Professional Documents

Culture Documents

Deepak-Law of Taxation

Uploaded by

deepak singh0 ratings0% found this document useful (0 votes)

9 views17 pagesCopyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views17 pagesDeepak-Law of Taxation

Uploaded by

deepak singhCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 17

LAW OF TAXATION

INCOME FROM HOUSE PROPERTY

[SEC : 22]

Mewar University –LLB III SEM

Sec : 22

Any income from houses, buildings, bungalows, godown etc.

are to be assessed under the head “ INCOME FROM HOUSE

PROPERTY”.

INCOME FROM HOUSE PROPERTY = ANNUAL VALUE OF THE

PROPERTY – DEDUCTIONS U/S 24.

Mewar University –LLB III SEM

HOUSE PROPERTY [Sec: 23]

LET OUT TO USED FOR

TENANT OCCUPIED USED BY THE

OWN

[May be used as FOR OWN ASSESSEE AS

BUSINESS OR

Residence or RESIDENCE STOCK – IN - TRADE

Business ]

PROFESSION

COMES AND ASSESSED COMES AND ASSESSED

UNDER THE HEAD UNDER THE HEAD

“INCOME FROM HOUSE “PROFITS AND GAINS OF

PROERTY” BUSINESS OR PROFESSION”

Mewar University –LLB III SEM

DIFFERENT VALUATION OF A PROPERTY :

1.MUNICIPAL VALUE : Valuation of a property made by the local

municipality.

2.FAIR RENTAL VALUE : Valuation of a property made on the basis

of the valuation of a same type of property (size, specification etc.)

in the same locality.

3.STANDARD RENT : It is the valuation of a property made on the

basis of the rent determined by the Rent Control Act of the

concerned State.

4.ACTUAL RENT RECEIVED / RECEIVABLE : It is the valuation of a

property made on the basis of the rent received / receivable from

the tenant.

Mewar University –LLB III SEM

WHAT IS ANNUAL VALUE [SEC 23] ?

It is the value for which a property can be let-out from year to

year

HOW TO DETERMINE OF ADJUSTED ANNUAL VALUE U/S : 23(1) ?

I. FOR LET-OUT PROPERTY :

Rs.

GROSS ANNUAL VALUE OF THE PROPERTY ×××

LESS : MUNICIPAL TAX PAID BY THE OWNER ×××

ADJUSTED ANNUAL VALUE : ×××

Mewar University –LLB III SEM

HOW TO DETERMINE INCOME FROM HOUSE PROPERTY

FOR LET OUT PROPERTY

Rs.

Gross annual value of the property ×××

Less : municipal tax paid by the owner ×××

Adjusted annual value : ×××

Less: Deductions u/s 24

Standard deduction u/s 24(a) xxxx

Interest on Borrowed Capital u/s 24(b) xxxx xxx

_____

Income From House Property (let-out) xxx

Mewar University –LLB III SEM

HOW TO DETERMINE INCOME FROM HOUSE PROPERTY

FOR SELF OCCUPIED PROPERTY

Rs.

Adjusted annual value of the property u/s 23(2)(a) NIL

or 23(2)(b)

Less: Deductions u/s 24

Interest on Borrowed Capital u/s 24(b)

xxx

Loss From House Property (Self occupied) _____

xxx

Mewar University –LLB III SEM

DETERMINETION OF GROSS ANNUAL VALUE OF A

PROPERTY :

STEP 1 :

Determine ‘’Reasonable Expected Rent’’ U/S : 23(1)(a) :

How To ?

Take The Highest Between :

1.MUNICIPAL VALUE

2.FAIR RENT

But Subject To Max. of (i.e. it should not exceed) - Standard

Rent

RESULT FIGURE IS THE ‘’REASONABLE EXPECTED RENT’’

U/S 23(1)(a) Mewar University –LLB III SEM

STEP 2 :

DETERMINE ‘GROSS ANNUAL VALUE’’

HOW TO ?

CONDITION 1 :

a.When there is no unrealised rent and vacancy period and the Property is

actually let out:

GROSS ANNUAL VALUE IS THE HIGHEST ONE BETWEEN :

1.REASONABLE EXPECTED RENT

2.ACTUAL RENT RECEIVED / RECEIVABLE

b.Property is actually let out + vacancy period + but actual rent received

/ receivable is more than RER : sec 23(1)(b)

Gross annual value = rent received / receivable

Mewar University –LLB III SEM

CONDITION 2 : Property is actually let out + actual rent received /

receivable is less than RER because of vacancy: sec 23(1)(c)

Explanation:

1.[(Annual Rent – Rent pertaining to vacancy) < Reasonable

Expected Rent]

2. [(Annual Rent – Unrealised Rent) > Reasonable Expected Rent]

BUT

[(Annual Rent – Unrealised Rent - Rent pertaining to vacancy) <

Reasonable Expected Rent]

GAV = Actual Rent Received / Receivable

Mewar University –LLB III SEM

CONDITION 3: Property is actually let out + no vacancy period +

actual rent received / receivable is less than RER because of

any other factor (unrealised rent) :

EXPLANATION:

[(Annual Rent – Unrealised Rent) < Reasonable Expected

Rent]

GAV = Reasonable Expected Rent

Mewar University –LLB III SEM

CONDITION 4: Property is actually let out + actual rent

received / receivable is less than RER partly because of

vacancy and partly because of other factors:

EXPLANATION:

[(Annual Rent – Unrealised Rent) < Reasonable Expected Rent ,

even if loss of rent due to vacancy is ignored]

GAV = Reasonable Expected Rent – loss of rent due to vacancy

Mewar University –LLB III SEM

WHEN UNREALISED RENT IS DEDUCTABLE?

RULE 4 :

If the following conditions are fulfilled :-

1.The tenancy is bonafide

2.The defaulting tenant has vacated or steps have been taken to vacate the

house

3.The defaulting tenant is not in occupation of any other property of the

assessee.

4.The assessee has taken all legal steps to recover the unpaid rent.

Mewar University –LLB III SEM

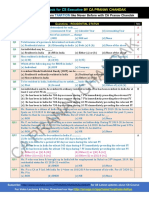

DEDUCTIONS U/S 24

FOR THE ASSESSMENT YEAR 2019-20

SELF OCCUPIED

DEDUCTIONS LET OUT PROPERTY

PROPERTY

STANDARD

30 % OF ADJUSTED

DEDUCTIONS N.A

ANNUAL VALUE

[SEC 24(a)]

1. IF THE LOAN IS TAKEN ON

OR AFTER 01.04.1999 AND

INTEREST ON ALL OTHER CONDITIONS *

BORROWED ARE SATISFIED:

NO LIMIT

CAPITAL

Rs. 2,00,000

[SEC 24(b)]

2. IN ANY OTHER CASE :

Rs. 30,000

Mewar University –LLB III SEM

CONDITIONS TO BE SATISFIED :

1.Loan used for constructioin or acquisition of house property on or after

01.04.1999

2.Construction and acquisition is coompleted within 5 years from the date of such

loan taken

3.A certificate should be obtained from the lender in respect of the utilisation of

the loan (construction, / purchase / refinance of the previous outstanding loan

(principal amount)

Mewar University –LLB III SEM

ADDITIONAL POINTS TO BE REMEMBERED

[A/Y : 2019-20]

If an assessee owns more than one self occupied house for residence ,

then one house will be treated as self occupied for whom the adjusted

annual value will be taken as nil and the other will be treated as deemed to

be let-out.

Mewar University –LLB III SEM

Presented & Submitted By

Mr. Deepak Kumar Singh

MEWAR UNIVERSITY

SUBJECT- TAXATION OF LAWS

COURSE- LLB (3YEARS)

SEMESTER- III SEM

ENROLL. NO.- MUR2105119

ROLL. NO.-223690010135

Mewar University –LLB III SEM

You might also like

- Robert Kiyosaki's Speech - Why The Rich Are Getting Richer TEDxUCSDDocument2 pagesRobert Kiyosaki's Speech - Why The Rich Are Getting Richer TEDxUCSDR AlyaNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument16 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy Perante100% (1)

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Notice of RegistrationDocument1 pageNotice of Registrationbra9tee9tiniNo ratings yet

- (Digest) CIR v. Pineda, 21 SCRA 105Document2 pages(Digest) CIR v. Pineda, 21 SCRA 105Homer SimpsonNo ratings yet

- LBP v. NABLEDocument3 pagesLBP v. NABLESusie SotoNo ratings yet

- Classification of Taxes: A. Domestic CorporationDocument5 pagesClassification of Taxes: A. Domestic CorporationWenjunNo ratings yet

- 6 CIR vs. Next Mobile, GR No. 212825Document2 pages6 CIR vs. Next Mobile, GR No. 212825Joshua Erik Madria100% (1)

- CIR vs. Seagate Technology (G.R. No. 153866 February 11, 2005) - H DIGESTDocument4 pagesCIR vs. Seagate Technology (G.R. No. 153866 February 11, 2005) - H DIGESTHarlene0% (1)

- Commissioner of Internal Revenue vs. Azucena T. Reyes The FactsDocument2 pagesCommissioner of Internal Revenue vs. Azucena T. Reyes The FactsHartel Buyuccan100% (1)

- Abhijit Lahiri, Dept. of Commerce, St. Joseph'S College DarjeelingDocument16 pagesAbhijit Lahiri, Dept. of Commerce, St. Joseph'S College Darjeelingशहेरी बाबूNo ratings yet

- Income From House Property PriteshDocument16 pagesIncome From House Property Priteshpritesh.ks1409No ratings yet

- House PropertyDocument7 pagesHouse Propertyatul.maurya0290No ratings yet

- Final PPT of Income From House PropertyDocument33 pagesFinal PPT of Income From House PropertyAzhar Ali100% (1)

- Computation of Income From Let Out HouseDocument5 pagesComputation of Income From Let Out HouseArpit GoyalNo ratings yet

- Unit 2 (Income From House Property)Document13 pagesUnit 2 (Income From House Property)Vijay GiriNo ratings yet

- Income From House Property 1218216635017392 8Document24 pagesIncome From House Property 1218216635017392 8saru1988No ratings yet

- Income From House Property Cia TaxationDocument23 pagesIncome From House Property Cia TaxationSIDDHART BHANSALINo ratings yet

- House PropertyDocument14 pagesHouse Property083 Ronak ShahNo ratings yet

- Computation of Income From House PropertDocument20 pagesComputation of Income From House PropertSIDDHART BHANSALINo ratings yet

- Income From House PropertyDocument47 pagesIncome From House PropertyNidhi GuptaNo ratings yet

- Income From House Property: Section/Rule Subject MatterDocument21 pagesIncome From House Property: Section/Rule Subject Matterphanidhar varanasiNo ratings yet

- BY. Vinit Jain ERO0161104Document33 pagesBY. Vinit Jain ERO0161104Azhar AliNo ratings yet

- House Property - Paper MAY NOV 24Document5 pagesHouse Property - Paper MAY NOV 24gkumar10121979No ratings yet

- Income From House PropertyDocument5 pagesIncome From House PropertyParas SinghNo ratings yet

- Income From House PropertyDocument31 pagesIncome From House PropertyAarti SainiNo ratings yet

- Income From HP PDFDocument14 pagesIncome From HP PDFNanda NanduNo ratings yet

- commerce-HP - AY 20-21-Sem4Document11 pagescommerce-HP - AY 20-21-Sem4MilyNo ratings yet

- Income From House PropertyDocument32 pagesIncome From House PropertyhanumanthaiahgowdaNo ratings yet

- Fundamentals of Taxation: Sec. 22 of The OrdinanceDocument10 pagesFundamentals of Taxation: Sec. 22 of The OrdinanceMd.Shadid Ur RahmanNo ratings yet

- S021 - Haroon Shaik DIT AssignmentDocument10 pagesS021 - Haroon Shaik DIT AssignmentHaroonNo ratings yet

- Income From House Property: Section/Rule Subject MatterDocument29 pagesIncome From House Property: Section/Rule Subject MatterRajesh NangaliaNo ratings yet

- House Property NotesDocument38 pagesHouse Property Notesshriram bhatNo ratings yet

- Unit 3 (Income From House Property) - 1Document5 pagesUnit 3 (Income From House Property) - 1Vijay GiriNo ratings yet

- Income From House Property: Ms. Harmanpreet Kaur Assistant Professor Shivaji College University of DelhiDocument40 pagesIncome From House Property: Ms. Harmanpreet Kaur Assistant Professor Shivaji College University of DelhiRAKESH KUMAR GOUTAMNo ratings yet

- Income From House Property Notes For CA CSCMA StudentsDocument28 pagesIncome From House Property Notes For CA CSCMA StudentsSantosh Chavan100% (1)

- Econ NeustDocument91 pagesEcon NeustJohn vincent SalazarNo ratings yet

- 5 House Property PDFDocument23 pages5 House Property PDFDamodar SejpalNo ratings yet

- Income From House Property: Prepared By: Vaishali NaroliaDocument15 pagesIncome From House Property: Prepared By: Vaishali NaroliaROYNo ratings yet

- House Property-Income TaxDocument26 pagesHouse Property-Income TaxSwetaNo ratings yet

- Vacancy & Unrealised RentDocument7 pagesVacancy & Unrealised RentKiran ChristyNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument18 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- Income From House PropertyDocument40 pagesIncome From House PropertyDrPreeti JindalNo ratings yet

- 1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFDocument168 pages1491816804house Property, Othersources, Salary, Clubbing, Setoff, Tax Planning PDFPranav PuriNo ratings yet

- Computation of Income From House PropertDocument23 pagesComputation of Income From House PropertMríñålÀryäñNo ratings yet

- Income From HP - March, 2023Document5 pagesIncome From HP - March, 2023Ayush BholeNo ratings yet

- (uploadMB - Com) 18 - House PropertyDocument22 pages(uploadMB - Com) 18 - House PropertyhariomnarayanNo ratings yet

- Income From House Propert Notes (Chapterof ICSI) PDFDocument28 pagesIncome From House Propert Notes (Chapterof ICSI) PDFSHIVAM AGRAHARINo ratings yet

- Income From Capital Gain, Income From Household Property, Income From Other SourcesDocument24 pagesIncome From Capital Gain, Income From Household Property, Income From Other Sourcesamol_more37No ratings yet

- Income From House PropertyDocument7 pagesIncome From House PropertyJoyanta SinghaNo ratings yet

- Income From House PropertyDocument6 pagesIncome From House Propertypardeep bainsNo ratings yet

- House Property IncomeDocument4 pagesHouse Property IncomeVachanamrutha R.VNo ratings yet

- House ProDocument7 pagesHouse Prosb_jainNo ratings yet

- Tax ProjectDocument12 pagesTax ProjectUtkarsh SinghNo ratings yet

- Income From House Property PracticalDocument52 pagesIncome From House Property PracticalShreekanta DattaNo ratings yet

- Income From House Property: Chapter - 4 Unit - 3Document24 pagesIncome From House Property: Chapter - 4 Unit - 3srinidhivrNo ratings yet

- Lecture Note BA212 L2 - Lease: (Katen / Lease Accounting/ DBS PNGUOTDocument3 pagesLecture Note BA212 L2 - Lease: (Katen / Lease Accounting/ DBS PNGUOTBee jayNo ratings yet

- House PropertyDocument33 pagesHouse PropertypriyaNo ratings yet

- 041 - IFRS 16 - Lessor AccountingDocument2 pages041 - IFRS 16 - Lessor AccountingNoman AnserNo ratings yet

- Income From House Property PDFDocument7 pagesIncome From House Property PDFGiri SukumarNo ratings yet

- Income From House PropertiesDocument5 pagesIncome From House PropertiesMd.HasanNo ratings yet

- Dr. Shannu Narayan Fintax PGP - Finance 02 Batch Session 5Document26 pagesDr. Shannu Narayan Fintax PGP - Finance 02 Batch Session 5ayman abdul salamNo ratings yet

- Chapter 5Document9 pagesChapter 5CA Mohit SharmaNo ratings yet

- Pre-Exam Marathon 3 - House Property, Capital Gains, IFOS, Salaries, PGBP, TDS, TCS, Advance Tax, PDFDocument106 pagesPre-Exam Marathon 3 - House Property, Capital Gains, IFOS, Salaries, PGBP, TDS, TCS, Advance Tax, PDFParmeet NainNo ratings yet

- Chapter 5 Income From House Property PMDocument14 pagesChapter 5 Income From House Property PMMohammad Yusuf NabeelNo ratings yet

- RENTAL INCOME UgandaDocument4 pagesRENTAL INCOME Ugandaambrose kibuukaNo ratings yet

- Real Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsFrom EverandReal Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsNo ratings yet

- From Distressed to Deluxe: Airbnb Property Flipping Strategies for InvestorsFrom EverandFrom Distressed to Deluxe: Airbnb Property Flipping Strategies for InvestorsNo ratings yet

- VVQjb9XZmUm94q2eLRR0Fg PDFDocument4 pagesVVQjb9XZmUm94q2eLRR0Fg PDFObnoNo ratings yet

- ECON 247 Practice Midterm ExaminationDocument9 pagesECON 247 Practice Midterm ExaminationRobyn ShirvanNo ratings yet

- Tax Invoice: Holvin Foods Pvt. LTDDocument1 pageTax Invoice: Holvin Foods Pvt. LTDHolvin FoodsNo ratings yet

- Amendments To IFRS 2 'Share-Based Payment'Document1 pageAmendments To IFRS 2 'Share-Based Payment'Rizshelle D. AlarconNo ratings yet

- Orders, Decorations, and Medals of Samoa: History Current Honours and Awards References External LinksDocument3 pagesOrders, Decorations, and Medals of Samoa: History Current Honours and Awards References External LinksAlfred Jimmy UchaNo ratings yet

- ST Ending:: CincinnatiDocument3 pagesST Ending:: CincinnatiMassiNo ratings yet

- Residential Status MCQs - Part 1Document5 pagesResidential Status MCQs - Part 1Manikandan ManoharNo ratings yet

- Document PDFDocument1 pageDocument PDFArup GhoshNo ratings yet

- CIR Vs Toledo Power Co., 775 SCRA 709Document5 pagesCIR Vs Toledo Power Co., 775 SCRA 709Yasser MambuayNo ratings yet

- Rashtriya Ispat Nigam LTD Vs Dewan Chand Ram Sarans120265COM336369 PDFDocument11 pagesRashtriya Ispat Nigam LTD Vs Dewan Chand Ram Sarans120265COM336369 PDFAnanya SinghNo ratings yet

- (2023) 148 Taxmann - Com 184 (Bombay) (08-03-2023) Digi1 Electronics (P.) Ltd. vs. Assistant Commissioner of Income Tax-13Document1 page(2023) 148 Taxmann - Com 184 (Bombay) (08-03-2023) Digi1 Electronics (P.) Ltd. vs. Assistant Commissioner of Income Tax-13Jai ModiNo ratings yet

- FA - Company Profile Prima InataxDocument30 pagesFA - Company Profile Prima InataxSiti MaryatiNo ratings yet

- Neeraj Jawla & Associates: Chartered AccountantsDocument2 pagesNeeraj Jawla & Associates: Chartered AccountantsSandeep TyagiNo ratings yet

- Flemingo Travel Retail Limited Versus Union of India Ti Be EditedDocument13 pagesFlemingo Travel Retail Limited Versus Union of India Ti Be Editedshubham kumarNo ratings yet

- Tax Sa1Document2 pagesTax Sa1Lhulaan OrdanozoNo ratings yet

- A, Traditional Tax System Prior To 1941-In The Axumite Kingdom, There Was A Practice of TraditionalDocument7 pagesA, Traditional Tax System Prior To 1941-In The Axumite Kingdom, There Was A Practice of Traditionalliya100% (1)

- Form 1040 SeniorDocument4 pagesForm 1040 SeniorStuti TiwariNo ratings yet

- Sebastian de Jesus Torres Aquino - Washington & Congress AssignmentDocument7 pagesSebastian de Jesus Torres Aquino - Washington & Congress AssignmentSebastian TorresNo ratings yet

- Tax Law ProjectDocument9 pagesTax Law ProjectJyoti pandeyNo ratings yet

- 2015 VAT in Cambodia Sesion II 22aug 2015Document27 pages2015 VAT in Cambodia Sesion II 22aug 2015Sovanna HangNo ratings yet