0% found this document useful (0 votes)

59 views4 pagesOnline Statement

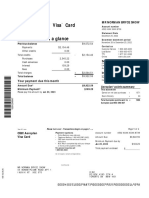

This document is a credit card statement for Anthony Edward Taylor for the period from December 26, 2019, to January 25, 2020, showing a previous balance of $342.42, total payments of $417.42, and a new balance of $473.02. The statement includes details of transactions, Aventura points earned, and payment options. The payment due date is February 18, 2020, with a minimum payment of $10.00.

Uploaded by

height2398Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

59 views4 pagesOnline Statement

This document is a credit card statement for Anthony Edward Taylor for the period from December 26, 2019, to January 25, 2020, showing a previous balance of $342.42, total payments of $417.42, and a new balance of $473.02. The statement includes details of transactions, Aventura points earned, and payment options. The payment due date is February 18, 2020, with a minimum payment of $10.00.

Uploaded by

height2398Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd