Professional Documents

Culture Documents

Group One Banking &.PPTX Investment

Uploaded by

bright letsah0 ratings0% found this document useful (0 votes)

18 views10 pagesThe ratios show the company has strong liquidity and debt levels are low. Profitability is excellent across most margins. However, inventory turnover is low and collection periods are rising, indicating issues with managing inventory and receivables. Asset usage is also relatively low. Returns have declined as assets have grown significantly.

Original Description:

Original Title

Group One Banking &.Pptx Investment (1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe ratios show the company has strong liquidity and debt levels are low. Profitability is excellent across most margins. However, inventory turnover is low and collection periods are rising, indicating issues with managing inventory and receivables. Asset usage is also relatively low. Returns have declined as assets have grown significantly.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views10 pagesGroup One Banking &.PPTX Investment

Uploaded by

bright letsahThe ratios show the company has strong liquidity and debt levels are low. Profitability is excellent across most margins. However, inventory turnover is low and collection periods are rising, indicating issues with managing inventory and receivables. Asset usage is also relatively low. Returns have declined as assets have grown significantly.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 10

Group one

1. EMERALD AMISSAH 10108425 16. FOSU EMMANUEL EFFAH 10105607

2. FRANK ESSIBU ANNAN 10106294 17. AGYEMANG GERTRUDE SERWAH

3. QUANSAH REBECCA ARMATSO 10105813

10105976 18. BRIGHT LETSAH 10107531

4. GAWU COMFORT. 10109338 19. CAESAR JESSICA OGBOO 10107607

5. AFFARE KOJO 10107524 20. ADAMTEY CLEMENT KWASHIE 10107782

6. QUANSAH ABIGAIL 10107887 21. NII-FIO JUSTINE ANTWI 10108113

7. KOKROKO PRINCE YAO 10108461 22. SEMEGLO HARRISON KOKUO 10107698

8. ASAMANI HILDA NYAMEWAA 23. GRACE OWUSU 10093583

10108462 24. LARYEA JESSICA NAA ADJELEY- 10106456

9. VINCENT MENSAH 10096949 25. AGBLEKPE ELIZABETH 10106455

10. IBRAHIM ADAMS 10093913 26. ASANTE ABIGAIL 10106438

11. SULLEY AMANDA 10107696 27. HILDA AYIKPA 10106435

12. ABEBU BLESS 10107977 28. Nartey Israel Claassen 10108066

13. EWURAKUA CONDUAH 10107527 29. OPPONG EDITH 10106007

14. ISSIFU NASIR 10107606

15. WAGBA CHERYLLA 10105273

QUESTION 1

Gallery of Dreams

Ratios

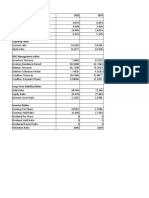

Ratio Industry 2015 2014 2013

Current 2.50x 4.48x 4.06x 3.48x

Quick 0.80x 1.47x 1.18x 0.96x

Average collection period 11 days 16 days 15 days 9 days

Inventory turnover 2.30x 1.19x 1.24x 1.37x

Days payable outstanding 15 days 11 days 12 days 8 days

Fixed asset turnover 17.50x 9.74x 9.09x 8.85x

Total asset turnover 2.80x 1.50x 1.67x 1.82x

Debt ratio 62.00% 29.47% 34.04% 39.17%

Long term debt to

total capitalization 25.53% 14.09% 18.91% 22.33%

Times interest 9.93x 22.02x 19.00x 14.23x

earned

Fixed charge 8.69x 4.59x 4.47x 4.25x

coverage

Gross profit margin 31.10% 59.21% 59.39% 58.52%

Operating profit 8.06% 22.05% 21.86% 20.52%

margin

Net profit margin 4.32% 11.89% 11.00% 10.97%

Return on 9.21% 17.97% 18.28% 18.35%

investment

Return on equity 11.34% 24.14% 27.51% 29.88%

SOLUTION

Strengths:

• Current and quick ratios are above industry

average and increasing

• Accounts payable are paid in a timely manner

• Overall debt has declined significantly and is well

below the industry average

• Interest is covered by profits as are lease payments and the

number of times covered has increased each year

• Profitability is excellent with gross, operating and net profit

margins above industry average and increasing all years with the

exception of gross profit margin which decreased slightly in 2015

Weaknesses:

• The average collection period is increasing and is

now above industry average

• Inventory turnover is below industry average and

is extremely low indicating the firm does not

move inventory well

• Fixed asset turnover, while increasing, is still

below industry average

• Total asset turnover is decreasing which implies sales are declining

and/or investments in assets are too high relative to sales

• Fixed charge coverage is below industry average and implies that

the firm has significant operating leases

• Return on investment is declining due to significant investment in

assets

• Return on equity is declining, but this is also positive as it is

partially due to the significant decline in debt.

You might also like

- Fritz Springmeier InterviewDocument59 pagesFritz Springmeier InterviewCzink Tiberiu100% (4)

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Digital Wealth: An Automatic Way to Invest SuccessfullyFrom EverandDigital Wealth: An Automatic Way to Invest SuccessfullyRating: 4.5 out of 5 stars4.5/5 (3)

- History of Madre de DiosDocument3 pagesHistory of Madre de DiosMisterJanNo ratings yet

- Arts - 9 - Quarter 3 Module 1Document4 pagesArts - 9 - Quarter 3 Module 1John Mark Prestoza100% (3)

- Online Investing on the Australian Sharemarket: How to Research, Trade and Invest in Shares and Securities OnlineFrom EverandOnline Investing on the Australian Sharemarket: How to Research, Trade and Invest in Shares and Securities OnlineNo ratings yet

- Welcome To Our PresentationDocument38 pagesWelcome To Our PresentationTamanna ShaonNo ratings yet

- Business Finance PeTa Shell Vs Petron FinalDocument5 pagesBusiness Finance PeTa Shell Vs Petron FinalFRANCIS IMMANUEL TAYAGNo ratings yet

- Pierre Jeanneret Private ResidencesDocument21 pagesPierre Jeanneret Private ResidencesKritika DhuparNo ratings yet

- Hindustan Unilever LTD.: Trend AnalysisDocument7 pagesHindustan Unilever LTD.: Trend AnalysisAnkitaBansalNo ratings yet

- AsherDocument10 pagesAsherAbdullah QureshiNo ratings yet

- Stock Recommendation 20012014Document6 pagesStock Recommendation 20012014Bawonda IsaiahNo ratings yet

- FMCV PresentationDocument12 pagesFMCV PresentationManmeet SinghNo ratings yet

- Corporate Finance Submitted To: Prof. Sudhanshu Pani Submitted By: Group 6 - Division J Ganesh Textiles CaseDocument10 pagesCorporate Finance Submitted To: Prof. Sudhanshu Pani Submitted By: Group 6 - Division J Ganesh Textiles CaseYOGESH NISHANTNo ratings yet

- Dairy Spending DecisionsDocument23 pagesDairy Spending DecisionsLőrincz SzilárdNo ratings yet

- FinalDocument54 pagesFinalMukul BansalNo ratings yet

- Ratio AnalysisDocument6 pagesRatio Analysisamitca9No ratings yet

- Report On Beximco and Aci PharmaDocument22 pagesReport On Beximco and Aci PharmaAnowarul IslamNo ratings yet

- WZ Wealth Ideas November 11Document4 pagesWZ Wealth Ideas November 11satish kumar0% (1)

- 1.inroduction: Working Capital Management Refers To A Company's ManagerialDocument7 pages1.inroduction: Working Capital Management Refers To A Company's Managerialmaa digitalxeroxNo ratings yet

- RanbaxyDocument2 pagesRanbaxyamit_sachdevaNo ratings yet

- Key RatiosDocument6 pagesKey RatiosSumeet ChaurasiaNo ratings yet

- Lanka Bangla Finance LTD.: MissionDocument5 pagesLanka Bangla Finance LTD.: MissionMd.Ashraful Islam RiyadNo ratings yet

- Mini CaseDocument4 pagesMini CaseHesham MansourNo ratings yet

- Dividend Weekly 21 - 2013Document33 pagesDividend Weekly 21 - 2013Tom RobertsNo ratings yet

- Accounts Termpaper1Document21 pagesAccounts Termpaper1Nisha RialchNo ratings yet

- Valuation Index GroupDocument2 pagesValuation Index Groupbaongan23062003No ratings yet

- Chapter3 AssismentDocument6 pagesChapter3 Assismentchaoyuan tanNo ratings yet

- Dividend Weekly 38 - 2013Document33 pagesDividend Weekly 38 - 2013Tom RobertsNo ratings yet

- Woolworths Analyst Presentation Feb 2005Document45 pagesWoolworths Analyst Presentation Feb 2005rushabNo ratings yet

- Chapter - FinanceDocument11 pagesChapter - FinanceShubham ShirkeNo ratings yet

- Industry Ratio Final Na Final 1 With InterpretationDocument3 pagesIndustry Ratio Final Na Final 1 With InterpretationClaudine Anne AguiatanNo ratings yet

- C450 - Long Term Liabilites - Lecture NotesDocument14 pagesC450 - Long Term Liabilites - Lecture NotesFreelansirNo ratings yet

- Financial Analysis of Power SectorDocument19 pagesFinancial Analysis of Power SectorPKNo ratings yet

- Case Analysis. There's More To Us Than Meets The EyeDocument5 pagesCase Analysis. There's More To Us Than Meets The EyeCorporate Accountant Marayo BankNo ratings yet

- Ratio Analysis of Dutch Bangla Bank LimitedDocument6 pagesRatio Analysis of Dutch Bangla Bank LimitedSafiur_AIUBNo ratings yet

- Maskeliya Plantations PLC - Ratios CalculationDocument1 pageMaskeliya Plantations PLC - Ratios CalculationNuwani ManasingheNo ratings yet

- Document 8Document2 pagesDocument 8ayeshaNo ratings yet

- Introduction To Finance: Ratio AnalysisDocument18 pagesIntroduction To Finance: Ratio AnalysisTahmid ZamanNo ratings yet

- AFT 2073 Financial Management: Group Tutorial: L1 Lect Name: Sir Ahmad Ridhuwan Bin Abdullah Group MemberDocument25 pagesAFT 2073 Financial Management: Group Tutorial: L1 Lect Name: Sir Ahmad Ridhuwan Bin Abdullah Group MemberwawanNo ratings yet

- Damodaran KDDocument65 pagesDamodaran KDEduardo El Khouri BuzatoNo ratings yet

- Class Case 1: Krispy Kreme Doughnuts, IncDocument9 pagesClass Case 1: Krispy Kreme Doughnuts, IncJeanDianeJoveloNo ratings yet

- 1631386577DI Tables Assignment 2Document4 pages1631386577DI Tables Assignment 2sabir aliNo ratings yet

- Winfield Refuse Waste ManagementDocument6 pagesWinfield Refuse Waste ManagementAakash Singh BJ22162No ratings yet

- Financial Statements of HSYDocument16 pagesFinancial Statements of HSYAqsa Umer0% (2)

- Gul Ahmad Textiles LimitedDocument3 pagesGul Ahmad Textiles LimitedmadihaNo ratings yet

- Cetes-Version 3.0Document7 pagesCetes-Version 3.0Daniel MartinezNo ratings yet

- Cetes Version 3.0Document7 pagesCetes Version 3.0Daniel MartinezNo ratings yet

- Cetes Version 3.0Document7 pagesCetes Version 3.0Ivan VillanevaNo ratings yet

- Sourav ReportDocument6 pagesSourav Reportantecgaming010No ratings yet

- National Foods PROJECTDocument20 pagesNational Foods PROJECTusman faisalNo ratings yet

- INS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Document4 pagesINS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Thảo Thiên ChiNo ratings yet

- Particulars 2018-19 2017-18 Liquidity AnalysisDocument10 pagesParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiNo ratings yet

- Tire City SpreadsheetDocument7 pagesTire City Spreadsheetp23ayushsNo ratings yet

- Corp Fin - Radio One IncDocument39 pagesCorp Fin - Radio One IncMarco Quispe PerezNo ratings yet

- Basic Java ProgrammingDocument45 pagesBasic Java ProgrammingTeda Tech TipsNo ratings yet

- Mangalore Refinery and Petrochemicals LimitedDocument16 pagesMangalore Refinery and Petrochemicals Limitedsheetal ghugareNo ratings yet

- Chapter 6 - Bond ValuationDocument46 pagesChapter 6 - Bond ValuationHarith DaniealNo ratings yet

- General Insurance Corporation of IndiaDocument6 pagesGeneral Insurance Corporation of IndiaGukan VenkatNo ratings yet

- Ratio Analysis File 2Document4 pagesRatio Analysis File 2MD HAFIZUR RAHMANNo ratings yet

- Equity and Liabilities: Description Mar-21 Mar-20 Mar-19 Mar-18 Mar-17 Share Capital Total ReservesDocument102 pagesEquity and Liabilities: Description Mar-21 Mar-20 Mar-19 Mar-18 Mar-17 Share Capital Total Reservesaditya jainNo ratings yet

- 21P184 AkshaySingh CFDocument3 pages21P184 AkshaySingh CFChittrieta GorainNo ratings yet

- MA 104 Team ActivityDocument5 pagesMA 104 Team ActivityRhema BashzieeNo ratings yet

- FishboneDocument5 pagesFishboneGhibran MaulanaNo ratings yet

- Personal HygieneDocument58 pagesPersonal Hygienebright letsahNo ratings yet

- Facilitator: Simon Kormla Donkor Uew, WinnebaDocument7 pagesFacilitator: Simon Kormla Donkor Uew, Winnebabright letsahNo ratings yet

- Lesson 2 Teaching EnergyDocument22 pagesLesson 2 Teaching Energybright letsahNo ratings yet

- Basic ElectronicsDocument22 pagesBasic Electronicsbright letsahNo ratings yet

- Week 2 - ICTs in EducationDocument39 pagesWeek 2 - ICTs in Educationbright letsahNo ratings yet

- Week 1 - Introduction To LMSDocument21 pagesWeek 1 - Introduction To LMSbright letsahNo ratings yet

- Week 1 - Information SocietyDocument14 pagesWeek 1 - Information Societybright letsahNo ratings yet

- Types of Aca WritingDocument2 pagesTypes of Aca Writingbright letsahNo ratings yet

- Financial Markets and Institutions: 12 EditionDocument34 pagesFinancial Markets and Institutions: 12 Editionbright letsahNo ratings yet

- Corporate Reporting II Lecture 4 Vertical GroupsDocument58 pagesCorporate Reporting II Lecture 4 Vertical Groupsbright letsahNo ratings yet

- Week 3 - (Reading) Computer SoftwareDocument11 pagesWeek 3 - (Reading) Computer Softwarebright letsahNo ratings yet

- Week 2 - (Reading) Introduction To ComputersDocument17 pagesWeek 2 - (Reading) Introduction To Computersbright letsahNo ratings yet

- Week 4 - Computer NetworksDocument17 pagesWeek 4 - Computer Networksbright letsahNo ratings yet

- Risk and Return 1Document28 pagesRisk and Return 1bright letsahNo ratings yet

- Containers For Every Need: Maersk Equipment GuideDocument12 pagesContainers For Every Need: Maersk Equipment GuideSharath RadhakrishnanNo ratings yet

- The Need For Culturally Relevant Dance EducationDocument7 pagesThe Need For Culturally Relevant Dance Educationajohnny1No ratings yet

- WWDC 2020 Viewing GuideDocument13 pagesWWDC 2020 Viewing GuidejuniorNo ratings yet

- Organ TransplantationDocument36 pagesOrgan TransplantationAnonymous 4TUSi0SqNo ratings yet

- CW-80 ManualDocument12 pagesCW-80 ManualBrian YostNo ratings yet

- DM Plan Manda Upazila Noagaon District - English Version-2014Document104 pagesDM Plan Manda Upazila Noagaon District - English Version-2014CDMP BangladeshNo ratings yet

- A Study On Supply Chain and Logistics Managemernt For K.M.B GraniteDocument50 pagesA Study On Supply Chain and Logistics Managemernt For K.M.B GraniteRaja Thrisangu100% (1)

- PACEDocument23 pagesPACEGonzalo SkuzaNo ratings yet

- PSV Circular 29 of 2023Document422 pagesPSV Circular 29 of 2023Bee MashigoNo ratings yet

- Causes and Effects of The Cold WarDocument2 pagesCauses and Effects of The Cold WarkhanrrrajaNo ratings yet

- 47049-2623-402045analysis and Synthesis of MechanismsDocument4 pages47049-2623-402045analysis and Synthesis of MechanismsHarsh SinghNo ratings yet

- List of Affilited CollegesDocument28 pagesList of Affilited Collegesuzma nisarNo ratings yet

- Job Offer Electrical EngineerDocument3 pagesJob Offer Electrical EngineerAbner ZaldivarNo ratings yet

- ACT 1, SCENE 7: Macbeth's CastleDocument3 pagesACT 1, SCENE 7: Macbeth's CastleViranthi CoorayNo ratings yet

- Group 1 Prelims Test 3 Ans PDFDocument30 pagesGroup 1 Prelims Test 3 Ans PDFMT MuruganNo ratings yet

- Michigan Clinic 2008 NotesDocument10 pagesMichigan Clinic 2008 NotesCoach Brown100% (3)

- Anatomy and Physiology Outline PDFDocument2 pagesAnatomy and Physiology Outline PDFHampson MalekanoNo ratings yet

- GST Compensation CessDocument2 pagesGST Compensation CessPalak JioNo ratings yet

- 0000 Mathematica at WWUDocument11 pages0000 Mathematica at WWUWilhelm Richard WagnerNo ratings yet

- Week 1Document15 pagesWeek 1Jamaica AlejoNo ratings yet

- Vision N MissionDocument8 pagesVision N MissionIshpreet SinghNo ratings yet

- Kanban COP - Lean Kanban Training PDFDocument14 pagesKanban COP - Lean Kanban Training PDFEdward Schaefer100% (1)

- Hidden FiguresDocument4 pagesHidden FiguresMa JoelleNo ratings yet

- 6to Present Continuous AllDocument1 page6to Present Continuous AllEliana VogtNo ratings yet

- Surfactants and Emulsifying Agents: January 2009Document7 pagesSurfactants and Emulsifying Agents: January 2009Jocc Dee LightNo ratings yet

- Say's Law of Market and Quantity Theory of MoneyDocument19 pagesSay's Law of Market and Quantity Theory of MoneyBHANU TYAGINo ratings yet