Professional Documents

Culture Documents

FM II - Chapter 03, Financial Planning & Forecasting

Uploaded by

Hace Adis100%(1)100% found this document useful (1 vote)

106 views28 pagesThis document discusses financial planning and forecasting. It defines financial planning as a process consisting of analyzing investment options, projecting the consequences of decisions, deciding on alternatives, and measuring performance against goals. The key components of a financial planning model are inputs like forecasts, the planning model that calculates implications, and outputs like pro forma financial statements. Forecasting estimates future business performance to project financing needs, while planning is concerned with unlikely events as well as likely ones. Common forecasting procedures include projecting sales, estimating asset investments, determining financing needs, and preparing pro forma statements. The percentage-of-sales model and pro forma statements are described as methods to forecast financial statements.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses financial planning and forecasting. It defines financial planning as a process consisting of analyzing investment options, projecting the consequences of decisions, deciding on alternatives, and measuring performance against goals. The key components of a financial planning model are inputs like forecasts, the planning model that calculates implications, and outputs like pro forma financial statements. Forecasting estimates future business performance to project financing needs, while planning is concerned with unlikely events as well as likely ones. Common forecasting procedures include projecting sales, estimating asset investments, determining financing needs, and preparing pro forma statements. The percentage-of-sales model and pro forma statements are described as methods to forecast financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

106 views28 pagesFM II - Chapter 03, Financial Planning & Forecasting

Uploaded by

Hace AdisThis document discusses financial planning and forecasting. It defines financial planning as a process consisting of analyzing investment options, projecting the consequences of decisions, deciding on alternatives, and measuring performance against goals. The key components of a financial planning model are inputs like forecasts, the planning model that calculates implications, and outputs like pro forma financial statements. Forecasting estimates future business performance to project financing needs, while planning is concerned with unlikely events as well as likely ones. Common forecasting procedures include projecting sales, estimating asset investments, determining financing needs, and preparing pro forma statements. The percentage-of-sales model and pro forma statements are described as methods to forecast financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 28

CH.

III

Financial Forecasting & Planning

Compiled by Andualem 14-1

Chapter Outline

I. Financial forecasting Vs Financial Planning

II. Importance of sales forecasting

III. The financial planning process

IV. Methods of forecasting financial statements

• Percentage of sales method

• Pro-forma financial statement method

V.The EFR (External Fund Required( Formula

Compiled by Andualem 02-2

Financial planning

Definition - Financial planning is a process consisting of:

1.Analyzing the investment and financing choices open to the firm.

2.Projecting the future consequences of current decisions.

3.Deciding which alternatives to undertake.

4.Measuring subsequent performance against the goals set forth in the financial plan.

Compiled by Andualem 02-3

Financial planning

Components of a Financial Planning Model

Inputs. The inputs to the financial plan consist of the firm’s current

financial statements and its forecasts about the future.

The Planning Model. The financial planning model calculates the

implications of the manager’s forecasts for profits, new

investment, and financing. The model consists of equations

relating output variables to forecasts. For example, the equations

can show how a change in sales is likely to affect costs, working

capital, fixed assets, and financing requirements.

Compiled by Andualem 02-4

Financial planning

Components of a Financial Planning Model

Outputs. The output of the financial model consists of financial statements

such as income statements, balance sheets, and statements describing sources

and uses of cash. These statements are called pro formas, which means that

they are forecasts based on the inputs and the assumptions built into the plan.

Compiled by Andualem 02-5

Financial planning

Components of a Financial Planning Model

Outputs. The output of the financial model consists of financial statements

such as income statements, balance sheets, and statements describing sources

and uses of cash. These statements are called pro formas, which means that

they are forecasts based on the inputs and the assumptions built into the plan.

Compiled by Andualem 02-6

Financial planning

The Purpose of Planning and Plan Information

The Planning Process: The planning process can pull a management team into a cohesive unit with common

goals.

A Road Map for Running the Business: A business plan functions as a road map for getting an organization to

its goal.

A Statement of Goals: A business plan is a projection of the future that generally reflects what management

would like to see happen.

Predicting Financing Needs: Financial planning is extremely important for companies that rely on outside

financing.

Communicating Information to Investors: A business plan is management’s statement about what the

company is going to be in the future, and can be used to communicate those ideas to investors.

Compiled by Andualem 02-7

Financial planning

Financial Planning vs Financial Forecasting

Financial forecasting is the process of identifying the opportunities in

the future in terms of market size, customer base, or business

strategies. Forecasting involves making projections about what will

happen in the future. As a process, financial forecasting involves

estimating future business performance. It provides information of the

organization’s future revenues and costs that is needed by management

to project financing requirements. The “future” is the planning period

that could be short-term (one or less), medium term (3-5 years), or

long-term (over five years).

Compiled by Andualem 02-8

Financial planning

Financial Planning vs Financial Forecasting

Some argue that financial planning and financial forecasting are one and the

same. However, financial forecasting is the basis for financial planning. Financial

planning is done effectively through financial forecasting.

Financial planning is not just forecasting. Forecasting concentrates on the most

likely future outcome. But financial planners are not concerned solely with

forecasting. They need to worry about unlikely events as well as likely ones.

Compiled by Andualem 02-9

Financial planning

Financial Forecasting Procedures

The following procedures may be used in predicting the future (financial

forecasting).

1.Projection of Organization’s sales revenues -Financial forecasting begins

with sales forecast.

2.Estimation of the level of investments in current assets and fixed assets

3.Determination of the organization’s financing needs & sources of funds

4.Preparing pro forma or forecasted financial statements, namely, pro forma

income statement, pro forma balance sheet, and cash budget.

Compiled by Andualem 02-10

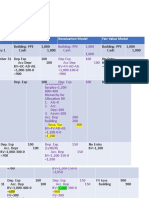

The Percentage-of-Sales Model

Compiled by Andualem 02-11

The Percentage-of-Sales Model

Compiled by Andualem 02-12

The Percentage-of-Sales Model

Compiled by Andualem 02-13

The Percentage-of-Sales Model

Example

Top Company has prepared the following Balance Sheet and Income

Statement for the year ended December 31, 2005.

Assets Liabilities and Stockholders’ Equity

Cash 175,000 A/P 140,000

A/R 150,000 Accrued liabilities 150,000

Inventory 800,000 Mortgage N/P 1,410,000

Plant Assets, Net 1,500,000 Common Stock 800,000

Retained earnings 125,000

Total 2,625,000 Total 2,625,000

Sales 2500000

Costs and Expenses except depreciation 1,400,000

Depreciation 200,000

Total costs and expenses 1,600,000

Income before taxes 900,000

Taxes (40%) 360,000

Net Income 540,000

Compiled by Andualem 02-14

The Percentage-of-Sales Model

• Additional Information

The company plans to have dividend payout ratio of 45%

Sales are expected to increase by 25% during next year (2006).

All assets are affected by sales proportionately. Accounts Payable

and accrued liabilities are also affected by sales.

All expenses are directly proportional to sales

The firm has been operating at full capacity.

The company has no preferred stock.

Assume that additional funds needed would be financed from

bond issue and common stock in 40% and 60% respectively.

Compiled by Andualem 02-15

The Percentage-of-Sales Model

Compiled by Andualem 02-16

The Percentage-of-Sales Model

Compiled by Andualem 02-17

The Percentage-of-Sales Model

Compiled by Andualem 02-18

The Percentage-of-Sales Model

Compiled by Andualem 02-19

The Percentage-of-Sales Model

Compiled by Andualem 02-20

The Percentage-of-Sales Model

Determinants of External Capital (Fund) Requirements

1.Sales growth rate

• The higher the sales growth rate, the greater the need for external capital

and vice versa

• The financial feasibility of the expansion plans should be reconsidered if the

company expects difficulties in raising the required capital.

2.Dividend payout ratio

• The higher the payout ratio, the greater the need for external capital

requirement

• Management should balance between internally generated funds (by

reducing payout ratio) and the need for increasing stock price because

divided policy affects stock price.

3.Capital intensity

• Capital intensity refers to the amount of asset required per Birr of sales

• Capital intensity Ratio = Assets/ Sales

• The lower capital intensity ratio, the lower the need for external capital

Compiled by Andualem 02-21

The Percentage-of-Sales Model

Excess capacity Adjustments

The assumption of constant ratio between assets and sales may not

always hold true. In that case, the percentage of sales model or

Additional Funds Needed model is not appropriate.

What are the conditions under which constant ratios are not

maintained between asset, and sales?

1. Economies of scale

Economies of scale imply that as a plant gets larger and volume

increases, the average cost per unit of output drops. This is

particularly due to lower operating and capital cost. A piece of

equipment with twice that capacity of another piece typically does

not cost twice as much to purchase or operate. Plants also gain

efficiencies when they become large enough to fully utilize dedicated

resources for tasks such as materials handling, computer equipment,

and administrative support personnel.

Compiled by Andualem 02-22

The Percentage-of-Sales Model

Excess capacity Adjustments …

2. Lumpy asset increments

Lumpy assets are assets that cannot be acquired in small increments,

but must be obtained (added) in large, discrete units. Suppose, if we

obtained that Br. 25,000 is needed for additional investment in fixed

assets, it may be difficult to get fixed assets that exactly cost Br. 25,000.

The minimum prices for the lowest capacity fixed asset may be Br.

45,000. Thus, if you decided to make additional investment in fixed

assets, you need to purchase fixed assets of Br. 45,000 instead of Br.

25,000.

Compiled by Andualem 02-23

The Percentage-of-Sales Model

Excess capacity Adjustments …

3. Excess assets due to forecasting errors.

Actual assets to sales ratio may be different from planed ratio

because actual sales may be different from planed sales. Actual

assets may be different from planned assets. Excess capacity may

occur plant assets and inventories.

When excess capacity exists, sales can grow to the full capacity sales

with no increase whatever in fixed assets. However, beyond full

capacity sales, increase in sales requires increase in assets.

The following steps may be used in determining additional

investments in fixed assets in excess capacity situation.

Compiled by Andualem 02-24

The Percentage-of-Sales Model

Compiled by Andualem 02-25

The Percentage-of-Sales Model

Compiled by Andualem 02-26

The Percentage-of-Sales Model

• Increase in sales without increase in Fixed Assets (FA)

= Full capacity sales – current sales = 1,250,000 – 1,000,000 = 250,000

• Required level of FA = (TFA to sales ratio) x (projected sales)

= 0.48 x 1,400,000 = 672,000

• Additional Investment in FA = (1,400,000 – 1,250,000) x 0.48 = 72,000

• Increase in Current assets = 0.15 x 400,000 = 60,000

• Spontaneously generated funds= 0.09 x 400,000 = 36,000

• Internally generated funds = M (S1) (1-d) = 0.10(1,400,000) (1 –0.60)

= 56,000

• AFN = (72,000 + 60,000) – (36,000 + 56,000)

= 132,000 – 92,000 = 40,000

Compiled by Andualem 02-27

The Pro-forma Financial Statement Method

• Refer Cost and Management Accounting – Master Budget

Compiled by Andualem 02-28

You might also like

- Topic 2 FINANCIAL PLANNING AND FORECASTINGDocument5 pagesTopic 2 FINANCIAL PLANNING AND FORECASTINGAbdallah SadikiNo ratings yet

- Financial Planning Forecasting Financial Statements Bahria University 01012022 084944pmDocument22 pagesFinancial Planning Forecasting Financial Statements Bahria University 01012022 084944pmmeaowNo ratings yet

- Financial Forecasting Planning 1226943025978198 9Document20 pagesFinancial Forecasting Planning 1226943025978198 9Surya PratapNo ratings yet

- Chapter 17 - Financial Planning and ForecastingDocument7 pagesChapter 17 - Financial Planning and ForecastingAnaNo ratings yet

- Ch17 Financial Planning and Forecasting English - StudentDocument46 pagesCh17 Financial Planning and Forecasting English - StudentThiện NhânNo ratings yet

- Financial Forecasting, Planning, and BudgetingDocument49 pagesFinancial Forecasting, Planning, and BudgetingShivaji YamgarNo ratings yet

- Chapter 5-Financial Planning and ForecastingDocument20 pagesChapter 5-Financial Planning and ForecastingMOHAMAD SAFWAN BIN FAUZI STUDENTNo ratings yet

- TM-Functions Chapter on Planning and ForecastingDocument8 pagesTM-Functions Chapter on Planning and ForecastingSukhbinder KaurNo ratings yet

- Notes in Financial Planning and ForecastingDocument2 pagesNotes in Financial Planning and ForecastingLiana Monica LopezNo ratings yet

- Financial Planning and ForecastingDocument20 pagesFinancial Planning and ForecastingG-KaiserNo ratings yet

- Financial Planning & Forecasting GuideDocument17 pagesFinancial Planning & Forecasting GuideSachin Barde50% (2)

- Financial Planning and ForecastingDocument24 pagesFinancial Planning and ForecastingVenn Bacus Rabadon100% (1)

- Long-Term Financial Planning and Growth StrategiesDocument26 pagesLong-Term Financial Planning and Growth StrategiespushmbaNo ratings yet

- Budgeting Case Study Kraft PDFDocument2 pagesBudgeting Case Study Kraft PDFpoojahj100% (1)

- Pepsi and Coke Financial ManagementDocument11 pagesPepsi and Coke Financial ManagementNazish Sohail100% (1)

- The Role of Finacial ManagementDocument25 pagesThe Role of Finacial Managementnitinvohra_capricorn100% (1)

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Financial Forecasting: Pro Forma Statements Using Percent-of-SalesDocument3 pagesFinancial Forecasting: Pro Forma Statements Using Percent-of-SalesMikie AbrigoNo ratings yet

- Financial Planning and Forecasting GuideDocument35 pagesFinancial Planning and Forecasting GuideSaidarshan RevandkarNo ratings yet

- Strategic Cost Cutting After COVID: How to Improve Profitability in a Post-Pandemic WorldFrom EverandStrategic Cost Cutting After COVID: How to Improve Profitability in a Post-Pandemic WorldNo ratings yet

- Financial Planning and ForecastingDocument33 pagesFinancial Planning and ForecastingJeasmine Andrea Diane PayumoNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 1Document4 pagesBUS 5111 - Financial Management - Written Assignment Unit 1LaVida LocaNo ratings yet

- Financial Planning ForecastingDocument12 pagesFinancial Planning ForecastingAnanda RiskiNo ratings yet

- Financial Planning and ForecastingDocument5 pagesFinancial Planning and ForecastingPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Dividend PolicyDocument44 pagesDividend PolicyShahNawazNo ratings yet

- Week 1 Conceptual Framework For Financial ReportingDocument17 pagesWeek 1 Conceptual Framework For Financial ReportingSHANE NAVARRONo ratings yet

- Financial Planning and ForecastingDocument25 pagesFinancial Planning and ForecastingAhsan100% (2)

- Financial Planning and ForecastingDocument8 pagesFinancial Planning and Forecastingscridd_usernameNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume IV: Technical Note—Designing a Small and Medium-Sized Enterprise Development IndexNo ratings yet

- Statement of Cash Flows: HOSP 2110 (Management Acct) Learning CentreDocument6 pagesStatement of Cash Flows: HOSP 2110 (Management Acct) Learning CentrePrima Rosita AriniNo ratings yet

- Cost of Capital Lecture Slides in PDF FormatDocument18 pagesCost of Capital Lecture Slides in PDF FormatLucy UnNo ratings yet

- The Delphi Technique A Case StudyDocument3 pagesThe Delphi Technique A Case StudyFeisal Ramadhan MaulanaNo ratings yet

- FM II - Chapter 03, Financial Planning & ForecastingDocument14 pagesFM II - Chapter 03, Financial Planning & ForecastingHace AdisNo ratings yet

- Financial Management SummaryDocument3 pagesFinancial Management SummaryChristoph MagistraNo ratings yet

- Financial Forecasting and Capital RaisingDocument17 pagesFinancial Forecasting and Capital RaisingCrina EdithNo ratings yet

- Time Value of MoneyDocument24 pagesTime Value of MoneyShoaib Ahmed (Lecturer-EE)No ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- FIN 103 - V. Financial Planning and ForecastingDocument6 pagesFIN 103 - V. Financial Planning and ForecastingJill Roxas100% (1)

- Radio AnalysisDocument100 pagesRadio Analysisabhayjain686No ratings yet

- Green Bond Market Survey for the Philippines: Insights on the Perspectives of Institutional Investors and UnderwritersFrom EverandGreen Bond Market Survey for the Philippines: Insights on the Perspectives of Institutional Investors and UnderwritersNo ratings yet

- HP Sales Figures & Hedging Policy for FY2014Document7 pagesHP Sales Figures & Hedging Policy for FY2014Tricky TratzNo ratings yet

- Chapter 04 Working Capital 1ce Lecture 050930Document71 pagesChapter 04 Working Capital 1ce Lecture 050930rthillai72No ratings yet

- Discounted Cash Flow (DCF) Definition - InvestopediaDocument2 pagesDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532No ratings yet

- Financial Planning and ForecastingDocument35 pagesFinancial Planning and Forecastingphyu sweNo ratings yet

- Ac 1Document39 pagesAc 1taajNo ratings yet

- The Time Value Of Money ExplainedDocument40 pagesThe Time Value Of Money Explainedeshkhan100% (1)

- DEF "Financial Management Is The Activity Conce-Rned With Planning, Raising, Controlling and Administering of Funds Used in The Business."Document190 pagesDEF "Financial Management Is The Activity Conce-Rned With Planning, Raising, Controlling and Administering of Funds Used in The Business."katta swathi100% (1)

- Case Studies Internal ControlDocument3 pagesCase Studies Internal Controlakq153No ratings yet

- Strategy and The Master BugdetDocument38 pagesStrategy and The Master BugdetPhearl Anjeyllie PilotonNo ratings yet

- L28 29 Non Financial Measures of Performance EvaluationDocument11 pagesL28 29 Non Financial Measures of Performance Evaluationapi-3820619100% (1)

- Microsoft PowerPoint - 01 ODocument27 pagesMicrosoft PowerPoint - 01 OSeidu AbdullahiNo ratings yet

- Financial Forecasting, Planning and ControlDocument10 pagesFinancial Forecasting, Planning and Controlkelvin pogiNo ratings yet

- Construction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22Document22 pagesConstruction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22varadu1963No ratings yet

- Options and Corporate Finance QuestionsDocument2 pagesOptions and Corporate Finance QuestionsbigpoelNo ratings yet

- The Nature and Purpose of Financial Management - NotesDocument2 pagesThe Nature and Purpose of Financial Management - NotesWsxQaz100% (4)

- FCFE and FCFF Model SessionDocument25 pagesFCFE and FCFF Model SessionABHIJEET BHUNIA MBA 2021-23 (Delhi)No ratings yet

- Apv PDFDocument10 pagesApv PDFSam Sep A SixtyoneNo ratings yet

- Budgeting - IntroductionDocument46 pagesBudgeting - Introductionkamasuke hegdeNo ratings yet

- Financial Accounting Reviewer - FinalsDocument2 pagesFinancial Accounting Reviewer - FinalsYvette Pauline Joven100% (1)

- Chapter - Three Budgets and Budgetary ControlDocument83 pagesChapter - Three Budgets and Budgetary ControlHace AdisNo ratings yet

- Date Cost Model Revaluation Model Fair Value ModelDocument4 pagesDate Cost Model Revaluation Model Fair Value ModelHace AdisNo ratings yet

- Ipsas 16: Investment PropertyDocument25 pagesIpsas 16: Investment PropertyHace AdisNo ratings yet

- Impairment of Non-Cash AssetsDocument25 pagesImpairment of Non-Cash AssetsHace AdisNo ratings yet

- Ipsas 23: Revenue From Non Exchange TransactionsDocument11 pagesIpsas 23: Revenue From Non Exchange TransactionsHace AdisNo ratings yet

- IFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERSDocument46 pagesIFRS 15 REVENUE FROM CONTRACTS WITH CUSTOMERSHace AdisNo ratings yet

- CHAPTER Four NewDocument16 pagesCHAPTER Four NewHace AdisNo ratings yet

- Finance AttachementDocument21 pagesFinance AttachementHace AdisNo ratings yet

- FM II - Chapter 03, Financial Planning & ForecastingDocument28 pagesFM II - Chapter 03, Financial Planning & ForecastingHace Adis100% (1)

- Article Review FinalDocument5 pagesArticle Review FinalHace AdisNo ratings yet

- FM II - Chapter 03, Financial Planning & ForecastingDocument14 pagesFM II - Chapter 03, Financial Planning & ForecastingHace AdisNo ratings yet

- Financial Hand Out 22-2Document13 pagesFinancial Hand Out 22-2Hace AdisNo ratings yet