Professional Documents

Culture Documents

Topic-1-An Overview of Taxation

Uploaded by

Javed Anwar0 ratings0% found this document useful (0 votes)

7 views29 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views29 pagesTopic-1-An Overview of Taxation

Uploaded by

Javed AnwarCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 29

An Overview of Taxation

Prof. Javed Anwar

General Understanding of Tax

• Literal meanings ----- Burden, Strain

• General Definition of Tax

– General compulsory contributions of wealth levied

upon persons by the state, to meet the expenses

incurred in providing common benefits to the

residents.

General Understanding of Tax

• Statutory Definition of Tax

– Tax means any tax imposed under chapter II includes a

penalty, fee or other charge or any sum or amount leviable

or payable under this ordinance.

• Taxes Vs Fees:

– Taxes are compulsory levy and it is the legal obligation of

the person to pay the amount of tax which is required to

pay under the law, where as payment of fee is the

discretion of any person and when a fee is paid, the person

becomes an entitled to claim counter benefits.

– Taxes are important instrument of Fiscal Policy.

OBJECTIVES OF TAX LAWS

• Definition of taxation and objectives of the

taxation laws

• Non-revenue objectives

• Illustration

• Taxes as mean for development

Definition of taxation and objectives of the

taxation laws

• Taxation is defined in many ways, common

definition is as under:

– It is the process by which the sovereign, through its law

making body, raises revenues in order to use it for

expenses of government.

– It is a means for the government in increasing its revenue

under the authority of the law, purposely used to promote

welfare and protection of its citizenry.

– It is the collection of the share of individual and

organizational income by a government under the

authority of the law.

Non-revenue objectives

• Taxes are primary revenue yielding tools of

the Government of modern ages. The

government levies taxes in order to achieve

following objectives:

– For collection of revenue to run and administer the

Government;

– To use as a tool for implementation of its policies;

and

– For fair distribution of wealth.

Non-revenue objectives

• Aside from purely financing government

operational expenditures, taxation is also

utilized as a tool to carry out the national

objective of social and economic development.

– To strengthen anemic enterprises by granting them

tax exemptions or other conditions or incentives

for growth;

– To protect local industries against foreign

competition by increasing local import taxes;

Non-revenue objectives

• As a bargaining tool in trade negotiations with other

countries;

• To counter the effects of inflation or depression;

• To reduce inequalities in the distribution of wealth;

• To promote science and invention, finance educational

activities or maintain and improve the efficiency of local

forces;

• To implement laws which eliminate discrimination

among various elements in the markets/businesses.

• To discourage certain undesirable sectors and activities.

Taxes as means for development

• Taxes are one of the main sources for

development. This is not because revenue

collected by the state is used on developmental

projects. Rather, taxes can be used in many

different ways for development of the country.

Some examples are as under:

Taxes as means for development

• The Government can declare some areas as

free zone, industrial zone, and economic zone

and provide tax incentives to such areas. Such

incentives could attract

businessman/industrialist who may opt to

establish business concerns/industrial units

that would bring employment, opportunities

and overall prosperity in these under

developed areas.

Taxes as means for development

• Taxing the rich at higher rates while taxing the low income

groups at lower tax rates.

• Imposition of high custom duty rates on luxury items or items

which are also manufactured in Pakistan. This promotes local

manufacturers and industry.

• Tax credits on charity/donations to promote welfare

activities.

• Tax exemptions to charity organisation/educational

institutions to promote these activities.

• Tax incentives for agro based projects to promote agriculture.

BASICS OF TAXATION LAWS

• Basics of tax laws

• Principles for levy of tax

• Structure of taxes

• Characteristics of tax laws

• Forms of escape from taxation

• Strategies of taxation management

• Illustration

BASICS OF TAX LAWS

• Adam Smith’s in his famous book “Wealth of Nations” has

elaborated following canons of Taxation:

– Equality

• Tax payments should be proportional to income and

applied equally to all concerned areas

– Certainty

• Tax liabilities should be clear and certain

– Convenience of payment

• Taxes should be collected at a time and in a manner

convenient for taxpayer

– Economy of collection

• Taxes should not be expensive to collect and should not

discourage business.

Principles for levy of tax

Following are some broad principles for levy of taxes:

• The Benefit Principle.

– This principle holds that the individuals should be taxed in proportion

to the benefits they receive from the governments and that taxes should

be paid by those people who receive the direct benefit of government

programs and projects out of the taxes paid.

• The Ability-to-Pay Principle.

– This principle holds that taxes should relate with the person’s income

or the ability to pay, that is, those with greater income or wealth who

can afford to pay should be taxed. Similarly, even rate of tax could

increase with higher income.

• The Equal-Distribution Principle.

– Income, wealth, and transaction may be taxed at a fixed percentage;

that is, people who earn more and spend more should pay more taxes,

but not pay a higher rate of tax.

Structure of taxes

• Proportional tax.

– A tax system that requires the same percentage of

income from all taxpayers, regardless of their

earnings. A proportional tax applies the same tax

rate across low-, middle- and high-income

taxpayers. The proportional tax is in contrast to a

progressive tax, where taxpayers with higher

incomes pay higher tax rates than taxpayers with

lower incomes.

• A proportional tax is also called a flat tax.

Structure of taxes

• Regressive tax.

– A tax that takes a larger percentage from a person’s low-

income than from another person’s high-income. A

regressive tax is generally a tax that is applied uniformly.

This means that it hits lower-income individuals harder.

• Progressive tax.

– A tax that takes a larger percentage from high-income

earners than it does from low-income earners. In other

words, the more one earns, the more tax he would have to

pay. The tax amount is proportionately equal to someone’s

status in the society. A rich man should pay more than a

poor man.

Characteristics of tax laws

Following are major characteristics of a taxation system:

• It is enforced contribution.

– Its payment is not voluntary in nature, and the imposition is

not dependent upon the will of the person taxed.

• It is generally payable in cash.

– This means that payment by cheques, promissory notes, or

in kind is not accepted.

• It is proportionate in character.

– Payment of taxes should be based on the ability to pay

principle; higher income of the tax payer, the bigger

amount of the tax paid.

Characteristics of tax laws

• It is levied (to impose; collect) on income, , transactions or

property.

– There are taxes that are imposed or levied on acts, rights or

privileges.

• It is levied by the state which has jurisdiction over the person or

property.

– As a general rule, only persons, properties, acts, right or

transaction within the jurisdiction of the taxing state are subjects

for taxation.

• It is levied by the law making body of the state.

– This means that law must be enacted first by the Parliament in

Pakistan.

• It is levied for public purposes.

– Taxes are imposed to support the government in implementation

of projects and programs.

Characteristics of tax laws

• Fiscal adequacy

– Means that the sources of revenue taken as a whole

should be sufficient to meet the expenditures of the

government, regardless of business, export taxes,

trade balances, and problems of economic

adjustments. Revenues should be capable of

expanding or contracting annually in response to

variations in public expenditures.

• Equality or Theoretical Justice.

– Means the taxes levied must be based upon the

ability of the citizen to pay.

Characteristics of tax laws

• Administrative Feasibility.

– This principle connotes that in a successful tax system,

such tax should be clear and plain to taxpayers, capable of

enforcement by an adequate and well-trained public

officials, convenient as to the time and manner of payment,

and not unduly burdensome to discourage business activity.

• Consistency or Compatibility with Economic

Goals.

– This refer to the tax laws that should be consistent with

economic goals or programs of the government which

pertain to basic services intended for the masses.

Forms of escape from taxation

• Shifting

– It is one way of passing the burden of tax

from one person to another.

– For example: Taxes paid by the

manufacturer may be shifted to the

consumer by adding the amount of the tax

paid to the price of the product.

Forms of escape from taxation

• Kinds of Shifting

– Forward shifting occurs when the burden of the

tax is transferred from a factor of the production to

the factor of distribution.

– Backward shifting occurs when the burden of tax

is transferred from the consumer to the producer or

manufacturer.

– Onward shifting occurs when tax is shifted two or

more times either forward or backward.

Forms of escape from taxation

• Capitalization

– This refers to the reduction in the price of

the tax object to the capitalized value of

future taxes which the purchaser expects to

be called upon to pay.

– For example: A reduction made by the seller

on the price of the real estate, in anticipation

of the future tax to be shouldered by the

future buyer.

Forms of escape from taxation

• Transformation occurs when the

manufacturer or producer upon whom the tax

has been imposed pays the tax and endeavors

to “recoup” (make up for) himself by

improving his process of production.

Forms of escape from taxation

• Tax Exemption is the granting of immunity or

freedom from a financial charge or obligation

or burden to which others are subjected.

– Grounds for tax exemption:

– Contract, wherein the government is the

contracting party.

– Public policy

– Reciprocity

Strategies of taxation management

• Tax practitioners and taxpayer normally adopts

any of the following technique to lessen tax

burden:

– Tax avoidance is generally the legal exploitation

of the tax regime to one's own advantage, to

attempt to reduce the amount of tax that is payable

by means that are within the law whilst making a

full disclosure of the material information to the

tax authorities. Examples of tax avoidance involve

using tax deductions, changing one's business

structure through incorporation or establishing an

offshore company in a tax haven.

Strategies of taxation management

– By contrast tax evasion is the general term for

efforts by individuals, firms, trusts and other

entities to evade the payment of taxes by illegal

means. Tax evasion usually entails taxpayers

deliberately misrepresenting or concealing the true

state of their affairs to the tax authorities to reduce

their tax liability, and includes, in particular,

dishonest tax reporting (such as under declaring

income, profits or gains; or overstating

deductions).

You might also like

- Taxation Overview: Objectives, Principles and CharacteristicsDocument29 pagesTaxation Overview: Objectives, Principles and CharacteristicsJaved AnwarNo ratings yet

- Introduction to Taxation Principles and ConceptsDocument15 pagesIntroduction to Taxation Principles and ConceptsJarÎnAnJumChôwdhuryNo ratings yet

- Lecture-1-An Overview of TaxationDocument14 pagesLecture-1-An Overview of TaxationJaved AnwarNo ratings yet

- ACC717 Topic 1.TAXATIONDocument29 pagesACC717 Topic 1.TAXATIONJason MaelumaNo ratings yet

- TAXATION Chapter 1Document20 pagesTAXATION Chapter 1chandruNo ratings yet

- Lecture 2 - Taxation and Public SpendingDocument34 pagesLecture 2 - Taxation and Public SpendingAmelia BaileyNo ratings yet

- Lecture Notes - PEconomics IIDocument112 pagesLecture Notes - PEconomics IIAmelia BaileyNo ratings yet

- General Principles of Taxation ExplainedDocument22 pagesGeneral Principles of Taxation ExplainedMohammadNo ratings yet

- Gen. Principles of TaxationDocument22 pagesGen. Principles of TaxationPageduesca RouelNo ratings yet

- Unit-I Taxation by Prof. Anbalagan ChinniahDocument23 pagesUnit-I Taxation by Prof. Anbalagan ChinniahProf. Dr. Anbalagan ChinniahNo ratings yet

- Topic 3 Canons of TaxationDocument20 pagesTopic 3 Canons of TaxationJaved AnwarNo ratings yet

- Lec 9 Fiscal Policy TaxationDocument36 pagesLec 9 Fiscal Policy Taxationdua tanveerNo ratings yet

- Tax Management - An Overview of Taxation Principles and StructureDocument22 pagesTax Management - An Overview of Taxation Principles and StructureHASNAT SABIRNo ratings yet

- IntroductionDocument30 pagesIntroductionSeifu BekeleNo ratings yet

- General Principles of Taxation: Tax 111 - Income Taxation Ferdinand C. Importado Cpa, MbaDocument22 pagesGeneral Principles of Taxation: Tax 111 - Income Taxation Ferdinand C. Importado Cpa, Mbaangelo_maranan100% (1)

- Philippine Tax History and ConceptsDocument22 pagesPhilippine Tax History and ConceptsBJ Ambat100% (1)

- Characteristics and Types of TaxationDocument61 pagesCharacteristics and Types of TaxationYoseph KassaNo ratings yet

- Taxation LawsDocument15 pagesTaxation LawsVikas RockNo ratings yet

- Fiscal Policy and Public Finance Explained in 40 CharactersDocument21 pagesFiscal Policy and Public Finance Explained in 40 Charactersali mughalNo ratings yet

- Introduction To TaxationDocument28 pagesIntroduction To TaxationpcandohNo ratings yet

- Tax Equity and Canons ExplainedDocument25 pagesTax Equity and Canons ExplainedyebegashetNo ratings yet

- Public Finance CH 2Document30 pagesPublic Finance CH 2kussia toramaNo ratings yet

- Tax Planning and Management TaxDocument5 pagesTax Planning and Management TaxHarsha HarshaNo ratings yet

- Module 3 General Principles of TaxationDocument80 pagesModule 3 General Principles of TaxationFlameNo ratings yet

- Corporate Tax Planning and ManagementDocument46 pagesCorporate Tax Planning and ManagementViraja GuruNo ratings yet

- Chapter 1 Introduction To TaxationDocument21 pagesChapter 1 Introduction To TaxationErica FlorentinoNo ratings yet

- Taxation: Definition and Explanation Miss Rabia Asad Iqra University IslamabadDocument18 pagesTaxation: Definition and Explanation Miss Rabia Asad Iqra University IslamabadSaif Ur RehmanNo ratings yet

- Taxation TheoryDocument32 pagesTaxation TheoryKaycia HyltonNo ratings yet

- Tax Equity Principles ExplainedDocument25 pagesTax Equity Principles ExplainedEyob MogesNo ratings yet

- 5.1 Taxation IssuesDocument21 pages5.1 Taxation IssuesFranco FungoNo ratings yet

- Local Taxation GuideDocument20 pagesLocal Taxation GuideShanique WilliamsNo ratings yet

- Taxaton - EconDocument18 pagesTaxaton - EconJaugan MarkyNo ratings yet

- (Unit3) Public Revenue and TaxationDocument32 pages(Unit3) Public Revenue and Taxationaaquib1110No ratings yet

- Principles of TaxationDocument18 pagesPrinciples of TaxationTessie Cua100% (1)

- Chapter I Tax LawDocument44 pagesChapter I Tax LawzinedinaleNo ratings yet

- I. Concept of TaxationDocument7 pagesI. Concept of TaxationYen AneleyNo ratings yet

- Income Taxation 1Document86 pagesIncome Taxation 1guerradhonaelizaNo ratings yet

- GOV SECTOR FINANCEDocument48 pagesGOV SECTOR FINANCECM MukukNo ratings yet

- Definition of Taxation and Its Key ConceptsDocument16 pagesDefinition of Taxation and Its Key ConceptsMd. Rayhanul IslamNo ratings yet

- Government Without Any Expectation of Direct Return in Benefit ". Ability To Pay. Taxed in The Same Way Without Any DiscriminationDocument42 pagesGovernment Without Any Expectation of Direct Return in Benefit ". Ability To Pay. Taxed in The Same Way Without Any DiscriminationyebegashetNo ratings yet

- CHAPTER - 01 Caf2 TaxDocument23 pagesCHAPTER - 01 Caf2 TaxMuhammad JunaidNo ratings yet

- CLWTAXN General Principles of Taxation Part OneDocument46 pagesCLWTAXN General Principles of Taxation Part Oneclassic swagNo ratings yet

- Taxation and ObjectivesDocument32 pagesTaxation and ObjectivesgeddadaarunNo ratings yet

- Acfrogc9mb7nlbmkbcfuonpkva Vyrnoeit6djnpfc7lg6tcqzyu5ol816zlfbcl1raopr4fsadz2whfjxvv9nnopz-Lpheunvkzhneewx05ytz Fube13x36w Uybxnqntbje9wv-VkaanvllqmDocument48 pagesAcfrogc9mb7nlbmkbcfuonpkva Vyrnoeit6djnpfc7lg6tcqzyu5ol816zlfbcl1raopr4fsadz2whfjxvv9nnopz-Lpheunvkzhneewx05ytz Fube13x36w Uybxnqntbje9wv-VkaanvllqmCrystal MaeNo ratings yet

- Sources of Revenues of Local Government Units Sources of Revenues of Local Government UnitsDocument73 pagesSources of Revenues of Local Government Units Sources of Revenues of Local Government Unitsaige mascodNo ratings yet

- TaxationDocument15 pagesTaxationgyytgvyNo ratings yet

- Philippine Tax SystemDocument11 pagesPhilippine Tax SystemHyacinth Eiram AmahanCarumba LagahidNo ratings yet

- TAXATION REFORMSDocument27 pagesTAXATION REFORMSCaranay BillyNo ratings yet

- Presentation of Taxation - ScribdDocument17 pagesPresentation of Taxation - ScribdAbdellah BelhouariNo ratings yet

- Taxation Chapter OverviewDocument79 pagesTaxation Chapter OverviewKalkidan ZerihunNo ratings yet

- TAXATION001Document31 pagesTAXATION001Boqorka AmericaNo ratings yet

- Principles of TaxationDocument51 pagesPrinciples of TaxationAlvigrace PuguonNo ratings yet

- Importance of TaxDocument6 pagesImportance of Taxmahabalu123456789No ratings yet

- Introduction to Taxation PrinciplesDocument13 pagesIntroduction to Taxation PrinciplesApex LionheartNo ratings yet

- S.6 Ent One NotesDocument47 pagesS.6 Ent One NotesjamesrichardogwangNo ratings yet

- Taxation Law NotesDocument43 pagesTaxation Law NotesShruti AgrawalNo ratings yet

- Objectives and Principles of Taxation - GeeksforGeeksDocument5 pagesObjectives and Principles of Taxation - GeeksforGeeksLMRP2 LMRP2No ratings yet

- Principle of Equity, Uniformity and Progressivity of TaxationDocument3 pagesPrinciple of Equity, Uniformity and Progressivity of TaxationAshera MonasterioNo ratings yet

- PF Chapter - TwoDocument51 pagesPF Chapter - TwoBamlak WenduNo ratings yet

- Money and Banking Chapter 05Document26 pagesMoney and Banking Chapter 05Muntazir HussainNo ratings yet

- 1 MSA Syllabus Summer 2021Document6 pages1 MSA Syllabus Summer 2021Javed AnwarNo ratings yet

- Topic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANDocument18 pagesTopic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANJaved AnwarNo ratings yet

- CH 01Document13 pagesCH 01Javed AnwarNo ratings yet

- Taxable Income CalculationDocument24 pagesTaxable Income CalculationJaved AnwarNo ratings yet

- Topic-4-Basic Concepts of TaxationDocument8 pagesTopic-4-Basic Concepts of TaxationJaved AnwarNo ratings yet

- Taxable Income CalculationDocument24 pagesTaxable Income CalculationJaved AnwarNo ratings yet

- Chap 014Document22 pagesChap 014AhsanNo ratings yet

- Topic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANDocument18 pagesTopic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANJaved AnwarNo ratings yet

- Chap004 - Strategic Customer Relationship ManagementDocument13 pagesChap004 - Strategic Customer Relationship ManagementFarhadNo ratings yet

- Topic 3 Canons of TaxationDocument20 pagesTopic 3 Canons of TaxationJaved AnwarNo ratings yet

- Topic 3 Canons of TaxationDocument20 pagesTopic 3 Canons of TaxationJaved AnwarNo ratings yet

- Topic-4-Basic Concepts of TaxationDocument8 pagesTopic-4-Basic Concepts of TaxationJaved AnwarNo ratings yet

- Statutory Definitions ExplainedDocument26 pagesStatutory Definitions ExplainedJaved AnwarNo ratings yet

- Tax On Income: Prof. Javed AnwarDocument33 pagesTax On Income: Prof. Javed AnwarJaved AnwarNo ratings yet

- Strategic Marketing: 11. Pricing StrategyDocument26 pagesStrategic Marketing: 11. Pricing StrategyJaved AnwarNo ratings yet

- Strategic Marketing: 5. Capabilities For Learning About Customers and MarketsDocument25 pagesStrategic Marketing: 5. Capabilities For Learning About Customers and MarketsamitcmsNo ratings yet

- Lecture-2-BASIC FEATURES OF INCOME TAXDocument9 pagesLecture-2-BASIC FEATURES OF INCOME TAXJaved AnwarNo ratings yet

- Sample HeaderDocument1 pageSample HeaderJaved AnwarNo ratings yet

- Lecture-1-Islamic Banking, Theory and PracticesDocument33 pagesLecture-1-Islamic Banking, Theory and PracticesJaved AnwarNo ratings yet

- Lecture-3-Mudaraba As A Mode of Islamic FinanceDocument38 pagesLecture-3-Mudaraba As A Mode of Islamic FinanceJaved AnwarNo ratings yet

- Phulchand Exports Vs OOO PatriortDocument17 pagesPhulchand Exports Vs OOO PatriortAayush PandeyNo ratings yet

- Affidavit of Loss: IBP No. 017673 July 15, 2017 Tarlac ChapterDocument7 pagesAffidavit of Loss: IBP No. 017673 July 15, 2017 Tarlac ChapterRegua and MadambaNo ratings yet

- PNP SOP on Investigating Heinous CrimesDocument12 pagesPNP SOP on Investigating Heinous CrimesMark ViernesNo ratings yet

- 3.history Civics and Geography PDFDocument64 pages3.history Civics and Geography PDFloose manusyaNo ratings yet

- Dean'S Office: Second Floor PlanDocument1 pageDean'S Office: Second Floor PlanZy GarciaNo ratings yet

- Introduction The First World War and Its AftermathDocument8 pagesIntroduction The First World War and Its AftermathYASMIN SAADNo ratings yet

- Adcb - Faq - CrsDocument5 pagesAdcb - Faq - CrsAndrea FuentesNo ratings yet

- The Recovery of Debts Due To Banks and Financial Institutions ACT, 1993Document21 pagesThe Recovery of Debts Due To Banks and Financial Institutions ACT, 1993jagankilariNo ratings yet

- Dr. Bhimrao Ambedkar University, AgraDocument2 pagesDr. Bhimrao Ambedkar University, Agraajay sharmaNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoCentralised NumberNo ratings yet

- ڈپلیکیٹ بل - Jul-2023 - 0400024512868Document2 pagesڈپلیکیٹ بل - Jul-2023 - 0400024512868Adnan Ahmed KidwaiNo ratings yet

- Labor LawDocument2 pagesLabor LawChielsea CruzNo ratings yet

- Love God and Love Your Neighbor: The Great CommandmentsDocument4 pagesLove God and Love Your Neighbor: The Great CommandmentsMarcos SilvaNo ratings yet

- Brgy. Clearance SampleDocument5 pagesBrgy. Clearance SampleEdmar De Guzman Jane73% (11)

- Sabelo J Ndlovugatsheni Global Coloniality and The Challenges of Creating African Futures PDFDocument22 pagesSabelo J Ndlovugatsheni Global Coloniality and The Challenges of Creating African Futures PDFJakub CzmychNo ratings yet

- Plaintiff-Appellee: Second DivisionDocument14 pagesPlaintiff-Appellee: Second DivisionAurora SolastaNo ratings yet

- Iajuddin AhmedDocument6 pagesIajuddin AhmedMichael FelicianoNo ratings yet

- Special 510 (K) Summary: Medtronic VascularDocument6 pagesSpecial 510 (K) Summary: Medtronic VascularManoj NarukaNo ratings yet

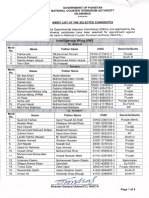

- Merit List of Selected CandidateDocument5 pagesMerit List of Selected CandidateAli Sher0% (1)

- Runbeti's Violation of International Law Regarding Its Wind Farm ProjectDocument117 pagesRunbeti's Violation of International Law Regarding Its Wind Farm ProjectMichaela PortarcosNo ratings yet

- Labor Dispute Rulings SummaryDocument332 pagesLabor Dispute Rulings SummaryLuis de leonNo ratings yet

- En Banc: Romeo A. Zarcilla and Marita Bumanglag, Complainants, V. Atty. Jose C. Quesada, JR., Respondent. DecisionDocument11 pagesEn Banc: Romeo A. Zarcilla and Marita Bumanglag, Complainants, V. Atty. Jose C. Quesada, JR., Respondent. DecisionM A J esty FalconNo ratings yet

- CS Form No. 9 Request For Publication of Vacant Positions With Instructions jUNE 7 2019Document2 pagesCS Form No. 9 Request For Publication of Vacant Positions With Instructions jUNE 7 2019John SantoNo ratings yet

- Go Go International-3Document2 pagesGo Go International-3sahil.goelNo ratings yet

- Brainy Kl6 Unit Test 1 A PDFDocument1 pageBrainy Kl6 Unit Test 1 A PDFwiktoriaNo ratings yet

- A Report On 10 Netiquette Guidelines Every Online StudentsDocument1 pageA Report On 10 Netiquette Guidelines Every Online StudentsJade BehecNo ratings yet

- VIEWMASTER CONSTRUCTION CORPORATION v. MAULITDocument1 pageVIEWMASTER CONSTRUCTION CORPORATION v. MAULITrhodz 88No ratings yet

- Sexual Harassment Case Studies ExplainedDocument20 pagesSexual Harassment Case Studies ExplainedMegumi ParkNo ratings yet

- Gateway VS AsianbankDocument2 pagesGateway VS AsianbankJulioNo ratings yet

- Admission of New States in IndiaDocument4 pagesAdmission of New States in IndiaMahi SrivastavaNo ratings yet