Professional Documents

Culture Documents

Analysis of Financial Statements and Ratios for MicroDrive Inc

Uploaded by

aulia febrianiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Financial Statements and Ratios for MicroDrive Inc

Uploaded by

aulia febrianiCopyright:

Available Formats

ANALYSIS OF FINANCIAL

STATEMENTS

ARDI PAMINTO - UNMUL

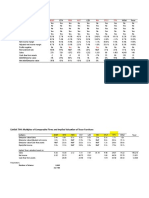

Table 2-1 : MicroDrive Inc., Income Statement for Years Ending December 31

(Millions of $, Expect for Per-Share Data)

1993 1992

Net Sales 3,000.0 2,850.0

Cost excluding depreciation 2,616.2 2,497.0

Depreciation 100.0 90.0

Total operating costs 2,716.2 2,587.0

EBIT 283.8 263.0

Less interest 88.0 60.0

EBT 195.8 203.0

Taxes (40%) 78.3 81.0

Net income before preferred dividends 117.5 122.0

Preferred dividends 4.0 4.0

Net income available for common stockholder 113.5 118.0

Common dividends 57.5 53.0

Additional to retained earnings 56.0 65.0

Per-Share Data :

Common stock price 23.00 24.00

EPS 2.27 2.36

Dividends Per Share 1.15 1.06

Table 2-2 : MicroDrive Inc.: December 31 Balance Sheets (Millions of $)

Assets 1993 1992 Liabilities and Equity 1993 1992

Cash 10 15 Account payable 60 30

Marketable securities 0 65 Notes payable 110 60

Accounts receivable 375 315 Accruals 140 130

Inventories 615 415 Total current liabilities 310 220

Total current assets 1,000 810 Long term bonds 754 580

Net plant & equipment 1,000 870 Total debt 1,064 800

Preferred stock (400000) 40 40

Common stock (50000000) 50 50

Paid in capital 80 80

Retained earnings 766 710

Common equity 896 840

Total assets 2,000 1,680 Total liabilities and equity 2,000 1,680

SUMMARY OF FINANCIAL RATIOS

1993 Comment

Ratio Formula for calculation 1992 1993 Industry

average

LIQUIDITY

Current Current assets 3.7X 3.2X 4.2X Poor

Current liabilities

Quick, or acid, Current assets-Inventories 1.8X 1.2X 2.1X Poor

test Current liabilities

1993 Comment

Ratio Formula for calculation 1992 1993 Industry

average

ASSET

MANAGEMENT

Inventory Sales 6.9X 4.9X 9.0X Poor

turnover Inventories

Day sales Receivables 40 days 45 days 36 days Poor

outstanding Annual sales/360

Fixed assets Sales 3.3X 3.0X 3.0X OK

turnover Net fixed assets

Total assets Sales 1.7X 1.5X 1.8X Some-

turnover Total assets what low

1993 Comment

Ratio Formula for calculation 1992 1993 Industry

average

DEBT

MANAGEMENT

Total debt to Total debt 47.6% 53.3% 40.0% High

total assets Total assets (risky)

Times-interest- EBIT 3.4X 3.2X 6.0X Low

earned (TIE) Interest charges (risky)

1993 Comment

Ratio Formula for calculation 1992 1993 Industry

average

PROFITABILITY

Profit margin on Net income available to 4.1% 3.8% 5.0% Poor

sales common stockholder

Sales

Basic earning EBIT 12.1% 14.2% 17.2% Poor

power Total assets

Return on total Net income available to

assets (ROA) common stockholder 7.0% 5.7% 9.0% Poor

Total assets

Return on Net income available to

common equity common stockholder 14.0% 12.7% 15.0% Poor

(ROE) Common equity

1993 Comment

Ratio Formula for calculation 1992 1993 Industry

average

MARKET

VALUE

Price/earning Price per share 10.2X 10.1X 12.5X Low

(P/E) Earning per share

Market/book Market price per share 1.4X 1.3X 1.7X Low

Book value per share

Ratio Nilai Perusahaan

1. Price to Book Value (PBV) yaitu perbandingan

antara harga saham dengan nilai buku saham.

2. Market to Book Ratio (MBR) yaitu perbandingan

antara harga pasar saham dengan nilai buku

saham.

3. Market to Book Assets Ratio yaitu ekpektasi

pasar tentang nilai dari peluang investasi dan

pertumbuhan perusahaan yaitu perbandingan

antara nilai pasar aset dengan nilai buku aset.

Ratio Nilai Perusahaan

4. Market Value of Equity yaitu nilai pasar ekuitas

perusahaan menurut penilaian para pelaku pasar. Nilai

pasar ekuitas adalah jumlah ekuitas (saham beredar)

dikali dengan harga per lembar ekuitas.

5. Price Earnings Ratio (PER) yaitu harga yang bersedia

dibayar oleh pembeli apabila perusahaan itu dijual. PER

dapat dirumuskan sebagai PER = Price per Share /

Earnings per Share.

6. Tobin’s Q yaitu nilai pasar dari suatu perusahaan

dengan membandingkan nilai pasar suatu perusahaan

dengan nilai penggantian aset (asset replacement value)

perusahaan, ( EMV + D ) / ( EBV + D )

Du Pont Analysis

ROA = Profit margin x Total assets turnover

Net income Sales

= x

Sales Total assets

= 3.8% x 1.5 = 5.7%

Lanjutan

ROE = ROA x Equity multiplier

Net income Total assets

= x

Total assets Common equity

= 5.7% x $2,000/$896

= 5.7% x 2.23

= 12.7%

Lanjutan

ROE = P M x T A Turnover x Equity multiplier

Net income Sales Total assets

= x x

Sales Total assets Common equity

= 3.8% x 1.5 x 2.23

= 12.7%

You might also like

- Financial Ratios Analysis of Company from 2018-2021Document12 pagesFinancial Ratios Analysis of Company from 2018-2021AkshitNo ratings yet

- Astral - XLS: Assumptions / InputsDocument6 pagesAstral - XLS: Assumptions / InputsNarinderNo ratings yet

- FSA CompleteDocument41 pagesFSA Completeabdul moizNo ratings yet

- Assignment - Allied Food ProductDocument2 pagesAssignment - Allied Food ProductMaribel ZafeNo ratings yet

- DCF Analysis for Robertson Tool CompanyDocument14 pagesDCF Analysis for Robertson Tool Companyhao pengNo ratings yet

- Thi ThiDocument26 pagesThi ThiNhật HạNo ratings yet

- Lloyds Banking Group PLC 2017 Q1 RESULTSDocument33 pagesLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobNo ratings yet

- IS Participant - Simplified v3Document7 pagesIS Participant - Simplified v3luaiNo ratings yet

- IS Participant - Simplified v3Document7 pagesIS Participant - Simplified v3Art EuphoriaNo ratings yet

- Menkeu Kelompok 2Document12 pagesMenkeu Kelompok 2FACHRI OMALEYNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ritvik SharmaNo ratings yet

- GPA (Y) Test Score (X) Month Earnings ExpensesDocument20 pagesGPA (Y) Test Score (X) Month Earnings ExpensesJipin ThomasNo ratings yet

- Net Synergies and Valuation of SBC Acquisition of AT&TDocument16 pagesNet Synergies and Valuation of SBC Acquisition of AT&TAnonymous 5z7ZOpNo ratings yet

- Assignment 1 Financial and Managerial Accounting PDFDocument42 pagesAssignment 1 Financial and Managerial Accounting PDFNorNo ratings yet

- Safari - 26-Feb-2018 at 3:42 PM-1Document1 pageSafari - 26-Feb-2018 at 3:42 PM-1Hesamuddin KhanNo ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- Latihan Bab 3Document19 pagesLatihan Bab 3Noura AdriantyNo ratings yet

- Berkley 2009 AnnualReportDocument122 pagesBerkley 2009 AnnualReportbpd3kNo ratings yet

- Finance Questions 4Document3 pagesFinance Questions 4asma raeesNo ratings yet

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocument4 pages(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanNo ratings yet

- Home Depot Company Credit AnalysisDocument8 pagesHome Depot Company Credit AnalysisAndreas StevenNo ratings yet

- Citsit MankeuDocument14 pagesCitsit MankeuAgna AegeanNo ratings yet

- Strategic Management Case Study: Hailey College of Commerce University of The PunjabDocument21 pagesStrategic Management Case Study: Hailey College of Commerce University of The PunjabRafia RiazNo ratings yet

- Financial Risk AnalysisDocument6 pagesFinancial Risk AnalysisolafedNo ratings yet

- Capital Inc. Case SolutionDocument3 pagesCapital Inc. Case SolutionKamilNo ratings yet

- Otc Adddf 2014Document268 pagesOtc Adddf 2014msm5108No ratings yet

- 1 Ratio ProblemDocument3 pages1 Ratio ProblemChandni AgrawalNo ratings yet

- Valuing and Acquiring A Business: Hawawini & Viallet 1Document53 pagesValuing and Acquiring A Business: Hawawini & Viallet 1Kishore ReddyNo ratings yet

- Sus KpiDocument2 pagesSus KpisyahamkaNo ratings yet

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupebi ayatNo ratings yet

- Worksheet valuation model for Robertson companyDocument5 pagesWorksheet valuation model for Robertson companySaksham GoyalNo ratings yet

- Deutsche Bank Annual Review 2009 StrengthDocument436 pagesDeutsche Bank Annual Review 2009 StrengthCebotar AndreiNo ratings yet

- Cross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameDocument7 pagesCross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameRebecca Fady El-hajjNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Ringkasan Laporan Keuangan / Financial HighlightsDocument2 pagesRingkasan Laporan Keuangan / Financial HighlightsNur RahmahNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. Zenderrohin gargNo ratings yet

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDocument5 pagesHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947No ratings yet

- FIN254 Assignment# 1Document6 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- WBSLive Lecture 5 Slides Pres VevoxDocument25 pagesWBSLive Lecture 5 Slides Pres VevoxabhirejanilNo ratings yet

- Factbook 2018 0Document92 pagesFactbook 2018 0Yves-donald MakoumbouNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderYudi Ahmad FaisalNo ratings yet

- Csgag Csag Ar 2022 enDocument604 pagesCsgag Csag Ar 2022 encbrnspm-20180717cdcntNo ratings yet

- Ratio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosDocument10 pagesRatio Analysis Summary Particulars Mar '17 Mar '18 Mar '19 Revenue Growth Profitability RatiosKAVYA GUPTANo ratings yet

- RMIT ACCT 2105 Financial Report AnalysisDocument6 pagesRMIT ACCT 2105 Financial Report AnalysisTrúc NguyễnNo ratings yet

- Fin Ratio AnalysisDocument43 pagesFin Ratio AnalysisMadiha ZamanNo ratings yet

- VALMET Rapport 1997Document54 pagesVALMET Rapport 1997Maryvonne Le GourzadecNo ratings yet

- Mayes 8e CH03 SolutionsDocument37 pagesMayes 8e CH03 SolutionsKHANJNo ratings yet

- Berger Paints Ratio Analysis Summary 2015Document8 pagesBerger Paints Ratio Analysis Summary 2015KARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Financial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismDocument18 pagesFinancial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismPham Thuy HuyenNo ratings yet

- Diagnosing Profitability, Risk, and Growth: Hawawini & Viallet 1Document29 pagesDiagnosing Profitability, Risk, and Growth: Hawawini & Viallet 1Imelda Gonzalez MedinaNo ratings yet

- Ratios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosDocument5 pagesRatios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosYasir AamirNo ratings yet

- Book 3Document62 pagesBook 3pg23ishika.kumariNo ratings yet

- Metron Assignment 2-AnaitaDocument7 pagesMetron Assignment 2-AnaitaAnaita DaruwalaNo ratings yet

- MarvelDocument14 pagesMarvelabhinav_gogia100% (1)

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- VonRoll Geschaeftsbericht 2017 ENDocument116 pagesVonRoll Geschaeftsbericht 2017 ENraul_beronNo ratings yet

- Ratio AnalysisDocument11 pagesRatio AnalysisMadavee JinadasaNo ratings yet

- Business Cycles & Theories of Business CyclesDocument7 pagesBusiness Cycles & Theories of Business CyclesAppan Kandala VasudevacharyNo ratings yet

- Soft Skills Chapter 6 Professional EthicsDocument22 pagesSoft Skills Chapter 6 Professional EthicsEida HidayahNo ratings yet

- And of Clay We Are CreatedDocument10 pagesAnd of Clay We Are CreatedDaniela Villarreal100% (1)

- Employment and Labor LawsDocument7 pagesEmployment and Labor LawsTrisha RamentoNo ratings yet

- Noli Me TangereDocument2 pagesNoli Me TangereLilimar Hao EstacioNo ratings yet

- Rape Case AppealDocument11 pagesRape Case AppealEricson Sarmiento Dela CruzNo ratings yet

- Asobi CoinDocument37 pagesAsobi CoinVankokhNo ratings yet

- EVS Complete Notes PDFDocument148 pagesEVS Complete Notes PDFrevantrajkpdh2002No ratings yet

- Removal of Corporate PresidentDocument5 pagesRemoval of Corporate PresidentDennisSaycoNo ratings yet

- My Resume 10Document2 pagesMy Resume 10api-575651430No ratings yet

- Wind BandDocument19 pagesWind BandRokas Põdelis50% (2)

- Wilkins, A Zurn CompanyDocument8 pagesWilkins, A Zurn CompanyHEM BANSALNo ratings yet

- Shapers Dragons and Nightmare An OWbN Guide To Clan Tzimisce 2015Document36 pagesShapers Dragons and Nightmare An OWbN Guide To Clan Tzimisce 2015EndelVinicius AlvarezTrindadeNo ratings yet

- The 1798 RebellionDocument16 pagesThe 1798 RebellionThiha Lin (Logan)No ratings yet

- Messianic Movements 1st CentDocument28 pagesMessianic Movements 1st CentFernando HutahaeanNo ratings yet

- Afcons Africa Company ProfileDocument80 pagesAfcons Africa Company ProfileHarrison O OdoyoNo ratings yet

- DH 4012286Document5 pagesDH 4012286Edwin KurniawanNo ratings yet

- Syllabus+ +Obligations+and+ContractsDocument10 pagesSyllabus+ +Obligations+and+ContractsEmman KailanganNo ratings yet

- Chapter 1 1Document4 pagesChapter 1 1Arhann Anthony Almachar Adriatico67% (3)

- FCC Checker TP09Document3 pagesFCC Checker TP09Alex Valdez MoralesNo ratings yet

- Using Debate To Enhance Students SpeakingDocument15 pagesUsing Debate To Enhance Students SpeakingCafe SastraNo ratings yet

- Humanities Concept PaperDocument6 pagesHumanities Concept PaperGabriel Adora70% (10)

- Varian9e LecturePPTs Ch38 PDFDocument76 pagesVarian9e LecturePPTs Ch38 PDF王琦No ratings yet

- Evolution of CommunicationDocument20 pagesEvolution of CommunicationKRISTINE MARIE SOMALONo ratings yet

- Forensic Accounting and Fraud Control in Nigeria: A Critical ReviewDocument10 pagesForensic Accounting and Fraud Control in Nigeria: A Critical ReviewKunleNo ratings yet

- Chapter 1 IntroductionDocument60 pagesChapter 1 IntroductionAndrew Charles HendricksNo ratings yet

- Dangerous Weapons 1 E4 E5 - Emms, Flear, GreetDocument337 pagesDangerous Weapons 1 E4 E5 - Emms, Flear, GreetYony Javier94% (18)

- Safety in PlantsDocument18 pagesSafety in PlantsVikas NigamNo ratings yet

- Titus Edison M. CalauorDocument5 pagesTitus Edison M. CalauorTay Wasnot TusNo ratings yet

- Monzo Bank Statement 2020 10 26 193614Document5 pagesMonzo Bank Statement 2020 10 26 193614Lorena PennaNo ratings yet