Professional Documents

Culture Documents

Management and Cost Accounting: Colin Drury

Management and Cost Accounting: Colin Drury

Uploaded by

maryam rajputtOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management and Cost Accounting: Colin Drury

Management and Cost Accounting: Colin Drury

Uploaded by

maryam rajputtCopyright:

Available Formats

MANAGEMENT

AND COST

ACCOUNTING

SIXTH EDITION

COLIN DRURY

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2004 Colin Drury

Part Four:

Information for planning, control and performance

Chapter Fifteen:

The budgeting process

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.1

Fig 15.1 An overview of the

planning process

1. Identify the objectives of the

organization.

2. Identify potential strategies.

3. Evaluate alternative

strategic options.

4. Select course of action.

5. Implement the long-term

plan in the form of the annual

budget.

6. Monitor actual results.

7. Respond to divergencies

from plan.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.2a

Why do we produce budgets?

1. To aid the planning of actual operations:

• by forcing managers to consider how conditions might

change and what steps should be taken now.

• by encouraging managers to consider problems before

they arise.

2. To co-ordinate the activities of the organization:

• by compelling managers to examine relationships

between their own operation and those of other

departments.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.2b

Why do we produce budgets?

3. To communicate plans to various responsibility centre managers:

• everyone in the organization should have a clear

understanding of the part they are expected to play in

achieving the annual budget.

• by ensuring appropriate individuals are made

accountable for implementing the budget.

4. To motivate managers to strive to achieve the budget goals:

• by focusing on participation

• by providing a challenge/target.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.2c

5. To control activities:

• by comparison of actual with budget (attention

directing/management by exception).

6. To evaluate the performance of managers:

• by providing a means of informing managers of how

well they are performing in meeting targets they

have previously set.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.3

Stages in the budgeting process

1.Communicate details of budget policy and guidelines to those people responsible

for preparing the budget.

2. Determine the factor that restricts output.

3. Preparation of the sales budget.

4. Initial preparation of budgets.

5. Negotiation of budgets with higher management. (See figure on slide 15.4)

6. Co-ordination and review of budgets.

7. Final acceptance of budgets.

8. Ongoing review of the budgets.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.4

Fig 15.4 An illustration of budgets moving up the organizational hierarchy.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.5a

Activity-based budgeting (ABB)

• Conventional budgeting is inappropriate for those activities where

the consumption of resources does not vary proportionately with the

volume of the final output of products or services.

• For support activities conventional incremental budgets merely

serve as authorization levels for certain levels of spending.

• Incremental budgeting results in the cost of non-unit level activities

becoming fixed.

• ABB aims to authorize only the supply of those resources that are

needed to perform activities required to meet budgeted production

and sales volumes.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.5b

• The ABB process is the reverse of the ABC process:

Budgeted output of cost objects

Determine the necessary activities

Determine the resources required for the budget period

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.6a

ABB involves the following stages:

1. Estimate the production and sales volume by individual products and

customers.

2. Estimate the demand for organizational activities.

(e.g.Process 5,000 customers’ orders for the customer order

processing activity)

3. Determine the resources that are required to perform organizational

activities.

(e.g.0.5 hours per order = 5,000 × 0.5 hours =

2,500 labour hours for the customer processing

activity must be supplied)

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.6b

4. Estimate for each resource the quantity that must be supplied to meet

the demand.

(e.g.Assume a step cost function with each

person employed contracted to work 1,500 hours

per year so that quantity of resources required =

2,500/1,500 =1.67 persons meaning that 2

persons must be employed)

5.Take action to adjust the capacity of resources to match the projected

supply.

(e.g If 3 persons are presently employed on the

activity resources must be reduced,or redeployed,

by one person)

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.7a

• Periodically actual results should be compared with an adjusted

(flexible)

budget.

Example

Budgeted activity for processing orders = 2,800 orders

Orders processed per person = 600

Resources required = 4.67 persons

Resources supplied

(practical capacity for 3,000 orders) = 5 persons

Employment costs (£25,000 per person per year) = £125,000

Cost driver rate (£125,000/3,000 orders) = £41.67

Actual orders processed for the period = 2,500 orders

Performance report:

Flexed budget (2,500 ×£41.67 ) = £104,175

Budgeted unused capacity (3,000 — 2,800)× £41.67 = 8,334

Unplanned unused capacity (2,800 –2,500)× £41.67 = 12,491

125,000

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

15.7b

• Above represent committed resources but for flexible resources

(e.g.office supplies) resources supplied can be matched exactly to

resources demanded.

• See sheet 8 for an illustration of an activity-based budget for an order

processing activity.

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

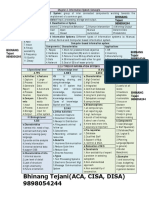

15.8

Exhibit 15.1 Activity-based budget for an order receiving process

Management and Cost Accounting, 6th edition, ISBN 1-84480-028-8

© 2000 Colin Drury

© 2004 Colin Drury

You might also like

- Petty Cash Exercises ANSWERSDocument2 pagesPetty Cash Exercises ANSWERSXDragunov Alcroix100% (10)

- Management and Cost Accounting Chapter 3Document28 pagesManagement and Cost Accounting Chapter 3Muhammad SohailNo ratings yet

- Raja Nand Kumar CaseDocument3 pagesRaja Nand Kumar CaseCAptain Sparrow0% (1)

- NescafeDocument49 pagesNescafepatil_rekha0873% (11)

- Chapter 1 Colin Drury 6eDocument19 pagesChapter 1 Colin Drury 6eMohsin Ali TajummulNo ratings yet

- Management and Cost Accounting: Colin DruryDocument23 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Colin Drury 6e Chapter 2Document18 pagesColin Drury 6e Chapter 2Mohsin Ali TajummulNo ratings yet

- Introduction of Cost - Man Accounting - 1Document24 pagesIntroduction of Cost - Man Accounting - 1Emmmanuel ArthurNo ratings yet

- Management and Cost Accounting: Colin DruryDocument21 pagesManagement and Cost Accounting: Colin Druryashok jaipalNo ratings yet

- Chapter 1 UpdatedDocument66 pagesChapter 1 UpdatedTran Ngoc Anh ThuNo ratings yet

- Chap 023Document11 pagesChap 023abdullah faisalNo ratings yet

- Chapter 2 Budgeting Maf420Document28 pagesChapter 2 Budgeting Maf420FeeZzy Fq100% (1)

- Introduction To Budgets and The Master BudgetDocument33 pagesIntroduction To Budgets and The Master BudgetkunalNo ratings yet

- Management and Cost Accounting: Colin DruryDocument18 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Lecture 1-Introduction To MADocument72 pagesLecture 1-Introduction To MAshanilmallawarajaNo ratings yet

- Management and Cost Accounting: Colin DruryDocument30 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Budget (!Document6 pagesBudget (!Timilehin GbengaNo ratings yet

- Chapter 1 Introduction To M&ADocument29 pagesChapter 1 Introduction To M&AK60 Phạm Thị Phương AnhNo ratings yet

- Full SlidesDocument293 pagesFull SlidesK60 Phạm Thị Phương AnhNo ratings yet

- Iafm Ch11 Fall 2023 NuDocument94 pagesIafm Ch11 Fall 2023 Nugigih satyaNo ratings yet

- Mab4 01Document20 pagesMab4 01Mohamed ElmahgoubNo ratings yet

- Mod 4 p2Document8 pagesMod 4 p2Jison FrancisNo ratings yet

- Topic 3 - Budgeting and Budgetary ControlDocument42 pagesTopic 3 - Budgeting and Budgetary ControlSYAZANA HUDA MOHD AZLINo ratings yet

- Tut 8 & 9Document4 pagesTut 8 & 9Tang TammyNo ratings yet

- Process of Management: Cost and Management Accounting: An OverviewDocument17 pagesProcess of Management: Cost and Management Accounting: An OverviewFAEETNo ratings yet

- Marginal Costing For Decision Making & CVP Analysis - BudgetingDocument15 pagesMarginal Costing For Decision Making & CVP Analysis - BudgetingSravya MagantiNo ratings yet

- Topic 6 Financial Management in The WorkshopDocument27 pagesTopic 6 Financial Management in The Workshopjohn nderitu100% (1)

- Task 4Document7 pagesTask 4babluanandNo ratings yet

- Management Accounting 1 An IntroductionDocument18 pagesManagement Accounting 1 An IntroductionLoshinee KrishnanmuthyNo ratings yet

- BudgetDocument17 pagesBudgetARRAICE YAM NERAKNo ratings yet

- Budget Types: 9 Types of Budget - Cost AccountancyDocument14 pagesBudget Types: 9 Types of Budget - Cost AccountancymbapritiNo ratings yet

- Part One: Introduction To Management and Cost Accounting Chapter One: Introduction To Management AccountingDocument19 pagesPart One: Introduction To Management and Cost Accounting Chapter One: Introduction To Management AccountingRajesh DantinaNo ratings yet

- Budgeting 101: By: Limheya Lester Glenn National University-ManilaDocument42 pagesBudgeting 101: By: Limheya Lester Glenn National University-ManilaXXXXXXXXXXXXXXXXXXNo ratings yet

- Assessment Task4Document15 pagesAssessment Task4ottoNo ratings yet

- F5 Part I Becker 2017Document246 pagesF5 Part I Becker 2017cabienoNo ratings yet

- Lecture 2 Nature and Objectives of Financial StatementsDocument22 pagesLecture 2 Nature and Objectives of Financial Statementsdev guptaNo ratings yet

- Cost and Management Accounting Chapter 06Document10 pagesCost and Management Accounting Chapter 06Muhammad SohailNo ratings yet

- Week 4 Lectures: Budgeting For Planning and ControlDocument56 pagesWeek 4 Lectures: Budgeting For Planning and ControlWinston 葉永隆 DiepNo ratings yet

- Budgeting f2Document104 pagesBudgeting f2Munyaradzi Onismas ChinyukwiNo ratings yet

- Budgeting and Budgetary Control 2019Document10 pagesBudgeting and Budgetary Control 2019Kerrice RobinsonNo ratings yet

- Ch9 - Budgetary PlanningDocument24 pagesCh9 - Budgetary PlanningTú NguyênNo ratings yet

- FIN4001 Assessment Questions 1Document10 pagesFIN4001 Assessment Questions 1Kreach411No ratings yet

- Chapter - Working CapitalDocument35 pagesChapter - Working CapitalchandoraNo ratings yet

- ACC705 Budgetting Lecture NotesDocument35 pagesACC705 Budgetting Lecture NotesRachel LeuaNo ratings yet

- MAHM8e Chapter01.Ab .AzDocument21 pagesMAHM8e Chapter01.Ab .AzNouman SheikhNo ratings yet

- Lecture 1 - OVERVIEW OF MANAGEMENT ACCOUNTINGDocument24 pagesLecture 1 - OVERVIEW OF MANAGEMENT ACCOUNTINGOkello PaulNo ratings yet

- Review FM (Q)Document11 pagesReview FM (Q)ektaNo ratings yet

- 1.1 Evolution of Management Accounting - Part 1Document23 pages1.1 Evolution of Management Accounting - Part 1Dabbie JoyNo ratings yet

- T2 Budgeting Behaviour (A)Document3 pagesT2 Budgeting Behaviour (A)JIN FEN SOONo ratings yet

- Management and Cost Accounting: Colin DruryDocument21 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- 2022SC Lecture Notes Topic2.1 Valuation Foundation 1Document26 pages2022SC Lecture Notes Topic2.1 Valuation Foundation 1AsadvirkNo ratings yet

- Unit 13 - BudgetsDocument20 pagesUnit 13 - BudgetsAdeirehs Eyemarket BrissettNo ratings yet

- Lecture 9: Budgeting: ACCT10001 Accounting Reports and AnalysisDocument38 pagesLecture 9: Budgeting: ACCT10001 Accounting Reports and AnalysisBáchHợpNo ratings yet

- Garrison12ce PPT Ch09Document129 pagesGarrison12ce PPT Ch09snsahaNo ratings yet

- MAHM8e Chapter01.Ab - AzDocument21 pagesMAHM8e Chapter01.Ab - AzOkta SelregaNo ratings yet

- Budgetary ControlDocument11 pagesBudgetary ControlrscjatNo ratings yet

- Budgeting Ch09Document10 pagesBudgeting Ch09CM_NguyenNo ratings yet

- PGP23 CMA PPT Module1 PDFDocument62 pagesPGP23 CMA PPT Module1 PDFShubham MeenaNo ratings yet

- Performance Management & ControlDocument13 pagesPerformance Management & ControlanisahNo ratings yet

- Budgeting LectureDocument59 pagesBudgeting LectureCristineNo ratings yet

- Management and Cost Accounting: Colin DruryDocument21 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Management and Cost Accounting: Colin DruryDocument30 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Management and Cost Accounting: Colin DruryDocument24 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Management and Cost Accounting: Colin DruryDocument18 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Mobile Id Client Reference Guide V 2 7 PDFDocument49 pagesMobile Id Client Reference Guide V 2 7 PDFNyamdorj PurevbatNo ratings yet

- DM816x C6A816x AM389x EVM Quick Start GuideDocument2 pagesDM816x C6A816x AM389x EVM Quick Start GuideMichal KrawczynskiNo ratings yet

- Economics Today The Macro View 18th Edition Miller Solutions ManualDocument15 pagesEconomics Today The Macro View 18th Edition Miller Solutions Manualletitiamelanienhz100% (31)

- Numerical Simulation of 1D Heat Conduction in Spherical and Cylindrical Coordinates by Fourth-Order Finite Difference MethodDocument5 pagesNumerical Simulation of 1D Heat Conduction in Spherical and Cylindrical Coordinates by Fourth-Order Finite Difference MethodGokma Sahat Tua SinagaNo ratings yet

- Kepimpinan Strategik Dan Hubungannya Dengan Kualiti Pengajaran GuruDocument13 pagesKepimpinan Strategik Dan Hubungannya Dengan Kualiti Pengajaran GuruGunalatcumy KarunanitheNo ratings yet

- Ilano v. Hon. Espanol, G.R. No. 161756, 16 December 2005Document6 pagesIlano v. Hon. Espanol, G.R. No. 161756, 16 December 2005Jessamine OrioqueNo ratings yet

- Eng Spec For Fire Fighting System DesignDocument27 pagesEng Spec For Fire Fighting System DesignIndunil WarnasooriyaNo ratings yet

- 800 Series: Articulating Boom LiftsDocument2 pages800 Series: Articulating Boom LiftsRAFA SNo ratings yet

- IGNOU MVPP 1 (PGDFSQM) PROJECT - Development of Training Modules For Workers On GMP & GHPDocument7 pagesIGNOU MVPP 1 (PGDFSQM) PROJECT - Development of Training Modules For Workers On GMP & GHPNiklausNo ratings yet

- Dynamic Testing: White Box Testing Techniques: © Oxford University Press 2011. All Rights ReservedDocument33 pagesDynamic Testing: White Box Testing Techniques: © Oxford University Press 2011. All Rights ReservedShaurya KumarNo ratings yet

- Motor Kubota Oc-Serie (Epa Tier 4)Document13 pagesMotor Kubota Oc-Serie (Epa Tier 4)Kevin Ricardo Mendoza AmadorNo ratings yet

- Code::Blocks Manual: Version 2.0 BetaDocument140 pagesCode::Blocks Manual: Version 2.0 BetaQuite omiNo ratings yet

- CMHC Annual Report 2022 enDocument177 pagesCMHC Annual Report 2022 enHelena MarlynNo ratings yet

- Cash Flow Estimation and Risk AnalysisDocument39 pagesCash Flow Estimation and Risk AnalysisRanyDAmandaNo ratings yet

- Qra HPCL Jalandhar Ird-Draft r1Document92 pagesQra HPCL Jalandhar Ird-Draft r1PABNo ratings yet

- Isca Chap 2 Revision ChartDocument2 pagesIsca Chap 2 Revision ChartKumar SwamyNo ratings yet

- Use of GENTPJ Generator ModelDocument13 pagesUse of GENTPJ Generator Modelabdulkadir aliNo ratings yet

- Sharing Options: Share or Embed DocumentDocument64 pagesSharing Options: Share or Embed DocumentREYES, JANICENo ratings yet

- Mit Neet Globalstateengineeringeducation2018 PDFDocument170 pagesMit Neet Globalstateengineeringeducation2018 PDFAljohn CamuniasNo ratings yet

- Crack Microsoft Excel Password FreeDocument5 pagesCrack Microsoft Excel Password FreeHoang VânNo ratings yet

- FSAE Powertrain Packaging - MITDocument42 pagesFSAE Powertrain Packaging - MITPreetam RayNo ratings yet

- Congratulations! You Are On One Airtel 1349 PlanDocument10 pagesCongratulations! You Are On One Airtel 1349 Plansandeep salavarNo ratings yet

- Vsphere Storage Appliance 10 Install ConfigDocument50 pagesVsphere Storage Appliance 10 Install Configstefmont2004No ratings yet

- Research Paper Servo MotorDocument6 pagesResearch Paper Servo Motorc9rz4vrm100% (1)

- Americare BrochureDocument2 pagesAmericare BrochureEthan WeisheitNo ratings yet

- 66 - 15575 - EC 732 - 2014 - 1 - 1 - 2 - Chapter 2 - ADocument30 pages66 - 15575 - EC 732 - 2014 - 1 - 1 - 2 - Chapter 2 - AMourougapragash Subramanian50% (2)

- 25 - Vvimp Interview QuestionsDocument14 pages25 - Vvimp Interview QuestionsBala RanganathNo ratings yet