0% found this document useful (0 votes)

362 views53 pagesStatement of Financial Position: Fundamental of Accountancy, Business, and Management 2 ABM12

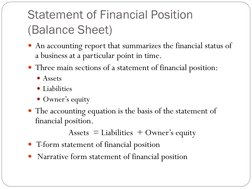

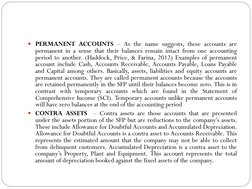

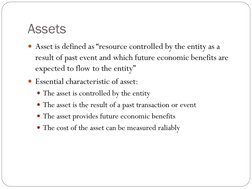

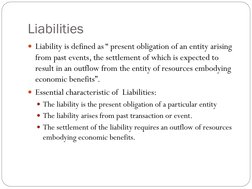

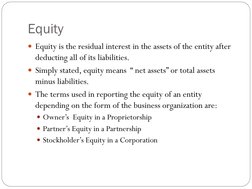

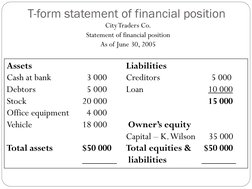

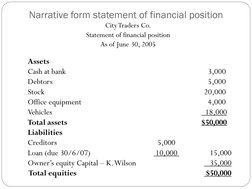

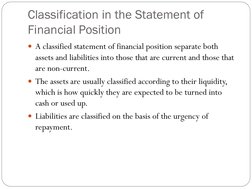

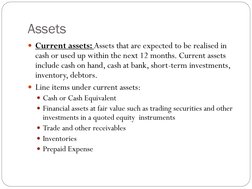

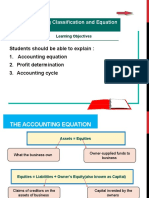

The document provides information about the statement of financial position (balance sheet). It discusses the three main sections of the statement of financial position - assets, liabilities, and owner's equity. It also explains the accounting equation that the statement of financial position is based on, which is assets = liabilities + owner's equity. Different types of accounts are also defined such as permanent accounts and contra assets. Finally, it provides examples of T-form and narrative format statements of financial position.

Uploaded by

Mercy P. YbanezCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

362 views53 pagesStatement of Financial Position: Fundamental of Accountancy, Business, and Management 2 ABM12

The document provides information about the statement of financial position (balance sheet). It discusses the three main sections of the statement of financial position - assets, liabilities, and owner's equity. It also explains the accounting equation that the statement of financial position is based on, which is assets = liabilities + owner's equity. Different types of accounts are also defined such as permanent accounts and contra assets. Finally, it provides examples of T-form and narrative format statements of financial position.

Uploaded by

Mercy P. YbanezCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd