Professional Documents

Culture Documents

Profit Management Presentation

Uploaded by

siddhartha4uCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit Management Presentation

Uploaded by

siddhartha4uCopyright:

Available Formats

Annual Report

Analysis for Profit

and Loss Statement

The Indian Hotels Company

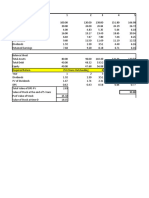

Statement of Profit and Loss

For the Year ended 31st March, 2016

Particular

2014

2015

2016

Ratio

Ratio

Ratio

77.45

Total Revenue

1977.33

Total Operating Expenses

1540.05 1665.71 1845.15 77.89% 79.18%

2103.6 2382.32

%

22.55

Operating Profit

Profit Before Tax and

Exceptional Items

437.28

437.89

537.17 22.11% 20.82%

%

13.51

216.2

230.58

321.89 10.93% 10.96%

%

13.08

Profit/ (Loss) Before Tax

-520.9

1.88

311.68 -26.34% 0.09%

-590.49

-82.02

Net Profit / Loss After Tax

201.04 -29.86% -3.90% 8.44%

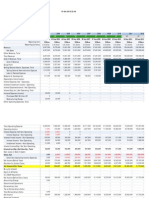

Revenue Growth Analysis

(YoY)

Revenue

Revenue

YOY

3,000.00

15.00%

2,382.32

13.25%

2,103.60

1,977.33

2,000.00

10.00%

Total Revenue (Crores)

1,000.00

0.00

6.39%

2.73%

2014

2015

Year

2016

5.00%

0.00%

YoY %

Revenue Growth Analysis

Companies Comparison (YoY)

20.00%

16.29%

10.00% 7.97%

2.73%

Revenue Growth YoY

0.00%

2014

-10.00%

7.35%

6.39%

-0.80%

2015

Year

Taj

2016

-12.03%

-20.00%

Leela

13.25%

6.61%

Oberoi

Operating Expenses Analysis

Companies Comparison (YoY)

Operating Expenses Analysis

(YoY)

Total Operating Expenses

TOE (Crores)

1900

1800

1700

1600

1500

1400

1300

79.18%

1665.71

1540.05

77.89%

2014

2015

1845.15

79.50%

79.00%

78.50%

78.00%

77.50%

77.45%

77.00%

76.50%

2016

Year

Total Operating Expenses

YOY

YoY %

Operating Profit Analysis

(YoY)

Operating Profit

600

500 437.28437.89

400

Operating Profit (Crores)

300

200

100

0

537.17 23.00%

22.55%

22.50%

22.11%

22.00%

21.50%

21.00%

20.82%

20.50%

20.00%

19.50%

2014

2015

2016

Year

Operating Profit

YOY

YoY %

Operating Profit Analysis

Companies Comparison (YoY)

30.00%

25.38%

25.00%

22.11%

21.84% Profit

Operating

20.00%

22.28%

20.82%

19.79%

24.25%

22.55%

21.30%

Leela

Taj

Oberoi

15.00%

10.00%

5.00%

0.00%

2014

2015

Year

2016

Profit Before Tax Analysis

(YoY)

Profit Before Tax

311.68

400

200

PBT (Crores)

0

-200

-400

-600

20.00%

13.08%

10.00%

1.88

2014

0.09%

2015

2016

0.00%

-10.00%

-20.00%

-26.34%

-30.00%

-520.9

Year

Profit Before Tax

YOY

YoY %

Profit before Tax

Companies Comparison (YoY)

11.32% 11.02% 13.51%

20.00%

10.50%

0.09%

0.00%

2014

2015

2016

-20.00%

-24.65%

-26.34%

Leela

Profit before Tax Growth (YoY)

-40.00%

Taj

-63.44%

Oberoi

-60.00%

-61.70%

-80.00%

Year

Profit After Tax Analysis

(YoY)

Profit After Tax

400

200

0

PAT (Crores) -200

-400

-600

-800

20.00%

10.00%

8.44%

0.00%

2016

-10.00%

-20.00%

-30.00%

-40.00%

201.04

2014

-82.02

-3.90%

2015

-29.86%

-590.49

Year

PAT

YOY

YOY %

Profit After Tax Analysis

Companies Comparison (YoY)

Net Profit Growth YoY

20.00%

7.43%

0.00%

2014

-20.00%

-29.86%

7.04%

-3.90%

2015

-40.00%

-57.47%

-60.00%

-54.58%

-80.00%

Year

8.44%

6.93%

2016

Leela

Taj

-55.45%

Oberoi

You might also like

- Class Work 3 Modern Music Shops Six-Month Financial ProjectionDocument2 pagesClass Work 3 Modern Music Shops Six-Month Financial ProjectiongagoodaNo ratings yet

- FINANCIAL PERFORMANCEDocument16 pagesFINANCIAL PERFORMANCELaston Milanzi50% (2)

- NYSF Walmart Templatev2Document49 pagesNYSF Walmart Templatev2Avinash Ganesan100% (1)

- Coffee Shop - Industry ReportsDocument17 pagesCoffee Shop - Industry ReportsCristina Garza0% (1)

- Bodie Industrial SupplyDocument14 pagesBodie Industrial SupplyHectorZaratePomajulca100% (2)

- 911 BIZ201 Assessment 3 Student WorkbookDocument7 pages911 BIZ201 Assessment 3 Student WorkbookAkshita ChordiaNo ratings yet

- Financial Ratio Analysis ReportDocument8 pagesFinancial Ratio Analysis ReportJeff AtuaNo ratings yet

- Hoshimo Ltd/Year 1 2 3 4 5 Income StatementDocument6 pagesHoshimo Ltd/Year 1 2 3 4 5 Income StatementSeemaNo ratings yet

- Adani Enterprises LTD Financial ModelDocument15 pagesAdani Enterprises LTD Financial ModelkjNo ratings yet

- 6 Polaroid Corporation 1996Document64 pages6 Polaroid Corporation 1996jk kumarNo ratings yet

- Apple - Income StatementDocument5 pagesApple - Income StatementhappycolourNo ratings yet

- Group valuation modelDocument3 pagesGroup valuation modelSoufiane EddianiNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- New Jersey Treasury Monthly Revenue Report With Snapshot-FY23MayDocument1 pageNew Jersey Treasury Monthly Revenue Report With Snapshot-FY23MayMichelle Rotuno-JohnsonNo ratings yet

- Boston Creamery AnalysisDocument18 pagesBoston Creamery AnalysisBrad AndersonNo ratings yet

- Fu-Wang Foods Ltd. Financial Calculations (2009 - 2013)Document46 pagesFu-Wang Foods Ltd. Financial Calculations (2009 - 2013)BBACSE113100% (3)

- Ceat, 11th January, 2013Document12 pagesCeat, 11th January, 2013Angel Broking100% (2)

- Polaroid Corporation ENGLISHDocument14 pagesPolaroid Corporation ENGLISHAtul AnandNo ratings yet

- Atlas Power Plant Complex Output Correction Factors for Ambient TemperatureDocument247 pagesAtlas Power Plant Complex Output Correction Factors for Ambient TemperaturesitehabNo ratings yet

- Case For Project FinanceDocument21 pagesCase For Project FinanceKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Particulars Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best CaseDocument31 pagesParticulars Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Trailing Best CasePranay Singh Raghuvanshi100% (1)

- Ratio Analysis Tata MotorsDocument8 pagesRatio Analysis Tata MotorsVivek SinghNo ratings yet

- Amgen Financial AnalysisDocument2 pagesAmgen Financial AnalysisNiNo ratings yet

- Amgen IS Analysis PDFDocument2 pagesAmgen IS Analysis PDFNiNo ratings yet

- Oil & Gas Development Company LTD: Income Statement 2014 2015 2016Document8 pagesOil & Gas Development Company LTD: Income Statement 2014 2015 2016mohammad bilalNo ratings yet

- Financial Statement Analysis of Yes BankDocument12 pagesFinancial Statement Analysis of Yes BankAjay Suthar100% (1)

- Bongaigaon Ref - FinanDocument10 pagesBongaigaon Ref - FinansdNo ratings yet

- Modelling SolutionDocument45 pagesModelling SolutionLyricsical ViewerNo ratings yet

- 12008-Dave Tejaskumar Rakeshkumar (Fa&b) PptDocument31 pages12008-Dave Tejaskumar Rakeshkumar (Fa&b) PptAchal SharmaNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- Advanced ExcelDocument3 pagesAdvanced ExcelEsani DeNo ratings yet

- Advanced ExcelDocument3 pagesAdvanced ExcelEsani DeNo ratings yet

- Dairy Crest Valuation - Sample ModelDocument29 pagesDairy Crest Valuation - Sample ModelSelvi balanNo ratings yet

- Financial Management Insights of Exide IndustriesDocument10 pagesFinancial Management Insights of Exide IndustriesAlok ChowdhuryNo ratings yet

- UntitledDocument12 pagesUntitledSushil MohantyNo ratings yet

- General Insurance Corporation of IndiaDocument6 pagesGeneral Insurance Corporation of IndiaGukan VenkatNo ratings yet

- Financial AnalysisDocument9 pagesFinancial AnalysisSam SumoNo ratings yet

- Income Statement FormatDocument24 pagesIncome Statement FormatTrisha Mae AbocNo ratings yet

- Puma R To L 2020 Master 3 PublishDocument8 pagesPuma R To L 2020 Master 3 PublishIulii IuliikkNo ratings yet

- Assignment - F&A For ManagementDocument16 pagesAssignment - F&A For Managementvimalrparmar001No ratings yet

- UNITED SPIRITS LTD-SIrDocument39 pagesUNITED SPIRITS LTD-SIrnishantNo ratings yet

- IntoductionDocument7 pagesIntoductionaamit87No ratings yet

- Income Statement: USD $000s 2014A 2015A 2016E 2017E 2018EDocument3 pagesIncome Statement: USD $000s 2014A 2015A 2016E 2017E 2018EAgyei DanielNo ratings yet

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- KPR MillsDocument32 pagesKPR MillsSatyam1771No ratings yet

- AFS HinoPak MotorsDocument21 pagesAFS HinoPak MotorsrolexNo ratings yet

- PT Prima Hidup Lestari Profit and Loss Projection Periode 2022 S/D 2024Document7 pagesPT Prima Hidup Lestari Profit and Loss Projection Periode 2022 S/D 2024Asyam AbyaktaNo ratings yet

- Q4-2015: Performance Highlights: ProfitabilityDocument5 pagesQ4-2015: Performance Highlights: ProfitabilityAbhimanyu SahniNo ratings yet

- Financial Statements For BYCO Income StatementDocument3 pagesFinancial Statements For BYCO Income Statementmohammad bilalNo ratings yet

- Infosys Fact SheetDocument7 pagesInfosys Fact SheetDerrick ArmstrongNo ratings yet

- Team7 FMPhase2 Trent SENIORSDocument75 pagesTeam7 FMPhase2 Trent SENIORSNisarg Rupani100% (1)

- KPR Phase_1Document23 pagesKPR Phase_1Satyam1771No ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financials and CompsDocument5 pagesFinancials and CompsHardik GuptaNo ratings yet

- MSFTDocument83 pagesMSFTJohn wickNo ratings yet

- Financial Analysis of Automobile Companies Solvency RatiosDocument11 pagesFinancial Analysis of Automobile Companies Solvency RatiosAnuj BehlNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document5 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument7 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialআসিফহাসানখানNo ratings yet

- Audited Financial Results March 2009Document40 pagesAudited Financial Results March 2009Ashwin SwamiNo ratings yet

- E Business AssignmentDocument25 pagesE Business Assignmentsiddhartha4uNo ratings yet

- Marketing Mix and Strategic Plan of Indigo AirlinesDocument22 pagesMarketing Mix and Strategic Plan of Indigo Airlinessiddhartha4uNo ratings yet

- Marketing Project IndigoDocument20 pagesMarketing Project Indigosiddhartha4uNo ratings yet

- Eih Limited Final ProjectDocument14 pagesEih Limited Final Projectsiddhartha4uNo ratings yet

- RM An Overview of Research On Issues Effecting Implimentation of RMSDocument6 pagesRM An Overview of Research On Issues Effecting Implimentation of RMSsiddhartha4uNo ratings yet

- Future of Internet in India ReportDocument57 pagesFuture of Internet in India ReportNASSCOMNo ratings yet