Professional Documents

Culture Documents

Tax Invoice: Cariot Auto Private Limited

Tax Invoice: Cariot Auto Private Limited

Uploaded by

Jay Koshti0 ratings0% found this document useful (0 votes)

0 views2 pagesOriginal Title

01987

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

0 views2 pagesTax Invoice: Cariot Auto Private Limited

Tax Invoice: Cariot Auto Private Limited

Uploaded by

Jay KoshtiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

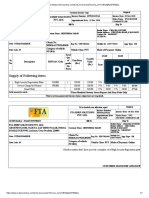

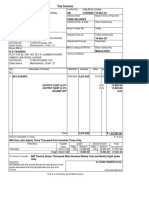

Tax Invoice

Cariot Auto Private Limited Original for recipient

Address : Office No. 03-316, WeWork Vi-John Invoice No. : C2CGJ/2324/01987

Tower 393, Phase 3, Gurugram, Gurgaon, Invoice Date : 2024-01-07

Haryana, 122016

Customer Ref No. : Q75GUK

State Code : GJ

RCM : NA

GSTIN : 24AAJCC8558K1Z5

CIN : U50400DL2021PTC388728

PAN : AAJCC8558K

Billing Address Customer Contact Details

Customer Name : Koshti jay Contact Number : 8160041848

Email Id : jaykoshti9914@gmail.com

: matribhumi society, near

Address Ayodhyanagar, Ahmedabad, Customer PAN : HLPPK0774Q

Gujarat, 382449

City : Ahmedabad

State : Gujarat

Place of Supply/State Code : 24

HSN/SAC Total (incl. GST as per

S. No. Description Qty Rate/Price (INR)

Code Act)

Sale of Motor Vehicle

1. 870390 1 1,79,000 1,79,000

Car Reg No: GJ01RA4635

PG Commission on Payment Collected (GST

2. 999799 1 66 66

@18%)

RC Transfer convenience charges (GST

3. 999799 1 118 118

@18%)

4. FASTag Charges (GST @18%) 999799 1 499 499

Total Amount 1,79,683

* RTO vendor's charges (incurred as pure agent) 3,882

Invoice Value 1,83,565

Invoice Value in Words Rupees One Lakh Eighty Three Thousands Five Hundred Sixty Five Only

Terms And Conditions:

1) The vehicle is a second hand good/Used good.

2) GST on Taxable value is being duly deposited with the Government on this transaction in terms of Rule 32 (5) of CGST Rules 2017.

3) RTO vendor’s charges are incurred in capacity of pure agent of buyer of car.

4) Convenience fees charged for facilitation of RC transfer services from vendor.

5) Cariot is acting as a pure agent of the buyer of car for the RC transfer services by RTO vendor and incurring RTO related charges on behalf of the

buyer of the car and paying to RTO vendor. RTO vendor discharges GST on RTO vendor’s charges to Govt. as per the applicable tax law.

*Note: This is computer generated Invoice. No signature is required.

You might also like

- Jac JW 23241549Document3 pagesJac JW 23241549Jugal mahatoNo ratings yet

- Lucky ScootyDocument1 pageLucky ScootyPramodKumarNo ratings yet

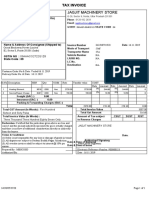

- Jagjit Machinery Store: Name & Address of Receiver (Billed To)Document1 pageJagjit Machinery Store: Name & Address of Receiver (Billed To)Ankit SolankiNo ratings yet

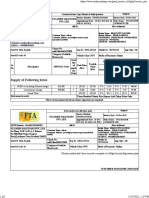

- Tax Invoice: Pest Kare (India) PVT - LTDDocument1 pageTax Invoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3No ratings yet

- Print Invoice Old - PHPDocument1 pagePrint Invoice Old - PHPDishank RastogiNo ratings yet

- InvoicePDF C2C090823099260Document2 pagesInvoicePDF C2C090823099260Bishnu KumarNo ratings yet

- RP JagadGuru Shree Vallabhacharya MahaprabhujiDocument10 pagesRP JagadGuru Shree Vallabhacharya MahaprabhujiRaggy TannaNo ratings yet

- 0654 2013 IGCSE Coordinated Sciences Paper 2Document32 pages0654 2013 IGCSE Coordinated Sciences Paper 2jwinlynNo ratings yet

- Samsung Refrigerator Tax InvoiceDocument1 pageSamsung Refrigerator Tax InvoiceJyoti Sarkar0% (1)

- Sales Invoice Report New-3Document1 pageSales Invoice Report New-3NRJ PANDITNo ratings yet

- SET 1 - MOCK ALE Day 2 Design ProblemsDocument6 pagesSET 1 - MOCK ALE Day 2 Design Problemsallyssa monica duNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- AB Corporation PDFDocument6 pagesAB Corporation PDFNirmal UmaretiyaNo ratings yet

- Tax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraDocument1 pageTax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraSHANTANU PATHAKNo ratings yet

- Filmora KeyDocument3 pagesFilmora KeyMis50% (2)

- Tax Invoice: Cariot Auto Private LimitedDocument2 pagesTax Invoice: Cariot Auto Private Limitedfiatlinea3689No ratings yet

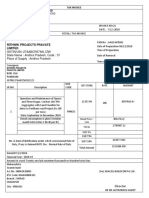

- 21 BILL NO RPPL 21-1Document1 page21 BILL NO RPPL 21-1abhijeetbishnoiNo ratings yet

- 61.SV InfraDocument1 page61.SV Infrarajnani7373No ratings yet

- InvoiceDocument1 pageInvoiceRAJAT GARGNo ratings yet

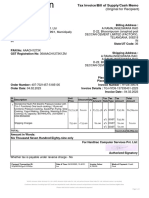

- Mukesh Bhai: Tax Invoice/Bill of Supply/Cash MemoDocument1 pageMukesh Bhai: Tax Invoice/Bill of Supply/Cash MemoMiten VoraNo ratings yet

- AC GST Tax Invoice 1Document1 pageAC GST Tax Invoice 1ngidlaniNo ratings yet

- 1176-Veermani Engineering Co.Document1 page1176-Veermani Engineering Co.NILAY VASANo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceelectroniclyfNo ratings yet

- A G ConstructionDocument6 pagesA G ConstructionpopemiNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/758 3588 9-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/758 3588 9-Feb-2022bhola.vilesh7No ratings yet

- NR7625274800605093Document2 pagesNR7625274800605093hariharan7275No ratings yet

- Bill 1Document1 pageBill 1Shaikh ShamsudNo ratings yet

- HSRPDocument1 pageHSRPAbhinandan SahaniNo ratings yet

- Tax Invoice: Billing To Biller DetailsDocument1 pageTax Invoice: Billing To Biller DetailsBala GangadharNo ratings yet

- Item Invoice DownloadDocument3 pagesItem Invoice DownloadKiranmayee NalkariNo ratings yet

- Tshirt InvoiceDocument1 pageTshirt InvoiceSayantanNo ratings yet

- My Invoice 20231230134432 7007982673Document1 pageMy Invoice 20231230134432 7007982673tomkuldeep1998No ratings yet

- eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceDocument2 pageseEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceAsad ShakilNo ratings yet

- File PDFDocument1 pageFile PDFjanathadistributors19No ratings yet

- Bill No 1207Document3 pagesBill No 1207luckythkr98No ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAvijitSinharoyNo ratings yet

- Sale Bill 081Document2 pagesSale Bill 081Nilesh PatilNo ratings yet

- Jac JW 23241545Document3 pagesJac JW 23241545Jugal mahatoNo ratings yet

- HIL Limited - Project Order Approval Form: Babulal & CompanyDocument2 pagesHIL Limited - Project Order Approval Form: Babulal & CompanyRavinandan KumarNo ratings yet

- 14 TechDocument1 page14 Tech11rj.thakurNo ratings yet

- NC78691577813083Document2 pagesNC78691577813083spganeNo ratings yet

- Invoice IXITRN4712391663216796Document1 pageInvoice IXITRN4712391663216796rahul swainNo ratings yet

- Tax Invoice: Tax Amount Amount Rate ValueDocument4 pagesTax Invoice: Tax Amount Amount Rate ValueaaftabganaiNo ratings yet

- User Charge Invoice5325930181Document1 pageUser Charge Invoice5325930181kumarprince5092No ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

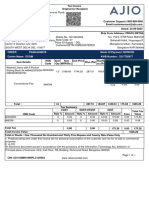

- Ajio FN4044406978 1705833538362Document1 pageAjio FN4044406978 1705833538362ShubhamNo ratings yet

- InvoiceDocument2 pagesInvoiceDeepeshwar KumarNo ratings yet

- Switch and Installation-3980 PaidDocument1 pageSwitch and Installation-3980 PaidAnkur AgarwalNo ratings yet

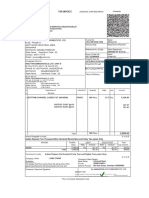

- Tax InvoiceDocument1 pageTax InvoiceShahbaz KhanNo ratings yet

- ARS-2023-24-38 With EwayDocument4 pagesARS-2023-24-38 With EwaypmmahobaNo ratings yet

- VAHAN 4.0 (Citizen Services) Onlineapp01 135 8013 Sivam123Document1 pageVAHAN 4.0 (Citizen Services) Onlineapp01 135 8013 Sivam123Shivam GuptaNo ratings yet

- InvoiceDocument1 pageInvoiceRamalingeswaraRao AmpalamNo ratings yet

- Jac JW 23241546Document3 pagesJac JW 23241546Jugal mahatoNo ratings yet

- Taxinvoice R Oct23 12694Document3 pagesTaxinvoice R Oct23 12694sunny253067No ratings yet

- Tax Invoice: Customer Details Just Dial DetailsDocument2 pagesTax Invoice: Customer Details Just Dial DetailsaashiyanacontractorsNo ratings yet

- GOFLDSTTGXQBTUG61976Document1 pageGOFLDSTTGXQBTUG61976joysreekakotiNo ratings yet

- Tax Invoice: Zomato LimitedDocument1 pageTax Invoice: Zomato Limitedjasmin parmarNo ratings yet

- Bank of Baroda Fastag: Payment AcknowledgementDocument2 pagesBank of Baroda Fastag: Payment AcknowledgementnikilNo ratings yet

- ZEE5 Invoice 11 03 2022Document1 pageZEE5 Invoice 11 03 2022Shajin NambiarNo ratings yet

- Invoice 110945 SHIVAM JAISWALDocument1 pageInvoice 110945 SHIVAM JAISWALShivam JaiswalNo ratings yet

- MPIDCDocument1 pageMPIDCMAGIC ELEVATORSNo ratings yet

- AC GST Tax Invoice 1-1Document1 pageAC GST Tax Invoice 1-1Rahul GhugeNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Payment Schedule Template 22Document12 pagesPayment Schedule Template 22Raggy TannaNo ratings yet

- Basics of Open Source Embedded Development Board (Arduino) : Prepared By: Hiren D. ShuklaDocument64 pagesBasics of Open Source Embedded Development Board (Arduino) : Prepared By: Hiren D. ShuklaRaggy TannaNo ratings yet

- 4 Student Placement Higher Study Data FormatDocument8 pages4 Student Placement Higher Study Data FormatRaggy TannaNo ratings yet

- Interface Digital and Analog I/O Devices (Arduino Interfacing)Document29 pagesInterface Digital and Analog I/O Devices (Arduino Interfacing)Raggy TannaNo ratings yet

- Gujarat Technological UniversityDocument1 pageGujarat Technological UniversityRaggy TannaNo ratings yet

- Mobile SyllabusDocument7 pagesMobile SyllabusRaggy TannaNo ratings yet

- RoomDocument2 pagesRoomRaggy TannaNo ratings yet

- JK FFDocument1 pageJK FFRaggy TannaNo ratings yet

- JAVASCRIPT Path FinderDocument98 pagesJAVASCRIPT Path FindernandanNo ratings yet

- Group One: David, Hegel, Carlos, Jay, Jenni, Yvette, GingerDocument40 pagesGroup One: David, Hegel, Carlos, Jay, Jenni, Yvette, GingerFederico FioriNo ratings yet

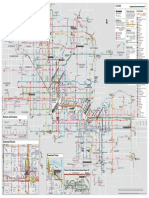

- Valley Metro System MapDocument1 pageValley Metro System MapLục Ẩn ĐạtNo ratings yet

- DebugDocument3 pagesDebugxuNo ratings yet

- The Edge - Financial Daily PDFDocument33 pagesThe Edge - Financial Daily PDFQuatly QasyahNo ratings yet

- Writing A Parable (Grade 8)Document16 pagesWriting A Parable (Grade 8)JON-VIC FIGUEROANo ratings yet

- End of Year Reflection ElaDocument4 pagesEnd of Year Reflection Elaapi-528608734No ratings yet

- University of Mumbai: (Computer Systems and ApplicationsDocument21 pagesUniversity of Mumbai: (Computer Systems and ApplicationsManish YadavNo ratings yet

- Modals - MaiorDocument9 pagesModals - MaiorGabriel CintraNo ratings yet

- Multiple Integrals: Example 3 SolutionDocument15 pagesMultiple Integrals: Example 3 SolutionshivanshNo ratings yet

- Arts 6 Module 1Document18 pagesArts 6 Module 1Elexthéo JoseNo ratings yet

- Mathematics Lesson 4 - 4 Digits Addition Worded With 0Document9 pagesMathematics Lesson 4 - 4 Digits Addition Worded With 0api-381088463No ratings yet

- Thesis Statement Arranged MarriagesDocument5 pagesThesis Statement Arranged Marriageskimberlypattersoncoloradosprings100% (2)

- Bella Pro Series 5.3 Qt. Digital Air Fryer 90065Document32 pagesBella Pro Series 5.3 Qt. Digital Air Fryer 90065مصطفى الأصفرNo ratings yet

- Neil Armstrong BiographyDocument4 pagesNeil Armstrong Biographyapi-232002863No ratings yet

- #6 Clinical - Examination 251-300Document50 pages#6 Clinical - Examination 251-300z zzNo ratings yet

- Chapter-Ii Project Description 2.1 Type of ProjectDocument20 pagesChapter-Ii Project Description 2.1 Type of ProjectOMSAINATH MPONLINENo ratings yet

- MIE Consent FormDocument1 pageMIE Consent FormSibongiseni NtuliNo ratings yet

- EpicsDocument5 pagesEpicsLynette JavaNo ratings yet

- Sf2460i Line 163Document123 pagesSf2460i Line 163Santiago SilvaNo ratings yet

- Aqa 83622 SMS PDFDocument14 pagesAqa 83622 SMS PDFT SolomonNo ratings yet

- Enable Root Access openSUSEDocument4 pagesEnable Root Access openSUSEAgung PambudiNo ratings yet

- Lesson 1Document35 pagesLesson 1Irish GandolaNo ratings yet

- CHEM 1412. Chapter 16. Acids and Bases - Homework - SDocument13 pagesCHEM 1412. Chapter 16. Acids and Bases - Homework - STrisha Anne SyNo ratings yet

- Workshop 3 - MathsDocument5 pagesWorkshop 3 - MathsJuan David Bernal QuinteroNo ratings yet

- MDA Report Tata Industries FY20 21Document6 pagesMDA Report Tata Industries FY20 21Darshan VadherNo ratings yet

- PWD Comfort Room Plan and DetailsDocument1 pagePWD Comfort Room Plan and DetailsRexter UnabiaNo ratings yet