0% found this document useful (0 votes)

53 views1 pageTDS Chart

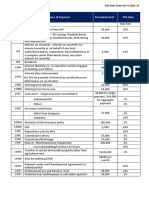

The TDS chart outlines various sections related to tax deduction at source (TDS) for different types of payments. It specifies the nature of payment, applicable thresholds, and corresponding TDS rates for categories such as salary, interest, contractor payments, commission, rent, professional fees, and purchase of goods. Key thresholds and rates include a 10% rate for unsecured loans over 5000, and varying rates for contractors and rent based on transaction amounts.

Uploaded by

Mahesh BharadCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

53 views1 pageTDS Chart

The TDS chart outlines various sections related to tax deduction at source (TDS) for different types of payments. It specifies the nature of payment, applicable thresholds, and corresponding TDS rates for categories such as salary, interest, contractor payments, commission, rent, professional fees, and purchase of goods. Key thresholds and rates include a 10% rate for unsecured loans over 5000, and varying rates for contractors and rent based on transaction amounts.

Uploaded by

Mahesh BharadCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd