Professional Documents

Culture Documents

Half-Year Report Julius Baer Group LTD

Uploaded by

Evgeny SkorobogatkoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Half-Year Report Julius Baer Group LTD

Uploaded by

Evgeny SkorobogatkoCopyright:

Available Formats

Half-year Report 2011 Julius Baer Group Ltd.

Content

Half-year Report 2011 Julius Baer Group Ltd.

2 3 Consolidated income statement Consolidated statement of comprehensive income Consolidated balance sheet Consolidated statement of changes in equity Consolidated statement of cash flows (condensed) Notes to the half-year reporting

4 6

Half-year Report 2011 Julius Baer Group Ltd.

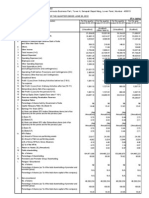

Consolidated income statement

H1 2011

Note CHF m

H1 2010

CHF m

H2 2010

CHF m

Change to H1 2010 in %

Interest income Interest expense Net interest income Fee and commission income Commission expense Net fee and commission income Net trading income Other ordinary results Operating income Personnel expenses General expenses Depreciation of property and equipment Amortisation of customer relationships Amortisation of other intangible assets Operating expenses Profit before taxes Income taxes Net profit Attributable to: Shareholders of Julius Baer Group Ltd. Non-controlling interests 4 5 2 3 1

350.8 34.5 316.3 601.0 104.8 496.3 86.0 -0.7 897.8 413.3 228.2 14.5 45.6 15.3 717.0 180.9 33.5 147.4

277.7 32.5 245.2 601.0 109.1 491.9 163.1 16.3 916.4 424.6 184.5 13.1 42.6 14.2 679.1 237.3 52.1 185.2

241.8 31.6 210.2 596.1 107.6 488.5 169.3 10.0 878.0 399.1 191.5 15.3 49.0 26.1 681.0 197.0 29.4 167.6

26.3 6.2 29.0 -3.9 0.9 -47.3 -2.0 -2.7 23.7 10.7 7.0 7.7 5.6 -23.8 -35.7 -20.4

147.3 0.1 147.4

184.8 0.4 185.2

167.2 0.4 167.6

-20.3 -20.4

H1 2011

CHF

H1 2010

CHF

H2 2010

CHF

Change to H1 2010 in %

Share information Basic net profit per registered share Diluted net profit per registered share 0.7 0.7 0.9 0.9 0.8 0.8 -19.8 -20.1

Half-year Report 2011 Julius Baer Group Ltd.

Consolidated statement of comprehensive income

H1 2011

CHF m

H1 2010

CHF m

H2 2010

CHF m

Change to H1 2010 in %

Net profit recognised in the income statement

147.4

185.2

167.6

-20.4

Other comprehensive income (net of taxes): Net unrealised gains/(losses) on financial investments available-for-sale Net realised (gains)/losses reclassified to the income statement on financial investments available-for-sale Hedging reserve for cash flow hedges Translation differences Other comprehensive income for the period recognised directly in equity -7.2 16.7 -0.8 -11.5 7.9 8.9 0.9 -8.9 4.7 9.4 0.1 -20.4

-2.8

8.8

-6.2

Total comprehensive income for the period recognised in the income statement and in equity

144.6

194.0

161.4

Attributable to: Shareholders of Julius Baer Group Ltd. Non-controlling interests 144.5 0.1 144.6 193.6 0.4 194.0 161.0 0.4 161.4

Half-year Report 2011 Julius Baer Group Ltd.

Consolidated balance sheet

30.06.2011

Note CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Change to 31.12.10 in %

Assets Cash Due from banks Loans Trading assets Derivative financial instruments Financial assets designated at fair value Financial investments available-for-sale Investments in associates Property and equipment Goodwill and other intangible assets Accrued income and prepaid expenses Deferred tax assets Other assets Total assets 7 6 6 262.8 7 462.0 16 268.5 3 199.1 1 973.3 1 001.9 14 484.1 51.0 362.4 1 767.4 174.3 11.6 453.1 47 471.5 1 514.7 6 419.9 12 898.7 2 561.3 2 777.8 1 030.0 17 289.4 371.6 1 842.8 170.8 5.0 489.4 47 371.4 1 121.3 6 586.6 14 570.4 3 752.0 2 713.1 1 006.1 13 885.1 371.8 1 797.8 174.6 10.1 297.6 46 286.6 -76.6 13.3 11.7 -14.7 -27.3 -0.4 4.3 -2.5 -1.7 -0.2 14.9 52.3 2.6

Half-year Report 2011 Julius Baer Group Ltd.

30.06.2011

CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Change to 31.12.10 in %

Liabilities and equity Due to banks Due to customers Trading liabilities Derivative financial instruments Financial liabilities designated at fair value Debt issued Accrued expenses and deferred income Current tax liabilities Deferred tax liabilities Provisions Other liabilities Total liabilities Share capital Retained earnings Other components of equity Treasury shares Equity attributable to shareholders of Julius Baer Group Ltd. Non-controlling interests Total equity Total liabilities and equity 5 108.8 30 016.1 934.8 1 877.2 4 362.4 236.9 246.9 42.4 116.9 26.2 107.4 43 076.0 4.1 4 607.9 -84.6 -133.7 4 222.3 30 054.2 732.2 2 991.0 4 094.4 244.8 258.4 12.4 110.1 40.3 302.7 43 062.8 4.1 4 413.6 -75.6 -35.4 4 251.8 28 846.7 800.9 2 772.4 4 160.6 240.2 349.5 44.8 121.9 32.2 181.5 41 802.6 4.1 4 581.9 -81.8 -22.5 20.2 4.1 16.7 -32.3 4.9 -1.4 -29.4 -5.4 -4.1 -18.6 -40.8 3.0 0.6 -3.4 -494.2

4 393.7 1.8 4 395.5 47 471.5

4 306.8 1.9 4 308.6 47 371.4

4 481.8 2.2 4 484.0 46 286.6

-2.0 -18.2 -2.0 2.6

Half-year Report 2011 Julius Baer Group Ltd.

Consolidated statement of changes in equity

Share capital CHF m

Retained earnings 1 CHF m

At 1 January 2010 Net profit attributable to shareholders of Julius Baer Group Ltd. Net profit attributable to non-controlling interests Unrealised gains/(losses) Realised (gains)/losses reclassified to the income statement Changes Dividends Treasury shares and own equity derivative activity Changes in derivatives on own shares Acquisitions of own shares Disposals of own shares At 30 June 2010

4.1 4.1

4 312.9 184.8 -82.7 -1.4 4 413.6

At 1 July 2010 Net profit attributable to shareholders of Julius Baer Group Ltd. Net profit attributable to non-controlling interests Unrealised gains/(losses) Realised (gains)/losses reclassified to the income statement Changes Treasury shares and own equity derivative activity Changes in derivatives on own shares Acquisitions of own shares Disposals of own shares At 31 December 2010

4.1 4.1

4 413.6 167.2 1.1 4 581.9

At 1 January 2011 Net profit attributable to shareholders of Julius Baer Group Ltd. Net profit attributable to non-controlling interests Unrealised gains/(losses) Realised (gains)/losses reclassified to the income statement Changes Dividends Treasury shares and own equity derivative activity Changes in derivatives on own shares Acquisitions of own shares Disposals of own shares At 30 June 2011

1

4.1 4.1

4 581.9 147.3 -124.0 2.6 4 607.9

Retained earnings include the capital reserves of Bank Julius Baer & Co. Ltd. and the share premium of Julius Baer Group Ltd.

Half-year Report 2011 Julius Baer Group Ltd.

Other components of equity Hedging reserve for cash flow hedges, net of taxes CHF m

Financial investments availablefor-sale, net of taxes CHF m

Translation differences CHF m

Treasury shares CHF m

Equity attributable to shareholders of Julius Baer Group Ltd. CHF m

Non-controlling interests CHF m

Total equity CHF m

-65.2 7.9 8.9 -48.4

-1.1 0.9 -0.2

-18.1 -8.9 -27.0

-42.6 22.6 -105.4 90.0 -35.4

4 190.1 184.8 8.8 8.9 -8.9 -82.7 -1.4 22.6 -105.4 90.0 4 306.8

1.7 0.4 -0.3 1.9

4 191.8 184.8 0.4 8.8 8.9 -8.9 -83.0 -1.4 22.6 -105.4 90.0 4 308.6

-48.4 4.7 9.4 -34.4

-0.2 0.1 -0.1

-27.0 -20.4 -47.3

-35.4 3.9 -37.1 46.1 -22.5

4 306.8 167.2 4.8 9.4 -20.4 1.1 3.9 -37.1 46.1 4 481.8

1.9 0.4 2.2

4 308.6 167.2 0.4 4.8 9.4 -20.4 1.1 3.9 -37.1 46.1 4 484.0

-34.4 -7.2 16.7 -24.8

-0.1 -0.8 -0.9

-47.3 -11.5 -58.9

-22.5 -1.0 -257.3 147.1 -133.7

4 481.8 147.3 -8.0 16.7 -11.5 -124.0 2.6 -1.0 -257.3 147.1 4 393.7

2.2 0.1 -0.5 1.8

4 484.0 147.3 0.1 -8.0 16.7 -11.5 -124.5 2.6 -1.0 -257.3 147.1 4 395.5

Half-year Report 2011 Julius Baer Group Ltd.

Consolidated statement of cash flows (condensed)

H1 2011

CHF m

H1 2010

CHF m

H2 2010

CHF m

Cash and cash equivalents at the beginning of the period Cash flow from operating activities after taxes Cash flow from investing activities Cash flow from financing activities Effects of exchange rate changes Cash and cash equivalents at the end of the period

13 263.1 799.4 -874.6 -43.8 211.4 13 355.5

18 390.5 621.7 -2 261.9 -12.7 159.0 16 896.6

16 896.6 -3 877.0 13.1 90.9 139.4 13 263.1

Half-year Report 2011 Julius Baer Group Ltd.

Condensed accounting policies and valuation principles

This unaudited interim report was produced in accordance with International Accounting Standard 34. The condensed consolidated half-year financial statements of the Group as at, and for the six month ended, 30 June 2011 comprise of Julius Baer Group Ltd. and its subsidiaries. They were prepared on the basis of the accounting policies and valuation principles of the consolidated financial statements of Julius Baer Group Ltd. as of 31 December 2010 with the exception of the recently adopted accounting pronouncements. Starting 1 January 2011, the following new or revised accounting standards are in force or have been early applied and are relevant to the Group: IAS 24 Related Party Disclosures Classification of Rights Issues (Amendment to IAS 32 Financial Instruments: Presentation) Prepayments of a Minimum Funding Requirement (Amendments to IFRIC 14) IFRIC 19 Extinguishing Financial Liabilities with Equity Instruments Improvements to IFRSs The adoption of these changes had no significant impact on the interim reporting.

Events after the balance sheet date The Audit Committee of the Board of Directors, together with representatives of the Group Executive Board, approved the half-year condensed consolidated financial statements at its meeting on 21 July 2011. There were no significant events to report until this date.

Exchange rates as at

Average exchange rates

30.06.2011 30.06.2010 31.12.2010 USD/CHF EUR/CHF GBP/CHF 0.8420 1.2208 1.3519 1.0784 1.3209 1.6133 0.9321 1.2505 1.4594

H1 2011 0.8910 1.2680 1.4480

H1 2010 1.0820 1.4210 1.6430

2010 1.0365 1.3690 1.5985

Half-year Report 2011 Julius Baer Group Ltd.

Information on the consolidated income statement 1 Net interest income

H1 2011

CHF m

H1 2010

CHF m

H2 2010

CHF m

Change to H1 2010 in %

Interest income on amounts due from banks Interest income on loans Interest income on money market instruments Interest income on financial investments available-for-sale Dividend income on financial investments available-for-sale Interest income on trading portfolios Dividend income on trading portfolios Total interest income Interest expense on amounts due to banks Interest expense on amounts due to customers Interest expense on debt issued Total interest expense Total

16.3 129.6 20.8 63.7 2.2 21.5 96.8 350.8 4.9 25.6 4.1 34.5 316.3

14.9 117.5 20.1 62.6 2.3 1.3 59.0 277.7 6.8 21.6 4.1 32.5 245.2

16.1 121.8 22.8 69.0 4.7 7.3 241.8 4.8 22.7 4.1 31.6 210.2

9.4 10.3 3.5 1.8 -4.3 64.1 26.3 -27.9 18.5 6.2 29.0

2 Net fee and commission income

H1 2011

CHF m

H1 2010

CHF m

H2 2010

CHF m

Change to H1 2010 in %

Investment fund fees Fiduciary commissions Portfolio and other management fees Total fee and commission income from asset management Income from brokerage and securities underwriting Commission income on lending activities Commission income on other services Total fee and commission income Commission expense Total

58.7 9.3 307.3 375.3 199.3 2.6 23.9 601.0 104.8 496.3

59.6 9.6 301.5 370.7 210.4 1.8 18.1 601.0 109.1 491.9

52.9 9.8 299.0 361.7 202.5 3.0 29.0 596.1 107.6 488.5

-1.5 -3.1 1.9 1.2 -5.3 44.4 32.0 -3.9 0.9

10

Half-year Report 2011 Julius Baer Group Ltd.

3 Net trading income

H1 2011

CHF m

H1 2010

CHF m

H2 2010

CHF m

Change to H1 2010 in %

Debt instruments Equity instruments1 Foreign exchange Total

1

7.7 -85.6 163.9 86.0

2.7 -25.6 186.0 163.1

5.4 14.4 149.5 169.3

-11.9 -47.3

Dividend income related to trading instruments is recognised in Net interest income (see Note 1).

4 Personnel expenses

H1 2011

CHF m

H1 2010

CHF m

H2 2010

CHF m

Change to H1 2010 in %

Salaries and bonuses Contributions to staff pension plans Other social security contributions Share-based payments Other personnel expenses Total

334.9 30.7 27.7 13.5 6.5 413.3

334.2 31.1 26.0 11.7 21.6 424.6

314.5 37.4 27.4 8.7 11.2 399.1

0.2 -1.3 6.5 15.4 -69.9 -2.7

5 General expenses

H1 2011

CHF m

H1 2010

CHF m

H2 2010

CHF m

Change to H1 2010 in %

Occupancy expense IT and other equipment expense Information, communication and advertising expense Service expense, fees and taxes Valuation adjustments, provisions and losses Other general expenses Total

1

25.9 26.2 53.2 61.2 61.1 0.5 228.2

1

26.8 27.4 55.1 61.8 12.9 0.5 184.5

28.4 28.2 63.0 59.2 11.9 0.7 191.5

-3.4 -4.4 -3.4 -1.0 23.7

On 14 April 2011, it was announced that German authorities and Julius Baer had agreed on a one-off payment by the latter of EUR 50 million. This payment ended the investigations against Julius Baer and unknown employees regarding tax matters in Germany.

11

Half-year Report 2011 Julius Baer Group Ltd.

Information on the consolidated balance sheet 6a Due from banks

30.06.2011

CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Change to 31.12.10 in %

Due from banks Allowance for credit losses Total

7 470.9 -8.9 7 462.0

6 430.8 -10.9 6 419.9

6 596.3 -9.7 6 586.6

13.3 -8.2 13.3

6b Loans

30.06.2011

CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Change to 31.12.10 in %

Loans Mortgages Subtotal Allowance for credit losses Total

12 376.5 3 946.2 16 322.7 -54.2 16 268.5

9 855.3 3 097.5 12 952.8 -54.1 12 898.7

10 991.4 3 631.9 14 623.4 -52.9 14 570.4

12.6 8.7 11.6 2.5 11.7

6c Allowance for credit losses

H1 2011

Specific CHF m Collective CHF m Specific CHF m

H1 2010

Collective CHF m Specific CHF m

H2 2010

Collective CHF m

6c Allowance for credit losses Balance at the beginning of the period Write-offs Increase in allowance for credit losses Decrease in allowance for credit losses Translation differences and other adjustments Balance at the end of the period 37.2 1.9 -3.0 36.1 25.5 1.5 27.0 42.3 -9.3 6.3 -0.1 0.8 40.0 23.2 1.8 25.0 40.0 -0.3 2.5 -0.4 -4.6 37.2 25.0 0.5 25.5

12

Half-year Report 2011 Julius Baer Group Ltd.

6d Impaired loans

30.06.2011

CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Change to 31.12.10 in %

Gross loans Specific allowance for credit losses Net loans

63.8 -36.1 27.7

69.1 -40.0 29.1

63.2 -37.2 26.0

0.9 -3.0 6.5

7a Financial investments available-for-sale

30.06.2011

CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Change to 31.12.10 in %

Money market instruments Government and agency bonds Financial institution bonds Corporate bonds Debt instruments of which listed of which unlisted Equity instruments of which listed of which unlisted Total

6 043.2 2 259.4 3 824.2 2 226.6 8 310.2 7 778.8 531.4 130.7 8.9 121.8 14 484.1

9 170.3 3 235.0 2 906.3 1 818.9 7 960.2 7 453.6 506.6 158.9 30.7 128.2 17 289.4

5 993.1 2 517.6 3 368.6 1 858.8 7 745.0 7 323.5 421.5 147.0 15.2 131.9 13 885.1

0.8 -10.3 13.5 19.8 7.3 6.2 26.1 -11.1 -41.4 -7.7 4.3

13

Half-year Report 2011 Julius Baer Group Ltd.

7b Financial investments available-for-sale Credit ratings

30.06.2011

CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Debt instruments by credit rating classes (excluding money market instruments) 12 3 4 57 89 Unrated Total

1

Fitch, S&P AAA AAA+ ABBB+ BBBBB+ CCCCC D

Moodys Aaa Aa3 A1 A3 Baa1 Baa3 Ba1 Caa3 Ca C

6 464.5 1 605.9 124.9 35.0 2.6 77.3 8 310.2

6 300.0 1 368.1 140.5 39.2 112.4 7 960.2

5 843.2 1 709.4 131.6 31.6 29.2 7 745.0

This document may contain information obtained from third parties, including ratings from rating agencies such as Standard & Poors, Moodys, Fitch and other similar rating agencies. Reproduction and distribution of third-party content in any form is prohibited except with the prior written permission of the related third party. Third-party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. Third-party content providers give no express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. Third-party content providers shall not be liable for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or profits and opportunity costs) in connection with any use of their content, including ratings. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the market value of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

14

Half-year Report 2011 Julius Baer Group Ltd.

Capital ratios

30.06.2011

CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Risk-weighted positions Credit risk Non-counterparty-related risk Market risk

1

8 773.5 540.3 1 145.3 2 867.8 13 326.9

7 951.1 514.7 421.8 2 949.0 11 836.6

8 115.9 534.1 514.2 2 896.3 12 060.5

Operational risk Total Eligible capital Eligible tier 1 capital of which hybrid tier 1 capital2 Eligible tier 1 and tier 2 capital

2 896.4 225.0 2 930.9

2 695.3 225.0 2 766.5

2 873.4 225.0 2 933.6

BIS tier 1 ratio BIS total capital ratio

1

21.7% 22.0%

22.8% 23.4%

23.8% 24.3%

The calculated risk-weighted assets for market risk more than doubled compared to 31 December 2010 mainly due to regulatory changes in force as at 1 January 2011. 2 The hybrid tier 1 capital consists of preferred securities issued by Julius Baer Capital (Guernsey) I Limited.

15

Half-year Report 2011 Julius Baer Group Ltd.

Assets under management

30.06.2011

CHF m

30.06.2010

CHF m

31.12.2010

CHF m

Change to 31.12.10 in %

Assets with discretionary mandate Other assets under management Total assets under management (including double counting) of which double counting

24 235 141 404

23 784 142 279

22 955 146 715

5.6 -3.6

165 639 2 674

166 063 3 057

169 670 2 851

-2.4 -6.2

H1 2011

CHF m

H1 2010

CHF m

H2 2010

CHF m

Change through net new money Change through market and currency appreciation Change through acquisition Client assets

1

4 934 -8 965 259 972

3 293 -4 390 13 558 255 096

1

5 460 -1 805 -48 267 313

1

-2.7

On 15 January 2010, the Group acquired ING Bank (Switzerland) Ltd.

Method of calculation Assets under management are stated according to the Guidelines of the Swiss Financial Market Supervisory Authority (FINMA) governing financial statement reporting.

16

Half-year Report 2011 Julius Baer Group Ltd.

Purchase of subsidiary

On 15 January 2010, Julius Baer Group acquired ING Bank (Switzerland) Ltd, a fully owned subsidiary of ING Group NV, including its subsidiaries in Monaco and Jersey. The Group paid a total consideration of CHF 499.1 million in cash. The purchase price was fully funded by existing excess capital of the Group. ING Bank (Switzerland) Ltd, which was active in private banking business, has been fully integrated into Bank Julius Baer & Co. Ltd. At the time of acquisition, the assets under management amounted to CHF 13.5 billion. The assets and liabilities of the acquired entity were recorded as follows:

Fair value CHF m

Assets Cash Due from banks Loans Financial investments available-for-sale Customer relationships Goodwill Deferred tax assets All other assets Total assets 265.2 1 745.9 1 185.5 350.0 163.0 4.3 3.3 83.2 3 800.5

Liabilities and equity Due to banks Due to customers Deferred tax liabilities All other liabilities Total liabilities Total equity Total liabilities and equity 1 118.4 2 053.4 33.0 96.5 3 301.4 499.1 3 800.5

The transaction resulted in goodwill of CHF 4.3 million, which represents expected synergies and growth opportunities from the combined private banking activities. Other intangible assets recog-

nised consist of CHF 163.0 million for existing customer relationships of the acquired entity, which are amortised over an expected useful life of ten years.

17

Half-year Report 2011 Julius Baer Group Ltd.

Purchase of associate

On 3 May 2011, Julius Baer Group acquired 30 percent of So Paulo-based GPS Investimentos e Participaes S.A., which includes GPS Planejamento Financeiro Ltda. and CFO Administrao de Recursos Ltda. (GPS). GPS is specialised in discretionary portfolio management and advisory services. The minority participation is treated as a strategic investment and the future close co-operation will further add growth momentum for GPS.

18

Half-year Report 2011 Julius Baer Group Ltd.

19

Half-year Report 2011 Julius Baer Group Ltd.

Corporate contacts Group Communications Jan A. Bielinski Chief Communications Officer Telephone +41 (0) 58 888 5777 Investor Relations Alexander C. van Leeuwen Head Investor Relations Telephone +41 (0) 58 888 5256 International Banking Relations Kaspar H. Schmid Telephone +41 (0) 58 888 5497

This Half-year Report also appears in German. The English version is prevailing.

20

JULIUS BAER GROUP LTD. Bahnhofstrasse 36 P.O. Box 8010 Zurich Switzerland Telephone +41 (0) 58 888 1111 Fax +41 (0) 58 888 5517 www.juliusbaer.com

The Julius Baer Group is present in over 40 locations worldwide. From Zurich (Head Office), Dubai, Frankfurt, Geneva, Hong Kong, London, Lugano, Milan, Monaco, Montevideo, Moscow to Singapore.

07/2011 Publ. No. PU00063EN JULIUS BAER GROUP, 2011

You might also like

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 5 out of 5 stars5/5 (5)

- Chapter 6Document24 pagesChapter 6jake doinog88% (16)

- Implementing Beyond Budgeting: Unlocking the Performance PotentialFrom EverandImplementing Beyond Budgeting: Unlocking the Performance PotentialRating: 5 out of 5 stars5/5 (1)

- Investment in Equity SecuritiesDocument42 pagesInvestment in Equity SecuritiesJhay AbabonNo ratings yet

- Capital Structure DecisionDocument18 pagesCapital Structure DecisionFALAK OBERAINo ratings yet

- Financial Statements PDFDocument91 pagesFinancial Statements PDFHolmes MusclesFanNo ratings yet

- Financial Reporting and AnalysisDocument34 pagesFinancial Reporting and AnalysisNatasha AzzariennaNo ratings yet

- ABM FABM 2 Q1 Course Guide PDFDocument58 pagesABM FABM 2 Q1 Course Guide PDFEarl Christian BonaobraNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- 2011 Financial Statements NESTLE GROUPDocument118 pages2011 Financial Statements NESTLE GROUPEnrique Timana MNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Different: ... and Better Than EverDocument4 pagesDifferent: ... and Better Than EverViral PatelNo ratings yet

- Annual Report: Registered OfficeDocument312 pagesAnnual Report: Registered OfficeDNo ratings yet

- Roadshow Natixis Mar09Document47 pagesRoadshow Natixis Mar09sl7789No ratings yet

- HOLCIM 2011 Annual ResultsDocument5 pagesHOLCIM 2011 Annual ResultsgueigunNo ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document72 pagesCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3chNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Interim Report Q4 2012 EngDocument25 pagesInterim Report Q4 2012 Engyamisen_kenNo ratings yet

- 155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportDocument14 pages155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportASX:ILH (ILH Group)No ratings yet

- Infosys LimitedDocument3 pagesInfosys Limitedjyoti_jazzzNo ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- Kuoni Gb12 Financialreport en 2012Document149 pagesKuoni Gb12 Financialreport en 2012Ioana ElenaNo ratings yet

- International Monetary Fund: Quarter Ended July 31, 2011Document51 pagesInternational Monetary Fund: Quarter Ended July 31, 2011Mark KGNo ratings yet

- Colcom Press Results Dec2011Document1 pageColcom Press Results Dec2011Kristi DuranNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- CSS Financial Report Web 10-11Document20 pagesCSS Financial Report Web 10-11LIFECommsNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Financial Statements Review Q4 2010Document17 pagesFinancial Statements Review Q4 2010sahaiakkiNo ratings yet

- HMC Annual StatementDocument65 pagesHMC Annual Statementৰিতুপর্ণ HazarikaNo ratings yet

- Consolidated Accounts December 31 2011 For Web (Revised) PDFDocument93 pagesConsolidated Accounts December 31 2011 For Web (Revised) PDFElegant EmeraldNo ratings yet

- The Siam Cement Public and Its Subsidiaries: Company LimitedDocument73 pagesThe Siam Cement Public and Its Subsidiaries: Company LimitedMufidah 'mupmup'No ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- 1st QTR 30 Sep 11Document18 pages1st QTR 30 Sep 11m__saleemNo ratings yet

- Shell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011Document19 pagesShell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011roker_m3No ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- DemonstraDocument53 pagesDemonstraJBS RINo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- 2011 Consolidated All SamsungDocument43 pages2011 Consolidated All SamsungGurpreet Singh SainiNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- ITR3Q11Document67 pagesITR3Q11Klabin_RINo ratings yet

- Assets: Balance Sheet 2009 2010Document21 pagesAssets: Balance Sheet 2009 2010raohasanNo ratings yet

- Microsoft Corporation Annual Report 2011Document9 pagesMicrosoft Corporation Annual Report 2011rajesh_dawat1991No ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisSaema JessyNo ratings yet

- Adidas Group AR2011 Consolidated Statement of Financial PositionDocument2 pagesAdidas Group AR2011 Consolidated Statement of Financial PositionJan Johnny JonathanNo ratings yet

- 5ead0financial RatiosDocument3 pages5ead0financial RatiosGourav DuttaNo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- Chap-6 Financial AnalysisDocument15 pagesChap-6 Financial Analysis✬ SHANZA MALIK ✬No ratings yet

- IAS Conversion Document Mar12 LcciDocument22 pagesIAS Conversion Document Mar12 LcciStpmTutorialClassNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Income StatementDocument1 pageIncome StatementDeepan BaluNo ratings yet

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Vodafone AnnexturesDocument3 pagesVodafone AnnexturesQamar AftabNo ratings yet

- Ual Jun2011Document10 pagesUal Jun2011asankajNo ratings yet

- Nu WareDocument22 pagesNu WaresslbsNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- 1st Half Report - June 30, 2010Document75 pages1st Half Report - June 30, 2010PiaggiogroupNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- General-Line Sporting Goods Store Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral-Line Sporting Goods Store Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- BRANDA AWARNESS HyundaiDocument96 pagesBRANDA AWARNESS HyundaiRamesh naiduNo ratings yet

- ACCOUNTING FOR MANAGEMENT MCQDocument14 pagesACCOUNTING FOR MANAGEMENT MCQEr. THAMIZHMANI MNo ratings yet

- Krishi Rasayan Exports PVT LTDDocument5 pagesKrishi Rasayan Exports PVT LTDIndia Business ReportsNo ratings yet

- Financing Decisions Capital Structure: M. Pavan KumarDocument26 pagesFinancing Decisions Capital Structure: M. Pavan KumarPavan Kumar MylavaramNo ratings yet

- Auditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFDocument51 pagesAuditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFrickeybrock6oihx100% (11)

- Capital Structure Definitions Determinants Theories and Link With Performance Literature Review 1Document24 pagesCapital Structure Definitions Determinants Theories and Link With Performance Literature Review 1Sk nabilaNo ratings yet

- Bank of BarodaDocument17 pagesBank of Barodashortbig09No ratings yet

- Feir Alexa Mae C. Final Exam Financial Analysis and ReportingDocument7 pagesFeir Alexa Mae C. Final Exam Financial Analysis and ReportingEnalyn AldeNo ratings yet

- NFL Annual Report 2019 Compressed PDFDocument130 pagesNFL Annual Report 2019 Compressed PDFZUBAIRNo ratings yet

- Financial Statement (FS) AnalysisDocument41 pagesFinancial Statement (FS) AnalysisJasy Nupt GilloNo ratings yet

- Valuation of Equity ShareDocument11 pagesValuation of Equity ShareSarthak SharmaNo ratings yet

- GTL Infrastructure LTD: Key Financial IndicatorsDocument4 pagesGTL Infrastructure LTD: Key Financial IndicatorsMehakBatlaNo ratings yet

- Consalidated Statement of Profit and LossDocument40 pagesConsalidated Statement of Profit and LossG. DhanyaNo ratings yet

- Century 21 Accounting, 9E: General Journal Key Terms and DefinitionsDocument24 pagesCentury 21 Accounting, 9E: General Journal Key Terms and Definitionsect565No ratings yet

- Amended IRR of The SRCDocument255 pagesAmended IRR of The SRCEdgar Jino Bartolata0% (1)

- Aro Granite ReportDocument7 pagesAro Granite ReportsiddharthgrgNo ratings yet

- United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDocument32 pagesUnited States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QmontyviaderoNo ratings yet

- Topic 1 Introduction To AccountingDocument30 pagesTopic 1 Introduction To AccountingShanti GunaNo ratings yet

- Accounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsDocument14 pagesAccounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsJoel Christian MascariñaNo ratings yet

- FBC Audited Results For FY Ended 31 Dec 13Document9 pagesFBC Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Accoutning Chapter 10Document78 pagesAccoutning Chapter 10Brisa MasiniNo ratings yet

- Chap 013Document60 pagesChap 013zeidNo ratings yet

- BBA 2nd Semester Syllabus 2022Document16 pagesBBA 2nd Semester Syllabus 2022Ramanand YadavNo ratings yet

- Formula Sheet Short-Term Solvency RatiosDocument2 pagesFormula Sheet Short-Term Solvency RatiosNguyễn Ngọc Phương LinhNo ratings yet

- Cashflows TestDocument1 pageCashflows TestNonilon RoblesNo ratings yet