

- Honda Balance SheetDocument2 pagesHonda Balance Sheetmeri4uNo ratings yet

- 07 MalabonCity2018 - Part1 FSDocument8 pages07 MalabonCity2018 - Part1 FSJuan Uriel CruzNo ratings yet

- A04 T86uxmwsyll4x6ve.1Document44 pagesA04 T86uxmwsyll4x6ve.1citybizlist11No ratings yet

- NRSP-MFBL-Q3-Financials-Sept 2022 - V1Document15 pagesNRSP-MFBL-Q3-Financials-Sept 2022 - V1shahzadnazir77No ratings yet

- Dialog Axiata PLCDocument15 pagesDialog Axiata PLCgirihellNo ratings yet

- Fauji Food 30 June 2023Document3 pagesFauji Food 30 June 2023mrordinaryNo ratings yet

- A04 Zur57zgu4yzwvtfj.1Document47 pagesA04 Zur57zgu4yzwvtfj.1Paul BluemnerNo ratings yet

- Synthetic and Structured Assets: A Practical Guide to Investment and RiskFrom EverandSynthetic and Structured Assets: A Practical Guide to Investment and RiskNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- THC 5 Lesson 7-8Document10 pagesTHC 5 Lesson 7-8Cindy SorianoNo ratings yet

- Technical AnalysisDocument5 pagesTechnical AnalysisOnkar PanditNo ratings yet

- Options - December 2021Document1 pageOptions - December 2021Rajesh SirsathNo ratings yet

- Pride Microfinance RFPDocument53 pagesPride Microfinance RFPGodfrey BukomekoNo ratings yet

- Yes Bank Interest ChargesDocument3 pagesYes Bank Interest ChargessaiaviNo ratings yet

- ICT Mentorship EP4 SummaryDocument27 pagesICT Mentorship EP4 SummaryYassine ZerNo ratings yet

- Methodology SP Cse Sector and Industry Group IndicesDocument18 pagesMethodology SP Cse Sector and Industry Group Indicescrappy blue angelNo ratings yet

- CH 01Document126 pagesCH 01Hassaan ShaikhNo ratings yet

- Fab-Form Industries LTDDocument20 pagesFab-Form Industries LTDiroeinrgre9302bNo ratings yet

- ESOP Guide For Founders - Xto10xDocument28 pagesESOP Guide For Founders - Xto10xAdarsh ChamariaNo ratings yet

- Ent300 MKTG PlanDocument27 pagesEnt300 MKTG Planakaunsimpan123No ratings yet

- Is Bitcoin GoldenDocument3 pagesIs Bitcoin GoldenMarcia BellNo ratings yet

- Delalpha16 Manager ProfilesDocument39 pagesDelalpha16 Manager Profilesdcdb23No ratings yet

- B. Downward UpwardDocument9 pagesB. Downward Upwardtuân okNo ratings yet

- Classic Chart Patterns: A Quick Reference Guide For TradersDocument2 pagesClassic Chart Patterns: A Quick Reference Guide For TradersAbhay Pratap100% (1)

- Order Placement GuideDocument18 pagesOrder Placement GuideZaraki KenpachiNo ratings yet

- Bursa Malaysia - Company Warrants Information For The Month of December 2011Document0 pagesBursa Malaysia - Company Warrants Information For The Month of December 2011khlis81No ratings yet

- BEE3032 2013 May ExamDocument5 pagesBEE3032 2013 May ExamMarius George CiubotariuNo ratings yet

- 2018 Portfolio Risk and Return: Part II: Test Code: R42 PRR2 Q-BankDocument14 pages2018 Portfolio Risk and Return: Part II: Test Code: R42 PRR2 Q-BankAhmed RiajNo ratings yet

- Project Report On Mutual FundsDocument86 pagesProject Report On Mutual Fundsrtkob0% (2)

- Option GreeksDocument2 pagesOption GreeksPrasanna kumarNo ratings yet

- SPX Franchise Income System: Candy RekerDocument7 pagesSPX Franchise Income System: Candy Rekerkaush23No ratings yet

- Bloomberg TradeDocument4 pagesBloomberg TradeJuan Antonio100% (1)

- Technical Indicators - ExplainedDocument28 pagesTechnical Indicators - Explainedvenkat_chennaNo ratings yet

- A Case of De-Merger ofDocument6 pagesA Case of De-Merger ofKunal JainNo ratings yet

- DCF Valuation ModelsDocument27 pagesDCF Valuation ModelsKanav Gupta100% (1)

- Chapter 5Document36 pagesChapter 5Baby KhorNo ratings yet