Professional Documents

Culture Documents

Taxation in The Philippines: Readings in Philippine History

Taxation in The Philippines: Readings in Philippine History

Uploaded by

BJ Ambat0 ratings0% found this document useful (0 votes)

4 views23 pagesOriginal Title

Taxation in the Philippines

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views23 pagesTaxation in The Philippines: Readings in Philippine History

Taxation in The Philippines: Readings in Philippine History

Uploaded by

BJ AmbatCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 23

TAXATION IN THE PHILIPPINES

Readings in Philippine History

WHAT IS TAXATION?

Taxation is a term for when a taxing authority, usually a

government, levies or imposes a financial obligation on

its citizens or residents. Paying taxes to governments or

officials has been a mainstay of civilization since ancient

times.

CONCEPT OF TAXATION

Taxation is the inherent power of the state to impose and

demand contribution upon persons, properties, or rights

for the purpose of generating revenues for public

purposes.

Taxes are enforced proportional contributions from

persons and property levied by the lawmaking body of

the state by virtue of its sovereignty for the support of the

government and all public needs.

ESSENTIAL CHARACTERISTICS OF

TAX

1. It is an enforced contribution.

2. It is generally payable in money.

3. It is proportionate in character, usually based on the ability to pay.

4. It is levied on persons and property within the jurisdiction of the state.

5. It is levied pursuant to legislative authority, the power to tax can only be

exercised by the law making body or congress.

6. It is levied for public purpose.

7. It is commonly required to be paid a regular intervals.

TYPES OF TAXES IN THE

PHILIPPINES

National Taxes are those that we pay to the government

through the Bureau of Internal Revenue.

Local Taxes are taxes, fees or charges are imposed by

the local government units, such as provinces, cities,

municipalities, and barangays, who have been given the

power to levy such taxes by the code.

NATIONAL TAXES

Capital Gains Tax is a tax imposed on the gains

presumed to have been realized by the seller from the

sale, exchange, or other disposition of capital assets

located in the Philippines, including pacto de retro sales

and other forms of conditional sale.

NATIONAL TAXES

Documentary Stamp Tax is a tax on documents,

instruments, loan agreements and papers evidencing the

acceptance, assignment, sale or transfer of an obligation,

rights, or property incident thereto.

NATIONAL TAXES

Donor’s Tax is a tax on a donation or gift, and is imposed on the

gratuitous transfer of property between two or more persons who

are living at the time of the transfer.

Estate Tax is a tax on the right of the deceased person to transmit

his/her estate to his/her lawful heirs and beneficiaries at the time

of death and on certain transfers which are made by law as

equivalent to testamentary disposition.

NATIONAL TAXES

Income Tax is a tax on all yearly profits arising from

property, profession, trades or offices or as a tax on a

person’s income, emoluments, profits and the like. Self-

employed individuals and corporate taxpayers pay

quarterly income taxes from 1st quarter to 3rd quarter.

NATIONAL TAXES

Percentage Tax is a business tax imposed on persons or entities

who sell or lease goods, properties or services in the course of

trade or business whose gross annual sales or receipts do not

exceed the amount required to register as VAT-registered

taxpayers.

Value Added Tax is a business tax imposed and collected from

the seller in the course of trade or business on every sale of

properties (real or personal) lease of goods or properties (real or

personal) or vendors of services.

NATIONAL TAXES

Excise Tax is a tax imposed on goods manufactured or

produced in the Philippines for domestic sale or

consumption or any other disposition.

Expanded Withholding Tax is a kind of withholding tax

which is prescribed only for certain payers and is

creditable against the income tax due of the payee for the

taxable quarter year.

NATIONAL TAXES

Final Withholding Tax is a kind of withholding tax

which is prescribed only for certain payers and is not

creditable against the income tax due of the payee for the

taxable year. Income Tax withheld constitutes the full and

final payment of the Income Tax due from the payee on

the said income.

LOCAL TAXES

Local taxes the local government taxation in the

Philippines are based on Republic Act 7160 or otherwise

known as the Local Government Code of 1991, as

amended. These taxes, fees or charges are imposed by the

local government units, such as provinces, cities,

municipalities, and barangays, who have been given the

power to levy such taxes by the code.

LOCAL TAXES

Tax on Transfer of Real Property Ownership – tax

imposed on the sale, donation, barter, or on any other

mode of transferring ownership or title of real property.

Tax on Business of Printing and Publication – tax on

the business of persons engaged in the printing and/or

publication of books, cards, posters, leaflets, handbills,

certificates, receipts, pamphlets, and others of similar

nature.

LOCAL TAXES

Franchise Tax – tax on businesses enjoying a franchise,

at the rate not exceeding fifty percent (50%) of one

percent (1%) of the gross annual receipts for the

preceding calendar year based on the incoming receipt, or

realized, within its territorial jurisdiction.

LOCAL TAXES

Tax on Sand, Gravel and Other Quarry Resources –

tax imposed on ordinary stones, sand, gravel, earth, and

other quarry resources, as defined under the National

Internal Revenue Code, as amended, extracted from

public lands or from the beds of seas, lakes, rivers,

streams, creeks, and other public waters within its

territorial jurisdiction.

LOCAL TAXES

Professional Tax – an annual professional tax on each

person engaged in the exercise or practice of his

profession requiring government examination.

Amusement Tax – tax collected from the proprietors,

lessees, or operators of theaters, cinemas, concert halls,

circuses, boxing stadia, and other places of amusement.

LOCAL TAXES

Tax on Business – taxes imposed by cities, municipalities on

businesses before they will be issued a business license or permit

to start operations based on the schedule of rates prescribed by the

local government code, as amended.

Fees for Sealing and Licensing of Weights and Measures – fees

for the sealing and licensing of weights and measures at such

reasonable rates as shall be prescribed by the sangguniang bayan

of the municipality or city.

LOCAL TAXES

Fishery Rentals, Fees and Charges – rentals, fees or

charges imposed by the municipality/city to grantees of

fishery privileges in the municipal/city waters, e.g.,

fishery privileges to erect fish corrals, oysters, mussels or

other aquatic beds or bangus fry areas and others as

mentioned in the local government code, as amended.

LOCAL TAXES

Community Tax – tax levied by cities or municipalities

to every inhabitant of the Philippines eighteen (18) years

of age or over who has been regularly employed on a

wage or salary basis for at least thirty (30) consecutive

working days during any calendar year, or who is

engaged in business or occupation, or who owns real

property with an aggregate assessed value of One

thousand pesos (P1,000.00) or more, or who is required

by law to file an income tax return.

LOCAL TAXES

Taxes that may be levied by the barangays on stores

or retailers with fixed business establishments with

gross sales of receipts of the preceding calendar year of

Fifty thousand pesos (P50,000.00) or less, in the case of

cities and Thirty thousand pesos (P30,000.00) or less, in

the case of municipalities, at a rate not exceeding one

percent (1%) on such gross sales or receipts.

LOCAL TAXES

Service Fees or Charges – fees or charges that may be collected

by the barangays for services rendered in connection with the

regulations or the use of barangay-owned properties or service

facilities, such as palay, copra, or tobacco dryers.

Barangay Clearance – a reasonable fee collected by barangays

upon issuance of barangay clearance – a document required for

many government transactions, such as when applying for

business permit with the city or municipality.

REPRESENTED BY:

Sheila Anne L. Maningding

&

Mac Escat

Don’t forget to wear mask always. Be healthy and stay safe.

You might also like

- TaxationDocument5 pagesTaxationThonieroce Apryle Jey Morelos100% (1)

- Brief History of Taxation in The PhillipinesDocument1 pageBrief History of Taxation in The PhillipinesMica BarrunNo ratings yet

- Pos Cavite MutinyDocument3 pagesPos Cavite MutinyDianne BalagsoNo ratings yet

- 1899: Malolos ConstitutionDocument4 pages1899: Malolos ConstitutionNeil Patrick OrdoñezNo ratings yet

- Taxation During The Commonwealth Period (1935-1945Document2 pagesTaxation During The Commonwealth Period (1935-1945VALENCIA, JR. ANGELITONo ratings yet

- The Philippine Reform and Taxation in The PhilippinesDocument24 pagesThe Philippine Reform and Taxation in The PhilippinesBrylle Angelo PolintanNo ratings yet

- Taxation During Commonwealth PeriodDocument18 pagesTaxation During Commonwealth PeriodLEIAN ROSE GAMBOA100% (2)

- Readings in Philippine History Evolution of Philippine TaxationDocument4 pagesReadings in Philippine History Evolution of Philippine TaxationAngel Joseph Tejada100% (1)

- Taxation in The Philippine SDocument22 pagesTaxation in The Philippine SBJ Ambat100% (1)

- Fiscal Policy From 1946 To PresentDocument7 pagesFiscal Policy From 1946 To PresentRhoxane Santos100% (1)

- Evolution of Philippine TaxationDocument6 pagesEvolution of Philippine TaxationGuki Suzuki0% (1)

- Evolution of Philippine TaxationDocument20 pagesEvolution of Philippine TaxationJohara Bayabao100% (2)

- Cry of Balintawak or Pugad Lawin.Document3 pagesCry of Balintawak or Pugad Lawin.Sherwin TanoNo ratings yet

- Module 4 Social, Political, Economic, and Cultural Issues in Philippine HistoryDocument22 pagesModule 4 Social, Political, Economic, and Cultural Issues in Philippine HistoryPrincess Vee ReyesNo ratings yet

- RPH 2Document13 pagesRPH 2BJ AmbatNo ratings yet

- Biography of A Prominent FilipinoDocument38 pagesBiography of A Prominent FilipinoGypcel Seguiente Arellano100% (1)

- Case Study: What Happened in The Cavite Mutiny?Document9 pagesCase Study: What Happened in The Cavite Mutiny?Vernn67% (3)

- Evolution of Philippine ConstitutionDocument92 pagesEvolution of Philippine ConstitutionAlyanna Elisse Vergara100% (1)

- Lesson 3 Evolution of Philippine TaxationDocument8 pagesLesson 3 Evolution of Philippine TaxationZendee Jade MaderaNo ratings yet

- Customs of The Tagalogs: Lesson 4Document9 pagesCustoms of The Tagalogs: Lesson 4Majestyy Sean100% (1)

- Case Study 2: What Happened in The Cavite Mutiny?Document14 pagesCase Study 2: What Happened in The Cavite Mutiny?Claudette Nicole GardoceNo ratings yet

- Evolution of Philippine TaxationDocument22 pagesEvolution of Philippine TaxationRaymart OsiaNo ratings yet

- Chapter 10 - Philippine TaxationDocument58 pagesChapter 10 - Philippine TaxationThea MallariNo ratings yet

- Institutional History of SchoolsDocument31 pagesInstitutional History of SchoolsDaguil, Joyce A.100% (1)

- The Two Faces of The 1872 Cavite MutinyDocument6 pagesThe Two Faces of The 1872 Cavite MutinyElizabeth Perez Rodriguez50% (2)

- Seven Days at Mazaua 85-86Document4 pagesSeven Days at Mazaua 85-86Maria Julie Flor MacasaetNo ratings yet

- Taxation During Spanish ColonizationDocument44 pagesTaxation During Spanish Colonizationgladyl bermioNo ratings yet

- Concept-Evolution of ConstitutionDocument46 pagesConcept-Evolution of Constitutionmaricrisandem100% (1)

- Landownership in The Philippines Under SpainDocument1 pageLandownership in The Philippines Under SpainツBienNo ratings yet

- Comparative Matrix. Exercise Two Primary and Secondary SourceDocument4 pagesComparative Matrix. Exercise Two Primary and Secondary SourceJerome De JesusNo ratings yet

- Case Study 3 Did Rizal RetractDocument18 pagesCase Study 3 Did Rizal RetractLou OrtegaNo ratings yet

- History Assignment Truce of Biak-na-BatoDocument2 pagesHistory Assignment Truce of Biak-na-BatoKenneth Marvin Mateo100% (2)

- First Voyage Around The World by Antonio Pigafetta: Readings in Philippine HistoryDocument4 pagesFirst Voyage Around The World by Antonio Pigafetta: Readings in Philippine HistoryJohn Michael Luzaran ManilaNo ratings yet

- THE EVOLUTION OF PHILIPPINE CONSTITUTIONsDocument39 pagesTHE EVOLUTION OF PHILIPPINE CONSTITUTIONsMo PadillaNo ratings yet

- Cry of BalintawakDocument4 pagesCry of Balintawakmikol vegaNo ratings yet

- Social Political Economic and Cultural Issues Part 3Document20 pagesSocial Political Economic and Cultural Issues Part 3Crizza Mae Cureg100% (1)

- 001 PPT GEC102 Meaning of HistoryDocument11 pages001 PPT GEC102 Meaning of HistoryRESTY FERNANDEZNo ratings yet

- Chapter 3 HistoryDocument59 pagesChapter 3 HistoryJoahn ROCREO100% (1)

- What Happened in The Cavite MutinyDocument17 pagesWhat Happened in The Cavite MutinyFaith Ann CortezNo ratings yet

- A Brief Summary of The First Voyage Around The World by MagellanDocument5 pagesA Brief Summary of The First Voyage Around The World by Magellanjonie claire pallayocNo ratings yet

- Famous Historic Shrines and Monuments in The PhilippinesDocument2 pagesFamous Historic Shrines and Monuments in The Philippinesjonelyn villanuevaNo ratings yet

- Retraction of Rizal Retraction of Rizal: Report ConflictDocument9 pagesRetraction of Rizal Retraction of Rizal: Report ConflictJan Rae MarianoNo ratings yet

- Compare and Contrast The 1899 Malolos Constitution and 1935 Commonwealth Constitution Using Venn DiagramDocument1 pageCompare and Contrast The 1899 Malolos Constitution and 1935 Commonwealth Constitution Using Venn DiagramCloe100% (1)

- CAVITE MUTINY (Repaired)Document27 pagesCAVITE MUTINY (Repaired)Yasmin G. BaoitNo ratings yet

- Filipino American RelationshipDocument3 pagesFilipino American RelationshipSamuel Grant ZabalaNo ratings yet

- 1973 ConstitutionDocument9 pages1973 ConstitutionBJ AmbatNo ratings yet

- Cavite MutinyDocument16 pagesCavite MutinyMiguel Martinez100% (1)

- Corazon Aquino SpeechDocument17 pagesCorazon Aquino SpeechricoliwanagNo ratings yet

- Antonio Pigaffeta and Cavite Mutiny ReflectionDocument2 pagesAntonio Pigaffeta and Cavite Mutiny ReflectionCriszia May MallariNo ratings yet

- Biography of Prominent Filipino FiguresDocument3 pagesBiography of Prominent Filipino Figuresjovani capizNo ratings yet

- Module 6 Rizal and The Chinese Connection PDFDocument5 pagesModule 6 Rizal and The Chinese Connection PDFClaire Evann Villena Ebora0% (1)

- GE 102 - Reading in The Philippine HistoryDocument20 pagesGE 102 - Reading in The Philippine HistoryLiezel Pable DajuyaNo ratings yet

- First MassDocument18 pagesFirst Massgag ksshNo ratings yet

- Injustice Response - Filipino VersionDocument36 pagesInjustice Response - Filipino VersionKennethEdiza100% (4)

- Primary Secondary SourcesDocument7 pagesPrimary Secondary Sourcesanabel abalosNo ratings yet

- Political Caricatures of The American Era 1900 1941Document18 pagesPolitical Caricatures of The American Era 1900 1941April HullanaNo ratings yet

- Filipino Grievances Against Governor Wood: Loading..Document19 pagesFilipino Grievances Against Governor Wood: Loading..Layla MainNo ratings yet

- Case Study 2 DIFFERING ACCOUNTS OF THE EVENTS 1872Document10 pagesCase Study 2 DIFFERING ACCOUNTS OF THE EVENTS 1872Vernn100% (8)

- Taxes: Orduna Santos Dumalag PinesDocument56 pagesTaxes: Orduna Santos Dumalag PinesJosh DumalagNo ratings yet

- Different Kinds of Taxes in The PhilippinesDocument5 pagesDifferent Kinds of Taxes in The PhilippinesJosephine Berces100% (2)

- Flag Heraldic CodeDocument33 pagesFlag Heraldic CodeBJ AmbatNo ratings yet

- The Constitution of The Philippine CommonwealthDocument11 pagesThe Constitution of The Philippine CommonwealthBJ AmbatNo ratings yet

- Happy Thanks Giving Day PowerPoint TemplatesDocument48 pagesHappy Thanks Giving Day PowerPoint TemplatesBJ AmbatNo ratings yet

- Geographic Profile of The PhilippinesDocument38 pagesGeographic Profile of The PhilippinesBJ Ambat100% (1)

- The Constitution of The Philippine CommonwealthDocument11 pagesThe Constitution of The Philippine CommonwealthBJ AmbatNo ratings yet

- RPH 2Document13 pagesRPH 2BJ AmbatNo ratings yet

- RPH 2Document13 pagesRPH 2BJ AmbatNo ratings yet

- Taxation in The Philippine SDocument22 pagesTaxation in The Philippine SBJ Ambat100% (1)

- Taxation: Presenter: Kristian J. Cargo Prince Jude R. PitinezDocument14 pagesTaxation: Presenter: Kristian J. Cargo Prince Jude R. PitinezBJ AmbatNo ratings yet

- 1935 CONSTITUTION - Dacumos and ValdezDocument20 pages1935 CONSTITUTION - Dacumos and ValdezBJ AmbatNo ratings yet

- 1973 ConstitutionDocument9 pages1973 ConstitutionBJ AmbatNo ratings yet

- 1899 Malolos ConstitutionDocument11 pages1899 Malolos ConstitutionBJ Ambat100% (3)

- 1935 ConstitutionDocument9 pages1935 ConstitutionBJ Ambat100% (1)

- Agrarian Reform PoliciesDocument22 pagesAgrarian Reform PoliciesBJ AmbatNo ratings yet

- 1987 Philippine Constitution: Dannylyn Esporsado Avegail Ines Bs Coe - 1CDocument29 pages1987 Philippine Constitution: Dannylyn Esporsado Avegail Ines Bs Coe - 1CBJ Ambat100% (2)

- Flipkart Labels 23 Aug 2021 04 16Document42 pagesFlipkart Labels 23 Aug 2021 04 16Sudip SenNo ratings yet

- Tax CalculatorDocument10 pagesTax Calculatorgsagar879No ratings yet

- physicalCustomerInvoice 4118 2023 06 03 physicalCustomerInvoice-9407603014-4118-f7ef1e26 24aa 45c4 9595 3b571c1be741qBHT42yLLr-4927682657Document1 pagephysicalCustomerInvoice 4118 2023 06 03 physicalCustomerInvoice-9407603014-4118-f7ef1e26 24aa 45c4 9595 3b571c1be741qBHT42yLLr-4927682657Shirishma RajuNo ratings yet

- April FS AAA 14Document47 pagesApril FS AAA 14Levi Lazareno EugenioNo ratings yet

- "H & R Block India Pvt. LTD.": A Project Report OnDocument98 pages"H & R Block India Pvt. LTD.": A Project Report OnraviNo ratings yet

- Ym0654 Tax - PNL 2019 04 01 2020 03 31Document52 pagesYm0654 Tax - PNL 2019 04 01 2020 03 31Jayachandra JcNo ratings yet

- Used BellDocument6 pagesUsed Bell9gfydvypg9No ratings yet

- State Bank CollectDocument3 pagesState Bank CollectKartik PrajapatiNo ratings yet

- OutlineDocument71 pagesOutlineMaxwell NdunguNo ratings yet

- CA Bimal Jain GST DocumentDocument59 pagesCA Bimal Jain GST DocumentdurairajNo ratings yet

- US Legal InvoicesDocument2 pagesUS Legal Invoiceslarry-612445100% (1)

- Du 1NoTvuFPBsnn5D7OBtMcho1n-chargeback Issuer evidence-VPhkdSTHfelrNtp8DjIoC79FQWQ2Pp-SdUHmFmq5Ws4Document2 pagesDu 1NoTvuFPBsnn5D7OBtMcho1n-chargeback Issuer evidence-VPhkdSTHfelrNtp8DjIoC79FQWQ2Pp-SdUHmFmq5Ws4Nguyen LyNo ratings yet

- InvoiceDocument1 pageInvoiceCyber CrackerNo ratings yet

- Tax PPT - DeductionsDocument20 pagesTax PPT - Deductionsjayparekh28No ratings yet

- Amol Srivastava April Income TaxDocument1 pageAmol Srivastava April Income TaxRemruata FanaiNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDocument8 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDipen AdhikariNo ratings yet

- 0 - Study On DIRECT TAX CODE 2Document35 pages0 - Study On DIRECT TAX CODE 2Ravi SinghNo ratings yet

- Det Charge OoclDocument7 pagesDet Charge OoclHudaya FirdausNo ratings yet

- Hinweis2227963 Update23 04 19 PDFDocument12 pagesHinweis2227963 Update23 04 19 PDFBiswajit GhoshNo ratings yet

- CIR Vs Filinvest Development Corporation - Tax CaseDocument17 pagesCIR Vs Filinvest Development Corporation - Tax CaseKyle AlmeroNo ratings yet

- Bank Payment Voucher FormatDocument1 pageBank Payment Voucher FormatSyed Oneeb JafriNo ratings yet

- Centrelink RH0LURH0K8Document3 pagesCentrelink RH0LURH0K8chxwmfztyxNo ratings yet

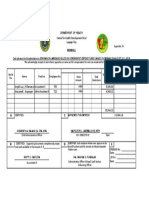

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollAngeli Lou Joven Villanueva100% (1)

- iQOO by Vivo 55 W NA 6 A Mobile Q5550H0A0-IN Charger: Grand Total 704.00Document1 pageiQOO by Vivo 55 W NA 6 A Mobile Q5550H0A0-IN Charger: Grand Total 704.00Baid GroupNo ratings yet

- FI CIN User Manual V1Document38 pagesFI CIN User Manual V1jagankilariNo ratings yet

- Offer Sault COllegeDocument2 pagesOffer Sault COllegevikram toorNo ratings yet

- US Internal Revenue Service: f10492Document1 pageUS Internal Revenue Service: f10492IRSNo ratings yet

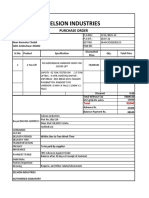

- 11 - PO No - Kohinoor Fabricators - 28.07.21Document1 page11 - PO No - Kohinoor Fabricators - 28.07.21Vipul RathodNo ratings yet

- Acmdc vs. CirDocument2 pagesAcmdc vs. CirBae IreneNo ratings yet

- Jonathan M Luna Account Number: 5779 81XX XXXX 2560: Account Activity Since Your Last StatementDocument4 pagesJonathan M Luna Account Number: 5779 81XX XXXX 2560: Account Activity Since Your Last StatementJonathan LunaNo ratings yet