Professional Documents

Culture Documents

First-Time Homebuyer Credit Supporting Documents

First-Time Homebuyer Credit Supporting Documents

Uploaded by

Francis Wolfgang UrbanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

First-Time Homebuyer Credit Supporting Documents

First-Time Homebuyer Credit Supporting Documents

Uploaded by

Francis Wolfgang UrbanCopyright:

Available Formats

Form 886-H-FTHBC (Rev.

September 2009)

First-Time Homebuyer Credit Supporting Documents

We need to verify information related to the First-Time Homebuyer Credit claimed. We need to verify the details of the purchase and that the property is your primary residence. To allow us to verify the details of the purchase, please provide all of the following:

A copy of the final closing contract (for example, the HUD-1 Settlement Statement),

bearing all parties signatures, the property address, the seller(s) and buyer(s) names, and purchase price AND

A copy of your most recent monthly mortgage statement

NOTE: If your purchase was financed through a private mortgage and monthly statements are not available, please provide a copy of a cancelled check (front and back) from a payment made within the last three months. If your purchase was a cash sale, please provide proof you paid for the property a copy of your cancelled check(s) (front and back) or other payment instrument AND

If the home you purchased was newly-constructed, a copy of the occupancy permit

To allow us to verify the property is your residence, please provide at least two of the following:

A copy of your current drivers license or other state-issued identification showing your

home address

A copy of a recent pay statement (within the last two months) showing your name and

home address

A copy of a recent bank statement (within the last two months) showing your name and

home address

A copy of a current automobile registration showing your name and home address

Please return the requested information with a copy of the letter in the envelope provided.

Form

886-H-FTHBC (Rev. 9-2009)

Cat. No. 52819Z

Page

publish.no.irs.gov

Department of the Treasury Internal Revenue Service

You might also like

- ALVEO CHECKLIST - Indiv LocalDocument1 pageALVEO CHECKLIST - Indiv LocalLiv ValdezNo ratings yet

- Checklist of Requirements For Pag-Ibig Home Rehabilitation/Reconstruction Loan Program (Regular)Document2 pagesChecklist of Requirements For Pag-Ibig Home Rehabilitation/Reconstruction Loan Program (Regular)Jireh DuhinaNo ratings yet

- Shed PlansDocument16 pagesShed PlansFrancis Wolfgang Urban100% (7)

- Acq Applicantchecklist 1Document3 pagesAcq Applicantchecklist 1api-335214311No ratings yet

- Checklist For All Loan TypesDocument2 pagesChecklist For All Loan TypesSedaka DonaldsonNo ratings yet

- Chinabank Homeplus RequirmentsDocument1 pageChinabank Homeplus RequirmentsKielRinonNo ratings yet

- State of Delaware: Department of Finance Office of Unclaimed PropertyDocument2 pagesState of Delaware: Department of Finance Office of Unclaimed Propertylyneth lacourtNo ratings yet

- BPI Family Housing Loans Requirements & ProcessDocument2 pagesBPI Family Housing Loans Requirements & ProcessAdrian FranciscoNo ratings yet

- FNF Nationwide App FillableDocument3 pagesFNF Nationwide App FillableDarnell WoodardNo ratings yet

- Administrative TitlingDocument12 pagesAdministrative TitlingDebra BraciaNo ratings yet

- Transfer of Land TitleDocument8 pagesTransfer of Land TitleAnonymous uMI5BmNo ratings yet

- A. Steps in Casual Sale of Real Estate: Fees To Be IncurredDocument9 pagesA. Steps in Casual Sale of Real Estate: Fees To Be IncurredMinmin WaganNo ratings yet

- The Ultimate Checklist and Steps For Land Title TransferDocument4 pagesThe Ultimate Checklist and Steps For Land Title Transferarmi tanguancoNo ratings yet

- Chinabank Home Loan Updated List of Requirements - 2023Document2 pagesChinabank Home Loan Updated List of Requirements - 2023ANDI CastroNo ratings yet

- Transfer of Ownership (Too) - IndividualDocument2 pagesTransfer of Ownership (Too) - IndividualHarold VargasNo ratings yet

- HLF452 ChecklistRequirementsHRRLRegular V03 PDFDocument2 pagesHLF452 ChecklistRequirementsHRRLRegular V03 PDFFirmament DevelopmentNo ratings yet

- Quick Guide On Title TransfersDocument6 pagesQuick Guide On Title TransfersBam SantosNo ratings yet

- AL NEW-Documentary Requirements For The Release of Collateral DocumentDocument3 pagesAL NEW-Documentary Requirements For The Release of Collateral DocumentfpcpbtjsfxNo ratings yet

- PAG IBIG Housing LoanDocument38 pagesPAG IBIG Housing LoanKrisha Jean ManzanoNo ratings yet

- MCUS B0034 Full Doc Processing Checklist NRDocument3 pagesMCUS B0034 Full Doc Processing Checklist NRScott RoyvalNo ratings yet

- Short Sale Cover LetterDocument1 pageShort Sale Cover Letterdrobin74No ratings yet

- PNB Home Loan CircularDocument1 pagePNB Home Loan CircularNavdeep BainsNo ratings yet

- Chase Short Sale PackageDocument12 pagesChase Short Sale PackageZenMaster1969No ratings yet

- Checklist and Steps For Land Title TransferDocument3 pagesChecklist and Steps For Land Title TransferBeth de Vera100% (1)

- How To Transfer Land Title in The PhilippinesDocument3 pagesHow To Transfer Land Title in The PhilippinesMarilyn Perez OlañoNo ratings yet

- Pagibig RequirementsDocument4 pagesPagibig RequirementsDanzen SenolosNo ratings yet

- Steps For Title TransferDocument2 pagesSteps For Title TransferLisyela Fenol RaboyNo ratings yet

- Home LoanDocument1 pageHome LoanShubham DarekarNo ratings yet

- 1Document3 pages1jerry.msgrdcNo ratings yet

- Purchase CG Fe GHDocument2 pagesPurchase CG Fe GHLenin Rey PolonNo ratings yet

- Titling 1. File and Secure The Documentary Requirements at The Bureau of Internal Revenue Regional District Office (BIR RDDocument3 pagesTitling 1. File and Secure The Documentary Requirements at The Bureau of Internal Revenue Regional District Office (BIR RDara abuNo ratings yet

- SOP - Acquiring and Transferring TitleDocument5 pagesSOP - Acquiring and Transferring TitlelegallyhungryblueNo ratings yet

- Step by Step - Transfer of TitleDocument4 pagesStep by Step - Transfer of TitleRommyr P. Caballero100% (2)

- AXIA Loan Modification ChecklistDocument1 pageAXIA Loan Modification ChecklistKara Lazcano-HuffNo ratings yet

- Registration Steps ProcessDocument2 pagesRegistration Steps ProcessngmihahNo ratings yet

- Document ChecklistDocument2 pagesDocument ChecklistSuresh IndhumathiNo ratings yet

- MortgageloandocDocument1 pageMortgageloandocpraveenkanugula21No ratings yet

- Loan Against Property: 1. Documents Required For All ApplicantsDocument1 pageLoan Against Property: 1. Documents Required For All ApplicantsK. CustodioNo ratings yet

- If You Would Like To Make Changes To Your Name and Address Please Visit Our Nearest Location With The Attached Document Filled.Document1 pageIf You Would Like To Make Changes To Your Name and Address Please Visit Our Nearest Location With The Attached Document Filled.Ademuyiwa OlaniyiNo ratings yet

- Blaw PresentationDocument2 pagesBlaw PresentationSachleen KaurNo ratings yet

- Transfer of Title in The PhilsDocument6 pagesTransfer of Title in The PhilsAriel FFulgencioNo ratings yet

- Presentation On Home Loan DocumentationDocument16 pagesPresentation On Home Loan Documentationmesba_17No ratings yet

- Buying A Home: Your Mortgage Application ChecklistDocument2 pagesBuying A Home: Your Mortgage Application ChecklistMohamed JirNo ratings yet

- General GuidelinesDocument1 pageGeneral GuidelinesBebs MondragonNo ratings yet

- SSS GroupDocument49 pagesSSS GroupKassandra Peralta MadarangNo ratings yet

- Land Registration ProcessDocument4 pagesLand Registration ProcessRheinhart Pahila100% (1)

- Steps For Transferring A TitleDocument4 pagesSteps For Transferring A TitleLouisPNo ratings yet

- ABCHome Loan Document Salaried ChecklistDocument1 pageABCHome Loan Document Salaried ChecklistamiteshnegiNo ratings yet

- Steps in Transferring TitleDocument4 pagesSteps in Transferring TitleMJ PerryNo ratings yet

- Documents For Project ApprovalDocument1 pageDocuments For Project ApprovalntawareNo ratings yet

- Housing Loan Requirement PAGIBIGDocument2 pagesHousing Loan Requirement PAGIBIGMaria Lena HuecasNo ratings yet

- Transfer Land TitleDocument8 pagesTransfer Land TitleEmariel CuarioNo ratings yet

- Land Purchase Agreement TemplateDocument3 pagesLand Purchase Agreement TemplateAndre Hartanto HonggareNo ratings yet

- FLH050-6 Cor - W3Document2 pagesFLH050-6 Cor - W3Alipot Bacud TabulaNo ratings yet

- Check List For Creation of MortgageDocument2 pagesCheck List For Creation of MortgageAmmy MaverickNo ratings yet

- Home ChecklistDocument3 pagesHome ChecklisthomeloansNo ratings yet

- What To Bring WellsfargoDocument2 pagesWhat To Bring WellsfargobrotherunkownNo ratings yet

- HLF065 ChecklistOfRequirements Window1 V04Document2 pagesHLF065 ChecklistOfRequirements Window1 V04Eve GranadaNo ratings yet

- Risalah Membeli Rumah June 2013 EngDocument6 pagesRisalah Membeli Rumah June 2013 Engapi-270127751No ratings yet

- How To Transfer Title in Your NameDocument2 pagesHow To Transfer Title in Your Namebodyofagod1108No ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang UrbanNo ratings yet

- Shed Material List Part (1 of 9)Document2 pagesShed Material List Part (1 of 9)nwright_besterNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang UrbanNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang UrbanNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang Urban50% (2)

- Figure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Document1 pageFigure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Francis Wolfgang UrbanNo ratings yet

- Shed PlansDocument1 pageShed PlansFrancis Wolfgang UrbanNo ratings yet

- 25 Foot CabinDocument28 pages25 Foot Cabinapi-3708365100% (1)

- Figure A Trusses: Inner (Common) Truss (9 Req'd)Document1 pageFigure A Trusses: Inner (Common) Truss (9 Req'd)Francis Wolfgang UrbanNo ratings yet

- 15 Foot SailDocument4 pages15 Foot SailjdogheadNo ratings yet

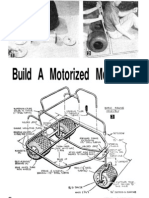

- 3 Wheel 2Document5 pages3 Wheel 2jii_907001No ratings yet

- 6 Inch Reflector PlansDocument12 pages6 Inch Reflector PlansSektordrNo ratings yet

- IRS Publication Form Instructions 2106Document8 pagesIRS Publication Form Instructions 2106Francis Wolfgang UrbanNo ratings yet

- 10 Dollar Telescope PlansDocument9 pages10 Dollar Telescope Planssandhi88No ratings yet

- 3inchrefractorDocument6 pages3inchrefractorGianluca SalvatoNo ratings yet

- IRS Publication Form 8919Document2 pagesIRS Publication Form 8919Francis Wolfgang UrbanNo ratings yet

- IRS Publication Form Instructions 1099 MiscDocument10 pagesIRS Publication Form Instructions 1099 MiscFrancis Wolfgang UrbanNo ratings yet

- IRS Publication Form Instructions 8853Document8 pagesIRS Publication Form Instructions 8853Francis Wolfgang UrbanNo ratings yet