Professional Documents

Culture Documents

Challenges Facing DTH Providers in India's Competitive Pay-TV Market

Uploaded by

Shephali SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Challenges Facing DTH Providers in India's Competitive Pay-TV Market

Uploaded by

Shephali SinghCopyright:

Available Formats

X L R I

D T H A CASE STUDY

By DEBDATTA MUKHERJEE (PGCRM 2) SID RR 09013 SMD ID - 104497

Centre : Jamshedpur

CHALLENGES BEFORE DISH TV

I. CHALLENGES BEFORE DISH TV WHEN IT PIONEERED THE MARKET

Building up distribution network from the base zero. Uncertainty as to whether the distribution system would actually pay off and yield the desired result since it was the pioneer in the field and in the market .

The success of distribution thru dealers was questionable as the dealers were used to selling low cost telecom products like handsets as compared to Set Top Boxes (STB) whose price was high.

When the distribution channels would start operating , they would keep other brands as well to offer choices to the willing customers ,thereby throwing competition before Dish TV from other brands , that are offered by the dealers . Acceptance of its output across various pockets backgrounds and segments of society , spread over various geographical territories having dissimilar, activities and composition. It was not merely selling a Set Top Box , but greater challenge lay in acquisition of and retaining a CUSTOMER . Competence of Channel management , closely monitoring the movements of customers in the markets and taking necessary and adequate steps to ensure that they only buy its Set Top Boxes.

PERFORMANCE OF TATA SKY

II.PERFORMANCE OF TATA SKY

Launch : Launched on 15th August 2006.

Market Share : Of the 120 million TV homes in India at present, 80 million are

cable &satellite homes (C & S) , and 14 million avail of DTH. Out of these, Tata Sky has sold 2.3 million connections , and presently occupying the third position in this industry.

Key Performance Strategies:

Tata Sky has adopted interactive service as its key proposition and recently roped in film celebrity Amir Khan as its brand ambassador . To stand apart from other players, Tata Sky has decided to invest more in interactive services particularly, as Indian broadcasting regulation does not allow exclusivity of content. It has about 10 interactive services including : Active Wizkids About 1500 schools across the country have been persuaded to adopt Active Wizkids as part of their teaching, and children spend about 66 minutes on weekdays and 78 minutes on weekends on this interactive learning aid. Active Stories Another interactive learning aid for children and students.

PERFORMANCE OF TATA SKY contd.(2)

Active Matrimony It provides a platform for match selection and further negotiations, which, if positive, culminates into marriage. It has also tied up with Bharat matrimony.com to provide a matrimonial channel to the users.

Active Star News - It brings new across the world to its viewers.

Showcase It is a system of movie rentals on pay per view basis . However, movie on demand service has not been very successful and has not been able to generate great revenues for the company. On the movie front, to change the perception of watching pirated movies on cable with half of the screen covered by advertisement ,Tata Sky has focussed on and working hard on two aspects : Approaching the producer to release the movie simultaneously on Tata Sky alongwith its normal release, thereby minimising the possibility of piracy , and To apprise and educate the customers of the pleasure of an ad-free movie experience.

PERFORMANCE OF TATA SKY contd.(3)

Pricing : To increase its market share , Tata Sky, with the second highest number of subscribers , has dropped the prices of its Set Top Boxes by 50% and lowered the subscription fees by 20% , with plans to reduce even further. Investments : Tata Sky DTH service has invested Rs. 2000 crores to acquire 20 lakh customers, and another 2000 crore investment is on its way. Product Launch : Towards mid October08, Tata Sky has launched a new service Tata Sky + with a premium Set Top Box which gives the power to pause , record and rewind live TV, the ads for which have been endorsed by Amir Khan . Future Prospect : Tata Sky hopes to have 8 million connections by 2012.

ENTRY OF AIRTEL & BIG TV

III. CHANGE IN MARKET DYNAMICS WITH ENTRY OF AIRTEL & BIG TV.

AIRTEL :

Airtels DTH services from Bharti, were launched in early October08. It has a distribution network of close to a million outlets. In pricing sphere , it has come up with two pricing points One, keeping in tune with current market prices & The other , a superior offering . It has also hired a galaxy of celebrities to endorse its product(s). Airtel , with a subscriber base of 75 million , has very ambitious plans of capturing a significant market share in the near future and make its foray in the market .

ENTRY OF AIRTEL & BIG TVcontd(2)

BIG TV :

Big TV from Reliance Communications , has focussed on marketing in various forms Within first three weeks of its launch , Big TV : Took 15000 spots on television , 20,000 spots on Radio and over 600 screens in cinema halls. Taken up advertising on Internet through sites like Yahoo , Rediff & Google Taken up several thousand hoardings , 80,000 retail signage and digital screen inside malls. Created special experience zones at over 2000 Reliance branded outlets. Targeted campaigns to cover 5 crore Reliance mobile customers 5 million Reliance Energy customers 4 million ADAG shareholders, and 2 million Reliance PCO partners. Taken up retailing through a lakh outlets across the country . Big TV aims to capture 40% market share in next 12 months .

ENTRY OF AIRTEL & BIG TVcontd(3)

Thus with strong entrants like Airtel & Big TV , equipped with their respective powerful tools, they would emerge as market leaders in the industry in times to come , surpassing confidently all other players and contenders in the market.

FACTORS HELPING THE NEW ENTRANTS :

DISTRIBUTION NETWORK

Big TV and Airtel are telecom players and have a well laid out distribution network in place by virtue of their telecom business .

TECHNOLOGY

Both Airtel & Big TV are MPE4 ready. MPE4 format helps in better compression and not only superior reproduction of image and audio output , but also more number of channels can be squeezed out of a limited number of transponders .

OTHERS

Among other parameters like content , reach , pricing etc, which determine the position of a player in the market , Airtel & Big TV have an edge over other players in all these spheres , particularly Airtel , which is coming in a big way . Thus , they are the biggest contenders for market leaders in the near future.

CHALLENGES BEFORE TATA SKY AND DISH TV

IV. CHALLENGES BEFORE DISH TV & TATA SKY IN THE CONTEXT OF MPEG2 VS MPEG4 FORMAT

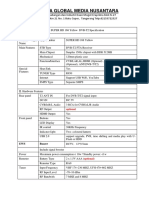

Most of the DTH players import their Set Top Box. Both Dish TV & Tata Sky have MPEG2 format. MPEG2 Set Top Box costs Rs.1568/- to Rs.2450/- to import. However, almost all players sell their Set Top Box below their cost price . In contrast to MPEG2 format, Airtel & Big TV are MPEG4 ready. MPEG4 format helps in better compression and superior reproduction of image and audio output . MPEG4 is a compression technology that not only helps in squeezing out more channels on a limited number of transponders but also enables high definition content to be viewed. In view of improved technology of MPEG4 Set Top Boxes as against MPEG2 , Dish TV & Tata Sky have been thrown open to the following challenges :

UPGRADATION OF TECHNOLOGY

It is imperative that Dish TV & Tata Sky upgrade their technology from MPEG2 to MPEG4 and thus remain in competition alongwith new players who are armed with superior technology .

CHALLENGES BEFORE TATA SKY AND DISH TV contd.(2)

INVESTMENT REQUIRED FOR UPGRADATION

Both Dish TV & Tata Sky have to invest huge amount in switching over to MPEG4 technology. While doing so , it has two options : a) It can either dispose off MPEG2 Set Top Boxes and replace them with MPEG4 STBs b) It can upgrade the existing MPEG2 Set Top Boxes with MPEG4 technology. The relative expenditure involved in both the cases have to be carefully looked into before taking a decision.

CUSTOMER RETENTION AND CUSTOMER ACQUISITION

Unless Dish TV & Tata Sky switches over to MPEG4 technology on a war footing basis, it is quite likely that with Big TVs entry into the market and launching of Bhartis Airtel DTH, customers of Dish TV & Tata Sky would switch over to Airtel or Big TV DTH , because customers these days no longer go by brands alone but also look for value for money. Therefore , it is essential for Dish TV and Tata Sky that after technology upgradation , they not only have to ensure that their existing customer base is retained intact but also acquire new customers who may , given a chance , would turn to other players.

CHALLENGES BEFORE TATA SKY AND DISH TV contd.(3)

PRICING FACTOR

In spite of huge investments on upgradation , Dish TV and Tata Sky have to keep their subscription rates very competitive , preferably on the lower side , and come up with attractive pricing packages so as to lure new customers and prevent the existing customers from switching loyalty to other brands.

BREAKING EVEN

Breaking even in this industry is a tough game . Now with technology upgradation and low pricing , it becomes all the more tougher for Dish TV and Tata Sky to break even and the period required to break even under new situation and scenario becomes even more longer.

EXPANSION ACTVITIES OF SUN DIRECT

V. ACTIVITIES REQUIRED BY SUN DIRECT FOR EXPANSION

Sun Direct was launched in the beginning of 2008 in four southern states of India , viz. Tamilnadu , Kerala, Karnataka, Andhra Pradesh and Pondicherry as it only had south Indian language channels numbering to 110. In order to expand to other regions , it should take up the following activities :

CONVERSION OF EXISTING CABLE CUSTOMERS

Sun Direct should target to convert its existing cable TV network Arasus customers to its DTH customers.

PRICE REVISION

Although it offers the most competitive price package with subscription at Rs. 75/a month , which is equal or even lower than cable operators charges, it should raise its charges reasonably and justifiably so as to include add ons such as Hindi package , Kids package , and English movie packages to have a wider network of customers.

EXPANSION ACTVITIES OF SUN DIRECT

contd. (2)

LAY EMPHASIS ON HINDI PACKAGES By inclusion of Hindi Packages , it can reach out to Hindi speaking markets and thus expand its customer base to all over India instead of confining only to South India . CHANGES IN TECHNOLOGY Technological improvements and innovations , which are key factors for expansion , should be thoroughly examined , evaluated and adopted because in fact , technology is the primary factor for a customer to experience anything . MODIFICATION IN PACKAGE DEAL The present package of Rs.1999/- for installation plus one years free subscription can be modified to a justifiably higher rate with a two years free subscription , which would, no doubt , not only attract new customers , but would also invite switchovers form other brands.

EXPANSION ACTVITIES OF SUN DIRECT

contd. (3)

IMAGE MAKEOVER In order to overcome being tagged as a regional channel , it should lay stress on its brand building exercise by taking celebrities of other regions apart from south India , to endorse its products and thus present a national look instead of a regional appearance . COUNTRYWIDE LAUNCH Sun Directs plan to go pan India soon should be implemented and executed as early as possible.

KEY ISSUES FOR FUTURE SUCCESS

VI. KEY ISSUES IN THIS INDUSTRY FOR FUTURE SUCCESS Distribution network Technological Development Price Package Value added service (VAS) Marketing campaigns , advertisements & promotions Govt. Regulation making Conditional Access System (CAS) mandatory , leaving the customer to choose between Free to Air (FTA) or CAS or DTH.

With DTH dishing out a greater and better fare , this would be the obvious choice of customers , thus paving the way for this industry to grow faster .

KEY ISSUES FOR FUTURE SUCCESS contd.(2)

Interoperability of Set Top Boxes duly certified by Bureau of Indian Standards, whereby a single Set Top Box would provide access to the service of any service provider with technical changes in the box. Brand image building by players. Contents offered and no. of channels available to a customer for viewing . Setting up of call centres for customer service . Breaking language barriers to make foray into regional markets which was hitherto dominated by regional players .

You might also like

- Direct Broadcast SatelliteDocument12 pagesDirect Broadcast Satellitedgosalia_1No ratings yet

- Tata Sky Marketing PlanDocument13 pagesTata Sky Marketing PlanSwathi Velisetty91% (11)

- Tata Sky AnalysisDocument7 pagesTata Sky AnalysisKevin GalaNo ratings yet

- Airt Airt Airt Airtel Digital TV El Digital TV El Digital TV El Digital TVDocument19 pagesAirt Airt Airt Airtel Digital TV El Digital TV El Digital TV El Digital TVGaurav JainNo ratings yet

- Project report on Direct To Home TechnologyDocument22 pagesProject report on Direct To Home TechnologyShashank DubeyNo ratings yet

- DTH Case Study Explains Market Leaders and Future Prospects/TITLEDocument17 pagesDTH Case Study Explains Market Leaders and Future Prospects/TITLEsachinmodi2001No ratings yet

- Case Study On Tata SkyDocument4 pagesCase Study On Tata Skychitra_shresthaNo ratings yet

- MM Assignment Number 2Document12 pagesMM Assignment Number 2supratim shomeNo ratings yet

- Tata SkyDocument12 pagesTata SkyAbhimanyu ArjunNo ratings yet

- Tata Sky...Document18 pagesTata Sky...Karan MagoNo ratings yet

- Tata Sky: Isko Laga Daala Toh Life JingalalaDocument12 pagesTata Sky: Isko Laga Daala Toh Life JingalalamcbaajaNo ratings yet

- TATA SKY Case StudyDocument4 pagesTATA SKY Case StudyDinesh MaharjanNo ratings yet

- Comparing India's top DTH providers: Tata Sky vs Dish TVDocument22 pagesComparing India's top DTH providers: Tata Sky vs Dish TVMohd AzamNo ratings yet

- DTH ReportDocument40 pagesDTH Reporti_kool_anilNo ratings yet

- "Isko Laga Daala Toh Life Jhingalala": Tata SkyDocument8 pages"Isko Laga Daala Toh Life Jhingalala": Tata SkyTanya KaurNo ratings yet

- DTH Vs CableDocument32 pagesDTH Vs Cablepinkeshparvani100% (1)

- ListenDocument17 pagesListenAnuj SharmaNo ratings yet

- Case Study#1 (Tata Sky)Document9 pagesCase Study#1 (Tata Sky)Ananta MallikNo ratings yet

- FinalProjec On Tata SkyDocument52 pagesFinalProjec On Tata SkyManisankar SenapatiNo ratings yet

- DTH FinalDocument28 pagesDTH FinalAzhar ShaikhNo ratings yet

- War in Sky: Direct TO HomeDocument48 pagesWar in Sky: Direct TO Homeprasuagrawal6588No ratings yet

- Project Report On Dish TVDocument18 pagesProject Report On Dish TVaryan00712No ratings yet

- Executive SummaryDocument8 pagesExecutive Summarysagarbsc_480No ratings yet

- Indian DTH Market PresentationDocument32 pagesIndian DTH Market Presentationjindalmanoj06100% (1)

- Changes in Satellite and Cable Television in India Terms of Technology Like DTH, Cas, HitsDocument33 pagesChanges in Satellite and Cable Television in India Terms of Technology Like DTH, Cas, HitsImran AbidNo ratings yet

- Ntroduction To Dish TV and Its Features: Definition ChannelsDocument9 pagesNtroduction To Dish TV and Its Features: Definition Channelsnarendra_luv4uNo ratings yet

- Tata Sky 2Document8 pagesTata Sky 2Shruti SumanNo ratings yet

- Competitor AnalysisDocument7 pagesCompetitor AnalysiscaprisrulzNo ratings yet

- Case Study For Class DiscussionDocument3 pagesCase Study For Class DiscussionKiran GowdaNo ratings yet

- Report On Marketing Strategy of Wateen TelecomDocument28 pagesReport On Marketing Strategy of Wateen TelecomnaranaolabaNo ratings yet

- Manu Main Project Dish TVDocument90 pagesManu Main Project Dish TVAditya SalgotraNo ratings yet

- Ateko ProjectDocument108 pagesAteko ProjectAditya SalgotraNo ratings yet

- India's largest conglomerate Reliance exploredDocument22 pagesIndia's largest conglomerate Reliance exploredKarthik GowdaNo ratings yet

- Project Report-Tata SkyDocument19 pagesProject Report-Tata SkyJai Kumar25% (4)

- Case 4 - Customer Satisfaction With DTH Services in India (Sampling)Document4 pagesCase 4 - Customer Satisfaction With DTH Services in India (Sampling)Nawazish KhanNo ratings yet

- A Project Work ON Integrated Marketing Communication OF DTH IndustryDocument22 pagesA Project Work ON Integrated Marketing Communication OF DTH IndustryPreeti BiswalNo ratings yet

- Visibility of DISH TV and Scope of HD STB in Bathinda & Mansa DistrictsDocument73 pagesVisibility of DISH TV and Scope of HD STB in Bathinda & Mansa DistrictsSourav Roy100% (1)

- Tata Sky Is A Direct Broadcast Satellite Television Provider in India, Using Mpeg-2 Andmpeg-4 DigitalDocument5 pagesTata Sky Is A Direct Broadcast Satellite Television Provider in India, Using Mpeg-2 Andmpeg-4 DigitalChintan MaldeNo ratings yet

- Consumer Awareness On Tata Sky (Final)Document72 pagesConsumer Awareness On Tata Sky (Final)Akil2250% (2)

- Tata Sky Case StudyDocument7 pagesTata Sky Case StudySudeep Bir TuladharNo ratings yet

- Dish TVDocument14 pagesDish TVaviroy16No ratings yet

- Future of The DTHDocument5 pagesFuture of The DTHdevjhanwarNo ratings yet

- DTH Market India ReportDocument19 pagesDTH Market India Reportjindalmanoj06100% (2)

- Marketing Plan of Wateen DTHDocument30 pagesMarketing Plan of Wateen DTHchamman9No ratings yet

- DTH IndustryDocument14 pagesDTH IndustryjassgNo ratings yet

- Strategic Analysis of TATA CommunicationDocument29 pagesStrategic Analysis of TATA CommunicationSmrutiranjan MeherNo ratings yet

- Tata Sky Summer Interns Project ReportDocument38 pagesTata Sky Summer Interns Project ReportPrashant DubeyNo ratings yet

- Marketing Strategies of DTHDocument30 pagesMarketing Strategies of DTHRanjeet Rajput100% (1)

- Strategic Impact of IT in DTH IndustryDocument24 pagesStrategic Impact of IT in DTH IndustrySaurabh GuptaNo ratings yet

- Marketing Management Product Life Cycle Stages Growth Tata Sky DTHDocument20 pagesMarketing Management Product Life Cycle Stages Growth Tata Sky DTHmarch20poojaNo ratings yet

- Tata Sky StrategyDocument15 pagesTata Sky StrategyKaushik SarkarNo ratings yet

- Project Report On Marketing of Wateen TelecomDocument20 pagesProject Report On Marketing of Wateen TelecomSheikh KhalidNo ratings yet

- Tata Sky DTH ServiceDocument12 pagesTata Sky DTH ServiceSanket DaveNo ratings yet

- How to Get Rid of Cable TV & Save Money: Watch Digital TV & Live Stream Online MediaFrom EverandHow to Get Rid of Cable TV & Save Money: Watch Digital TV & Live Stream Online MediaRating: 5 out of 5 stars5/5 (1)

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterFrom EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNo ratings yet

- OTT Business Opportunities: Streaming TV, Advertising, TV Apps, Social TV, and tCommerceFrom EverandOTT Business Opportunities: Streaming TV, Advertising, TV Apps, Social TV, and tCommerceNo ratings yet

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryFrom EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- The Comprehensive Guide for Minority Tech Startups Securing Lucrative Government Contracts, Harnessing Business Opportunities, and Achieving Long-Term SuccessFrom EverandThe Comprehensive Guide for Minority Tech Startups Securing Lucrative Government Contracts, Harnessing Business Opportunities, and Achieving Long-Term SuccessNo ratings yet

- Summary of Sunil Gupta's Driving Digital StrategyFrom EverandSummary of Sunil Gupta's Driving Digital StrategyRating: 5 out of 5 stars5/5 (1)

- An Introduction to SDN Intent Based NetworkingFrom EverandAn Introduction to SDN Intent Based NetworkingRating: 5 out of 5 stars5/5 (1)

- List of Programs Broadcast by TV5 ArticlesDocument317 pagesList of Programs Broadcast by TV5 ArticlesPcnhs Sal100% (1)

- Mando Tele CasaDocument104 pagesMando Tele Casapepeloko123No ratings yet

- Led Panasonic Th-55c330m Ch. Ms06b-APDocument39 pagesLed Panasonic Th-55c330m Ch. Ms06b-APjoseNo ratings yet

- Chassi MXDocument49 pagesChassi MXAntonio SoutinhoNo ratings yet

- Effectiveness of Advertising A Study On Coca Cola Research ReportDocument77 pagesEffectiveness of Advertising A Study On Coca Cola Research Reportvinay sainiNo ratings yet

- Texas 2Document25 pagesTexas 2Thierry LarcherNo ratings yet

- HW DVBDocument6 pagesHW DVBPrasetya AnggiNo ratings yet

- Insignia Ns l37q 10a Ns l42q 10a LCD TVDocument151 pagesInsignia Ns l37q 10a Ns l42q 10a LCD TVronald stew100% (1)

- JVC RX-9010VBK Service ManualDocument21 pagesJVC RX-9010VBK Service ManualklynsdadNo ratings yet

- Optibox Alligator EngDocument39 pagesOptibox Alligator EngbocaidNo ratings yet

- HE6 q1 Mod8Document26 pagesHE6 q1 Mod8Katrina ReyesNo ratings yet

- SilverCrest KH 2159 Univerzalni Daljinski Upravljač - UputeDocument107 pagesSilverCrest KH 2159 Univerzalni Daljinski Upravljač - Uputeforrestgump74100% (4)

- DVB-T2 STB SpecificationsDocument3 pagesDVB-T2 STB Specificationsanomali mobileNo ratings yet

- TV Key Facts 2017Document160 pagesTV Key Facts 2017Cardi VariusNo ratings yet

- Atari 2600 Programming For Newbies by Andrew Davie: AtariageDocument172 pagesAtari 2600 Programming For Newbies by Andrew Davie: AtariageArkinuxNo ratings yet

- Implementation of A VLC HDTV Distribution System For Consumer PremisesDocument475 pagesImplementation of A VLC HDTV Distribution System For Consumer PremisesSergeyNo ratings yet

- Javasiana IPTV Channels GuideDocument185 pagesJavasiana IPTV Channels GuideBerto Sembiring0% (1)

- History of Public Service BroadcastingDocument30 pagesHistory of Public Service BroadcastingArchana Shukla50% (2)

- O'Guinn APM CH-1 TBDocument23 pagesO'Guinn APM CH-1 TBEduardo David PérezNo ratings yet

- Chapter 1 System Part 1Document9 pagesChapter 1 System Part 1Belén Iturralde GómezNo ratings yet

- LU9245Document2 pagesLU9245mudassir.bukhariNo ratings yet

- Introduction To ICT Lecture#14: Prepared by Qurat-Ul-AinDocument15 pagesIntroduction To ICT Lecture#14: Prepared by Qurat-Ul-AinmahazkhanNo ratings yet

- Raspored Predajnika SrbijaDocument7 pagesRaspored Predajnika Srbijanesa_p5No ratings yet

- DLP Brochure PDFDocument8 pagesDLP Brochure PDFaldo_suvi0% (1)

- Ruri Rahmadani Salsabila Devina Sheilla N. I Tommy Minggus Yurischa Nuzulul Zayla KusumaDocument9 pagesRuri Rahmadani Salsabila Devina Sheilla N. I Tommy Minggus Yurischa Nuzulul Zayla KusumaIcha Juja IschaNo ratings yet

- Manual Tevion 20DRW 208005Document43 pagesManual Tevion 20DRW 208005AAurelianNo ratings yet

- MFL69673603 1.4+MFL69673502 1.4+RSDocument65 pagesMFL69673603 1.4+MFL69673502 1.4+RSSandeep PatnalaNo ratings yet

- LITEON 5005 English For EU Manual PDFDocument35 pagesLITEON 5005 English For EU Manual PDFPhasebookerNo ratings yet

- Lecture7 & 8 - FDMDocument58 pagesLecture7 & 8 - FDMrizwanahmed06No ratings yet