Professional Documents

Culture Documents

HO - Consignment Arrangements Students

HO - Consignment Arrangements Students

Uploaded by

patburner1108Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HO - Consignment Arrangements Students

HO - Consignment Arrangements Students

Uploaded by

patburner1108Copyright:

Available Formats

AFAR 2: Accounting for Special Transactions

Consignment Accounting

CONSIGNMENT ARRANGEMENTS

- Consignment arrangements entail the delivery of goods from one entity to another while maintaining ownership and control.

- Within such arrangements, the consignor refrains from recognizing revenue upon the delivery of products to the consignee, as

ownership remains with the consignor until the goods are sold by the consignee.

WHEN IS REVENUE RECOGNIZED?

1. When the dealer/distributor/consignee sells the products to a customer; or

2. When the dealer/distributor/consignee obtains control of the product

Normally, in consignment sales, the consignor recognizes revenue after receiving notification of the sale and cash remittance from the

consignee.

FEATURES OF CONSIGNMENT ARRANGEMENTS

1. The consigned goods remain the inventory of the consignor.

2. The consignee sells the goods on account and risk of the consignor.

3. Expenses incurred by the consignee on the consigned goods are reimbursed by the consignor.

4. The consignee is expected to take reasonable care of the consigned goods.

5. The consignee is not liable to pay the consignor until the goods are sold to a customer.

Here are the pro-forma journal entries in the books of the consignor and consignee in consignment transactions.

Transactions Books of Consignor Books of Consignee

Dr. Cr. Dr. Cr.

1. Shipment of goods on consignment Inventory on Consignment XX Memorandum entry only

Merchandise Inventory XX

2. Payment of inventoriable expenses by the consignor Inventory on consignment XX No entry

Cash XX

3. Payment of reimbursable expenses by consignee Inventory on consignment XX Consignor Receivable XX

Consignee Payable XX Cash XX

4. Advances by consignor Cash XX Advances to Consignor XX

Advances from Consignee XX Cash XX

5. Sale of merchandise by consignee No entry Cash XX

Consignor Payable XX

6. Notification of sale to consignor and payment of cash due Commission Expenses XX Consignor Payable XX

Consignee Payable XX Cash XX

Cash XX Commission Income XX

Advances from Consignee XX Advances to Consignor XX

Consignment Revenue XX Consignor Receivable XX

SOLUTION GUIDES:

• Amount of remittance to the consignor

Total cash collections from customers XXX

Less:

Commission - actual (XXX)

Reimbursable expenses incurred by the consignee (XXX)

Advances to consignor (XXX)

Net remittance to the consignor P XXX

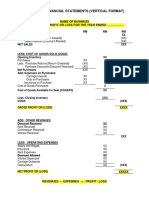

• Profit or loss on consignment

Consignment Sales P XXX

Less: Sales Discount (XXX)

Sales Returns and Allowances from Customers (XXX)

Net Sales XXX

Less: Cost of Consignment Sales (XXX)

Gross Profit XXX

Less: Commission Expense (accrual basis) (XXX)

Freight/Cartage related to returned goods by the consignee to the consignor (XXX)

Other expenses (XXX)

Net profit or (loss) on consignment P XXX

SAMPLE PROBLEMS (adapted)

Problem 1: Jingka Juice Supplier sends P60,000 (120 sachets of herbal foods) worth of goods on consignment to Lipton Enterprises.

Following are the costs incurred:

• Shipping costs of P600 are paid by Jingka Juice

• Reimbursable finishing costs of P2,400 is paid by Lipton

• Lipton advances P3,360 to Jingka.

• At year-end, one-half of the goods on consignment are sold for P48,000 cash.

• A 10% commission on sales is earned by Lipton according to the terms of the consignment.

Requirements:

a. Prepare journal entries in the books of the consignor and consignee.

b. Determine the amount of remittance by the consignee.

Problem 2: On June 1, SMART Company shipped twenty-five DVD to EASY View Store on consignment. The DVD is to be sold at

an advertised price of P200 per item. The cost of each DVD to the consignor is P100. The consignor paid P75 to ship the merchandise.

Commission is to be 25% of sales price. During the month, two DVD were returned.

On June 30, EASY View Store remitted the amount due to consignor after deducting commission of P400.

Questions:

1. Amount of remittance

2. Consignment Profit

3. Cost of Inventory on consignment

Problem 3: On May 15, 2024, AA Sales Company received a shipment of merchandise with a selling price of P15,000 from PC

Company. The consigned goods cost PC Company P10,000 and freight charges of P120 had been paid to ship the goods to AA Sales

Company.

The consignment arrangement provided for a sale of merchandise on credit with terms of 2/10, n/30. The 15% commission is to be based

on the accounts receivable collected by the consignee. Cash discounts taken by customers, expenses applicable to goods on consignment

and any cash advanced to the consignor are deductible from the remittance by the consignee.

AA Sales Company advanced P6,000 to PC Company upon receipt of the shipment. An expense of P800 was paid by AA. By June 2024,

70% of the shipment had been sold, and 80% of the resulting accounts receivable had been collected, all within the discount period.

Remittance of the amount due was made on June 30, 2024.

Determine the following:

a. Profit on consignment

b. Cash remittance by AA Sales Company

c. Cost of unsold units in the hands of AA

Problem 4: Lover Company delivered ten albums to Enchanted Company on consignment. These albums cost P3,000 each and are to

be sold at P5,000 each. Lover Company paid shipment cost of P2,500.

Enchanted Company submitted an account sales report stating that it had returned one album and was remitting P21,900. This amount

represents the total amount due to Lover Company after deducting the following from the selling price of the album sold:

Commission 20% of the selling price

Advertising P1,000

Delivery and Installation 600

Cartage on consigned goods 500

Requirements: Compute for the following:

1. Number of albums sold

2. Consignment profit

3. Cost of Inventory in the hands of Enchanted Company

Problem 5: Information relating to regular sales and consignment sales of DEPTALS Inc. for the year ended June 30, 2024 follows:

Regular Sales Consignment Sales Total

SALES P120,000 P30,000 P150,000

COST OF SALES 84,000 26,000 110,000

OPEX ? 1,760 16,910

You ascertain that merchandise costing P6,500 is in the possession of consignees and included in the cost of consigned merchandise

sold. Operating expenses of P15,150 (more than half of which are fixed) are to be allocated to regular sales and to consignment sales on

the basis of sales amount. The P1,760 operating expenses relating to consignment sales include a commission of 5% and P260 costs

incurred by consignees relating to the entire shipment of merchandise worth P26,000.

Compute the (a) net income on regular sales and (b) net income on consignment sales.

You might also like

- CONSIGNMENT - Focus NotesDocument5 pagesCONSIGNMENT - Focus NotesbrunxNo ratings yet

- Consignment Sales NotesDocument2 pagesConsignment Sales NotesSittiehaina GalmanNo ratings yet

- Proforma Journal Entries - Merchandising TransactionsDocument4 pagesProforma Journal Entries - Merchandising TransactionsJames Christian AvesNo ratings yet

- FAR Freight ChargesDocument2 pagesFAR Freight ChargesJaybie John Palco Eralino100% (1)

- Consignment Accounting Notes and CPAR QuizzerDocument5 pagesConsignment Accounting Notes and CPAR QuizzerAman SinayaNo ratings yet

- Transfer and Business Taxation Accounting Methods and PeriodsDocument5 pagesTransfer and Business Taxation Accounting Methods and PeriodsApril Joy Padua SimonNo ratings yet

- Format - Sole Trader Final AccountsDocument4 pagesFormat - Sole Trader Final AccountsachalaNo ratings yet

- Accounting For Merchandising BusinessDocument5 pagesAccounting For Merchandising BusinessArlene AlemaniaNo ratings yet

- 9 Consignment SalesDocument11 pages9 Consignment SalesNil Justeen GarciaNo ratings yet

- Accounting Notes (24mar23) - 0Document40 pagesAccounting Notes (24mar23) - 0Shun Lae MonNo ratings yet

- Jurnal Laba DipisahDocument2 pagesJurnal Laba DipisahCindy SamberaNo ratings yet

- Financial Statements - Format#3 (GR10)Document3 pagesFinancial Statements - Format#3 (GR10)Nathefa LayneNo ratings yet

- 08 Inventories EstimationsDocument8 pages08 Inventories EstimationsKhen HannaNo ratings yet

- 2023 - 02 - 28 07 - 23 Office Lens PDFDocument9 pages2023 - 02 - 28 07 - 23 Office Lens PDFRoy AnkiNo ratings yet

- ACC106-FORMAT OF FINAL ACCOUNTS-amendedDocument2 pagesACC106-FORMAT OF FINAL ACCOUNTS-amendedhaziqkings20100% (1)

- Format Sopl SofpDocument2 pagesFormat Sopl SofpkhaiNo ratings yet

- Accounting 511 - ConsignmentDocument6 pagesAccounting 511 - ConsignmentLorenz BaguioNo ratings yet

- XYZ Trading Income Statement For The Year 31 December 2016 RM RM RM RMDocument1 pageXYZ Trading Income Statement For The Year 31 December 2016 RM RM RM RMmaheswaran perumalNo ratings yet

- Control Accounts Notes (2docxDocument1 pageControl Accounts Notes (2docxCarisa LynchNo ratings yet

- SOPL and SOFP FormatDocument3 pagesSOPL and SOFP Formatnurizzatul syazwaniNo ratings yet

- ACC106-FORMAT OF FINAL ACCOUNTS-amendedDocument2 pagesACC106-FORMAT OF FINAL ACCOUNTS-amendedMuhammad Irfan100% (1)

- FABM FORMAT STATEMENT (Final)Document6 pagesFABM FORMAT STATEMENT (Final)RishiiieeeznNo ratings yet

- Afar 2814 Consignment Sales PDFDocument4 pagesAfar 2814 Consignment Sales PDFMay Grethel Joy Perante100% (1)

- Format of Final Accounts ACC 415 UITMDocument2 pagesFormat of Final Accounts ACC 415 UITMAifaa ArinaNo ratings yet

- ConsignmentDocument5 pagesConsignmentMANKARAN SINGH BHATIA 21-22No ratings yet

- CHAPTER 16 PartnershipDocument22 pagesCHAPTER 16 PartnershipbabarNo ratings yet

- As A Rule, All Goods To Which The Entity Has TITLE (Ownership) Shall Be INCLUDED in The INVENTORY, Regardless of LocationDocument2 pagesAs A Rule, All Goods To Which The Entity Has TITLE (Ownership) Shall Be INCLUDED in The INVENTORY, Regardless of LocationVincent BuyanNo ratings yet

- PDAFDocument2 pagesPDAFMaeNo ratings yet

- FAR 215 Inventory EstimationDocument8 pagesFAR 215 Inventory EstimationJai BacalsoNo ratings yet

- Merchandising Operations: Inventory Base. These Items Are Then Resold To Customers and Recorded As Sales RevenueDocument12 pagesMerchandising Operations: Inventory Base. These Items Are Then Resold To Customers and Recorded As Sales RevenueMingxNo ratings yet

- BAFSDocument2 pagesBAFSBleh Bleh blehNo ratings yet

- Format of Final Accounts (Vertical Format)Document3 pagesFormat of Final Accounts (Vertical Format)ummieulfahNo ratings yet

- Quarterly Statement of Cash FlowDocument3 pagesQuarterly Statement of Cash FlowDILG San FabianNo ratings yet

- EC 1 - Acctg Cycle Part 2 ConceptsDocument3 pagesEC 1 - Acctg Cycle Part 2 ConceptsChelay EscarezNo ratings yet

- Perpetual Inventory SystemDocument9 pagesPerpetual Inventory SystemAgdum BagdumNo ratings yet

- Financial Accounting 2Document89 pagesFinancial Accounting 2Colince johnson0% (1)

- Consignment AccountDocument9 pagesConsignment AccountGamers 4 lyfNo ratings yet

- Unit VII - Consignment SalesDocument5 pagesUnit VII - Consignment SalesNovylyn AldaveNo ratings yet

- Preparation of Financial Statements-Sole TradersDocument5 pagesPreparation of Financial Statements-Sole TradersHeavens Mupedzisa100% (1)

- Merchandising BusinessDocument9 pagesMerchandising BusinessSean Justin EspinaNo ratings yet

- AAC20203 - Format of FSDocument2 pagesAAC20203 - Format of FSphoenixNo ratings yet

- Name of Business: Format of Final Accounts (Vertical Format)Document2 pagesName of Business: Format of Final Accounts (Vertical Format)adamyasmin825No ratings yet

- Format of Financial StatementsDocument2 pagesFormat of Financial StatementsAmeerul HarithNo ratings yet

- Vertical Balance SheetDocument3 pagesVertical Balance Sheetamit2201No ratings yet

- FORMAT OF THE TRADING Account With The AdjustmentsDocument2 pagesFORMAT OF THE TRADING Account With The AdjustmentsTajay Kadeem ThomasNo ratings yet

- Format SOCI & SOFPDocument2 pagesFormat SOCI & SOFPafiqjr2No ratings yet

- Consignment Account PDFDocument13 pagesConsignment Account PDFAyush KumarNo ratings yet

- 2 Assignment For Midterm - Merchandising Business: (Periodic System)Document4 pages2 Assignment For Midterm - Merchandising Business: (Periodic System)Lisa PalermoNo ratings yet

- Corporation Liquidation NotesDocument7 pagesCorporation Liquidation Notesiptrcrml100% (1)

- Balance Sheet (LIST)Document6 pagesBalance Sheet (LIST)Apryl TaiNo ratings yet

- 06 Receivable FinancingDocument10 pages06 Receivable Financingsharielles /No ratings yet

- QSCF 6Document2 pagesQSCF 6ricohizon99No ratings yet

- Vertical Income Statement: FormatDocument5 pagesVertical Income Statement: FormatHermann Schmidt EbengaNo ratings yet

- 14 Acctg Ed 1 - Receivable FinancingDocument19 pages14 Acctg Ed 1 - Receivable FinancingNath BongalonNo ratings yet

- Quick NotesDocument7 pagesQuick NotesMelvin BagasinNo ratings yet

- FDP Form 9 - Statement of Cash FlowsDocument1 pageFDP Form 9 - Statement of Cash FlowsNoel Jr BuenafeNo ratings yet

- CorpLiq Draft (Recovered)Document9 pagesCorpLiq Draft (Recovered)Via Samantha de AustriaNo ratings yet

- Periodic Vs PerpetualDocument17 pagesPeriodic Vs PerpetualJERICKO LIAN DEL ROSARIONo ratings yet

- Freight GuideDocument1 pageFreight GuideFrancis AsisNo ratings yet

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeFrom EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNo ratings yet

- 06 Donors TaxDocument4 pages06 Donors Taxpatburner1108No ratings yet

- MOD007 Code of Ethics For Professional AccountantsDocument97 pagesMOD007 Code of Ethics For Professional Accountantspatburner1108No ratings yet

- 05-CHED2021 Part1-Auditors ReportDocument4 pages05-CHED2021 Part1-Auditors Reportpatburner1108No ratings yet

- MT - Assignment 01 StudentsDocument2 pagesMT - Assignment 01 Studentspatburner1108No ratings yet

- Robo Signer 11.1Document151 pagesRobo Signer 11.1Foreclosure Self Defense100% (2)

- Disposition of VariancesDocument7 pagesDisposition of VariancescabbyNo ratings yet

- 6072-p1 - Kunci Jawab PT Cahaya KosongDocument91 pages6072-p1 - Kunci Jawab PT Cahaya KosongilhamdzakipratamaNo ratings yet

- Budget Workshop 3 FY 2022Document41 pagesBudget Workshop 3 FY 2022Dan LehrNo ratings yet

- High-Tech Banking: Unit VDocument24 pagesHigh-Tech Banking: Unit VtkashvinNo ratings yet

- Code Head Appendix-IvDocument29 pagesCode Head Appendix-IvPrashant AtreNo ratings yet

- Fa Chapt 1-3Document63 pagesFa Chapt 1-3sushNo ratings yet

- Journal of Regulation & Risk - North Asia, Volume VI, Issue I, Spring 2014Document210 pagesJournal of Regulation & Risk - North Asia, Volume VI, Issue I, Spring 2014Christopher Dale RogersNo ratings yet

- Lending-Times Business Plan Final June 2016Document74 pagesLending-Times Business Plan Final June 2016kago khachana100% (2)

- Ethiopia D3S4 Income TaxesDocument19 pagesEthiopia D3S4 Income TaxesEshetie Mekonene AmareNo ratings yet

- B326 Course StructureDocument16 pagesB326 Course StructureAyeshaNo ratings yet

- Finals Quiz 2 HBA111 PDFDocument7 pagesFinals Quiz 2 HBA111 PDFMarife GloriaNo ratings yet

- Zelman Subprime ReportDocument1 pageZelman Subprime Reportpeter100% (2)

- KPMG Learning Academy CatalogueDocument20 pagesKPMG Learning Academy CatalogueSabyasachi KarNo ratings yet

- Quiz-on-Related-Party-Disclosures AnsweDocument3 pagesQuiz-on-Related-Party-Disclosures AnsweLynssej Barbon67% (3)

- Assignment - LCA - MarriottDocument4 pagesAssignment - LCA - MarriottPrashant100% (1)

- Ethical Lessons of LehmanDocument2 pagesEthical Lessons of LehmanAnindya BasuNo ratings yet

- Bar QuestionsDocument5 pagesBar QuestionsPatrick RamosNo ratings yet

- Richard Dennis CBOT FLOOR tRADERDocument3 pagesRichard Dennis CBOT FLOOR tRADERukxgerardNo ratings yet

- 03 Personal Income Taxes Professional TaxDocument83 pages03 Personal Income Taxes Professional TaxHO HONo ratings yet

- A Project Report On Icici Online BankingDocument18 pagesA Project Report On Icici Online BankingAmit SinghNo ratings yet

- T Mobile Original 2021Document1 pageT Mobile Original 2021tyger ndaNo ratings yet

- 31 Life Cycle of A TradeDocument45 pages31 Life Cycle of A TradeSaurabh SumanNo ratings yet

- Vendor Master FormDocument2 pagesVendor Master Formrekha0% (1)

- Revision For Mid Exam Beeb3023 Intmd Macro A191 1Document18 pagesRevision For Mid Exam Beeb3023 Intmd Macro A191 1Amirul AimanNo ratings yet

- New DGT Form - PER 25Document5 pagesNew DGT Form - PER 25superandrosaNo ratings yet

- Account Statement As of 08-06-2020 15:04:32 GMT +0530Document16 pagesAccount Statement As of 08-06-2020 15:04:32 GMT +0530sunojNo ratings yet

- Assessment TestDocument3 pagesAssessment TestDaniel HunksNo ratings yet

- IBL Midterm NotesDocument40 pagesIBL Midterm Notesalyza burdeos100% (1)

- AFM 2021 Marjun ADocument10 pagesAFM 2021 Marjun ACheng Chin HwaNo ratings yet