Professional Documents

Culture Documents

Investment Appraisal 2020

Uploaded by

Submission Portal0 ratings0% found this document useful (0 votes)

10 views9 pagesOriginal Title

Investment Appraisal 2020 (1)(1)

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views9 pagesInvestment Appraisal 2020

Uploaded by

Submission PortalCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

May 2020

Investment appraisal

No PIN: optional lecture

cost 2200000 2600000

disposal 300000

Year Project Beta

£ £

1 1,000,000 300,000

2 1,000,000 500,000

3 800,000 900,000

4 200,000 1,200,000

5 1,200,000

5

depreciation 2,200,000 2,300,000

300,000

260,000 – 300,000 = 2,300,000

No PIN: optional lecture

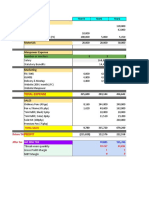

ARR cost 2200000 2600

A B disposal 300

Cash flows 3,000,000 4,100,000

Year Project Beta

Depreciation 2,200,000 2,300,000

£ £

total 800,000 1,800,000 1 1,000,000 300,000

Years 4 5 2 1,000,000 500,000

Average annual 3 800,000 900,000

Profit 200,000 360,000

4 200,000 1,200,000

Capital invested at 5 1,200,000

start 2,200,000 2,600,000 5

Capital invested at 0 300,000 depreciation 2,200,000 2,300,000

end (disposal)

Average capital

invested 1,100,000 1,450,000

ARR % 18%

No PIN: optional lecture 25%

ARR = average annual profit/average capital invested x 100

Payback

Project A

£m cumulative

0 -2,200,000 -2,200,000

1 1,000,000 -1,200,000

2 1,000,000 -200,000 2 + 2/8

years

3 800,000 600,000

4 200,000 800,000

No PIN: optional lecture

Project B

£m cumulative

0 -2,600,000 -2,600,000

1 300,000 -2,300,000

2 500,000 -1,800,000

3 900,000 -900,000

4 1,200,000 300,000 3 + 9/12 years 3.75

5 1,500,000 1,800,000

No PIN: optional lecture

NPV

Project A

£m disc. Factor disc. Flows

0 -2,200,000 1.000 -2,200,000

1 1,000,000 0.870 869,565

2 1,000,000 0.756 756,144

3 800,000 0.658 526,013

4 200,000 0.572 114,351

5

The NPV of Project A £66,073

No PIN: optional lecture

Project B

disc. Factor disc. Flows

0 -2,600,000 1.000 -2,600,000

1 300,000 0.870 260,870

2 500,000 0.756 378,072

3 900,000 0.658 591,765

4 1,200,000 0.572 686,104

5 1,500,000 0.497 745,765

The NPV of Project B £62,575

No PIN: optional lecture

IRR Project A

Discount factor of

16%

NPV @ 15% £66,073

£m disc. Factor disc. Flows

0-2,200,000 1 -2,200,000 NPV @ 16% £28,216

1 1,000,000 0.862 862,069

2 1,000,000 0.743 743,163

3 800,000 0.641 512,526 L = lower discount rate

4 200,000 0.552 110,458 H = higher

5

NPV £28,216

IRR = L + [NPVL/(NPVL-NPVH)] x (difference in discount rates)

IRR = 15 + [66073/(66073-28216)] x (16-15) = 16.75%

No PIN: optional lecture

IRR Project B

Discount factor of 16%

NPV @ 15% £62,575

£m disc. Factor disc. Flows

NPV @ 16% -£16,287

0 -2,600,000 1 -2,600,000

1 300,000 0.862 258,621

2 500,000 0.743 371,581

3 900,000 0.641 576,592

4 1,200,000 0.552 662,749

5 1,500,000 0.476 714,170

-£16,287

IRR = 15 + [62575/(62575-(-16287))] x (16-15) = 15.79%

No PIN: optional lecture

You might also like

- 01 FM New RAVI KISHOR PDFDocument21 pages01 FM New RAVI KISHOR PDFAKSHAT ARORA0% (2)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Mis Unit III-2Document20 pagesMis Unit III-2Meenakshi Pawar100% (2)

- Wiley CFA Test Bank 180408 (40 Preguntas)Document23 pagesWiley CFA Test Bank 180408 (40 Preguntas)rafav10No ratings yet

- Introduction To Corporate Finance: True / False QuestionsDocument89 pagesIntroduction To Corporate Finance: True / False QuestionsBet NaroNo ratings yet

- GRC FinMan Capital Budgeting ModuleDocument10 pagesGRC FinMan Capital Budgeting ModuleJasmine FiguraNo ratings yet

- Case Solution of Target Corporation Capital Budgeting Harvard Publishing Case StudyDocument2 pagesCase Solution of Target Corporation Capital Budgeting Harvard Publishing Case Studyalka murarka59% (17)

- Case Solutions Chapter - 08Document2 pagesCase Solutions Chapter - 08chadtandon67% (6)

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- Answer ALL Questions: PHYS 3701 - Advanced Renewable Energy Technologies and Solutions Course Work Assessment IIIDocument6 pagesAnswer ALL Questions: PHYS 3701 - Advanced Renewable Energy Technologies and Solutions Course Work Assessment IIIrahvin harveyNo ratings yet

- Ejercicio 2.1Document1 pageEjercicio 2.1Josue Caracara FloresNo ratings yet

- Years Operating Cost Benefit Depreciation Net Benefit Old NewDocument8 pagesYears Operating Cost Benefit Depreciation Net Benefit Old NewBilal AhmedNo ratings yet

- Tugas Ke 5 Ade Hidayat Kelas 1a MMDocument4 pagesTugas Ke 5 Ade Hidayat Kelas 1a MMadeNo ratings yet

- CF 2Document26 pagesCF 2PUSHKAL AGGARWALNo ratings yet

- March June 2022-PlatformDocument4 pagesMarch June 2022-PlatformOlivier MNo ratings yet

- Year Project 1-Low Risk Project 2-High Risk Project 3 - Medium RiskDocument3 pagesYear Project 1-Low Risk Project 2-High Risk Project 3 - Medium RiskAkshaya LakshminarasimhanNo ratings yet

- Project and Risk AnalysisDocument2 pagesProject and Risk AnalysisvipukNo ratings yet

- Accounting ExamDocument6 pagesAccounting Examgenn katherine gadunNo ratings yet

- Managerial Economics (Chapter 14)Document4 pagesManagerial Economics (Chapter 14)api-3703724No ratings yet

- Lab 9 - What To Invest inDocument16 pagesLab 9 - What To Invest inbegum.ozturkNo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Fin Strategy Ass 1Document3 pagesFin Strategy Ass 1mqondisi nkabindeNo ratings yet

- Weighted Average Cost of Capital (WACC) : C e D DTDocument6 pagesWeighted Average Cost of Capital (WACC) : C e D DTAditya RathiNo ratings yet

- Answers 01 Capital-Budgeting Quizzer-1Document8 pagesAnswers 01 Capital-Budgeting Quizzer-1Mary Grace MontojoNo ratings yet

- AA Chapter2Document6 pagesAA Chapter2Nikki GarciaNo ratings yet

- CH 3 Problem SolutionsDocument9 pagesCH 3 Problem SolutionsFrancisco PradoNo ratings yet

- Topic 8 - Inv App 1 Ans 2019-20Document4 pagesTopic 8 - Inv App 1 Ans 2019-20Gaba RieleNo ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Solution of Tutorial 6Document4 pagesSolution of Tutorial 6Richard MidgleyNo ratings yet

- Solution To Capital Investment ExercisesDocument7 pagesSolution To Capital Investment ExercisesMaria ClaraNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- 2004 DecemberDocument6 pages2004 DecemberSherif AwadNo ratings yet

- Engg. Economics ProjectDocument13 pagesEngg. Economics ProjectkawtharNo ratings yet

- FM09-CH 08Document9 pagesFM09-CH 08Mukul KadyanNo ratings yet

- Example Sensitivity AnalysisDocument4 pagesExample Sensitivity Analysismc lim100% (1)

- Answersto Question Bank - Leverages and Capital StructureDocument3 pagesAnswersto Question Bank - Leverages and Capital StructureSakshi SharmaNo ratings yet

- NPV CalculationDocument14 pagesNPV CalculationMLastTryNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- BRS3B Assessment Opportunity 1 2019Document11 pagesBRS3B Assessment Opportunity 1 2019221103909No ratings yet

- Capital Budgeting ExamplesDocument16 pagesCapital Budgeting ExamplesMuhammad azeemNo ratings yet

- Sample Muscovado CTMDDocument29 pagesSample Muscovado CTMDJan ryanNo ratings yet

- Practice Probelm S6 StudentDocument12 pagesPractice Probelm S6 StudentKartik SharmaNo ratings yet

- Financial EvaluationDocument5 pagesFinancial EvaluationAbebe GetanehNo ratings yet

- Feasibility Study Excel TemplateDocument5 pagesFeasibility Study Excel TemplateARISNo ratings yet

- Error and Corrections Solutionpa CheckDocument5 pagesError and Corrections Solutionpa Checkmartinfaith958No ratings yet

- 財管作業Document5 pages財管作業1 1No ratings yet

- Case 1: Market PriceDocument6 pagesCase 1: Market PriceNoor ul HudaNo ratings yet

- Calpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01Document68 pagesCalpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01KshitishNo ratings yet

- Bacani HW FinalsDocument10 pagesBacani HW FinalsKyle BacaniNo ratings yet

- Chapter 1Document18 pagesChapter 1Kenny WongNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Spread Sheet ModelingDocument9 pagesSpread Sheet ModelingAbhay BaraNo ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisAlaa AlsultanNo ratings yet

- CH 13Document6 pagesCH 13Agung PrabowoNo ratings yet

- Phạm Quốc Đạt: Initial investment: 300,000Document13 pagesPhạm Quốc Đạt: Initial investment: 300,000Thảo Nguyễn Thị PhươngNo ratings yet

- Year Investment Net Cash Flow Cumulative Cash Flow Year InvestmentDocument5 pagesYear Investment Net Cash Flow Cumulative Cash Flow Year InvestmentMan RadNo ratings yet

- Financials of StartupDocument31 pagesFinancials of StartupJanine PadillaNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Tugas Af Chapter 13Document5 pagesTugas Af Chapter 13Nana NurhayatiNo ratings yet

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- Net Present ValueDocument6 pagesNet Present ValueIshita KapadiaNo ratings yet

- Group 1 Written Assignment V FIN C FIN304Document15 pagesGroup 1 Written Assignment V FIN C FIN304Rajesh MongerNo ratings yet

- Es - Group 8Document4 pagesEs - Group 8Papa NketsiahNo ratings yet

- Case File 2.0Document4 pagesCase File 2.0abeer alamNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Ganesh YuvaDocument40 pagesGanesh YuvaSubmission PortalNo ratings yet

- Lecture 3 - Time Series Analysis - LecturerDocument38 pagesLecture 3 - Time Series Analysis - LecturerSubmission PortalNo ratings yet

- ASB3210 Exam 2020 With SolutionsDocument19 pagesASB3210 Exam 2020 With SolutionsSubmission PortalNo ratings yet

- Lecture 1 - Introduction To StatisticsDocument48 pagesLecture 1 - Introduction To StatisticsSubmission PortalNo ratings yet

- Lecture 4 - Correlation and Regression AnalysisDocument41 pagesLecture 4 - Correlation and Regression AnalysisSubmission PortalNo ratings yet

- Lecture 2 - On Balance of All Probabilities - StudentsDocument38 pagesLecture 2 - On Balance of All Probabilities - StudentsSubmission PortalNo ratings yet

- Lecture 5 - Correlation Regression Analysis Part IIDocument35 pagesLecture 5 - Correlation Regression Analysis Part IISubmission PortalNo ratings yet

- Lecture 7 - Data Visualisation - LecturerDocument43 pagesLecture 7 - Data Visualisation - LecturerSubmission PortalNo ratings yet

- Lecture 6 - Multiple Regression AnalysisDocument32 pagesLecture 6 - Multiple Regression AnalysisSubmission PortalNo ratings yet

- May Exam 2021 Asb4007Document10 pagesMay Exam 2021 Asb4007Submission PortalNo ratings yet

- May Exam 2021 Asb4007 ResitDocument10 pagesMay Exam 2021 Asb4007 ResitSubmission PortalNo ratings yet

- Excel Template 3Document324 pagesExcel Template 3Submission PortalNo ratings yet

- Excel Class ExamplesDocument8 pagesExcel Class ExamplesSubmission PortalNo ratings yet

- Invesment Appraisal May 2020Document1 pageInvesment Appraisal May 2020Submission PortalNo ratings yet

- Budgeting For Planning QuestionDocument1 pageBudgeting For Planning QuestionSubmission PortalNo ratings yet

- Mock Exam QuestionDocument11 pagesMock Exam QuestionSubmission PortalNo ratings yet

- FMDocument386 pagesFMArpan PatelNo ratings yet

- Ebook PDF Contemporary Financial Management 13th Edition PDFDocument41 pagesEbook PDF Contemporary Financial Management 13th Edition PDFlori.parker237100% (36)

- Cost and MGMT Acct IIDocument171 pagesCost and MGMT Acct IIAddisNo ratings yet

- NPV and IRRDocument19 pagesNPV and IRRGukan VenkatNo ratings yet

- Chapter 10 Problems 10-8. Using The Excel Toolkit,: Inputs: 14%Document2 pagesChapter 10 Problems 10-8. Using The Excel Toolkit,: Inputs: 14%jinharzahidiNo ratings yet

- Nimisha Sharma 6035057Document4 pagesNimisha Sharma 6035057Nimisha sharmaNo ratings yet

- Alagappa University, Karaikudi Revised Syllabus Under Cbcs Pattern (W.E.F. 2011-12) B.B.A. Programme StructureDocument23 pagesAlagappa University, Karaikudi Revised Syllabus Under Cbcs Pattern (W.E.F. 2011-12) B.B.A. Programme StructureMathan NaganNo ratings yet

- Capital Budgeting TechniquesDocument16 pagesCapital Budgeting TechniquesAmirah RahmanNo ratings yet

- Jerome4 Chapter16 2 PDFDocument36 pagesJerome4 Chapter16 2 PDFIrsyadul FikriNo ratings yet

- Government Owned Fixed Asset Management Training Manual AmharicDocument89 pagesGovernment Owned Fixed Asset Management Training Manual Amharicawlachew67% (3)

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting DecisionsSovraj G. BaruahNo ratings yet

- FinMan SyllabusDocument11 pagesFinMan SyllabusJamelleNo ratings yet

- Chapter 6 - Capital BudgetingDocument14 pagesChapter 6 - Capital BudgetingThuyDuong BuiNo ratings yet

- 01-34-11 11-10-2016 Brasil - Feasibility Study For The Waste To Energy Plant Vol.1Document255 pages01-34-11 11-10-2016 Brasil - Feasibility Study For The Waste To Energy Plant Vol.1Sekretariat SPSPNo ratings yet

- Cost Accounting and Financial ManagementDocument921 pagesCost Accounting and Financial Managementmalikkamran06552989% (18)

- Capital Budgeting Techniques SlidesDocument36 pagesCapital Budgeting Techniques SlidesAryan ShahNo ratings yet

- CH 2 Capital Budgeting FinalDocument21 pagesCH 2 Capital Budgeting FinalSureshArigelaNo ratings yet

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- Investment AppraisalDocument14 pagesInvestment AppraisalKarim ManjiyaniNo ratings yet

- Capital Budgeting IntroductionDocument13 pagesCapital Budgeting Introductionjoann pauraNo ratings yet

- 33 - 11. Unit 10 (Solved)Document12 pages33 - 11. Unit 10 (Solved)Rana Zafar ArshadNo ratings yet

- Capital Budgeting 1Document39 pagesCapital Budgeting 1Carla CarreonNo ratings yet

- Question Bank SFM (Old and New)Document232 pagesQuestion Bank SFM (Old and New)MBaralNo ratings yet