Professional Documents

Culture Documents

NAME Under Name DR CR

NAME Under Name DR CR

Uploaded by

Viswanadh PeriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NAME Under Name DR CR

NAME Under Name DR CR

Uploaded by

Viswanadh PeriCopyright:

Available Formats

(1)NAME Capital Cash In Hand Building Stock Sundry Debtors Commission Paid Rent & Taxes Purchases Purchase

Return Furniture Loan To Suba Discount Allowed Drawings Bills Receivable Cash At Bank Sales Sales Return Salaries Discount Earned Bank Overdraft Bills Payable Sundrry

UNDER NAME Capital Cash In Hand Fixed Asset Stock In Hand Sundry Debtors Indirect Expenses Indirect Expenses Purchases Purcahase Fixed Asset Loans Liability Indirect Expenses Capital Current Assets Bank Sales Sales Indirect Expenses Indirect Income Bank O/D Current Liability Sundry

DR 900 2500 47000 50000 100 3500 70800

CR 24000

Creditors Travelling Expness

Creditors Indirect Expenses TOTAL 2000 2201 00 2201 00

Result :Gateway of tally-DisplayTrailbalance(Alt+F1)

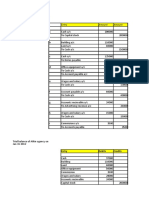

(2)NAME Drawings Goodwill

1100

UNDER NAME Capital Current Assets Fixed Assets Fixed Assets Current Assets Stock In Hand Purchase

4500 10000 4600 6000 5200 12500 12800 0 1000 9500 4000 6000 4000 43000

Building Machinery Bills Receivable Opening Stock Purchases

Wages Direct Expenses Carriage Outward Indirect Expenses Carriage Inward Direct Expenses Salaries Rent Discount Repairs Bank Cash Debtors Indirect Expenses Indirect Expenses Indirect Expenses Direct Expenses Bank Cash In Hand Sundry Debtors

DR 4500 0 9000 0 6000 0 4000 0 6000 4000 0 5100 0 2600 0 500 1000 3500 0 3000 1100 2300 2500 0 1600 4500

CR

Bad Debtors Sales Return Furniture Advertising Gneral Expenses Capital Bills Payable Creditors Purchase Return Sales

Indirect Expenses Sales Fixed Assets Indirect Expenses Indirect Expenses Capital Current Liablility Sundry Creditors Purchase Sales TOTAL

0 1200 2000 6000 3500 450 1600 00 3500 0 7000 0 2650 2180 00 4856 50

Cash In Hand Cash At Bank Return Inwards Wages Fuel & Power Carriage On Sales Carrage On Purchase Salaries General Expenses Insurance Drawings Capital Sales Return Outwards

Cash In Hand Bank Sales Direct Expenses Direct Expenses Indirect Expenses Direct Expenses Indirect Expenses Indirect Expenses Indirect Expenses Capital Capital Sales Purchase Sundry Creditors Current Liability TOTAL

540 2630 680 8480 4730 3200 2040 15000 3000 600 5245 62000 98780 500 6300 9000 1765 80 1765 80

4856 50

Result :Gateway of tally-DisplayTrailbalance(Alt+F1)

(3)NAME Land And Building Machinery Purchase 1.4.2009 Stock Sundry Debtors Patents

UNDER NAME Fixed Assets Fixed Assets Purchase Stock In Hand Sundry Debtors Current Assets

DR 42000 20000 7500 5760 14500 40675

CR

Sundry Creditors Bills Payable

Result :Gateway of Tally-DisplayTrailbalance(Alt+F1)

(4)NAME

UNDER NAME

DR

CR

Capital Sales Sundry Creditors Furniture Gneral Expenses Commission Rent Bills Receivable Sundry Debtors Buildings Stock 1.4.2009 Purchase Wages Cash In Hand Cash At Bank Drawings

Capital Sales Sundry Creditors Fixed Assets Indirect Expenses Indirect Expenses Indirect Expenses Curretn Assets Sundry Debtors Fixed Assets Stock In Hand Purchase Direct Expenses Cash In Hand Bank Capital TOTAL 500 800 250 450 2900 4400 10000 6000 2000 1000 6500 1700 4000 4050 0

20000 16000 4500 (5)NAME Opening Stock Buildings Furniture Purchase Salaries Bad Debts Cash In Hand Return Inwards Rent Miscellaneous Exp Capital Bank Loan Sundry Creditors Return Outwards Interest 4050 0 Dividends Sales Postage UNDER NAME Stock In Hand Fixed Assets Fixed Assets Purchase Indirect Expenses Indirect Expenses Cash In Hand Sales Indirect Expenses Indirect Expenses Capital Loan Liability Sundry Creditors Purchase Indirect Incomes Indirect Incomes Sales Indirect Expenses Indirect Expenses Direct Expenses Direct Expenses Indirect Expenses Direct DR 3100 17000 1000 21200 2200 120 1300 1020 600 500 12000 3000 4920 420 130 110 41460 280 260 5200 560 800 900 CR

* closing stock 4000 RESULT: Gateway of Tally- PROFIT& LOSS A/C / BALANCE

SHEET

Printing Wages Freight Carriage On Sales Repairs

GROSS PROFIT NET PROFIT BALANCE SHEET

RS. RS. RS.

Sundry Debtors

Expenses Sundry Debtors TOTAL

6000 6204 0

Bank Balance 6204 0 Petty Cash

Bank

8800 70 300 12000 880 89680 5620 25659 0 2780 40970 62000 37770 4500 5000 55055 0

* closing stock 980 GROSS PROFIT RS: NET PROFIT RS:

BALANCE SHEET RS:

Cash In Hand Indirect Interest On Loan Expenses Indirect Travelling Expnes Expenses Indirect Printing Expenses Stock On 1.1.2009 Stock In Hand Postage Pruchase Return Inwards Wages And Salary Indirect Expens Purchase Sales Direct Expenses Sundry Debtors Fixed Assets Current Assets Capital

(6)NAME Capital Loan At 6% P.A Sales Interest Sundry Creditors Commission Recei Return Outward Investment Furniture Commission Reparis

UNDER NAME Capital Loans Liability Sales Indirect Income Sundry Creditors Indirect Income Purchase Investment Fixed Assets Indirect Expenses Direct Expenses

DR

CR 108850 20000 350000 5640 59000 630 6430

Sundry Debtors Land & Building Bills Receivable Drawings

TOTAL *Closing stock rs.128960 GROSS PROFIT NET PROFIT RS: BALANCE SHEETRS: RS:

550550

19000 500 470 3620

(7) Capital NAME UNDER NAME Capital DR CR 40000

Gross Profit:9700 Net profit;5890 Balance sheet:42190 Sales Purchase Salaries Rent Insurance Drawings Machinery Bank Balance Cash Stock 1.1.2009 Debtors Creditors Sales Purchase Indirect Expenses Indirect Expenses Indirect Expenses Capital Fixed Assets Bank Cash Stock In Hand Sundry Debtors Sundry Creditors 66000 adjustments: 15000 2000 1500 300 5000 28000 4500 2000 5200 2500 100 66000 F7 ONLY 25000 Next go to Gateway of tally-display-daybook-Alt+F1

1.Stock 31.12.2009 rs.4900 A/C INFORMATION - LEDGER - CREATE - PAGEUP SELECT STOCK SELECT OPENING STOCK -TYPE CLSOING STOCK . STOCK DEBIT BALANCE 2.Salaries unpaid rs.300 SALARY A/C DR (IND.EXP) 300 TO OUTSATNDING SALARY(CURRENTLIABILITIES) 300 3.Rent paid in advance rs.200 PREPAID RENT A/C DR 200(CURRENT ASSETS) TO RENT A/C 200(INDIRECTEXP) 4.Insruance prepaid rs.90 PREPAID INSURANCE A/C DR 90(CURREN ASSETS) TO INSURANCE A/C 90(INDIRECT EXP) Result:Gatewayof tally-Profit&loss a/c-Balancesheet

(8) NAME Land And Building Machinery Purchase 1.4.2009 Stock Sundry Debtors Patents Cash In Hand Cash At Bank Return Inwards Wages Fuel & Power Carriage On Sales Carrage On Purchase Salaries General Expenses Insurance Drawings Capital Sales Return Outwards Sundry Creditors Bills Payable

UNDER NAME Fixed Assets Fixed Assets Purchase Stock In Hand Sundry Debtors Current Assets Cash In Hand Bank Sales Direct Expenses Direct Expenses Indirect Expenses Direct Expenses Indirect Expenses Indirect Expenses Indirect Expenses Capital Capital Sales Purchase Sundry Creditors Current Liability

DR 42000 20000 7500 5760 14500 40675 540 2630 680 8480 4730 3200 2040 15000 3000 600 5245

CR

62000 98780 500 6300 9000 17658 0 17658 0

NEXT GO TO GATEWAY OF TALLY -DISPLAY DAYBOOK -ALT+FI DETAIL adjustments: F7 (JOURNAL ONLY) 1.Stock on 31.3.2009 was rs.6800 A/C INFORMATION - LEDGER - CREATE - PAGEUP - SELECT STOCK SELECT OPENING STOCK -TYPE CLSOING STOCK STOCK DEBIT BALANCE ONLY (9) NAME Drawings Goodwill Building Machinery Bills Receivable Opening Stock Purchases Wages Carriage Outward Carriage Inward Salaries Rent Discount Repairs Bank Cash Debtors Bad Debtors Sales Return Furniture Advertising Gneral Expenses UNDER NAME Capital Current Assets Fixed Assets Fixed Assets Current Assets Stock In Hand Purchase Direct Expenses Indirect Expenses Direct Expenses Indirect Expenses Indirect Expenses Indirect Expenses Direct Expenses Bank Cash In Hand Sundry Debtors Indirect Expenses Sales Fixed Assets Indirect Expenses Indirect Expenses DR 45000 90000 60000 40000 6000 40000 51000 26000 500 1000 35000 3000 1100 2300 25000 1600 45000 1200 2000 6000 3500 450 CR

2.Salary outstanding rs.1500 SALARY A/C DR (IND.EXP) 1500 TO OUTSATNDING SALARY(CURRENTLIABILITIES)1500

3.Insurance parepaid rs.150 PREPAID INSURANCE A/C DR 150(CURRENASSETS) TO INSURANCE A/C 150(INDIRECT EXP)

4.Depreciate machinery @ 10% and patents @ 20% DEPRECIATION A/C DR(INDIRECT EXPENSES) 4600 TO MACHINERY A/C(F.A) 2000 TO PATENTS A/C (C.A)2600

5.Create a provision of 2% on debtors for bad debts BAD DEBTS A/C DR (INDIRECT EXPENSES) 290 TOSUNDRY DEBOTS A/C(SUNDRY DEBOTS)290 RESULT: Gateway of tally - PROFIT& LOSS A/C / B S GROSS PROFIT RS:43715 NET PROFIT RS:16775 BALANCE SHEET RS:90330

Capital Bills Payable

Capital

16000 35000 70000 2650 21800 48565 0 48565

TO ADVERTISEMENT AIC EXPENSES) 500

(INDIRECT

Current Liablility Creditors Sundry Creditors Purchase Return Purchase Sales Sales

5.Create 5% on debtors for bad debts as provision BAD DEBTS A/C DR (INDIRECT EXPENSES) 2250 TO SUNDRY DEBOTS A/C(SUNDRY DEBOTS) 2250 RESULT: A/C INFORMATION - PROFIT& LOSS A/C / BALANCE SHEET GROSS PROFIT NET PROFIT BALANCE SHEET RS.134150 RS.807 50 RS.302250

*NEXT GO TO GATEWAY OF TALLY -DISPLAY DAYBOOK -ALT+FI adjustments: F7 ONLY

Enter the following transactions in the

voucher

1.closing stock was rs.35000 A/C INFORMATION - LEDGER - CREATE - PAGEUP - SELECT STOCK SELECT OPENING STOCK -TYPE CLSOING STOCK - STOCK DEBIT BALANCE ONLY

entry

of Idhayam of Kumbakonam 180000 a/c 000 180 Cash in hand Capital

Cash a/c Dr To capital

2.Depreciate machinery and furniture by 10% DEPRECIATION A/C DR(INDIRECT EXPENSES) 4600 TO MACHINERY A/C (FIXED ASSETS) 4000 TO FURNITURE A/C (FIXED ASSETS) 600 3.Outstanding wages rs.1500 WAGES A/C DR (DIRECT EXPENSES) TOOUTSTANDING WAGES A/C (CURRENT LIABILITY)1500 4.Prepaid advertisement rs.500 PREPAID ADVERTISEMENT A/C DR (CURRENT ASSETS)500 1500

1.1.2010 Commenced business with cash rs.180000

(F6.Receipt)

3 Depostied into Indian bank rs.55000 (F4.Contra)

BAnk a/c Dr To cashl a/c

55000 55 000

Bank Cash in hand

(F4.Contra)

Purchases goods for cash rs.22000 Purchase a/c Dr To cash a/c 000 22000 22 Purchase Cash in hand

(F9.Purchase)

Bought goods of Siva rs.72000 Purchase a/c Dr To Siva a/c 72000 72 000 Purchase Sundry creditors

(F9.Purchase)

Cash sales rs.16200 Cash a/c Dr To Sales a/c 16200 16 200 Cash in hand Sales

(F8.Sales)

11

Cash deposited into Bank rs.23000

Indian Bank a/c Dr To Cash a/c

23000 23 000

Bank Cash in hand

Cash a/c Dr Discount allowed a/c To Ram a/c

12446 254 12 700

Cash in hand Indirect expenses Sundry Debtors

14

Purchased furniture for cash rs.4000 Furniture a/c Dr To Cash a/c 4000 40 00 Fixed assets Cash in hand 18 Paid Siva Cash rs.12000 Discount allowed by him rs.240 Siva a/c Dr To cash To Discount Received a/c Sundry Debtors Sales * (F5.Payment) 12240 a/c 000 12 Sundry Creditors Cash in hand Indirect Income

(F5.Payment)

16

Sold goods to Ram rs.12700 Ram a/c Dr To Sales a/c 12700 12 700

240

(F8.Sales) Wages a/c Dr To Cash a/c 20 * 1800 1 800 17 Received cash from Ram rs.12446 Allowed him discount rs.254 (F6.Receipt) Paid Wages rs.1800

(F5.Payment)

Indirect expneses Cash in hand

21

Sold goods to Raj rs.35000 Raj Dr To Sales a/c a/c 000 35000 35 Sundry Debtors Sales

Purchase a/c Dr To cash Raj a/c Dr Roja a/c To Sales Dr a/c

6000 600 0 9000

Purchase Cash in hand Sundry Debtors Cash in hand Sales Indirec Purchase expenses

5.bought goods for cash rs.6000-(F9.purchase)

a/c

13000 0 13600 00 00 00 9600

900 5

ToDiscount Purchase a/c received a/c Dr To Cash To Devi a/c a/c

14.Sold goods to Raj on Credit 9000-(IGNORED)

125 Sundry 136 Sundry Debtors creditors Fixed assets 960 Cash in hand

Furniture a/c Dr To Cash a/c

15.Bought goods from Devi on Credit13600-(IGNORED)

20

Paid to cash from Roja rs.12500 Discount received rs.254 (F5.Payment)

20.Purchased furniture9600-(F4.payment)

Stationery Cash a/c a/c Dr To Cash a/c capital a/c

160 24000 160 2400 0

Fixed assets Cash in hand Cash in hand Capital

21.Purchased stationery160-(F4.payment)

Result : GATEWAY OF TALLY DISPLAY ACCOUNTS BOOKS LEGER - select EACH ACCOUNTS LEGER(example. refer to sundry debtors/creditors accounts) Enter the following transaction in a SIMPLE CASH BOOK of SONA feb.2010 1.Commenced business with cash rs.24000-(F6.Receipt)

23.received cheque from Raj9000-(F6.Receipt) Cash Dr To Raj a/c a/c 9000 Cash in Hand

9 Sundry 000 Debtors 25.Paid Devi13600-(F5.Payment)

Devi a/c Dr To Cash a/c

3600 3

Sundry Creditors Cash in hand

600 26.Received Commission 740-(F6.Receipt) Cash a/c Dr 740 Cash in hand To Commission 7 Indirect a/c 40 Income 26.Paid into Bank 2500-(F4.Contra) Bank a/c Dr 2500 Bank To Cash a/c 25 Cash in hand 00 27.Paid Telephone Charges300-(F5.Payment) Telephone a/c Dr To Cash a/c 300 30 Indirect Expenses Cash in hand

0 28.Drawn from Bank 3800-(F4.Contra) Cash a/c Dr 3800 Cash in hand To Bank a/c 3800 Bank 28.Goods sold for cash 11200-(F8.Sales) Cash a/c Dr 11200 Cash in hand to Sales a/c 112 Sales 00 Result :Gateway of Tally-Display-Accounts books-Cash a/c (OR)Ledger-cash-E+E DOUBLE COLMN CASH BOOK Enter the following transaction in ROJAs Cash book with Discount and Cash Columns March 2010 1.cash balance18500 Give Opening balance of cash 3.cash sales 33000-(F8.sales) Cash a/c 33000 Cash in hand Dr To Sales a/c 330 Sales 00

7.paid Dravid15850 and discount allowed by him 150(F5.Payment) Dravid a/c Dr 16000 Sundry creditors To Cash a/c 158 Cash in hand 50 To Discount 1 Indirect Received 50 income 13.sold goods to Manohar on credit 19200 (IGNORED) Manohar a/c Dr 19200 Sundry debtors To Sales a/c 1920 Sales 0 15.cash withdrawn for personal expenses 2400(F5.payment) Drawing a/c Dr 2400 Indirect expenses To cash a/c 2400 Cash 16.purchased goods from charles on credit 14300(IGNORED) Purchase a/c Dr 14300 Purchase To charles a/c 1430 Sundry 0 creditors 22.paid into bank22750(F5.payment) Bank a/c Dr 22750 Bank To cash a/c 2275 Cash in hand 0 25.cash received from Manohar 19000 and allowed him discount200(F6.receipt) Cash a/c Dr 19000 Cash in hand Discount allowed 200 Indirect expenses To Mahohar 1920 Sundry 0 debtors 26.drew a cheque for office use 17500(F4.contra) Cash a/c Dr 17500 Cash in hand To Bank a/c 1750 Bank 0 27.paid cash to saravanan2950 and discount received form him 50(F5.payment) Saravanan a/c 3000 Sundry

Dr To cash a/c

29

creditors Cash in hand

50 To Discount Indirect received 50 income 28.paid cash to charles less discount 14200(F5.payment) Charles a/c Dr 14300 Sundry creditors To cash a/c 1420 Cash in hand 0 To Discount 80 Indirect received 0 income 29.cash purchase 13500(F9.purchase) Purchase a/c Dr 13500 Purchases To cash a/c 135 Cash in hand 00 30.paid for Advertising 600(F5.payment) Advertising a/c 600 Indirect Dr expenses To cash a/c 600 Cash in hand 31.paid Salaries 12000(F5.payment) Salaries a/c Dr 12000 Indirect expenses To cash a/c 1200 Cash in hand 0

PETTY CASH BOOK Petty cashier received rs.600, Give opening balance of cash 3.stamps 50-(F5.payment) Stamps a/c Dr 50 To cash a/c 50 5.taxi fare 100-(F5.payment) Taxi fare a/c 100 Dr

Indirect expenses Cash in hand Indirect expenses

To cash a/c 100 Cash in hand 6.Pencils & Pads 75-(F5.payment) Pencils & pads 75 Indirect a/cDr expenses To cash a/c 75 Cash in hand 7.Registry 25-(F5.payment) Registry a/c Dr 25 Indirect expenses To cash a/c 25 Cash in hand 10.Speed Post 45-(F5.payment) Speed post a/c 45 Indirect Dr expenses To cash a/c 45 Cash in hand 12.Telegram35-(F5.payment) Telegram a/c 35 Indirect Dr expenses Cash a/c 35 Cash in hand 15.Refreshment55-(F5.payment) Refreshment a/c 55 Indirect Dr expenses To cash a/c 55 Cash in hand 16.Auto fare20-(F5.payment) Autor fare a/c 20 Indirect Dr expenses To cash a/c 20 Cash in hand 19.Typing Paper 60-(F5.payment) Typeing paper a/c 60 Indirect Dr expenses To Cash a/c 60 Cash in hand 20.Bus fare 15-(F5.payment) Bus fare a/c Dr 15 Indirect expenses To Cash a/c 15 Cash in hand 22.Trunk calls 43-(F5.payment) Trunk calls a/c 43 Indirect Dr expenses To cash a/c 43 Cash in hand 25.Office cleaning 18-(F5.payment) Office cleaning 18 Indirect a/c Dr expenses To cash a/c 18 Cash in hand

30.Courier Services 17-(F5.payment) Courier service 17 Indirect a/c Dr expenses To Cash a/c 17 Cash in hand Result :Gateway of Tally-Display-Accounts books-Cash a/c (OR)Ledger-cash-E+E-F8.columnar-select Yes or NoType of column(select.All items (automatic columns)Accept.etc., BANK RECONLATION STATEMENT Company Create(Date April.2010)-Gateway of TallyAccounts Info-Ledger-create(indian bank(u/n.Bank accounts-Rs.1,00,000(Effective dae of Reconcilation ? YES),Raja(S.Dr),Roja(S.Dr)-Ram(S.Dr)Suba(S.Cr),Sutha(S.Cr),Suji(S.Cr)) NEXT go to Voucher EntryApril 2.cheque received on Raja 1500(F6.Receipt) Indian bank a/c 1500 Bank accounts Dr To Raja a/c 1500 Sundry debtors April 3.cheque issued on Suba 1000(F5.Payment) Suba a/c Dr 1000 Sundry creditors To Indian bank 1000 Bank accounts a/c April 6.cheque received on Roja 3000(F6.Receipt) Indian bank a/c 3000 Bank accounts Dr To Roja a/c 3000 Sundry debtors April 9.cheque issued on Sutha 2000(F5.Payment) Sutha a/c Dr 2000 Sundry creditors To Indian bank 2000 Bank accounts a/c

April 12.cheque received on Ram 6000(F6.Receipt) Indian bank a/c 6000 Bank accounts Dr To Ram a/c 6000 Sundry debtors April 15.cheque issued on suji 4000(F5.Payment) Suji a/c Dr 4000 Sundry creditors Indian bank a/c 4000 Bank accounts Gateway of Tally-Display-Accounts books-Bank bookBank account(OR)Ledger-select Indian bank-E+E-press F5.Reconcil-(Checked Balance as per Company books and Balance as per Bank)Newly open BANK DATE give cheques isssued and received DATE(Again Checked Balance as per Company books and Balance as per Bank).Once give the date again you give F5.Reconcil is blanked.

F.11 - FEATURES

Allow multi currency ? YES

1.Gateway of tally-Account Info-Currencies-CreateSymbols($,E,R,D,Y)-Formal name (Dallor,Euro,Reyal,Dhinar,Yen)-Accept-Esc+Esc Next -Rate of Exchange-Std.Rate=50,Selling Rate=60,Buying Rate=40-Accept.NEXT 2.Account info-Ledger-Create-(Purchase(u/nPurchase),Sales(u/n-sales),Rentpaid(u/n-Ind.Exp),Interest received(u/n-Ind.Income).Esc*3 times-NEXT 3.Voucher Entry-Type 4 entires each entry currencies converted the Display:-Purchase & Payment entry(Take Buying rate), Sales & receipt(Take Selling rate) Maintain Budget and Control? YES

Gateway of tally-Account Info-Budget-Create(1.Name:Advertising, 2.Under:Primary,3.Period of Budget From 1.4.2009 To 30.6.2009. 4.Set/Alter Budget of (Groups Yes-NEXT-give Account Name-Indirect Expenses NEXT Type of Budget = 2 types : 1.on closing balance 2.on nett transactions(you select any one methods)NEXT-give budget amount rs.5000)NEXT(Ledger -Yes-NEXT- Name-(Press Alt+C Create Ledger Advertising.u/n Indirect Expneses)Advertising NEXT Type of Budget = 2 types : 1.on closing balance 2.on nett transactions(you select any one methods)*select budget Types and Amount is same groups&ledger NEXT-give budget amount rs.5000)-Accept. NEXT-Gateway of tally-Voucher entry-F5.PaymentF2.Date is given each voucher entries (up to Budget Period) 5.4.2009 Paid Advertising 2000 Advertising a/c 2000 Dr To Cash a/c 2000 6.5.2009 Paid Advertising 2500 Advertising a/c 2500 Dr To Cash a/c 2500 30.6.2009 Paid Advertising 1000 Advertising a/c 2000 Dr To Cash a/c 2000 NEXT-Gateway of Tally-Display-Account bookLedger-Advertising+E-NEXT 1.Press Alt+C(see commands area-New column)-give budget date-From 1.4.2009 To 30.6.2009, Budget value-Actual. Name of the Ledger-Advertising+E-Display Ledger Monthly Summary-To refer Amount and Grafe-Press Esc.

NEXT-Ledger-advertising 2.Press Alt+A(see commands area-Alter column)-give budget date-From 1.4.2009 To 30.6.2009, Budget value-Actual. Name of the Ledger-Advertising+E-Display Ledger Monthly Summary-To refer Amount and Grafe-Press Esc. NEXT -Ledger-advertising- 1.Press Alt+C(see commands area-New column)-give budget date-From 1.4.2009 To 30.6.2009, Budget value-Advertising. Name of the Ledger-Advertising+E-Display Ledger Monthly Summary-To refer Amount and Grafe-Press Esc. NEXT -Ledger-advertising- 2.Press Alt+A(see commands area-Alter column)-give budget date-From 1.4.2009 To 30.6.2009, Budget value-Advertising. Name of the Ledger-Advertising+E-Display Ledger Monthly Summary-To refer Amount and Grafe-Press Esc. Maintain Billwise detail ? YES (for non trading a/c also) ? YES Gateway of Tally-Account Info-LedgerCreate1.Sales(u/n.sales), Maintain balances bill-by-bill ? Yes 2.Anbu,Anand,babu,basu (u/n.Sundry Debtors), Maintain balances bill-by-bill ? Yes NEXT:Gateway of Tally-Voucher entry-F8.salesF2.Date1)April.1.Goods sold to Anbu 1000- 30 days creditF8.sales Anbu a/c Dr 1000 Display Bill wise details(Type of Ref= -select New RefName=Anbu or give number-Credit days=30-Amount 1000+E -NEXT TO Sales a/c 1000 2)April.2.Goods sold to Anand 2000-25 days creditF8.salesAnand a/c Dr 2000

Display Bill wise details(Type of Ref= -select New RefName=Anand or give number-Credit days=25-Amount 2000+E -NEXT TO Sales a/c 2000 3)April.3.Goods sold to Babu 3000-20 days creditF8.sales Anand a/c Dr 3000 Display Bill wise details(Type of Ref= -select New RefName=Babu or give number-Credit days=20-Amount 3000+E -NEXT TO Sales a/c 3000 4)April.4.Goods sold to Basu 4000-15 days creditF8.sales Anand a/c Dr 4000 Display Bill wise details(Type of Ref= -select New RefName=Basu or give number-Credit days=20-Amount 4000+E -NEXT TO Sales a/c 4000 NEXT:Gateway of Tally-Display-Account book-Ledgerselect Sales+E-select F8.Other report-select Bill wise details-check Ledger outstandings NEXT:Gateway of Tally-Voucher entry-F6.Receipt-give credit days last date(example:31.4.2009) I will give only one (Anbu transaction) results TO Anbu a/c 900 Display Bill wise details(Type of Ref= -select Agst Ref+E-Name=List of pending bills display+E-900+E -NEXT Cash a/c 900 Accept NEXT:Gateway of tally-Display-Accounts bookLedger-select Anbu+E-(Display Ledger monthly summary & referred acutal amount and Pending amount)-Select F8.Other report-Bill wise details+E+E(referred detail bill wise details in Anbu). NEXT: Gateway of tally-Display-Accounts book-Ledgerselect Anbu+E-F10.Acc.Rep-Select Bills Receivable(credit sales only) &Bills payable(credit purchase only) refered over dues excess date (OR)

NEXT: Gateway of tally-Display-Statement of AccountsOutstandings-Check Receivable(credit sales only)\Payable(credit purchase only) Maintain Cost Centres ? Yes ? Yes

More than one Cost Categories

Gateway of Tally-Accounts Info-Cost Categories-CreateName=Travelling-Accept+Esc+Esc+EscNEXT-Cost Centres-Create-Category=TravellingName=1.Airfare,2.Busfare,3.Trainfare,4.Carfare,5.Autofa re-Under=Primary-Accept.NEXT- Gateway of TallyAccounts Info-Ledger-Create-Travelling Expenses(u/n.Indirect Expenses)-Cost Centre are applicabale ? Yes. Accept. NEXT-Gateway of Tally-Voucher entry-F5.PaymentF2.Date (Different date 3 or 4 voucher entry passed) 1)Jan.2. Paid Traveling Expenses rs.500-by CarfareF5.Payment Travelling exp 500 a/cDr Display Cost allocation(Cost category= Traveling, Name of the Cost Centre=Carefare 500+E )-NEXT To Cash a/c 500 2) 1)Jan.4. Paid Traveling Expenses rs.250-by TrainfareF5.Payment Travelling exp 250 a/cDr Display Cost allocation(Cost category= Traveling, Name of the Cost Centre=Trainfare- 250+E )-NEXT To Cash a/c 2 50 3) 1)Jan.6. Paid Traveling Expenses rs.125-by BusfareF5.Payment Travelling exp 125 a/cDr

Display Cost allocation(Cost category= Traveling, Name of the Cost Centre=Busfare 125+E )-NEXT To Cash a/c 125 4) 1)Jan.8. Paid Traveling Expenses rs.75-by AutofareF5.Payment Travelling exp 75 a/cDr Display Cost allocation(Cost category= Traveling, Name of the Cost Centre=Autofare 75+E )-NEXT To Cash a/c 75 5) 1)Jan.2. Paid Traveling Expenses rs.3500-by AirefareF5.Payment Travelling exp 3500 a/cDr Display Cost allocation(Cost category= Traveling, Name of the Cost Centre=Airfare 3500+E )-NEXT To Cash a/c 3500 NEXT:Gateway of Tally-Display-Statement of AccountsCost centre-referred each heads.(OR)Gateway of tally-Display-Accounts book-Ledger-select Travelling expE- F8.Other Rep-select Cost Centre Breakup- see cost breakup ledger Use Rev. Journals ? Yes

discount/rebate or when is there is an excess debit to any party. Create New Company-Gateway of Tally-Accounts InfoLedger-create(sales(u/n.Sales),Suresh(u/n.Sundry Debtors), NEXT-Voucher Entry-F8.Sales 1. Jan.10. sold goods to Ram Rs.1000 Ram a/c Dr 1000 To Sales a/c 1000 *goods return(sales return) discount/rebate was adjusted Rs.100 NEXT:Gateway of Tally-Voucher entry-Pressing F7.Journal-select Credit Note+E+F2.Date. To/Cr Ram a/c 1 00 Sales a/c 100 NEXT:Gateway of Tally-Display-Accounts book-Ledgerselect Ram+E+E Result: 1000-100=900 anser(less the Credit Note amount in a/cs) Debit Note: You raise a Debit Note when you make purchase Return or when you have shortbilled a customer or you are granted Credit by your Supplier due to rate difference, discount etc., 1. Jan.20.purchased goods from Ponni Rs.200 Purchase/c Dr 200 To ponni a/c 2 00 *goods return(purchase return) discount/rebate was adjust Rs.20 NEXT:Gateway of Tally-Voucher entry-Pressing F7.Journal-select Debit Note+E+F2.Date. Ponni a/c Dr 20 purchase a/c 20 NEXT:Gateway of Tally-Display-Accounts book-Ledgerselect Ponni+E+E

If you want to use Reverse Journal Vouchers, then it will be available in Voucher on Pressiong F10.momos-It is smimiar to Journal Voucher but is not included in regular accounts. To get mid-year Final Accounts, make entries in Reverse Journal and while viewing Reports ask to include it. Use Debit/Credit note ? Yes

Credit Note: You generally raise a Credit note when a buyer returns some goods that you Sold him (Sales Return) or you grant him credit due to rate difference or

Result: 200-20=180 anser(less the Debit Note amount in a/cs)

You might also like

- Tally PracticeQuestion 1Document3 pagesTally PracticeQuestion 1Khushi Kumari78% (9)

- Lifestyle Upper - Intermediate CB 2012 177p PDFDocument177 pagesLifestyle Upper - Intermediate CB 2012 177p PDFMonicaMartirosyan100% (1)

- Payroll Tally Notes With Assignment - SSC STUDYDocument7 pagesPayroll Tally Notes With Assignment - SSC STUDYParminder Kaur100% (1)

- ARTA MC 2022 05 - Annex A. CSM Questionnaire PDFDocument2 pagesARTA MC 2022 05 - Annex A. CSM Questionnaire PDFBSU Legal Affairs Office0% (1)

- A Complete Practice Book Tally 9Document19 pagesA Complete Practice Book Tally 9bagsourav100% (5)

- Tally Practice ProblemsDocument4 pagesTally Practice Problemskumarbcomca83% (6)

- Tally Practice PaperDocument20 pagesTally Practice PaperAjitesh anand83% (6)

- Tally Questions Batch Wise Entry PDFDocument4 pagesTally Questions Batch Wise Entry PDFAjitesh anand100% (3)

- Case Study 1 Tally Prime ExerciseDocument43 pagesCase Study 1 Tally Prime ExerciseRishi bhatiya89% (9)

- Tally.9 Voucher Entry QuestionsDocument3 pagesTally.9 Voucher Entry QuestionsBarani Dharan82% (193)

- Practice Assignment For Student (Project 1)Document4 pagesPractice Assignment For Student (Project 1)Saibal Dutta75% (8)

- Tally ERP AssignmentDocument44 pagesTally ERP Assignmentvipin baidNo ratings yet

- Fox Pro 2.6Document31 pagesFox Pro 2.6Barani Dharan100% (1)

- Tally.9 Voucher Entry QuestionsDocument3 pagesTally.9 Voucher Entry QuestionsBarani Dharan82% (193)

- Essay To Be First Mover in A Business, You Do Not Have To Have Market AnalysisDocument3 pagesEssay To Be First Mover in A Business, You Do Not Have To Have Market AnalysisHaniatun HanieNo ratings yet

- Tally Practice BookDocument20 pagesTally Practice BookJancy Sunish100% (1)

- Tally AssignmentDocument22 pagesTally AssignmentRahul Aggarwal64% (11)

- Tally Business Entry ExericiseDocument1 pageTally Business Entry ExericiseVinay Kumar82% (28)

- Tally Record Notes MainDocument20 pagesTally Record Notes MainRemesh A RNo ratings yet

- Tally Prime Course Cost Center, Order, Price List, BOMDocument12 pagesTally Prime Course Cost Center, Order, Price List, BOMAnkit Singh100% (2)

- Tally Journal EntriesDocument11 pagesTally Journal Entriessainimeenu92% (24)

- Tally Exercise 1Document1 pageTally Exercise 1Arun91% (11)

- Practical ProblemsDocument25 pagesPractical Problemsvicky24198984% (44)

- Tally Practice QuestionsDocument68 pagesTally Practice Questionspranav tomar100% (1)

- Tally ERP AssignmentDocument42 pagesTally ERP Assignmentdisha_200983% (93)

- Tally Questions Inventry and Bill Wise Entry PDFDocument9 pagesTally Questions Inventry and Bill Wise Entry PDFAjitesh anandNo ratings yet

- Tally Practical ProblemsDocument13 pagesTally Practical Problemsafreenbanukatchi100% (1)

- Tally Sample Question PaperDocument1 pageTally Sample Question Paperilovejaya77% (73)

- Tally LedgersDocument2 pagesTally Ledgersnagendra tiwari82% (79)

- Tally Exam Paper 2018Document2 pagesTally Exam Paper 2018Dilip Bhagat100% (1)

- Tally Prime With GST Example - 01Document4 pagesTally Prime With GST Example - 01Goyal mitra50% (4)

- Tally AssignmentDocument26 pagesTally AssignmentPravah Shukla80% (65)

- Tally Question PaperDocument5 pagesTally Question PaperAmsa Veni100% (4)

- Tally Exercise - 1Document30 pagesTally Exercise - 1RAMESH83% (6)

- Tally Questions Zero Value, Billed and Actual Quantity PDFDocument4 pagesTally Questions Zero Value, Billed and Actual Quantity PDFAjitesh anandNo ratings yet

- Tally Questions Interest Calculation and Multiple Currencies PDFDocument7 pagesTally Questions Interest Calculation and Multiple Currencies PDFAjitesh anandNo ratings yet

- Tally 9 AssignmentDocument49 pagesTally 9 AssignmentmayankNo ratings yet

- Tally Assignment Point of Sale Sum-3Document2 pagesTally Assignment Point of Sale Sum-3Santosh Kuperkar100% (2)

- Tally Assignment FINAL 3 MONTHS PDFDocument44 pagesTally Assignment FINAL 3 MONTHS PDFrakesh8roy75% (4)

- Tally Tutorial Purchase Voucher EntryDocument4 pagesTally Tutorial Purchase Voucher EntryUday Pali100% (2)

- Voucher Entry & Practical Problem - TallyDocument7 pagesVoucher Entry & Practical Problem - TallyBackiyalakshmi Venkatraman91% (11)

- T.D.S. Assignment: Match The Following:-CASH .. 1,01,950 SBI 37,550Document2 pagesT.D.S. Assignment: Match The Following:-CASH .. 1,01,950 SBI 37,550Reema Kumari67% (3)

- 59journal Solved Assignment 13-14Document8 pages59journal Solved Assignment 13-14karishma1082% (11)

- Tally Erp 9 Exercise With GSTDocument2 pagesTally Erp 9 Exercise With GSTSatyabarta73% (52)

- 10-Pay Roll Tally Prime Notes PDFDocument7 pages10-Pay Roll Tally Prime Notes PDFSaikumar Timmaraju67% (3)

- Practice Questions of TallyDocument18 pagesPractice Questions of TallyVISHAL100% (2)

- Tally Coaching FileDocument7 pagesTally Coaching FileG Subramaniam92% (26)

- Tally LedgersDocument18 pagesTally LedgersAAC aacNo ratings yet

- Tally Practical QuestionDocument11 pagesTally Practical QuestionNandhini VimalNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- FA-Lecture - 15 (Comprehensive Example)Document14 pagesFA-Lecture - 15 (Comprehensive Example)agaNo ratings yet

- CFAS Module 3 ProblemsDocument16 pagesCFAS Module 3 ProblemsChristen HerceNo ratings yet

- Prob 5 UnsolvedDocument3 pagesProb 5 UnsolvedBhushan ShirsathNo ratings yet

- Workbook 1Document2 pagesWorkbook 1Mayur AgrawalNo ratings yet

- Teresita Buenaflor ShoesDocument13 pagesTeresita Buenaflor ShoesThe Phoebie JhemNo ratings yet

- General Journal: Date Description Debit CreditDocument7 pagesGeneral Journal: Date Description Debit CreditAmanuel DemekeNo ratings yet

- Additional MaterialsDocument9 pagesAdditional MaterialsShovan KarmakarNo ratings yet

- Transaction Details Assets Bank Adv. Rent Stationary EquipmentDocument5 pagesTransaction Details Assets Bank Adv. Rent Stationary EquipmentDipty NarnoliNo ratings yet

- Journal Entry For Atkin AgencyDocument4 pagesJournal Entry For Atkin AgencySamarth LahotiNo ratings yet

- Income Statement Balance Sheet For The Year Ended 31 July 2012 As at 31 July 2012 Sales Non Current AssetsDocument1 pageIncome Statement Balance Sheet For The Year Ended 31 July 2012 As at 31 July 2012 Sales Non Current Assetshananiqbal1999No ratings yet

- Balance Sheet QuestionDocument14 pagesBalance Sheet QuestionArooj ArshadNo ratings yet

- Banking 9 & 10 QuestionsDocument2 pagesBanking 9 & 10 Questionssara.028279No ratings yet

- Accouting Equation Problems BBA 2025Document18 pagesAccouting Equation Problems BBA 2025hjhjhjNo ratings yet

- Book 1Document2 pagesBook 1geraldabubopaduaNo ratings yet

- Assignment Quesiions Accounting 1Document7 pagesAssignment Quesiions Accounting 1muhammad muzzammilNo ratings yet

- Statistical - Index NumberDocument11 pagesStatistical - Index NumberBarani DharanNo ratings yet

- Statistical - Time SeriesDocument9 pagesStatistical - Time SeriesBarani DharanNo ratings yet

- Statistical - Time SeriesDocument7 pagesStatistical - Time SeriesBarani DharanNo ratings yet

- Tally 9.0 New 2010Document43 pagesTally 9.0 New 2010Barani Dharan50% (2)

- Idhaya - NSS - 200986Document1 pageIdhaya - NSS - 200986Barani DharanNo ratings yet

- Stat .1Document10 pagesStat .1Barani DharanNo ratings yet

- T I I CDocument7 pagesT I I CBarani DharanNo ratings yet

- Practical Tally QuestionDocument3 pagesPractical Tally QuestionPrabhu G UmadiNo ratings yet

- Idhaya College For Women: TALLY 5.4 Accounts OnlyDocument3 pagesIdhaya College For Women: TALLY 5.4 Accounts OnlyBarani DharanNo ratings yet

- SFC SDocument8 pagesSFC SBarani DharanNo ratings yet

- Tally Record NoteDocument74 pagesTally Record NoteBarani DharanNo ratings yet

- Tall 9.0 Practical QuestionsDocument14 pagesTall 9.0 Practical QuestionsBarani Dharan100% (3)

- Practical Tally54 HeadDocument2 pagesPractical Tally54 HeadBarani DharanNo ratings yet

- Excel M.com Record NoteDocument2 pagesExcel M.com Record NoteBarani DharanNo ratings yet

- V 112Document4 pagesV 112simon_someone217No ratings yet

- Nwdpra - Sunken pond-NATARAJ-A2-2side-OK-OK-okDocument17 pagesNwdpra - Sunken pond-NATARAJ-A2-2side-OK-OK-okanbukgiNo ratings yet

- Sagana Vs FranciscoDocument2 pagesSagana Vs FranciscoBruce WayneNo ratings yet

- Burner Sequence ControllersDocument72 pagesBurner Sequence ControllersJorge Cotzomi100% (1)

- ProcessorsDocument25 pagesProcessorschuck212No ratings yet

- Making Sense of VoluDocument44 pagesMaking Sense of VoluImprovingSupportNo ratings yet

- Gar-Dur UHMW Profile ExtrusionsDocument2 pagesGar-Dur UHMW Profile ExtrusionsGarlandMfg100% (1)

- AGRD04B-15 Guide To Road Design Part 4B Roundabouts Ed3.1Document97 pagesAGRD04B-15 Guide To Road Design Part 4B Roundabouts Ed3.1fbturaNo ratings yet

- Record of Professional Learning Anabella CPL Record of Professional LearningDocument6 pagesRecord of Professional Learning Anabella CPL Record of Professional Learningapi-603557441No ratings yet

- ThermoplasticDocument25 pagesThermoplasticArisanti AritonangNo ratings yet

- Remanufacturing Operations Performance, Firm Performance, PakistanDocument18 pagesRemanufacturing Operations Performance, Firm Performance, PakistanSandesh TariNo ratings yet

- Graduation Paper TUDelft DPdeBruijn 4036549 RepositoryDocument197 pagesGraduation Paper TUDelft DPdeBruijn 4036549 RepositoryErmal SpahiuNo ratings yet

- 73 Disinfecting Acid BR Cleaner Sell Sheet PDFDocument2 pages73 Disinfecting Acid BR Cleaner Sell Sheet PDFMarie Kris NogaNo ratings yet

- Avarta WhitepaperDocument33 pagesAvarta WhitepaperTrần Đỗ Trung MỹNo ratings yet

- Chapter 5 QuizDocument6 pagesChapter 5 QuizArunNo ratings yet

- Padmalaya MishraDocument5 pagesPadmalaya MishraPadmalayaNo ratings yet

- International Accounting Standards Board: Structure of IFRSDocument11 pagesInternational Accounting Standards Board: Structure of IFRSHadeel Abdul SalamNo ratings yet

- (nRF52840) MDBT50Q-1MV2 & MDBT50Q-P1MV2 Spec (Ver.K)Document75 pages(nRF52840) MDBT50Q-1MV2 & MDBT50Q-P1MV2 Spec (Ver.K)luisNo ratings yet

- Adaptive LeadershipDocument3 pagesAdaptive Leadershiprashid090967No ratings yet

- Levich Ch11 Net Assignment SolutionsDocument16 pagesLevich Ch11 Net Assignment SolutionsNisarg JoshiNo ratings yet

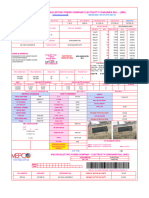

- MEPCO ONLINE BILL BankDocument1 pageMEPCO ONLINE BILL Bankahmadjutt19823No ratings yet

- 12.Dr. Sheela Srivastava Mr. M. Sivakoti Reddy Vol.2, Issue 1 & 2 PDFDocument3 pages12.Dr. Sheela Srivastava Mr. M. Sivakoti Reddy Vol.2, Issue 1 & 2 PDFMuhammad Ibrahim100% (1)

- Instalar o Hyper-V Dentro Da Máquina Virtual Utilizando o VirtualboxDocument4 pagesInstalar o Hyper-V Dentro Da Máquina Virtual Utilizando o VirtualboxmariodesaNo ratings yet

- Full Text Cases Canon 7 To 10Document302 pagesFull Text Cases Canon 7 To 10Nem UelNo ratings yet

- 489 Assignment 1 Official Converted Management Accounting GreenwichfptDocument38 pages489 Assignment 1 Official Converted Management Accounting GreenwichfptPham Phu Phuoc (FGW DN)No ratings yet

- Payslip Nov - Sailu1 fINALDocument2 pagesPayslip Nov - Sailu1 fINALChristine HallNo ratings yet

- Movements of Moored Ships in HarboursDocument14 pagesMovements of Moored Ships in Harbourskkchung123No ratings yet