Professional Documents

Culture Documents

Business Judgment Rule

Uploaded by

SAI SUVEDHYA R0 ratings0% found this document useful (0 votes)

24 views15 pagesBycrw

Original Title

business judgment rule

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBycrw

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views15 pagesBusiness Judgment Rule

Uploaded by

SAI SUVEDHYA RBycrw

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

Business Judgement Rule

The business judgment rule provides a director of a corporation immunity from liability when a plaintiff

sues on grounds that the director violated the duty of care to the corporation so long as the director’s

actions fall within the parameters of the rule.

In suits alleging a corporation's director violated their duty of care to the company, courts will evaluate the

case based on the business judgment rule. Under this standard, the court will uphold the decisions of a

director as long as they are made (1) in good faith, (2) with the care that a reasonably prudent person

would use, and (3) with the reasonable belief that the director is acting in the best interests of the

corporation.

Practically, the business judgment rule is a presumption in favor of the board. As such, it is sometimes

referred to as the "business judgment presumption."

There are a number of ways to defeat the business judgment rule. If the plaintiff can prove that the director

acted in gross negligence or bad faith, then the court will not uphold the business judgment rule. Similarly,

if the plaintiff can prove that the director had a conflict of interest, then the court will not uphold the

business judgment rule.

When the corporation pleads the business judgment rule, if the court finds that the rule applies, then the

burden of proof shifts to the plaintiff to prove that the business judgment rule does not apply. However, if

the court finds that the rule does not apply, the burden shifts against and the board must prove that the

process and the substance of the transaction was fair

What Is the Business Judgment Rule

The Business Judgment Rule is a legal doctrine that helps to guard a corporation's board of directors

against frivolous legal allegations about the way it conducts business. A legal staple in common law

countries, the rule states that boards are presumed to act in "good faith"—that is, within the fiduciary

standards of loyalty, prudence, and care directors owe to stakeholders.

Fiduciary standards include the "duty of care" and the "duty of loyalty." The first is an obligation to

act on an informed basis. The second requires directors to put the interests of the corporation and

over their own self-interest or the interests of others.

Enron

The Enron Scandl is one of the largest in the US corporate history.IT was revealed in October 2001

Enron was formed in 1985 by Kennath Lay after merging the natural gas pipeline companies of Houston Natural Gas

and InterNorth. In the early year 1990s deregulation of sale of natural gas in the US made it possible for Enron to sell

energy at higher prices , thereby significantly increasing its revenue.Enron to become the largest seller of natural gas in

North America by 1992. In an attempt to achieve further growth ,Enron pursued a diversification strategy . The

company owned and operated a variety of assets including gas pipelines ,paper plants waterplants etc.The corporation

also gained additional revenue by trading contracts for the array of products and services it was involved in.

Flaws of Cororate Governance

> Board of directors

> Audit Committee

> Low Ethical Standards

> Stakeholders

> Whistle Blower

> Failure of the financial audit

Aftermath of the Enron Scam

It eventually led to the bankruptcy of the Enron Corporation. which was an American

energy company. Enron $63.4 billion in assets made it the largest corporate bankruptcy in

US history at that time.

As a consequence, shareholders lost nearly $11 billions end of nov 2001

Many excutives of Enron including the chairman Mr. Kennath Lay, president Mr. Jeffery

Skilling, and chief Financial Officers and Mr. Andrew Fastow were indicted and later

sentenced to prison.

Enron’s auditor, Arthur Anderson, was found guilty and altimately the audit firm was

closed down.

Employees and shareholders received limited returns in lawsuits, despite losing billions in

pensions and stock price.

In the aftermath of the scandal , new regulations and legislations were enacted in the US to

increase accuracy of financial reports

Causes of downfall

Faulty Revenue Recognition model

Mark to market accounting

Excessive Executive Compensation

Risk mis- management

v

Woldcom

Woldcom was the number two largest long- distance phone company of the US. The

company applied for bankruptcy under the US laws in July 2002.with$107 billion in assets,

Woldcome bankruptcy was the largest in United States history.

Rise of Worldcom

Worldcom began in 1983 as a small provider of long distance telecom service under the name

“ Long Distance Discount services”(LDDS). The venture was profitable right from the

starting. In 1985 Bernie Ebbers became the company CEO.Ebbers reportedly played a major

role in the success of LDDS in the following years . The company went public in 1989 when

it acquired advantage companies Inc,.A publicly traded long distance telecom services

company. Throughout the 1990s, the company continued to grow by acquiring various

companies and expanding its operating across the world. The acquisitions boosted Worldcom

revenue report is $154 million in1990 to 39.2 billion in 2001. It purchases UU Net, Compu

serve and American data network

Causes of the failure of WorldCom

Inorganic growth and poor Customer service.

Failed Merger

Oversupply

Accounting fraud

Bankruptcy

Flaws in Corporate Governance

Weakness in control system

Dominance of the CEO

Board of directors

Audit Committee

Audit Failure

Aftermath-

On July 21 2002 woldcom filed for bankruptcy production, the laegest such

filling in US history. In2004 the bankruptcy with about $5.7 billion in debt

On April 14 2003 Woldcom changed its name to MCI. Under the bankruptcy

reorganization agreement the company paid $750 million to the Securities and

Exchange Commission in cash and stock MCI which was intended to be paid to

the investors who suffered on account of the failure .

In March 2005 Bernard Ebbers, the CEO of the company was guilty of all

charges related to the $11 billion accounting scandal at the telecommunications

company he founded and convicted of fraud

Worldcom stock had fallen from a high of $64.50 a share in mid 1999 to less than than $2

a share. The price fell down below$1 a share.

Worldcom employees who hold the company’s stock in their retirement plans .also

suffered losses

3

You might also like

- Final Draft On Auditing Term PaperDocument11 pagesFinal Draft On Auditing Term PaperMoud KhalfaniNo ratings yet

- World Com ScandalDocument7 pagesWorld Com ScandalAddis FikruNo ratings yet

- EntrinaDocument7 pagesEntrinaevemil berdinNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- EnronDocument6 pagesEnronRohit KumarNo ratings yet

- WorldCom CaseDocument9 pagesWorldCom CaseunjustvexationNo ratings yet

- WorldCom's Rise and Fall: A Case of Failed Corporate GovernanceDocument4 pagesWorldCom's Rise and Fall: A Case of Failed Corporate Governancejainender80No ratings yet

- Worldcom - Executive Summary Company BackgroundDocument4 pagesWorldcom - Executive Summary Company BackgroundYosafat Hasvandro HadiNo ratings yet

- Daniels Fund Ethics Initiative University of New Mexico HTTPDocument12 pagesDaniels Fund Ethics Initiative University of New Mexico HTTPMuhammad TariqNo ratings yet

- Joy of Management Assignment: Presentation On: Why Do Business Organizations Exists?Document14 pagesJoy of Management Assignment: Presentation On: Why Do Business Organizations Exists?Harshit KanchanNo ratings yet

- Current Business Affairs: Assignment-1Document17 pagesCurrent Business Affairs: Assignment-1Salman JanNo ratings yet

- Rise & Fall of WorldComDocument14 pagesRise & Fall of WorldComkanabaramitNo ratings yet

- Corporate Governance: The Worldcom Scandal: Ugba107 Week 11Document16 pagesCorporate Governance: The Worldcom Scandal: Ugba107 Week 11Clarence FernandoNo ratings yet

- How Acquisitions Led to the Downfall of WorldCom, Enron, and TycoDocument3 pagesHow Acquisitions Led to the Downfall of WorldCom, Enron, and TycoJamilleNo ratings yet

- Assignment - Busiiness EthicsDocument6 pagesAssignment - Busiiness EthicsEmad BelalNo ratings yet

- Sarbanes-Oxley (SOX) Act of 2002: Presented by GroupDocument11 pagesSarbanes-Oxley (SOX) Act of 2002: Presented by GroupMathew Joshy 18099No ratings yet

- A62JonathanHGabrielMisdirectDocument21 pagesA62JonathanHGabrielMisdirectCamilo OvalleNo ratings yet

- Individual Assignment: TopicDocument6 pagesIndividual Assignment: TopicNguyễn Đăng Huy - K15 FUG CTNo ratings yet

- Fraud ReportDocument5 pagesFraud ReportGiang DuongNo ratings yet

- Enron Case StudyDocument6 pagesEnron Case Studyali goharNo ratings yet

- Enron Scandal Case Study in Business EthicsDocument4 pagesEnron Scandal Case Study in Business EthicsShiney BenjaminNo ratings yet

- ENRON SCANDAL REPORT EXPOSES $600M FRAUDDocument12 pagesENRON SCANDAL REPORT EXPOSES $600M FRAUDJOEMARI CRUZNo ratings yet

- Major Corporate Scams PresentationDocument24 pagesMajor Corporate Scams PresentationGanesh Prasad PandaNo ratings yet

- WorldCom Scandal: Accounting Fraud and its ImpactDocument11 pagesWorldCom Scandal: Accounting Fraud and its ImpactDeepanshu 241 KhannaNo ratings yet

- CASE STUDY - WHAT WENT WRONG-WorldComDocument3 pagesCASE STUDY - WHAT WENT WRONG-WorldComMark Jaypee SantiagoNo ratings yet

- Value Creation Through Corporate GovernanceDocument11 pagesValue Creation Through Corporate GovernanceAbdel AyourNo ratings yet

- Strategic Management Business EthicsDocument16 pagesStrategic Management Business EthicsRonald DecinaNo ratings yet

- Corporate America and SarbanesDocument2 pagesCorporate America and SarbanesMohammad Nowaiser MaruhomNo ratings yet

- The Rise and Fall of EnronDocument22 pagesThe Rise and Fall of EnronDhanwantri SharmaNo ratings yet

- Scandal FRAPPTDocument31 pagesScandal FRAPPTUtkarsh SinghNo ratings yet

- GAAP and IFRS: Standards for Financial ReportingDocument28 pagesGAAP and IFRS: Standards for Financial ReportingArockia Sagayaraj TNo ratings yet

- WorldCom CaseDocument7 pagesWorldCom Casebayu pratama putraNo ratings yet

- Ankit Jain Rohan Sharma Tushar Shigwan Sneha Agrawal Sujay Bachewar Abhinandan Nandanikar Abhilash Nair Payal ModyDocument20 pagesAnkit Jain Rohan Sharma Tushar Shigwan Sneha Agrawal Sujay Bachewar Abhinandan Nandanikar Abhilash Nair Payal ModypuneethkunderNo ratings yet

- Case Study On WorldComDocument8 pagesCase Study On WorldComsateybanik100% (4)

- The Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallyDocument2 pagesThe Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallySi Reygie Rojas KoNo ratings yet

- Answers - Test - Pmba Business EthicsDocument6 pagesAnswers - Test - Pmba Business EthicsKuzi TolleNo ratings yet

- Examples of Agency ProblemsDocument3 pagesExamples of Agency ProblemsdaleNo ratings yet

- Report On Corporate FraudDocument16 pagesReport On Corporate FraudShivani SharmaNo ratings yet

- I. Background of The StudyDocument13 pagesI. Background of The StudyalyssaNo ratings yet

- Accounting Info - Updated partHDTASTF - RoldanDocument16 pagesAccounting Info - Updated partHDTASTF - RoldanRyan Joseph Agluba DimacaliNo ratings yet

- Case Study GovDocument5 pagesCase Study GovSucreNo ratings yet

- World ComDocument15 pagesWorld Commkg750No ratings yet

- Enron Scandal PresentationDocument11 pagesEnron Scandal PresentationYujia JinNo ratings yet

- WorldCom Scandal Rocks Wall StreetDocument2 pagesWorldCom Scandal Rocks Wall StreetAaditya ManojNo ratings yet

- Embargoed Speech on Trust, Markets and GovernanceDocument10 pagesEmbargoed Speech on Trust, Markets and GovernancewhitestoneoeilNo ratings yet

- Unethical Leadership and Downfall: WorldcomDocument2 pagesUnethical Leadership and Downfall: WorldcomAyman ChowdhuryNo ratings yet

- Enron Scandal: Assignment 1Document5 pagesEnron Scandal: Assignment 1Afnan TufailNo ratings yet

- Directors' Duties: J. Dine, Company Law © Janet Dine 1998Document2 pagesDirectors' Duties: J. Dine, Company Law © Janet Dine 1998ravinNo ratings yet

- Failures of Corporate GovernanceDocument9 pagesFailures of Corporate Governancek gowtham kumar100% (2)

- Worldcom Inc.: Case Study On The Most Controversial Fraud in U.S. HistoryDocument34 pagesWorldcom Inc.: Case Study On The Most Controversial Fraud in U.S. HistoryEira ShaneNo ratings yet

- EnronDocument8 pagesEnronjualNo ratings yet

- Brief History of Corporate GovernanceDocument27 pagesBrief History of Corporate GovernanceM YounasNo ratings yet

- WorldCom Fraud PPT (Accounting Learning)Document12 pagesWorldCom Fraud PPT (Accounting Learning)蒲睿灵No ratings yet

- Aj Ibañez - Assignment 2Document19 pagesAj Ibañez - Assignment 2AJ Louise IbanezNo ratings yet

- SPEs and Mark-to-Market Accounting Fueled Enron's Rise and FallDocument8 pagesSPEs and Mark-to-Market Accounting Fueled Enron's Rise and FallMustansar RanjhaNo ratings yet

- Case Study WorldComDocument4 pagesCase Study WorldComMuhammad ZubairNo ratings yet

- Worldcom ScamDocument26 pagesWorldcom Scamzabi ullah MohammadiNo ratings yet

- Chapter 11Document10 pagesChapter 11HusainiBachtiarNo ratings yet

- How creative accounting and weak oversight led to Enron's collapseDocument7 pagesHow creative accounting and weak oversight led to Enron's collapseShyam ChoudharyNo ratings yet

- Veena_Kalia_vs_Jatinder_Nath_Kalia_and_Ors_05051990827d960049COM436103Document11 pagesVeena_Kalia_vs_Jatinder_Nath_Kalia_and_Ors_05051990827d960049COM436103SAI SUVEDHYA RNo ratings yet

- Frank_M_Costanzo_and_Ors__vs_The_Regional_PassportT102526COM584330Document5 pagesFrank_M_Costanzo_and_Ors__vs_The_Regional_PassportT102526COM584330SAI SUVEDHYA RNo ratings yet

- Anju Garg vs Hotel Association of India & Ors. - 2008 - SCDocument19 pagesAnju Garg vs Hotel Association of India & Ors. - 2008 - SCSAI SUVEDHYA RNo ratings yet

- Laxman Omana vs State of Karnataka - KAR HC - 2001Document5 pagesLaxman Omana vs State of Karnataka - KAR HC - 2001SAI SUVEDHYA RNo ratings yet

- Jagadish Singh vs Heeralal & Ors. - 2014 - SCDocument15 pagesJagadish Singh vs Heeralal & Ors. - 2014 - SCSAI SUVEDHYA RNo ratings yet

- Jakir Hussain Kosangi and Ors Vs State of Andhra PAP201721081716393012COM209535Document23 pagesJakir Hussain Kosangi and Ors Vs State of Andhra PAP201721081716393012COM209535SAI SUVEDHYA RNo ratings yet

- P Ethics-IntDocument27 pagesP Ethics-IntSAI SUVEDHYA RNo ratings yet

- Right To PracticeDocument5 pagesRight To PracticeSAI SUVEDHYA RNo ratings yet

- Minor L THR Guardian J Vs State and Ors 04112023 DEOR20230203942COM320549Document3 pagesMinor L THR Guardian J Vs State and Ors 04112023 DEOR20230203942COM320549SAI SUVEDHYA RNo ratings yet

- Iel Cases Mid SemDocument28 pagesIel Cases Mid SemSAI SUVEDHYA RNo ratings yet

- YaswanthDocument3 pagesYaswanthSAI SUVEDHYA RNo ratings yet

- Sui Generis Protection for Plant Varieties in IndiaDocument19 pagesSui Generis Protection for Plant Varieties in IndiaAnitaNo ratings yet

- Supreme Court upholds BCCI's 5-year ban on cricketer Ajay JadejaDocument41 pagesSupreme Court upholds BCCI's 5-year ban on cricketer Ajay JadejaSAI SUVEDHYA RNo ratings yet

- History and Development of the Legal Profession in IndiaDocument16 pagesHistory and Development of the Legal Profession in IndiaSAI SUVEDHYA RNo ratings yet

- International Criminal LawDocument18 pagesInternational Criminal LawSAI SUVEDHYA RNo ratings yet

- Sports Law Material For Discussion - Mr. P.Bayola Kiran PDFDocument406 pagesSports Law Material For Discussion - Mr. P.Bayola Kiran PDFSAI SUVEDHYA RNo ratings yet

- Ad ActDocument9 pagesAd ActSAI SUVEDHYA RNo ratings yet

- CARTAL - Payment GuideDocument6 pagesCARTAL - Payment GuideSAI SUVEDHYA RNo ratings yet

- SLPC Ten Reforms ReportDocument59 pagesSLPC Ten Reforms ReportSejal LahotiNo ratings yet

- SYLLABUSDocument1 pageSYLLABUSSAI SUVEDHYA RNo ratings yet

- Ethics 1Document18 pagesEthics 1SAI SUVEDHYA RNo ratings yet

- Historical Reviewof General Electionsin IndiaDocument19 pagesHistorical Reviewof General Electionsin IndiaSAI SUVEDHYA RNo ratings yet

- International Environmental Law Case VideosDocument1 pageInternational Environmental Law Case VideosSAI SUVEDHYA RNo ratings yet

- B.a., Ll.b. Hons. - 2019 20Document3 pagesB.a., Ll.b. Hons. - 2019 20SAI SUVEDHYA RNo ratings yet

- 7th CARTAL Conference on International Arbitration, 2023Document8 pages7th CARTAL Conference on International Arbitration, 2023SAI SUVEDHYA RNo ratings yet

- MARA Labs v Trent Limited arbitration claimDocument9 pagesMARA Labs v Trent Limited arbitration claimSAI SUVEDHYA RNo ratings yet

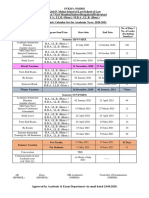

- NMIMS Kirit P. Mehta School of Law Academic Calendar 2020-2021Document1 pageNMIMS Kirit P. Mehta School of Law Academic Calendar 2020-2021SAI SUVEDHYA RNo ratings yet

- Hari Sankaran V UOI &others 2019 Indlaw SC 586Document9 pagesHari Sankaran V UOI &others 2019 Indlaw SC 586SAI SUVEDHYA RNo ratings yet

- International Arbitration as New Frontier for Business and Human Rights DisputesDocument29 pagesInternational Arbitration as New Frontier for Business and Human Rights DisputesSAI SUVEDHYA RNo ratings yet

- Atos Syntel Legal Associate Positions Mumbai PuneDocument3 pagesAtos Syntel Legal Associate Positions Mumbai PuneSAI SUVEDHYA RNo ratings yet

- Assessing Internal Controls for Audit EfficiencyDocument6 pagesAssessing Internal Controls for Audit EfficiencyGia Sarah Barillo BandolaNo ratings yet

- University Cordilleras Engineering Statics ForcesDocument7 pagesUniversity Cordilleras Engineering Statics ForcesBryanHarold BrooNo ratings yet

- General Rules and Guidelines To Debating HandbookDocument26 pagesGeneral Rules and Guidelines To Debating HandbookShalinei.CNo ratings yet

- ILP-week 3 & 4Document13 pagesILP-week 3 & 4Jamielor GN BalmedianoNo ratings yet

- Acctg 101 Ass. #15,17,19&21Document8 pagesAcctg 101 Ass. #15,17,19&21Danilo Diniay Jr67% (6)

- Appeal Allowed by Seesion Case No.2Document13 pagesAppeal Allowed by Seesion Case No.2Naveen KumarNo ratings yet

- Dela CruzDocument1 pageDela CruzJp Dela CruzNo ratings yet

- Alcala Vda. Alcaneses v. AlcanesesDocument15 pagesAlcala Vda. Alcaneses v. AlcanesesEun ChoiNo ratings yet

- Provisional Remedies Remedial Law ReviewerDocument14 pagesProvisional Remedies Remedial Law ReviewerMae Anne PioquintoNo ratings yet

- Globalization and the Changing Global EconomyDocument9 pagesGlobalization and the Changing Global EconomyLê MỹNo ratings yet

- Understanding Society, Culture and PoliticsDocument4 pagesUnderstanding Society, Culture and PoliticsericacadagoNo ratings yet

- Annulment of Judgment Referred by Mike GranatinDocument4 pagesAnnulment of Judgment Referred by Mike GranatinDAR,Legal DivisionNo ratings yet

- Huge Edu Alliance For ExcellenceDocument70 pagesHuge Edu Alliance For ExcellenceJP StorkNo ratings yet

- Cabarroguis Vs BasaDocument9 pagesCabarroguis Vs BasaMark John Geronimo BautistaNo ratings yet

- Pre-Acceptance LetterDocument3 pagesPre-Acceptance Letterabel24143No ratings yet

- EXPORT SALES AGREEMENTDocument7 pagesEXPORT SALES AGREEMENTRajvi ChatwaniNo ratings yet

- 53 - Union Bank v. PeopleDocument3 pages53 - Union Bank v. PeopleadeeNo ratings yet

- Muller v. MullerDocument2 pagesMuller v. MullerFrances Ann TevesNo ratings yet

- Iit Maths - Trigonometry, Functions, Graphs, Differentiation EtcDocument20 pagesIit Maths - Trigonometry, Functions, Graphs, Differentiation EtcParas Thakur67% (3)

- Contract of Lease: Block 5 Lot 9 Melbourne St. Margarita HMS, San Antonio, Biñan City, LagunaDocument4 pagesContract of Lease: Block 5 Lot 9 Melbourne St. Margarita HMS, San Antonio, Biñan City, LagunaPau JoyosaNo ratings yet

- SOP NR 1 (Disposition of Anonymous Complaints or Reports)Document1 pageSOP NR 1 (Disposition of Anonymous Complaints or Reports)Air ProvostNo ratings yet

- 10 STG WelcomeToYourEngagement LM 02 UC Financial Statements PY-IsADocument12 pages10 STG WelcomeToYourEngagement LM 02 UC Financial Statements PY-IsAHumbertNo ratings yet

- NDA AgreementDocument2 pagesNDA AgreementAngelica Caisip-RomeroNo ratings yet

- Philippine Statute Law ReportDocument7 pagesPhilippine Statute Law ReportAbbeyBandola0% (1)

- Daka Research v. Starkiss - ComplaintDocument286 pagesDaka Research v. Starkiss - ComplaintSarah BursteinNo ratings yet

- Manlapaz - ADVENT OF SPAIN ESSAYDocument4 pagesManlapaz - ADVENT OF SPAIN ESSAYGlenn C. Batincila Jr.No ratings yet

- Ballatan vs. Court of AppealsDocument2 pagesBallatan vs. Court of Appealshmn_scribdNo ratings yet

- People Vs GumimbaDocument2 pagesPeople Vs GumimbaJune Erik Ylanan100% (1)

- The Full-Belly Thesis - Should Economics Rights Take Priority OverDocument49 pagesThe Full-Belly Thesis - Should Economics Rights Take Priority Overmailtojamil05No ratings yet

- Proforma Invoice-7-26Document1 pageProforma Invoice-7-26sergio antonio martinez cansinoNo ratings yet