Professional Documents

Culture Documents

Circular Income Flow in A Three Sector and Four Sector Economy

Uploaded by

Haren Shylak0 ratings0% found this document useful (0 votes)

3 views12 pagesOriginal Title

Circular Income Flow in a Three Sector and Four Sector Economy

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views12 pagesCircular Income Flow in A Three Sector and Four Sector Economy

Uploaded by

Haren ShylakCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

Circular Income Flow in a Three

Sector Economy with Government

• Government purchases goods and services just as

households and firms do.

• Government expenditure takes many forms

including spending on capital goods and

infrastructure (highways, power, communication),

on defense goods, and on education and public

health and so on.

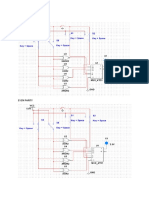

Circular Income Flow Model with Government

• Government expenditure may be financed through

taxes, out of assets or by borrowing.

• The money flow from households and business

firms to the government is labelled as tax payments

in Fig. 6.3

• This money flow includes all the tax payments

made by households less transfer payments

received from the Government. Transfer payments

are treated as negative tax payments.

• The government borrowing through its effect on

the rate of interest affects the behaviour of firms

and households.

• Business firms consider the interest rate as cost of

borrowing and the rise in the interest rate as a

result of borrowing by the Government lowers

private investment.

• However, households who view the rate of interest

as return on savings feel encouraged to save more.

• The inclusion of the Government sector

significantly affects the overall economic

situation.

• Total expenditure flow in the economy is

now the sum of consumption expenditure

(denoted by C), investment expenditure (I)

and Government expenditure (denoted by

G).

• Thus Total expenditure (E) = C + I + G …..(i)

• Total income (K) received is allocated to

consumption (C), savings (S) and taxes (T).

• Thus, Y = C + S + T … (ii)

• Since expenditure) made must be equal to the income

received (Y), from equations (i) and (ii) above we

have

• C + I + G = C + S + T … (iii)

• Since C occurs on both sides of the equation (iii) and

will therefore be cancelled out, we have

• I + G = S + T …(iv)

• By rearranging we obtain

• G – T = S – I … (v)

• Equation (v) is very significant as it depicts what

would be the consequences if government budget is

not balanced, that is, if Government expenditure (G) is

greater than the tax revenue (7), that is, G >T, the

government will have a deficit budget.

• To finance the deficit budget, the Government will

borrow from the financial market.

• For this purpose, then private investment by business

firms must be less than the savings of the households.

• Thus Government borrowing reduces private

investment in the economy. In other words,

Government borrowing crowds out private investment.

Money Income Flows in the Four Sector Open

Economy: Adding Foreign Sector

• To explain the money flows that are generated in an

open economy, that is, economy which have trade

relations with foreign countries.

• Thus, the inclusion of the foreign sector will reveal

to us the interaction of the domestic economy with

foreign countries.

• Foreigners interact with the domestic firms and

households through exports and imports of goods

and services as well as through borrowing and

lending operations through financial market.

• Goods and services produced within the domestic

territory which are sold to the foreigners are called

exports.

• On the other hand, purchases of foreign-made

goods and services by domestic households are

called imports.

• If exports are equal to the imports, then there exists a

balance of trade. Generally, exports and imports are not

equal to each other.

• If value of exports exceeds the value of imports, trade

surplus occurs.

• On the other hand if value of imports exceeds value of

exports of a country, trade deficit occurs.

• In the open economy there is interaction between

countries not only through exports and imports of goods

and services but also through borrowing and lending

funds or what is also called financial market.

• These days financial markets around the world have

become well integrated.

• From the circular flows that occur in the open economy the

national income must be measured by aggregate

expenditure that includes net exports, that is, X-M where X

represents exports and M represents imports.

• Imports must be subtracted from the total expenditure on

foreign produced goods and services to get the value of net

exports.

Thus, in the open economy

• National Income = C + I + G + NX

• where NX represents net exports, X-M.

• Since national income can be either consumed, saved or

paid as taxes to the Government we have

• C + I + G + NX = C + S + T

You might also like

- Product Analytics For DummiesDocument21 pagesProduct Analytics For DummiesHaren ShylakNo ratings yet

- GTM Strategy For Nike's NeoStrideDocument3 pagesGTM Strategy For Nike's NeoStrideHaren ShylakNo ratings yet

- Uber Case StudyDocument16 pagesUber Case StudyHaren ShylakNo ratings yet

- Major Difference Between Micro and Macro EconomicsDocument7 pagesMajor Difference Between Micro and Macro EconomicsHaren ShylakNo ratings yet

- The Concepts of National IncomeDocument22 pagesThe Concepts of National IncomeHaren ShylakNo ratings yet

- Product Assignment - Scheduling Interviews - by Vishal Goyal - Nov, 2023 - MediumDocument12 pagesProduct Assignment - Scheduling Interviews - by Vishal Goyal - Nov, 2023 - MediumHaren ShylakNo ratings yet

- Trip Advisor Case StudyDocument3 pagesTrip Advisor Case StudyHaren ShylakNo ratings yet

- FALLSEM2019-20 ECE1004 ETH VL2019201003919 Reference Material V 02-Aug-2019 Ref 31Document82 pagesFALLSEM2019-20 ECE1004 ETH VL2019201003919 Reference Material V 02-Aug-2019 Ref 31Haren ShylakNo ratings yet

- Circular Flow of IncomeDocument19 pagesCircular Flow of IncomeHaren ShylakNo ratings yet

- FALLSEM2019-20 ECE1004 ETH VL2019201003919 Reference Material I 02-Aug-2019 FourierSeries 4Document20 pagesFALLSEM2019-20 ECE1004 ETH VL2019201003919 Reference Material I 02-Aug-2019 FourierSeries 4Haren ShylakNo ratings yet

- 21 Continuous-Time Second-Order Systems: Solutions To Recommended ProblemsDocument15 pages21 Continuous-Time Second-Order Systems: Solutions To Recommended ProblemsHaren ShylakNo ratings yet

- Nature and Scope of MacroeconomicsDocument12 pagesNature and Scope of MacroeconomicsHaren Shylak0% (1)

- Say's Law of MarketDocument14 pagesSay's Law of MarketHaren ShylakNo ratings yet

- Importance of Macro EconomicsDocument9 pagesImportance of Macro EconomicsHaren ShylakNo ratings yet

- 4-Terminated Lossless Transmission Line-09-Dec-2019Material - I - 09-Dec-2019 - Module - 1-3Document13 pages4-Terminated Lossless Transmission Line-09-Dec-2019Material - I - 09-Dec-2019 - Module - 1-3Haren ShylakNo ratings yet

- Electrodynamics - I: Dr. Yogesh Kumar ChoukikerDocument13 pagesElectrodynamics - I: Dr. Yogesh Kumar ChoukikerHaren ShylakNo ratings yet

- Electrostatics - I: Dr. Yogesh Kumar ChoukikerDocument8 pagesElectrostatics - I: Dr. Yogesh Kumar ChoukikerHaren ShylakNo ratings yet

- Labtask 2Document3 pagesLabtask 2Haren ShylakNo ratings yet

- 2-Equivalent Circuit For A Transmission line-04-Dec-2019Material - I - 04-Dec-2019 - Module-1 - 1Document16 pages2-Equivalent Circuit For A Transmission line-04-Dec-2019Material - I - 04-Dec-2019 - Module-1 - 1Haren ShylakNo ratings yet

- FALLSEM2019-20 ECE1003 TH VL2019201000575 Reference Material I 04-Sep-2019 Lecture 16 19 PDFDocument7 pagesFALLSEM2019-20 ECE1003 TH VL2019201000575 Reference Material I 04-Sep-2019 Lecture 16 19 PDFHaren ShylakNo ratings yet

- A Technique To Encrypt-Decrypt Stereo Wave File: October 2016Document7 pagesA Technique To Encrypt-Decrypt Stereo Wave File: October 2016Haren ShylakNo ratings yet

- Electrostatics - IX: Dr. Yogesh Kumar ChoukikerDocument4 pagesElectrostatics - IX: Dr. Yogesh Kumar ChoukikerHaren ShylakNo ratings yet

- Name - Harenshylak M KDocument7 pagesName - Harenshylak M KHaren ShylakNo ratings yet

- 1-Introduction To Transmission lines-02-Dec-2019Material - I - 02-Dec-2019 - Module1 - 1Document27 pages1-Introduction To Transmission lines-02-Dec-2019Material - I - 02-Dec-2019 - Module1 - 1Haren ShylakNo ratings yet

- Aec Project 1Document5 pagesAec Project 1Haren ShylakNo ratings yet

- Introduction To Nanoscience and Nanotechnology (Ece1006)Document10 pagesIntroduction To Nanoscience and Nanotechnology (Ece1006)Haren ShylakNo ratings yet

- 5-Voltage, Current, and Impedance Variation Along A Short Circuited & Open Circuited Transmission line-11-Dec-2019MDocument8 pages5-Voltage, Current, and Impedance Variation Along A Short Circuited & Open Circuited Transmission line-11-Dec-2019MHaren ShylakNo ratings yet

- 3-Lossless Line, Solving problems-05-Dec-2019Material - I - 05-Dec-2019 - Module-1-2Document24 pages3-Lossless Line, Solving problems-05-Dec-2019Material - I - 05-Dec-2019 - Module-1-2Haren ShylakNo ratings yet

- Aec ProjectDocument4 pagesAec ProjectHaren ShylakNo ratings yet

- DLD DaDocument2 pagesDLD DaHaren ShylakNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fixed Asset Guide For Financial ReportingDocument13 pagesFixed Asset Guide For Financial ReportingSyed Nafis JunaedNo ratings yet

- Invoice GoogleDocument2 pagesInvoice GoogleRizki BaihakiNo ratings yet

- Note For ISO 27001Document6 pagesNote For ISO 27001Piiseth KarPearNo ratings yet

- Balaji ResumeDocument3 pagesBalaji ResumeNaveen KumarNo ratings yet

- LBR JWB Sesi 1 - Bandung Computer - 2022-1Document49 pagesLBR JWB Sesi 1 - Bandung Computer - 2022-1Indah NuraeniNo ratings yet

- Su B.com (General) Cbcs Semester III SyllabusDocument11 pagesSu B.com (General) Cbcs Semester III SyllabusVivek VickieNo ratings yet

- Thames and Hudson. - Olins, Wally - Brand New - The Shape of Brands To Come-Thames & Hudson (2014) - P15nsk1m01171uj4j1ukk1s6j4Document164 pagesThames and Hudson. - Olins, Wally - Brand New - The Shape of Brands To Come-Thames & Hudson (2014) - P15nsk1m01171uj4j1ukk1s6j4Raul Diaz MirandaNo ratings yet

- The Innovation of Grocery StoreDocument5 pagesThe Innovation of Grocery StoreNguyễn Hồng VũNo ratings yet

- Thanks For Downloading A Sample Plan: Click Here To Save 50% Off The First Month of Liveplan!Document35 pagesThanks For Downloading A Sample Plan: Click Here To Save 50% Off The First Month of Liveplan!deshanNo ratings yet

- Assignment On GSTDocument12 pagesAssignment On GSTTushar BhatiNo ratings yet

- Technical Specifications For Construction Tower Support 113-Shc-Ta-001 and 113-Sch-Ta-002 at The Coke Handling SystemDocument12 pagesTechnical Specifications For Construction Tower Support 113-Shc-Ta-001 and 113-Sch-Ta-002 at The Coke Handling SystemAna RojasNo ratings yet

- Casestudy 2Document8 pagesCasestudy 2Sugaintheran MuniandyNo ratings yet

- Student Fees Guide Book Final Year 2022Document98 pagesStudent Fees Guide Book Final Year 2022lindokuhlemashaba877No ratings yet

- 1668685479145-Tender No 005 Supply of SmatrphonesDocument31 pages1668685479145-Tender No 005 Supply of SmatrphonesGeorge MbuthiaNo ratings yet

- Group 2 Report (Lea 13 - SLCB)Document48 pagesGroup 2 Report (Lea 13 - SLCB)yvonneNo ratings yet

- Module 12. Cost Volume Profit Analysis 22.06.2012Document36 pagesModule 12. Cost Volume Profit Analysis 22.06.2012vini2710No ratings yet

- 12e.MCQs.C1 For StsDocument12 pages12e.MCQs.C1 For StsTrang HoàngNo ratings yet

- 9 Investing Secrets of Warren BuffettDocument31 pages9 Investing Secrets of Warren Buffettsatoni12No ratings yet

- HULDocument10 pagesHUL..sravana karthikNo ratings yet

- AgribusinessDocument234 pagesAgribusinessPurna DhanukNo ratings yet

- 21.1.7 Campus Support - Internal Revenue ServiceDocument150 pages21.1.7 Campus Support - Internal Revenue ServiceRichard eldon wood100% (1)

- Data Science and Big Data AnalyticsDocument2 pagesData Science and Big Data Analyticsanbhute3484No ratings yet

- The Hospitality Business ToolkitDocument17 pagesThe Hospitality Business ToolkitOanaa ComanNo ratings yet

- Global Supplier Manual Revsion 32Document21 pagesGlobal Supplier Manual Revsion 32sudar1477No ratings yet

- 2022SC Lecture Notes Topic1.1 OrientationDocument12 pages2022SC Lecture Notes Topic1.1 OrientationAsadvirkNo ratings yet

- Splunk Pricing OptionsDocument3 pagesSplunk Pricing OptionseDu809No ratings yet

- BMN 506 - Week 2Document87 pagesBMN 506 - Week 2Shubham SrivastavaNo ratings yet

- CH 3 Test Your UnderstandingDocument5 pagesCH 3 Test Your UnderstandingPutin PhyNo ratings yet

- AllcargotodDocument12 pagesAllcargotodNikhil kumarNo ratings yet

- Suggested Solution To Mid Year Test - AFM300 - 2015Document11 pagesSuggested Solution To Mid Year Test - AFM300 - 2015Dolly VongweNo ratings yet