Professional Documents

Culture Documents

Excise Duty Is Indirect Tax

Uploaded by

satishkr14Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excise Duty Is Indirect Tax

Uploaded by

satishkr14Copyright:

Available Formats

Excise duty is indirect tax. means the final consumer only bear the tax levy.

it levied on manufactured goods at the time crossing the factory gate excise duty = input raw materials (including excise duty on that goods) + factory & other processing cost X 8% +( 2% of that 8%) + (1% of that 8%) the excise duty of that raw material input is called CENVAT CREDIT

EXAMPLE: I bought from you raw material of 216480/- include excise duty (Rs.16480) further I processed with Rs. 50000/I sold the goods Rs.324720 with profit & excise duty (Rs.24720) I only paid to the excise department Rs. 8240/- i.e. (24720-16480)

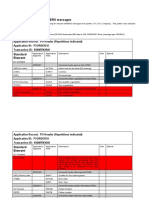

Practical Examples on Cenvat

Question An assessee cleared various manufactured final products during June 2007. The duty payable for June 2007 on his final products was as follows Basic Rs 2,00,000 Education Cesses As applicable. During the month, he received various inputs on which total duty paid by suppliers of inputs was as follows Basic duty Rs 50,000, Education Cess Rs 1,000, SAH education Cess Rs 500. Excise duty paid on capital goods received during the month was as follows Basic duty Rs 12,000. Education Cess - Rs 240. SAH education cess - Rs 120. Service tax paid on input services was as follows Service Tax Rs 10,000. Education cess Rs 200 SAH Education Cess - Rs 100. How much duty the assessee will be required to pay by GAR-7 challan for the month of June 2007, if assessee had no opening balance in his PLA account? What us last date for payment? Answer Education Cess payable on final products is Rs 4,000 (2% of Rs 2,00,000). SAH education cess payable is Rs 2,000. The Cenvat credit available for June 2007 is as follows Description Basic duty Service Tax Education Cess 1,000 120 SAH Education Cess 500 60

Inputs Capital Goods (50% will be eligible and balance next year) Input Service Total

50,000 6,000

56,000

10,000 10,000

200 1,320

100 660

Credit of Rs 66,000 (56,000 + 10,000) can be utilised for basic duty Credit of education cess and SAH education cess can be utilised only for payment of education cess and SAH education cess on final product only. Hence, duty payable through GAR-7 challan for June 2007 is as follows Basic Duty Rs Education Cess Rs 4,000 1,320 2,680 SAH Education Cess Rs 2,000 660 1,340

(A) Duty payable (b) Cenvat Credit Net amount payable (A-B)

2,00,000 66,000 1,34,000

Last date for payment is 5th July, 2007. Question - In aforesaid example, calculate duty payable by GAR-7 challan if assessee had following balance in his PLA account on 6-6-2007 (after debiting utilised amount for payment of duty for May 2007) - Basic duty - Rs 1,70,000, Service tax - Rs 30,000. Education Cess - Rs 4,000. SAH education Cess Nil. Answer - If credit was available on 1-6-2007, the total Cenvat credit available for June 2007 is as follows Description Basic duty Rs 1,70,000 50,000 6,000 Service Tax Rs 30,000 Education Cess Rs 4,000 1,000 120 SAH Education Cess Rs Nil 500 60

Opening Balance Inputs Capital Goods (50% will be eligible and balance next year) Input Service Total

2,26,000

10,000 40,000

200 5,320

100 660

The duty payable will be as follows Hence, duty payable through GAR-7 challan for June 2007 is as follows Basic Duty Rs Education Cess Rs 4,000 5,320 SAH Education Cess Rs 2,000 660

(A) Duty payable (b) Cenvat Credit (basic plus service tax)

2,00,000 2,66,000

Net amount payable (A-B)

(-66,000)

(-1,120)

1,340

The credit of education cess of Rs 1,120 is to be carried forward since the credit cannot be utilised for payment of any other duty. Credit of basic duty can be utilised for payment of SAH education cess. Hence, the balance left in basic duty account will be Rs 64,660. Thus, no excise duty is required to be paid for the month of June 2007. Balance carried forward will be as follows - (a) Basic duty - Rs 64,660 (b) Education Cess - Rs 1,120. Question - An assessee cleared his manufactured final products during January 2008. The duty payable for the month on his final products was as follows: Basic duty Rs. 44,000, NCCD Rs. 2,000, Education cesses As applicable. During the month, he received various inputs on which total duty paid by suppliers of inputs was as follows - Basic duty Rs. 40,000 plus applicable education cess. Service tax paid on input services was as follows: Service tax Rs. 8,000. Education cess Rs. 160. There is no opening balance in his PLA account. How much duty the assessee will be required to pay through account current for the month of January 2008? (ICWA Inter June 2006 adopted) Education Cess payable on final products is Rs 920 (2% of Rs 46,000). SAH education cess payable on final products is Rs 460. Education cess on his inputs is Rs 800 (2% of Rs 40,000)> SAH education cess on inputs is Rs 400. The Cenvat credit available for the month of January, 2008 is as follows Description Basic duty 40,000 40,000 8,000 8,000 Service Tax Education Cess 800 160 960 SAH Education Cess 400 80 480

Inputs Input Service Total

Credit of Rs 48,000 (40,000 + 8,000) can be utilised for payment of any duty. Credit of education cess of Rs 960 can be utilised only for payment of education cess on final product. Credit of SAH education cess of Rs 960 can be utilised only for payment of education cess on final product. Basic Duty NCCD Education SAH Rs Cess Rs Education Cess Rs (A) Duty 44,000 2,000 920 460 payable (b) Cenvat 48,000 960 480 Credit (basic plus service tax) Net (-4,000) (-40) (-20) amount payable (A-B) The credit of basic duty and service tax of Rs 4,000 can be utilised for payment of NCCD of Rs 2,000. Hence for the month of January, 2008, assessee is not required to pay any duty through PLA.

He will carry forward following balances for February 2008 - Basic duty - Rs 2,000. Education Cess - Rs 40. SAH education Cess - Rs 20. Question An assessee cleared his manufactured final products during July 2007. The duty payable for July 2007 on his final products was as follows Basic Rs 49,000. NCCD Rs 1,000. Education Cess As applicable. During the month, he received various inputs on which total duty paid by suppliers of inputs was as follows Basic duty Rs 40,000, Education Cess Rs 800, SAH education Cess - Rs 400. Service tax paid on input services was as follows Service Tax Rs 8,000. Education cess Rs 160, SAH education Cess - Rs 80. How much duty the assessee will be required to pay by GAR-7 challan for the month of July 2007, if there was no opening balance in his PLA account? Kept for self study. Question - Sona Ltd. purchased a lathe machine at a cum-duty price of Rs. 18,63,680. The excise duty rate charged on the said machine was 16% plus education cess 2% plus secondary and higher education cess 1%. The machine was purchased on 1-7-2007 and was disposed of on 30-09-2009 for a price of Rs. 10,00,000 in working condition as second hand machine. Calculate the amount of CENVAT credit allowable for the financial years 2007-08 and 200809 and also specify the amount payable towards CENVAT credit already taken at the time of disposal of the machinery in the year 2009-10 (CA Final New Syllabus November 2010) Answer Kept for self study.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Novell Extend Composer: Edi Connect User'S GuideDocument90 pagesNovell Extend Composer: Edi Connect User'S Guidesatishkr14No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- EDI Guidelines: Purchase OrderDocument30 pagesEDI Guidelines: Purchase Ordersatishkr14No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Functional Information For Inbound EDI Purchase Order (PO) Edifact - Orders ANSI X12 - 850Document44 pagesFunctional Information For Inbound EDI Purchase Order (PO) Edifact - Orders ANSI X12 - 850satishkr14No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Novell Extend Composer: Edi Connect User'S GuideDocument90 pagesNovell Extend Composer: Edi Connect User'S Guidesatishkr14No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 850 Purchase Order: ANSI ASC X12 Version 4010Document47 pages850 Purchase Order: ANSI ASC X12 Version 4010muddisetty umamaheswarNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- EDI 850 To IDoc - Scenario PDFDocument27 pagesEDI 850 To IDoc - Scenario PDFRAMESH100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- BSCP EDI 850 Purchase Order IG V1.3Document100 pagesBSCP EDI 850 Purchase Order IG V1.3satishkr14No ratings yet

- Functional Information For Inbound EDI Purchase Order (PO) Edifact - Orders ANSI X12 - 850Document44 pagesFunctional Information For Inbound EDI Purchase Order (PO) Edifact - Orders ANSI X12 - 850satishkr14No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Mapping Inbound ORDERS MessagesDocument11 pagesMapping Inbound ORDERS Messagesgawayne25% (4)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Presentation Sef BrazilDocument5 pagesPresentation Sef Brazilsatishkr14No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- EDI 850 To IDoc - Scenario PDFDocument27 pagesEDI 850 To IDoc - Scenario PDFRAMESH100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Mapping Inbound ORDERS MessagesDocument11 pagesMapping Inbound ORDERS Messagesgawayne25% (4)

- Creation and Use of Variant TransactionDocument11 pagesCreation and Use of Variant Transactionorchidocean5627No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Fi-Sup2 Mr11 Gr-Ir Differences - Qty ErrorDocument20 pagesFi-Sup2 Mr11 Gr-Ir Differences - Qty ErrorNaveed ArshadNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- SAP Brazil Localization PortfolioDocument31 pagesSAP Brazil Localization Portfoliosatishkr14No ratings yet

- Consignment Fill UpDocument1 pageConsignment Fill Upsatishkr14No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Fi-Sup2 Mr11 Gr-Ir Differences - Qty ErrorDocument20 pagesFi-Sup2 Mr11 Gr-Ir Differences - Qty ErrorNaveed ArshadNo ratings yet

- Creation and Use of Variant TransactionDocument11 pagesCreation and Use of Variant Transactionorchidocean5627No ratings yet

- SAP VOFM Formula RoutinesDocument19 pagesSAP VOFM Formula RoutinesNitin Fatnani100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Creation of BC SetsDocument8 pagesCreation of BC Setssatishkr14100% (1)

- Sap Authorization SopDocument4 pagesSap Authorization Sopsatishkr14No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- SAP SD BBPDocument205 pagesSAP SD BBPsatishkr14100% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SAP SD CIN ConfigurationDocument18 pagesSAP SD CIN Configurationsatishkr14No ratings yet

- Ca Final DT (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalDocument5 pagesCa Final DT (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalROHIT JAIN100% (1)

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- Worksheet-The Brilliant CompanyDocument15 pagesWorksheet-The Brilliant Companytristan ignatiusNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- SF-Q1: Key Capital Gains Tax ConceptsDocument5 pagesSF-Q1: Key Capital Gains Tax ConceptsGarcia Alizsandra L.No ratings yet

- Financial Aid Cover LetterDocument1 pageFinancial Aid Cover Letterrob_crowell_1No ratings yet

- Payslip SpreadsheetDocument2 pagesPayslip Spreadsheetjamesz100% (13)

- Commissioner of Internal Revenue, Petitioner, GENERAL FOODS (PHILS.), INC., RespondentDocument5 pagesCommissioner of Internal Revenue, Petitioner, GENERAL FOODS (PHILS.), INC., RespondentYvon BaguioNo ratings yet

- Actividad 7 1040 FormDocument2 pagesActividad 7 1040 FormKevin ÁlvarezNo ratings yet

- Advanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Document6 pagesAdvanced Financial Accounting and Reporting 14 - NGAS: Straight Problems Problem 1Jem ValmonteNo ratings yet

- ESTATE OF HILARIO M. RUIZ v. CADocument4 pagesESTATE OF HILARIO M. RUIZ v. CAMadam JudgerNo ratings yet

- (GROUP 2) Chp13aDocument8 pages(GROUP 2) Chp13aAia SantosNo ratings yet

- Chapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, Brief, 7e (Gitman)Document75 pagesChapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, Brief, 7e (Gitman)El jokerNo ratings yet

- Faisalabad Electric Supply Company: Say No To CorruptionDocument2 pagesFaisalabad Electric Supply Company: Say No To CorruptionSamar Ali AbbasNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ifive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityDocument1 pageIfive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityReymar BanaagNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- 16 Roxas V CTA 23 SCRA 276 1968 Digest 1Document3 pages16 Roxas V CTA 23 SCRA 276 1968 Digest 1Graziella AndayaNo ratings yet

- Types of Taxes in India: Direct and IndirectDocument19 pagesTypes of Taxes in India: Direct and Indirectharsh Vardhan CharanNo ratings yet

- Clear TaxDocument12 pagesClear TaxsrawannathNo ratings yet

- Basilan Estates Inc. v. CIR and CTADocument2 pagesBasilan Estates Inc. v. CIR and CTATon Ton CananeaNo ratings yet

- SOLUTION FUNAC FINALEXAM2019 20 1Document21 pagesSOLUTION FUNAC FINALEXAM2019 20 1Rynette FloresNo ratings yet

- Basics of Income TaxDocument21 pagesBasics of Income TaxAvNo ratings yet

- Authority and Escalation MatrixDocument5 pagesAuthority and Escalation MatrixAdvisory S&ANo ratings yet

- Further Clarifications On The Retirement20210424-12Document3 pagesFurther Clarifications On The Retirement20210424-12rian.lee.b.tiangcoNo ratings yet

- Obillos, Jr. vs. Cir - 139 Scra 436Document4 pagesObillos, Jr. vs. Cir - 139 Scra 436Ygh E SargeNo ratings yet

- 2019 Worldwide VAT GST and Sales Tax GuideDocument1,190 pages2019 Worldwide VAT GST and Sales Tax GuidepellazgusNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- Principals of Taxation of Partnerships: Tanzania Revenue Authority Institute of Tax AdministrationDocument62 pagesPrincipals of Taxation of Partnerships: Tanzania Revenue Authority Institute of Tax AdministrationMoud KhalfaniNo ratings yet

- Rs. Eight Hundred Twenty-One Only 821: Certificate Issued byDocument1 pageRs. Eight Hundred Twenty-One Only 821: Certificate Issued byMuhammad SajidNo ratings yet

- Taxation Examination Taxation Examination: Accounting (Cagayan State University) Accounting (Cagayan State University)Document47 pagesTaxation Examination Taxation Examination: Accounting (Cagayan State University) Accounting (Cagayan State University)Kc AguiluzNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet