Professional Documents

Culture Documents

SADC Tax Harmonization

Uploaded by

Emmanuel Alenga MakhetiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SADC Tax Harmonization

Uploaded by

Emmanuel Alenga MakhetiCopyright:

Available Formats

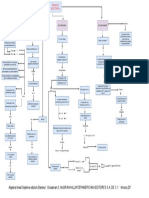

What’s driving

your Tax Agenda?

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Contents Tax Agenda

Where are you?

Internal influences

External influences

Tax Function

Bridging the gap

Internal influences

External influences

Tax Function

Notes

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Tax Agenda

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Where are you? Internal influences

Use the scales below to rate the maturity level of your tax function

Leading

Developing Established

► Tax team has a strategy to improve connections ► Tax team is connected with some key stakeholders across ► Tax team is well connected with key stakeholders across the

Internal with stakeholders across the organization and is

the organization, but not always involved with internal organization, and is effective at consistently assessing internal factors

influences often not involved in internal matters that may

matters that could impact the tax function that may impact the tax function

overview impact the tax function

► C-suite views tax function primarily as a cost ► C-suite, tax and operations periodically consult on ► Operations, tax and C-suite agendas are aligned

center strategic matters ► Tax and CFO meet regularly

► Minimal alignment between operations, tax, and ► Tax and business operations agendas are partially aligned ► Tax function is viewed as a strategic business partner across the

Strategy C-suite ► Tax strategy supports the company’s working capital enterprise

► Tax doesn’t report directly to the C-suite requirements as needed ► Tax strategy supports the company’s overall need for working capital

► Relevant data is extracted, validated and passed to the tax

► Tax employees have limited technology skills ► Builds or employs tax capabilities within new operating models

function

► Tax extracts data manually from ERP systems ► Secures appropriate tax talent in HQ and other key operating centers

► Tax employees are fairly proficient in the use of finance

► Tax requirements are often overlooked during new ► Tax employees are trained and use new technology, including data

systems

system implementations analytics

► Tax requirements are included in end-stages of new system

► Tax talent is disconnected across the enterprise ► Tax requirements are included in new system implementations

Enterprise implementations

► Balancing responsibilities on an ad hoc basis to ► Balancing responsibilities to shareholders and the C-suite’s sensitivity

► Minimal focus on shareholders and the C-suite’s shareholders and the C-suite’s sensitivity to financial and to financial and reputational risks

sensitivity to financial and reputational risks reputational risks ► Comprehensive tax control framework in place and using technology

► Minimal processes in place to identify and manage ► Developing a tax control framework to track/manage tax risks

tax risks ► Uses processes to identify and manage risk on an ad hoc ► Maintains a corporate-wide methodology for identifying and

► Tax has limited interaction with the audit basis remediating risk

committee ► Tax has effective and structured interactions with the board of

Governance directors and audit committee

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Where are you? External influences

Use the scales below to rate the maturity level of your tax function

Leading

Developing Established

► Tax team is aware of some of the latest regulatory, ► Tax team is proactively monitoring the latest regulatory, economic

► Tax is mostly reactive in the review of the latest economic and industry trends, but not always informed of and industry trends and consistently analyzes how they may impact

External regulatory, economic and industry trends and how their potential tax impact the tax function

influences they may impact the tax function

overview

► Closely monitors and responds to regulatory changes

► Ad hoc monitoring of regulatory changes ► Monitors developments related to tax, trade and data privacy, and data

► Adopts a ‘wait and see’ approach on most

► Some activity undertaken on potential changes in protection

regulatory changes

regulations ► Participates in industry groups to actively take part in consultations on

Regulatory ► Unaware of options to take part in consultations

► Usually reactive to developments related to tax, trade and potential changes in regulations

on potential changes in regulations

data privacy, and data protection ► Uses modelling tools to evaluate multinational/pan-national operating

models and tax implications

► Has a high level view on economic trends and ► Analyzes economic trends and related tax implications ► Analyze and consider tax impact of foreign exchange movements

their tax implications but no structured analysis ► Intermittently considers tax implications in emerging and ► Regularly assesses geographical and tax implications in emerging and

► Has not determined tax implications in emerging developed markets developed markets

Economic

and developed markets ► Monitors foreign exchange movements ► Understands economic trends and related tax implications

► Has limited or no awareness of emerging trends ► Has performed some benchmarking amongst select ► Regularly conducts benchmarking exercises amongst industry peer

within industry peer groups industry peers

groups and is considered “best in class”

► Minimal benchmarking performed amongst ► Has reasonable understanding of emerging trends amongst

Industry ► Regularly vets emerging trends amongst industry peer groups

industry peer groups industry peer groups

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Where are you? Tax function

Use the scales below to rate the maturity level of your tax function

Leading

Developing Established

► The various tax function components are not ► Components of the tax function are integrated, may have

Tax function ► All components of the tax function are globally integrated, have

adequately integrated, do not have the necessary sufficient talent, time and budgets allocated but may not be

overview optimum talent, time and budgets allocated, are aligned with the overall

talent, time and budgets allocated, and are not aligned with the overall business strategy or achieve most

business strategy and achieve the organization’s tax goals and objectives

aligned with the overall business strategy goals and objectives

► In-country cash tax planning process/capabilities do ► Proactive review of tax rate compared to peers

► Cash tax planning strategy is performed on an ad hoc basis

not exist or are limited ► Tax is fully represented in business processes and functions (e.g. M&A)

only

► Inappropriate amount of tax budget allocated to tax ► Tax planning addresses short and long-term strategic opportunities

► Consulting procedures in place for M&A committees and tax

Planning planning ► Technology and data analytics are used to enable effective tax planning

► Periodic review of tax rate compared to peers

► Minimal review of tax rate compared to peers activities

► Centralized process for computations in all geographies

► Local finance teams prepare submissions using a ► HQ Tax reviews provision, interprets tax law and tax ► Fully documented review processes in place and controls are integrated

decentralized process with limited review accounting policies, leads in resolving open items and with compliance

► Processes may be documented at a high level and are prepares top-side adjustments ► Regular communication and tax accounting training in place for all tax

Accounting non-standardized across all geographies ► Processes are largely documented and standardized with roles and finance employees

► Tax and finance work together to resolve some and timing identified ► Significant tax accounting judgments and transactions are approved by

issues with tax provision, tax accounts and ► Tax reconciles and validates most current and deferred tax and finance

disclosures income tax balances to start compliance activities ► Tax accounting closely coordinates with planning, compliance and

controversy to ensure accuracy of the tax reserve

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Where are you? Tax function

Use the scales below to rate the maturity level of your tax function

Leading

Developing Established

► Accountability for compliance is unclear or each ► Centrally filed tax returns are available and scheduled status ► Available technologies are consistently leveraged for recurring

country finance/business unit exercises own reporting is provided to key stakeholders compliance activities

discretion in the use of internal/external resources ► Compliance activities are tracked and reported, with proactive ► Consistent compliance process and documentation are applied and

► Countries extract their own information from the prevention addressing late filing risks integrated across all geographies

ERP or other local systems ► ERP data is extracted and validated before use ► ERP data is sensitized to finance and tax needs, is consistent across

Compliance ► Independent decision making on compliance multiple processes, and centrally provided for local compliance

methodology and issue resolution per country ► External suppliers are globally identified, contracted and managed

► Reactive approach to disputes and controversies ► Approach is effective in addressing most tax risks but has not ► Globally integrated, proactive approach to tax risk and controversy

► Minimal action taken around regional and global yet completely eliminated unexpected surprise issues management, supported across the enterprise, to Prevent, Manage and

resources, processes and systems for tax risk ► Group policies and procedures provide periodic visibility to Resolve controversy

management tax function for only the most significant uncertainties in ► Manage – mitigate the impact of controversy by gaining a full picture of

► Uncoordinated approach to tax controversy and risk controversy matters risks with a global tracking platform and harness tools to proactively

with little proactive tax controversy planning ► Tax strategy provides a standard approach to tax controversy manage them across multiple jurisdictions

► Use of a patchwork approach of professional and risk at a region or country level, with limited ► Prevent – stop controversy before it occurs with top-down governance,

Controversy services companies in multiple markets effectiveness systems and processes that enhance risk monitoring and compliance

► Resolve – utilize all available pre and post-filing resolution tools and

processes so the company can move forward

► A single tax operating strategy does not exist ► Additional technology tools and data analytics are being ► Regular or real-time tax dashboard reflect KPIs, and data analytics are

► Limited monitoring of tax policies evaluated utilized to enhance the tax function performance

► Tax talent development plan has not been designed ► Most tax policies are monitored and documented ► Tax policies have clearly defined governance, are Board approved and

► Tax strategy is partially linked to the organization's overall globally applied

strategy and updated infrequently ► Tax strategy is updated, continually monitored and aligned to overall

► Tax talent development plan and KPIs set in accordance with business strategy

Tax

Performance

tax strategy ► Tax talent development plan and KPIs set in accordance with tax strategy

Management

and measured

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Bridging the gap – Internal influences

Impact

Identify and prioritize the actions below based on impact and urgency

Urgency

High impact, High impact, High urgency, Low urgency,

Recommended actions high urgency low urgency low impact low impact

► Align your tax strategy with your business and legal strategies following a transaction.

► Consider outsourcing business processes within your tax function

► Review how digital transformation and the digital economy will impact the tax

Strategy function

► Develop a plan to better align tax with the business and C-suite priorities

►

► Assess whether the company’s data is fit for Country by Country reporting (Action 13

of the OECD BEPS initiative)

► Review business processes to achieve potential savings

► Improve the tax function’s engagement with the enterprise around transformation

Enterprise

activities

►

► Enhance the effectiveness of the tax function with regard to managing risk and

providing governance oversight

►

Governance

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Bridging the gap – External influences

Impact

Identify and prioritize the actions below based on impact and urgency

Urgency

High impact, High impact, High urgency, Low urgency,

Recommended actions high urgency low urgency low impact low impact

► Determine the tax impact of changes in the regulatory environment resulting from Brexit, US tax reform or other geopolitical changes

Regulatory

► Improve the tax function’s monitoring and responsiveness to regulatory changes

► Take into account both business and tax issues when assessing US tax reform’s impact

►

► Formulate a plan to improve how the tax function addresses and responds to economic changes

►

Economic

► GENERAL: Better prepare the tax function to address and respond to industry trends

► AUTO HOT TOPIC: Align with e-mobility, digitalization and connected cars strategies and developments

► BCM HOT TOPIC: Consider taking advantage of increasing tax reporting regulations to enhance the customer experience

► CPR HOT TOPIC: Review the current operating model to determine if it is fit for purpose

Industry ► GPS HOT TOPIC: Develop a plan to address cross border tax issues in direct, indirect and reporting areas

► HEALTH HOT TOPIC: Develop a plan to address cross border tax issues in direct, indirect and reporting areas in an increasingly

globalized environment

► INSURANCE HOT TOPIC: Better streamline your global tax reporting obligations across all aspects of the tax lifecycle

► LIFE SCIENCES HOT TOPIC: Determine where to locate Intellectual Property in an uncertain legislative environment

► M&E HOT TOPIC: Analyze the value of customer data you obtain through digital transactions from local tax, transfer pricing, and BEPS

perspectives on your supply chain

► MINING & METALS HOT TOPIC: Assess the impact of Robotics and Process Automation on your tax function

► O&G HOT TOPIC: Evaluate the tax impact from digital oil field operations and core services

► P&U HOT TOPIC: Evaluate the use of RPA across the tax function

► PRIVATE EQUITY HOT TOPIC: Manage the growing compliance burden and associated risks efficiently

► REAL ESTATE HOT TOPIC: Assess impact of regulatory developments on the underwriting of real estate investments and your

organizational model

► TECHNOLOGY HOT TOPIC: Evaluate whether your global supply chain is configured for Post BEPS IP alignment and supply chain

landscape

► TELECOM HOT TOPIC: Perform economic analysis of cloud-based business model and IP ownership

► WAM HOT TOPIC: Evaluate use of robotics and process automation to capture data for the tax compliance processes

►

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Bridging the gap – Tax function

Impact

Identify and prioritize the actions below based on impact and urgency

Urgency

High impact, High impact, High urgency, Low urgency,

Recommended actions high urgency low urgency low impact low impact

► Develop a plan on how to best leverage data analytics

Tax ► Develop a strategy to improve managing tax data

performance ► Develop a tax talent strategy that aligns with the tax function’s KPIs

management ► Evaluate new tax technologies to improve speed, accuracy and cost

► Develop a performance management plan to improve the effectiveness of the tax function

►

► Increase your tax function’s focus on tax planning

►

Planning

► Improve your tax function’s tax accounting policies and procedures

►

Accounting

► Evaluate the use of RPA for your tax compliance requirements

► Develop an approach to improve the consistency, efficiency and effectiveness of your compliance and reporting

processes

Compliance ►

► Improve the methodology of identifying, managing and resolving tax controversy, disputes and litigation

►

Controversy

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

Notes

►

►

►

►

►

►

►

►

►

►

►

►

►

►

►

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

EY | Building a better working world

EY exists to build a better working world, helping to create long-

term value for clients, people and society and build trust in the

capital markets.

Enabled by data and technology, diverse EY teams in over 150

countries provide trust through assurance and help clients grow,

transform and operate.

Working across assurance, consulting, law, strategy, tax and

transactions, EY teams ask better questions to find new answers for

the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more,

of the member firms of Ernst & Young Global Limited, each of

which is a separate legal entity. Ernst & Young Global Limited, a UK

company limited by guarantee, does not provide services to clients.

Information about how EY collects and uses personal data and a

description of the rights individuals have under data protection

legislation are available via ey.com/privacy. EYG member firms do

not practice law where prohibited by local laws. For more

information about our organization, please visit ey.com.

© 2021 EYGM Limited.

All Rights Reserved.

EYG no. DL1516

BSG no. 1510-1715875

ED None

In line with EY’s commitment to minimize its impact on the environment, this

document has been printed on paper with a high recycled content.

This publication contains information in summary form and is therefore intended for general guidance

only. It is not intended to be a substitute for detailed research or the exercise of professional judgment.

Neither EYGM Limited nor any other member of the global Ernst & Young organization can accept any

responsibility for loss occasioned to any person acting or refraining from action as a result of any

material in this publication. On any specific matter, reference should be made to the appropriate

advisor.+

© 2017 EYGM Limited

All Rights Reserved EY Tax Agenda

You might also like

- Tax Function Effectiveness Best Practice ChecklistDocument2 pagesTax Function Effectiveness Best Practice ChecklistGbengaNo ratings yet

- Ey Faas Branch Accounting Deck FinalDocument41 pagesEy Faas Branch Accounting Deck FinalTouseef AslamNo ratings yet

- Strategic Tax Management ReviewerDocument47 pagesStrategic Tax Management ReviewerJoyce Macatangay100% (1)

- Strategic Tax Planning and ManagementDocument37 pagesStrategic Tax Planning and Managementle youtuber classicNo ratings yet

- Tax Function Effectiveness EngDocument8 pagesTax Function Effectiveness Engmarta.stepinska.poltaxNo ratings yet

- DTTL Tax TMC Emea Conference 2016 Integrated Process DeliveryDocument19 pagesDTTL Tax TMC Emea Conference 2016 Integrated Process Deliverymarta.stepinska.poltaxNo ratings yet

- Traf Presentation India WebcastDocument48 pagesTraf Presentation India WebcastSwastik GroverNo ratings yet

- Goods & Services Tax: Are You Ready For The Change?Document3 pagesGoods & Services Tax: Are You Ready For The Change?Ashish PandeyNo ratings yet

- Charternet'S Suite of Innovative Solutions For Your BusinessDocument4 pagesCharternet'S Suite of Innovative Solutions For Your BusinessAnonymous 2sdpF7vVNo ratings yet

- GCC Vat Sap BrochureDocument4 pagesGCC Vat Sap BrochureHiren ThakkarNo ratings yet

- Results Accountability - PPT NotesDocument72 pagesResults Accountability - PPT NotesEmma WongNo ratings yet

- Ifrs 17 - Operational Implications: Martyn Van Wensveen, Partner EY Malaysia IFRS 17 Implementation Lead (APAC)Document21 pagesIfrs 17 - Operational Implications: Martyn Van Wensveen, Partner EY Malaysia IFRS 17 Implementation Lead (APAC)Sulist SulistNo ratings yet

- 7 Factors Tax Management - 04122020Document21 pages7 Factors Tax Management - 04122020Chrusty NurilNo ratings yet

- Ey Process Automation in Asset ServicingDocument4 pagesEy Process Automation in Asset ServicingRajesh NeppalliNo ratings yet

- Partnering KDS Group Thru An S/4HANA Led Business Transformation JourneyDocument78 pagesPartnering KDS Group Thru An S/4HANA Led Business Transformation Journeyayman2710100% (2)

- Deloitte Indirect Tax TechnologyDocument32 pagesDeloitte Indirect Tax Technologyhleeatrimini67% (3)

- PWC - Teams - Management - Enhancing Tax Process Management and ControlsDocument17 pagesPWC - Teams - Management - Enhancing Tax Process Management and ControlsbiduzNo ratings yet

- CF - UM21MB641B Unit 1 Class 3-Finance Function and Its OrganisationDocument11 pagesCF - UM21MB641B Unit 1 Class 3-Finance Function and Its OrganisationPrajwalNo ratings yet

- KPMG Tax Data Hub BrochureDocument2 pagesKPMG Tax Data Hub BrochuremaheshbangaliNo ratings yet

- Corporate Tax Services: The Power of Being UnderstoodDocument2 pagesCorporate Tax Services: The Power of Being Understoodgra8leoNo ratings yet

- Faktor Yang Mempengaruhi Perencanaan PajakDocument15 pagesFaktor Yang Mempengaruhi Perencanaan PajakNUR FADILAHNo ratings yet

- Slides CH07Document19 pagesSlides CH07Daniel ChristandyNo ratings yet

- Ey-The-Dawning-Of-Digital-Economy-TaxationDocument8 pagesEy-The-Dawning-Of-Digital-Economy-TaxationStefanny BedoyaNo ratings yet

- CMA Class 1 A FDocument58 pagesCMA Class 1 A FRithesh KNo ratings yet

- Financial Ratios - Non Financial Sector - March2021Document11 pagesFinancial Ratios - Non Financial Sector - March2021karishmapatel93No ratings yet

- 05 Tax Risk Management in A Tax Data Analytics Era (SKS)Document19 pages05 Tax Risk Management in A Tax Data Analytics Era (SKS)fazh lpsvNo ratings yet

- C 2008 2 Biggelaar PDFDocument8 pagesC 2008 2 Biggelaar PDFManohar G ShankarNo ratings yet

- EPM Cloud Tax Reporting Overview - EMEA Training May 2020Document25 pagesEPM Cloud Tax Reporting Overview - EMEA Training May 2020zaymounNo ratings yet

- KPMG Tax Impact Reporting: Embarking On Your Tax Transparency JourneyDocument9 pagesKPMG Tax Impact Reporting: Embarking On Your Tax Transparency JourneySoofi AthamNo ratings yet

- OEM and Equlisation LevyDocument16 pagesOEM and Equlisation LevyYash SharmaNo ratings yet

- Fifteenth Edition: ConfidentialityDocument18 pagesFifteenth Edition: Confidentialitysyafiq rossleyNo ratings yet

- A201 - 1 - Intro To Cost Accounting (Jamero 2022)Document23 pagesA201 - 1 - Intro To Cost Accounting (Jamero 2022)MARIAN DORIANo ratings yet

- Vat ImplementationDocument2 pagesVat ImplementationnareshkumharNo ratings yet

- F2 Lecture Notes 2022Document86 pagesF2 Lecture Notes 2022Trần PhươngNo ratings yet

- Linking Business Tax Reform With Governance - How To Measure SuccessDocument4 pagesLinking Business Tax Reform With Governance - How To Measure SuccessdmaproiectNo ratings yet

- AnnexuresDocument6 pagesAnnexuresWadey SchoemanNo ratings yet

- ABM2 ReviewerDocument5 pagesABM2 ReviewerDave LumigidNo ratings yet

- The Global Tax Disputes EnvironmentDocument16 pagesThe Global Tax Disputes EnvironmentFlaisLibelNo ratings yet

- 5 THDocument4 pages5 THrohanNo ratings yet

- Tax Risk Management PolicyDocument15 pagesTax Risk Management PolicyAzhar JamalNo ratings yet

- Basic Concepts in Cost FYBBA-IBDocument14 pagesBasic Concepts in Cost FYBBA-IBSakuraNo ratings yet

- Management Control Systems: Chapter 7: Financial Responsibility Centers (And The Transfer Pricing Problem)Document10 pagesManagement Control Systems: Chapter 7: Financial Responsibility Centers (And The Transfer Pricing Problem)Riza EmiyaNo ratings yet

- 11th Commerce 3 MarksDocument5 pages11th Commerce 3 Marksts varshaNo ratings yet

- 03 Sample IT Cost Forecasting and Budgeting WorkbookDocument106 pages03 Sample IT Cost Forecasting and Budgeting Workbookkrishnamohan.chennareddyNo ratings yet

- Fundamentals of Beps: After Studying This Chapter, You Would Be Able ToDocument29 pagesFundamentals of Beps: After Studying This Chapter, You Would Be Able ToZ H SolutionsNo ratings yet

- Forrester StudyDocument24 pagesForrester StudyanimeshsenNo ratings yet

- EPGP Platform Batch 13 Pankaj Baag Faculty Block 01, Room No 21 Mob: 8943716269 PH (O) : 0495-2809121 Ext. 121 EmailDocument66 pagesEPGP Platform Batch 13 Pankaj Baag Faculty Block 01, Room No 21 Mob: 8943716269 PH (O) : 0495-2809121 Ext. 121 EmailSANDIP KUMARNo ratings yet

- Branches of AccountingDocument21 pagesBranches of AccountingRhona Primne ServañezNo ratings yet

- Future Taxation of Company Profits 1558972582 PDFDocument21 pagesFuture Taxation of Company Profits 1558972582 PDFJORGESHSSNo ratings yet

- Future Taxation of Company Profits 1558972582 PDFDocument21 pagesFuture Taxation of Company Profits 1558972582 PDFJORGESHSSNo ratings yet

- Cost AccountingDocument31 pagesCost AccountingRayala SaisrinivasNo ratings yet

- 01 Deloitte-Tax-Operations-Transformation-Trends-Survey-2021Document29 pages01 Deloitte-Tax-Operations-Transformation-Trends-Survey-2021Angel AriasNo ratings yet

- Financial AccountingDocument1 pageFinancial Accountingmayurk87No ratings yet

- Ey Sap Tax Compliance BrochureDocument16 pagesEy Sap Tax Compliance BrochureSajjad QureshiNo ratings yet

- Behavioural Insights For Better Tax Administration A Brief GuideDocument36 pagesBehavioural Insights For Better Tax Administration A Brief Guideamornchaiw2603No ratings yet

- Introducing The Value-Added Tax Considerations For ImplementationDocument8 pagesIntroducing The Value-Added Tax Considerations For ImplementationdmaproiectNo ratings yet

- ACFAR ReviewDocument39 pagesACFAR ReviewYza IgartaNo ratings yet

- GCC VAT Solution PresentationDocument35 pagesGCC VAT Solution PresentationSandeep Mahindra80% (5)

- East African Community Double Taxation AgreementDocument21 pagesEast African Community Double Taxation AgreementEmmanuel Alenga MakhetiNo ratings yet

- STATA Panel Data Anlysis PDFDocument40 pagesSTATA Panel Data Anlysis PDFHafiz WaqasNo ratings yet

- Probit and LogitDocument84 pagesProbit and LogitEmmanuel Alenga MakhetiNo ratings yet

- Ch3 SlidesDocument30 pagesCh3 SlidesYiLinLiNo ratings yet

- Introduction To Panel DataDocument20 pagesIntroduction To Panel DataEmmanuel Alenga MakhetiNo ratings yet

- HeteroskedasticityDocument20 pagesHeteroskedasticityEmmanuel Alenga MakhetiNo ratings yet

- 2006 EAC Gazette 15th DecemberDocument2 pages2006 EAC Gazette 15th DecemberEmmanuel Alenga MakhetiNo ratings yet

- 2007 EAC Gazette 1st MarchDocument6 pages2007 EAC Gazette 1st MarchEmmanuel Alenga MakhetiNo ratings yet

- 2015 EAC Gazette 10th DecemberDocument12 pages2015 EAC Gazette 10th DecemberEmmanuel Alenga MakhetiNo ratings yet

- 2008 EAC Gazette 1st MayDocument5 pages2008 EAC Gazette 1st MayEmmanuel Alenga MakhetiNo ratings yet

- Research GuideDocument1 pageResearch GuideEmmanuel Alenga MakhetiNo ratings yet

- 11 PJBUMI Digital Data Specialist DR NOOR AZLIZADocument7 pages11 PJBUMI Digital Data Specialist DR NOOR AZLIZAApexs GroupNo ratings yet

- Cyber Ethics IssuesDocument8 pagesCyber Ethics IssuesThanmiso LongzaNo ratings yet

- Basic Elements of Rural DevelopmentDocument7 pagesBasic Elements of Rural DevelopmentShivam KumarNo ratings yet

- Public Versus Private Education - A Comparative Case Study of A P PDFDocument275 pagesPublic Versus Private Education - A Comparative Case Study of A P PDFCindy DiotayNo ratings yet

- Algebra Lineal Septima Edicion Stanley I. Grossman S. Mcgraw-Hilliinteramericana Editores S.A. de C.V Mexico, DFDocument1 pageAlgebra Lineal Septima Edicion Stanley I. Grossman S. Mcgraw-Hilliinteramericana Editores S.A. de C.V Mexico, DFJOSE JULIAN RAMIREZ ROJASNo ratings yet

- D3Document2 pagesD3zyaNo ratings yet

- SyerynDocument2 pagesSyerynHzlannNo ratings yet

- Coaching Manual RTC 8Document1 pageCoaching Manual RTC 8You fitNo ratings yet

- Introduction To Communication Systems: James Flynn Sharlene KatzDocument15 pagesIntroduction To Communication Systems: James Flynn Sharlene KatzAnisari MeiNo ratings yet

- Albert Einstein's Riddle - With Solution Explained: October 19, 2009 - AuthorDocument6 pagesAlbert Einstein's Riddle - With Solution Explained: October 19, 2009 - Authorgt295038No ratings yet

- WILDLIFEDocument35 pagesWILDLIFEnayab gulNo ratings yet

- Wa0009.Document14 pagesWa0009.Pradeep SinghNo ratings yet

- Arc Studio ReviewerDocument62 pagesArc Studio ReviewerKristine100% (1)

- CHP 11: Setting Goals and Managing The Sales Force's PerformanceDocument2 pagesCHP 11: Setting Goals and Managing The Sales Force's PerformanceHEM BANSALNo ratings yet

- Conformity Observation Paper 1Document5 pagesConformity Observation Paper 1api-524267960No ratings yet

- Global Slump: The Economics and Politics of Crisis and Resistance by David McNally 2011Document249 pagesGlobal Slump: The Economics and Politics of Crisis and Resistance by David McNally 2011Demokratize100% (5)

- Lozada Vs MendozaDocument4 pagesLozada Vs MendozaHarold EstacioNo ratings yet

- Glint 360 Design GuideDocument2 pagesGlint 360 Design GuidebNo ratings yet

- Reason and ImpartialityDocument21 pagesReason and ImpartialityAdriel MarasiganNo ratings yet

- TAX Report WireframeDocument13 pagesTAX Report WireframeHare KrishnaNo ratings yet

- PH Scale: Rules of PH ValueDocument6 pagesPH Scale: Rules of PH Valuemadhurirathi111No ratings yet

- Ips Rev 9.8 (Arabic)Document73 pagesIps Rev 9.8 (Arabic)ahmed morsyNo ratings yet

- DeathoftheegoDocument123 pagesDeathoftheegoVictor LadefogedNo ratings yet

- The Relationship Between Law and MoralityDocument12 pagesThe Relationship Between Law and MoralityAnthony JosephNo ratings yet

- WWW - Nswkendo IaidoDocument1 pageWWW - Nswkendo IaidoAshley AndersonNo ratings yet

- TRYOUT1Document8 pagesTRYOUT1Zaenul WafaNo ratings yet

- Ogl 350 Paper 2Document5 pagesOgl 350 Paper 2api-672448292No ratings yet

- RS485 Soil 7in1 Sensor ES SOIL 7 in 1 Instruction ManualDocument15 pagesRS485 Soil 7in1 Sensor ES SOIL 7 in 1 Instruction ManualĐoàn NguyễnNo ratings yet

- Phoenix Wright Ace Attorney - Episode 2-2Document39 pagesPhoenix Wright Ace Attorney - Episode 2-2TheKayOneNo ratings yet

- 5 L&D Challenges in 2024Document7 pages5 L&D Challenges in 2024vishuNo ratings yet