Professional Documents

Culture Documents

Budget Impact Report 2013

Budget Impact Report 2013

Uploaded by

Nemi Sangharajka0 ratings0% found this document useful (0 votes)

2 views11 pagesbudget info of 2013

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbudget info of 2013

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views11 pagesBudget Impact Report 2013

Budget Impact Report 2013

Uploaded by

Nemi Sangharajkabudget info of 2013

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

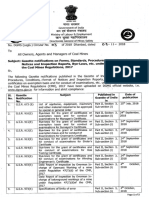

Exclusive Union Budget

2013 Impact Report

February 2013

Brought to you by

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 1 of 11

Preface

Whether justified or not, Union Budgets have always generated excitement in India. This

time around though, the excitement was more than usual and for two reasons. First, it was

to be presented by a man with a reputation for big bang budgets. And secondly, it was to

be the last budget before the next general elections. And thus people were keen to know

how populist it could possibly be? Especially against the backdrop of stubbornly high

inflation and bloated Government finances.

The verdict is out and Mr P Chidambaram has chosen to play very safe we believe.

There certainly isnt any big bang announcements and only minor tweaking here and there.

The good news though is that the FM has also managed to keep the populist in him

under strict check. In other words, there will be no more fiscal profligacy and fiscal

consolidation will be doggedly pursued.

However, committing to fiscal prudence is one thing. And sticking to the target entirely

another. Thus, questions have been raised about how exactly the FM and his team would

manage to bring down the deficit to below 5% in the next fiscal? A valid question indeed

we believe. For while the expenditure has been raised substantially, very little has

been done by way of increasing revenues. The optimists in the markets though are

willing to give the minister a chance. They contend that whatever incentives have been

given by him will help in pushing economic growth further and thus, help him meet his

fiscal targets.

Warm regards,

Team Equitymaster

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 2 of 11

Key sector impact of the Budget

Autos

The Jawaharlal Nehru National Urban Renewal Mission (JNNURM) will be

continued in the 12th Plan. The Budget has provided Rs 148.7 bn for JNNURM.

Out of this, a significant portion will be used to support the purchase of up to

10,000 buses especially by the hill States. This is a positive for companies such as

Tata Motors and Ashok Leyland which are leading players in the bus space and

especially in an environment where volumes of MHCVs have been declining.

The governments stress on the road sector will also augur well for the auto

sector from a long term perspective. The Government has decided to constitute a

regulatory authority for the road sector. Bottlenecks that have been stalling road

projects will be addressed and 3,000 kms of road projects in Gujarat, Madhya

Pradesh, Maharashtra, Rajasthan and Uttar Pradesh will be awarded in the first six

months of FY14.

The Budget proposes to increase the excise duty on SUVs from 27% to 30%.

However, the increase will not apply to SUVs registered as taxis. This is a negative

for players such as Mahindra & Mahindra (M&M), Tata Motors and Maruti Suzuki,

which are strong players in the overall UV space. It must be noted that at a time

when most segments in the auto industry were under pressure, utility vehicles

(UVs) including SUVs grew at a very healthy pace in the current fiscal.

Banking

The target for agricultural credit which is a major driver of agricultural production

is expected to increase to Rs 7 trillion in FY14 from Rs 5.75 trillion in FY13. The

interest subvention scheme for short-term crop loans is to be continued and a

farmer repaying the loan on time will be able to get credit at 4% p.a.

Before the end of FY13, the Finance Ministry shall provide Rs 125.2 bn as an

additional capital infusion for 13 PSU banks. This is set to increase to Rs 140 bn in

FY14. The government is committed that these banks will meet Basel III norms as

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 3 of 11

and when they come to force in a phased manner. However, PSU banks have been

seeing major asset quality stresses and have written off a number of non-

performing assets (NPAs), thus eroding capital. Taxpayer money is thus being

used to fund the NPAs of these banks especially accounts like Kingfisher

Airlines. We believe that this constant recapitalization of PSU banks may just be a

case of throwing good money after bad.

The Finance Minister also proposed to set up Indias first Womens Bank which

will be a public sector bank. Rs 10 bn will be granted by the government as initial

capital and necessary approvals, including the banking licence is expected to be set

in place by October, 2013. While we appreciate the FMs efforts on gender issues,

we dont believe that such a bank has anything new to offer in Indias crowded

banking space. In consultation with RBI, the finance minister proposes to provide

Rs 60 bn to the Rural Housing Fund in 2013-14. The Rural Housing Fund set up

through the National Housing Bank is used to refinance lending institutions,

including Regional Rural Banks, that extend loans for rural housing.

A fund for urban housing is proposed to be set up in order to mitigate the shortage

of houses in urban areas. The finance ministry proposes to ask National Housing

Bank to set up the Urban Housing Fund and, in consultation with RBI, and

proposes to provide Rs 20 bn to the Fund in 2013-14.

Banks will be permitted to act as insurance brokers so that the entire network of

bank branches will be utilized to increase insurance penetration, which is relatively

low in India. Banking correspondents will also be allowed to sell micro-insurance

products.

Engineering

In order to improve the availability of power in the Leh-Kargil region, a

transmission system from Srinagar to Leh is expected to be constructed at the cost

of Rs 18.4 bn. This will improve connectivity in the northern region.

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 4 of 11

FMCG, Foods & Tobacco

The specific excise duty on cigarettes has been increased by about 18% with similar

increases proposed on cigars and cigarillos. While market leader ITC may be able

to pass on the higher burden, companies like Godfrey Phillips and VST Industries

reeling under falling off take may be have to take a hit on margins.

The much-anticipated Goods and Services Tax (GST) which was expected to

provide a level playing field to the FMCG industry and boost its output has

been delayed yet again for want of Constitutional Amendment and draft bill on

GST. The Finance Minister has taken the first step by setting aside a sum of Rs 90

bn towards the first installment of the balance of Central Sales Tax (CST)

compensation.

Infrastructure & Real Estate

3,000 kms of road projects in Gujarat, Madhya Pradesh, Maharashtra, Rajasthan

and Uttar Pradesh will be awarded in the first six months of 2013-14.

The FM proposed to constitute a regulatory authority to address the many concerns

faced by the road construction sector.

Measures taken to increase investment in infrastructure, including encouragement

of infrastructure debt funds, credit enhancements to infra companies, doubling the

limit of issuing tax infra free bonds to Rs 50,000 crores, amongst others.

TDS of 1% when there is transfer of immovable property for a consideration

exceeding Rs 50 lacs.

Additional deduction of interest to the tune of Rs 1 lac for a first time home buyer

who is taking a loan up to Rs 25 lacs. This will give a fillip to the brick, cement

and steel sectors and provide employment to construction laborers.

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 5 of 11

Metals and Mining Sector

India is facing a coal shortage problem for some time now. The Finance Minister

has acknowledged this in his budget speech. Coal imports during the period April-

December, 2012 have crossed 100 million tonnes (mt). It is estimated that imports

will rise to 185 mt in 2016-17. If the coal requirements of the existing power plants

and the power plants that will come into operation by March 31, 2015 are taken into

account, there is no alternative except to import coal and adopt a policy of blending

and pooled pricing. The Finance Minister has said that one of the ways to increase

domestic coal production was to devise a PPP policy framework, with Coal India as

one of the partners.

The government has also introduced a 4% excise duty on silver manufactured from

smelting zinc or lead, to bring the rate on par with the excise duty applicable to

silver obtained from copper ores and concentrates. This could be negative for

players like Hindustan Zinc. But will not have much impact on the overall mining

sector.

Oil & Gas sector

Proposal to move from profit sharing to revenue sharing for oil and gas

blocks/contracts. Under the current system, the oil firms first recover their costs

from sales of oil and gas and then share profits with the Government. Such practice

promotes cost inflation or front lining of the costs to delay the distribution of

profits by oil firms to the Government. This has led to delays in decision-making on

exploration and development investments of the Contractor.

With the proposed move, the Government will start getting its share (in line with

the level of oil and gas output and the price at which these would be sold) with the

onset of production in the field irrespective of the cost recovery. It will also ensure

immediate gains for the Government in case of a hydrocarbon price surge or

significant field discoveries. Most importantly, the move will lead to greater

synergy between the Government and oil companies, minimise government

intervention and complications in accounting and promote Governments objective

of promoting rapid exploration and development in the oil and gas sector.

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 6 of 11

Review of Natural Gas Pricing - The ridiculously low domestic gas prices have

disincentivised further exploration and investment in domestic gas assets. If

gas prices are hiked, it will promote further investment in gas sector and will be

positive for gas producing (such as Oil and Natural Gas Corporation Ltd) and

distribution companies. That said, an increase in gas prices will adversely impact

the financial prospects of end users, especially power and fertilizer sector that have

been thriving on subsidized gas so far. The Government is likely to face stiff

opposition against this proposal and barely a year before elections, execution risk is

high.

Policy on exploration of shale gas on the anvil - The move is positive as it will

reduce dependence on oil and gas imports. At the same time, even if timely action

is taken, the gestation period for such projects will be huge and benefits will take a

long time to flow in.

5 million metric tonnes per annum (MMTPA) terminal in Dabhol to be fully

operational in 2013-14

Pharma

The 15% investment allowance on investment in plant and machinery above Rs 100

cr can benefit Pharma companies making such investments.

Power

Proposed to extend the eligible date of power projects to avail benefit under section

80-IA till next year. This would be a positive for power generators.

India is facing a coal shortage problem for some time now. The Finance Minister

has acknowledged this in his budget speech. Coal imports during the period April-

December, 2012 have crossed 100 million tonnes (mt). It is estimated that imports

will rise to 185 mt in 2016-17. If the coal requirements of the existing power plants

and the power plants that will come into operation by March 31, 2015 are taken into

account, there is no alternative except to import coal and adopt a policy of blending

and pooled pricing. The Finance Minister has said that one of the ways to increase

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 7 of 11

domestic coal production was to devise a PPP policy framework, with Coal India

Limited as one of the partners.

Telecom, Media and Information Technology

The Finance Minister has proposed to increase the excise duty on high end mobile

phones from 1% to 6%. For this purpose, the higher end mobile phones are those

that cost more than Rs 2,000. This would have a major impact on the penetration

levels in the country. As such the incremental penetration is more from the rural

side. This segment typically goes for mobile phones in the lower cost categories

which are untouched by this increased duty.

Import duty on set top boxes has been hiked from 5% to 10% which will make

imported set top boxes costlier thereby impacting the cost structure of DTH

companies.

The Budget has required that all post offices are required to move to core banking

solutions. It has allocated Rs 5.3 bn towards this endeavor. This would attract IT

companies having the requisite domain knowledge and product offering to serve the

need.

Textile sector

Continuing the Technology Upgradation Fund Scheme (TUFS) for the textile sector

during the 12th Plan will mean subsidized interest rates for capital investments in

the sector. The investment target for the plan period is Rs 1.5 trillion. The major

focus would be on modernisation of the power-loom sector. We think this will have

a meaningful impact only on the smaller players in the sector.

Apparel and garment manufactures, which includes some of the major players in

Indian textile sector, could benefit from the grant of up to Rs 100 m each for setting

up Apparel Parks to house apparel manufacturing units.

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 8 of 11

What to expect?

The Finance Minister has decided to tap the super rich category in the country to collect

more taxes. This category, classified as those with taxable income above Rs 10 m, would

be contributing more this year in order to fund the necessary expenditures. However, the

relief for them is that the surcharge of 10% would be valid for only a year.

The interesting aspect in the Union Budget was the increase in overall expenditure.

Despite the need to curb the growing fiscal deficit, the Finance Minister has increased the

overall expenditure to Rs 16.65 trillion in 2013-2014 (higher by 11.7% YoY). A large part

of this expenditure would continue to be made towards populist measures like increasing

allocation to the NREGS scheme, PMGSY scheme for rural development, increasing

allocation for minorities and scheduled castes, etc. But given that this is the last Budget

before the elections, a populist approach was expected.

There were a lot of benefits announced for the women including a bank set up for them.

There was also an allocation of funds towards improving safety for women. Such

measures we feel would have limited use unless there is a reform in laws as well. While

gender bias and equality is a concern in the country, but it requires reforms in laws

and not just allocation of funds. Hopefully the government will enact these laws and

ensure that the funds are utilized for the purpose for which they are intended.

The Budget was largely silent on measures to attract foreign direct investments (FDI) and

increase exports so as to curtail deficits. The measures to boost investments in capital

markets too were non committal. As expected the Budget has increased the scope of the

Rajiv Gandhi Savings Scheme. It has also cut down the securities transaction tax in all of

the categories. This would provide a boost to the capital markets. However, we do not

think the measures will incentivize investors enough to invest in equities.

Overall the Budget was a lackluster one. All eyes were on the Finance Minister in the hope

that Budget measures would look at reducing the fiscal deficit. Though he has pegged the

fiscal deficit at 4.8% of GDP this year, he has also increased the expenditures. These

expenditures would be funded by additional surcharges on the super rich category.

But having left the tax slabs unchanged, there would not be much increase from the tax

revenues from the larger taxpaying community. There was also a lack of announcements

on other major avenues through which the government plans to raise revenues this year.

While the fiscal deficit targets do look ambitious, they dont seem impossible to achieve as

per us. A little help from rain gods and the global economy and we should be there we

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 9 of 11

believe. As far as stock markets are concerned, weve never believed that budgets have the

ability to alter the long term story of an economy. More so a budget as neutral as this one.

Hence one would be better off not focusing on it too much. Attention should instead

be paid to the fundamentals of the company and the valuations that it is trading at.

Exclusive Union Budget 2013 Impact Report

February 2013

Exclusive Union Budget 2013 Impact Report Page 10 of 11

Share these fantastic market beating ideas with your friends and colleagues:

Disclaimer

This booklet a) is for Private Circulation only and not for sale. b) is only for information purposes and Equitymaster Agora

Research Private Ltd (Equitymaster) is not providing any professional/investment advice through it and Equitymaster disclaims

warranty of any kind, whether express or implied, as to any matter/content contained in this booklet, including without

limitation the implied warranties of merchantability and fitness for a particular purpose. Equitymaster will not be responsible for

any loss or liability incurred by the user as a consequence of his taking any investment decisions based on the contents of this

booklet. Use of this booklet is at the users own risk. The user must make his own investment decisions based on his specific

investment objective and financial position and using such independent advisors as he believes necessary. Information contained

in this Report is believed to be reliable but Equitymaster does not warrant its completeness or accuracy.

About Equitymaster

Equitymaster, India's leading independent equity research initiative, is the preferred destination

of the thinking, long-term investor. Our research coverage extends to over 500 companies and 23

sectors. We provide in-depth analysis on the stocks and sectors under coverage. We also offer

live stock market commentary and free newsletters.

Do post your feedback on this guide to us at info@equitymaster.com. Or on our Facebook Page!

To know more about us, please visit www.equitymaster.com or call +91 22 6143 4055.

You might also like

- 2012 Budget - Impact On Indian Automobile IndustryDocument6 pages2012 Budget - Impact On Indian Automobile IndustryKalicharan GuptaNo ratings yet

- Key Expectations ..: Income TaxDocument4 pagesKey Expectations ..: Income TaxManjunath GundalliNo ratings yet

- State of The Markets BUDGET - 2014 - 2015: July 10, 2014Document5 pagesState of The Markets BUDGET - 2014 - 2015: July 10, 2014api-255983286No ratings yet

- Budget 2012 13 Reality Check May 2012Document9 pagesBudget 2012 13 Reality Check May 2012Mountbatten GadkariNo ratings yet

- Key Features of Budget 2012-2013Document15 pagesKey Features of Budget 2012-2013anupbhansali2004No ratings yet

- Inshare Share On TumblrDocument7 pagesInshare Share On TumblrSyamily ChandranNo ratings yet

- Infusion of Rs.15888 Crore in Public, Regional Rural and NABARD inDocument12 pagesInfusion of Rs.15888 Crore in Public, Regional Rural and NABARD inFASNAASLAMNo ratings yet

- In FY18 and FY19 Put Together, The Government Pumped In: Budget Highlights For Media InteractionsDocument2 pagesIn FY18 and FY19 Put Together, The Government Pumped In: Budget Highlights For Media InteractionsPriyaNo ratings yet

- A Market Neutral BudgetDocument14 pagesA Market Neutral BudgetVishal SawhneyNo ratings yet

- India Union BudgetDocument12 pagesIndia Union BudgetMd DhaniyalNo ratings yet

- Union Budget 2013-14: Key Takeout's From The BudgetDocument4 pagesUnion Budget 2013-14: Key Takeout's From The BudgetFeedback Business Consulting Services Pvt. Ltd.No ratings yet

- Budget Key Highlights: Information Technology: The Impact of The Union Budget On Industries Like InformationDocument5 pagesBudget Key Highlights: Information Technology: The Impact of The Union Budget On Industries Like InformationYASH ALMALNo ratings yet

- 01-03-2016 - The Hindu - Shashi Thakur PDFDocument22 pages01-03-2016 - The Hindu - Shashi Thakur PDFdeepeshkumarpal5194No ratings yet

- Key Features of Budget 2012-2013Document15 pagesKey Features of Budget 2012-2013Avinash ShahiNo ratings yet

- Budget BOOK FinalDocument19 pagesBudget BOOK FinalAmin ChhipaNo ratings yet

- Budget 2010: Impact On Sectors That Investors Need To FollowDocument33 pagesBudget 2010: Impact On Sectors That Investors Need To FollowNMRaycNo ratings yet

- PUBLIC PERCEPTION: It Is Not Finance Minister Pranab Mukherjee's Way of Life To Shock orDocument4 pagesPUBLIC PERCEPTION: It Is Not Finance Minister Pranab Mukherjee's Way of Life To Shock orjitendrakumarsinghNo ratings yet

- General Budget 2010Document7 pagesGeneral Budget 2010avnehguddanNo ratings yet

- Budget 2012Document3 pagesBudget 2012Ankit AgarwalNo ratings yet

- Union Budget 2012Document11 pagesUnion Budget 2012vivek1245No ratings yet

- Highlights of Budget 2011-12 For The Banking SectorDocument8 pagesHighlights of Budget 2011-12 For The Banking SectornehasachdevaNo ratings yet

- Union Budget Highlights 2012-13Document15 pagesUnion Budget Highlights 2012-13rockyNo ratings yet

- Union Budget 2012-13: HighlightsDocument15 pagesUnion Budget 2012-13: HighlightsNDTVNo ratings yet

- Budget 2013 - 14Document3 pagesBudget 2013 - 14Jagdeep PabbaNo ratings yet

- Union BUDGET 2019-2020Document42 pagesUnion BUDGET 2019-2020fxfdsxshshsdhNo ratings yet

- Aatm Nirbhar Abhiyan: Analysis of Promises and ImplementationDocument8 pagesAatm Nirbhar Abhiyan: Analysis of Promises and ImplementationNeha MakeoversNo ratings yet

- Liquidity Injection - A Real Solution To The Current Crisis in India?Document4 pagesLiquidity Injection - A Real Solution To The Current Crisis in India?CritiNo ratings yet

- Union Budget 2010 2012Document20 pagesUnion Budget 2010 2012Karteek ManeNo ratings yet

- BETA Budget 2012 13Document8 pagesBETA Budget 2012 13Karu TyagiNo ratings yet

- Economics of Business-Ii: Jaipuria Institute of ManagementDocument5 pagesEconomics of Business-Ii: Jaipuria Institute of ManagementsarazehraNo ratings yet

- Indian Budget 2018: Rejig in Income Tax SlabsDocument2 pagesIndian Budget 2018: Rejig in Income Tax Slabsnarendra_pNo ratings yet

- EconomicSurvey2014 15Document22 pagesEconomicSurvey2014 15tbharathkumarreddy3081No ratings yet

- Impact Analysis: Budget 2014-15Document4 pagesImpact Analysis: Budget 2014-15Raj AraNo ratings yet

- MacroeconomicsDocument7 pagesMacroeconomicsreinaelizabeth890No ratings yet

- 2012-13 Budget Presentation As of 1-4-12 JugunuDocument24 pages2012-13 Budget Presentation As of 1-4-12 JugunuAhsan DileepNo ratings yet

- I M S Engineering College Ghaziabad: Presented To Supriya Mam Presented by Shobhit Verma Ved PrakashDocument16 pagesI M S Engineering College Ghaziabad: Presented To Supriya Mam Presented by Shobhit Verma Ved PrakashLavi VermaNo ratings yet

- Telecom Industry: Group Member: Sunil Soni Shashank Chaturvedi Mukesh Saurabh KumarDocument17 pagesTelecom Industry: Group Member: Sunil Soni Shashank Chaturvedi Mukesh Saurabh Kumarmukesh04No ratings yet

- Advantage of Budget: Infrastructure: RoadsDocument3 pagesAdvantage of Budget: Infrastructure: RoadsPriya TikmaniNo ratings yet

- O o o o o o o o o o o o o oDocument5 pagesO o o o o o o o o o o o o oAneesha KasimNo ratings yet

- Union BudgetUnion Budget 2013Document4 pagesUnion BudgetUnion Budget 2013Chiranjit DuttaNo ratings yet

- Budget Preview 2011Document8 pagesBudget Preview 2011Premchand_Tang_9036No ratings yet

- Budget AnalysisDocument9 pagesBudget AnalysisAdeel AshrafNo ratings yet

- BudgetDocument24 pagesBudgetSumit BhanderiNo ratings yet

- Union Budget 2019-2020 (Part 1)Document6 pagesUnion Budget 2019-2020 (Part 1)paulson arulNo ratings yet

- Impact of Budget On Various SectorsDocument2 pagesImpact of Budget On Various SectorsAbhijeet R DegaonkarNo ratings yet

- Who Is Entitled To A Tax Holiday?Document8 pagesWho Is Entitled To A Tax Holiday?MosarafNo ratings yet

- Budget Analysis: Taxila Business School: by Prof Gaurav MalpaniDocument2 pagesBudget Analysis: Taxila Business School: by Prof Gaurav MalpaniTaxila Business School JaipurNo ratings yet

- Highlights of The Union Budget 2022 Partt 222Document33 pagesHighlights of The Union Budget 2022 Partt 222KUSUMA ANo ratings yet

- Budget Notes For SBI PO'sDocument3 pagesBudget Notes For SBI PO'svinnuganjiNo ratings yet

- General Budget 2013-14Document7 pagesGeneral Budget 2013-14Shibraiz AneesNo ratings yet

- Knowledgehub SBI A Group For-SbitiansDocument13 pagesKnowledgehub SBI A Group For-SbitiansdeepaNo ratings yet

- What, According To You, Are The Pros and Cons of The Indian Union Budget 2015?Document4 pagesWhat, According To You, Are The Pros and Cons of The Indian Union Budget 2015?Mian Muhammad Rizwan SarwarNo ratings yet

- Implication of Budget 2013Document23 pagesImplication of Budget 2013Rahul SinglaNo ratings yet

- Edristi February 2019 English PDFDocument148 pagesEdristi February 2019 English PDFmadhukar tiwariNo ratings yet

- Budget 2009Document7 pagesBudget 2009akashNo ratings yet

- Introduction of Budget, 2010Document18 pagesIntroduction of Budget, 2010Alisha GargNo ratings yet

- Public Financial Management Systems—Bangladesh: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Bangladesh: Key Elements from a Financial Management PerspectiveNo ratings yet

- Asia’s Fiscal Challenge: Financing the Social Protection Agenda of the Sustainable Development GoalsFrom EverandAsia’s Fiscal Challenge: Financing the Social Protection Agenda of the Sustainable Development GoalsNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Sponge Iron Industry Current Scenario SDocument2 pagesSponge Iron Industry Current Scenario Sapi-26041653100% (1)

- Chapter 6. Energy Flows and BalancesDocument17 pagesChapter 6. Energy Flows and BalancesCheng Chiv ÏïNo ratings yet

- Challenges and Opporunities of Using TBM in MiningDocument13 pagesChallenges and Opporunities of Using TBM in MiningVignesh Ayyathurai100% (1)

- M/s. Gravity Sponge and Power Pvt. LTDDocument52 pagesM/s. Gravity Sponge and Power Pvt. LTDiexNo ratings yet

- BP's Statistical Review of World Energy Full Report 2009Document48 pagesBP's Statistical Review of World Energy Full Report 2009TheBusinessInsider100% (5)

- OceanofPDF - Com Absolute Essentials of Green Business - Alan SitkinDocument135 pagesOceanofPDF - Com Absolute Essentials of Green Business - Alan Sitkininfoabsolutesafety.ieNo ratings yet

- Legis Cir 03 2018Document2 pagesLegis Cir 03 2018Deepak KumarNo ratings yet

- Finex ProcessDocument25 pagesFinex Processduvanp92No ratings yet

- @chirimiri Coals, Koriya District, Chhatisgarh, IndiaDocument12 pages@chirimiri Coals, Koriya District, Chhatisgarh, IndiaSonali SwagatikaNo ratings yet

- Chapter 6 Cybercrime - Group 2Document12 pagesChapter 6 Cybercrime - Group 2Billy Joe G. BautistaNo ratings yet

- Skills Training in The Australian Mining Industry With Emphasis On Safety and Productivity OutcomesDocument14 pagesSkills Training in The Australian Mining Industry With Emphasis On Safety and Productivity OutcomesfenderlimaNo ratings yet

- Fuels Liq Manufacture of Metallurgical Coke: Beehive Oven Otto Hoffmann OvenDocument51 pagesFuels Liq Manufacture of Metallurgical Coke: Beehive Oven Otto Hoffmann OvenAgnivesh Sharma0% (3)

- 2015-09-17 PM 12 by Li Yao CNDocument21 pages2015-09-17 PM 12 by Li Yao CNDare SmithNo ratings yet

- High Ash Coal Gasification)Document4 pagesHigh Ash Coal Gasification)Kailash NathNo ratings yet

- Adekunle Ajasin Univeristy Akungba AkokoDocument23 pagesAdekunle Ajasin Univeristy Akungba AkokoDaniel EmekaNo ratings yet

- 2000 Vresova Czech PDFDocument8 pages2000 Vresova Czech PDFanshuman432No ratings yet

- E Ciency Studies of Combination Tube Boilers: Alexandria Engineering JournalDocument10 pagesE Ciency Studies of Combination Tube Boilers: Alexandria Engineering JournalJuan Sebastian AlarconNo ratings yet

- Eneva SA: A Key Solution To Enhance Electricity Supply in Brazil: Initiate With BuyDocument58 pagesEneva SA: A Key Solution To Enhance Electricity Supply in Brazil: Initiate With BuyBeto ParanaNo ratings yet

- Air Pollution (Environmental Issue)Document13 pagesAir Pollution (Environmental Issue)Irish Virtudazo100% (1)

- Aim 6 - Cycle 08 - Lesson 05 - Writing NoteDocument6 pagesAim 6 - Cycle 08 - Lesson 05 - Writing NoteMai HiếuNo ratings yet

- Minerals and Energy ResourcesDocument6 pagesMinerals and Energy ResourcesVrindha Vijayan100% (1)

- The Business Case Fora Low Carbon Energy Policy ICREED 8-14-2007 FinalDocument32 pagesThe Business Case Fora Low Carbon Energy Policy ICREED 8-14-2007 FinalYubaraj SenguptaNo ratings yet

- Through Seam Blasting: Project SummaryDocument2 pagesThrough Seam Blasting: Project SummaryRido Rezeki SitumorangNo ratings yet

- MIT Press 2012 FallDocument120 pagesMIT Press 2012 FallStan SmithNo ratings yet

- Safety - Milling of FuelsDocument17 pagesSafety - Milling of FuelsAnonymous Cxriyx9HIXNo ratings yet

- The Shand CCS Feasibility Study Public ReportDocument124 pagesThe Shand CCS Feasibility Study Public ReportSai RuthvikNo ratings yet

- Term Paper For Macroeconomics PDFDocument14 pagesTerm Paper For Macroeconomics PDFmanojpuruNo ratings yet

- David HumphreyDocument7 pagesDavid HumphreyMarcoFranchinottiNo ratings yet

- Informe 2021 de Climate TransparencyDocument20 pagesInforme 2021 de Climate TransparencyTodo NoticiasNo ratings yet

- Stirling Power Boiler by Babcock & WilcoxDocument6 pagesStirling Power Boiler by Babcock & WilcoxarjmandquestNo ratings yet