Professional Documents

Culture Documents

Template Doa & Briefing Pagi New - Jun 2023

Uploaded by

Sofyan Agustiawan0 ratings0% found this document useful (0 votes)

7 views7 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views7 pagesTemplate Doa & Briefing Pagi New - Jun 2023

Uploaded by

Sofyan AgustiawanCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

BRI Performance Highlight

(Mei 2023 – Bank Only)

BBRI : 5375 -50 (-0.92%)

BALANCE SHEET BANK ONLY

RASIO-RASIO BANK ONLY

- Asset: 1.631,18 T (7,09% yoy)

- LDR: 90,38%

- Kredit: 1.086,69 T (10,05% yoy) - NPL (Gross) : 3,29%

- DPK: 1.202,40 T (7,64% yoy) - NPL Coverage: 244,36%

Giro: 259,79 T (11,52% yoy) - LAR: 16,14%

- LAR Coverage: 49,79%

Tabungan: 507,56 T (2,30% yoy) - Credit Cost: 3,02%

Deposito: 435,06 T (12,13% yoy) - NIM: 6,69%

- CASA: 767,35 T (5,25% yoy) - BOPO: 65,92%

- ROA BT: 3,60%

INCOME STATEMENT BANK ONLY - CIR: 36,85%

- COF: 2,64%

- Pendapatan Bunga: 57,89 T (10,31% yoy) - %FBI trhdp total pendapatan:

- Beban Bunga: (14,44) T (78,43% yoy)

PINJAMAN BBRI PER SEGMEN (OS & YOY) BANK ONLY

- OHC, B.CKPN, Lain: (34,04) T (3,61% yoy)

-Total Pinjaman: 1.086,69 T (10,05% yoy)

- FBI, Rec, Lain: 15,73 T (9,35% yoy) - Mikro: 464,33 T (10,36% yoy)

- LABA: 20,12 T (5,07% yoy) - Konsumer: 169,75 T (11,26% yoy)

- Kecil: 223,57 T (6,39% yoy)

- Menengah: 26,38 T (32,54% yoy)

- Korporasi: 202,67 T (10,10% yoy)

You might also like

- MCB IR Presentation March 2021Document19 pagesMCB IR Presentation March 2021SACHINNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- United Bank Limited United Bank Limited United Bank Limited United Bank LimitedDocument34 pagesUnited Bank Limited United Bank Limited United Bank Limited United Bank LimitedZeeshan YaqubNo ratings yet

- South Central Africa Top CompaniesDocument16 pagesSouth Central Africa Top CompaniesaddyNo ratings yet

- MP 1 PagerDocument2 pagesMP 1 PagerNikos DiakogiannisNo ratings yet

- Financial Modeling From ACCA GroupDocument37 pagesFinancial Modeling From ACCA GroupNeehsadNo ratings yet

- Notes: Market IndicesDocument2 pagesNotes: Market IndicesMUHAMMAD UMAR GURCHANINo ratings yet

- Stock PriceDocument1 pageStock PriceWeazelllNo ratings yet

- Financial HighlightsDocument1 pageFinancial Highlightsarman_277276271No ratings yet

- SouthIndianBank 2QFY2013RU NWDocument13 pagesSouthIndianBank 2QFY2013RU NWAngel BrokingNo ratings yet

- Financial TechnologyDocument49 pagesFinancial Technologyeileen ganiNo ratings yet

- Stock PriceDocument1 pageStock PriceWeazelllNo ratings yet

- Reliance Industries Ratios and AnalyticsDocument6 pagesReliance Industries Ratios and AnalyticsTI678No ratings yet

- Stock PriceDocument1 pageStock PriceWeazelllNo ratings yet

- Indian Overseas Bank: Performance HighlightsDocument11 pagesIndian Overseas Bank: Performance HighlightsAngel BrokingNo ratings yet

- Traders' Takedown: Stories For The DayDocument8 pagesTraders' Takedown: Stories For The DayLeslie MirandaNo ratings yet

- Stock PriceDocument2 pagesStock PriceWeazelllNo ratings yet

- Yes Bank - IDFC SSKI - 22 01 09Document6 pagesYes Bank - IDFC SSKI - 22 01 09api-19728845No ratings yet

- The West Africa Companies: (Quar Terly)Document16 pagesThe West Africa Companies: (Quar Terly)addyNo ratings yet

- Exxon Mobil CorpDocument2 pagesExxon Mobil CorpBhubaneshwari Roy MNo ratings yet

- 040821-SBI Press Release Q1FY22Document2 pages040821-SBI Press Release Q1FY22Prateek WadhwaniNo ratings yet

- Panel I - Jahja Setiaatmadja - CEO BCADocument21 pagesPanel I - Jahja Setiaatmadja - CEO BCADimas HardiNo ratings yet

- Treasury Weekly Report W-33-1Document2 pagesTreasury Weekly Report W-33-1shyamalNo ratings yet

- End Term Paper FACD 2020Document8 pagesEnd Term Paper FACD 2020Saksham SinhaNo ratings yet

- Exercise Full and Partial Goodwill CMK Q&ADocument2 pagesExercise Full and Partial Goodwill CMK Q&ANur Dina AbsbNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Dow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Document5 pagesDow 12,233.15 +71.52 +0.59% S&P 500 1,324.57 +5.52 +0.42% Nasdaq 2,797.05 +13.06 +0.47%Andre_Setiawan_1986No ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Analyzing Bank Performance: Using The UbprDocument70 pagesAnalyzing Bank Performance: Using The UbpraliNo ratings yet

- Zimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWDocument1 pageZimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWBen GanzwaNo ratings yet

- Or No Shutdown?Document6 pagesOr No Shutdown?Andre_Setiawan_1986No ratings yet

- Please Click On The Link For The Report:: cm09MjgDocument2 pagesPlease Click On The Link For The Report:: cm09Mjgneil5mNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- Slumped, Again: Revenues in Billions of Dollars Earnings Per ShareDocument5 pagesSlumped, Again: Revenues in Billions of Dollars Earnings Per ShareAndre SetiawanNo ratings yet

- PCBK Stsa C WFC BK Cbbo BAC JPM BBT COF PNC MTB KEY RF STI CacbDocument3 pagesPCBK Stsa C WFC BK Cbbo BAC JPM BBT COF PNC MTB KEY RF STI CacbWeazelllNo ratings yet

- Traders' Takedown: Stories For The DayDocument9 pagesTraders' Takedown: Stories For The DayLeslie MirandaNo ratings yet

- SURYODAY 19072021124619 Announcement Under Regulation 30 Business UpdateDocument2 pagesSURYODAY 19072021124619 Announcement Under Regulation 30 Business UpdateAbdul ShaheenNo ratings yet

- Stock PriceDocument1 pageStock PriceWeazelllNo ratings yet

- Kyb 2023Document10 pagesKyb 2023RudraNo ratings yet

- Notes: Market IndicesDocument2 pagesNotes: Market IndicesMUHAMMAD UMAR GURCHANINo ratings yet

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingNo ratings yet

- Arthneeti: All The Best!Document10 pagesArthneeti: All The Best!Kanav GuptaNo ratings yet

- Muthoot Finance - Initiating Coverage - 120221Document13 pagesMuthoot Finance - Initiating Coverage - 120221DeepikaNo ratings yet

- End Term Paper FACD 2020Document4 pagesEnd Term Paper FACD 2020Saksham SinhaNo ratings yet

- Stock PriceDocument1 pageStock PriceWeazelllNo ratings yet

- Stock PriceDocument1 pageStock PriceWeazelllNo ratings yet

- 15 Sep DerivativeDocument3 pages15 Sep DerivativeMansukhNo ratings yet

- Stock PriceDocument2 pagesStock PriceWeazelllNo ratings yet

- Vietnam Macro Econimics & Securities MarketDocument22 pagesVietnam Macro Econimics & Securities MarketThuyen NgoNo ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Banks 03 SHAW ValuationDocument57 pagesBanks 03 SHAW Valuationmerag76668No ratings yet

- Casa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqDocument3 pagesCasa Growth Drives Robust Liquidity Position: (RP Billion) Jun-19 Dec-19 Mar-20 Jun-20 Yoy Ytd QoqErica ZulianaNo ratings yet

- Issue Under ConsiderationDocument9 pagesIssue Under ConsiderationShaurya SinghNo ratings yet

- Yes Bank: Performance HighlightsDocument12 pagesYes Bank: Performance HighlightsAngel BrokingNo ratings yet

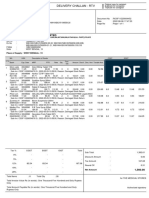

- Delivery Challan - RTV: Consignee: Reliance Retail LimitedDocument1 pageDelivery Challan - RTV: Consignee: Reliance Retail LimitedLalu DasNo ratings yet

- MMB - OMG RecommendationDocument2 pagesMMB - OMG RecommendationLogic Gate CapitalNo ratings yet

- Stock PriceDocument1 pageStock PriceWeazelllNo ratings yet

- 2009-01-26 CEE Valuation MonitorDocument66 pages2009-01-26 CEE Valuation MonitorInternational Business TimesNo ratings yet

- RealPoint CMBS Methodology DisclosureDocument19 pagesRealPoint CMBS Methodology DisclosureCarneadesNo ratings yet