Professional Documents

Culture Documents

Digital Banking Coming To The Phil. REPORT

Digital Banking Coming To The Phil. REPORT

Uploaded by

Cristine P. Masangcay0 ratings0% found this document useful (0 votes)

2 views8 pagesThe Philippines may see its first digital banks by 2022 as the central bank prepares to issue them licenses. Digital banks can help reduce barriers to financial access like small incomes, high costs, distance, and lack of documentation. However, building trust will be a challenge for digital banks, as Filipinos prefer face-to-face interactions. Partnering with local merchants can help digital banks forge connections and build trust in the absence of physical branches. Traditional banks have strong positions in the Philippines, so digital banks may have limited early success unless they significantly improve products and lower costs.

Original Description:

Original Title

Digital Banking coming to the Phil. REPORT

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Philippines may see its first digital banks by 2022 as the central bank prepares to issue them licenses. Digital banks can help reduce barriers to financial access like small incomes, high costs, distance, and lack of documentation. However, building trust will be a challenge for digital banks, as Filipinos prefer face-to-face interactions. Partnering with local merchants can help digital banks forge connections and build trust in the absence of physical branches. Traditional banks have strong positions in the Philippines, so digital banks may have limited early success unless they significantly improve products and lower costs.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views8 pagesDigital Banking Coming To The Phil. REPORT

Digital Banking Coming To The Phil. REPORT

Uploaded by

Cristine P. MasangcayThe Philippines may see its first digital banks by 2022 as the central bank prepares to issue them licenses. Digital banks can help reduce barriers to financial access like small incomes, high costs, distance, and lack of documentation. However, building trust will be a challenge for digital banks, as Filipinos prefer face-to-face interactions. Partnering with local merchants can help digital banks forge connections and build trust in the absence of physical branches. Traditional banks have strong positions in the Philippines, so digital banks may have limited early success unless they significantly improve products and lower costs.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 8

Digital Banking coming to the

Philippines soon; “WINNING

TRUST IS THE KEY TO

SUCCESS”.

The Philippines may see its

first purely digital banks by 2022

as the central bank prepares to

issue them licenses. But the

challenge for the neobanks will be

to build trust and convince

customers in a country with low

financial services penetration and a

preference for face-to-face

interaction, analysts say.

The Bangko Sentral ng Pilipinas in

November 2020 approved a new

license category for digital banks.

"Digital banks can help reduce the

barriers that hinder financial access,

such as the small and irregular

income of clients, high transaction

costs, geographical distance, and

lack of proper documentation" -

Fonacier said.

The BSP sees digital banks as future

partners in advancing financial

inclusion in the country by

leveraging on digital technology to

offer financial products and services

that bridge the market gaps in the

unserved and underserved segments.

STRONG LOCAL BANKS

Digital banks may find it challenging

to chip away at the entrenched market

positions of the traditional lenders given

their strong franchise, particularly in the

Metro Manila area, the nation's wealth hub.

The top five banks in terms of assets in the

Philippines handle about 60% of the

country's loans and deposits.

"Digital banks will only meaningfully

compete for the mass-affluent market if they

provide significantly improved, and cheaper,

products and services. Otherwise, while they

may make inroads into specialized

financing, their market share will remain

small" Anand said.

Traditional banks "are lumbered with old,

slow, unreliable legacy technology, while

also having to deliver to much larger

customer segments across many services"

-Finastra's Jain said.

Digital banks can move faster and innovate

quickly and easily integrate new services,

Jain said. "They may not take significant

market share from incumbents in the first

few years, but over a period of time they will

start becoming the primary account holders

for customers who currently hold primary

accounts with incumbent banks”

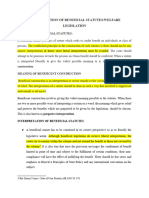

CHALLENGES FOR NEOBANKS

A challenge for the neobanks will be

to win consumer trust as they are starting

from scratch, compared with incumbent

banks that have already built their

reputations over many decades, said Shweta

Jain, director of digital and cloud product

and strategy at Finastra.

"Since neobanks are faceless and

branchless, a powerful way for them to build

consumer trust is by forging partnerships

with local merchants such as, convenience

stores, to enable some level of face-to-face

interaction for things like payments and

remittance services”.

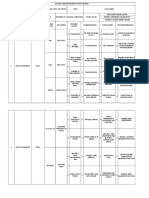

NEW GUIDELINES

Under the BSP's guidelines, digital banks will be required to have a

minimum capitalization of 1 billion pesos and will be allowed to offer

traditional banking services. They will not be allowed to establish

physical branches and will need to maintain a head office in the

Philippines.

"Virtual banks have a huge opportunity in the

Philippines, where most of the country is

young, online and without access to any

banking services. Youthful demographics, a

large untapped market, low costs and

regulatory latitude make the Philippines an

attractive market" Nikita Anand, an analyst at

S&P Global Ratings, said.

-END!

Masangcay, Cristine P. BSBA-4A

You might also like

- A Report onE-BankingDocument123 pagesA Report onE-Bankingsachin91% (74)

- BCG I Love Retail Banking 2021Document10 pagesBCG I Love Retail Banking 2021Primrose HoangNo ratings yet

- Digital Imperative in BankingDocument16 pagesDigital Imperative in BankingMatthew IrwinNo ratings yet

- Idc Infobrief Guide To Hyper Personalization in Sea FsiDocument18 pagesIdc Infobrief Guide To Hyper Personalization in Sea Fsiraghs4uNo ratings yet

- Optimization Design of The U-Shaped Metal BellowsDocument5 pagesOptimization Design of The U-Shaped Metal BellowsdaymonNo ratings yet

- SpaceX Response DOJ Hiring SubpoenaDocument21 pagesSpaceX Response DOJ Hiring SubpoenaCNBC.comNo ratings yet

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsFrom EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNo ratings yet

- As 4120-1994 Code of TenderingDocument7 pagesAs 4120-1994 Code of TenderingSAI Global - APAC0% (5)

- List of Licensed Private Employment Agencies For Local Employment (Dec 14, 2020)Document37 pagesList of Licensed Private Employment Agencies For Local Employment (Dec 14, 2020)fxlnxNo ratings yet

- 01.4.5 Common Practices in Business OrganizationsDocument30 pages01.4.5 Common Practices in Business OrganizationsChristian Carator Magbanua100% (5)

- Valleylab Ft10 Energy Platform Users GuideDocument174 pagesValleylab Ft10 Energy Platform Users Guideavanteb ajamNo ratings yet

- IMEI OrdersDocument4 pagesIMEI Ordersrynocloud9No ratings yet

- Bfsi - Innovations in Digital BankingDocument6 pagesBfsi - Innovations in Digital BankingHimalay SiyotaNo ratings yet

- Classroom Training Manual. Ultrasonic TestingDocument216 pagesClassroom Training Manual. Ultrasonic TestingConstantine Polyakov100% (11)

- HAZOP FinalDocument2 pagesHAZOP Finalchiang95100% (3)

- Digitalization in BankingDocument18 pagesDigitalization in Bankingप्रवीण घिमिरेNo ratings yet

- Mba Project ONLINE BANKING SERVICES IciciDocument56 pagesMba Project ONLINE BANKING SERVICES IciciAnita Sona100% (5)

- Pac Ai in Banking 2023Document13 pagesPac Ai in Banking 2023AnanthuNo ratings yet

- Digitalization in Banking and Factors That Makes It More CompellingDocument18 pagesDigitalization in Banking and Factors That Makes It More CompellingJaljala NirmanNo ratings yet

- Somnath Sardar Research PaperDocument18 pagesSomnath Sardar Research Paperaaquib1110No ratings yet

- ProjDocument15 pagesProjAsghar Muhammad HussainNo ratings yet

- 50.digital Banking in Bangladesh New Era For Financial Revolution - PDF Version 1Document2 pages50.digital Banking in Bangladesh New Era For Financial Revolution - PDF Version 1Shakil Bin AzizNo ratings yet

- Digital Banking Get Real in SGDocument14 pagesDigital Banking Get Real in SGNguyen KhanhNo ratings yet

- The Changing Face of BankingDocument12 pagesThe Changing Face of BankingAsish Dash100% (1)

- Pakista 2Document2 pagesPakista 2Undaunted SpiritNo ratings yet

- Online Banking Services Icici BankDocument51 pagesOnline Banking Services Icici BankMubeenNo ratings yet

- Neo Banks in IndiaDocument20 pagesNeo Banks in Indiavijay shetNo ratings yet

- For Indian Neobanks, Raising $900M in Funding Was The Easy PartDocument10 pagesFor Indian Neobanks, Raising $900M in Funding Was The Easy PartDeep SharmaNo ratings yet

- Banking Regulation Act 1949Document70 pagesBanking Regulation Act 1949Reshma Radhakrishnan0% (1)

- Banking SectorDocument7 pagesBanking SectoradilkidwaiNo ratings yet

- Financial InclusionDocument6 pagesFinancial InclusionsignNo ratings yet

- E Banking ProjectDocument123 pagesE Banking ProjectRavi MoriNo ratings yet

- Why People Should Shift Towards The Digital Bank?Document3 pagesWhy People Should Shift Towards The Digital Bank?sarthak25No ratings yet

- Recent Trends in Indian Banking SectorDocument2 pagesRecent Trends in Indian Banking SectorsjoytuNo ratings yet

- Executive SummaryDocument51 pagesExecutive SummaryDhawal TankNo ratings yet

- Can Virtual Banks Accelerate Initiatives Toward Cashless and Smart NationsDocument12 pagesCan Virtual Banks Accelerate Initiatives Toward Cashless and Smart NationsElevate VentureNo ratings yet

- Meaning of RetailDocument17 pagesMeaning of RetailVivek YesodharanNo ratings yet

- Innovation in Banking SectorDocument6 pagesInnovation in Banking SectorKashishNo ratings yet

- Banks in 2010Document7 pagesBanks in 2010Srishty Puri GajbhiyeNo ratings yet

- Banking AssignmentDocument7 pagesBanking AssignmentAswath ChandrasekarNo ratings yet

- Meaning of Retail: Banking Regulation Act 1949Document22 pagesMeaning of Retail: Banking Regulation Act 1949chinu1303No ratings yet

- Weekly Bulletin: MET-BytesDocument3 pagesWeekly Bulletin: MET-BytesMehul BariNo ratings yet

- Mobile Finance Services in BangladeshDocument4 pagesMobile Finance Services in Bangladeshsn nNo ratings yet

- Digital Banking UnitsDocument3 pagesDigital Banking UnitsSohil DalNo ratings yet

- Existing FrameworkDocument4 pagesExisting FrameworkReyes BeeNo ratings yet

- Mobile BankingDocument2 pagesMobile BankingknightrrodersNo ratings yet

- Future of BankingDocument11 pagesFuture of BankingYoananda SyarafinaNo ratings yet

- The Emerging Role of Banks in EcommerceDocument5 pagesThe Emerging Role of Banks in EcommercePrerna SharmaNo ratings yet

- Neo BanksDocument11 pagesNeo BanksKhushi KashyapNo ratings yet

- D Sneha e BankDocument16 pagesD Sneha e BankMOHAMMED KHAYYUMNo ratings yet

- Seeded Question Sustainable BankingDocument5 pagesSeeded Question Sustainable Bankingshrmarcheline_641022No ratings yet

- Building The Contextual, Pervasive Bank of The FutureDocument2 pagesBuilding The Contextual, Pervasive Bank of The FutureSuntec SNo ratings yet

- Rural Financial Inclusions Through Digital Banking Services in IndiaDocument4 pagesRural Financial Inclusions Through Digital Banking Services in IndiaShishir GuptaNo ratings yet

- Mob Cia 3.Document44 pagesMob Cia 3.Niya ThomasNo ratings yet

- E Banking ProjectDocument123 pagesE Banking ProjectRezwan Bobby100% (1)

- New Adaptation by State Bank of IndiaDocument4 pagesNew Adaptation by State Bank of IndiaAnkit SharmaNo ratings yet

- Joining The Next Generation of Digital Banks in AsiaDocument12 pagesJoining The Next Generation of Digital Banks in AsiaChi PhamNo ratings yet

- 10 Challenges That Could Make or Break IndiaDocument3 pages10 Challenges That Could Make or Break IndiaarchanaNo ratings yet

- Case Study Solution IBS HyderabadDocument5 pagesCase Study Solution IBS HyderabadDeepak BhatiaNo ratings yet

- Financial Markets and Services Cia Iii: Topic: Modern Channels in Banking ServicesDocument3 pagesFinancial Markets and Services Cia Iii: Topic: Modern Channels in Banking ServicesValencia DonsonNo ratings yet

- Why (And How) Should Lenders Start Building An Online Loan PortfolioDocument3 pagesWhy (And How) Should Lenders Start Building An Online Loan PortfolioDivjyot88No ratings yet

- BUS235 Discussion 2Document7 pagesBUS235 Discussion 2wwwNo ratings yet

- Challeneges and Issues in Digital BankingDocument4 pagesChalleneges and Issues in Digital BankingHarshikaNo ratings yet

- Kotak's 811 Banking App - Digital Customer On-Boarding For The First Time in IndiaDocument9 pagesKotak's 811 Banking App - Digital Customer On-Boarding For The First Time in IndiajeetNo ratings yet

- What Is Financial InclusionDocument5 pagesWhat Is Financial InclusiondebasishpahiNo ratings yet

- USD TIME DEPOST RATES Long Quiz Preterm (Cristine P. Masangcay)Document4 pagesUSD TIME DEPOST RATES Long Quiz Preterm (Cristine P. Masangcay)Cristine P. MasangcayNo ratings yet

- Oral Recit. INCDocument4 pagesOral Recit. INCCristine P. MasangcayNo ratings yet

- Endorsment & NegotationDocument1 pageEndorsment & NegotationCristine P. MasangcayNo ratings yet

- Nature of CreditDocument6 pagesNature of CreditCristine P. MasangcayNo ratings yet

- FS Table of ContentsDocument2 pagesFS Table of ContentsCristine P. MasangcayNo ratings yet

- Lloyd Metzler HARDDocument4 pagesLloyd Metzler HARDCristine P. MasangcayNo ratings yet

- International Business Trade (IBT) : Pointers To Review A) The Major Trends in International Business/Small BusinessDocument6 pagesInternational Business Trade (IBT) : Pointers To Review A) The Major Trends in International Business/Small BusinessCristine P. MasangcayNo ratings yet

- Section 70: Purchase and Sales of Foreign ExchangeDocument12 pagesSection 70: Purchase and Sales of Foreign ExchangeCristine P. MasangcayNo ratings yet

- Career PlanningDocument3 pagesCareer PlanningCristine P. MasangcayNo ratings yet

- 5 Building Blocks in Achieving Financial SuccessDocument2 pages5 Building Blocks in Achieving Financial SuccessCristine P. MasangcayNo ratings yet

- 2017 h2 Prelim (Apgp)Document13 pages2017 h2 Prelim (Apgp)toh tim lamNo ratings yet

- Accounting - QuizDocument3 pagesAccounting - QuizAmelynieNo ratings yet

- Examination Papers On Introductory GeotechnicsDocument53 pagesExamination Papers On Introductory GeotechnicsTakchandra JaikeshanNo ratings yet

- Greek Democracy: AssignmentDocument11 pagesGreek Democracy: AssignmentMahima RaoNo ratings yet

- NSTP Project ProposalDocument3 pagesNSTP Project ProposalReena Maye Escalante MataNo ratings yet

- BPM Project ReportDocument12 pagesBPM Project Reportrohitshetty2011100% (1)

- Immigration and Ethnic and Racial Inequality in The USDocument29 pagesImmigration and Ethnic and Racial Inequality in The USLucas RodriguezNo ratings yet

- Inner Cover For Langstroth Hive: Ed RiceDocument4 pagesInner Cover For Langstroth Hive: Ed RiceFernandes HélioNo ratings yet

- qmc122 Mold Magnetic Clamping enDocument8 pagesqmc122 Mold Magnetic Clamping enAlper SakalsizNo ratings yet

- OB GYN Pages From Vmueller Snowdenpencer Armamentarium Catalogue 2Document36 pagesOB GYN Pages From Vmueller Snowdenpencer Armamentarium Catalogue 2Frechel Ann Landingin PedrozoNo ratings yet

- Learning Activity 1: Evidence: Unforgettable RestaurantDocument12 pagesLearning Activity 1: Evidence: Unforgettable RestaurantHankold AlvaradoNo ratings yet

- Matlab EXPO 2021Document57 pagesMatlab EXPO 2021trandat9789No ratings yet

- Hr900-Afg-N301 - 10/100/100M 30W Poe Injector: Shenzhen Hong Rui Optical Technology Co., LTDDocument4 pagesHr900-Afg-N301 - 10/100/100M 30W Poe Injector: Shenzhen Hong Rui Optical Technology Co., LTDdelapenar843No ratings yet

- Constraint Satisfaction Problems (CSP)Document36 pagesConstraint Satisfaction Problems (CSP)ShamsNo ratings yet

- Group 1: Abordo, Jezzle Anne Boreros, Christall Jane Gumobao, Winzelle Morales, Jane Erica Sibala, Rayshell KateDocument14 pagesGroup 1: Abordo, Jezzle Anne Boreros, Christall Jane Gumobao, Winzelle Morales, Jane Erica Sibala, Rayshell KateRudy LugasNo ratings yet

- Penetration Testing LAB Setup Guide: Internal Attacker - Beginner VersionDocument19 pagesPenetration Testing LAB Setup Guide: Internal Attacker - Beginner VersionpouetNo ratings yet

- 2010 PCDC Annual Spring Gala - Dinner JournalDocument86 pages2010 PCDC Annual Spring Gala - Dinner Journalpcdc1993No ratings yet

- Welfare LegislationDocument4 pagesWelfare LegislationMahek ShahNo ratings yet

- Patty Cake 09 321 Martha Chavez ResumeDocument2 pagesPatty Cake 09 321 Martha Chavez Resumeapi-24664729No ratings yet

- CJV30 Mechanical Drawing Supplement Version D500388 Ver.2.3b PDFDocument7 pagesCJV30 Mechanical Drawing Supplement Version D500388 Ver.2.3b PDFaigarsNo ratings yet

- Ipv4 DATA GRAMDocument40 pagesIpv4 DATA GRAMssankara narayananNo ratings yet