Professional Documents

Culture Documents

11 Acctg For BOT

Uploaded by

Peterson Manalac0 ratings0% found this document useful (0 votes)

11 views20 pagesThis document discusses accounting for build-operate-transfer (BOT) arrangements under IFRIC 12. It defines a BOT arrangement and notes they are also called service concession arrangements. It explains that IFRIC 12 applies if the grantor controls the services provided and residual interest. The operator does not recognize the infrastructure as an asset. If consideration is a financial asset, intangible asset, or both, they are accounted for under PFRS 9, PAS 38, or both respectively. Construction services are accounted for under PFRS 15 and the resulting asset under PFRS 9, PAS 38 or both. Operation services are also accounted under PFRS 15. Borrowing costs may be capitalized if consideration is an

Original Description:

Original Title

11 Acctg for BOT

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses accounting for build-operate-transfer (BOT) arrangements under IFRIC 12. It defines a BOT arrangement and notes they are also called service concession arrangements. It explains that IFRIC 12 applies if the grantor controls the services provided and residual interest. The operator does not recognize the infrastructure as an asset. If consideration is a financial asset, intangible asset, or both, they are accounted for under PFRS 9, PAS 38, or both respectively. Construction services are accounted for under PFRS 15 and the resulting asset under PFRS 9, PAS 38 or both. Operation services are also accounted under PFRS 15. Borrowing costs may be capitalized if consideration is an

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views20 pages11 Acctg For BOT

Uploaded by

Peterson ManalacThis document discusses accounting for build-operate-transfer (BOT) arrangements under IFRIC 12. It defines a BOT arrangement and notes they are also called service concession arrangements. It explains that IFRIC 12 applies if the grantor controls the services provided and residual interest. The operator does not recognize the infrastructure as an asset. If consideration is a financial asset, intangible asset, or both, they are accounted for under PFRS 9, PAS 38, or both respectively. Construction services are accounted for under PFRS 15 and the resulting asset under PFRS 9, PAS 38 or both. Operation services are also accounted under PFRS 15. Borrowing costs may be capitalized if consideration is an

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 20

ACCOUNTING FOR SPECIAL

TRANSACTIONS

(Advanced Accounting 1)

LECTURE AID

2018

ZEUS VERNON B. MILLAN

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Chapter 13

Accounting for Build-operate-transfer (BOT)

Learning Competencies

• Define a “build-operate-transfer” (BOT)

arrangement that is within the scope of IFRIC

Interpretation 12 and SIC Interpretation 29.

• Differentiate the accounting procedures for a BOT

arrangement depending on the type of

consideration received by the “operator.”

• Account for BOT arrangements.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

“Build-Operate-Transfer” (BOT) arrangements

• Under a BOT arrangement, the construction of a new infrastructure

or the development or maintenance of an existing infrastructure is

outsourced by the government (‘grantor’) from private companies

(called the ‘operators’) through competitive bidding or direct

negotiation.

• The ‘operator’ awarded with the BOT contract is allowed to finance

the construction, development or maintenance of the

infrastructure and commercially operate it for a fixed period of

time sufficient for him to earn back the capital he invested as well as

collect profit. After which, the ‘operator’ transfers the

infrastructure to the government without further compensation.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Other terms

Other terms for BOT arrangements are:

• “service concession arrangement,”

• “rehabilitate-operate-transfer,”

• “public-to-private service concession” and

• “private-public partnership (PPP).

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Features of BOT arrangements

a. The service to be provided by the operator under the BOT arrangement is

of public service nature and shall be provided to the public on behalf of

the public sector entity or government.

b. The grantor of the BOT contract is a public sector entity (i.e., government).

c. The operator is responsible for at least some of the management of the

infrastructure and related services and does not merely act as an agent on

behalf of the grantor.

d. The contract sets the initial prices to be levied by the operator and

regulates price revisions over the period of the service arrangement.

e. The operator is obliged to hand over the infrastructure to the grantor in a

specified condition at the end of the period of the arrangement, for little or

no incremental consideration, irrespective of which party initially financed

it. ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

IFRIC 12 Service Concession Arrangements

• IFRIC 12 applies to Build-Operate-Transfer (BOT) contracts if:

a. The grantor (i.e., government) controls or regulates

i. what services the operator must provide with the

infrastructure,

ii. to whom it must provide them, and

iii. at what price; and

b. The grantor controls, through ownership, beneficial

entitlement or otherwise, any significant residual

interest in the infrastructure at the end of the term of the

arrangement.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

IFRIC 12 (continuation)

• The outsourcing of the operation of a

governmental unit’s internal services (e.g.,

employee cafeteria, building maintenance, and

accounting or information technology functions)

is not a service concession arrangement within

the scope of IFRIC 12 or SIC 29.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Accounting issues

• IFRIC 12 deals with the accounting for the following:

1. Treatment of the operator’s rights over the infrastructure;

2. Recognition and measurement of arrangement consideration;

3. Construction or upgrade services;

4. Operation services;

5. Borrowing costs;

6. Subsequent accounting treatment of a financial asset and an

intangible asset; and

7. Items provided to the operator by the grantor.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Treatment of the operator’s rights over the infrastructure

• The infrastructure referred to in a BOT contract

accounted for under IFRIC 12 shall not be recognized as

property, plant and equipment of the operator.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Recognition and measurement of arrangement consideration

• Under a BOT arrangement that is within the scope of

IFRIC 12, the operator acts as a service provider.

• Such services may be:

1. Construction or upgrade services – the operator

constructs or upgrades infrastructure used to provide

a public service; and

2. Operation services – the operator operates and

maintains that infrastructure for a specified period of

time.

• The operator shall recognize and measure revenue in

accordance with PFRS 15 Revenue from Contracts with

Customers for the services it performs.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Construction or upgrade services

• The consideration from construction or upgrade services may be rights to:

1. Financial asset,

2. Intangible asset, or

3. Partly financial asset and partly intangible asset

• The operator shall account for construction or upgrade services in

accordance with PFRS 15.

• After completion of the construction services, the asset recognized

from the contract is accounted for under PFRS 9 (for a financial

asset) or PAS 38 (for an intangible asset) or both (if the

consideration is partly a financial asset and partly an intangible

asset.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Financial asset

• A financial asset shall be recognized if the operator has an

unconditional contractual right to receive cash or another

financial asset from the grantor, such as when the grantor

contractually guarantees to pay the operator

1. Specified or determinable amounts or

2. The shortfall, if any, between amounts received from users of

the public service and specified or determinable amounts, even

if payment is contingent on the operator ensuring that the

infrastructure meets specified quality or efficiency

requirements.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Financial asset (Continuation)

• The amount due from or at the direction of the grantor is

accounted for in accordance with PFRS 9 Financial

Instruments as measured at:

1. Amortized cost; or

2. Fair value through other comprehensive income (FVOCI);

or

3. Fair value through profit or loss (FVPL).

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Intangible asset

• An intangible asset shall be recognized if the operator

receives a right (a license) to charge users of the

public service.

• The operator shall account for the intangible asset

(license) it has received from the grantor using PAS 38

Intangible Assets.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Partly by a financial asset and an intangible asset

• If the consideration received or receivable is partly a

financial asset and partly an intangible asset, each

component shall be accounted for separately and both

components be recognized initially in accordance with

PFRS 15.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Operation services

• The operator shall account for operation services in

accordance with PFRS 15.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

Borrowing costs incurred by the operator

• The operator is allowed to capitalize borrowing costs, subject

to the provisions of PAS 23 Borrowing Costs, if the

consideration in a service concession arrangement is in the

form of an intangible asset.

ACCOUNTING FOR SPECIAL

TRANSACTIONS (Advanced

Accounting 1) - (by: MILLAN)

APPLICATION OF CONCEPTS

PROBLEM 2: FOR CLASSROOM DISCUSSION

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

OPEN FORUM

QUESTIONS????

REACTIONS!!!!!

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

END

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) - (by:

MILLAN)

You might also like

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- 11.1.2. Accounting For BotDocument90 pages11.1.2. Accounting For BotAnne Jasmine FloresNo ratings yet

- Accounting For Build Operate TransferDocument8 pagesAccounting For Build Operate TransferDanielle MarundanNo ratings yet

- Service Concession AgreementsDocument18 pagesService Concession AgreementsCharles MateoNo ratings yet

- Chapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesDocument21 pagesChapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesRey Joyce AbuelNo ratings yet

- Service Concession ArrangementDocument2 pagesService Concession Arrangementkim cheNo ratings yet

- Build, Operate and TransferDocument11 pagesBuild, Operate and TransferChloe OberlinNo ratings yet

- Acc For Spe TransacDocument4 pagesAcc For Spe TransacSarah Jane SeñidoNo ratings yet

- Chapter 1Document17 pagesChapter 1Mydel AvelinoNo ratings yet

- Chapter 1 CURRENT LIABDocument17 pagesChapter 1 CURRENT LIABSwelyn Angelee Mendoza BalelinNo ratings yet

- Acctg For BODocument2 pagesAcctg For BOUlyssa GeraldeNo ratings yet

- Chapter 11 Investments - Additional ConceptsDocument15 pagesChapter 11 Investments - Additional ConceptsAna Leah Delfin100% (1)

- Chapter 1 - Current LiabilitiesDocument17 pagesChapter 1 - Current LiabilitiesGrezel NiceNo ratings yet

- Service Concession Accounting - IND AS 115Document25 pagesService Concession Accounting - IND AS 115Bishow MaharjanNo ratings yet

- 6 Service Concession Arrangements PDFDocument2 pages6 Service Concession Arrangements PDFGayle LalloNo ratings yet

- Chapter 1 - Current LiabilitiesDocument17 pagesChapter 1 - Current LiabilitiesCaladhiel100% (1)

- Chapter 1 - Current LiabilitiesDocument17 pagesChapter 1 - Current LiabilitiesJEFFERSON CUTENo ratings yet

- Govt. Acctg CHP 15Document21 pagesGovt. Acctg CHP 15Shane KimNo ratings yet

- Service Concession Arrangements: IFRIC Interpretation 12Document7 pagesService Concession Arrangements: IFRIC Interpretation 12Tanvir PrantoNo ratings yet

- Ifric 12Document7 pagesIfric 12J Satya SarawanaNo ratings yet

- Chapter 1 - Current LiabilitiesDocument17 pagesChapter 1 - Current LiabilitiesIra Charisse BurlaosNo ratings yet

- Chapter 1 - Current LiabilitiesDocument15 pagesChapter 1 - Current LiabilitiesDissentNo ratings yet

- IFRIC 12 - Service Concession ArrangementsDocument12 pagesIFRIC 12 - Service Concession ArrangementsTopy DajayNo ratings yet

- (Intermediate Accounting 1B) : Zeus Vernon B. MillanDocument19 pages(Intermediate Accounting 1B) : Zeus Vernon B. MillanAngelica PagaduanNo ratings yet

- (AFAR) (S04) - Insurance Contracts, Service Concession Arrangements, and Updates On Special Concerns PDFDocument7 pages(AFAR) (S04) - Insurance Contracts, Service Concession Arrangements, and Updates On Special Concerns PDFPolinar Paul MarbenNo ratings yet

- Chapter 1 - Current LiabilitiesDocument25 pagesChapter 1 - Current LiabilitiesKathleen MarcialNo ratings yet

- Chapter 1 Current LiabilitiesDocument17 pagesChapter 1 Current Liabilitiesneraizagutierrez11No ratings yet

- Build Operate TransferDocument5 pagesBuild Operate TransferNita Costillas De MattaNo ratings yet

- Chapter 1-Current LiabilitiesDocument15 pagesChapter 1-Current LiabilitiesMonique AlarcaNo ratings yet

- Chapter 15 Miscellaneous TopicsDocument6 pagesChapter 15 Miscellaneous TopicsAngelica Joy ManaoisNo ratings yet

- Service ConcessionDocument31 pagesService ConcessionAngelica AllanicNo ratings yet

- Ifric 12Document12 pagesIfric 12Cryptic LollNo ratings yet

- D2 S3 ISAK 16 - IFRIC 12 Illustrative Examples-HTDocument22 pagesD2 S3 ISAK 16 - IFRIC 12 Illustrative Examples-HTHendri Pecinta KedamaiAnNo ratings yet

- International AccountingDocument11 pagesInternational AccountingJOLLYBEL ROBLES0% (1)

- 19 Ifric-12Document9 pages19 Ifric-12DM BuenconsejoNo ratings yet

- Chapter 15 Ppe Part 1 2020 EditionDocument24 pagesChapter 15 Ppe Part 1 2020 EditionMark Rafael MacapagalNo ratings yet

- Ifric12 PDFDocument12 pagesIfric12 PDFJorreyGarciaOplasNo ratings yet

- Chapter 11 Investments Additional ConceptsDocument15 pagesChapter 11 Investments Additional ConceptsPrincess Ann FranciscoNo ratings yet

- 15 Ppe Part 1Document36 pages15 Ppe Part 1Lyan OriasNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&A) Q&A No. 2018-12 Pfrs 15 Implementation Issues Affecting The Real Estate IndustryDocument54 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&A) Q&A No. 2018-12 Pfrs 15 Implementation Issues Affecting The Real Estate IndustryJaey EmmNo ratings yet

- Service Concession Agreement by GrantorDocument16 pagesService Concession Agreement by GrantorRonnell Vic Cañeda YuNo ratings yet

- Interim PaymentsDocument29 pagesInterim PaymentsthimirabandaraNo ratings yet

- Concession AgreementDocument66 pagesConcession Agreementrohitsomani2209100% (1)

- GST AmmendmentsDocument97 pagesGST AmmendmentsCA Keshav MadaanNo ratings yet

- Quiz - Chapter 13 - Acctg For BotDocument3 pagesQuiz - Chapter 13 - Acctg For BotMark CanoNo ratings yet

- Chapter-4 ProvisionsDocument18 pagesChapter-4 ProvisionsJEFFERSON CUTENo ratings yet

- History: 3 March 2005Document2 pagesHistory: 3 March 2005Juan TañamorNo ratings yet

- BDO - Revenue ArticlesDocument22 pagesBDO - Revenue Articlesyung kenNo ratings yet

- Group1 Presentation - Ipsas 32 - Service Concession Arrangements - Grantor - 012913Document10 pagesGroup1 Presentation - Ipsas 32 - Service Concession Arrangements - Grantor - 012913Kudzaishe chigwaNo ratings yet

- Module 2c Additional Concepts - ReceivablesDocument15 pagesModule 2c Additional Concepts - ReceivablesMelanie RuizNo ratings yet

- ClanakIFRIC12 DarioSiliciHrvojeVolarevicDocument17 pagesClanakIFRIC12 DarioSiliciHrvojeVolarevicŞtefan AlinNo ratings yet

- Cfas Pfrs 15 SummaryDocument4 pagesCfas Pfrs 15 SummaryAngelica SandraNo ratings yet

- Chapter 15 Ppe Part 1Document28 pagesChapter 15 Ppe Part 1marianNo ratings yet

- Chapter 1 AbcDocument24 pagesChapter 1 AbcChennie Mae Pionan SorianoNo ratings yet

- Chapter 23Document17 pagesChapter 23Sia DLSLNo ratings yet

- Service Concession AgreementDocument31 pagesService Concession AgreementvorapratikNo ratings yet

- Wiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- 10 Accounting For Not-For-Profit Entities and CooperativesDocument41 pages10 Accounting For Not-For-Profit Entities and CooperativesPeterson ManalacNo ratings yet

- 09 Financial Report SystemDocument72 pages09 Financial Report SystemPeterson ManalacNo ratings yet

- 04 The Revised Chart of AccountsDocument20 pages04 The Revised Chart of AccountsPeterson ManalacNo ratings yet

- 05 Procurement ProcessDocument41 pages05 Procurement ProcessPeterson ManalacNo ratings yet

- 06 Accounting For DisbursemntDocument49 pages06 Accounting For DisbursemntPeterson ManalacNo ratings yet

- 03 Accounting For Budgetary Accounts PT 2Document23 pages03 Accounting For Budgetary Accounts PT 2Peterson ManalacNo ratings yet

- 03 Accounting For Budgetary Accounts PT 1Document27 pages03 Accounting For Budgetary Accounts PT 1Peterson ManalacNo ratings yet

- 02 The Budgeting ProcessDocument48 pages02 The Budgeting ProcessPeterson ManalacNo ratings yet

- 01 Basic Features of Government AcctgDocument15 pages01 Basic Features of Government AcctgPeterson ManalacNo ratings yet

- Statement of Comprehensive Income: Basic Financial Statements IiDocument5 pagesStatement of Comprehensive Income: Basic Financial Statements IiEurica LimNo ratings yet

- PWDocument11 pagesPWAshu PatelNo ratings yet

- 1-Activities EcoDocument6 pages1-Activities EcombondoNo ratings yet

- History of Marketing.Document5 pagesHistory of Marketing.amran mohammedNo ratings yet

- Chapter 10 Solution Manual Kieso IFRSDocument74 pagesChapter 10 Solution Manual Kieso IFRSIvan JavierNo ratings yet

- Obalana W09GroupAssignmentDocument9 pagesObalana W09GroupAssignmentwilliamslaw123 WilliamsNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSarath KumarNo ratings yet

- 22 April - PP - Suggested Answers - CS Anoop JainDocument6 pages22 April - PP - Suggested Answers - CS Anoop JainAnu GargNo ratings yet

- Annual Report - Quant Mutual Fund - Financial Year 2022-23Document105 pagesAnnual Report - Quant Mutual Fund - Financial Year 2022-23R RNo ratings yet

- Agri S.B.A Business PlanDocument21 pagesAgri S.B.A Business Planlashaunlewis.stu2019No ratings yet

- Empower B1 - Student's BookDocument180 pagesEmpower B1 - Student's BookEma MezaNo ratings yet

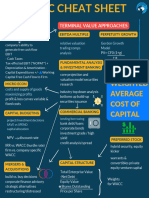

- Comprehensive Finance Cheat Sheet Collection 1698244606Document52 pagesComprehensive Finance Cheat Sheet Collection 1698244606muratgreywolf100% (1)

- W10 Financial Phase Presentation 1Document9 pagesW10 Financial Phase Presentation 1Dave John LavariasNo ratings yet

- Lesson 5 Summative TestDocument2 pagesLesson 5 Summative Testalexiacabatas17No ratings yet

- Saqib Ahmad MirDocument18 pagesSaqib Ahmad Mirsaqib mirNo ratings yet

- McDowell Digital Media, Inc.Document14 pagesMcDowell Digital Media, Inc.Seok WilliamsNo ratings yet

- Financial Management and Control - AssignmentDocument7 pagesFinancial Management and Control - AssignmentSabahat BashirNo ratings yet

- Reliance Industry LimitedDocument21 pagesReliance Industry LimitedMehak guptaNo ratings yet

- Sol-Lecture Ques - MOODLEDocument15 pagesSol-Lecture Ques - MOODLERami RRKNo ratings yet

- Cfa L 1 Mock Paper - Question-22-09-19Document13 pagesCfa L 1 Mock Paper - Question-22-09-19guayrestudioNo ratings yet

- SEPO Policy Brief - Maharlika Investment Fund - FinalDocument15 pagesSEPO Policy Brief - Maharlika Investment Fund - FinalDaryl AngelesNo ratings yet

- By I/, /uDocument21 pagesBy I/, /uContra Value BetsNo ratings yet

- My Most Precious Investing Lessons - Series 2Document19 pagesMy Most Precious Investing Lessons - Series 2Mangesh kNo ratings yet

- Chapter 21 - Audit of The Capital Acquisition and Repayment CycleDocument5 pagesChapter 21 - Audit of The Capital Acquisition and Repayment CycleRaymond GuillartesNo ratings yet

- Performance Analysis of BFPLDocument42 pagesPerformance Analysis of BFPLALL IN ONENo ratings yet

- 1.notes For PDICDocument6 pages1.notes For PDICAna Marie VirayNo ratings yet

- E-Commerce Eje 2Document7 pagesE-Commerce Eje 2Sindy ParraNo ratings yet

- Original PDF Advanced Accounting 12th Edition by Fischer PDFDocument41 pagesOriginal PDF Advanced Accounting 12th Edition by Fischer PDFbarbara.sastre874100% (36)

- Sawera Tailoring UnitDocument8 pagesSawera Tailoring UnitA KsNo ratings yet

- Customer Relationship ManagementDocument11 pagesCustomer Relationship ManagementisolongNo ratings yet