Professional Documents

Culture Documents

Tender Offer: I. Ii. Iii. Iv. V

Uploaded by

Aniruddha Rantu0 ratings0% found this document useful (0 votes)

11 views12 pagesOriginal Title

tehder offer

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views12 pagesTender Offer: I. Ii. Iii. Iv. V

Uploaded by

Aniruddha RantuCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

Tender offer: 8 factor test:

i. Active and widespread solicitation of public

shareholders for the shares of an issuer

ii. Solicitation made for a substantial percentage

of the issuer’s stock

iii. Offer to purchase made at a premium over the

prevailing market price

iv. Terms of the offer are firm rather than

negotiable

v. Offer contingent on the tender of a fixed

number of shares, often subject to a fixed

maximum number to be purchased

vi. Offer open only for a limited period of time

vii. Offeree subjected to pressure to sell his stock

viii. Public announcements of a purchasing

program concerning the target company precede

or accompany rapid accumulation of large

amounts of the target company’s securities.

Bidding process under US law:

Shareholders may wait out the bid until the last

minute without prejudice. Whether the offer is for

any and all shares tendered or only for some of the

shares, it must remain open for 20 business days.

Shares that are tended may be withdrawn at

any time during the offer which gives the target about a

month to come up with a better alternative. A new offer, or an

increase in the price of the original offer, will extend the

duration of the offer and the withdrawn period by 10 business

days. If the offer is for less than all the shares, acceptance

must be on a pro-rata basis, not first-come, first-served. An

increase in the offer must apply retroactively. But even

though the rules allow shareholders to take their time and

change their minds, most sell unless a better deal is presented

because they realize that if they do not, the market after the

offer is likely to be inactive and the stock’s price is likely to

retreat to pro-offer levels. Many will not even wait for the

offer period to end. Rather, they sell their shares soon after

the offer is made, pocketing a sure profit rather than waiting

to see if the offer succeeds.

During this opening period of tender offer the

arbitrageurs (Arbs), brokers and professional risk

takers, owned large amount of shares of the bidder

with a hope of selling them in high price.

Ultimately, the tender offer will run its course.

Several possible outcomes may exist-

The bidder may succeed on approximately the

terms originally offered

The target may have agreed to be acquired by a

suitor of its choice, a ‘white knight’.

The target’s management may make a competing

bid or may propose a financial restructuring,

usually with the target financing a substantial

borrowed funds.

The bidder and the target may reach a

compromise, perhaps compelled by the strength

of the target’s defenses, whereby the bidder

increases the price it is offering and,

sometimes, provides some job security to the

target’s management

The target will be able to thwart the bid entirely

on some legal objection, or through its internal

defenses, and remain largely intact.

Procedural requirement for bidding:

At the moment of bidding at least 5% of total

no pre-offer filing requirement is necessary

call for information required by specific form of SEC

description of the bidder purpose and plan for the target

certain financial information about the bidder (e.g., who are

loan provider Bank or who are investor Banks)

US Security law makes it unlawful ‘for any person to make

any untrue statement of a material fact or omit to state any

material fact necessary in order to make the statements

made, in the light of the circumstances under which they

are made, not misleading, or to engage in any fraudulent,

deceptive, or manipulative acts or practices, in connection

with any tender offer or request or invitation for tenders, or

any solicitation of security holders in opposition to or in

favor of any such offer, request or invitation.’

Defensive tactics:

Poison pills: a rights plan grants to each

shareholders a dividend upon condition to

purchase stock or other securities at any time

within a long time period (10 years). But the right

is not exercisable until a triggering event occurs, it

has little present value to the holders and the board

(target) retains the power to redeem the rights for a

nominal payment.

Flip-over poison pills: here the target company

allows own shareholders to purchase shares of the

bidder’s stock at half-price if the bidder merges

with the target after the tender offer.

Flip-in poison pills: it allows a rights holder, other than the

bidder, to purchase stock or other securities of the target at a

below market price. When such rights are exercised, the

overall cost of the takeover is raised to an uneconomic level.

Amendment of corporate machinery: a supermajority

voting requirement through amendment of trigger’s

memorandum may state that all mergers be approved by 80%

of the shares.

Corporate restructuring: the target will borrow much of the

money it needs, sell non-essential assets and attempt to

streamline its business. Management, to survive, will have to

find a way to both service the debt and maintain the viability

of the company’s operation.

Spin-off:

leveraged buyout:

Spin-off: Businesses wishing to streamline their

operations often sell less productive or unrelated

subsidiary businesses as spinoffs. For example, a

company might spin off one of its mature

business units that is experiencing little or no

growth so it can focus on a product or service

with higher growth prospects. The spun-off

companies are expected to be worth more as

independent entities than as parts of a larger

business.

leveraged buyout:

Defensive mergers: a white night defense to target to

search for a more compatible merger partner through an

alternative to restructuring the company.

Problem in white night: a hostile bidder may have

studied the target for months before launching its bid. But

in white night the target may have only a few weeks to find

and conclude an acquisition agreement. The white night,

caught up in the excitement of a battle for corporate control,

may discover that the business it has acquired is not exactly

the business it thought it was buying.

Issuance of stock: issuance of stock to an investor friendly

to management acts as defense against the bidder control.

Greenmail: the willingness of some companies to resolve

take-

Over threats by repurchasing their shares at a

premium made it attractive for entrepreneurial

investors to acquire substantial blocks of stock in

potential targets and then threaten bid in the hope

that the target would offer to repurchase the stock

instead. Such payment is greenmail and investors

who sought them are known as greenmailers.

Golden Parachutes: The target company awards

very favorable employment contract to its senior

management. The employee is either given the

unilateral right to terminate employment and

receive a substantial lump sum payment (‘single

trigger’ parachutes), or if the right is not entirely

is changed (‘double trigger’ parachutes). Awarding

management golden parachutes adds a second

asset to management’ portfolio: the expectation of

a large termination payment which can be realized

only if a takeover actually occurs.

You might also like

- Chapter 06Document20 pagesChapter 06যুবরাজ মহিউদ্দিনNo ratings yet

- Tender OfferDocument5 pagesTender OfferkiranaishaNo ratings yet

- Hostile Takeover Tactics ExplainedDocument17 pagesHostile Takeover Tactics ExplainedManoj BansiwalNo ratings yet

- Chapter 5Document30 pagesChapter 5Krupa ShahNo ratings yet

- Merger & Acquisition: Defences Against Unwelcome TakeoversDocument22 pagesMerger & Acquisition: Defences Against Unwelcome TakeoversViraj GawandeNo ratings yet

- Bid Strategy & TacticsDocument15 pagesBid Strategy & TacticsRashmi Ranjan Panigrahi67% (3)

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsFrom EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsNo ratings yet

- CV&FM Imp QuationsDocument8 pagesCV&FM Imp QuationsNAVEEN KUMAR NNo ratings yet

- Takeovers N Defencive TacticsDocument4 pagesTakeovers N Defencive TacticsSwetha PriyaNo ratings yet

- Unit 3 - 1 Take Over and Defence TacticsDocument27 pagesUnit 3 - 1 Take Over and Defence TacticsDIVYANSH SANKHLANo ratings yet

- HOSTILE TAKEOVER TITLEDocument7 pagesHOSTILE TAKEOVER TITLEVenkat SatishNo ratings yet

- Merger & AcquisitionsDocument5 pagesMerger & Acquisitionskrutik09No ratings yet

- Chapter 5Document31 pagesChapter 5FăÍż SăįYąðNo ratings yet

- Analysis On Combating Hostile TakeoverDocument14 pagesAnalysis On Combating Hostile TakeoverLAW MANTRA100% (1)

- Rights Issue Learning ObjectiveDocument14 pagesRights Issue Learning ObjectiveSrinivas ReddyNo ratings yet

- Analysis On Combating Hostile TakeoversDocument14 pagesAnalysis On Combating Hostile TakeoversLAW MANTRANo ratings yet

- Article - Partial BidsDocument13 pagesArticle - Partial BidsVrishank SinghaniaNo ratings yet

- L5,6 - Common Takeover Tactics and Antitakeover DefensesDocument28 pagesL5,6 - Common Takeover Tactics and Antitakeover DefensesNông Đức MinhNo ratings yet

- Role of HR in M&A: Term Sheets, ROFR, ROFO, PE vs VC vs Buyout (40Document30 pagesRole of HR in M&A: Term Sheets, ROFR, ROFO, PE vs VC vs Buyout (40PriyankaNo ratings yet

- Takeover and Defence TacticsDocument31 pagesTakeover and Defence TacticsSachinGoelNo ratings yet

- Explain What A Preemptive Rights Offering Is With Example and Why A Standby Underwriting Arrangements May Be Needed. Also, Define Subscription PriceDocument4 pagesExplain What A Preemptive Rights Offering Is With Example and Why A Standby Underwriting Arrangements May Be Needed. Also, Define Subscription PriceuzairNo ratings yet

- Types of TakeoverDocument105 pagesTypes of TakeoverShephard Jack100% (1)

- Acquisition Meaning and ProcessDocument25 pagesAcquisition Meaning and ProcessMadhurGuptaNo ratings yet

- RaidDocument14 pagesRaidkobra2010No ratings yet

- Understanding Performance Appraisal EffectivenessDocument6 pagesUnderstanding Performance Appraisal EffectivenessVamsi KowthavarapuNo ratings yet

- Buy BackDocument15 pagesBuy BackRishi BajajNo ratings yet

- SWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)From EverandSWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)No ratings yet

- OPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)From EverandOPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)No ratings yet

- Sebi guidelines on open offer price determinationDocument6 pagesSebi guidelines on open offer price determinationSalman ShaikhNo ratings yet

- Chapter 5 M&ADocument30 pagesChapter 5 M&Achand1234567893No ratings yet

- Convertible Debentures: Convert Debt Into EquityDocument4 pagesConvertible Debentures: Convert Debt Into EquityPrateek MishraNo ratings yet

- Theories On Stock ValuationDocument4 pagesTheories On Stock ValuationRandy ManzanoNo ratings yet

- Takeover Defense Tactics GuideDocument32 pagesTakeover Defense Tactics GuideShefali PawarNo ratings yet

- Issuing SecuritiesDocument6 pagesIssuing SecuritiesKomal ShujaatNo ratings yet

- M&A Process Hostile Takeover & Takeover Defenses Valuation of IntangiblesDocument30 pagesM&A Process Hostile Takeover & Takeover Defenses Valuation of IntangiblesMnk BhkNo ratings yet

- BUYBACK OF SHARES EXPLAINEDDocument19 pagesBUYBACK OF SHARES EXPLAINEDChirag VashishtaNo ratings yet

- Scenarios in AgreementsDocument8 pagesScenarios in AgreementsAbhinav BharadwajNo ratings yet

- Homework 6Document6 pagesHomework 6LiamNo ratings yet

- ASSIGNMENTDocument11 pagesASSIGNMENTxyzNo ratings yet

- Corporate RestructingDocument69 pagesCorporate RestructingNguyen NhanNo ratings yet

- 02 IFRS 3 Business CombinationDocument15 pages02 IFRS 3 Business CombinationtsionNo ratings yet

- IIFT Finance CompendiumDocument40 pagesIIFT Finance CompendiumaishaNo ratings yet

- Hostile TakeoverDocument4 pagesHostile TakeoverSaqib Kazmi100% (1)

- Types of PrivatizationDocument3 pagesTypes of Privatizationshivam03454No ratings yet

- GREEN SHOE OPTION AND BOUGHT OUT DEALSDocument5 pagesGREEN SHOE OPTION AND BOUGHT OUT DEALSyesetNo ratings yet

- Take Over CodeDocument3 pagesTake Over CodeShobhit GoelNo ratings yet

- Short Term and Working Capital Financing OptionsDocument44 pagesShort Term and Working Capital Financing OptionsSarahNo ratings yet

- Just DialDocument50 pagesJust Dialsili core100% (1)

- Take Over: BY Shirin Sneha - LS Seema.S Soujanya.N Shruthi.S.HollaDocument26 pagesTake Over: BY Shirin Sneha - LS Seema.S Soujanya.N Shruthi.S.Hollasoujanya_nagarajaNo ratings yet

- Reasons for Listing in IPODocument6 pagesReasons for Listing in IPOkdoshi23No ratings yet

- Financial Engineering AssignmentsDocument20 pagesFinancial Engineering AssignmentsKenadid Ahmed Osman100% (1)

- Checklist - Alternate Term Sheet ProvisionsDocument2 pagesChecklist - Alternate Term Sheet ProvisionsShehzad AhmedNo ratings yet

- June, 2010: Initial Public Offering EquityDocument6 pagesJune, 2010: Initial Public Offering EquityRahul AnandNo ratings yet

- Checklist - Alternate Term Sheet ProvisionsDocument2 pagesChecklist - Alternate Term Sheet ProvisionsKnownUnknowns-XNo ratings yet

- Anti Takeover 1 ESSAY 1Document13 pagesAnti Takeover 1 ESSAY 1Amrita Dhasmana100% (1)

- Bcoc 137 Corporate Accounting Assignment EnglishDocument17 pagesBcoc 137 Corporate Accounting Assignment EnglishShreya PansariNo ratings yet

- Capital IqDocument32 pagesCapital IqEkta1989No ratings yet

- Mergers and Acquisitions: A Glossary of Terms: AcquisitionDocument8 pagesMergers and Acquisitions: A Glossary of Terms: AcquisitionMussab KarjikarNo ratings yet

- Chapter 4 FIDocument7 pagesChapter 4 FISeid KassawNo ratings yet

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentAniruddha RantuNo ratings yet

- Batting Like A Gentleman" Brand Strategy Depicted in Print Ad and TVCDocument3 pagesBatting Like A Gentleman" Brand Strategy Depicted in Print Ad and TVCAniruddha RantuNo ratings yet

- MKT 337Document1 pageMKT 337Aniruddha RantuNo ratings yet

- North South University: MGT-210 Submitted To: Nusrat Nabi (NBI)Document9 pagesNorth South University: MGT-210 Submitted To: Nusrat Nabi (NBI)Aniruddha RantuNo ratings yet

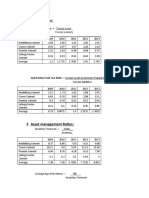

- Liquidity Ratio:: Current Ratio: Current AssetDocument6 pagesLiquidity Ratio:: Current Ratio: Current AssetAniruddha RantuNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentAniruddha RantuNo ratings yet

- Pressure Groups: Influence Policy & Further Common CausesDocument16 pagesPressure Groups: Influence Policy & Further Common CausesAniruddha RantuNo ratings yet

- Problems and recommendations for Zonayed's batting loungeDocument3 pagesProblems and recommendations for Zonayed's batting loungeAniruddha RantuNo ratings yet

- Riyad PC DraftDocument1 pageRiyad PC DraftAniruddha RantuNo ratings yet

- RatioDocument2 pagesRatioAniruddha RantuNo ratings yet

- Furniture ReportDocument2 pagesFurniture ReportAniruddha RantuNo ratings yet

- Section 2 Mid 2 ScoresDocument1 pageSection 2 Mid 2 ScoresAniruddha RantuNo ratings yet

- Readme !Document1 pageReadme !Aniruddha RantuNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisAniruddha RantuNo ratings yet

- Final Exam Lec - 1 Employees and Business EthicsDocument36 pagesFinal Exam Lec - 1 Employees and Business EthicsNourinJahanRintaNo ratings yet

- Final Exam Lec - 1 Employees and Business EthicsDocument36 pagesFinal Exam Lec - 1 Employees and Business EthicsNourinJahanRintaNo ratings yet

- Accounting: Making Sound Decisions: Non-Current AssetsDocument2 pagesAccounting: Making Sound Decisions: Non-Current AssetsAniruddha Rantu40% (5)

- Fin435 2Document3 pagesFin435 2Aniruddha RantuNo ratings yet

- Three elements of corporate veil piercing under the instrumentality doctrineDocument8 pagesThree elements of corporate veil piercing under the instrumentality doctrineAniruddha RantuNo ratings yet

- Three elements of corporate veil piercing under the instrumentality doctrineDocument8 pagesThree elements of corporate veil piercing under the instrumentality doctrineAniruddha RantuNo ratings yet

- Chapter 01 - The Investment EnvironmentDocument44 pagesChapter 01 - The Investment EnvironmentSalam Nazmi Mahmoud Al-QuranNo ratings yet

- Fin435 1Document2 pagesFin435 1Aniruddha RantuNo ratings yet

- Fin435 2Document3 pagesFin435 2Aniruddha RantuNo ratings yet

- CV Writing bootcampFinActDocument35 pagesCV Writing bootcampFinActAniruddha RantuNo ratings yet

- Fin435 1Document3 pagesFin435 1Aniruddha RantuNo ratings yet

- Chap 005Document65 pagesChap 005Zein AhmadNo ratings yet

- Chapter 03 - How Securities Are TradedDocument47 pagesChapter 03 - How Securities Are TradedAniruddha RantuNo ratings yet

- Chapter 01 - The Investment EnvironmentDocument44 pagesChapter 01 - The Investment EnvironmentSalam Nazmi Mahmoud Al-QuranNo ratings yet

- Chapter 03 - How Securities Are TradedDocument47 pagesChapter 03 - How Securities Are TradedAniruddha RantuNo ratings yet

- Chap 005Document65 pagesChap 005Zein AhmadNo ratings yet

- Module 6B CreditDocument41 pagesModule 6B CreditLorejhen VillanuevaNo ratings yet

- Bài Báo CIEMB 4thDocument36 pagesBài Báo CIEMB 4thThu PhươngNo ratings yet

- Yee (Donlaporn) Intarasorn: Finance Business Partner Industry Thailand and LaosDocument2 pagesYee (Donlaporn) Intarasorn: Finance Business Partner Industry Thailand and LaosYee IntaraNo ratings yet

- UiTM Melaka Technical Analysis ResearchDocument11 pagesUiTM Melaka Technical Analysis ResearchAzrul IkhwanNo ratings yet

- Manila International Airport Authority Vs CA, 495 SCRA 591Document14 pagesManila International Airport Authority Vs CA, 495 SCRA 591Winnie Ann Daquil LomosadNo ratings yet

- Corporate Tax ProblemsDocument21 pagesCorporate Tax Problemsnavtej02No ratings yet

- An Overview of The Financial System: © 2005 Pearson Education Canada IncDocument12 pagesAn Overview of The Financial System: © 2005 Pearson Education Canada IncYasser AlmishalNo ratings yet

- Glencore: Revised Guidance Highlights Cash Flow Underpin. BUYDocument13 pagesGlencore: Revised Guidance Highlights Cash Flow Underpin. BUYMudit KediaNo ratings yet

- Islamic Mutual Funds Presentation Part IDocument20 pagesIslamic Mutual Funds Presentation Part Itobyas.pearlNo ratings yet

- Recruitment and Selection Process at HSBCDocument48 pagesRecruitment and Selection Process at HSBCPooja MishraNo ratings yet

- FBM-354 - Unit (9-14)Document23 pagesFBM-354 - Unit (9-14)Shubham Satish WakhareNo ratings yet

- Updated BIR Citizen's Charter ServicesDocument40 pagesUpdated BIR Citizen's Charter Servicesfightingmaroon0% (2)

- PWC Introduction Locked Box Closing Mechanism 2014 01 enDocument12 pagesPWC Introduction Locked Box Closing Mechanism 2014 01 enAnonymous 45z6m4eE7pNo ratings yet

- BCHDE5311 - Regular MORNINGDocument10 pagesBCHDE5311 - Regular MORNINGDhruv ShahNo ratings yet

- CIR v. RufinoDocument1 pageCIR v. RufinoChou TakahiroNo ratings yet

- Philippine Institute For Development Studies Discussion Paper: Regulatory Measures Affecting Services Trade and Investment: Distribution, Multimodal Transport, and Logistics ServicesDocument247 pagesPhilippine Institute For Development Studies Discussion Paper: Regulatory Measures Affecting Services Trade and Investment: Distribution, Multimodal Transport, and Logistics ServicesPortCalls100% (1)

- CH 4Document6 pagesCH 4Jean ValderramaNo ratings yet

- ROIC ExplanationAndExamplesDocument4 pagesROIC ExplanationAndExamplesMichael OdiemboNo ratings yet

- Kushal Yadav ProjectDocument65 pagesKushal Yadav Projectarjunmba119624No ratings yet

- AGBA 2012 Conference Proceedings PDFDocument715 pagesAGBA 2012 Conference Proceedings PDFRamiesRahmanNo ratings yet

- Capital Structure and Cost of CapitalVal Exercises StudentsDocument2 pagesCapital Structure and Cost of CapitalVal Exercises StudentsApa-ap, CrisdelleNo ratings yet

- BUS 2203: Three Exciting NYSE ProductsDocument5 pagesBUS 2203: Three Exciting NYSE ProductsNamasiku KakulaNo ratings yet

- ResearchDocument31 pagesResearchVerven Dela CruzNo ratings yet

- Sample Questions Level IDocument31 pagesSample Questions Level IWong Yun Feng Marco100% (1)

- Analyzing Operating Activities: ReviewDocument38 pagesAnalyzing Operating Activities: Reviewandrea de capellaNo ratings yet

- 8 RatioAnalysisDocument22 pages8 RatioAnalysisDr. Bhavana Raj KNo ratings yet

- Projected Financials and ValuationDocument44 pagesProjected Financials and ValuationAlex ElliottNo ratings yet

- Practice Final Exam MCQsDocument17 pagesPractice Final Exam MCQsDhivyaa ThayalanNo ratings yet

- Cash Flow Statement ProblemsDocument19 pagesCash Flow Statement ProblemsSubbu ..No ratings yet