Professional Documents

Culture Documents

3rd Party Dept Collector

Uploaded by

joerocketmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3rd Party Dept Collector

Uploaded by

joerocketmanCopyright:

Available Formats

I see from your post that you are dealing with a 3rd party collector.

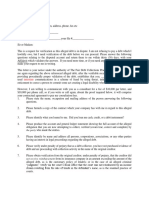

When dealing with collections agencies, the best way I found to deal with them is use the Fair Debt Collection Practices Act (FDCPA). I love 3rd party collectors as they are not the original owners of the account. Most of the time they bought the account for pennies on the dollar and what they are able to collect is gravy. You said in your post you requested Demand for Production and Inspection of Documents which to me sounds like you are asking for validation of the debt and that is your right under the FDCPA. To collect they have to prove they are the holders in due course of this debt and 99% of them cannot prove this fact. Just to state that you owe this account is not proof that you dowhere is the proof??????? Signed charge tickets, copies of all payments, etc. I will bet they do not have this informationthus how are they going to prove that you owe this debt. Anyone can say you owe thembut again where is the proof?? 3rd party collectors use fear and intimation to collect what they canthey are not use to any one knowing the FDCPA and when they come across someone that doesit throws them for a loop. What I did not understand from your post was intent to sue it for a fraudulent balance from 3 years ago. What do they mean by fraudulent balance? How did they come up with a fraudulent balance charge? Your time frame of May 5, 2013 does not give you much timebut if you have to go into court, demand proper validation of the debt and dispute the debt to the court let the burden of proof fall to them. The following is what I have used and recommended to others to use to ask for validation of an alleged debt and so far with a 100% success ratebut was sent to the collections agencies long before any court hearings were scheduled. The request for validation letter was sent to them by certified mail. Now sometimes it took 3-4-5 letters but each time I ask the same thingover and over again as most of the time they ignored the 1st , 2nd , 3rd request but you have proof that you indeed asked for proper debt validation and when they fail to prove the debtthey usually go away and cannot place any derogatory remarks on your credit. Anyone else in here that is having a problem with a collections agencies, I would strongly recommend send them a copy of the below just fill in the blanks with your infonow dont be surprised if they ignore you and send you another collection letterbut just keep sending (by certified mail as you want a track record) and sooner or later they should go away. Also I would strongly recommend that everyone take time a read and study the Fair Debt Collection Practices Act and become knowledgeable of this law. It is very useful. EXAMPLE

I am in receipt of your letter dated ____________________ requesting payment from me in the amount of $_____________ on behalf of_______________________________. . By copy of this letter, I dispute this debt. As a debt collector, I'm sure you are aware of the provisions in the Fair Debt Collection Practices Act (FDCPA), and I am requesting validation of this debt. To refresh your memory on what constitutes legal debt validation, I am providing you a list of the required documentation: (1) Complete payment history, the requirement of which has been established via Spears v Brennan 745 N.E.2d 862; 2001 Ind. App. LEXIS 509. (2) Agreement that bears the signature of the alleged debtor wherein I agreed to pay the original creditor. Since you have listed my personal name (your name) on your correspondence I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation which is binding on me personally to pay this debt. (3) As a 3rd party collector, a letter of sale or assignment from the original creditor to your company. Agreement with your client that grants you the authority to collect on this alleged debt. Coppola v. Arrow Financial Services, 302CV577, 2002 WL 32173704 (D.Conn., Oct. 29, 2002) - Information relating to the purchase of a bad debt is not proprietary or burdensome. Debtor must phrase their request clearly to obtain: The source of a debt and the amount a bad debt buyer paid for plaintiff's debt, how amount sought was calculated, where in issue a list of reports to credit bureaus, and documents conferring authority on defendant to collect debt. Intimate knowledge of the creation of the debt by you, the collection agency. (4) Copies of all charges and /or credits billing for this alleged account. As I am sure you are well aware, under FDCPA Section 809 (b), you are not allowed to pursue collection activity until the debt is validated. You should be made aware that in TWYLA BOATLEY, Plaintiff, vs. DIEM CORPORATION, No. CIV 030762 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF ARIZONA, 2004, the courts ruled that reporting a collection account indeed is considered collection activity. Sincerely, sign your name

You might also like

- TIPS On How To Respond To A Collection LawsuitDocument8 pagesTIPS On How To Respond To A Collection LawsuitWXYZ-TV Channel 7 Detroit100% (3)

- Validation of Debt, Rule 1002 Requirement of OriginalDocument10 pagesValidation of Debt, Rule 1002 Requirement of Originalwicholacayo100% (3)

- Combo Debt Dispute LetterDocument4 pagesCombo Debt Dispute Letterfgtrulin91% (47)

- You Can Beat Credit Card Debt CollectorsDocument7 pagesYou Can Beat Credit Card Debt Collectorswoozyseer7665100% (6)

- 14 Debt ValidationDocument6 pages14 Debt Validationstarhoney82% (11)

- Stop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsFrom EverandStop Bill Collectors: The No Bull Guide to Outwitting Bill CollectorsRating: 5 out of 5 stars5/5 (1)

- Sample Student Loan Debt Validation LetterDocument3 pagesSample Student Loan Debt Validation LetterNotarys To Go100% (12)

- Sample Student Loan Debt Validation LetterDocument3 pagesSample Student Loan Debt Validation LetterStan Burman100% (20)

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsFrom EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsRating: 5 out of 5 stars5/5 (12)

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- Collection Harassment 101: An Easy Step by Step Guide to Overcoming Abusive Bill Collectors and Collection AgenciesFrom EverandCollection Harassment 101: An Easy Step by Step Guide to Overcoming Abusive Bill Collectors and Collection AgenciesNo ratings yet

- The Complete Debt Relief Manual: Step-By-Step Procedures For: Budgeting, Paying off Debt, Negotiating Credit Card and Irs Debt Settlements, Avoiding Bankruptcy, Dealing with Collectors and Lawsuits, and Credit Repair - Without Debt Settlement CompaniesFrom EverandThe Complete Debt Relief Manual: Step-By-Step Procedures For: Budgeting, Paying off Debt, Negotiating Credit Card and Irs Debt Settlements, Avoiding Bankruptcy, Dealing with Collectors and Lawsuits, and Credit Repair - Without Debt Settlement CompaniesRating: 5 out of 5 stars5/5 (1)

- Using RICO To Handle Debt CollectorsDocument19 pagesUsing RICO To Handle Debt CollectorsRandy Rosado100% (9)

- How To Stop Creditors Harrassing Phone CallsDocument22 pagesHow To Stop Creditors Harrassing Phone CallsDave Falvey0% (1)

- IRS or IR Debt CollectorDocument28 pagesIRS or IR Debt CollectorWillAsher100% (7)

- Attack The Debt CollectorDocument9 pagesAttack The Debt CollectorMichael Peterson97% (32)

- Successfully Defending Your Credit Card Lawsuit: What to Do If You Are Sued for a Credit Card DebtFrom EverandSuccessfully Defending Your Credit Card Lawsuit: What to Do If You Are Sued for a Credit Card DebtRating: 3.5 out of 5 stars3.5/5 (2)

- Have Fun With Debt CollectorsDocument3 pagesHave Fun With Debt CollectorsTitle IV-D Man with a plan94% (16)

- Collection Letter - StrongDocument6 pagesCollection Letter - StrongPublic Knowledge95% (22)

- All Debts Are Prepaid PDFDocument7 pagesAll Debts Are Prepaid PDFNat Williams100% (1)

- Debt Collector Verification LetterDocument2 pagesDebt Collector Verification LetterPublic Knowledge100% (20)

- AFFIDAVIT Debt CollectorDocument1 pageAFFIDAVIT Debt Collector1bruceman100% (2)

- Collection Agency Cease and DesistDocument1 pageCollection Agency Cease and DesistCarlo OroNo ratings yet

- Tips For Dealing With A Debt Collector PDFDocument19 pagesTips For Dealing With A Debt Collector PDFCK in DC100% (4)

- How To Protect Yourself From Debt CollectorsDocument5 pagesHow To Protect Yourself From Debt CollectorsHarvey18100% (2)

- FDCPA PitfallsDocument35 pagesFDCPA Pitfallsspcbanking100% (2)

- 18 U.S. Code 241 Conspiracy Against Rights: Commerce Commerce Robbery ExtortionDocument2 pages18 U.S. Code 241 Conspiracy Against Rights: Commerce Commerce Robbery ExtortionNat WilliamsNo ratings yet

- Credit Card Chase DisputeDocument19 pagesCredit Card Chase DisputeKNOWLEDGE SOURCE100% (6)

- Review FdcpaDocument2 pagesReview FdcpaTitle IV-D Man with a plan100% (1)

- Affidavit of Demand For Verification of DebtDocument2 pagesAffidavit of Demand For Verification of DebtZelimir100% (4)

- Full AcceptanceDocument6 pagesFull AcceptanceED Curtis100% (2)

- The Conditional Acceptance For Value ProcessDocument2 pagesThe Conditional Acceptance For Value Processpaul_anderson_3175% (4)

- Debt ValidationDocument9 pagesDebt ValidationBenne JamesNo ratings yet

- TilaDocument83 pagesTilafisherre2000100% (1)

- A Simple Letter That Voids Any Debt.Document1 pageA Simple Letter That Voids Any Debt.GezaLive100% (4)

- Debt Validation InstructionsDocument2 pagesDebt Validation InstructionsKNOWLEDGE SOURCE100% (18)

- Uniform Fradulent Transfer ActDocument37 pagesUniform Fradulent Transfer ActpouhkaNo ratings yet

- Fdcpa 30 Day RuleDocument16 pagesFdcpa 30 Day RuleTRISTARUSANo ratings yet

- 26 Ways To Shut Down A Court CaseDocument2 pages26 Ways To Shut Down A Court CaseMichael Peterson100% (15)

- The 3 Must Send Letters On Validation of DebtDocument5 pagesThe 3 Must Send Letters On Validation of Debtwicholacayo96% (73)

- 2-A-Notice of Fault-Oppurtunity To CureDocument4 pages2-A-Notice of Fault-Oppurtunity To CureEmpressInI100% (1)

- Prove A Creditor Is in Violation - Automatic Win For $1000Document7 pagesProve A Creditor Is in Violation - Automatic Win For $1000FreedomofMind100% (11)

- How To Draft An Answer To A Debt Collection Lawsuit in 3 StepsDocument5 pagesHow To Draft An Answer To A Debt Collection Lawsuit in 3 StepsJohn SkibaNo ratings yet

- 15 FdcpaDocument3 pages15 Fdcpadhondee130% (1)

- Fair Debt Collection Practices Act (ELI Highlights)Document27 pagesFair Debt Collection Practices Act (ELI Highlights)ExtortionLetterInfo.com60% (5)

- Using Court Procedure To Defeat Debt Collectors 12-24-13 NOTESDocument10 pagesUsing Court Procedure To Defeat Debt Collectors 12-24-13 NOTESTRISTARUSA100% (18)

- Debt Validation Letter 2020Document6 pagesDebt Validation Letter 2020Nat Williams97% (29)

- Accepted For Value Does It Really WorkDocument13 pagesAccepted For Value Does It Really WorkDamonta Henry50% (2)

- Validation of Debt Disbute LetterDocument2 pagesValidation of Debt Disbute Lettercolemanbe07No ratings yet

- Debt Collector DefenseDocument58 pagesDebt Collector DefenseClay Driskill100% (11)

- United States District Court Middle District of Florida Orlando DivisionDocument5 pagesUnited States District Court Middle District of Florida Orlando DivisionFreedomofMind100% (3)

- 2013.06.28 Debt Validation LetterDocument3 pages2013.06.28 Debt Validation Letteraquacool21No ratings yet

- The Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationFrom EverandThe Ultimate Weapon in Debt Elimination: Unlocking the Secrets in Debt EliminationRating: 5 out of 5 stars5/5 (1)

- Legal Potential Power LettersDocument28 pagesLegal Potential Power LettersKNOWLEDGE SOURCENo ratings yet

- 16 Key Laws That A Debt Collector Should FollowDocument2 pages16 Key Laws That A Debt Collector Should FollowFreedomofMindNo ratings yet

- PublishedDocument21 pagesPublishedScribd Government DocsNo ratings yet

- Debtors Remedies For Creditors WrongsDocument173 pagesDebtors Remedies For Creditors Wrongscyrusdh100% (4)

- Clearing Mortgage DebtDocument2 pagesClearing Mortgage Debtteachezi100% (1)

- Def of Legal Tender MatterDocument13 pagesDef of Legal Tender Matterjoerocketman100% (4)

- FL PROPERTY TAXES Essay 20 PagesDocument20 pagesFL PROPERTY TAXES Essay 20 Pagesjoerocketman100% (1)

- Description: Tags: Foia Request TemplateDocument3 pagesDescription: Tags: Foia Request Templateanon-6870No ratings yet

- Trommel Plans 1901Document7 pagesTrommel Plans 1901joerocketmanNo ratings yet

- Recorder'S Stamp: (Owner, Claimant, Agent, or Lessee)Document1 pageRecorder'S Stamp: (Owner, Claimant, Agent, or Lessee)joerocketman100% (1)

- One More Time Judge Anna Attempts To Straighten Out The Old ManDocument2 pagesOne More Time Judge Anna Attempts To Straighten Out The Old Manjoerocketman100% (1)

- Corruption in Government Must STOP - Obey The ConstitutionDocument50 pagesCorruption in Government Must STOP - Obey The ConstitutionGemini Research100% (2)

- 4 9 10 Rod Class Coast Guard FilingDocument33 pages4 9 10 Rod Class Coast Guard FilingjoerocketmanNo ratings yet

- How To Stop An ArrestDocument1 pageHow To Stop An ArrestJeff Anderson96% (120)

- Carl Miller - Right To Travel Without A License PlateDocument2 pagesCarl Miller - Right To Travel Without A License Platejoerocketman91% (11)

- 1857 Oregon ConstitutionDocument26 pages1857 Oregon Constitutionjoerocketman100% (2)

- Stan Preckel Workshops Curriculumtermsandconditions October14 1Document5 pagesStan Preckel Workshops Curriculumtermsandconditions October14 1joerocketmanNo ratings yet

- HAN4485 ManualDocument56 pagesHAN4485 ManualjoerocketmanNo ratings yet

- Transcript Jean KeatingDocument14 pagesTranscript Jean Keatingjoerocketman98% (65)

- Getting A Cusip NumberDocument2 pagesGetting A Cusip Numberjoerocketman94% (88)

- Case Law For Right To TravelDocument5 pagesCase Law For Right To Traveljoerocketman100% (1)

- Get Rid of 3rd Party Dept CollectorDocument2 pagesGet Rid of 3rd Party Dept Collectorjoerocketman100% (6)

- Jack Smith TranscriptDocument69 pagesJack Smith TranscriptTom Harkins100% (3)

- Example of Letter of RefusalDocument1 pageExample of Letter of RefusaljoerocketmanNo ratings yet

- Withdrawal Adverse Claim - KionisalaDocument2 pagesWithdrawal Adverse Claim - Kionisalarolando gualbert saliseNo ratings yet

- Art 65-77 Borromeo John Paul JD 1 Commentary.Document6 pagesArt 65-77 Borromeo John Paul JD 1 Commentary.Jp BorromeoNo ratings yet

- Petitioner vs. vs. Respondent Benedicto R Palacol Jimenez & AssociatesDocument6 pagesPetitioner vs. vs. Respondent Benedicto R Palacol Jimenez & AssociatesMark Jeson Lianza PuraNo ratings yet

- Sample Opposition To Motion To Strike For CaliforniaDocument3 pagesSample Opposition To Motion To Strike For CaliforniaStan Burman100% (3)

- Testate Estate of Suntay.Document60 pagesTestate Estate of Suntay.Gnairah Agua AmoraNo ratings yet

- People Vs GutierrezDocument10 pagesPeople Vs GutierrezElmer Dela CruzNo ratings yet

- 31 Suplico V NEDADocument2 pages31 Suplico V NEDADeo Paolo Marciano HermoNo ratings yet

- Syllabus in Civil Procedure: by Judge Rechie N. Ramos-MalabananDocument21 pagesSyllabus in Civil Procedure: by Judge Rechie N. Ramos-MalabananEuler De guzmanNo ratings yet

- Classnotes 15 Appointment, Retirement and Removal of TrusteesDocument10 pagesClassnotes 15 Appointment, Retirement and Removal of TrusteesBranice OkisoNo ratings yet

- Ust Faculty V. Bitonio G.R. NO. 131235 NOVEMBER 16, 1999 FactsDocument1 pageUst Faculty V. Bitonio G.R. NO. 131235 NOVEMBER 16, 1999 FactsJamiah Obillo HulipasNo ratings yet

- Beluso vs. Mun. of PanayDocument1 pageBeluso vs. Mun. of PanayOnnie Lee100% (1)

- Document 16 - Larson v. Perry (Dorland) ("Bad Art Friend")Document37 pagesDocument 16 - Larson v. Perry (Dorland) ("Bad Art Friend")x2478No ratings yet

- United States v. Mejia, 309 F.3d 67, 1st Cir. (2002)Document6 pagesUnited States v. Mejia, 309 F.3d 67, 1st Cir. (2002)Scribd Government DocsNo ratings yet

- Partnership 1767-1782Document57 pagesPartnership 1767-1782John Cloyd DejarmeNo ratings yet

- Consti Mohit KumarDocument3 pagesConsti Mohit KumarTushar GoyalNo ratings yet

- PHOTO EQUIPMENT RENTAL Booking Form + AgreementDocument4 pagesPHOTO EQUIPMENT RENTAL Booking Form + AgreementUjjawal RanjanNo ratings yet

- Consumer Protection Act, 1986Document34 pagesConsumer Protection Act, 1986dreamza2z50% (2)

- Cariño v. CHR, G.R. No. 96681, Dec 2, 1991Document10 pagesCariño v. CHR, G.R. No. 96681, Dec 2, 1991Jacquilou Gier MacaseroNo ratings yet

- Raglan Road LawsuitDocument19 pagesRaglan Road LawsuitAnthony TalcottNo ratings yet

- ACE Agreement 1: Design: 2009 EditionDocument33 pagesACE Agreement 1: Design: 2009 Editionmohamed_gameel_3No ratings yet

- Rule 115: Rights of The AccusedDocument2 pagesRule 115: Rights of The AccusedWitch BRIONNENo ratings yet

- The Financial Rehabilitation and Insolvency Act of 2010Document7 pagesThe Financial Rehabilitation and Insolvency Act of 2010Airiz Dela CruzNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Secured Transactions OutlineDocument30 pagesSecured Transactions OutlineShelby Bullitt100% (1)

- Akhil Gogoi Judgeme1Document57 pagesAkhil Gogoi Judgeme1DipeshNo ratings yet

- Sayo V Chief of PoliceDocument1 pageSayo V Chief of PoliceLotsee ElauriaNo ratings yet

- Randhir Singh Al Bhajnik Singh V Sunildave Singh Parmar (The Administrator of The Estate of K Surjit Kaur Ap Gean Kartar Singh, Deceased)Document10 pagesRandhir Singh Al Bhajnik Singh V Sunildave Singh Parmar (The Administrator of The Estate of K Surjit Kaur Ap Gean Kartar Singh, Deceased)Kayson LeeNo ratings yet

- Heirs of Uy Vs Int'l Exchange BankDocument7 pagesHeirs of Uy Vs Int'l Exchange BankVeah CaabayNo ratings yet

- Apache LicenseDocument2 pagesApache LicenseChrisNo ratings yet

- SC On Scheme of Prosecution and Essential Ingredients of Section 138 of NI ActDocument3 pagesSC On Scheme of Prosecution and Essential Ingredients of Section 138 of NI Actibrahim kannodwalaNo ratings yet