Professional Documents

Culture Documents

Adv & Dis Adv.

Uploaded by

suyash dugar0 ratings0% found this document useful (0 votes)

6 views6 pagesOriginal Title

ADV & DIS ADV.

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views6 pagesAdv & Dis Adv.

Uploaded by

suyash dugarCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 6

ADVANTAGES:

• GST eliminates the cascading effect of tax

GST is a comprehensive indirect tax that was designed to bring the

indirect taxation under one umbrella. More importantly, it is

eliminating the cascading effect of tax that was evident earlier.

Cascading tax effect can be best described as ‘Tax on Tax’.

• Higher threshold for registration

Under GST regime, however, this threshold has been increased to

Rs40 lakh, which exempts many small traders and service providers

• Composition scheme for small businesses

Under GST, small businesses can benefit as it gives an option to lower

taxes by utilizing the Composition Scheme. This move has brought

down the tax and compliance burden on many small businesses

• Simple and easy online procedure

This has been beneficial for start-ups especially, as they do not have to run

from pillar to post to get different registrations such as VAT, excise, and

service tax. he entire process of GST (from registation to filing returns) is

made online, and it is super simple.

• The number of compliances is lesser

Earlier, there was VAT and service tax, each of which had their own returns

and compliances. Under GST, however, there is just one, unified return to

be filed. Therefore, the number of returns to be filed has come down

• Defined treatment for E-commerce operators

Earlier to GST regime, supplying goods through e-commerce sector was not

defined. It had variable VAT laws

Differential treatments and confusing compliances have been removed

under GST.

For the first time, GST has clearly mapped out the provisions applicable to

the e-commerce sector and since these are applicable all over India, there

should be no complication regarding the inter-state movement of goods

anymore.

• Improved efficiency of logistics

Earlier, the logistics industry in India had to maintain multiple warehouses

across states to avoid the current CST and state entry taxes on inter-state

movement. These warehouses were forced to operate below their capacity,

giving room to increased operating costs.

Under GST, however, these restrictions on inter-state movement of goods

have been lessened.

Reduction in unnecessary logistics costs is already increasing profits for

businesses involved in the supply of goods through transportation .

• Unorganized sector is regulated under GST

In the pre-GST era, it was often seen that certain industries in India like

construction and textile were largely unregulated and unorganized.

Under GST, however, there are provisions for online compliances and

payments, and for availing of input credit only when the supplier has

accepted the amount. This has brought in accountability and regulation

to these industries.

DISADVANTAGES

• Increased costs due to software purchase

Businesses have to either update their existing accounting software

to GST-compliant one or buy a GST software so that they can keep

their business going. But both the options lead to increased cost of

software purchase and training of employees for an efficient

utilization of the new billing software.

• Being GST-compliant:

Small and medium-sized enterprises (SME) who have not yet signed

for GST have to quickly grasp the nuances of the GST tax regime.

They will have to issue GST-complaint invoices, be compliant to

digital record-keeping, and of course, file timely returns.

This means that the GST-complaint invoice issued must have

mandatory details such as GSTIN, place of supply, HSN codes, and

others.

• GST will mean an increase in operational costs

As we have already established that GST is changing the way how tax

is paid, businesses will now have to employ tax professionals to be

GST-complaint. This will gradually increase costs for small businesses

as they will have to bear the additional cost of hiring experts.

Also, businesses will need to train their employees in GST

compliance, further increasing their overhead expenses.

• GST came into effect in the middle of the financial year

Businesses may find it hard to get adjusted to the new tax regime,

and some of them are running these tax systems parallelly, resulting

in confusion and compliance issues.

• GST is an online taxation system

Unlike earlier, businesses are now switching from pen and paper

invoicing and filing to online return filing and making payments. This

might be tough for some smaller businesses to adapt to.

• SMEs will have a higher tax burden

Smaller businesses, especially in the manufacturing sector will face

difficulties under GST.

Earlier, only businesses whose turnover exceeded Rs 1.5 crore had

to pay excise duty. But now any business whose turnover exceeds

Rs 40 lakhs will have to pay GST.

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Draw A Chart Showin Tax Structure in IndiaDocument106 pagesDraw A Chart Showin Tax Structure in IndiagamingNo ratings yet

- Draw A Chart Showin Tax Structure in IndiaDocument55 pagesDraw A Chart Showin Tax Structure in IndiaShubh ShahNo ratings yet

- Solutions For GST Question BankDocument55 pagesSolutions For GST Question BankVarun VardhanNo ratings yet

- How GST Would Impact Startups & Small and Medium Size BusinessesDocument12 pagesHow GST Would Impact Startups & Small and Medium Size BusinessesSouravNo ratings yet

- GST Unit 5 BEDocument7 pagesGST Unit 5 BEarunyadav7869No ratings yet

- The First Level of Differentiation Will Come in Depending On Whether The Industry Deals With Manufacturing, Distributing and Retailing or Is Providing A ServiceDocument13 pagesThe First Level of Differentiation Will Come in Depending On Whether The Industry Deals With Manufacturing, Distributing and Retailing or Is Providing A ServiceMansi jainNo ratings yet

- 1 Benefits of GSTDocument18 pages1 Benefits of GSTpriyaNo ratings yet

- Benefits of GSTDocument18 pagesBenefits of GSTHiteshi AggarwalNo ratings yet

- Goods AND Service TAX: Rejoy Singh A3211118349Document8 pagesGoods AND Service TAX: Rejoy Singh A3211118349rejoy singhNo ratings yet

- Goods Sales Tax: Submitted By-Jagteshwar Submitted To - Mrs. PrabhjotDocument12 pagesGoods Sales Tax: Submitted By-Jagteshwar Submitted To - Mrs. PrabhjotSarbeshwar CheemaNo ratings yet

- Article On Reverse Charge 28jul2017Document6 pagesArticle On Reverse Charge 28jul2017Venkataramana NippaniNo ratings yet

- GST Impact on Supply Chain and LogisticsDocument5 pagesGST Impact on Supply Chain and LogisticsOMPRAKASH SM EE021No ratings yet

- GST Assignment-8779Document15 pagesGST Assignment-8779Omkar BhujbalNo ratings yet

- 2 How GST WorksDocument17 pages2 How GST WorkspriyaNo ratings yet

- History of taxation in India and key advantages of GSTDocument161 pagesHistory of taxation in India and key advantages of GSTAnurag KandariNo ratings yet

- GST 1Document13 pagesGST 1Ronove GamingNo ratings yet

- GST and DTCDocument8 pagesGST and DTCvarun2992No ratings yet

- A Summer Internship Program On: Implementation of GST (Goods and Services Tax)Document12 pagesA Summer Internship Program On: Implementation of GST (Goods and Services Tax)shruti modiNo ratings yet

- Disadvantages of GST compliance for businessesDocument2 pagesDisadvantages of GST compliance for businessesDr. Mustafa KozhikkalNo ratings yet

- Analysis of The GST Law: Is Your Business Prepared For The Change?Document23 pagesAnalysis of The GST Law: Is Your Business Prepared For The Change?Minecraft ServerNo ratings yet

- GST Is Known as-WPS OfficeDocument4 pagesGST Is Known as-WPS Officefinancialworld78100% (1)

- Lead Your Firm To Success in The GST SystemDocument16 pagesLead Your Firm To Success in The GST SystemTrinetra AgarwalNo ratings yet

- Advantages and Disadvantages of GST - 30.12.2017 - RksDocument6 pagesAdvantages and Disadvantages of GST - 30.12.2017 - Rksvishal siwachNo ratings yet

- GSTDocument6 pagesGSTpranaynagrale876No ratings yet

- ScribdDocument8 pagesScribdIshika GoyalNo ratings yet

- What Are The Advantages and Disadvantages of GST?Document4 pagesWhat Are The Advantages and Disadvantages of GST?nandita bhutra100% (1)

- 1) Explain GST and Its BenefitsDocument14 pages1) Explain GST and Its BenefitsRohit VishwakarmaNo ratings yet

- Clarifying the SST ConfusionDocument9 pagesClarifying the SST ConfusionKAM JIA LINGNo ratings yet

- India's Tax Structure and Pre-GST Indirect Tax SystemDocument73 pagesIndia's Tax Structure and Pre-GST Indirect Tax SystemVarun VardhanNo ratings yet

- GST Implementation Issues: Input Tax CreditDocument5 pagesGST Implementation Issues: Input Tax CreditSiva SankariNo ratings yet

- The Icfai Law School, Dehradun: GST and GST RefundDocument17 pagesThe Icfai Law School, Dehradun: GST and GST RefundTwinkle RajpalNo ratings yet

- GST Practical 1-39Document88 pagesGST Practical 1-39HarismithaNo ratings yet

- 2nd Answer PDFDocument5 pages2nd Answer PDFSHUBHAM GANDHINo ratings yet

- ECONOMICSDocument35 pagesECONOMICStanish kumarNo ratings yet

- Solutions For GST Question BankDocument73 pagesSolutions For GST Question BankSuprajaNo ratings yet

- Impact of GST On Small and Medium EnterprisesDocument5 pagesImpact of GST On Small and Medium Enterprisesarcherselevators0% (2)

- Group 2 Consumption Tax FinalDocument16 pagesGroup 2 Consumption Tax Finaljadyn nicholasNo ratings yet

- Benefits of GST for Businesses and Consumers in MalaysiaDocument4 pagesBenefits of GST for Businesses and Consumers in MalaysiaszeyingNo ratings yet

- There Is No Such Thing As 'SST'Document1 pageThere Is No Such Thing As 'SST'hfdghdhNo ratings yet

- GST (Unit 1)Document19 pagesGST (Unit 1)bcomh2103012No ratings yet

- Goods and Services Tax (GST) What Is GST in India? Indirect Tax Law ExplainedDocument28 pagesGoods and Services Tax (GST) What Is GST in India? Indirect Tax Law Explainedwh6x5q5kmmNo ratings yet

- Presentation by - Hitaksha Gambhir - Archana Ramesh - Kushal Shah - Harshil Bhadra - Suyog KandiDocument25 pagesPresentation by - Hitaksha Gambhir - Archana Ramesh - Kushal Shah - Harshil Bhadra - Suyog KandiKunal ChawlaNo ratings yet

- Tax in MalaysiaDocument3 pagesTax in MalaysiaMomin TariqNo ratings yet

- GST Issues and ChallengesDocument31 pagesGST Issues and ChallengesSiva Sankari100% (1)

- Goods and Services Tax: Sandeep Kumar Singh Roll No: 23 ITM ChennaiDocument10 pagesGoods and Services Tax: Sandeep Kumar Singh Roll No: 23 ITM ChennaiSandeep SinghNo ratings yet

- The Advantages of GSTDocument9 pagesThe Advantages of GSTJieya Lurve IslamNo ratings yet

- Indirect TaxDocument6 pagesIndirect TaxstepstobecomemillionaireNo ratings yet

- GST Lab 2022Document78 pagesGST Lab 2022Sreeja Reddy100% (1)

- GST Impact On The Supply ChainDocument8 pagesGST Impact On The Supply ChainAamiTataiNo ratings yet

- GST - Answer 2Document9 pagesGST - Answer 2Tarun SolankiNo ratings yet

- Cascading Effect of TaxesDocument5 pagesCascading Effect of TaxesPraveen NairNo ratings yet

- GST Unit 4Document48 pagesGST Unit 4SANSKRITI YADAV 22DM236No ratings yet

- GST Definition, Types, Registration Process Bajaj Finance 2Document1 pageGST Definition, Types, Registration Process Bajaj Finance 2Raman PalNo ratings yet

- Impact of GST On E-CommerceDocument4 pagesImpact of GST On E-CommerceIJAERS JOURNALNo ratings yet

- Elimination of Cascading Tax EffectDocument2 pagesElimination of Cascading Tax EffectHariharanNo ratings yet

- Goods & Services Tax - An Overview - ERO0240651 - ITT Batch 606Document12 pagesGoods & Services Tax - An Overview - ERO0240651 - ITT Batch 606Siddharth Shankar PaikrayNo ratings yet

- Goods and Service TaxDocument14 pagesGoods and Service TaxAmanNo ratings yet

- GST & Its Impact On Business 1Document16 pagesGST & Its Impact On Business 1Aditya Narayan DashNo ratings yet

- Registration Under GSTDocument13 pagesRegistration Under GSTsuyash dugarNo ratings yet

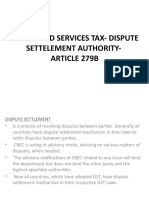

- Goods and Services Tax-Dispute Settelement Authority - Article 279BDocument6 pagesGoods and Services Tax-Dispute Settelement Authority - Article 279Bsuyash dugarNo ratings yet

- Basic Principles of Income-Tax: BY Bommaraju Ramakotaiah. M SC, LLB, IrsDocument75 pagesBasic Principles of Income-Tax: BY Bommaraju Ramakotaiah. M SC, LLB, Irssuyash dugarNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- Transaction Value, Which Is The Price Actually Paid or PayableDocument10 pagesTransaction Value, Which Is The Price Actually Paid or Payablesuyash dugarNo ratings yet

- Historical Development of The Customs Act and Customs DutyDocument47 pagesHistorical Development of The Customs Act and Customs Dutysuyash dugarNo ratings yet

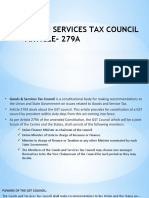

- Goods and Services Tax Council Article-279ADocument5 pagesGoods and Services Tax Council Article-279Asuyash dugarNo ratings yet

- UntitledDocument14 pagesUntitledsuyash dugarNo ratings yet

- UntitledDocument14 pagesUntitledsuyash dugarNo ratings yet

- Indian income tax slabs for AY 2018-2019Document7 pagesIndian income tax slabs for AY 2018-2019suyash dugarNo ratings yet

- UntitledDocument9 pagesUntitledsuyash dugarNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet

- Connotation of Receipt of Income and Accrual of IncomeDocument8 pagesConnotation of Receipt of Income and Accrual of Incomesuyash dugarNo ratings yet

- CUSTOMS DUTY AND TARIFF ACTSDocument26 pagesCUSTOMS DUTY AND TARIFF ACTSsuyash dugarNo ratings yet

- Than Money and Securities But Includes Actionable Claim, Growing CropsDocument8 pagesThan Money and Securities But Includes Actionable Claim, Growing Cropssuyash dugarNo ratings yet

- International TaxationDocument10 pagesInternational Taxationsuyash dugarNo ratings yet

- Customs Valuation GuideDocument6 pagesCustoms Valuation Guidesuyash dugarNo ratings yet

- PrintDocument6 pagesPrintsuyash dugarNo ratings yet

- UntitledDocument7 pagesUntitledsuyash dugarNo ratings yet

- Taxable Event Explained in 40 CharactersDocument2 pagesTaxable Event Explained in 40 Characterssuyash dugarNo ratings yet

- Clubbing of Income-PrintDocument5 pagesClubbing of Income-Printsuyash dugarNo ratings yet

- UntitledDocument12 pagesUntitledsuyash dugarNo ratings yet

- UntitledDocument17 pagesUntitledsuyash dugarNo ratings yet

- UntitledDocument8 pagesUntitledsuyash dugarNo ratings yet

- Constitutional Amendments and Provisions of GST in IndiaDocument20 pagesConstitutional Amendments and Provisions of GST in Indiasuyash dugarNo ratings yet

- International Tax SystemsDocument6 pagesInternational Tax Systemssuyash dugarNo ratings yet

- Tax FeeDocument1 pageTax Feesuyash dugarNo ratings yet

- Clubbing of Income-PrintDocument5 pagesClubbing of Income-Printsuyash dugarNo ratings yet

- A Partnership Firm With A, B and C Partners.: IllustrationsDocument4 pagesA Partnership Firm With A, B and C Partners.: Illustrationssuyash dugarNo ratings yet

- Setup EBTax for CanadaDocument41 pagesSetup EBTax for CanadaRajendran SureshNo ratings yet

- Commercial InvoiceDocument1 pageCommercial Invoice46swztng9xNo ratings yet

- Commercial Policy: Tariff and Non-Tariff BarriersDocument35 pagesCommercial Policy: Tariff and Non-Tariff BarriersKeshav100% (3)

- VR BILLDocument1 pageVR BILLAshu TayadeNo ratings yet

- SAP MM FlowDocument2 pagesSAP MM FlowAshok kumar kethineniNo ratings yet

- EDI Guide: Learn the Basics of Electronic Data InterchangeDocument9 pagesEDI Guide: Learn the Basics of Electronic Data InterchangeSwati HansNo ratings yet

- GST (Good and Service TaxDocument3 pagesGST (Good and Service TaxvkNo ratings yet

- CRM Final Project ReportDocument29 pagesCRM Final Project ReportSubrat Choudhury0% (1)

- Fusion Accounts Payable PDFDocument99 pagesFusion Accounts Payable PDFSatyajeetNo ratings yet

- (Original For Recipient) : Oneplus Bullets Wireless Z Bass Edition (Reverb Red) - B08Hltfb33 (B08Hltfb33) IgstDocument1 page(Original For Recipient) : Oneplus Bullets Wireless Z Bass Edition (Reverb Red) - B08Hltfb33 (B08Hltfb33) IgstPrajwal Birwadkar0% (2)

- Invoice Template ExcelDocument12 pagesInvoice Template ExcelTiago FerreiraNo ratings yet

- AmazonDocument1 pageAmazonAAYUSHI VERMA 7ANo ratings yet

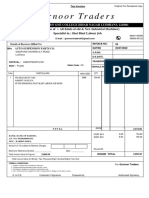

- Gurnoor Traders: Sale & Purchase Of:-All Kinds of Old & New Industrial Machinery Specialist In: Shot Blast Labour JobDocument1 pageGurnoor Traders: Sale & Purchase Of:-All Kinds of Old & New Industrial Machinery Specialist In: Shot Blast Labour JobANMOLNo ratings yet

- Advanced Ch.04 Procurement S4HANA 1709 V1.3Answers (1)Document7 pagesAdvanced Ch.04 Procurement S4HANA 1709 V1.3Answers (1)adiasmith381No ratings yet

- August InvoiceDocument1 pageAugust Invoicecindyshweta95No ratings yet

- Netsuite TricksDocument205 pagesNetsuite TricksJennifer Wagner100% (1)

- Django CRM Latest PDFDocument19 pagesDjango CRM Latest PDFpjrkrishnaNo ratings yet

- ANALYSISTABS - InvoiceDocument2 pagesANALYSISTABS - InvoiceJulio CabreraNo ratings yet

- List of Process For BBP Preparation (PP, SD, MM and FI)Document22 pagesList of Process For BBP Preparation (PP, SD, MM and FI)Debi GhoshNo ratings yet

- Annexes (Ahlone)Document13 pagesAnnexes (Ahlone)Sujeet KumarNo ratings yet

- Invoice for HI REACH-JN-100MbpsDocument2 pagesInvoice for HI REACH-JN-100MbpsBabu JuluriNo ratings yet

- Viking Tabela PreçosDocument377 pagesViking Tabela PreçosleonelNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- Assessment of Effectiveness of EFD Machi PDFDocument48 pagesAssessment of Effectiveness of EFD Machi PDFWinifrida100% (1)

- Fedex Rates Imp en TW 2022Document4 pagesFedex Rates Imp en TW 2022mrdaveylh1No ratings yet

- ACCTG16A FinalExamDocument5 pagesACCTG16A FinalExamJeane BongalanNo ratings yet

- Factura Comercial y Correo SneyderDocument4 pagesFactura Comercial y Correo SneyderDAVID SANTIAGO RODRÍGUEZ ZEANo ratings yet

- What Is ProcurementDocument7 pagesWhat Is ProcurementOmoding EmmanuelNo ratings yet

- Ola Ride Receipt May 2018Document3 pagesOla Ride Receipt May 2018sasenthil241464No ratings yet

- Magazine Proforma InvoiceDocument2 pagesMagazine Proforma Invoicesaketh pedagandham100% (1)