Professional Documents

Culture Documents

Chapter 10

Uploaded by

kenkoroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 10

Uploaded by

kenkoroCopyright:

Available Formats

Table of Contents

Chapter 10 (Forecasting)

An Overview of Forecasting Techniques (Section 10.1) 10.2–10.8

A Case Study: The Computer Club Warehouse Problem (Section 10.2) 10.9–10.13

Applying Time-Series Forecasting to the Case Study (Section 10.3) 10.14–10.30

The Time-Series Forecasting Methods in Perspective (Section 10.4) 10.31–10.35

Causal Forecasting with Linear Regression (Section 10.5) 10.36–10.40

Judgmental Forecasting Methods (Section 10.6) 10.41

McGraw-Hill/Irwin 10.1 © The McGraw-Hill Companies, Inc., 2013

Forecasting at Fastchips

• Fastchips is a leading producer of microprocessors.

• Six months ago, it launched the sales of its latest microprocessor.

• Month-by-month sales (in thousands) over the initial six months have been

17 25 24 26 30 28

Question: What is the forecast for next month’s sales?

McGraw-Hill/Irwin 10.2 © The McGraw-Hill Companies, Inc., 2013

The Last-Value Forecasting Method

The last-value forecasting method ignores all data points in a time series except

the last one.

Forecast = Last value

Fastchips: Month-by-month sales (in thousands) over the initial six months:

17 25 24 26 30 28

Forecast = 28

McGraw-Hill/Irwin 10.3 © The McGraw-Hill Companies, Inc., 2013

The Averaging Forecasting Method

The averaging forecasting method uses all the data points in the time series and

simply averages these points.

Forecast = Average of all data to date

Fastchips: Month-by-month sales (in thousands) over the initial six months:

17 25 24 26 30 28

Forecast = (17+25+24+26+30+28) / 6 = 25

McGraw-Hill/Irwin 10.4 © The McGraw-Hill Companies, Inc., 2013

The Moving-Average Forecasting Method

The moving-average forecasting method averages the data for only the most

recent time periods.

n = Number of recent periods to consider as relevant for forecasting

Forecast = Average of last n values

Fastchips: Month-by-month sales (in thousands) over the initial six months:

17 25 24 26 30 28

Forecast (n=3) = (26+30+28) / 3 = 28

McGraw-Hill/Irwin 10.5 © The McGraw-Hill Companies, Inc., 2013

The Exponential Smoothing Forecasting Method

• The exponential smoothing forecasting method provides a more

sophisticated version of the moving-average method.

• It gives the greatest weight to the last month and then progressively smaller

weights to the older months.

• Exponential smoothing with trend adjusts exponential smoothing by also

directly considering any current upward or downward trend in sales.

McGraw-Hill/Irwin 10.6 © The McGraw-Hill Companies, Inc., 2013

Linear Regression

• Linear regression uses a two-dimensional graph with sales measured along

the vertical axis and time measured along the horizontal axis.

• After plotting the sales data, this method finds a line passing through the midst

of the data as closely as possible.

• The extension of the line into future months provides the forecast of sales in

these future months.

McGraw-Hill/Irwin 10.7 © The McGraw-Hill Companies, Inc., 2013

Measuring the Forecast Error

• The mean absolute deviation (called MAD) measures the average forecasting

error.

MAD = (Sum of forecasting errors) / (Number of forecasts)

• The mean square error (often abbreviated MSE) measures the average of the

square of the forecasting error.

MSE = (Sum of square of forecasting errors) / (Number of forecasts).

• The MSE increases the weight of large errors relative to the weight of small

errors.

McGraw-Hill/Irwin 10.8 © The McGraw-Hill Companies, Inc., 2013

The Computer Club Warehouse (CCW)

• The Computer Club Warehouse (CCW) sells computer products at bargain

prices by taking telephone orders (as well as website and fax orders) directly

from customers.

• Products include computers, peripherals, supplies, software, and computer

furniture.

• The CCW call center is never closed. It is staffed by dozens of agents to take

and process customer orders.

• A large number of telephone trunks are provided for incoming calls. If an

agent is not free when a call arrives, it is placed on hold. If all the trunks are in

use (called saturation), the call receives a busy signal.

• An accurate forecast of the demand for agents is needed.

Question: How should the demand for agents be forecasted?

McGraw-Hill/Irwin 10.9 © The McGraw-Hill Companies, Inc., 2013

25 Percent Rule (Current Forecasting Method)

Since sales are relatively stable through the year except for a substantial increase

during the Christmas season, assume that each quarter’s call volume will be the

same as the preceding quarter, except for adding 25 percent for Quarter 4.

Forecast for Quarter 2 = Call volume for Quarter 1

Forecast for Quarter 3 = Call volume for Quarter 2

Forecast for Quarter 4 = 1.25(Call volume for Quarter 3)

Forecast for next Quarter 1 = (Call volume for Quarter 4) / 1.25

McGraw-Hill/Irwin 10.10 © The McGraw-Hill Companies, Inc., 2013

Average Daily Call Volume (3 Years of Data)

A B C D E

1 CCW's Average Daily Call Volume

2

3 Year Quarter Call Volume

4 1 1 6,809

5 1 2 6,465

6 1 3 6,569

7 1 4 8,266

8 2 1 7,257

9 2 2 7,064

10 2 3 7,784

11 2 4 8,724

12 3 1 6,992

13 3 2 6,822

14 3 3 7,949

15 3 4 9,650

McGraw-Hill/Irwin 10.11 © The McGraw-Hill Companies, Inc., 2013

Applying the 25-Percent Rule

A B C D E F G H I

1 Current Forecasting Method for CCW's Average Daily Call Volume

2

3 Forecasting

4 Year Quarter Data Forecast Error Mean Absolute Deviation

5 1 1 6,809 MAD = 424

6 1 2 6,465 6,809 344

7 1 3 6,569 6,465 104 Mean Square Error

8 1 4 8,266 8,211 55 MSE = 317,815

9 2 1 7,257 6,613 644

10 2 2 7,064 7,257 193

11 2 3 7,784 7,064 720

12 2 4 8,724 9,730 1,006

13 3 1 6,992 6,979 13

14 3 2 6,822 6,992 170

15 3 3 7,949 6,822 1,127

16 3 4 9,650 9,936 286

17 4 1 7,720

18 4 2

19 4 3

20 4 4

McGraw-Hill/Irwin 10.12 © The McGraw-Hill Companies, Inc., 2013

Measuring the Forecast Error

• The mean absolute deviation (called MAD) measures the average forecasting

error.

MAD = (Sum of forecasting errors) / (Number of forecasts)

• The mean square error (often abbreviated MSE) measures the average of the

square of the forecasting error.

MSE = (Sum of square of forecasting errors) / (Number of forecasts).

• The MSE increases the weight of large errors relative to the weight of small

errors.

McGraw-Hill/Irwin 10.13 © The McGraw-Hill Companies, Inc., 2013

Considering Seasonal Effects

• When there are seasonal patterns in the data, they can be addressed by

forecasting methods that use seasonal factors.

• The seasonal factor for any period of a year (a quarter, a month, etc.) measures

how that period compares to the overall average for an entire year.

Seasonal factor = (Average for the period) / (Overall average)

• It is easier to analyze data and detect new trends if the data are first adjusted to

remove the seasonal patterns.

Seasonally adjusted data = (Actual call volume) / (Seasonal factor)

McGraw-Hill/Irwin 10.14 © The McGraw-Hill Companies, Inc., 2013

Calculation of Seasonal Factors for CCW

Three-Year Seasonal

Quarter Average Factor

1 7,019 7,019 / 7,529 = 0.93

2 6,784 6,784 / 7,529 = 0.90

3 7,434 7,434 / 7,529 = 0.99

4 8,880 8,880 / 7,529 = 1.18

Total = 30,117

Average = 30,117 / 4 = 7,529

McGraw-Hill/Irwin 10.15 © The McGraw-Hill Companies, Inc., 2013

Excel Template for Calculating Seasonal Factors

A B C D E F G

1 Estimating Seasonal Factors for CCW

2

3 True

4 Year Quarter Value Type of Seasonality

5 1 1 6,809 Quarterly

6 1 2 6,465

7 1 3 6,569

8 1 4 8,266 Estimate for

9 2 1 7,257 Quarter Seasonal Factor

10 2 2 7,064 1 0.9323

11 2 3 7,784 2 0.9010

12 2 4 8,724 3 0.9873

13 3 1 6,992 4 1.1794

14 3 2 6,822

15 3 3 7,949

16 3 4 9,650

McGraw-Hill/Irwin 10.16 © The McGraw-Hill Companies, Inc., 2013

Seasonally Adjusted Time Series for CCW

A B C D E F

1 Seasonally Adjusted Time Series for CCW

2

3 Seasonal Actual Seasonally Adjusted

4 Year Quarter Factor Call Volume Call Volume

5 1 1 0.93 6,809 7,322

6 1 2 0.90 6,465 7,183

7 1 3 0.99 6,569 6,635

8 1 4 1.18 8,266 7,005

9 2 1 0.93 7,257 7,803

10 2 2 0.90 7,064 7,849

11 2 3 0.99 7,784 7,863

12 2 4 1.18 8,724 7,393

13 3 1 0.93 6,992 7,518

14 3 2 0.90 6,822 7,580

15 3 3 0.99 7,949 8,029

16 3 4 1.18 9,650 8,178

McGraw-Hill/Irwin 10.17 © The McGraw-Hill Companies, Inc., 2013

Outline for Forecasting Call Volume

1. Select a time-series forecasting method.

2. Apply this method to the seasonally adjusted time series to obtain a forecast of

the seasonally adjusted call volume for the next time period.

3. Multiply this forecast by the corresponding seasonal factor to obtain a forecast

of the actual call volume (without seasonal adjustment).

McGraw-Hill/Irwin 10.18 © The McGraw-Hill Companies, Inc., 2013

The Last-Value Forecasting Method

• The last-value forecasting method ignores all data points in a time series

except the last one.

Forecast = Last value

• The last-value forecasting method is sometimes called the naïve method,

because statisticians consider it naïve to use just a sample size of one when

other data are available.

• However, when conditions are changing rapidly, it may be that the last value is

the only relevant data point.

McGraw-Hill/Irwin 10.19 © The McGraw-Hill Companies, Inc., 2013

The Last-Value Method Applied to CCW’s Problem

A B C D E F G H I J K

1 Last-Value Forecasting Method with Seasonality for CCW

2

3 Seasonally Seasonally

4 True Adjusted Adjusted Actual Forecasting

5 Year Quarter Value Value Forecast Forecast Error Type of Seasonality

6 1 1 6,809 7,322 Quarterly

7 1 2 6,465 7,183 7,322 6,589 124

8 1 3 6,569 6,635 7,183 7,112 543 Quarter Seasonal Factor

9 1 4 8,266 7,005 6,635 7,830 436 1 0.93

10 2 1 7,257 7,803 7,005 6,515 742 2 0.90

11 2 2 7,064 7,849 7,803 7,023 41 3 0.99

12 2 3 7,784 7,863 7,849 7,770 14 4 1.18

13 2 4 8,724 7,393 7,863 9,278 554

14 3 1 6,992 7,518 7,393 6,876 116

15 3 2 6,822 7,580 7,518 6,766 56

16 3 3 7,949 8,029 7,580 7,504 445

17 3 4 9,650 8,178 8,029 9,475 175

18 4 1 8,178 7,606

19 4 2

20 4 3

21 4 4

22 5 1 Mean Absolute Deviation

23 5 2 MAD = 295

24 5 3

25 5 4 Mean Square Error

26 6 1 MSE = 145,909

McGraw-Hill/Irwin 10.20 © The McGraw-Hill Companies, Inc., 2013

The Averaging Forecasting Method

• The averaging forecasting method uses all the data points in the time series

and simply averages these points.

Forecast = Average of all data to date

• The averaging forecasting method is a good one to use when conditions are

very stable.

• However, the averaging method is very slow to respond to changing

conditions. It places the same weight on all the data, even though the older

values may be less representative of current conditions than the last value

observed.

McGraw-Hill/Irwin 10.21 © The McGraw-Hill Companies, Inc., 2013

The Averaging Method Applied to CCW’s Problem

A B C D E F G H I J K

1 Averaging Forecasting Method with Seasonality for CCW

2

3 Seasonally Seasonally

4 True Adjusted Adjusted Actual Forecasting

5 Year Quarter Value Value Forecast Forecast Error Type of Seasonality

6 1 1 6,809 7,322 Quarterly

7 1 2 6,465 7,183 7,322 6,589 124

8 1 3 6,569 6,635 7,252 7,180 611 Quarter Seasonal Factor

9 1 4 8,266 7,005 7,047 8,315 49 1 0.93

10 2 1 7,257 7,803 7,036 6,544 713 2 0.90

11 2 2 7,064 7,849 7,190 6,471 593 3 0.99

12 2 3 7,784 7,863 7,300 7,227 557 4 1.18

13 2 4 8,724 7,393 7,380 8,708 16

14 3 1 6,992 7,518 7,382 6,865 127

15 3 2 6,822 7,580 7,397 6,657 165

16 3 3 7,949 8,029 7,415 7,341 608

17 3 4 9,650 8,178 7,471 8,816 834

18 4 1 7,530 7,003

19 4 2

20 4 3

21 4 4

22 5 1 Mean Absolute Deviation

23 5 2 MAD = 400

24 5 3

25 5 4 Mean Square Error

26 6 1 MSE = 242,876

McGraw-Hill/Irwin 10.22 © The McGraw-Hill Companies, Inc., 2013

The Moving-Average Forecasting Method

• The moving-average forecasting method averages the data for only the most

recent time periods.

n = Number of recent periods to consider as relevant for forecasting

Forecast = Average of last n values

• The moving-average forecasting method is a good one to use when conditions

don’t change much over the number of time periods included in the average.

• However, the moving-average method is slow to respond to changing

conditions. It places the same weight on each of the last n values even though

the older values may be less representative of current conditions than the last

value observed.

McGraw-Hill/Irwin 10.23 © The McGraw-Hill Companies, Inc., 2013

The Moving-Average Method Applied to CCW

A B C D E F G H I J K

1 Moving Average Forecasting Method with Seasonality for CCW

2

3 Seasonally Seasonally

4 True Adjusted Adjusted Actual Forecasting Number of previous

5 Year Quarter Value Value Forecast Forecast Error periods to consider

6 1 1 6,809 7,322 n= 4

7 1 2 6,465 7,183

8 1 3 6,569 6,635 Type of Seasonality

9 1 4 8,266 7,005 Quarterly

10 2 1 7,257 7,803 7,036 6,544 713

11 2 2 7,064 7,849 7,157 6,441 623 Quarter Seasonal Factor

12 2 3 7,784 7,863 7,323 7,250 534 1 0.93

13 2 4 8,724 7,393 7,630 9,003 279 2 0.90

14 3 1 6,992 7,518 7,727 7,186 194 3 0.99

15 3 2 6,822 7,580 7,656 6,890 68 4 1.18

16 3 3 7,949 8,029 7,589 7,513 436

17 3 4 9,650 8,178 7,630 9,004 646

18 4 1 7,826 7,279

19 4 2

20 4 3

21 4 4

22 5 1

23 5 2

24 5 3

25 5 4 Mean Absolute Deviation

26 6 1 MAD = 437

27 6 2

28 6 3 Mean Square Error

29 6 4 MSE = 238,816

McGraw-Hill/Irwin 10.24 © The McGraw-Hill Companies, Inc., 2013

The Exponential Smoothing Forecasting Method

• The exponential smoothing forecasting method places the greatest weight

on the last value in the time series and then progressively smaller weights on

the older values.

Forecast = a (Last value) + (1 – a) (Last forecast)

a is the smoothing constant between 0 and 1.

• This method places a weight of a on the last value, a(1–a) on the next-to-last

value, a(1–a)2 on the next prior value, etc.

– For example, when a = 0.5, the method places a weight of 0.5 on the last value,

0.25 on the next-to-last, 0.125 on the next prior, etc.

– A larger value of a places more emphasis on the more recent values, a smaller value

places more emphasis on the older values.

• The choice of the value of the smoothing constant a has a substantial effect on

the forecast.

– A small value (say, a = 0.1) is appropriate if conditions are relatively stable.

– A larger value (say, a = 0.5) is appropriate if significant changes occur frequently.

McGraw-Hill/Irwin 10.25 © The McGraw-Hill Companies, Inc., 2013

The Exponential Smoothing Method Applied to CCW

A B C D E F G H I J K

1 Exponential-Smoothing Forecasting Method with Seasonality for CCW

2

3 Seasonally Seasonally

4 True Adjusted Adjusted Actual Forecasting Smoothing Constant

5 Year Quarter Value Value Forecast Forecast Error 0.5

6 1 1 6,809 7,322 7,500 6,975 166

7 1 2 6,465 7,183 7,411 6,670 205 Initial Estimate

8 1 3 6,569 6,635 7,297 7,224 655 Average = 7,500

9 1 4 8,266 7,005 6,966 8,220 46

10 2 1 7,257 7,803 6,986 6,497 760 Type of Seasonality

11 2 2 7,064 7,849 7,394 6,655 409 Quarterly

12 2 3 7,784 7,863 7,622 7,545 239

13 2 4 8,724 7,393 7,742 9,136 412 Quarter Seasonal Factor

14 3 1 6,992 7,518 7,568 7,038 46 1 0.93

15 3 2 6,822 7,580 7,543 6,789 33 2 0.90

16 3 3 7,949 8,029 7,561 7,486 463 3 0.99

17 3 4 9,650 8,178 7,795 9,199 451 4 1.18

18 4 1 7,987 7,428

19 4 2

20 4 3

21 4 4

22 5 1

23 5 2

24 5 3

25 5 4

26 6 1

27 6 2 Mean Absolute Deviation

28 6 3 MAD = 324

29 6 4

30 7 1 Mean Square Error

31 MSE = 157,836

McGraw-Hill/Irwin 10.26 © The McGraw-Hill Companies, Inc., 2013

A Time Series with Trend

(Population of a State over Time)

Population

(Millions)

5.4

5.2

5.0

Trend

line

4.8

1995 2000 2005 Year

McGraw-Hill/Irwin 10.27 © The McGraw-Hill Companies, Inc., 2013

Exponential Smoothing with Trend Forecasting Method

• The exponential smoothing with trend forecasting method uses the recent

values in the time series to estimate any current upward or downward trend in

these values.

Trend = Average change from one time-series value to the next

• The formula for forecasting the next value in the time series adds the

estimated trend.

Forecast = a (Last value) + (1 – a) (Last forecast) + Estimated trend

a is the smoothing constant between 0 and 1.

• Exponential smoothing also is used to obtain and update the estimated trend.

Estimated trend = b (Latest trend) + (1 – b) (Last estimate of trend)

b is the trend smoothing constant.

• The formula for forecasting n periods from now is

Forecast = a (Last value) + (1 – a) (Last forecast) + n (Estimated trend)

McGraw-Hill/Irwin 10.28 © The McGraw-Hill Companies, Inc., 2013

Exponential Smoothing with Trend Applied to CCW

A B C D E F G H I J K L M

1 Exponential-Smoothing with Trend Forecasting Method with Seasonality for CCW

2

3 Seasonally Seasonally

4 True Adjusted Latest Estimated Adjusted Actual Forecasting Smoothing Constant

5 Year Quarter Value Value Trend Trend Forecast Forecast Error 0.3

6 1 1 6,809 7,322 0 7,500 6,975 166 0.3

7 1 2 6,465 7,183 -54 -16 7,430 6,687 222

8 1 3 6,569 6,635 -90 -38 7,318 7,245 676 Initial Estimate

9 1 4 8,266 7,005 -243 -100 7,013 8,276 10 Average = 7,500

10 2 1 7,257 7,803 -102 -100 6,910 6,427 830 Trend = 0

11 2 2 7,064 7,849 167 -20 7,158 6,442 622

12 2 3 7,784 7,863 187 42 7,407 7,333 451 Type of Seasonality

13 2 4 8,724 7,393 179 83 7,627 9,000 276 Quarterly

14 3 1 6,992 7,518 13 62 7,619 7,085 93

15 3 2 6,822 7,580 32 53 7,642 6,877 55 Quarter Seasonal Factor

16 3 3 7,949 8,029 34 47 7,670 7,594 355 1 0.93

17 3 4 9,650 8,178 155 80 7,858 9,272 378 2 0.90

18 4 1 176 108 8,062 7,498 3 0.99

19 4 2 4 1.18

20 4 3

21 4 4

22 5 1

23 5 2

24 5 3

25 5 4

26 6 1

27 6 2

28 6 3

29 6 4 Mean Absolute Deviation

30 7 1 MAD = 345

31

32 Mean Square Error

33 MSE = 180,796

McGraw-Hill/Irwin 10.29 © The McGraw-Hill Companies, Inc., 2013

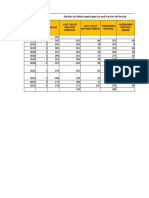

MAD and MSE for the Various Forecasting Method

Forecasting Method MAD MSE

CCW’s 25 percent rule 424 317,815

Last-value method 295 145,909

Averaging method 400 242,876

Moving-average method 437 238,816

Exponential smoothing 324 157,836

Exponential smoothing with trend 345 180,796

McGraw-Hill/Irwin 10.30 © The McGraw-Hill Companies, Inc., 2013

Typical Probability Distribution of Call Volume

(Assumes Mean = 7,500)

7,250 7,500 7,750

Mean

McGraw-Hill/Irwin 10.31 © The McGraw-Hill Companies, Inc., 2013

Typically Probability Distributions of Call Volume

in the Four Quarters (Assumes Annual Mean = 7,500)

Quarter 2 Quarter 1 Quarter 3 Quarter 4

6,500 7,000 7,500 8,000 8,500 9,000

McGraw-Hill/Irwin 10.32 © The McGraw-Hill Companies, Inc., 2013

Comparison of Typical Probability Distributions

of Seasonally-Adjusted Call Volumes in Years 1 and 2

Year 1 Year 2

6,500 7,000 7,500 8,000

McGraw-Hill/Irwin 10.33 © The McGraw-Hill Companies, Inc., 2013

Comparison of the Forecasting Methods

• Last value method: Suitable for a time series that is so unstable that even the

next-to-last value is not considered relevant for forecasting the next value.

• Averaging method: Suitable for a very stable time series where even its first

few values are considered relevant for forecasting the next value.

• Moving-average method: Suitable for a moderately stable time series where

the last few values are considered relevant for forecasting the next value.

• Exponential smoothing method: Suitable for a time series in the range from

somewhat unstable to rather stable, where the value of the smoothing constant

needs to be adjusted to fit the anticipated degree of stability.

• Exponential smoothing with trend: Suitable for a time series where the mean

of the distribution tends to follow a trend either up or down, provided that

changes in the trend occur only occasionally and gradually.

McGraw-Hill/Irwin 10.34 © The McGraw-Hill Companies, Inc., 2013

The Consultant’s Recommendations

1. Forecasting should be done monthly rather than quarterly.

2. Hiring and training of new agents also should be done monthly.

3. Recently retired agents should be offered the opportunity to work part time on an on-call

basis.

4. Since sales drive call volume, the forecasting process should begin by forecasting sales.

5. For forecasting purposes, total sales should be broken down into the major components:

a) The relatively stable market base of numerous small-niche products.

b) Each of the few (perhaps three or four) major new products.

6. Exponential smoothing with a relatively small smoothing constant is suggested for

forecasting sales of the marketing base of numerous small-niche products.

7. Exponential smoothing with trend, with relatively large smoothing constants, is

suggested for forecasting sales of each major new product.

8. Seasonally adjusted time series should be used for each application of the methods.

9. The forecasts in recommendation 5 should be summed to obtain a forecast of total sales.

10. Causal forecasting with linear regression should be used to obtain a forecast of call

volume from this forecast of total sales.

McGraw-Hill/Irwin 10.35 © The McGraw-Hill Companies, Inc., 2013

Causal Forecasting

Causal forecasting obtains a forecast of the quantity of interest (the dependent

variable) by relating it directly to one or more other quantities (the independent

variables) that drive the quantity of interest.

Possible Dependent Possible Independent

Type of Forecasting Variable Variable

Sales Sales of a product Amount of advertising

Spare parts Demand for spare parts Usage of equipment

Economic trends Gross domestic product Various economic factors

CCW call volume Call volume Total sales

Any quantity This same quantity Time

McGraw-Hill/Irwin 10.36 © The McGraw-Hill Companies, Inc., 2013

Sales and Call Volume Data for CCW

A B C D E

1 CCW's Average Daily Sales and Call Volume

2

3 Sales Call

4 Year Quarter ($thousands) Volume

5 1 1 4,894 6,809

6 1 2 4,703 6,465

7 1 3 4,748 6,569

8 1 4 5,844 8,266

9 2 1 5,192 7,257

10 2 2 5,086 7,064

11 2 3 5,511 7,784

12 2 4 6,107 8,724

13 3 1 5,052 6,992

14 3 2 4,985 6,822

15 3 3 5,576 7,949

16 3 4 6,647 9,650

McGraw-Hill/Irwin 10.37 © The McGraw-Hill Companies, Inc., 2013

Adding a Trendline to the Graph

A B C D E

1 CCW's Average Daily Sales and Call Volume

2

3 Sales Call

4 Year Quarter ($thousands) Volume

5 1 1 4,894 6,809

6 1 2 4,703 6,465

7 1 3 4,748 6,569

8 1 4 5,844 8,266

9 2 1 5,192 7,257

10 2 2 5,086 7,064

11 2 3 5,511 7,784

12 2 4 6,107 8,724

13 3 1 5,052 6,992

14 3 2 4,985 6,822

15 3 3 5,576 7,949

16 3 4 6,647 9,650

McGraw-Hill/Irwin 10.38 © The McGraw-Hill Companies, Inc., 2013

Linear Regression

• When doing causal forecasting with a single independent variable, linear

regression involves approximating the relationship between the dependent

variable (call volume for CCW) and the independent variable (sales for CCW)

by a straight line.

• This linear regression line is drawn on a graph with the independent variable

on the horizontal axis and the dependent variable on the vertical axis. The line

is constructed after plotting a number of points showing each observed value

of the independent variable and the corresponding value for the dependent

variable.

• The linear regression line has the form

y = a + bx

where

y = Estimated value of the dependent variable

a = Intercept of the linear regression line with the y-axis

b = Slope of the linear regression line

x = Value of the independent variable

McGraw-Hill/Irwin 10.39 © The McGraw-Hill Companies, Inc., 2013

Excel Template for Linear Regression

A B C D E F G H I J

1 Linear Regression of Call Volume vs. Sales Volume for CCW

2

3 Time Independent Dependent Estimation Square Linear Regression Line

4 Period Variable Variable Estimate Error of Error y = a + bx

5 1 4,894 6,809 6,765 43.85 1,923 a= -1,223.86

6 2 4,703 6,465 6,453 11.64 136 b= 1.63

7 3 4,748 6,569 6,527 42.18 1,780

8 4 5,844 8,266 8,316 49.93 2,493

9 5 5,192 7,257 7,252 5.40 29 Estimator

10 6 5,086 7,064 7,079 14.57 212 If x = 5,000

11 7 5,511 7,784 7,772 11.66 136

12 8 6,107 8,724 8,745 21.26 452 then y= 6,938.18

13 9 5,052 6,992 7,023 31.07 965

14 10 4,985 6,822 6,914 91.70 8,408

15 11 5,576 7,949 7,878 70.55 4,977

16 12 6,647 9,650 9,627 23.24 540

McGraw-Hill/Irwin 10.40 © The McGraw-Hill Companies, Inc., 2013

Judgmental Forecasting Methods

• Manager’s Opinion: A single manager uses his or her best judgment.

• Jury of Executive Opinion: A small group of high-level managers pool their

best judgment to collectively make the forecast.

• Salesforce Composite: A bottom-up approach where each salesperson

provides an estimate of what sales will be in his or her region. These estimates

are then aggregated into a corporate sales forecast.

• Consumer Market Survey: A grass-roots approach that surveys customers

and potential customers regarding their future purchasing plans and how they

would respond to various new features in products.

• Delphi Method: A panel of experts in different locations who independently

fill out a series of questionnaires. The results from each questionnaire are

provided with the next one, so each expert can evaluate the group information

in adjusting his or her responses next time.

McGraw-Hill/Irwin 10.41 © The McGraw-Hill Companies, Inc., 2013

You might also like

- Remainder Factor Theorem - MCQDocument2 pagesRemainder Factor Theorem - MCQvishal100% (1)

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Ch13 SolutionsManual FINAL 050417Document30 pagesCh13 SolutionsManual FINAL 050417Natalie ChoiNo ratings yet

- Lecture 6 - Ridge Regression, Polynomial Regression (DONE!!) PDFDocument26 pagesLecture 6 - Ridge Regression, Polynomial Regression (DONE!!) PDFSharelle TewNo ratings yet

- Operation ManagementDocument20 pagesOperation ManagementKelvin_1369100% (2)

- PID Control System Analysis & DesignDocument10 pagesPID Control System Analysis & DesignFeridinand Thainis100% (1)

- ForecastingDocument33 pagesForecastingG Murtaza Dars100% (1)

- Net Present Value and Other Investment CriteriaDocument23 pagesNet Present Value and Other Investment CriteriaHanniel Madramootoo100% (1)

- Forecasting SolutionsDocument11 pagesForecasting SolutionsNajam Hassan92% (12)

- Application of 6-Sigma For Error Reduction-AT Advance Informatics PVT LTDDocument15 pagesApplication of 6-Sigma For Error Reduction-AT Advance Informatics PVT LTDprakhar singhNo ratings yet

- Krajewski 11e SM Ch08 Krajewski 11e SM Ch08: Operations management (경희대학교) Operations management (경희대학교)Document67 pagesKrajewski 11e SM Ch08 Krajewski 11e SM Ch08: Operations management (경희대학교) Operations management (경희대학교)natalos100% (1)

- Champion CattlefarmsDocument24 pagesChampion Cattlefarmsshaniah1475% (4)

- Final ExamDocument4 pagesFinal ExamTabish HaqNo ratings yet

- Introduction To Management Science Hiller Hiller Chapter03Document57 pagesIntroduction To Management Science Hiller Hiller Chapter03alikaltayNo ratings yet

- Danh Sach Khach Hang San Giao Dich Vang VGB TPHCMDocument27 pagesDanh Sach Khach Hang San Giao Dich Vang VGB TPHCMMr. DATANo ratings yet

- Introduction to Dynamic Macroeconomic General Equilibrium ModelsFrom EverandIntroduction to Dynamic Macroeconomic General Equilibrium ModelsNo ratings yet

- Forecasting - IDocument28 pagesForecasting - IJunaid MalikNo ratings yet

- M05 Rend6289 10 Im C05Document14 pagesM05 Rend6289 10 Im C05Yamin Shwe Sin Kyaw100% (2)

- Chap 013Document40 pagesChap 013Alif Nur FirdausNo ratings yet

- Operations Management Processes and Supply Chains Global 11Th Edition Krajewski Solutions Manual Full Chapter PDFDocument53 pagesOperations Management Processes and Supply Chains Global 11Th Edition Krajewski Solutions Manual Full Chapter PDFkennethluongwetwu2100% (9)

- Chapter 13 - SolutionsManual - FINAL - 050417 PDFDocument30 pagesChapter 13 - SolutionsManual - FINAL - 050417 PDFNatalie ChoiNo ratings yet

- BY Deepak Asnora Gaurav Garg Adarsh SinghDocument13 pagesBY Deepak Asnora Gaurav Garg Adarsh Singhdeepak asnoraNo ratings yet

- Discussion and Review QuestionsDocument11 pagesDiscussion and Review QuestionsJessie jorgeNo ratings yet

- BUAD 831 Assignment 1Document2 pagesBUAD 831 Assignment 1Shubhangi DhokaneNo ratings yet

- Chapter 03Document44 pagesChapter 03hlethienngocNo ratings yet

- 3.3 Example of Moving Average - MinitabDocument3 pages3.3 Example of Moving Average - MinitabAna Paula García ElizondoNo ratings yet

- MAKALAH Time Series Analysis 13 NOV 10Document33 pagesMAKALAH Time Series Analysis 13 NOV 10Edi KurniawanNo ratings yet

- Business and Organisation Paper 2 HL Markscheme PDFDocument27 pagesBusiness and Organisation Paper 2 HL Markscheme PDFbonesNo ratings yet

- UpperMidscaleUrban 20130200 HKD EDocument10 pagesUpperMidscaleUrban 20130200 HKD EmariaNo ratings yet

- Homework 1 - Cost Management ProblemsDocument2 pagesHomework 1 - Cost Management ProblemsRickdev BhattacharyaNo ratings yet

- 1 or Assignment QuestionsDocument5 pages1 or Assignment QuestionsIns-VNo ratings yet

- Safari - 21 Aug 2019 at 6:30 PMDocument1 pageSafari - 21 Aug 2019 at 6:30 PMMaryjoy Sadiwa AlmeroNo ratings yet

- HW4Document3 pagesHW4timmyneutronNo ratings yet

- Crystal Ball Hillier Chap 16 05-04-07Document7 pagesCrystal Ball Hillier Chap 16 05-04-07xai1lanroiboNo ratings yet

- C2A October 2009 Questions & Solutions PDFDocument23 pagesC2A October 2009 Questions & Solutions PDFJeff GundyNo ratings yet

- Chapter 3 - Cash ForecastingDocument5 pagesChapter 3 - Cash ForecastingespartinalNo ratings yet

- MATHS Project Final - 2Document13 pagesMATHS Project Final - 2Tanmay ShettyNo ratings yet

- 2223ProdMgmt HW1 G# T#Document3 pages2223ProdMgmt HW1 G# T#Quỳnh DungNo ratings yet

- Practice ProblemsDocument3 pagesPractice ProblemsVibhuti BatraNo ratings yet

- Philippine School of Business Administration - PSBA ManilaDocument12 pagesPhilippine School of Business Administration - PSBA ManilaephraimNo ratings yet

- ForecastingDocument52 pagesForecastingPradeep SharmaNo ratings yet

- By Screenshots - 1.A Textbook Publisher For Books Used in Engineering Schools Believes That The Number ofDocument3 pagesBy Screenshots - 1.A Textbook Publisher For Books Used in Engineering Schools Believes That The Number ofFurkan BulutNo ratings yet

- BEA140 Assign 2015S2 QDocument8 pagesBEA140 Assign 2015S2 QSyed OsamaNo ratings yet

- Operations Management Creating Value Along Canadian 1St Edition Russel Solutions Manual Full Chapter PDFDocument55 pagesOperations Management Creating Value Along Canadian 1St Edition Russel Solutions Manual Full Chapter PDFstacyperezbrstzpmgif100% (8)

- M9 MME40001 Minor Activity Supply Chain ManagementDocument3 pagesM9 MME40001 Minor Activity Supply Chain ManagementAbidul IslamNo ratings yet

- Exercise No. 1: TM 706-Quantitative ManagementDocument4 pagesExercise No. 1: TM 706-Quantitative ManagementMark Allen ArmenionNo ratings yet

- Scream! Cheat Sheet: Backup Mitigation PoliciesDocument2 pagesScream! Cheat Sheet: Backup Mitigation Policiessoobins ppangNo ratings yet

- Hikkaduwa Beach Resorts PLC and Waskaduwa Beach Resorts PLCDocument17 pagesHikkaduwa Beach Resorts PLC and Waskaduwa Beach Resorts PLCreshadNo ratings yet

- Problem Set QuantiDocument1 pageProblem Set QuantiOnyx XynoNo ratings yet

- Estimation Eirr 2014Document11 pagesEstimation Eirr 2014M iqbalNo ratings yet

- Planned S CurvesDocument15 pagesPlanned S CurvesRonald Cario SeguinNo ratings yet

- Assignmet 1 INSE-6230 Total Quality Project ManagementDocument15 pagesAssignmet 1 INSE-6230 Total Quality Project Managementtatamaria15No ratings yet

- University of Gloucestershire: MBA-1 (GROUP-D)Document10 pagesUniversity of Gloucestershire: MBA-1 (GROUP-D)Nikunj PatelNo ratings yet

- Krajewski Om12 SM 04Document31 pagesKrajewski Om12 SM 04victoriaysm99No ratings yet

- DipBBS621 SDocument10 pagesDipBBS621 Sthabo chuchuNo ratings yet

- Solution Manual For Supply Chain Focused Manufacturing Planning and Control 1st EditionDocument38 pagesSolution Manual For Supply Chain Focused Manufacturing Planning and Control 1st Editiontarenteunrigigzszi100% (12)

- IE 3265 Production & Operations Planning: Ch. 3 - Aggregate Planning R. Lindeke UMDDocument43 pagesIE 3265 Production & Operations Planning: Ch. 3 - Aggregate Planning R. Lindeke UMDaklank_218105No ratings yet

- Decision Intelligence: Time Series Forecasting Risk Analysis OptimizationDocument33 pagesDecision Intelligence: Time Series Forecasting Risk Analysis OptimizationMuhammed Al-BajriNo ratings yet

- Mock Final Exam Project Management 3.3.2023Document6 pagesMock Final Exam Project Management 3.3.2023Vũ Ngọc AnhNo ratings yet

- Chap003 ModifiedDocument32 pagesChap003 Modifiedjgu1994No ratings yet

- Carrying Cost: Inventory CostsDocument31 pagesCarrying Cost: Inventory CostsVivek Kumar GuptaNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Quiz2-10 S1Document2 pagesQuiz2-10 S1kenkoroNo ratings yet

- SOLVER BÀI TUYỀNDocument28 pagesSOLVER BÀI TUYỀNkenkoroNo ratings yet

- Chapter 03Document30 pagesChapter 03kenkoroNo ratings yet

- Quản Trị Nguồn Nhân LựcDocument1 pageQuản Trị Nguồn Nhân LựckenkoroNo ratings yet

- Forecast 10.S1Document2 pagesForecast 10.S1kenkoroNo ratings yet

- Excel D Đoán PL3Document9 pagesExcel D Đoán PL3kenkoroNo ratings yet

- Q2 NopDocument3 pagesQ2 NopkenkoroNo ratings yet

- Quiz2-10 S1Document3 pagesQuiz2-10 S1kenkoroNo ratings yet

- Ex MidtermDocument3 pagesEx MidtermkenkoroNo ratings yet

- Petrosetco Profile - 2021Document15 pagesPetrosetco Profile - 2021kenkoroNo ratings yet

- Ex MidtermDocument2 pagesEx MidtermkenkoroNo ratings yet

- Ergodicity Breaking Provably Robust To Arbitrary PerturbationsDocument15 pagesErgodicity Breaking Provably Robust To Arbitrary PerturbationsGB RaghavkrishnaNo ratings yet

- Plotting Decision Regions - MlxtendDocument5 pagesPlotting Decision Regions - Mlxtendakhi016733No ratings yet

- Theory of Computation (CS C351) : BITS PilaniDocument19 pagesTheory of Computation (CS C351) : BITS PilanidevNo ratings yet

- HW 3 SolutionDocument8 pagesHW 3 SolutionJuneNy On-lertNo ratings yet

- A Relativistic Generalization of The Kramers-Henneberger Transformation Madalina BOCADocument35 pagesA Relativistic Generalization of The Kramers-Henneberger Transformation Madalina BOCADaniel Bogdan DincaNo ratings yet

- College Algebra Real Mathematics Real People 7th Edition Larson Test Bank 1Document9 pagesCollege Algebra Real Mathematics Real People 7th Edition Larson Test Bank 1ahmed100% (34)

- Honey Encryption - 1Document7 pagesHoney Encryption - 1Cent SecurityNo ratings yet

- Division of Polynomials ExercisesDocument4 pagesDivision of Polynomials ExercisesKhang NguyễnNo ratings yet

- DL Exp-1.4 19BCS1431Document5 pagesDL Exp-1.4 19BCS1431phaneendra mothukuruNo ratings yet

- Auto CorrelationDocument9 pagesAuto CorrelationTaufiqurrahman KoemanNo ratings yet

- Ross-1973 - Agency Theory, Principal's ProblemDocument7 pagesRoss-1973 - Agency Theory, Principal's ProblemMohsinNo ratings yet

- Wavelets and Multi-Resolution ProcessingDocument31 pagesWavelets and Multi-Resolution ProcessingsrichitsNo ratings yet

- Lesson 1 - History, Definitions and Basic ConceptsDocument6 pagesLesson 1 - History, Definitions and Basic ConceptsSameera KhatoonNo ratings yet

- Public-Key Cryptography and Message AuthenticationDocument28 pagesPublic-Key Cryptography and Message Authenticationishita chakrabortyNo ratings yet

- PHD Thesis Image CompressionDocument4 pagesPHD Thesis Image Compressionfczeohief100% (1)

- Proceedings of Fifth International ConfeDocument1,021 pagesProceedings of Fifth International ConfeOmprakash VermaNo ratings yet

- Optimal Opeartion of A Batch Cooling Crystallizer-Jones1974Document13 pagesOptimal Opeartion of A Batch Cooling Crystallizer-Jones1974ishwarya rNo ratings yet

- Roadmap To Become A Data Scientist in 2024Document12 pagesRoadmap To Become A Data Scientist in 2024DurgeshNo ratings yet

- Singular Systems Versus Non-Singular Systems: - A Singular System Has No Solution or Infinitely Many SolutionDocument43 pagesSingular Systems Versus Non-Singular Systems: - A Singular System Has No Solution or Infinitely Many SolutionAppynCNo ratings yet

- 1 s2.0 S0950061822028185 MainDocument18 pages1 s2.0 S0950061822028185 Mainmohammad faresNo ratings yet

- STLDDocument3 pagesSTLDvenkataramireddyNo ratings yet

- Unit 2 - Z TransformDocument67 pagesUnit 2 - Z Transformchandrani deyNo ratings yet

- Quiz 3 Name: Kainat Iftikhar Reg# 2021630007 1. List Three Examples of Time Series Data. Time Series DataDocument2 pagesQuiz 3 Name: Kainat Iftikhar Reg# 2021630007 1. List Three Examples of Time Series Data. Time Series Dataraja ahmedNo ratings yet

- PDA2CFGDocument3 pagesPDA2CFGAmuk TamukNo ratings yet

- Nonlinear OscillationDocument19 pagesNonlinear OscillationAthul S GovindNo ratings yet

- PSD Computation Using Modified Welch AlgorithmDocument4 pagesPSD Computation Using Modified Welch AlgorithmijsretNo ratings yet

- 102 2019 2 B PDFDocument14 pages102 2019 2 B PDFThanyani SirumulaNo ratings yet