0% found this document useful (0 votes)

138 views46 pagesMerchandising Operations Overview

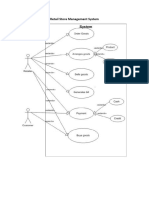

The document discusses the differences between service companies and merchandising companies. It notes that merchandising companies have a longer operating cycle as their operations involve inventory. Unlike service company revenues, merchandising company sales revenues are referred to. For merchandising companies, expenses are divided into cost of goods sold and operating expenses, with cost of goods sold representing the cost of inventory sold. The income measurement process for merchandising companies involves deducting cost of goods sold and operating expenses from sales revenues to determine gross profit and net income.

Uploaded by

Sina RahimiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

138 views46 pagesMerchandising Operations Overview

The document discusses the differences between service companies and merchandising companies. It notes that merchandising companies have a longer operating cycle as their operations involve inventory. Unlike service company revenues, merchandising company sales revenues are referred to. For merchandising companies, expenses are divided into cost of goods sold and operating expenses, with cost of goods sold representing the cost of inventory sold. The income measurement process for merchandising companies involves deducting cost of goods sold and operating expenses from sales revenues to determine gross profit and net income.

Uploaded by

Sina RahimiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd